Board of Governors of the Federal Reserve System

International Finance Discussion Papers

Number 990, January 2010 --- Screen Reader

Version*

Firm-Specific Capital, Nominal Rigidities and the Business Cycle1

NOTE: International Finance Discussion Papers are preliminary materials circulated to stimulate discussion and critical comment. References in publications to International Finance Discussion Papers (other than an acknowledgment that the writer has had access to unpublished material) should be cleared with the author or authors. Recent IFDPs are available on the Web at http://www.federalreserve.gov/pubs/ifdp/. This paper can be downloaded without charge from the Social Science Research Network electronic library at http://www.ssrn.com/.

Abstract:

This paper formulates and estimates a three-shock US business cycle model. The estimated model accounts for a substantial fraction of the cyclical variation in output and is consistent with the observed inertia in inflation. This is true even though firms in the model reoptimize prices on average once every 1.8 quarters. The key feature of our model underlying this result is that capital is firm-specific. If we adopt the standard assumption that capital is homogeneous and traded in economy-wide rental markets, we find that firms reoptimize their prices on average once every 9 quarters. We argue that the micro implications of the model strongly favor the firm-specific capital specification.

JEL classification: E3, E4, E5

1. Introduction

Macroeconomic data indicate that inflation is inertial. To account for this inertia, macro modeler embed assumptions that are either implausibe on a priori grounds or directly in conflict with micro data. For example, in many new-Keynesian macroeconomic models, firms index non-optimized prices to lagged inflation. These models account for inflation inertia by assuming that firms re-optimize their prices every six quarters or even less often.6 Other new-Keynesian models don't allow for indexing to lagged inflation. In estimated versions of these models, firms change prices once every two years or less often.7 This property contrasts sharply with findings in Bils and Klenow (2004), Golosov and Lucas (2007) and Klenow and Kryvstov (2008) who argue that firms change prices more frequently than once every two quarters.8

In this paper we formulate and estimate a model which is consistent with the evidence of inertia in inflation, even though firms re-optimize prices on average once every 1.8 quarters.9 In addition our model accounts for the dynamic response of 10 key U.S. macro time series to monetary policy shocks, neutral technology shocks and capital embodied shocks.10

In our model aggregate inflation is inertial despite the fact that firms re-optimize prices frequently. The inertia reflects that when firms do re-optimize prices, they change prices by a small amount. Firms change prices by a small amount because each firm's short run marginal cost curve is increasing in its own output.11 This positive dependency reflects our assumption that in any given period, a firm's capital stock is pre-determined. In standard equilibrium business cycle models a firm's capital stock is not pre-determined and all factors of production, including capital, can be instantly and costlessly transferred across firms. These assumptions are empirically unrealistic but are defended on the grounds of tractability. The hope is that these assumption are innocuous and do not affect major model properties. In fact these assumptions matter a lot.

In our model, a firm's capital is pre-determined and can only be changed over time by varying the rate of investment. These properties follow from our assumption that capital is completely firm-specific. Our assumptions about capital imply that a firm's marginal cost curve depends positively on its output level.12 To see the impact of this dependence on pricing decisions, consider a firm that contemplates raising its price. The firm understands that a higher price implies less demand and less output. A lower level of output reduces marginal cost, which other things equal, induces a firm to post a lower price. Thus, the dependence of marginal cost on firm-level output acts as a countervailing influence on a firm's incentives to raise price. This countervailing influence is why aggregate inflation responds less to a given aggregate marginal cost shock when capital is firm-specific.

Anything, including firm-specificity of some other factor of production or adjustment costs in labor, which causes a firm's marginal cost to be an increasing function of its output works in the same direction as firm-specificity of capital. This fact is important because our assumption that the firm's entire stock of capital is predetermined probably goes too far from an empirical standpoint.

We conduct our analysis using two versions of the model analyzed

by Christiano, Eichenbaum, and Evans (CEE henceforth, 2005): in

one, capital is homogeneous whereas in the other, it is firm

specific. We refer to these models as the homogeneous and

firm-specific capital models, respectively. We show that the only

difference between the log-linearized equations characterizing

equilibrium in the two models pertains to the equation relating

inflation to marginal costs. The form of this equation is identical

in both models: the change in inflation at time ![]() is

equal to discounted expected change in inflation at time

is

equal to discounted expected change in inflation at time

![]() plus a reduced form coefficient,

plus a reduced form coefficient,

![]() , multiplying time

, multiplying time ![]() economy-wide average real marginal cost. The difference between the

two models lies in the mapping between the structural parameters

and

economy-wide average real marginal cost. The difference between the

two models lies in the mapping between the structural parameters

and ![]() . In non-linear framework, however, it

is not true that the solutions to the homogeneous and firm-specific

capital models are obserbationally equivalent with respect to macro

data.13

. In non-linear framework, however, it

is not true that the solutions to the homogeneous and firm-specific

capital models are obserbationally equivalent with respect to macro

data.13

In the homogeneous capital model, ![]() depends

only on agents' discount rates and on the fraction,

depends

only on agents' discount rates and on the fraction, ![]() , of firms that re-optimize prices within the

quarter. In the firm-specific capital model,

, of firms that re-optimize prices within the

quarter. In the firm-specific capital model, ![]() is a function of a broader set of the structural

parameters. For example, the more costly it is for a firm to vary

capital utilization, the steeper is its marginal cost curve and

hence the smaller is

is a function of a broader set of the structural

parameters. For example, the more costly it is for a firm to vary

capital utilization, the steeper is its marginal cost curve and

hence the smaller is ![]() . A different example is

that in the firm-specific capital model, the parameter

. A different example is

that in the firm-specific capital model, the parameter ![]() is smaller the more elastic is the firm's demand

curve.14 This result reflects that the more

elastic is a firm's demand, the greater is the reduction in demand

and output in response to a given price increase. A bigger fall in

output implies a bigger fall in marginal cost which reduces a

firm's incentive to raise its price.

is smaller the more elastic is the firm's demand

curve.14 This result reflects that the more

elastic is a firm's demand, the greater is the reduction in demand

and output in response to a given price increase. A bigger fall in

output implies a bigger fall in marginal cost which reduces a

firm's incentive to raise its price.

The only way that ![]() enters into the

reduced form of the two models is via its impact on

enters into the

reduced form of the two models is via its impact on ![]() . If we parameterize the two models in terms of

. If we parameterize the two models in terms of

![]() rather than

rather than ![]() ,

they have identical implications for all aggregate quantities and

prices in a standard (log-)linearized framework. This observational

equivalence result implies that we can estimate the model in terms

of

,

they have identical implications for all aggregate quantities and

prices in a standard (log-)linearized framework. This observational

equivalence result implies that we can estimate the model in terms

of ![]() without taking a stand on whether

capital is firm-specific or homogeneous. The observational

equivalence result also implies that we cannot assess the relative

plausibility of the homogeneous and firm-specific capital models

using macro data. However, the two models have very different

implications for micro data. To assess the relative plausibility of

the two models, we focus on the mean time between price

re-optimization, and the dynamic response of the cross - firm

distribution of production and prices to aggregate shocks. These

implications depend on the parameters of the model, which we

estimate.

without taking a stand on whether

capital is firm-specific or homogeneous. The observational

equivalence result also implies that we cannot assess the relative

plausibility of the homogeneous and firm-specific capital models

using macro data. However, the two models have very different

implications for micro data. To assess the relative plausibility of

the two models, we focus on the mean time between price

re-optimization, and the dynamic response of the cross - firm

distribution of production and prices to aggregate shocks. These

implications depend on the parameters of the model, which we

estimate.

We follow CEE (2005) in choosing model parameter values to minimize the differences between the dynamic response to shocks in the model and the analog objects estimated using a vector autoregressive representation of 10 post-war quarterly U.S. time series.15 To compute vector autoregression (VAR) based impulse response functions, we use identification assumptions satisfied by our economic model: the only shocks that affect productivity in the long run are innovations to neutral and capital-embodied technology; the only shock that affects the price of investment goods in the long run is an innovation to capital-embodied technology;16 monetary policy shocks have a contemporaneous impact on the interest rate, but they do not have a contemporaneous impact on aggregate quantities or the price of investment goods. We estimate that together these three shocks account for almost 60 percent of cyclical fluctuations in aggregate output and other aggregate quantities.

We now discuss the key properties of our estimated model. First,

the model does a good job of accounting for the estimated response

of the economy to both monetary policy and technology shocks.

Second, according to our point estimates, households re-optimize

wages on average about once a year. Third, our point estimate of

![]() is 0.014. In the

homogeneous capital version of the model, this value of

is 0.014. In the

homogeneous capital version of the model, this value of ![]() implies that firms change prices on average once every

9.4 quarters. But in the firm-specific

capital model, this value of

implies that firms change prices on average once every

9.4 quarters. But in the firm-specific

capital model, this value of ![]() implies that

firms change price on average once every 1.8

quarters. The reason why the models have such different

implications for firms' pricing behavior is that according to our

estimates, firms' demand curves are highly elastic and their

marginal cost curves are very steep.

implies that

firms change price on average once every 1.8

quarters. The reason why the models have such different

implications for firms' pricing behavior is that according to our

estimates, firms' demand curves are highly elastic and their

marginal cost curves are very steep.

Finally, we show that the two versions of the model differ sharply in terms of their implications for the cross-sectional distribution of production. In the homogeneous capital model, a very small fraction of firms produce the bulk of the economy's output in the periods after a monetary policy shock. The implications of the firm-specific model are much less extreme. We conclude that both the homogeneous and firm-specific capital models can account for inflation inertia and the response of the economy to monetary policy and technology shocks. But only the firm-specific model can reconcile the micro-macro pricing conflict without obviously unpalatable micro implications.

It is useful to place this paper in the context of the

literature. That firm-specific capital can rationalize a lower

estimate of ![]() (more frequent price

re-optimization) was first demonstrated by Sbordone (1998, 2002)

and further discussed by Gali, Gertler and Lopez-Salido (2001) and

Woodford (2003). In these papers, the stock of capital owned by the

firm is fixed. Woodford (2005) analyzes the impact of firm specific

capital allowing for investment. As our discussion above indicates,

whether firm specific capital actually does rationalize a lower

estimate of

(more frequent price

re-optimization) was first demonstrated by Sbordone (1998, 2002)

and further discussed by Gali, Gertler and Lopez-Salido (2001) and

Woodford (2003). In these papers, the stock of capital owned by the

firm is fixed. Woodford (2005) analyzes the impact of firm specific

capital allowing for investment. As our discussion above indicates,

whether firm specific capital actually does rationalize a lower

estimate of ![]() depends critically on the other

parameters characterizing firms' environments. To the extent that

capital utilization rates can easily be varied, the assumption of

firm specific capital loses its ability to rationalize low values

of

depends critically on the other

parameters characterizing firms' environments. To the extent that

capital utilization rates can easily be varied, the assumption of

firm specific capital loses its ability to rationalize low values

of ![]() A maintained assumption of the

papers just cited is that firms cannot vary capital utilization

rates. So these papers leave open the question of how important

firm specific capital is once firms can vary capital utilization

rates. Similarly, the smaller is the elasticity of demand for a

firm's output, the smaller is the impact of firm specific capital

on inference about

A maintained assumption of the

papers just cited is that firms cannot vary capital utilization

rates. So these papers leave open the question of how important

firm specific capital is once firms can vary capital utilization

rates. Similarly, the smaller is the elasticity of demand for a

firm's output, the smaller is the impact of firm specific capital

on inference about ![]() The above cited

papers condition their inference on particular assumed values for

this elasticity. The key contribution of this paper is to estimate

the key parameters governing the operational importance of firm

specific capital and to assess the importance for firm specific

capital in an estimated dynamic stochastic general equilibrium

model. Our key result is that the assumption of firm specific

capital does in fact rationalize relatively low values of

The above cited

papers condition their inference on particular assumed values for

this elasticity. The key contribution of this paper is to estimate

the key parameters governing the operational importance of firm

specific capital and to assess the importance for firm specific

capital in an estimated dynamic stochastic general equilibrium

model. Our key result is that the assumption of firm specific

capital does in fact rationalize relatively low values of

![]() thereby helping to reconcile the

apparent conflicting pictures of pricing behavior painted by micro

and macro data.17

thereby helping to reconcile the

apparent conflicting pictures of pricing behavior painted by micro

and macro data.17

From a broader perspective, this paper belongs to a larger literature that tries to explain the mechanisms by which nominal shocks have effects on real economic activity that last longer than the frequency with which firms re-optimize prices. Perhaps the most closely related mechanisms are firm specific labor (Woodford (2005)), sector specific labor (Gertler and Leahy (2008)) and strategic complementarities arising from an elasticity of firm demand that is increasing in the firm's price (see for example Kimble (1995) and Eichenbaum and Fisher (2007)). A different propagation mechanism stems from heterogeneity across sectors in the frequency of price changes (see for example Bils and Klenow (2004), Carvalho (2006) and Steinsson and Nakamura (2008)) and the presence of intermediate inputs (see for example Basu (1995) and Huang (2006)).

An alternative and promising propagation mechanism arises from the assumption that firms cannot attend perfectly to all available information (see Sims (1998, 2003)). Mackowiak and Wiederholdt (2008) present a model in which firms decide what variables to pay attention to, subject to a constraint on information flow. When idiosyncratic conditions are more variable or more important than aggregate conditions, firms in their model pay more attention to idiosyncratic conditions than to aggregate conditions. Their model has the important property that firms react fast and by large amounts to idiosyncratic shocks, but only slowly and by small amounts to nominal shocks. As a result nominal shocks have strong and persistent real effects. Woodford (2008) develops a generalization of the standard, full-information model of state-dependent pricing in which decisions about when to review a firm's existing price must be made on the basis of imprecise awareness of current market conditions. He endogenizes imperfect information using a variant of the theory of " rational inattention" proposed by Sims (1998, 2003)). In related work, Mankiw and Reis (2002) and Reis (2006) stress the potential importance of slow dissemination of information to firms for generating persistent effects of nominal shocks.

The merits of these alternative propagation mechansims is a subject of an ongoing, vigorous debate. A detailed assessment of their empirical strengths is beyond the scope of this paper. It is clear however that the debate will be settled on the field of microeconomic data. For recent reviews of how firm level data on prices bears on alternative approaches we refer the reader to Mackowiak and Smets (2008), Eichenbaum, Jaimovich and Rebelo (2009), and Klenow and Malin (2009). While we emphasize the importance of firm specific capital in this paper, we leave open the possibility that the other propagation mechanisms discussed above may be at least as important.

The remainder of this paper is organized as follows. In Section 2 we describe our basic model economy. Section 3 describes our VAR-based estimation procedure. Section 4 presents our VAR-based impulse response functions and their properties. Sections 5 and 6 present and analyze the results of estimating our model. Section 7 discusses the implications of the homogeneous and firm-specific capital models for the cross-firm distribution of prices and production in the wake of a monetary policy shock. Section 8 concludes.

2. The Model Economy

In this section we describe the homogeneous and firm-specific capital models.

2.1. The Homogeneous Capital Model

The model economy is populated by goods-producing firms, households and the government.

2.1.1. Final Good Firms

At time ![]() , a final consumption good,

, a final consumption good, ![]() is produced by a perfectly competitive, representative

firm. The firm produces the final good by combining a continuum of

intermediate goods, indexed by

is produced by a perfectly competitive, representative

firm. The firm produces the final good by combining a continuum of

intermediate goods, indexed by

![]() using the technology

using the technology

![$\displaystyle Y_{t}=\left[ \int_{0}^{1}y_{t}(i)^{\frac{1}{\lambda_{f}}}di\right] ^{\lambda_{f}},$](img31.gif)

|

(1) |

where

![]() and

and ![]() denotes the time

denotes the time ![]() input of

intermediate good

input of

intermediate good ![]() The firm takes its output

price,

The firm takes its output

price, ![]() and its input prices,

and its input prices, ![]() as given and beyond its control. The first order

necessary condition for profit maximization is:

as given and beyond its control. The first order

necessary condition for profit maximization is:

|

(2) |

Integrating (2) and imposing (1), we obtain the following relationship between the price of the final good and the price of the intermediate good:

![$\displaystyle P_{t}=\left[ \int_{0}^{1}P_{t}(i)^{\frac{1}{1-\lambda_{f}}}di\right] ^{\left( 1-\lambda_{f}\right) }.$](img39.gif)

|

(3) |

2.1.2. Intermediate Good Firms

Intermediate good ![]() is produced by a

monopolist using the following technology:

is produced by a

monopolist using the following technology:

![$\displaystyle y_{t}(i)=\left\{ \begin{array}[c]{ll} K_{t}(i)^{\alpha}\left( z_{t}h_{t}(i)\right) ^{1-\alpha}-\phi z_{t}^{\ast} & \text{if }K_{t}(i)^{\alpha}\left( z_{t}h_{t}(i)\right) ^{1-\alpha}\geq\phi z_{t}^{\ast}\\ 0 & \text{otherwise} \end{array} \right.$](img41.gif)

|

(4) |

where

![]() Here,

Here, ![]() and

and ![]() denote time

denote time

![]() labor and capital services used to produce

the

labor and capital services used to produce

the ![]() intermediate good. The variable,

intermediate good. The variable,

![]() represents a time

represents a time ![]() shock to the technology for producing intermediate output. We refer

to

shock to the technology for producing intermediate output. We refer

to ![]() as a neutral technology shock and

denote its growth rate,

as a neutral technology shock and

denote its growth rate,

![]() by

by ![]() The

non-negative scalar,

The

non-negative scalar, ![]() parameterizes fixed

costs of production. The variable,

parameterizes fixed

costs of production. The variable,

![]() is given by:

is given by:

|

(5) |

where

![]() represents a time

represents a time ![]() shock to capital-embodied technology. We choose the

structure of the firm's fixed cost in (5) to

ensure that the non-stochastic steady state of the economy exhibits

a balanced growth path. We denote the growth rate of

shock to capital-embodied technology. We choose the

structure of the firm's fixed cost in (5) to

ensure that the non-stochastic steady state of the economy exhibits

a balanced growth path. We denote the growth rate of

![]() and

and

![]() by

by

![]() and

and

![]() respectively, so that:

respectively, so that:

| (6) |

Throughout, we rule out entry into and exit from the production of

intermediate good ![]()

Let

![]() denote

denote

![]() where

where

![]() is the growth rate of

is the growth rate of ![]() in non-stochastic steady state. We define all

variables with a hat in an analogous manner. The variables

in non-stochastic steady state. We define all

variables with a hat in an analogous manner. The variables

![]() evolves according to:

evolves according to:

| (7) |

where ![]()

![]()

![]() and

and

![]() is uncorrelated over

time and with all other shocks in the model. We denote the standard

deviation of

is uncorrelated over

time and with all other shocks in the model. We denote the standard

deviation of

![]() by

by

![]() Similarly, we assume:

Similarly, we assume:

| (8) |

where

Intermediate good firms rent capital and labor in perfectly

competitive factor markets. Profits are distributed to households

at the end of each time period. Let

![]() and

and

![]() denote the nominal rental rate on

capital services and the wage rate, respectively. We assume that

the firm must borrow the wage bill in advance at the gross interest

rate,

denote the nominal rental rate on

capital services and the wage rate, respectively. We assume that

the firm must borrow the wage bill in advance at the gross interest

rate, ![]()

Firms set prices according to a variant of the mechanism spelled

out in Calvo (1983). In each period, an intermediate goods firm

faces a constant probability,

![]() of being able to re-optimize its

nominal price. The ability to re-optimize prices is independent

across firms and time. As in CEE (2005), we assume that a firm

which cannot re-optimize its price sets

of being able to re-optimize its

nominal price. The ability to re-optimize prices is independent

across firms and time. As in CEE (2005), we assume that a firm

which cannot re-optimize its price sets ![]() according to:

according to:

| (9) |

Here, ![]() denotes aggregate inflation,

denotes aggregate inflation,

![]()

An intermediate goods firm's objective function is:

![$\displaystyle E_{t}\sum_{j=0}^{\infty}\beta^{j}\upsilon_{t+j}\left[ P_{t+j}(i)y_{t+j} (i)-P_{t+j}\left( w_{t+j}R_{t+j}h_{t+j}(i)+r_{t+j}^{k}K_{t+j}(i)\right) \right] ,$](img88.gif)

|

(10) |

where ![]() is the expectation operator conditioned

on time

is the expectation operator conditioned

on time ![]() information. The term,

information. The term,

![]() is proportional to

the state-contingent marginal value of a dollar to a

household.18 Also,

is proportional to

the state-contingent marginal value of a dollar to a

household.18 Also, ![]() is a

scalar between zero and unity. The timing of events for a firm is

as follows. At the beginning of period

is a

scalar between zero and unity. The timing of events for a firm is

as follows. At the beginning of period ![]() the firm

observes the technology shocks and sets its price,

the firm

observes the technology shocks and sets its price, ![]() . Then, a shock to monetary policy is realized, as is

the demand for the firm's product, (2). The firm

then chooses productive inputs to satisfy this demand. The problem

of the

. Then, a shock to monetary policy is realized, as is

the demand for the firm's product, (2). The firm

then chooses productive inputs to satisfy this demand. The problem

of the ![]() intermediate good firm is to choose

prices, employment and capital services, subject to the timing and

other constraints described above, to maximize (10).

intermediate good firm is to choose

prices, employment and capital services, subject to the timing and

other constraints described above, to maximize (10).

2.1.3. Households

There is a continuum of households, indexed by

![]() The sequence of events in a period

for a household is as follows. First, the technology shocks are

realized. Second, the household makes its consumption and

investment decisions, decides how many units of capital services to

supply to rental markets, and purchases securities whose payoffs

are contingent upon whether it can re-optimize its wage decision.

Third, the household sets its wage rate. Fourth, the monetary

policy shock is realized. Finally, the household allocates its

beginning of period cash between deposits at the financial

intermediary and cash to be used in consumption transactions.

The sequence of events in a period

for a household is as follows. First, the technology shocks are

realized. Second, the household makes its consumption and

investment decisions, decides how many units of capital services to

supply to rental markets, and purchases securities whose payoffs

are contingent upon whether it can re-optimize its wage decision.

Third, the household sets its wage rate. Fourth, the monetary

policy shock is realized. Finally, the household allocates its

beginning of period cash between deposits at the financial

intermediary and cash to be used in consumption transactions.

Each household is a monopoly supplier of a differentiated labor service, and sets its wage subject to Calvo-style wage frictions. In general, households earn different wage rates and work different amounts. A straightforward extension of arguments in Erceg, Henderson, and Levin (2000) and Woodford (1996) establishes that in the presence of state contingent securities, households are homogeneous with respect to consumption and asset holdings. Our notation reflects this result.

The preferences of the ![]() household are

given by:

household are

given by:

![$\displaystyle E_{t}^{j}\sum_{l=0}^{\infty}\beta^{l-t}\left[ \log\left( C_{t+l} -bC_{t+l-1}\right) -\psi_{L}\frac{h_{j,t+l}^{2}}{2}\right] ,$](img98.gif)

|

(11) |

where

![]() and

and ![]() is

the time

is

the time ![]() expectation operator, conditional on

household

expectation operator, conditional on

household ![]() 's time

's time ![]() information

set. The variable,

information

set. The variable, ![]() denotes time

denotes time

![]() consumption, and

consumption, and ![]() denotes time

denotes time ![]() hours worked. When

hours worked. When ![]() (11) exhibits habit

formation in consumption preferences.

(11) exhibits habit

formation in consumption preferences.

The household's asset evolution equation is given by:

| (12) | ||

Here, ![]()

![]() and

and

![]() denote the household's beginning of

period

denote the household's beginning of

period ![]() stock of money, cash balances and time

stock of money, cash balances and time

![]() nominal wage rate, respectively. In

addition,

nominal wage rate, respectively. In

addition,

![]()

![]() and

and ![]() denote

the household's physical stock of capital, the capital utilization

rate, firm profits and the net cash inflow from participating in

state-contingent securities at time

denote

the household's physical stock of capital, the capital utilization

rate, firm profits and the net cash inflow from participating in

state-contingent securities at time ![]() ,

respectively. The variable

,

respectively. The variable ![]() represents the

gross growth rate of the economy-wide per capita stock of money,

represents the

gross growth rate of the economy-wide per capita stock of money,

![]() The quantity

The quantity

![]() is a lump-sum payment

made to households by the monetary authority. The household

deposits

is a lump-sum payment

made to households by the monetary authority. The household

deposits

![]() with a

financial intermediary. The variable,

with a

financial intermediary. The variable, ![]() denotes

the gross interest rate.

denotes

the gross interest rate.

In (12), the price of investment goods

relative to consumption goods is given by

![]() which we assume is an

exogenous stochastic process. One way to rationalize this

assumption is that agents transform final goods into investment

goods using a linear technology with slope

which we assume is an

exogenous stochastic process. One way to rationalize this

assumption is that agents transform final goods into investment

goods using a linear technology with slope

![]() This rationalization also

underlies why we refer to

This rationalization also

underlies why we refer to

![]() as capital-embodied

technological progress.

as capital-embodied

technological progress.

The variable,

![]() denotes the time

denotes the time

![]() velocity of the household's cash

balances:

velocity of the household's cash

balances:

|

(13) |

where

![]() is increasing and

convex. The function

is increasing and

convex. The function

![]() captures the role of

cash balances in facilitating transactions. Similar specifications

have been used by a variety of authors including Sims (1994) and

Schmitt-Grohe and Uribe (2004). For the quantitative analysis of

our model, we require the level and the first two derivatives of

the transactions function,

captures the role of

cash balances in facilitating transactions. Similar specifications

have been used by a variety of authors including Sims (1994) and

Schmitt-Grohe and Uribe (2004). For the quantitative analysis of

our model, we require the level and the first two derivatives of

the transactions function,

![]() evaluated in steady

state. We denote these by

evaluated in steady

state. We denote these by ![]()

![]() and

and

![]() respectively. We chose

values for these objects as follows. The first order condition for

respectively. We chose

values for these objects as follows. The first order condition for

![]() is:

is:

Let

![]() denote the interest

semi-elasticity of money demand:

denote the interest

semi-elasticity of money demand:

Denote the curvature of ![]() by

by ![]() :

:

Then, the first order condition for ![]() implies

that the interest semi-elasticity of money demand in steady state

is:

implies

that the interest semi-elasticity of money demand in steady state

is:

where the steady state value of ![]() is

is

![]() We parameterize

We parameterize

![]() indirectly using

values for

indirectly using

values for ![]()

![]() and

and ![]()

The remaining terms in (12) pertain to the

household's capital-related income. The services of capital,

![]() are related to stock of physical

capital,

are related to stock of physical

capital,

![]() by

by

The term

![]() represents

the household's earnings from supplying capital services. The

function

represents

the household's earnings from supplying capital services. The

function

![]() denotes the cost, in

investment goods, of setting the utilization rate to

denotes the cost, in

investment goods, of setting the utilization rate to ![]() We assume

We assume ![]() is increasing and

convex. These assumptions capture the idea that the more intensely

the stock of capital is utilized, the higher are maintenance costs

in terms of investment goods. Our log-linear approximation solution

strategy requires the level and first two derivatives of

is increasing and

convex. These assumptions capture the idea that the more intensely

the stock of capital is utilized, the higher are maintenance costs

in terms of investment goods. Our log-linear approximation solution

strategy requires the level and first two derivatives of

![]() in steady state. We

treat

in steady state. We

treat

![]() as a

parameter to be estimated and impose that

as a

parameter to be estimated and impose that ![]() and

and ![]() in steady state. Although the steady

state of the model does not depend on the value of

in steady state. Although the steady

state of the model does not depend on the value of

![]() the dynamics do. Given our

solution procedure, we do not need to specify any other features of

the function

the dynamics do. Given our

solution procedure, we do not need to specify any other features of

the function ![]()

The household's stock of physical capital evolves according to:

|

(14) |

where ![]() denotes the physical rate of

depreciation, and

denotes the physical rate of

depreciation, and ![]() denotes time

denotes time

![]() investment goods. The adjustment cost

function,

investment goods. The adjustment cost

function, ![]() is assumed to be increasing, convex

and to satisfy

is assumed to be increasing, convex

and to satisfy

![]() in steady state. We treat the

second derivative of

in steady state. We treat the

second derivative of ![]() in steady state,

in steady state,

![]() as a parameter to be

estimated. Although the steady state of the model does not depend

on the value of

as a parameter to be

estimated. Although the steady state of the model does not depend

on the value of

![]() the dynamics do. Given our

solution procedure, we do not need to specify any other features of

the function

the dynamics do. Given our

solution procedure, we do not need to specify any other features of

the function ![]()

2.1.4. The Wage Decision

As in Erceg, Henderson, and Levin (2000), we assume that the

![]() household is a monopoly supplier of a

differentiated labor service,

household is a monopoly supplier of a

differentiated labor service, ![]() . It sells

this service to a representative, competitive firm that transforms

it into an aggregate labor input,

. It sells

this service to a representative, competitive firm that transforms

it into an aggregate labor input, ![]() using

the technology:

using

the technology:

![$\displaystyle H_{t}=\left[ \int_{0}^{1}h_{j,t}^{\frac{1}{\lambda_{w}}}dj\right] ^{\lambda_{w}},$](img179.gif)

The demand curve for ![]() is given by:

is given by:

|

(15) |

Here, ![]() is the aggregate wage rate, i.e., the

nominal price of

is the aggregate wage rate, i.e., the

nominal price of ![]() It is straightforward to show

that

It is straightforward to show

that ![]() is related to

is related to ![]() via the relationship:

via the relationship:

![$\displaystyle W_{t}=\left[ \int_{0}^{1}\left( W_{j,t}\right) ^{\frac{1}{1-\lambda_{w}} }dj\right] ^{1-\lambda_{w}}.$](img187.gif)

|

(16) |

The household takes ![]() and

and ![]() as given.

as given.

Households set their nominal wage according to a variant of the

mechanism by which intermediate good firms set prices. In each

period, a household faces a constant probability,

![]() of being able to re-optimize its

nominal wage. The ability to re-optimize is independent across

households and time. If a household cannot re-optimize its wage at

time

of being able to re-optimize its

nominal wage. The ability to re-optimize is independent across

households and time. If a household cannot re-optimize its wage at

time ![]() it sets

it sets ![]() according to:

according to:

| (17) |

The presence of

![]() in (17) implies that there are no distortions from wage

dispersion along the steady state growth path.

in (17) implies that there are no distortions from wage

dispersion along the steady state growth path.

2.1.5. Monetary and Fiscal Policy

We adopt the following specification of monetary policy:

Here ![]() represents the gross growth rate of

money,

represents the gross growth rate of

money,

![]() We assume that

We assume that

Here,

![]() represents a shock to

monetary policy. We denote the standard deviation of

represents a shock to

monetary policy. We denote the standard deviation of

![]() by

by

![]() . The dynamic response of

. The dynamic response of

![]() to

to

![]() is characterized by a

first order autoregression, so that

is characterized by a

first order autoregression, so that

![]() is the response of

is the response of

![]() to a one-unit time

to a one-unit time

![]() monetary policy shock. The term

monetary policy shock. The term

![]() captures the response of

monetary policy to an innovation in neutral technology,

captures the response of

monetary policy to an innovation in neutral technology,

![]() We assume that

We assume that

![]() is characterized by an

ARMA(1,1) process. The term,

is characterized by an

ARMA(1,1) process. The term,

![]() captures the response

of monetary policy to an innovation in capital-embodied technology,

captures the response

of monetary policy to an innovation in capital-embodied technology,

![]() We assume that

We assume that

![]() is also characterized

by an ARMA(1,1) process.

is also characterized

by an ARMA(1,1) process.

In models with nominal rigidities, it is generally the case that the dynamic response functions to shocks depend heavily on the nature of monetary policy. CEE (2005) show that for a very closely related model the impulse response function to a monetary policy shock as parameterized above are very similar to the response obtained when the central bank is instead assumed to follow an explicit Taylor rule.

Finally, we assume that the government adjusts lump sum taxes to ensure that its intertemporal budget constraint holds.

2.1.6. Loan Market Clearing, Final Goods Market Clearing and Equilibrium

Financial intermediaries receive

![]() from

the household. Our notation reflects the equilibrium condition,

from

the household. Our notation reflects the equilibrium condition,

![]() Financial intermediaries

lend all of their money to intermediate good firms, which use the

funds to pay labor wages. Loan market clearing requires that:

Financial intermediaries

lend all of their money to intermediate good firms, which use the

funds to pay labor wages. Loan market clearing requires that:

| (19) |

The aggregate resource constraint is:

| (20) |

We adopt a standard sequence-of-markets equilibrium concept. In the technical appendix to this paper, Altig et al. (ACEL henceforth, 2004), we discuss our computational strategy for approximating that equilibrium. This strategy involves taking a (log-)linear approximation about the non-stochastic steady state of the economy and using the solution methods discussed in Anderson and Moore (1985) and Christiano (2002).

2.2. The Firm-Specific Capital Model

In this model, firms own their own capital. The firm cannot adjust its capital stock within the period. It can only change its stock of capital over time by varying the rate of investment. In all other respects the problem of intermediate good firms is the same as before. In particular, they face the same demand curve, (2), production technology, (4)-(8), and Calvo-style pricing frictions, including the updating rule given by (9).

The technology for accumulating physical capital by intermediate

good firm ![]() is given by

is given by

The present discounted value of the ![]() intermediate good's net cash flow is given by:

intermediate good's net cash flow is given by:

![$\displaystyle E_{t}\sum_{j=0}^{\infty}\beta^{j}\upsilon_{t+j}\left\{ P_{t+j}(i)y_{t+j} (i)-P_{t+j}R_{t+j}w_{t+j}(i)h_{t}(i)-P_{t+j}\Upsilon_{t+j}^{-1}\left[ I_{t+j}(i)+a\left( u_{t+j}(i)\right) \bar{K}(i)_{t+j}\right] \right\} .$](img225.gif)

|

(21) |

Time ![]() net cash flow equals sales, less labor

costs (inclusive of interest charges) less the costs associated

with capital utilization and capital accumulation.

net cash flow equals sales, less labor

costs (inclusive of interest charges) less the costs associated

with capital utilization and capital accumulation.

The sequence of events as it pertains to the ![]() firm is as follows. At the beginning of period

firm is as follows. At the beginning of period

![]() the firm has a given stock of physical

capital,

the firm has a given stock of physical

capital,

![]() . After observing the

technology shocks, the firm sets its price,

. After observing the

technology shocks, the firm sets its price, ![]() subject to the Calvo-style frictions described above. The firm also

makes its investment and capital utilization decisions,

subject to the Calvo-style frictions described above. The firm also

makes its investment and capital utilization decisions, ![]() and

and ![]() respectively. The

time

respectively. The

time ![]() monetary policy shock then occurs and the

demand for the firm's product is realized. The firm then purchases

labor to satisfy the demand for its output. Subject to these timing

and other constraints, the problem of the firm is to choose prices,

employment, the level of investment and utilization to maximize net

discounted cash flow.

monetary policy shock then occurs and the

demand for the firm's product is realized. The firm then purchases

labor to satisfy the demand for its output. Subject to these timing

and other constraints, the problem of the firm is to choose prices,

employment, the level of investment and utilization to maximize net

discounted cash flow.

2.3. Implications for Inflation

The equations which characterize equilibrium for the homogenous and firm-specific capital model are identical except for the equation which characterizes aggregate inflation dynamics. This equation is of the form:

| (22) |

where

and ![]() is the first difference operator. The

information set

is the first difference operator. The

information set

![]() includes the current realization

of the technology shocks, but not the current realization of the

innovation to monetary policy. The variable

includes the current realization

of the technology shocks, but not the current realization of the

innovation to monetary policy. The variable ![]() denotes the economy-wide average marginal cost of production, in

units of the final good.

denotes the economy-wide average marginal cost of production, in

units of the final good.

In ACEL (2004) we establish the following19:

Proposition 1 (i) In the homogeneous capital model,

![]() (ii) In the firm-specific capital

model,

(ii) In the firm-specific capital

model, ![]() is a particular non-linear function of

the parameters of the model.

is a particular non-linear function of

the parameters of the model.

We parameterize the firm-specific and homogeneous capital model

in terms of ![]() rather than

rather than ![]() Consequently, the list of parameters for the two

models remains identical. Given values for these parameters, the

two models are observationally equivalent with respect to aggregate

prices and quantities. This means that we do not need to take a

stand on which version of the model we are working with at the

estimation stage of our analysis.

Consequently, the list of parameters for the two

models remains identical. Given values for these parameters, the

two models are observationally equivalent with respect to aggregate

prices and quantities. This means that we do not need to take a

stand on which version of the model we are working with at the

estimation stage of our analysis.

3. Econometric Methodology

We employ a variant of the limited information strategy used in

CEE (2005) (see also Rotemberg and Woodford (1997)). Define the ten

dimensional vector, ![]() :

:

![$\displaystyle \underset{10\times1}{\underbrace{Y_{t}}}=\left( \begin{array}[c]{c} \Delta\ln\text{(relative price of investment}_{t}\text{)}\\ \Delta\ln\text{(}GDP_{t}/\text{Hours}_{t}\text{)}\\ \Delta\ln\text{(}GDP\text{ deflator}_{t}\text{)}\\ \text{Capacity Utilization}_{t}\\ \ln\text{(Hours}_{t}\text{)}\\ \ln\text{(}GDP_{t}/\text{Hours}_{t}\text{)}-\ln\text{(}W_{t}/P_{t}\text{)}\\ \ln\text{(}C_{t}/GDP_{t}\text{)}\\ \ln\text{(}I_{t}/GDP_{t}\text{)}\\ \text{Federal Funds Rate}_{t}\\ \ln(GDP\text{ deflator}_{t})+\ln\text{(}GDP_{t}\text{)}-\ln\text{(} MZM_{t}\text{)} \end{array} \right) =\left( \begin{array}[c]{c} \underset{1\times1}{\underbrace{\Delta p_{It}}}\\ \underset{1\times1}{\underbrace{\Delta a_{t}}}\\ \underset{6\times1}{\underbrace{Y_{1t}}}\\ \underset{1\times1}{\underbrace{R_{t}}}\\ \underset{1\times1}{\underbrace{Y_{2t}}} \end{array} \right)$](img244.gif)

|

(23) |

We embed our identifying assumptions as restrictions on the parameters of the following reduced form VAR:

| (24) | ||

where ![]() is a

is a ![]() -ordered

polynomial in the lag operator,

-ordered

polynomial in the lag operator, ![]() The "

fundamental" economic shocks,

The "

fundamental" economic shocks,

![]() are related to

are related to ![]() as follows:

as follows:

| (25) |

where ![]() is a square matrix and

is a square matrix and ![]() is the identity matrix. We assume that

is the identity matrix. We assume that

![]() is a martingale difference

stochastic process, so that we allow for the presence of

conditional heteroscedasticity.20 We require

is a martingale difference

stochastic process, so that we allow for the presence of

conditional heteroscedasticity.20 We require ![]() and the

and the ![]() column of

column of ![]()

![]() to calculate the dynamic response of

to calculate the dynamic response of

![]() to a disturbance in the

to a disturbance in the ![]() fundamental shock,

fundamental shock,

![]()

According to our economic model, the variables in ![]() defined in (23), are stationary

stochastic processes. We partition

defined in (23), are stationary

stochastic processes. We partition

![]() conformably with the

partitioning of

conformably with the

partitioning of ![]()

![$\displaystyle \varepsilon_{t}=\left( \begin{array}[c]{ccccc} \underset{1\times1}{\underbrace{\varepsilon_{\Upsilon,t}}} & \underset{1\times 1}{\underbrace{\varepsilon_{z,t}}} & \underset{1\times 6}{\underbrace{\varepsilon_{1t}^{\prime}}} & \underset{1\times 1}{\underbrace{\varepsilon_{M,t}}} & \underset{1\times 1}{\underbrace{\varepsilon_{2t}}} \end{array} \right) ^{\prime}.$](img269.gif)

|

(26) |

Here,

![]() is the innovation to a

neutral technology shock,

is the innovation to a

neutral technology shock,

![]() is the innovation

in capital-embodied technology, and

is the innovation

in capital-embodied technology, and

![]() is the monetary policy

shock.

is the monetary policy

shock.

3.1. Identification of Impulse Responses

We assume that policy makers set the interest rate so that the following rule is satisfied:

| (27) |

where

![]() is the monetary policy

shock and

is the monetary policy

shock and

![]() is a constant. We interpret

(27) as a reduced form Taylor rule. To ensure

identification of the monetary policy shock, we assume

is a constant. We interpret

(27) as a reduced form Taylor rule. To ensure

identification of the monetary policy shock, we assume ![]() is linear,

is linear,

![]() contains

contains ![]()

![]() and the only date

and the only date ![]() variables in

variables in

![]() are {

are {

![]() }. Finally,

we assume that

}. Finally,

we assume that

![]() is orthogonal to

is orthogonal to

![]()

As in Fisher (2006), we assume that innovations to technology (both neutral and capital-embodied) are the only shocks which affect the level of labor productivity in the long run. In addition, we assume that capital embodied technology shocks are the only shocks that affect the price of investment goods relative to consumption goods in the long run. These assumptions are satisfied in our model.

To compute the responses of ![]() to

to

![]()

![]() and

and

![]() we require estimates of

the parameters in

we require estimates of

the parameters in ![]() as well as the

as well as the

![]()

![]() and

and

![]() columns of

columns of ![]() We

obtain these estimates using a suitably modified variant of the

instrumental variables strategy proposed by Shapiro and Watson

(1988). See ACEL (2004) for further details.

We

obtain these estimates using a suitably modified variant of the

instrumental variables strategy proposed by Shapiro and Watson

(1988). See ACEL (2004) for further details.

4. Estimation Results Based on a Structural Vector Autoregression

In this section we describe the dynamic response of the economy to monetary policy shocks, neutral technology shocks and capital embodied shocks. In addition, we discuss the quantitative contribution of these shocks to the cyclical fluctuations in aggregate economic activity. In the first subsection we describe the data used in the analysis. In the second and third subsections we discuss the impulse response functions and the importance of the shocks to aggregate fluctuations.

4.1. Data

With the exception of the price of investment and of monetary

transactions balances, all data were taken from the FRED Database

available through the Federal Reserve Bank of St. Louis.21 The

price of investment corresponds to the 'total investment' series

constructed and used in Fisher (2006).22 Our measure of

transactions balances, ![]() was obtained from the

Federal Reserve Bank of St. Louis's online database. Our data are

quarterly, and the sample period is 1982:1-2008:3.23

was obtained from the

Federal Reserve Bank of St. Louis's online database. Our data are

quarterly, and the sample period is 1982:1-2008:3.23

We work with the monetary aggregate, ![]() for the

following reasons. First,

for the

following reasons. First, ![]() is constructed

to be a measure of transactions balances, so it is a natural

empirical counterpart to our model variable,

is constructed

to be a measure of transactions balances, so it is a natural

empirical counterpart to our model variable, ![]() Second, our statistical procedure requires that the

velocity of money is stationary. The velocity of

Second, our statistical procedure requires that the

velocity of money is stationary. The velocity of ![]() is reasonably characterized as being stationary. The

stationarity assumption is more problematic for the velocity of

aggregates like the base,

is reasonably characterized as being stationary. The

stationarity assumption is more problematic for the velocity of

aggregates like the base, ![]() and

and ![]()

4.2. Estimated Impulse Response Functions

In this subsection we discuss our estimates of the dynamic

response of ![]() to monetary policy and technology

shocks. To obtain these estimates we set

to monetary policy and technology

shocks. To obtain these estimates we set ![]() the

number of lags in the VAR, to 4. Various

indicators suggest that this value of

the

number of lags in the VAR, to 4. Various

indicators suggest that this value of ![]() is large

enough to adequately capture the dynamics in the data. For example,

the Akaike, Hannan-Quinn and Schwartz criteria support a choice of

is large

enough to adequately capture the dynamics in the data. For example,

the Akaike, Hannan-Quinn and Schwartz criteria support a choice of

![]() 2, 1,

respectively.24 We also compute the multivariate

Portmanteau (Q) statistic to test the null hypothesis of zero

serial correlation up to lag

2, 1,

respectively.24 We also compute the multivariate

Portmanteau (Q) statistic to test the null hypothesis of zero

serial correlation up to lag ![]() in the VAR

disturbances. We consider

in the VAR

disturbances. We consider ![]() 6, 8, 10. The test

statistics are, respectively,

6, 8, 10. The test

statistics are, respectively, ![]() 475, 680, 880. Using

conventional asymptotic sampling theory, these

475, 680, 880. Using

conventional asymptotic sampling theory, these ![]() statistics all have a

statistics all have a ![]() -value very close to zero,

indicating a rejection of the null hypothesis. However, we find

evidence that the asymptotic sampling theory rejects the null

hypothesis too often. When we simulate the

-value very close to zero,

indicating a rejection of the null hypothesis. However, we find

evidence that the asymptotic sampling theory rejects the null

hypothesis too often. When we simulate the ![]() statistic using repeated artificial data sets generated from our

estimated VAR, we find that the

statistic using repeated artificial data sets generated from our

estimated VAR, we find that the ![]() -values of our

-values of our

![]() statistics are 97, 87, 90 and 95 percent, respectively. For these calculations, each

artificial data set is of length equal to that of our actual

sample, and is generated by bootstrap sampling from the fitted

disturbances in our estimated VAR. On this basis we do not strongly

reject the null hypothesis that the disturbance terms in a VAR with

statistics are 97, 87, 90 and 95 percent, respectively. For these calculations, each

artificial data set is of length equal to that of our actual

sample, and is generated by bootstrap sampling from the fitted

disturbances in our estimated VAR. On this basis we do not strongly

reject the null hypothesis that the disturbance terms in a VAR with

![]() are serially uncorrelated.

are serially uncorrelated.

Figure 1 displays the response of the variables in our analysis to a one standard deviation monetary policy shock (roughly 30 basis points). In each case, there is a solid line in the center of a gray area. The gray area represents a 95 percent confidence interval, and the solid line represents the point estimates.25 Except for inflation and the interest rate, all variables are expressed in percent terms. So, for example, the peak response of output is about 0.15 percent. The Federal Funds rate is expressed in units of percentage points, at an annual rate. Inflation is expressed in units of percentage points, at a quarterly rate.

Six features of Figure 1 are worth noting. First, the effect of a policy shock on the money growth rate and the interest rate is completed within roughly one year. Other quantity variables respond over a longer period of time. Second, there is a significant liquidity effect, i.e. the interest rate and money growth move in opposite directions after a policy shock. Third, inflation responds very weakly to the policy shock. Fourth, output, consumption, investment, hours worked and capacity utilization all display hump-shaped responses. With the exception of hours worked, the peak response in these aggregates occurs roughly one year after the shock. The hump shaped response in hours worked is more drawn out, with the peak occurring after approximately two years. Fifth, velocity co-moves with the interest rate, with both initially falling in response to a monetary policy shock, and then rising. Sixth, the real wage does not respond significantly to a monetary policy shock, but after a delay the price of investment does.

Figure 2 displays the response of the variables in our analysis

to a positive, one standard deviation shock in neutral technology,

![]() By construction, the impact of this

technology shock on output, labor productivity, consumption,

investment and the real wage can be permanent. Because the roots of

our estimated VAR are stable, the impact of a neutral technology

shock on the variables whose levels appear in

By construction, the impact of this

technology shock on output, labor productivity, consumption,

investment and the real wage can be permanent. Because the roots of

our estimated VAR are stable, the impact of a neutral technology

shock on the variables whose levels appear in ![]() must be temporary. These variables are the Federal

Funds rate, capacity utilization, hours worked, velocity and

inflation.

must be temporary. These variables are the Federal

Funds rate, capacity utilization, hours worked, velocity and

inflation.

According to Figure 2 a positive, neutral technology shock leads to a persistent rise in output with a peak rise of roughly 0.35 percent over the period displayed. In addition, hours worked, investment and consumption rise in response to the technology shock. These rises are only marginally statistically significant. Finally notice that a neutral technology shock leads to an initial sharp fall in the inflation rate.26. Overall, these effects are broadly consistent with what a student of real business cycle models might expect.

Figure 3 displays the response of the variables in our analysis

to a one standard deviation positive capital-embodied technology

shock,

![]() This shock leads

to statistically significant rises in output, hours worked,

capacity utilization, investment and the federal funds rate. At the

same time, it leads to an initial fall in the price of investment

of roughly 0.2 percent, followed by an ongoing

significant decline. Finally, the shock also leads a marginally

significant decline in real wages.

This shock leads

to statistically significant rises in output, hours worked,

capacity utilization, investment and the federal funds rate. At the

same time, it leads to an initial fall in the price of investment

of roughly 0.2 percent, followed by an ongoing

significant decline. Finally, the shock also leads a marginally

significant decline in real wages.

4.3. The Contribution of Monetary Policy and Technology Shocks to Aggregate Fluctuations

We now briefly discuss the contribution of monetary policy and

technology shocks to cyclical fluctuations in economic activity.

Table 1 summarizes the contribution of the three shocks to the

variables in our analysis. We define business cycle frequencies as

the components of a time series with periods of 8 to 32 quarters.

The columns in Table 1 report the fraction of the variance in the

cyclical frequencies accounted for by our three shocks. Each row

corresponds to a different variable. Using the techniques described

in Christiano and Fitzgerald (2003), we calculate the fractions as

follows. Let

![]() denote the spectral density at

frequency

denote the spectral density at

frequency ![]() of a given variable, when only

shock

of a given variable, when only

shock ![]() is active. That is, the variance of all

shocks in

is active. That is, the variance of all

shocks in

![]() apart from the

apart from the ![]() are set to zero and the variance of the

are set to zero and the variance of the ![]() shock in

shock in

![]() is set to unity. Let

is set to unity. Let

![]() denote the corresponding spectral

density when the variance of each element of

denote the corresponding spectral

density when the variance of each element of

![]() is set to unity. The

contribution of shock

is set to unity. The

contribution of shock ![]() to variance in the business

cycle frequencies is then defined as:

to variance in the business

cycle frequencies is then defined as:

Our estimate of the spectral density is the one implied by our estimated VAR.27 Numbers in parentheses are the standard errors, which we estimate by bootstrap methods. Finally, the fraction of the variance accounted for by all three shocks is just the sum of the individual fractions of the variance.

Table 1 shows that the three shocks together account for a substantial portion of the cyclical variance in the aggregate quantities. For example, they account for roughly 60 percent of the variation in aggregate output, with the capital-embodied technology shock playing the largest role. Indeed the capital-embodied technology shock is the largest contributor to the cyclical variation in all of the variables included in the VAR. Intriguingly, the capital embodied technology shock accounts for nearly 30% of the cyclical variation in the real wage, a variable whose cyclical variation is typically difficult to account for empirically.

5. Estimation Results for the Equilibrium Model

In this section we discuss the estimated parameter values. In addition, we assess the ability of the estimated model to account for the impulse response functions discussed in Section 4.

5.1. Benchmark Model Parameter Estimates

We partition the parameters of the model into three groups. The

first group of parameters,

![]() is:

is:

The second group of parameters,

![]() pertain to the 'non-stochastic

part' of the model:

pertain to the 'non-stochastic

part' of the model:

The third set of parameters,

![]() pertain to the stochastic part of

the model:

pertain to the stochastic part of

the model:

We estimate the values of ![]() and

and

![]() and set the values of

and set the values of ![]() a priori. We assume

a priori. We assume

![]() , which implies a steady

state annualized real interest rate of 3 percent. We

set

, which implies a steady

state annualized real interest rate of 3 percent. We

set

![]() which corresponds to a steady

state share of capital income equal to roughly 36

percent.28 We set

which corresponds to a steady

state share of capital income equal to roughly 36

percent.28 We set

![]() , which implies an annual rate

of depreciation on capital equal to 10 percent. This value of

, which implies an annual rate

of depreciation on capital equal to 10 percent. This value of

![]() is roughly equal to the estimate

reported in Christiano and Eichenbaum (1992). The parameter,

is roughly equal to the estimate

reported in Christiano and Eichenbaum (1992). The parameter,

![]() is set to guarantee that profits are

zero in steady state. As in CEE (2005), we set the parameter,

is set to guarantee that profits are

zero in steady state. As in CEE (2005), we set the parameter,

![]() to 1.05. We set

the parameter

to 1.05. We set

the parameter ![]() to one.

to one.

The steady state growth of real per capita GDP, ![]() is given by

is given by

Given an estimate of ![]() and

and

![]() we use this equation to

estimate

we use this equation to

estimate ![]() We use data over the sample period

1959II - 2001IV, the sample period in ACEL (2005), to estimate the

parameters

We use data over the sample period

1959II - 2001IV, the sample period in ACEL (2005), to estimate the

parameters

![]() and

and ![]() If we use the sample period 1982:1-2008:3, then the implied point

estimate of

If we use the sample period 1982:1-2008:3, then the implied point

estimate of ![]() is less than one, a value that

seems implausible to us. It seems reasonable to extend the sample

back in time because the value of

is less than one, a value that

seems implausible to us. It seems reasonable to extend the sample

back in time because the value of ![]() should

not be affected by any change in the monetary policy regime that

occurred in the early 1980's. For comparability with ACEL (2005) we

stopped the sample period at 2001IV.29With these

considerations in mind, we set the parameter

should

not be affected by any change in the monetary policy regime that

occurred in the early 1980's. For comparability with ACEL (2005) we

stopped the sample period at 2001IV.29With these

considerations in mind, we set the parameter

![]() to 1.0042.

At an annualized rate, this value is equal to the negative of the

average growth rate of the price of investment relative to the GDP

deflator which fell at an annual average rate of 1.68 percent over the ACEL (2005) sample period. The average

growth rate of per capita GDP in the ACEL (2005) sample period is

to 1.0042.

At an annualized rate, this value is equal to the negative of the

average growth rate of the price of investment relative to the GDP

deflator which fell at an annual average rate of 1.68 percent over the ACEL (2005) sample period. The average

growth rate of per capita GDP in the ACEL (2005) sample period is

![]() Solving the previous

equation for

Solving the previous

equation for ![]() yields

yields

![]() which is the value of

which is the value of

![]() we use in our analysis.30 We

set the average growth rate of money,

we use in our analysis.30 We

set the average growth rate of money, ![]() equal

to 1.017.31 This value corresponds to the

average quarterly growth rate of money

equal

to 1.017.31 This value corresponds to the

average quarterly growth rate of money ![]() over the

ACEL (2005) sample period.

over the

ACEL (2005) sample period.

We set the parameters

![]() and

and ![]() to

0.45 and 0.036, respectively.

The value of

to

0.45 and 0.036, respectively.

The value of

![]() corresponds to the average value

of

corresponds to the average value

of

![]() in the ACEL (2005) sample

period, where

in the ACEL (2005) sample

period, where ![]() is measured by

is measured by ![]() We chose

We chose ![]() so that in conjunction

with the other parameter values of our model, the steady state

value of

so that in conjunction

with the other parameter values of our model, the steady state

value of ![]() is 0.025. This

corresponds to the percent of value-added in the finance, insurance

and real estate industry (see Christiano, Motto, and Rostagno

(2004)).

is 0.025. This

corresponds to the percent of value-added in the finance, insurance

and real estate industry (see Christiano, Motto, and Rostagno

(2004)).

The row labeled 'benchmark' in Table 2 summarizes our point

estimates of the parameters in the vector

![]() Standard errors are reported in

parentheses. The lower bound of unity is binding on

Standard errors are reported in

parentheses. The lower bound of unity is binding on

![]() So we simply set

So we simply set

![]() to 1.01 when we

estimate the model. However, the estimation criterion displays very

little curvature with respect to

to 1.01 when we

estimate the model. However, the estimation criterion displays very

little curvature with respect to

![]() . When we individually test the

hypotheses that

. When we individually test the

hypotheses that

![]() is 1.05 or

1.20 against the null that

is 1.05 or

1.20 against the null that

![]() we obtain a chi-square

statistic equal to 0.01 and 0.2, respectively, with associated probability values 0.0002

and 0.024, respectively. So we cannot clearly

reject either hypothesis. Tables 2 and 3 report point estimates for

we obtain a chi-square

statistic equal to 0.01 and 0.2, respectively, with associated probability values 0.0002

and 0.024, respectively. So we cannot clearly

reject either hypothesis. Tables 2 and 3 report point estimates for

![]() and

and ![]() when

we re-estimate the model setting

when

we re-estimate the model setting

![]() to 1.05 and

1.20.

to 1.05 and

1.20.

Our point estimate of ![]() implies that wage

contracts are re-optimized, on average, once every 4.5 quarters. To interpret our point estimate of

implies that wage

contracts are re-optimized, on average, once every 4.5 quarters. To interpret our point estimate of ![]() recall that in the homogeneous capital model,

recall that in the homogeneous capital model,

![]() So our point estimate of

So our point estimate of ![]() implies a value of

implies a value of

![]() equal to

equal to ![]() This

implies that firms re-optimize prices roughly every 9.36 quarters (see Table 4). This value is much larger than

the value used by Golosov and Lucas (2007) who calibrate their

model to micro data to ensure that the firms re-optimize prices on

average once every 1.5 quarters.

This

implies that firms re-optimize prices roughly every 9.36 quarters (see Table 4). This value is much larger than

the value used by Golosov and Lucas (2007) who calibrate their

model to micro data to ensure that the firms re-optimize prices on

average once every 1.5 quarters.

Table 4 shows that if we adopt the assumption that capital is firm-specific, then our estimates imply that firms re-optimize prices on average once every 1.8 quarters.32 So the assumption that capital is firm-specific has a very large impact on inference about the frequency at which firms re-optimize price.

To interpret the estimated value of

![]() , we consider the homogeneous

capital model. Linearizing the household's first order condition

for capital utilization about steady state yields:

, we consider the homogeneous

capital model. Linearizing the household's first order condition

for capital utilization about steady state yields:

According to this expression,

![]() , equal to 0.08 of a percent, is the elasticity of capital utilization

with respect to the rental rate of capital. Our estimate of

, equal to 0.08 of a percent, is the elasticity of capital utilization

with respect to the rental rate of capital. Our estimate of

![]() is larger than the value

estimated by CEE (2005) and indicates that it is relatively costly

for firms to vary the utilization of capital.

is larger than the value

estimated by CEE (2005) and indicates that it is relatively costly

for firms to vary the utilization of capital.

Our point estimate of the habit parameter ![]() is 0.76. This value is reasonably close to the

point estimate of 0.66, reported in CEE (2005)

and the value of 0.7 reported in Boldrin, Christiano,

and Fisher (2001). The latter authors argue that the ability of

standard general equilibrium models to account for the equity

premium and other asset market statistics is considerably enhanced

by the presence of habit formation in preferences.

is 0.76. This value is reasonably close to the

point estimate of 0.66, reported in CEE (2005)

and the value of 0.7 reported in Boldrin, Christiano,

and Fisher (2001). The latter authors argue that the ability of

standard general equilibrium models to account for the equity

premium and other asset market statistics is considerably enhanced

by the presence of habit formation in preferences.

We now discuss our point estimate of

![]() Suppose we denote by

Suppose we denote by

![]() the shadow price of one

unit of

the shadow price of one

unit of

![]() in terms of output. The

variable

in terms of output. The

variable

![]() is what the price of

installed capital would be in the homogeneous capital model if

there were a market for

is what the price of

installed capital would be in the homogeneous capital model if

there were a market for

![]() at the beginning of period

at the beginning of period

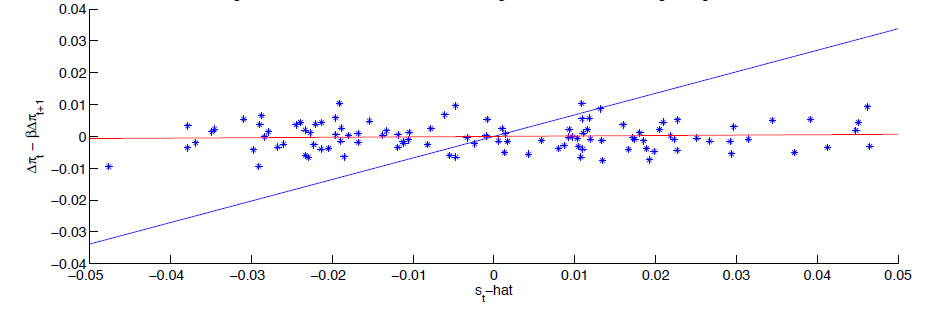

![]() Proceeding as in CEE (2005), it is