Overview: Federal Reserve System Boards of Directors

As the central bank of the United States, the Federal Reserve System conducts the nation's monetary policy and helps to maintain a stable financial system. Three key components of the Federal Reserve System—the Federal Reserve Board of Governors (Board of Governors), the Federal Reserve Banks (Reserve Banks), and the Federal Open Market Committee (FOMC)—interact to accomplish these goals. Pursuant to the Federal Reserve Act, each of the 12 Reserve Banks is subject to the supervision of a nine-member board of directors.

Structure and Composition

Reserve Bank Boards

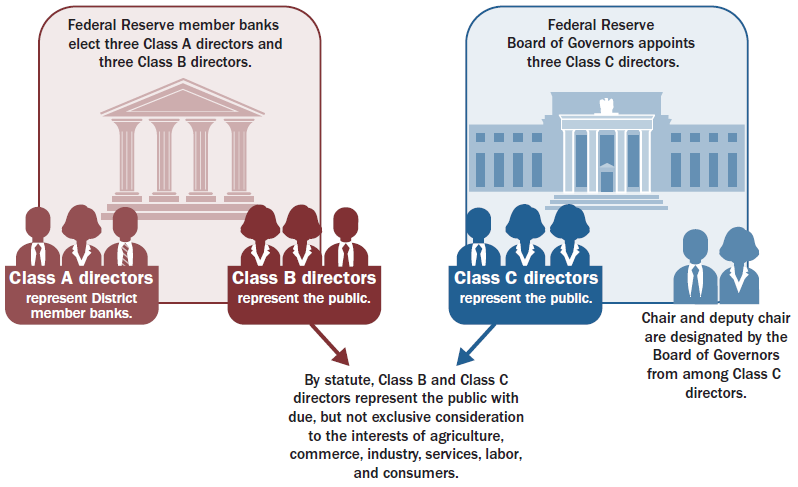

The Federal Reserve Act provides that Reserve Bank directors are divided into three classes—Class C, Class B, and Class A—of three directors each. Pursuant to the Act, the Board of Governors appoints Class C directors to represent the public, and designates a Chair and Deputy Chair for each Reserve Bank board from among that Bank’s Class C directors. Also by statute, Class B and A directors are elected by the member banks in their respective Federal Reserve District. Class B directors are elected to represent the public, and Class A directors are elected to represent the member banks.

Branch Boards

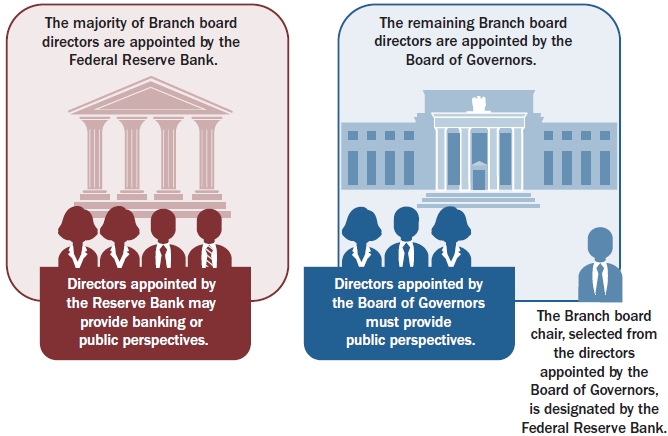

Most Reserve Banks, with the exception of Boston, New York, and Philadelphia, have at least one Branch, and each Branch has its own board of directors. Pursuant to the Federal Reserve Act, a majority of the directors on a Branch board are appointed by the Federal Reserve Bank in that District, and the remaining directors are appointed by the Board of Governors. Most Branch boards have seven directors, except for Helena, which has five directors.

Eligibility and Qualifications

The Federal Reserve Act also includes several provisions related to the eligibility and qualifications of directors. The Board has extended many of these statutory requirements by policy. Directors play a critical role in the effective functioning of the Federal Reserve System by providing a link between the System and the public, and their insights help to inform the FOMC's deliberations. In addition, directors perform an important corporate governance function for their respective Reserve Banks. For these reasons, directors are expected to contribute to the Federal Reserve System’s understanding of the economic conditions of their District and the effect of those conditions on the economy as a whole. Directors should be familiar with the economic and business community for the region for which they are selected. For more information about director eligibility and qualifications, and other policies governing directors, please consult the Roles and Responsibilities of Directors (PDF) and the Board Policies.

Tenure, Rotation, and Vacancies

Reserve Bank and Branch directors are elected or appointed to serve staggered, three-year terms. They are generally eligible to serve two full, three-year terms, or a maximum of seven consecutive years. When a director is unable to serve a full term, the successor director serves for the remaining portion of that three-year term.

Diversity

The Reserve Bank boards function most effectively when they are constituted in a manner that encourages a variety of perspectives and viewpoints. The Federal Reserve System works to ensure Reserve Bank and Branch boards of directors reflect the communities they serve. Further information about the composition of Reserve Bank and Branch boards and the sectors represented by Reserve Bank and Branch directors can be found in the linked tables.