FEDS Notes

June 30, 2022

Survey Responses Indicating Improved Perceptions of Discount Window Usage Align with Observed Borrowing Behavior

Abigail M. Roberts*

Summary

In this note, we examine borrowing activity through the discount window's primary credit program subsequent to the program changes made in March 2020 to assess the extent to which banks' behavior appeared consistent with their reported views of the discount window. Views were collected from 80 banks in the September 2020 Senior Financial Officer Survey (SFOS). About one-third of survey respondents indicated that their bank is more likely to use the discount window as a source of liquidity, suggesting a positive shift in bank views of the discount window. Overall, we found a strong positive association between SFOS respondents that indicated in September 2020 their bank is more likely to consider the discount window and their bank's actual discount window borrowing activity between March and June 2020.

Background on changes to discount window primary credit

The discount window is a funding source for banks to manage liquidity risks and support stability in the banking system and is a key tool used by the Federal Reserve particularly during times of stress in the financial system.1 However, in the past, banks have been hesitant to borrow from the window due to the potential negative perception by others of their financial condition. At the onset of the COVID-19 crisis, on March 15, 2020, the Federal Reserve Board (the Board) made changes to the discount window primary credit program to support the flow of credit to households and business. In particular, the Federal Reserve lowered the primary credit rate by 150 basis points to 0.25 percent, reflecting a 100 basis point reduction in the target range for the federal funds rate and a 50 basis point narrowing in the primary credit rate relative to the top of the target range. This action narrowed the spread between the primary credit rate relative to the general level of other money market rates. Also part of this announcement was that banks may borrow from the discount window for periods as long as 90 days, prepayable and renewable by the borrower on a daily basis.2 Figure 1 shows aggregate borrowing behavior following these changes, with a sharp increase of outstanding primary credit loans in March.

Source: Federal Reserve Board, Statistical Release H.4.1, "Factors Affecting Reserve Balances." Primary credit amounts are weekly averages as of Wednesday.

September 2020 Senior Financial Officer Survey

The Federal Reserve conducted a SFOS in September 2020 focused on gaining information on the implications of the increase in reserve balances for individual banks and on obtaining banks' views on Federal Reserve liquidity provision.3 In order to assess the impact of the changes to discount window primary credit rate and terms, the September 2020 SFOS included a question asking responding banks to characterize their view on the discount window following the changes.4 Responses were collected from senior financial officers at 46 domestic banks and 34 U.S. branches and agencies of foreign banking organizations (FBOs).5 In aggregate, these banks held roughly $15 trillion in assets at the time of the survey. While the banks sampled in the survey represented a wide range of asset sizes and business models, all had assets of greater than $5 billion and therefore the survey did not capture the views of smaller community banks.

Data, Tables, & Discussion

Nearly one-third of SFOS respondents indicated their bank was more likely to consider the discount window as a source of liquidity following the March 2020 changes to primary credit. Over seventy percent of those respondents' banks did borrow from the discount window between March and June 2020, representing thirty-two percent of total discount window borrowing.6 In contrast, only twenty percent of banks whose survey-reported views on the discount window had not changed actually borrowed from the discount window during this period.

Table 1: Reported likelihood of borrowing from the discount window versus actual behavior

| Likelihood | Total | Borrowed | Did Not Borrow |

|---|---|---|---|

| More Likely | 26 | 19 | 7 |

| Unchanged or Less Likely | 54 | 10 | 44 |

Source: Internal Federal Reserve records from the September 2020 Senior Financial Officer Survey and on primary credit borrowings from March 2020 through June 2020. The Federal Reserve publicly discloses data on all primary credit borrowings made in a quarter with a two-year lag. Quarterly disclosures of primary credit borrowings are available on the Board's public website here: https://www.federalreserve.gov/regreform/discount-window.htm

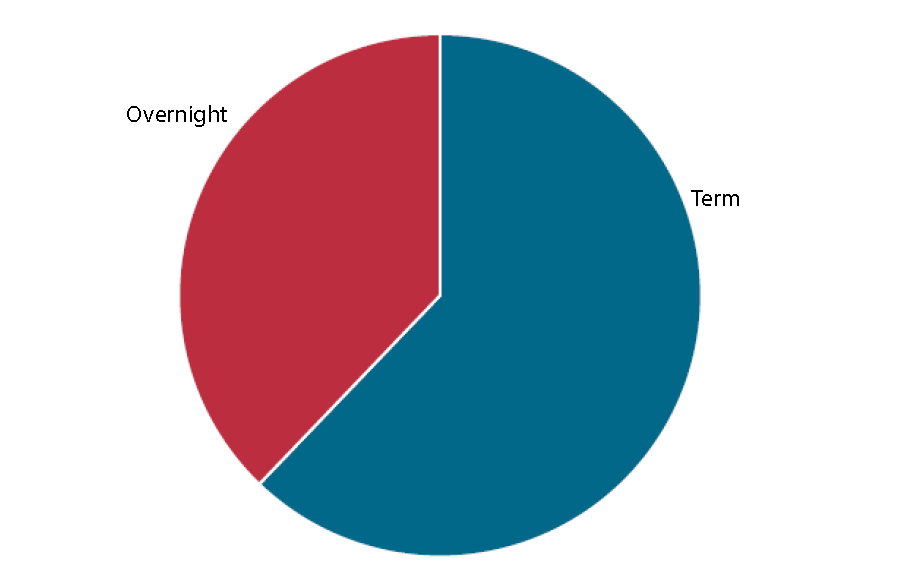

The SFOS included a follow-up question to gauge the drivers of banks' responses to the question discussed above. Of the survey respondents that indicated their banks were more likely to consider the discount window as a source of liquidity, the most important factor for this change was "Federal Reserve communications encouraging the use of the discount window." Also of note, the second most important factor was the "increase in the term of primary credit to allow depository institutions to borrow for up to 90 days." This result is consistent with the observations that, among the survey banks that borrowed from the discount window in this period, the total volume of term loans was almost double the total volume of overnight loans, shown in Figure 2.

Source: Internal federal Reserve records from the September 2020 Senior Financial Officer Survey and on primary credit borrowings from March 2020 through June 2020.

Further considerations

While improved bank sentiment towards the discount window among SFOS respondents is encouraging, the results should be interpreted with some caution. For the types of banks represented in the survey, the increased likelihood of and actual borrowing of primary credit suggests that the measures taken by the Federal Reserve in March 2020 to revise the terms of primary credit helped reduce stigma of using the discount window during the COVID-19 pandemic. As noted above, however, the survey sample of banks presents an incomplete view of banking sector views, due to the panel being comprised of the largest banks, grouped by asset size in Table 2, and an absence of smaller community banks. The wider universe of banks (beyond SFOS respondents) that borrowed from the discount window during this period includes nearly 900 additional banks, of which most had $5 billion or less in assets. Very large banks may have other lines of credit or sources of funding available to them that may not be available to smaller banks. Given these other options, very large banks may have been less likely than the broader banking universe, to actively consider and potentially adjust their views on the discount window. Thus, the survey results may underestimate the extent to which banks' views on the discount window evolved following the changes made to the primary credit program.

Table 2: Reported likelihood of borrowing from the discount window versus actual behavior (grouped by asset size, $bn)

| Assets ($bn) and Likelihood | Borrowed | Did Not Borrow |

|---|---|---|

| 5-100 | ||

| More Likely | 9 | 4 |

| Unchanged or Less Likely | 2 | 19 |

| 100-2000+ | ||

| More Likely | 10 | 1 |

| Unchanged or Less Likely | 6 | 13 |

Source: Internal Federal Reserve records from the September 2020 Senior Financial Officer Survey and on primary credit borrowings from March 2020 through June 2020

In addition, the results are based on borrowing activity that occurred before the survey was taken. Banks may have reported a greater willingness to borrow in the survey so that their survey responses appeared consistent with their earlier borrowing behavior. Finally, the survey asked about changes to respondents' views on the discount window as a source to meet liquidity needs. The survey does not establish a baseline measure of respondents' sentiment prior to March 2020. This lack of a baseline makes it difficult to interpret the overall degree of stigma that may have been reduced for discount window borrowing as a result of program changes.

Conclusion

In this note, we reviewed September 2020 SFOS responses regarding banks' views on the discount window following changes to the primary credit program in March 2020 and compared banks' individual responses to their actual discount window borrowing. In viewing these data together, a substantial portion of surveyed banks both indicated and displayed a greater willingness to borrow from the discount window. While the survey only represents a sample of banks with a higher share of mid-size and larger asset size than the overall population of banks, the results of this analysis are an encouraging indication that the Federal Reserve actions in March 2020 reduced some stigma associated with discount window borrowing.

* This note benefitted from comments by Margaret DeBoer, Laura Lipscomb, Matthew Malloy, Mark Carlson, Courtney Demartini, Heather Ford, Lyle Kumasaka, Francis Martinez, Jason Miu, and Mary-Frances Styczynski. The analysis and conclusions set forth are those of the author and do not indicate concurrence by other members of the staff, the Board of Governors, or the Federal Reserve Banks.. Return to text

1. For the purpose of this note, the term "bank" is used, but references can be applied to other depository institutions. Return to text

2. In addition to these changes to the primary credit and federal funds rates, the Board consolidated the reporting of loans by Reserve Bank on the H.4.1. to encourage use of the discount window by protecting the identity of borrowers, previously identified as a potential stigma-related concern. Return to text

3. The September 2020 SFOS public summary is available at https://www.federalreserve.gov/data/sfos/files/senior-financial-officer-survey-202009.pdf (PDF). Return to text

4. Banks were asked "On March 15, [2020] the Federal Reserve announced changes to the discount window and encouraged depository institutions to use the discount window to meet unexpected funding needs and support the flow of credit to households and businesses. In light of these actions, how would you characterize your bank's view on the discount window" and had the option to select "I. More likely to consider the discount window as a source to meet liquidity needs", "II. Unchanged", and "III. Less likely to consider the discount window as a source, regardless of liquidity need". Return to text

5. The FBOs included U.S. branches and agencies of foreign banks as well as one U.S. commercial bank that exhibited reserve management behavior more akin to this group than similarly sized domestic banks, and thus was classified as an FBO for the purpose of analyzing survey results. Return to text

6. Some banks periodically take out "test loans," small discount window loans to ensure operational readiness to borrow and not for liquidity purposes. Only non-test loans are included in this analysis. Return to text

Roberts, Abigail M. (2022). "Survey Responses Indicating Improved Perceptions of Discount Window Usage Align with Observed Borrowing Behavior," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, June 30, 2022, https://doi.org/10.17016/2380-7172.3101.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.