Senior Credit Officer Opinion Survey on Dealer Financing Terms

Senior Credit Officer Opinion Survey, September 2023

Current Release RSS DDP

Summary

The September 2023 Senior Credit Officer Opinion Survey on Dealer Financing Terms (SCOOS) collected qualitative information on changes in credit terms and conditions in securities financing and over-the-counter (OTC) derivatives markets between mid-May 2023 and mid-August 2023. In addition to the core questions, the survey included a set of special questions about risk-management practices and client activity in the trading of zero-days-to-expiry (0DTE) options.1 The 21 institutions participating in the survey account for almost all dealer financing of dollar-denominated securities to nondealers and are the most active intermediaries in OTC derivatives markets. The survey was conducted between August 14, 2023, and August 28, 2023. The core questions asked about changes between mid-May 2023 and mid-August 2023.

Core Questions

(Questions 1–79)2

With regard to the credit terms applicable to, and mark and collateral disputes with, different counterparty types across the entire range of securities financing and OTC derivatives transactions, responses to the core questions revealed the following:

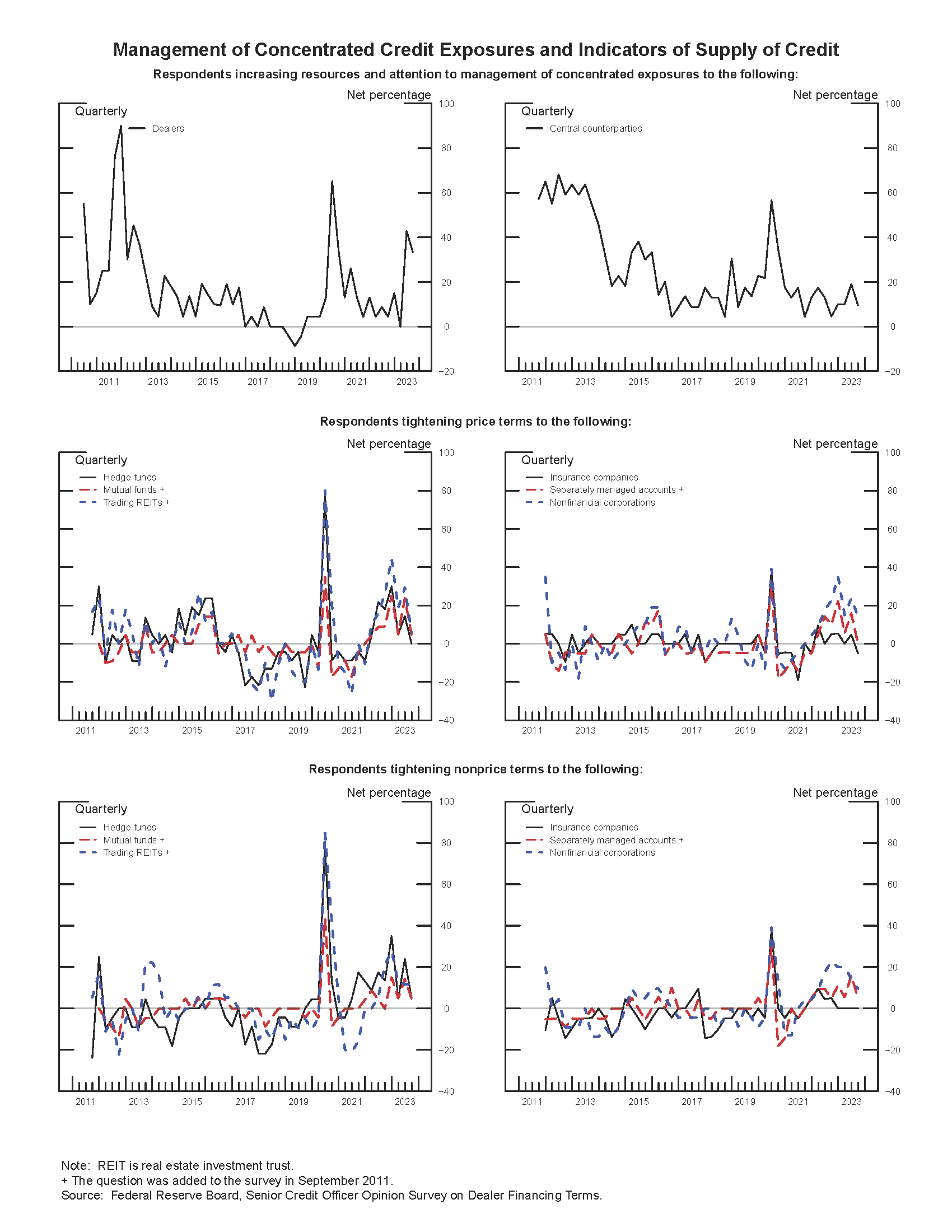

- Approximately two-fifths of dealers, on net, reported that they had increased the resources and attention they devoted to managing their concentrated credit exposure to other dealers and other financial intermediaries over the past three months. The net fractions reporting an increase in this survey and the June 2023 survey were the highest observed since the June 2020 SCOOS (see the exhibit "Management of Concentrated Credit Exposures and Indicators of Supply of Credit"). Nearly all dealers reported that the resources and attention they devoted to managing their concentrated credit exposure to central counterparties were unchanged. Almost all of the respondents indicated that changes in central counterparty practices have had either minimal or no effect on the credit terms they offer to clients on bilateral transactions that are not cleared.

- For all types of counterparties, the vast majority of dealers reported that both price and nonprice terms on securities financing transactions and OTC derivatives remained basically unchanged over the past three months.

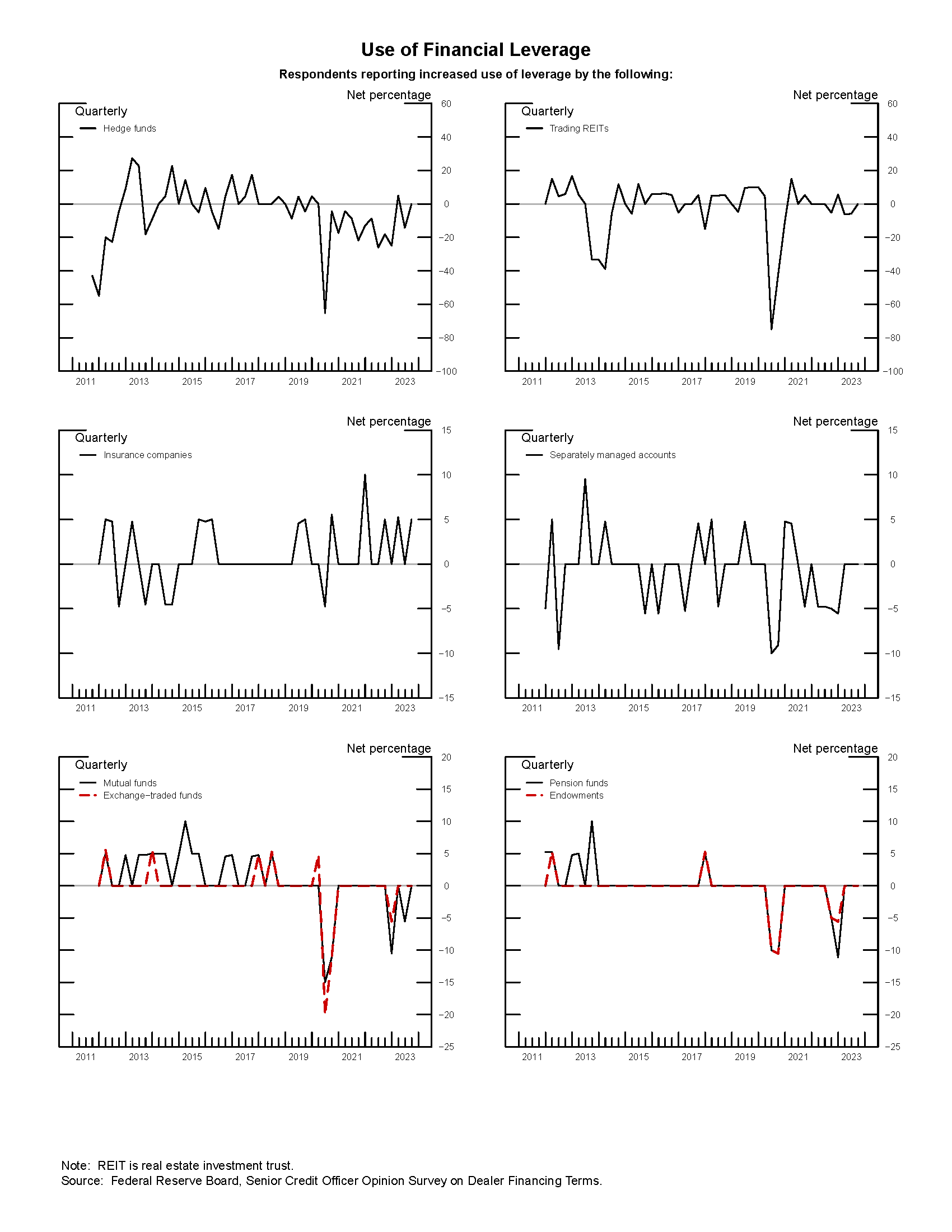

With respect to clients' use of financial leverage, all dealers reported that the use of financial leverage remained basically unchanged over the past three months (see the exhibit "Use of Financial Leverage").

With respect to OTC derivatives markets, responses to the core questions revealed the following:

- All dealers reported no changes in nonprice terms in master agreements.

- Nearly all dealers reported no changes in margin requirements for all types of OTC derivatives.

- The volume of mark and collateral disputes remained basically unchanged over the past three months for all types of OTC derivatives.

With respect to securities financing transactions, respondents indicated the following:

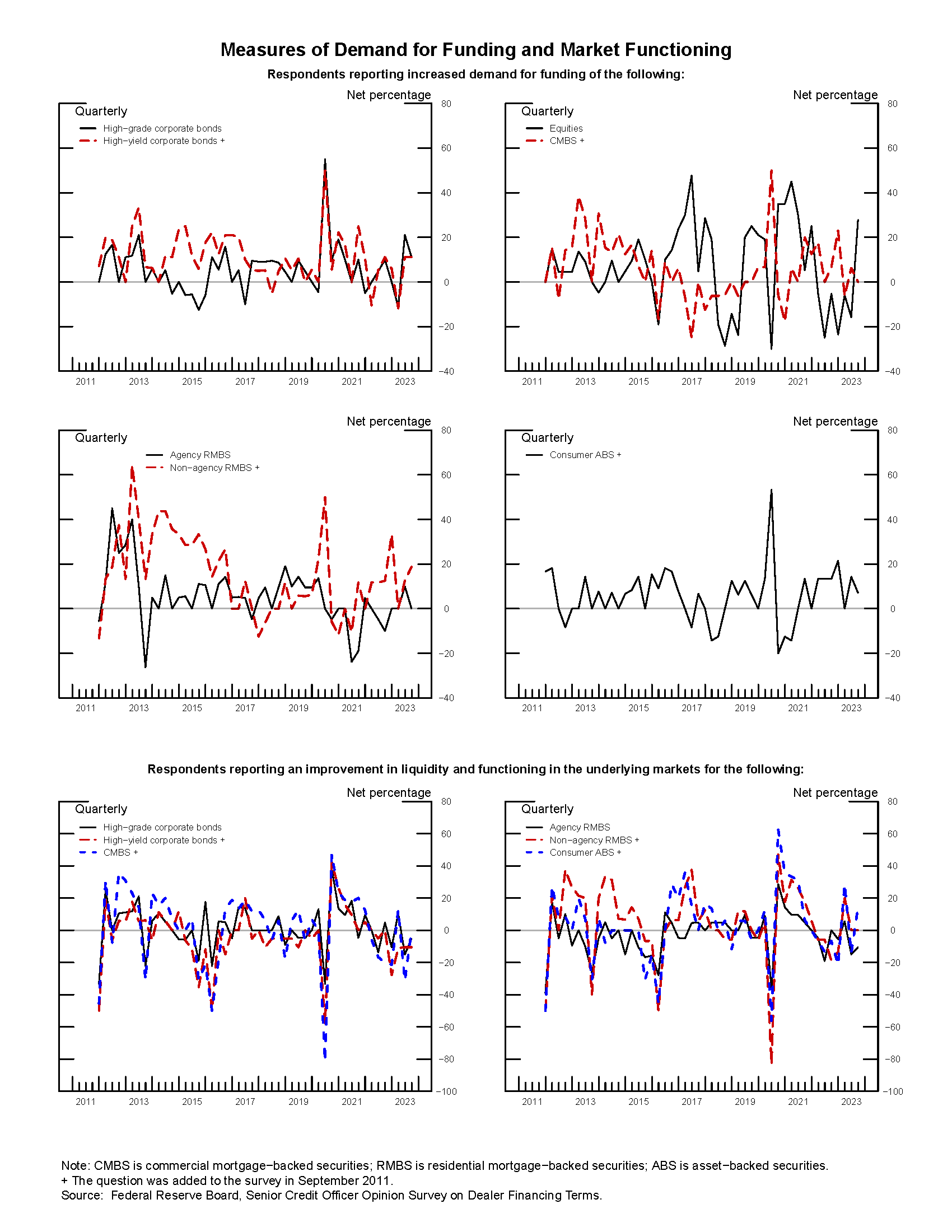

- Approximately one-fourth of dealers, on net, indicated increased funding demand for equities (including through stock loans) over the past three months (see the exhibit "Measures of Demand for Funding and Market Functioning"). Approximately one-seventh of dealers, on net, indicated increased funding and term funding demand for non-agency residential mortgage-backed securities.

- The vast majority of dealers indicated that securities financing terms remained unchanged over the past three months for all types of securities collateral.

- Nearly all dealers indicated that liquidity and market functioning for all types of securities remained unchanged over the past three months.

- The volume, duration, and persistence of mark and collateral disputes for all other securities remained basically unchanged over the past three months.

Special Questions on Risk-Management Practices and Client Activity in the Trading of Zero-Days-to-Expiry Options

(Questions 81–88)

In 2022, the Chicago Board Options Exchange introduced additional expiration cycles for weekly options on the S&P 500 index and on several index-linked exchange-traded funds (ETFs), thereby providing daily expirations for those options. This development was accompanied by a large increase in trading volume in options that expire on the same day the option trades are initiated, known as 0DTE options. These options now account for about half of all trading volume of S&P 500 index options and options on some index-linked ETFs. In the special questions, dealers were asked about the activity of their institutional clients who are actively trading 0DTE options and the dealers' management of counterparty risk associated with those clients.

Only dealers with clients who regularly trade equity options and also actively trade 0DTE options were asked to complete the special questions. Approximately one-half of survey participants (10 out of 21) reported to have such clients. In this section, fractions of responses are stated relative to the sample of the 10 responding dealers.3

With respect to the activity of institutional clients who actively trade 0DTE options, the dealers indicated the following:

- All dealers indicated that clients who actively trade 0DTE options constitute a small fraction of clients trading equity options.

- One-half of dealers indicated that for clients who actively trade 0DTE options, such trades account for less than 5 percent of option trades by option premiums paid or received. One-fifth of the dealers indicated that 0DTE trades account for between 10 and 20 percent of option trades, and one-fifth indicated that they account for over 50 percent of such trades.

- Only two-fifths of the dealers indicated an ability to identify 0DTE option strategies typically used by their clients. The survey asked about the share of 0DTE option trades (in dollars of option premiums paid or received) for each of the following types of strategies: spread trades with limited upside and downside (for example, bull or bear spreads, butterfly spreads, and iron condor); directional trades (long, or short, put or call); directional volatility trades (for example, long, or short, straddle or strangle); and calendar spread trades (trades involving opposing legs in 0DTE and longer-dated options). The responses revealed that each type of strategy accounts for at least a small share of 0DTE trading volume. Additionally, a few dealers reported a moderate share for spreads and calendar spreads, and a few dealers reported a large share for spreads and for directional trades.

- When asked about changes in clients' appetite for downside risk in 0DTE trades on days with elevated volatility early in the trading session, the great majority of dealers indicated that they were unable to judge that.

With respect to the management of counterparty risk associated with clients actively trading 0DTE options, the dealers reported the following:

- Three-fifths of the dealers reported that they collect margin on 0DTE option trades before the end of the trading session only when market volatility is elevated and that the margin is determined by the risk of the client's overall portfolio. Two-fifths of the dealers do not collect margin on 0DTE options.

- Over two-thirds of dealers ranked the collection of initial and variation margin among their top three most prevalent risk controls for overall portfolios of clients actively trading 0DTE options, with three-fifths of dealers selecting it as the most prevalent risk control measure. Fractions of one-half or more reported limits on potential future exposure, limits on profits and losses predicted by a stress test, and the monitoring of overall leverage and risk exposure among their top three most prevalent risk controls. Nearly all dealers indicated that the tightness of the three most prevalent risk controls for clients actively trading 0DTE options remained basically unchanged since the beginning of 2022.

- In response to the question on how frequently each of their top three most prevalent risk-control measures is monitored, dealers provided responses that varied by the type of risk control. The responses for the collection of initial and variation margin were nearly evenly split between being monitored periodically during the trading session, once a day after markets closed, and the former or the latter depending on market volatility and the size of the exposure. The responses further indicated that limits on potential future exposure and limits on stress-test profits and losses are predominantly monitored once a day after the market closes. Finally, the limits on long–short gross notional exposure and the monitoring of clients' overall leverage and risk exposure are predominantly checked periodically during the trading session.

This document was prepared by Valery Polkovnichenko, Division of Research and Statistics, Board of Governors of the Federal Reserve System. Assistance in developing and administering the survey was provided by staff members in the Capital Markets Function, the Statistics Function, and the Markets Group at the Federal Reserve Bank of New York.

1. 0DTE options expire on the same day the option trades are initiated, and daily margining requirements of the Options Clearing Corporation do not apply to these options. Return to text

2. Question 80, not discussed here, was optional and allowed respondents to provide additional comments. Return to text

3. Among the remaining dealers, seven indicated that they do not have institutional clients who regularly trade equity options, and four indicated that none of their clients who regularly trade equity options also actively trade 0DTE options. Return to text

Exhibit 1: Management of Concentrated Credit Exposures and Indicators of Supply of Credit

Exhibit 2: Use of Financial Leverage

Exhibit 3: Measures of Demand for Funding and Market Functioning

Results of the September 2023 Senior Credit Officer Opinion Survey on Dealer Financing Terms

The following results include the original instructions provided to the survey respondents. Please note that percentages are based on the number of financial institutions that gave responses other than "Not applicable." Components may not add to totals due to rounding.

Counterparty Types

Questions 1 through 40 ask about credit terms applicable to, and mark and collateral disputes with, different counterparty types, considering the entire range of securities financing and over-the-counter (OTC) derivatives transactions. Question 1 focuses on dealers and other financial intermediaries as counterparties; questions 2 and 3 on central counterparties and other financial utilities; questions 4 through 10 focus on hedge funds; questions 11 through 16 on trading real estate investment trusts (REITs); questions 17 through 22 on mutual funds, exchange-traded funds (ETFs), pension plans, and endowments; questions 23 through 28 on insurance companies; questions 29 through 34 on separately managed accounts established with investment advisers; and questions 35 through 38 on nonfinancial corporations. Questions 39 and 40 ask about mark and collateral disputes for each of the aforementioned counterparty types.

In some questions, the survey differentiates between the compensation demanded for bearing credit risk (price terms) and the contractual provisions used to mitigate exposures (nonprice terms). If your institution’s terms have tightened or eased over the past three months, please so report them regardless of how they stand relative to longer-term norms. Please focus your response on dollar-denominated instruments; if material differences exist with respect to instruments denominated in other currencies, please explain in the appropriate comment space. Where material differences exist across different business areas--for example, between traditional prime brokerage and OTC derivatives--please answer with regard to the business area generating the most exposure and explain in the appropriate comment space.

Dealers and Other Financial Intermediaries

1. Over the past three months, how has the amount of resources and attention your firm devotes to management of concentrated credit exposure to dealers and other financial intermediaries (such as large banking institutions) changed?

| Number of Respondents | Percentage | |

|---|---|---|

| Increased Considerably | 1 | 4.8 |

| Increased Somewhat | 7 | 33.3 |

| Remained Basically Unchanged | 12 | 57.1 |

| Decreased Somewhat | 1 | 4.8 |

| Decreased Considerably | 0 | 0.0 |

| Total | 21 | 100.0 |

Central Counterparties and Other Financial Utilities

2. Over the past three months, how has the amount of resources and attention your firm devotes to management of concentrated credit exposure to central counterparties and other financial utilities changed?

| Number of Respondents | Percentage | |

|---|---|---|

| Increased Considerably | 0 | 0.0 |

| Increased Somewhat | 2 | 9.5 |

| Remained Basically Unchanged | 19 | 90.5 |

| Decreased Somewhat | 0 | 0.0 |

| Decreased Considerably | 0 | 0.0 |

| Total | 21 | 100.0 |

3. To what extent have changes in the practices of central counterparties, including margin requirements and haircuts, influenced the credit terms your institution applies to clients on bilateral transactions which are not cleared?

| Number of Respondents | Percentage | |

|---|---|---|

| To A Considerable Extent | 0 | 0.0 |

| To Some Extent | 2 | 9.5 |

| To A Minimal Extent | 10 | 47.6 |

| Not At All | 9 | 42.9 |

| Total | 21 | 100.0 |

Hedge Funds

4. Over the past three months, how have the price terms (for example, financing rates) offered to hedge funds as reflected across the entire spectrum of securities financing and OTC derivatives transaction types changed, regardless of nonprice terms? (Please indicate tightening if terms have become more stringent-for example, if financing rates have risen.)

| Number of Respondents | Percentage | |

|---|---|---|

| Tightened Considerably | 0 | 0.0 |

| Tightened Somewhat | 0 | 0.0 |

| Remained Basically Unchanged | 21 | 100.0 |

| Eased Somewhat | 0 | 0.0 |

| Eased Considerably | 0 | 0.0 |

| Total | 21 | 100.0 |

5. Over the past three months, how has your use of nonprice terms (for example, haircuts, maximum maturity, covenants, cure periods, cross-default provisions, or other documentation features) with respect to hedge funds across the entire spectrum of securities financing and OTC derivatives transaction types changed, regardless of price terms? (Please indicate tightening if terms have become more stringent-for example, if haircuts have been increased.)

| Number of Respondents | Percentage | |

|---|---|---|

| Tightened Considerably | 0 | 0.0 |

| Tightened Somewhat | 1 | 4.8 |

| Remained Basically Unchanged | 20 | 95.2 |

| Eased Somewhat | 0 | 0.0 |

| Eased Considerably | 0 | 0.0 |

| Total | 21 | 100.0 |

6. To the extent that the price or nonprice terms applied to hedge funds have tightened or eased over the past three months (as reflected in your responses to questions 4 and 5), what are the most important reasons for the change?

- Possible reasons for tightening

- Deterioration in current or expected financial strength of counterparties

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Reduced willingness of your institution to take on risk

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Adoption of more-stringent market conventions (that is, collateral terms and agreements, ISDA protocols)

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Higher internal treasury charges for funding

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Diminished availability of balance sheet or capital at your institution

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Worsening in general market liquidity and functioning

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Less-aggressive competition from other institutions

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Other (please specify)

Number of Respondents Percentage Most Important 1 100.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 1 100.0

- Deterioration in current or expected financial strength of counterparties

- Possible reasons for easing

- Improvement in current or expected financial strength of counterparties

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Increased willingness of your institution to take on risk

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Adoption of less-stringent market conventions (that is, collateral terms and agreements, ISDA protocols)

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Lower internal treasury charges for funding

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Increased availability of balance sheet or capital at your institution

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Improvement in general market liquidity and functioning

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - More-aggressive competition from other institutions

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Other (please specify)

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0

- Improvement in current or expected financial strength of counterparties

7. How has the intensity of efforts by hedge funds to negotiate more-favorable price and nonprice terms changed over the past three months?

| Number of Respondents | Percentage | |

|---|---|---|

| Increased Considerably | 0 | 0.0 |

| Increased Somewhat | 2 | 9.5 |

| Remained Basically Unchanged | 19 | 90.5 |

| Decreased Somewhat | 0 | 0.0 |

| Decreased Considerably | 0 | 0.0 |

| Total | 21 | 100.0 |

8. Considering the entire range of transactions facilitated by your institution for such clients, how has the use of financial leverage by hedge funds changed over the past three months?

| Number of Respondents | Percentage | |

|---|---|---|

| Increased Considerably | 0 | 0.0 |

| Increased Somewhat | 0 | 0.0 |

| Remained Basically Unchanged | 21 | 100.0 |

| Decreased Somewhat | 0 | 0.0 |

| Decreased Considerably | 0 | 0.0 |

| Total | 21 | 100.0 |

9. Considering the entire range of transactions facilitated by your institution for such clients, how has the availability of additional (and currently unutilized) financial leverage under agreements currently in place with hedge funds (for example, under prime broker, warehouse agreements, and other committed but undrawn or partly drawn facilities) changed over the past three months?

| Number of Respondents | Percentage | |

|---|---|---|

| Increased Considerably | 0 | 0.0 |

| Increased Somewhat | 0 | 0.0 |

| Remained Basically Unchanged | 21 | 100.0 |

| Decreased Somewhat | 0 | 0.0 |

| Decreased Considerably | 0 | 0.0 |

| Total | 21 | 100.0 |

10. How has the provision of differential terms by your institution to most-favored (as a function of breadth, duration, and extent of relationship) hedge funds changed over the past three months?

| Number of Respondents | Percentage | |

|---|---|---|

| Increased Considerably | 0 | 0.0 |

| Increased Somewhat | 0 | 0.0 |

| Remained Basically Unchanged | 20 | 100.0 |

| Decreased Somewhat | 0 | 0.0 |

| Decreased Considerably | 0 | 0.0 |

| Total | 20 | 100.0 |

Trading Real Estate Investment Trusts

11. Over the past three months, how have the price terms (for example, financing rates) offered to trading REITs as reflected across the entire spectrum of securities financing and OTC derivatives transaction types changed, regardless of nonprice terms? (Please indicate tightening if terms have become more stringent-for example, if financing rates have risen.)

| Number of Respondents | Percentage | |

|---|---|---|

| Tightened Considerably | 0 | 0.0 |

| Tightened Somewhat | 1 | 5.9 |

| Remained Basically Unchanged | 16 | 94.1 |

| Eased Somewhat | 0 | 0.0 |

| Eased Considerably | 0 | 0.0 |

| Total | 17 | 100.0 |

12. Over the past three months, how has your use of nonprice terms (for example, haircuts, maximum maturity, covenants, cure periods, cross-default provisions or other documentation features) with respect to trading REITs across the entire spectrum of securities financing and OTC derivatives transaction types changed, regardless of price terms? (Please indicate tightening if terms have become more stringent-for example, if haircuts have been increased.)

| Number of Respondents | Percentage | |

|---|---|---|

| Tightened Considerably | 0 | 0.0 |

| Tightened Somewhat | 2 | 11.8 |

| Remained Basically Unchanged | 15 | 88.2 |

| Eased Somewhat | 0 | 0.0 |

| Eased Considerably | 0 | 0.0 |

| Total | 17 | 100.0 |

13. To the extent that the price or nonprice terms applied to trading REITs have tightened or eased over the past three months (as reflected in your responses to questions 11 and 12), what are the most important reasons for the change?

- Possible reasons for tightening

- Deterioration in current or expected financial strength of counterparties

Number of Respondents Percentage Most Important 2 100.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 2 100.0 - Reduced willingness of your institution to take on risk

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Adoption of more-stringent market conventions (that is, collateral terms and agreements, ISDA protocols)

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Higher internal treasury charges for funding

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Diminished availability of balance sheet or capital at your institution

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Worsening in general market liquidity and functioning

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Less-aggressive competition from other institutions

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Other (please specify)

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0

- Deterioration in current or expected financial strength of counterparties

- Possible reasons for easing

- Improvement in current or expected financial strength of counterparties

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Increased willingness of your institution to take on risk

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Adoption of less-stringent market conventions (that is, collateral terms and agreements, ISDA protocols)

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Lower internal treasury charges for funding

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Increased availability of balance sheet or capital at your institution

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Improvement in general market liquidity and functioning

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - More-aggressive competition from other institutions

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Other (please specify)

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0

- Improvement in current or expected financial strength of counterparties

14. How has the intensity of efforts by trading REITs to negotiate more-favorable price and nonprice terms changed over the past three months?

| Number of Respondents | Percentage | |

|---|---|---|

| Increased Considerably | 0 | 0.0 |

| Increased Somewhat | 1 | 5.9 |

| Remained Basically Unchanged | 15 | 88.2 |

| Decreased Somewhat | 1 | 5.9 |

| Decreased Considerably | 0 | 0.0 |

| Total | 17 | 100.0 |

15. Considering the entire range of transactions facilitated by your institution for such clients, how has the use of financial leverage by trading REITs changed over the past three months?

| Number of Respondents | Percentage | |

|---|---|---|

| Increased Considerably | 0 | 0.0 |

| Increased Somewhat | 1 | 5.9 |

| Remained Basically Unchanged | 15 | 88.2 |

| Decreased Somewhat | 1 | 5.9 |

| Decreased Considerably | 0 | 0.0 |

| Total | 17 | 100.0 |

16. How has the provision of differential terms by your institution to most-favored (as a function of breadth, duration, and extent of relationship) trading REITs changed over the past three months?

| Number of Respondents | Percentage | |

|---|---|---|

| Increased Considerably | 0 | 0.0 |

| Increased Somewhat | 0 | 0.0 |

| Remained Basically Unchanged | 17 | 100.0 |

| Decreased Somewhat | 0 | 0.0 |

| Decreased Considerably | 0 | 0.0 |

| Total | 17 | 100.0 |

Mutual Funds, Exchange-Traded Funds, Pension Plans, and Endowments

17. Over the past three months, how have the price terms (for example, financing rates) offered to mutual funds, ETFs, pension plans, and endowments as reflected across the entire spectrum of securities financing and OTC derivatives transaction types changed, regardless of nonprice terms? (Please indicate tightening if terms have become more stringent-for example, if financing rates have risen.)

| Number of Respondents | Percentage | |

|---|---|---|

| Tightened Considerably | 0 | 0.0 |

| Tightened Somewhat | 1 | 4.8 |

| Remained Basically Unchanged | 20 | 95.2 |

| Eased Somewhat | 0 | 0.0 |

| Eased Considerably | 0 | 0.0 |

| Total | 21 | 100.0 |

18. Over the past three months, how has your use of nonprice terms (for example, haircuts, maximum maturity, covenants, cure periods, cross-default provisions or other documentation features) with respect to mutual funds, ETFs, pension plans, and endowments across the entire spectrum of securities financing and OTC derivatives transaction types changed, regardless of price terms? (Please indicate tightening if terms have become more stringent-for example, if haircuts have been increased.)

| Number of Respondents | Percentage | |

|---|---|---|

| Tightened Considerably | 0 | 0.0 |

| Tightened Somewhat | 2 | 9.5 |

| Remained Basically Unchanged | 18 | 85.7 |

| Eased Somewhat | 1 | 4.8 |

| Eased Considerably | 0 | 0.0 |

| Total | 21 | 100.0 |

19. To the extent that the price or nonprice terms applied to mutual funds, ETFs, pension plans, and endowments have tightened or eased over the past three months (as reflected in your responses to questions 17 and 18), what are the most important reasons for the change?

- Possible reasons for tightening

- Deterioration in current or expected financial strength of counterparties

Number of Respondents Percentage Most Important 1 100.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 1 100.0 - Reduced willingness of your institution to take on risk

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Adoption of more-stringent market conventions (that is, collateral terms and agreements, ISDA protocols)

Number of Respondents Percentage Most Important 1 100.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 1 100.0 - Higher internal treasury charges for funding

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 1 100.0 3rd Most Important 0 0.0 Total 1 100.0 - Diminished availability of balance sheet or capital at your institution

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 1 100.0 Total 1 100.0 - Worsening in general market liquidity and functioning

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Less-aggressive competition from other institutions

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Other (please specify)

Number of Respondents Percentage Most Important 1 100.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 1 100.0

- Deterioration in current or expected financial strength of counterparties

- Possible reasons for easing

- Improvement in current or expected financial strength of counterparties

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Increased willingness of your institution to take on risk

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Adoption of less-stringent market conventions (that is, collateral terms and agreements, ISDA protocols)

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Lower internal treasury charges for funding

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Increased availability of balance sheet or capital at your institution

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Improvement in general market liquidity and functioning

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - More-aggressive competition from other institutions

Number of Respondents Percentage Most Important 1 100.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 1 100.0 - Other (please specify)

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0

- Improvement in current or expected financial strength of counterparties

20. How has the intensity of efforts by mutual funds, ETFs, pension plans, and endowments to negotiate more-favorable price and nonprice terms changed over the past three months?

| Number of Respondents | Percentage | |

|---|---|---|

| Increased Considerably | 0 | 0.0 |

| Increased Somewhat | 1 | 4.8 |

| Remained Basically Unchanged | 20 | 95.2 |

| Decreased Somewhat | 0 | 0.0 |

| Decreased Considerably | 0 | 0.0 |

| Total | 21 | 100.0 |

21. Considering the entire range of transactions facilitated by your institution, how has the use of financial leverage by each of the following types of clients changed over the past three months?

- Mutual funds

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 0 0.0 Remained Basically Unchanged 20 100.0 Decreased Somewhat 0 0.0 Decreased Considerably 0 0.0 Total 20 100.0 - ETFs

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 0 0.0 Remained Basically Unchanged 19 100.0 Decreased Somewhat 0 0.0 Decreased Considerably 0 0.0 Total 19 100.0 - Pension plans

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 0 0.0 Remained Basically Unchanged 20 100.0 Decreased Somewhat 0 0.0 Decreased Considerably 0 0.0 Total 20 100.0 - Endowments

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 0 0.0 Remained Basically Unchanged 19 100.0 Decreased Somewhat 0 0.0 Decreased Considerably 0 0.0 Total 19 100.0

22. How has the provision of differential terms by your institution to most-favored (as a function of breadth, duration, and extent of relationship) mutual funds, ETFs, pension plans, and endowments changed over the past three months?

| Number of Respondents | Percentage | |

|---|---|---|

| Increased Considerably | 0 | 0.0 |

| Increased Somewhat | 1 | 5.3 |

| Remained Basically Unchanged | 18 | 94.7 |

| Decreased Somewhat | 0 | 0.0 |

| Decreased Considerably | 0 | 0.0 |

| Total | 19 | 100.0 |

Insurance Companies

23. Over the past three months, how have the price terms (for example, financing rates) offered to insurance companies as reflected across the entire spectrum of securities financing and OTC derivatives transaction types changed, regardless of nonprice terms? (Please indicate tightening if terms have become more stringent-for example, if financing rates have risen.)

| Number of Respondents | Percentage | |

|---|---|---|

| Tightened Considerably | 0 | 0.0 |

| Tightened Somewhat | 0 | 0.0 |

| Remained Basically Unchanged | 19 | 95.0 |

| Eased Somewhat | 1 | 5.0 |

| Eased Considerably | 0 | 0.0 |

| Total | 20 | 100.0 |

24. Over the past three months, how has your use of nonprice terms (for example, haircuts, maximum maturity, covenants, cure periods, cross-default provisions or other documentation features) with respect to insurance companies across the entire spectrum of securities financing and OTC derivatives transaction types changed, regardless of price terms? (Please indicate tightening if terms have become more stringent-for example, if haircuts have been increased.)

| Number of Respondents | Percentage | |

|---|---|---|

| Tightened Considerably | 0 | 0.0 |

| Tightened Somewhat | 1 | 5.0 |

| Remained Basically Unchanged | 18 | 90.0 |

| Eased Somewhat | 1 | 5.0 |

| Eased Considerably | 0 | 0.0 |

| Total | 20 | 100.0 |

25. To the extent that the price or nonprice terms applied to insurance companies have tightened or eased over the past three months (as reflected in your responses to questions 23 and 24), what are the most important reasons for the change?

- Possible reasons for tightening

- Deterioration in current or expected financial strength of counterparties

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Reduced willingness of your institution to take on risk

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Adoption of more-stringent market conventions (that is, collateral terms and agreements, ISDA protocols)

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Higher internal treasury charges for funding

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Diminished availability of balance sheet or capital at your institution

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Worsening in general market liquidity and functioning

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Less-aggressive competition from other institutions

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Other (please specify)

Number of Respondents Percentage Most Important 1 100.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 1 100.0

- Deterioration in current or expected financial strength of counterparties

- Possible reasons for easing

- Improvement in current or expected financial strength of counterparties

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Increased willingness of your institution to take on risk

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Adoption of less-stringent market conventions (that is, collateral terms and agreements, ISDA protocols)

Number of Respondents Percentage Most Important 1 100.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 1 100.0 - Lower internal treasury charges for funding

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Increased availability of balance sheet or capital at your institution

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Improvement in general market liquidity and functioning

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - More-aggressive competition from other institutions

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Other (please specify)

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0

- Improvement in current or expected financial strength of counterparties

26. How has the intensity of efforts by insurance companies to negotiate more favorable price and nonprice terms changed over the past three months?

| Number of Respondents | Percentage | |

|---|---|---|

| Increased Considerably | 1 | 5.0 |

| Increased Somewhat | 0 | 0.0 |

| Remained Basically Unchanged | 19 | 95.0 |

| Decreased Somewhat | 0 | 0.0 |

| Decreased Considerably | 0 | 0.0 |

| Total | 20 | 100.0 |

27. Considering the entire range of transactions facilitated by your institution for such clients, how has the use of financial leverage by insurance companies changed over the past three months?

| Number of Respondents | Percentage | |

|---|---|---|

| Increased Considerably | 0 | 0.0 |

| Increased Somewhat | 1 | 5.0 |

| Remained Basically Unchanged | 19 | 95.0 |

| Decreased Somewhat | 0 | 0.0 |

| Decreased Considerably | 0 | 0.0 |

| Total | 20 | 100.0 |

28. How has the provision of differential terms by your institution to most favored (as a function of breadth, duration, and extent of relationship) insurance companies changed over the past three months?

| Number of Respondents | Percentage | |

|---|---|---|

| Increased Considerably | 0 | 0.0 |

| Increased Somewhat | 0 | 0.0 |

| Remained Basically Unchanged | 19 | 100.0 |

| Decreased Somewhat | 0 | 0.0 |

| Decreased Considerably | 0 | 0.0 |

| Total | 19 | 100.0 |

Investment Advisers to Separately Managed Accounts

29. Over the past three months, how have the price terms (for example, financing rates) offered to separately managed accounts established with investment advisers as reflected across the entire spectrum of securities financing and OTC derivatives transaction types changed, regardless of nonprice terms? (Please indicate tightening if terms have become more stringent-for example, if financing rates have risen.)

| Number of Respondents | Percentage | |

|---|---|---|

| Tightened Considerably | 0 | 0.0 |

| Tightened Somewhat | 0 | 0.0 |

| Remained Basically Unchanged | 19 | 100.0 |

| Eased Somewhat | 0 | 0.0 |

| Eased Considerably | 0 | 0.0 |

| Total | 19 | 100.0 |

30. Over the past three months, how has your use of nonprice terms (for example, haircuts, maximum maturity, covenants, cure periods, cross-default provisions or other documentation features) with respect to separately managed accounts established with investment advisers across the entire spectrum of securities financing and OTC derivatives transaction types changed, regardless of price terms? (Please indicate tightening if terms have become more stringent-for example, if haircuts have been increased.)

| Number of Respondents | Percentage | |

|---|---|---|

| Tightened Considerably | 0 | 0.0 |

| Tightened Somewhat | 2 | 10.5 |

| Remained Basically Unchanged | 16 | 84.2 |

| Eased Somewhat | 1 | 5.3 |

| Eased Considerably | 0 | 0.0 |

| Total | 19 | 100.0 |

31. To the extent that the price or nonprice terms applied to separately managed accounts established with investment advisers have tightened or eased over the past three months (as reflected in your responses to questions 29 and 30), what are the most important reasons for the change?

- Possible reasons for tightening

- Deterioration in current or expected financial strength of counterparties

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Reduced willingness of your institution to take on risk

Number of Respondents Percentage Most Important 1 100.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 1 100.0 - Adoption of more-stringent market conventions (that is, collateral terms and agreements, ISDA protocols)

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 1 100.0 3rd Most Important 0 0.0 Total 1 100.0 - Higher internal treasury charges for funding

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Diminished availability of balance sheet or capital at your institution

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Worsening in general market liquidity and functioning

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Less-aggressive competition from other institutions

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Other (please specify)

Number of Respondents Percentage Most Important 1 100.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 1 100.0

- Deterioration in current or expected financial strength of counterparties

- Possible reasons for easing

- Improvement in current or expected financial strength of counterparties

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Increased willingness of your institution to take on risk

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Adoption of less-stringent market conventions (that is, collateral terms and agreements, ISDA protocols)

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Lower internal treasury charges for funding

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Increased availability of balance sheet or capital at your institution

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Improvement in general market liquidity and functioning

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - More-aggressive competition from other institutions

Number of Respondents Percentage Most Important 1 100.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 1 100.0 - Other (please specify)

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0

- Improvement in current or expected financial strength of counterparties

32. How has the intensity of efforts by investment advisers to negotiate more-favorable price and nonprice terms on behalf of separately managed accounts changed over the past three months?

| Number of Respondents | Percentage | |

|---|---|---|

| Increased Considerably | 0 | 0.0 |

| Increased Somewhat | 2 | 10.5 |

| Remained Basically Unchanged | 17 | 89.5 |

| Decreased Somewhat | 0 | 0.0 |

| Decreased Considerably | 0 | 0.0 |

| Total | 19 | 100.0 |

33. Considering the entire range of transactions facilitated by your institution for such clients, how has the use of financial leverage by separately managed accounts established with investment advisers changed over the past three months?

| Number of Respondents | Percentage | |

|---|---|---|

| Increased Considerably | 0 | 0.0 |

| Increased Somewhat | 0 | 0.0 |

| Remained Basically Unchanged | 19 | 100.0 |

| Decreased Somewhat | 0 | 0.0 |

| Decreased Considerably | 0 | 0.0 |

| Total | 19 | 100.0 |

34. How has the provision of differential terms by your institution to separately managed accounts established with most-favored (as a function of breadth, duration, and extent of relationship) investment advisers changed over the past three months?

| Number of Respondents | Percentage | |

|---|---|---|

| Increased Considerably | 0 | 0.0 |

| Increased Somewhat | 2 | 10.5 |

| Remained Basically Unchanged | 17 | 89.5 |

| Decreased Somewhat | 0 | 0.0 |

| Decreased Considerably | 0 | 0.0 |

| Total | 19 | 100.0 |

Nonfinancial Corporations

35. Over the past three months, how have the price terms (for example, financing rates) offered to nonfinancial corporations as reflected across the entire spectrum of securities financing and OTC derivatives transaction types changed, regardless of nonprice terms? (Please indicate tightening if terms have become more stringent-for example, if financing rates have risen.)

| Number of Respondents | Percentage | |

|---|---|---|

| Tightened Considerably | 0 | 0.0 |

| Tightened Somewhat | 3 | 14.3 |

| Remained Basically Unchanged | 18 | 85.7 |

| Eased Somewhat | 0 | 0.0 |

| Eased Considerably | 0 | 0.0 |

| Total | 21 | 100.0 |

36. Over the past three months, how has your use of nonprice terms (for example, haircuts, maximum maturity, covenants, cure periods, cross-default provisions or other documentation features) with respect to nonfinancial corporations across the entire spectrum of securities financing and OTC derivatives transaction types changed, regardless of price terms? (Please indicate tightening if terms have become more stringent-for example, if haircuts have been increased.)

| Number of Respondents | Percentage | |

|---|---|---|

| Tightened Considerably | 0 | 0.0 |

| Tightened Somewhat | 2 | 9.5 |

| Remained Basically Unchanged | 19 | 90.5 |

| Eased Somewhat | 0 | 0.0 |

| Eased Considerably | 0 | 0.0 |

| Total | 21 | 100.0 |

37. To the extent that the price or nonprice terms applied to nonfinancial corporations have tightened or eased over the past three months (as reflected in your responses to questions 35 and 36), what are the most important reasons for the change?

- Possible reasons for tightening

- Deterioration in current or expected financial strength of counterparties

Number of Respondents Percentage Most Important 2 100.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 2 100.0 - Reduced willingness of your institution to take on risk

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Adoption of more-stringent market conventions (that is, collateral terms and agreements, ISDA protocols)

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Higher internal treasury charges for funding

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Diminished availability of balance sheet or capital at your institution

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Worsening in general market liquidity and functioning

Number of Respondents Percentage Most Important 1 100.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 1 100.0 - Less-aggressive competition from other institutions

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Other (please specify)

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0

- Deterioration in current or expected financial strength of counterparties

- Possible reasons for easing

- Improvement in current or expected financial strength of counterparties

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Increased willingness of your institution to take on risk

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Adoption of less-stringent market conventions (that is, collateral terms and agreements, ISDA protocols)

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Lower internal treasury charges for funding

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Increased availability of balance sheet or capital at your institution

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Improvement in general market liquidity and functioning

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - More-aggressive competition from other institutions

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0 - Other (please specify)

Number of Respondents Percentage Most Important 0 0.0 2nd Most Important 0 0.0 3rd Most Important 0 0.0 Total 0 0.0

- Improvement in current or expected financial strength of counterparties

38. How has the intensity of efforts by nonfinancial corporations to negotiate more favorable price and nonprice terms changed over the past three months?

| Number of Respondents | Percentage | |

|---|---|---|

| Increased Considerably | 0 | 0.0 |

| Increased Somewhat | 2 | 9.5 |

| Remained Basically Unchanged | 19 | 90.5 |

| Decreased Somewhat | 0 | 0.0 |

| Decreased Considerably | 0 | 0.0 |

| Total | 21 | 100.0 |

Mark and Collateral Disputes

39. Over the past three months, how has the volume of mark and collateral disputes with clients of each of the following types changed?

- Dealers and other financial intermediaries

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 2 9.5 Remained Basically Unchanged 18 85.7 Decreased Somewhat 1 4.8 Decreased Considerably 0 0.0 Total 21 100.0 - Hedge funds

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 1 4.8 Remained Basically Unchanged 19 90.5 Decreased Somewhat 1 4.8 Decreased Considerably 0 0.0 Total 21 100.0 - Trading REITs

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 1 5.6 Remained Basically Unchanged 16 88.9 Decreased Somewhat 0 0.0 Decreased Considerably 1 5.6 Total 18 100.0 - Mutual funds, ETFs, pension plans, and endowments

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 1 5.0 Remained Basically Unchanged 17 85.0 Decreased Somewhat 2 10.0 Decreased Considerably 0 0.0 Total 20 100.0 - Insurance companies

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 0 0.0 Remained Basically Unchanged 18 90.0 Decreased Somewhat 2 10.0 Decreased Considerably 0 0.0 Total 20 100.0 - Separately managed accounts established with investment advisers

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 0 0.0 Remained Basically Unchanged 17 94.4 Decreased Somewhat 0 0.0 Decreased Considerably 1 5.6 Total 18 100.0 - Nonfinancial corporations

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 0 0.0 Remained Basically Unchanged 17 89.5 Decreased Somewhat 1 5.3 Decreased Considerably 1 5.3 Total 19 100.0

40. Over the past three months, how has the duration and persistence of mark and collateral disputes with clients of each of the following types changed?

- Dealers and other financial intermediaries

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 2 9.5 Remained Basically Unchanged 17 81.0 Decreased Somewhat 1 4.8 Decreased Considerably 1 4.8 Total 21 100.0 - Hedge funds

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 1 4.8 Remained Basically Unchanged 18 85.7 Decreased Somewhat 2 9.5 Decreased Considerably 0 0.0 Total 21 100.0 - Trading REITs

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 1 5.6 Remained Basically Unchanged 17 94.4 Decreased Somewhat 0 0.0 Decreased Considerably 0 0.0 Total 18 100.0 - Mutual funds, ETFs, pension plans, and endowments

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 2 10.0 Remained Basically Unchanged 17 85.0 Decreased Somewhat 0 0.0 Decreased Considerably 1 5.0 Total 20 100.0 - Insurance companies

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 1 5.0 Remained Basically Unchanged 18 90.0 Decreased Somewhat 1 5.0 Decreased Considerably 0 0.0 Total 20 100.0 - Separately managed accounts established with investment advisers

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 1 5.6 Remained Basically Unchanged 16 88.9 Decreased Somewhat 0 0.0 Decreased Considerably 1 5.6 Total 18 100.0 - Nonfinancial corporations

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 1 5.3 Remained Basically Unchanged 15 78.9 Decreased Somewhat 2 10.5 Decreased Considerably 1 5.3 Total 19 100.0

Over-the-Counter Derivatives

Questions 41 through 51 ask about OTC derivatives trades. Question 41 focuses on nonprice terms applicable to new and renegotiated master agreements. Questions 42 through 48 ask about the initial margin requirements for most-favored and average clients applicable to different types of contracts: Question 42 focuses on foreign exchange (FX); question 43 on interest rates; question 44 on equity; question 45 on contracts referencing corporate credits (single-name and indexes); question 46 on credit derivatives referencing structured products such as mortgage-backed securities (MBS) and asset-backed securities (ABS) (specific tranches and indexes); question 47 on commodities; and question 48 on total return swaps (TRS) referencing nonsecurities (such as bank loans, including, for example, commercial and industrial loans and mortgage whole loans). Question 49 asks about posting of nonstandard collateral pursuant to OTC derivative contracts. Questions 50 and 51 focus on mark and collateral disputes involving contracts of each of the aforementioned types.

If your institution’s terms have tightened or eased over the past three months, please so report them regardless of how they stand relative to longer-term norms. Please focus your response on dollar-denominated instruments; if material differences exist with respect to instruments denominated in other currencies, please explain in the appropriate comment space.

New and Renegotiated Master Agreements

41. Over the past three months, how have nonprice terms incorporated in new or renegotiated OTC derivatives master agreements put in place with your institution's client changed?

- Requirements, timelines, and thresholds for posting additional margin

Number of Respondents Percentage Tightened Considerably 0 0.0 Tightened Somewhat 0 0.0 Remained Basically Unchanged 17 100.0 Eased Somewhat 0 0.0 Eased Considerably 0 0.0 Total 17 100.0 - Acceptable collateral

Number of Respondents Percentage Tightened Considerably 0 0.0 Tightened Somewhat 0 0.0 Remained Basically Unchanged 17 100.0 Eased Somewhat 0 0.0 Eased Considerably 0 0.0 Total 17 100.0 - Recognition of portfolio or diversification benefits (including from securities financing trades where appropriate agreements are in place)

Number of Respondents Percentage Tightened Considerably 0 0.0 Tightened Somewhat 0 0.0 Remained Basically Unchanged 16 100.0 Eased Somewhat 0 0.0 Eased Considerably 0 0.0 Total 16 100.0 - Triggers and covenants

Number of Respondents Percentage Tightened Considerably 0 0.0 Tightened Somewhat 0 0.0 Remained Basically Unchanged 17 100.0 Eased Somewhat 0 0.0 Eased Considerably 0 0.0 Total 17 100.0 - Other documentation features (including cure periods and cross-default provisions)

Number of Respondents Percentage Tightened Considerably 0 0.0 Tightened Somewhat 0 0.0 Remained Basically Unchanged 17 100.0 Eased Somewhat 0 0.0 Eased Considerably 0 0.0 Total 17 100.0 - Other (please specify)

Number of Respondents Percentage Tightened Considerably 0 0.0 Tightened Somewhat 0 0.0 Remained Basically Unchanged 0 0.0 Eased Somewhat 0 0.0 Eased Considerably 0 0.0 Total 0 0.0

Initial Margin

42. Over the past three months, how have initial margin requirements set by your institution with respect to OTC FX derivatives changed?

- Initial margin requirements for average clients

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 1 5.3 Remained Basically Unchanged 18 94.7 Decreased Somewhat 0 0.0 Decreased Considerably 0 0.0 Total 19 100.0 - Initial margin requirements for most favored clients, as a consequence of breadth, duration, and/or extent of relationship

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 1 5.3 Remained Basically Unchanged 17 89.5 Decreased Somewhat 1 5.3 Decreased Considerably 0 0.0 Total 19 100.0

43. Over the past three months, how have initial margin requirements set by your institution with respect to OTC interest rate derivatives changed?

- Initial margin requirements for average clients

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 0 0.0 Remained Basically Unchanged 16 88.9 Decreased Somewhat 1 5.6 Decreased Considerably 1 5.6 Total 18 100.0 - Initial margin requirements for most favored clients, as a consequence of breadth, duration, and/or extent of relationship

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 0 0.0 Remained Basically Unchanged 16 88.9 Decreased Somewhat 1 5.6 Decreased Considerably 1 5.6 Total 18 100.0

44. Over the past three months, how have initial margin requirements set by your institution with respect to OTC equity derivatives changed?

- Initial margin requirements for average clients

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 2 11.1 Remained Basically Unchanged 16 88.9 Decreased Somewhat 0 0.0 Decreased Considerably 0 0.0 Total 18 100.0 - Initial margin requirements for most favored clients, as a consequence of breadth, duration, and/or extent of relationship

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 2 11.1 Remained Basically Unchanged 16 88.9 Decreased Somewhat 0 0.0 Decreased Considerably 0 0.0 Total 18 100.0

45. Over the past three months, how have initial margin requirements set by your institution with respect to OTC credit derivatives referencing corporates (single-name corporates or corporate indexes) changed?

- Initial margin requirements for average clients

Number of Respondents Percentage Increased Considerably 1 6.7 Increased Somewhat 1 6.7 Remained Basically Unchanged 13 86.7 Decreased Somewhat 0 0.0 Decreased Considerably 0 0.0 Total 15 100.0 - Initial margin requirements for most favored clients, as a consequence of breadth, duration, and/or extent of relationship

Number of Respondents Percentage Increased Considerably 1 6.3 Increased Somewhat 1 6.3 Remained Basically Unchanged 14 87.5 Decreased Somewhat 0 0.0 Decreased Considerably 0 0.0 Total 16 100.0

46. Over the past three months, how have initial margin requirements set by your institution with respect to OTC credit derivatives referencing securitized products (such as specific ABS or MBS tranches and associated indexes) changed?

- Initial margin requirements for average clients

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 1 8.3 Remained Basically Unchanged 11 91.7 Decreased Somewhat 0 0.0 Decreased Considerably 0 0.0 Total 12 100.0 - Initial margin requirements for most favored clients, as a consequence of breadth, duration, and/or extent of relationship

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 1 9.1 Remained Basically Unchanged 10 90.9 Decreased Somewhat 0 0.0 Decreased Considerably 0 0.0 Total 11 100.0

47. Over the past three months, how have initial margin requirements set by your institution with respect to OTC commodity derivatives changed?

- Initial margin requirements for average clients

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 1 6.3 Remained Basically Unchanged 14 87.5 Decreased Somewhat 0 0.0 Decreased Considerably 1 6.3 Total 16 100.0 - Initial margin requirements for most favored clients, as a consequence of breadth, duration, and/or extent of relationship

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 0 0.0 Remained Basically Unchanged 16 94.1 Decreased Somewhat 0 0.0 Decreased Considerably 1 5.9 Total 17 100.0

48. Over the past three months, how have initial margin requirements set by your institution with respect to TRS referencing non-securities (such as bank loans, including, for example, commercial and industrial loans and mortgage whole loans) changed?

- Initial margin requirements for average clients

Number of Respondents Percentage Increased Considerably 1 6.7 Increased Somewhat 0 0.0 Remained Basically Unchanged 14 93.3 Decreased Somewhat 0 0.0 Decreased Considerably 0 0.0 Total 15 100.0 - Initial margin requirements for most favored clients, as a consequence of breadth, duration, and/or extent of relationship

Number of Respondents Percentage Increased Considerably 1 6.7 Increased Somewhat 0 0.0 Remained Basically Unchanged 14 93.3 Decreased Somewhat 0 0.0 Decreased Considerably 0 0.0 Total 15 100.0

Nonstandard Collateral

49. Over the past three months, how has the posting of nonstandard collateral (that is, other than cash and U.S. Treasury securities) as permitted under relevant agreements changed?

| Number of Respondents | Percentage | |

|---|---|---|

| Increased Considerably | 0 | 0.0 |

| Increased Somewhat | 2 | 9.5 |

| Remained Basically Unchanged | 19 | 90.5 |

| Decreased Somewhat | 0 | 0.0 |

| Decreased Considerably | 0 | 0.0 |

| Total | 21 | 100.0 |

Mark and Collateral Disputes

50. Over the past three months, how has the volume of mark and collateral disputes relating to contracts of each of the following types changed?

- FX

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 1 5.6 Remained Basically Unchanged 15 83.3 Decreased Somewhat 2 11.1 Decreased Considerably 0 0.0 Total 18 100.0 - Interest rate

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 1 5.6 Remained Basically Unchanged 16 88.9 Decreased Somewhat 1 5.6 Decreased Considerably 0 0.0 Total 18 100.0 - Equity

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 1 6.3 Remained Basically Unchanged 14 87.5 Decreased Somewhat 1 6.3 Decreased Considerably 0 0.0 Total 16 100.0 - Credit referencing corporates

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 0 0.0 Remained Basically Unchanged 16 100.0 Decreased Somewhat 0 0.0 Decreased Considerably 0 0.0 Total 16 100.0 - Credit referencing securitized products including MBS and ABS

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 0 0.0 Remained Basically Unchanged 13 100.0 Decreased Somewhat 0 0.0 Decreased Considerably 0 0.0 Total 13 100.0 - Commodity

Number of Respondents Percentage Increased Considerably 1 6.7 Increased Somewhat 0 0.0 Remained Basically Unchanged 14 93.3 Decreased Somewhat 0 0.0 Decreased Considerably 0 0.0 Total 15 100.0 - TRS referencing non-securities (such as bank loans, including, for example, commercial and industrial loans and mortgage whole loans)

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 0 0.0 Remained Basically Unchanged 14 100.0 Decreased Somewhat 0 0.0 Decreased Considerably 0 0.0 Total 14 100.0

51. Over the past three months, how has the duration and persistence of mark and collateral disputes relating to contracts of each of the following types changed?

- FX

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 2 11.1 Remained Basically Unchanged 13 72.2 Decreased Somewhat 3 16.7 Decreased Considerably 0 0.0 Total 18 100.0 - Interest rate

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 2 11.1 Remained Basically Unchanged 14 77.8 Decreased Somewhat 1 5.6 Decreased Considerably 1 5.6 Total 18 100.0 - Equity

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 1 6.3 Remained Basically Unchanged 14 87.5 Decreased Somewhat 1 6.3 Decreased Considerably 0 0.0 Total 16 100.0 - Credit referencing corporates

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 0 0.0 Remained Basically Unchanged 15 93.8 Decreased Somewhat 1 6.3 Decreased Considerably 0 0.0 Total 16 100.0 - Credit referencing securitized products including MBS and ABS

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 0 0.0 Remained Basically Unchanged 13 100.0 Decreased Somewhat 0 0.0 Decreased Considerably 0 0.0 Total 13 100.0 - Commodity

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 2 13.3 Remained Basically Unchanged 12 80.0 Decreased Somewhat 0 0.0 Decreased Considerably 1 6.7 Total 15 100.0 - TRS referencing non-securities (such as bank loans, including, for example, commercial and industrial loans and mortgage whole loans)

Number of Respondents Percentage Increased Considerably 0 0.0 Increased Somewhat 0 0.0 Remained Basically Unchanged 14 100.0 Decreased Somewhat 0 0.0 Decreased Considerably 0 0.0 Total 14 100.0

Securities Financing

Questions 52 through 79 ask about securities funding at your institution--that is, lending to clients collateralized by securities. Such activities may be conducted on a "repo" desk, on a trading desk engaged in facilitation for institutional clients and/or proprietary transactions, on a funding desk, or on a prime brokerage platform. Questions 52 through 55 focus on lending against high-grade corporate bonds; questions 56 through 59 on lending against high-yield corporate bonds; questions 60 and 61 on lending against equities (including through stock loan); questions 62 through 65 on lending against agency residential mortgage-backed securities (agency RMBS); questions 66 through 69 on lending against non-agency residential mortgage-backed securities (non-agency RMBS); questions 70 through 73 on lending against commercial mortgage-backed securities (CMBS); and questions 74 through 77 on consumer ABS (for example, backed by credit card receivables or auto loans). Questions 78 and 79 ask about mark and collateral disputes for lending backed by each of the aforementioned contract types.

If your institution’s terms have tightened or eased over the past three months, please so report them regardless of how they stand relative to longer-term norms. Please focus your response on dollar-denominated instruments; if material differences exist with respect to instruments denominated in other currencies, please explain in the appropriate comment space.

High-Grade Corporate Bonds

52. Over the past three months, how have the terms under which high-grade corporate bonds are funded changed?

- Terms for average clients

- Maximum amount of funding

Number of Respondents Percentage Tightened Considerably 0 0.0 Tightened Somewhat 0 0.0 Remained Basically Unchanged 16 88.9 Eased Somewhat 2 11.1 Eased Considerably 0 0.0 Total 18 100.0 - Maximum maturity

Number of Respondents Percentage Tightened Considerably 0 0.0 Tightened Somewhat 0 0.0 Remained Basically Unchanged 17 94.4 Eased Somewhat 1 5.6 Eased Considerably 0 0.0 Total 18 100.0 - Haircuts

Number of Respondents Percentage Tightened Considerably 0 0.0 Tightened Somewhat 1 5.6 Remained Basically Unchanged 16 88.9 Eased Somewhat 1 5.6 Eased Considerably 0 0.0 Total 18 100.0 - Collateral spreads over relevant benchmark (effective financing rates)

Number of Respondents Percentage Tightened Considerably 0 0.0 Tightened Somewhat 1 5.6 Remained Basically Unchanged 16 88.9 Eased Somewhat 1 5.6 Eased Considerably 0 0.0 Total 18 100.0 - Other (please specify)

Number of Respondents Percentage Tightened Considerably 0 0.0 Tightened Somewhat 0 0.0 Remained Basically Unchanged 0 0.0 Eased Somewhat 0 0.0 Eased Considerably 0 0.0 Total 0 0.0

- Maximum amount of funding

- Terms for most favored clients, as a consequence of breadth, duration and/or extent of relationship

- Maximum amount of funding

Number of Respondents Percentage Tightened Considerably 0 0.0 Tightened Somewhat 0 0.0 Remained Basically Unchanged 17 94.4 Eased Somewhat 1 5.6 Eased Considerably 0 0.0 Total 18 100.0 - Maximum maturity

Number of Respondents Percentage Tightened Considerably 0 0.0 Tightened Somewhat 1 5.6 Remained Basically Unchanged 16 88.9 Eased Somewhat 1 5.6 Eased Considerably 0 0.0 Total 18 100.0 - Haircuts

Number of Respondents Percentage Tightened Considerably 0 0.0 Tightened Somewhat 1 5.6 Remained Basically Unchanged 16 88.9 Eased Somewhat 1 5.6 Eased Considerably 0 0.0 Total 18 100.0 - Collateral spreads over relevant benchmark (effective financing rates)

Number of Respondents Percentage Tightened Considerably 0 0.0 Tightened Somewhat 1 5.6 Remained Basically Unchanged 16 88.9 Eased Somewhat 1 5.6 Eased Considerably 0 0.0 Total 18 100.0 - Other (please specify)

Number of Respondents Percentage Tightened Considerably 0 0.0 Tightened Somewhat 0 0.0 Remained Basically Unchanged 0 0.0 Eased Somewhat 0 0.0 Eased Considerably 0 0.0 Total 0 0.0

- Maximum amount of funding

53. Over the past three months, how has demand for funding of high-grade corporate bonds by your institution's clients changed?

| Number of Respondents | Percentage | |

|---|---|---|

| Increased Considerably | 0 | 0.0 |

| Increased Somewhat | 2 | 11.1 |

| Remained Basically Unchanged | 16 | 88.9 |

| Decreased Somewhat | 0 | 0.0 |

| Decreased Considerably | 0 | 0.0 |

| Total | 18 | 100.0 |

54. Over the past three months, how has demand for term funding with a maturity greater than 30 days of high-grade corporate bonds by your institution's clients changed?

| Number of Respondents | Percentage | |

|---|---|---|

| Increased Considerably | 0 | 0.0 |

| Increased Somewhat | 0 | 0.0 |

| Remained Basically Unchanged | 18 | 100.0 |

| Decreased Somewhat | 0 | 0.0 |

| Decreased Considerably | 0 | 0.0 |

| Total | 18 | 100.0 |

55. Over the past three months, how have liquidity and functioning in the high-grade corporate bond market changed?

| Number of Respondents | Percentage | |

|---|---|---|

| Improved Considerably | 0 | 0.0 |

| Improved Somewhat | 1 | 5.3 |

| Remained Basically Unchanged | 16 | 84.2 |

| Deteriorated Somewhat | 2 | 10.5 |

| Deteriorated Considerably | 0 | 0.0 |

| Total | 19 | 100.0 |

Funding of High-Yield Corporate Bonds

56. Over the past three months, how have the terms under which high-yield corporate bonds are funded changed?

- Terms for average clients

- Maximum amount of funding

Number of Respondents Percentage Tightened Considerably 0 0.0 Tightened Somewhat 1 5.6 Remained Basically Unchanged 17 94.4 Eased Somewhat 0 0.0 Eased Considerably 0 0.0 Total 18 100.0 - Maximum maturity

Number of Respondents Percentage Tightened Considerably 0 0.0 Tightened Somewhat 0 0.0 Remained Basically Unchanged 18 100.0 Eased Somewhat 0 0.0 Eased Considerably 0 0.0 Total 18 100.0 - Haircuts

Number of Respondents Percentage Tightened Considerably 0 0.0 Tightened Somewhat 1 5.6 Remained Basically Unchanged 16 88.9 Eased Somewhat 1 5.6 Eased Considerably 0 0.0 Total 18 100.0 - Collateral spreads over relevant benchmark (effective financing rates)

Number of Respondents Percentage Tightened Considerably 0 0.0 Tightened Somewhat 2 11.1 Remained Basically Unchanged 15 83.3 Eased Somewhat 1 5.6 Eased Considerably 0 0.0 Total 18 100.0 - Other (please specify)

Number of Respondents Percentage Tightened Considerably 0 0.0 Tightened Somewhat 0 0.0 Remained Basically Unchanged 0 0.0 Eased Somewhat 0 0.0 Eased Considerably 0 0.0 Total 0 0.0

- Maximum amount of funding

- Terms for most favored clients, as a consequence of breadth, duration and/or extent of relationship

- Maximum amount of funding

Number of Respondents Percentage Tightened Considerably 0 0.0 Tightened Somewhat 1 5.6 Remained Basically Unchanged 16 88.9 Eased Somewhat 1 5.6 Eased Considerably 0 0.0 Total 18 100.0 - Maximum maturity

Number of Respondents Percentage Tightened Considerably 0 0.0 Tightened Somewhat 0 0.0 Remained Basically Unchanged 18 100.0 Eased Somewhat 0 0.0 Eased Considerably 0 0.0 Total 18 100.0 - Haircuts

Number of Respondents Percentage Tightened Considerably 0 0.0 Tightened Somewhat 1 5.6 Remained Basically Unchanged 16 88.9 Eased Somewhat 1 5.6 Eased Considerably 0 0.0 Total 18 100.0 - Collateral spreads over relevant benchmark (effective financing rates)

Number of Respondents Percentage Tightened Considerably 0 0.0 Tightened Somewhat 2 11.1 Remained Basically Unchanged 15 83.3 Eased Somewhat 1 5.6 Eased Considerably 0 0.0 Total 18 100.0 - Other (please specify)

Number of Respondents Percentage Tightened Considerably 0 0.0 Tightened Somewhat 0 0.0 Remained Basically Unchanged 0 0.0 Eased Somewhat 0 0.0 Eased Considerably 0 0.0 Total 0 0.0

- Maximum amount of funding

57. Over the past three months, how has demand for funding of high-yield corporate bonds by your institution's clients changed?

| Number of Respondents | Percentage | |

|---|---|---|

| Increased Considerably | 0 | 0.0 |

| Increased Somewhat | 2 | 11.1 |

| Remained Basically Unchanged | 16 | 88.9 |

| Decreased Somewhat | 0 | 0.0 |

| Decreased Considerably | 0 | 0.0 |

| Total | 18 | 100.0 |

58. Over the past three months, how has demand for term funding with a maturity greater than 30 days of high-yield corporate bonds by your institution's clients changed?

| Number of Respondents | Percentage | |

|---|---|---|

| Increased Considerably | 0 | 0.0 |

| Increased Somewhat | 3 | 16.7 |

| Remained Basically Unchanged | 14 | 77.8 |

| Decreased Somewhat | 1 | 5.6 |

| Decreased Considerably | 0 | 0.0 |

| Total | 18 | 100.0 |

59. Over the past three months, how have liquidity and functioning in the high-yield corporate bond market changed?

| Number of Respondents | Percentage | |

|---|---|---|

| Improved Considerably | 0 | 0.0 |

| Improved Somewhat | 0 | 0.0 |

| Remained Basically Unchanged | 17 | 89.5 |

| Deteriorated Somewhat | 2 | 10.5 |

| Deteriorated Considerably | 0 | 0.0 |

| Total | 19 | 100.0 |

Equities (Including through Stock Loan)

60. Over the past three months, how have the terms under which equities are funded (including through stock loan) changed?

- Terms for average clients

- Maximum amount of funding

Number of Respondents Percentage Tightened Considerably 0 0.0 Tightened Somewhat 2 11.1 Remained Basically Unchanged 16 88.9 Eased Somewhat 0 0.0 Eased Considerably 0 0.0 Total 18 100.0 - Maximum maturity

Number of Respondents Percentage Tightened Considerably 0 0.0 Tightened Somewhat 2 11.1 Remained Basically Unchanged 16 88.9 Eased Somewhat 0 0.0 Eased Considerably 0 0.0 Total 18 100.0 - Haircuts