(a) Overview. A bank must calculate its total wholesale and retail risk-weighted asset amount in four distinct phases:

(1) Phase 1 - categorization of exposures;

(2) Phase 2 - assignment of wholesale obligors and exposures to rating grades and segmentation of retail exposures;

(3) Phase 3 - assignment of risk parameters to wholesale exposures and segments of retail exposures; and

(4) Phase 4 - calculation of risk-weighted asset amounts.

(b) Phase 1 - Categorization. The bank must determine which of its exposures are wholesale exposures, retail exposures, securitization exposures, or equity exposures. The bank must categorize each retail exposure as a residential mortgage exposure, a QRE, or an other retail exposure. The bank must identify which wholesale exposures are HVCRE exposures, sovereign exposures, OTC derivative contracts, repo-style transactions, eligible margin loans, eligible purchased wholesale receivables, unsettled transactions to which section 35 applies, and eligible guarantees or eligible credit derivatives that are used as credit risk mitigants. The bank must identify any on-balance sheet asset that does not meet the definition of a wholesale, retail, equity, or securitization exposure, as well as any non-material portfolio of exposures described in paragraph (e)(4) of this section.

(c) Phase 2 - Assignment of wholesale obligors and exposures to rating grades and retail exposures to segments - (1) Assignment of wholesale obligors and exposures to rating grades.

(i) The bank must assign each obligor of a wholesale exposure to a single obligor rating grade and may assign each wholesale exposure to loss severity rating grades.

(ii) The bank must identify which of its wholesale obligors are in default.

(2) Segmentation of retail exposures. (i) The bank must group the retail exposures in each retail subcategory into segments that have homogeneous risk characteristics.

(ii) The bank must identify which of its retail exposures are in default. The bank must segment defaulted retail exposures separately from non-defaulted retail exposures.

(iii) If the bank determines the EAD for eligible margin loans using the approach in paragraph (a) of section 32, the bank must identify which of its retail exposures are eligible margin loans for which the bank uses this EAD approach and must segment such eligible margin loans separately from other retail exposures.

(3) Eligible purchased wholesale receivables. A bank may group its eligible purchased wholesale receivables that, when consolidated by obligor, total less than $1 million into segments that have homogeneous risk characteristics. A bank must use the wholesale exposure formula in Table 2 in this section to determine the risk-based capital requirement for each segment of eligible purchased wholesale receivables.

(d) Phase 3 -" Assignment of risk parameters to wholesale exposures and segments of retail exposures - (1) Quantification process. Subject to the limitations in this paragraph (d), the bank must:

(i) Associate a PD with each wholesale obligor rating grade;

(ii) Associate an ELGD or LGD, as appropriate, with each wholesale loss severity rating grade or assign an ELGD and LGD to each wholesale exposure;

(iii) Assign an EAD and M to each wholesale exposure; and

(iv) Assign a PD, ELGD, LGD, and EAD to each segment of retail exposures.

(2) Floor on PD assignment. The PD for each wholesale exposure or retail segment may not be less than 0.03 percent, except for exposures to or directly and unconditionally guaranteed by a sovereign entity, the Bank for International Settlements, the International Monetary Fund, the European Commission, the European Central Bank, or a multi-lateral development bank, to which the bank assigns a rating grade associated with a PD of less than 0.03 percent.

(3) Floor on LGD estimation. The LGD for each segment of residential mortgage exposures (other than segments of residential mortgage exposures for which all or substantially all of the principal of each exposure is directly and unconditionally guaranteed by the full faith and credit of a sovereign entity) may not be less than 10 percent.

(4) Eligible purchased wholesale receivables. A bank must assign a PD, ELGD, LGD, EAD, and M to each segment of eligible purchased wholesale receivables. If the bank can estimate ECL (but not PD or LGD) for a segment of eligible purchased wholesale receivables, the bank must assume that the ELGD and LGD of the segment equals 100 percent and that the PD of the segment equals ECL divided by EAD. The estimated ECL must be calculated for the receivables without regard to any assumption of recourse or guarantees from the seller or other parties.

(5) Credit risk mitigation - credit derivatives, guarantees, and collateral. (i) A bank may take into account the risk reducing effects of eligible guarantees and eligible credit derivatives in support of a wholesale exposure by applying the PD substitution or LGD adjustment treatment to the exposure as provided in section 33 or, if applicable, applying double default treatment to the exposure as provided in section 34. A bank may decide separately for each wholesale exposure that qualifies for the double default treatment under section 34 whether to apply the double default treatment or to use the PD substitution or LGD adjustment approach without recognizing double default effects.

(ii) A bank may take into account the risk reducing effects of guarantees and credit derivatives in support of retail exposures in a segment when quantifying the PD, ELGD, and LGD of the segment.

(iii) Except as provided in paragraph (d)(6) of this section, a bank may take into account the risk reducing effects of collateral in support of a wholesale exposure when quantifying the ELGD and LGD of the exposure and may take into account the risk reducing effects of collateral in support of retail exposures when quantifying the PD, ELGD, and LGD of the segment.

(6) EAD for derivative contracts, repo-style transactions, and eligible margin loans. (i) A bank must calculate its EAD for an OTC derivative contract as provided in paragraphs (b) and (c) of section 32. A bank may take into account the risk-reducing effects of financial collateral in support of a repo-style transaction or eligible margin loan through an adjustment to EAD as provided in paragraphs (a) and (c) of section 32. A bank that takes financial collateral into account through such an adjustment to EAD under section 32 may not adjust ELGD or LGD to reflect the financial collateral.

(ii) A bank may attribute an EAD of zero to:

(A) Derivative contracts that are publicly traded on an exchange that requires the daily receipt and payment of cash-variation margin;

(B) Derivative contracts and repo-style transactions that are outstanding with a qualifying central counterparty (but not for those transactions that a qualifying central counterparty has rejected); and

(C) Credit risk exposures to a qualifying central counterparty in the form of clearing deposits and posted collateral that arise from transactions described in paragraph (d)(6)(ii)(B) of this section.

(7) Effective maturity. An exposure's M must be no greater than five years and no less than one year, except that a bank may set the M of an exposure equal to the greater of one day or M if the exposure has an original maturity of less than one year and is not part of the bank's ongoing financing of the obligor. An exposure is not part of a bank's ongoing financing of the obligor if the bank:

(i) Has a legal and practical ability not to renew or roll over the exposure in the event of credit deterioration of the obligor;

(ii) Makes an independent credit decision at the inception of the exposure and at every renewal or roll over; and

(iii) Has no substantial commercial incentive to continue its credit relationship with the obligor in the event of credit deterioration of the obligor.

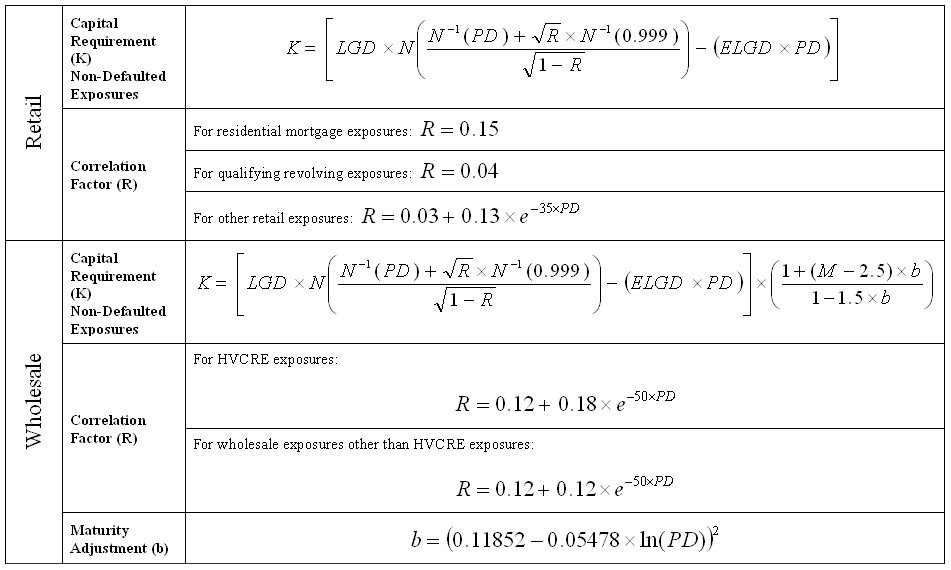

(e) Phase 4 - Calculation of risk-weighted assets - (1) Non-defaulted exposures. (i) A bank must calculate the dollar risk-based capital requirement for each of its wholesale exposures to a non-defaulted obligor and segments of non-defaulted retail exposures (except eligible guarantees and eligible credit derivatives that hedge another wholesale exposure and exposures to which the bank applies the double default treatment in section 34) by inserting the assigned risk parameters for the wholesale obligor and exposure or retail segment into the appropriate risk-based capital formula specified in Table 2 and multiplying the output of the formula (K) by the EAD of the exposure or segment.16

(ii) The sum of all of the dollar risk-based capital requirements for each wholesale exposure to a non-defaulted obligor and segment of non-defaulted retail exposures calculated in paragraph (e)(1)(i) of this section and in paragraph (e) of section 34 equals the total dollar risk-based capital requirement for those exposures and segments.

(iii) The aggregate risk-weighted asset amount for wholesale exposures to non-defaulted obligors and segments of non-defaulted retail exposures equals the total dollar risk-based capital requirement calculated in paragraph (e)(1)(ii) of this section multiplied by 12.5.

(2) Wholesale exposures to defaulted obligors and segments of defaulted retail exposures - (i) Wholesale exposures to defaulted obligors.

(A) For each wholesale exposure to a defaulted obligor, the bank must compare:

(1) 0.08 multiplied by the EAD of the wholesale exposure, plus the amount of any charge-offs or write-downs on the exposure; and

(2) K for the wholesale exposure (as determined in Table 2 immediately before the obligor became defaulted), multiplied by the EAD of the wholesale exposure immediately before the obligor became defaulted.

(B) If the amount calculated in paragraph (e)(2)(i)(A)(1) is equal to or greater than the amount calculated in paragraph (e)(2)(i)(A)(2), the dollar risk-based capital requirement for the exposure is 0.08 multiplied by the EAD of the wholesale exposure.

(C) If the amount calculated in paragraph (e)(2)(i)(A)(1) is less than the amount calculated in paragraph (e)(2)(i)(A)(2), the dollar risk-based capital requirement for the exposure is K for the wholesale exposure (as determined in Table 2 immediately before the obligor became defaulted) multiplied by the EAD of the wholesale exposure.

(ii) Segments of defaulted retail exposures. The dollar risk-based capital requirement for a segment of defaulted retail exposures equals 0.08 multiplied by the EAD of the segment.

(iii) The sum of all the dollar risk-based capital requirements for each wholesale exposure to a defaulted obligor calculated in paragraphs (e)(2)(i)(B) and (C) of this section plus the dollar risk-based capital requirements for each segment of defaulted retail exposures calculated in paragraph (e)(2)(ii) of this section equals the total dollar risk-based capital requirement for those exposures.

(iv) The aggregate risk-weighted asset amount for wholesale exposures to defaulted obligors and segments of defaulted retail exposures equals the total dollar risk-based capital requirement calculated in paragraph (e)(2)(iii) of this section multiplied by 12.5.

(3) Assets not included in a defined exposure category. A bank may assign a risk-weighted asset amount of zero to cash owned and held in all offices of the bank or in transit and for gold bullion held in the bank's own vaults, or held in another bank's vaults on an allocated basis, to the extent it is offset by gold bullion liabilities. The risk-weighted asset amount for the residual value of a retail lease exposure equals such residual value. The risk-weighted asset amount for an excluded mortgage exposure is determined under the [general risk-based capital rules].17 The risk-weighted asset amount for any other on-balance-sheet asset that does not meet the definition of a wholesale, retail, securitization, or equity exposure equals the carrying value of the asset.

(4) Non-material portfolios of exposures. The risk-weighted asset amount of a portfolio of exposures for which the bank has demonstrated to [AGENCY's] satisfaction that the portfolio (when combined with all other portfolios of exposures that the bank seeks to treat under this paragraph) is not material to the bank is the sum of the carrying values of on-balance sheet exposures plus the notional amounts of off-balance sheet exposures in the portfolio. For purposes of this paragraph (e)(4), the notional amount of an OTC derivative contract that is not a credit derivative is the EAD of the derivative as calculated in section 32.

This section describes two methodologies - a collateral haircut approach and an internal models methodology - that a bank may use instead of an ELGD/LGD estimation methodology to recognize the benefits of financial collateral in mitigating the counterparty credit risk of repo-style transactions, eligible margin loans, and collateralized OTC derivative contracts, and single product netting sets of such transactions. A third methodology, the simple VaR methodology, is available for single product netting sets of repo-style transactions and eligible margin loans. This section also describes the methodology for calculating EAD for an OTC derivative contract or a set of OTC derivative contracts subject to a qualifying master netting agreement. A bank also may use the internal models methodology to estimate EAD for qualifying cross-product master netting agreements.

A bank may use any combination of the three methodologies for collateral recognition; however, it must use the same methodology for similar exposures. A bank may use separate methodologies for agency securities lending transactions - that is, securities lending transactions in which the bank, acting as agent for a customer, lends the customer's securities and indemnifies the customer against loss - and all other repo-style transactions.

(a) EAD for eligible margin loans and repo-style transactions - (1) General. A bank may recognize the credit risk mitigation benefits of financial collateral that secures an eligible margin loan, repo-style transaction, or single-product group of such transactions with a single counterparty subject to a qualifying master netting agreement (netting set) by factoring the collateral into its ELGD and LGD estimates for the exposure. Alternatively, a bank may estimate an unsecured ELGD and LGD for the exposure and determine the EAD of the exposure using:

(i) The collateral haircut approach described in paragraph (a)(2) of this section;

(ii) For netting sets only, the simple VaR methodology described in paragraph (a)(3) of this section; or

(iii) The internal models methodology described in paragraph (c) of this section.

(2) Collateral haircut approach - (i) EAD equation. A bank may determine EAD for an eligible margin loan, repo-style transaction, or netting set by setting EAD = max {0, [(ΣE − ΣC) + Σ(Es × Hs) + Σ(Efx × Hfx)]}, where:

(A) ΣE equals the value of the exposure (that is, the sum of the current market values of all securities and cash the bank has lent, sold subject to repurchase, or posted as collateral to the counterparty under the transaction (or netting set));

(B) ΣC equals the value of the collateral (that is, the sum of the current market values of all securities and cash the bank has borrowed, purchased subject to resale, or taken as collateral from the counterparty under the transaction (or netting set));

(C) Es = absolute value of the net position in a given security (where the net position in a given security equals the sum of the current market values of the particular security the bank has lent, sold subject to repurchase, or posted as collateral to the counterparty minus the sum of the current market values of that same security the bank has borrowed, purchased subject to resale, or taken as collateral from the counterparty);

(D) Hs = market price volatility haircut appropriate to the security referenced in Es;

(E) Efx = absolute value of the net position of both cash and securities in a currency that is different from the settlement currency (where the net position in a given currency equals the sum of the current market values of any cash or securities in the currency the bank has lent, sold subject to repurchase, or posted as collateral to the counterparty minus the sum of the current market values of any cash or securities in the currency the bank has borrowed, purchased subject to resale, or taken as collateral from the counterparty); and

(F) Hfx = haircut appropriate to the mismatch between the currency referenced in Efx and the settlement currency.

(ii) Standard supervisory haircuts. (A) Under the "standard supervisory haircuts" approach:

(1) A bank must use the haircuts for market price volatility (Hs) in Table 3, as adjusted in certain circumstances as provided in paragraph (a)(2)(ii)(A)(3) and (4) of this section;

| Applicable external rating grade category for debt securities | Residual maturity for debt securities | Issuers exempt from the 3 b.p. floor | Other issuers |

| Two highest investment grade rating categories for long-term ratings/highest investment grade rating category for short-term ratings | ≤ 1 year | .005 | .01 |

| > 1 year, ≤ 5 years | .02 | .04 | |

| > 5 years | .04 | .08 | |

| Two lowest investment grade rating categories for both short- and long-term ratings | ≤ 1 year | .01 | .02 |

| > 1 year, ≤ 5 years | .03 | .06 | |

| > 5 years | .06 | .12 | |

| One rating category below investment grade | All | .15 | .25 |

| Main index equities (including convertible bonds) and gold | .15 | ||

| Other publicly traded equities (including convertible bonds) | .25 | ||

| Mutual funds | Highest haircut applicable to any security in which the fund can invest | ||

| Cash on deposit with the bank (including a certificate of deposit issued by the bank) | 0 | ||

(2) For currency mismatches, a bank must use a haircut for foreign exchange rate volatility (Hfx) of 8 percent, as adjusted in certain circumstances as provided in paragraph (a)(2)(ii)(A)(3) and (4) of this section.

(3) For repo-style transactions, a bank may multiply the supervisory haircuts provided in paragraphs (a)(2)(ii)(A)(1) and (2) by the square root of � (which equals 0.707107).

(4) A bank must adjust the supervisory haircuts upward on the basis of a holding period longer than 10 business days (for eligible margin loans) or 5 business days (for repo-style transactions) where and as appropriate to take into account the illiquidity of an instrument.

(iii) Own estimates for haircuts. With the prior written approval of [AGENCY], a bank may calculate haircuts (Hs and Hfx) using its own internal estimates of the volatilities of market prices and foreign exchange rates.

(A) To receive [AGENCY] approval to use internal estimates, a bank must satisfy the following minimum quantitative standards:

(1) A bank must use a 99th percentile one-tailed confidence interval.

(2) The minimum holding period for a repo-style transaction is 5 business days and for an eligible margin loan is 10 business days. When a bank calculates an own-estimates haircut on a TN-day holding period, which is different from the minimum holding period for the transaction type, the applicable haircut (HM) is calculated using the following square root of time formula:

(i) TM = 5 for repo-style transactions and 10 for eligible margin loans;

(ii) TN = holding period used by the bank to derive HN; and

(iii) HN = haircut based on the holding period TN.

(3) A bank must adjust holding periods upwards where and as appropriate to take into account the illiquidity of an instrument.

(4) The historical observation period must be at least one year.

(5) A bank must update its data sets and recompute haircuts no less frequently than quarterly and must also reassess data sets and haircuts whenever market prices change materially.

(B) With respect to debt securities that have an applicable external rating of investment grade, a bank may calculate haircuts for categories of securities. For a category of securities, the bank must calculate the haircut on the basis of internal volatility estimates for securities in that category that are representative of the securities in that category that the bank has actually lent, sold subject to repurchase, posted as collateral, borrowed, purchased subject to resale, or taken as collateral. In determining relevant categories, the bank must take into account:

(1) The type of issuer of the security;

(2) The applicable external rating of the security;

(3) The maturity of the security; and

(4) The interest rate sensitivity of the security.

(C) With respect to debt securities that have an applicable external rating of below investment grade and equity securities, a bank must calculate a separate haircut for each individual security.

(D) Where an exposure or collateral (whether in the form of cash or securities) is denominated in a currency that differs from the settlement currency, the bank must calculate a separate currency mismatch haircut for its net position in each mismatched currency based on estimated volatilities of foreign exchange rates between the mismatched currency and the settlement currency.

(E) A bank's own estimates of market price and foreign exchange rate volatilities may not take into account the correlations among securities and foreign exchanges rates on either the exposure or collateral side of a transaction (or netting set) or the correlations among securities and foreign exchange rates between the exposure and collateral sides of the transaction (or netting set).

(3) Simple VaR methodology. With the prior written approval of [AGENCY], a bank may estimate EAD for a netting set using a VaR model that meets the requirements in paragraph (a)(3)(iii) of this section. In such event, the bank must set EAD = max {0, [(ΣE − ΣC) + PFE]}, where:

(i) ΣE equals the value of the exposure (that is, the sum of the current market values of all securities and cash the bank has lent, sold subject to repurchase, or posted as collateral to the counterparty under the netting set);

(ii) ΣC equals the value of the collateral (that is, the sum of the current market values of all securities and cash the bank has borrowed, purchased subject to resale, or taken as collateral from the counterparty under the netting set); and

(iii) PFE (potential future exposure) equals the bank's empirically-based best estimate of the 99th percentile, one-tailed confidence interval for an increase in the value of (ΣE − ΣC) over a 5-business-day holding period for repo-style transactions or over a 10-business-day holding period for eligible margin loans using a minimum one-year historical observation period of price data representing the instruments that the bank has lent, sold subject to repurchase, posted as collateral, borrowed, purchased subject to resale, or taken as collateral. The bank must validate its VaR model, including by establishing and maintaining a rigorous and regular back-testing regime.

(b) EAD for OTC derivative contracts. (1) A bank must determine the EAD for an OTC derivative contract that is not subject to a qualifying master netting agreement using the current exposure methodology in paragraph (b)(5) of this section or using the internal models methodology described in paragraph (c) of this section.

(2) A bank must determine the EAD for multiple OTC derivative contracts that are subject to a qualifying master netting agreement using the current exposure methodology in paragraph (b)(6) of this section or using the internal models methodology described in paragraph (c) of this section.18

(3) Counterparty credit risk for credit derivatives. Notwithstanding the above,

(i) A bank that purchases a credit derivative that is recognized under section 33 or 34 as a credit risk mitigant for an exposure that is not a covered position under the [market risk rule] need not compute a separate counterparty credit risk capital requirement under this section so long as it does so consistently for all such credit derivatives and either includes all or excludes all such credit derivatives that are subject to a qualifying master netting agreement from any measure used to determine counterparty credit risk exposure to all relevant counterparties for risk-based capital purposes.

(ii) A bank that is the protection provider in a credit derivative must treat the credit derivative as a wholesale exposure to the reference obligor and need not compute a counterparty credit risk capital requirement for the credit derivative under this section, so long as it does so consistently for all such credit derivatives and either includes all or excludes all such credit derivatives that are subject to a qualifying master netting agreement from any measure used to determine counterparty credit risk exposure to all relevant counterparties for risk-based capital purposes (unless the bank is treating the credit derivative as a covered position under the [market risk rule], in which case the bank must compute a supplemental counterparty credit risk capital requirement under this section).

(4) Counterparty credit risk for equity derivatives. A bank must treat an equity derivative contract as an equity exposure and compute a risk-weighted asset amount for the equity derivative contract under part VI (unless the bank is treating the contract as a covered position under the [market risk rules]). In addition, if the bank is treating the contract as a covered position under the [market risk rules] and in certain other cases described in section 55, the bank must also calculate a risk-based capital requirement for the counterparty credit risk of an equity derivative contract under this part.

(5) Single OTC derivative contract. Except as modified by paragraph (b)(7) of this section, the EAD for a single OTC derivative contract that is not subject to a qualifying master netting agreement is equal to the sum of the bank's current credit exposure and potential future credit exposure on the derivative contract.

(i) Current credit exposure. The current credit exposure for a single OTC derivative contract is the greater of the mark-to-market value of the derivative contract or zero.

(ii) PFE. The PFE for a single OTC derivative contract, including an OTC derivative contract with a negative mark-to-market value, is calculated by multiplying the notional principal amount of the derivative contract by the appropriate conversion factor in Table 4. For purposes of calculating either the potential future credit exposure under this paragraph or the gross potential future credit exposure under paragraph (b)(6) of this section for exchange rate contracts and other similar contracts in which the notional principal amount is equivalent to the cash flows, notional principal amount is the net receipts to each party falling due on each value date in each currency. For any OTC derivative contract that does not fall within one of the specified categories in Table 4, the potential future credit exposure must be calculated using the "other commodity" conversion factors. Banks must use an OTC derivative contract's effective notional principal amount (that is, its apparent or stated notional principal amount multiplied by any multiplier in the OTC derivative contract) rather than its apparent or stated notional principal amount in calculating potential future credit exposure. PFE of the protection provider of a credit derivative is capped at the net present value of the amount of unpaid premiums.

| Remaining maturity** | Interest rate | Foreign exchange rate and gold | Credit (investment grade reference obligor)*** | Credit (non-investment grade reference obligor) | Equity | Precious metals (except gold) | Other commodity |

| One year or less | 0.00 | 0.01 | 0.05 | 0.10 | 0.06 | 0.07 | 0.10 |

| Over one to five years | 0.005 | 0.05 | 0.05 | 0.10 | 0.08 | 0.07 | 0.12 |

| Over five years | 0.015 | 0.075 | 0.05 | 0.10 | 0.10 | 0.08 | 0.15 |

** For an OTC derivative contract that is structured such that on specified dates any outstanding exposure is settled and the terms are reset so that the market value of the contract is zero, the remaining maturity equals the time until the next reset date. For an interest rate derivative contract with a remaining maturity of greater than one year that meets these criteria, the minimum conversion factor is 0.005. Return to text

*** A bank must use column 4 of this table - "Credit (investment grade reference obligor)" - for a credit derivative whose reference obligor has an outstanding unsecured long-term debt security without credit enhancement that has a long-term applicable external rating of at least investment grade. A bank must use column 5 of the table for all other credit derivatives. Return to text

(6) Multiple OTC derivative contracts subject to a qualifying master netting agreement. Except as modified by paragraph (b)(7) of this section, the EAD for multiple OTC derivative contracts subject to a qualifying master netting agreement is equal to the sum of the net current credit exposure and the adjusted sum of the PFE exposure for all OTC derivative contracts subject to the qualifying master netting agreement.

(i) Net current credit exposure. The net current credit exposure is the greater of:

(A) The net sum of all positive and negative mark-to-market values of the individual OTC derivative contracts subject to the qualifying master netting agreement; or

(B) zero.

(ii) Adjusted sum of the PFE. The adjusted sum of the PFE is calculated as Anet = (0.4×Agross)+(0.6×NGR×Agross), where:

(A) Anet = the adjusted sum of the PFE;

(B) Agross = the gross PFE (that is, the sum of the PFE amounts (as determined under paragraph (b)(5)(ii) of this section) for each individual OTC derivative contract subject to the qualifying master netting agreement); and

(C) NGR = the net to gross ratio (that is, the ratio of the net current credit exposure to the gross current credit exposure). In calculating the NGR, the gross current credit exposure equals the sum of the positive current credit exposures (as determined under paragraph (b)(5)(i) of this section) of all individual OTC derivative contracts subject to the qualifying master netting agreement.

(7) Collateralized OTC derivative contracts. A bank may recognize the credit risk mitigation benefits of financial collateral that secures an OTC derivative contract or single-product set of OTC derivatives subject to a qualifying master netting agreement (netting set) by factoring the collateral into its ELGD and LGD estimates for the contract or netting set. Alternatively, a bank may recognize the credit risk mitigation benefits of financial collateral that secures such a contract or netting set that is marked to market on a daily basis and subject to a daily margin maintenance requirement by estimating an unsecured ELGD and LGD for the contract or netting set and adjusting the EAD calculated under paragraph (b)(5) or (6) of this section using the collateral haircut approach in paragraph (a)(2) of this section. The bank must substitute the EAD calculated under paragraph (b)(5) or (6) of this section for ΣE in the equation in paragraph (a)(2)(i) of this section and must use a 10-business-day minimum holding period (TM=10).

(c) Internal models methodology. (1) With prior written approval from [AGENCY], a bank may use the internal models methodology in this paragraph (c) to determine EAD for counterparty credit risk for OTC derivative contracts (collateralized or uncollateralized) and single-product netting sets thereof, for eligible margin loans and single-product netting sets thereof, and for repo-style transactions and single-product netting sets thereof. A bank that uses the internal models methodology for a particular transaction type (OTC derivative contracts, eligible margin loans, or repo-style transactions) must use the internal models methodology for all transactions of that transaction type. A bank may choose to use the internal models methodology for one or two of these three types of exposures and not the other types. A bank may also use the internal models methodology for OTC derivative contracts, eligible margin loans, and repo-style transactions subject to a qualifying cross-product netting agreement if:

(i) The bank effectively integrates the risk mitigating effects of cross-product netting into its risk management and other information technology systems; and

(ii) The bank obtains the prior written approval of the [AGENCY]. A bank that uses the internal models methodology for a type of exposures must receive approval from the [AGENCY] to cease using the methodology for that type of exposures or to make a material change to its internal model.

(2) Under the internal models methodology, a bank uses an internal model to estimate the expected exposure (EE) for a netting set and then calculates EAD based on that EE.

(i) The bank must use its internal model's probability distribution for changes in the market value of an exposure or netting set that are attributable to changes in market variables to determine EE. The bank may include financial collateral currently posted by the counterparty as collateral when calculating EE.

(ii) Under the internal models methodology, EAD = α × effective EPE, or, subject to [AGENCY] approval as provided in paragraph (c)(7), a more conservative measure of EAD.

(A)  ,

(that is, effective EPE is the time-weighted average of effective EE where the weights are the proportion that an individual effective EE represents in a one year time interval) where:

,

(that is, effective EPE is the time-weighted average of effective EE where the weights are the proportion that an individual effective EE represents in a one year time interval) where:

(1)  (that is, for a specific date

tk, effective EE is the greater of EE at that date or the effective

EE at the previous date); and

(that is, for a specific date

tk, effective EE is the greater of EE at that date or the effective

EE at the previous date); and

(2) tk represents the kth future time period in the model and there are n time periods represented in the model over the first year; and

(B) α = 1.4 except as provided in paragraph (c)(6), or when [AGENCY] has determined that the bank must set α higher based on the bank's specific characteristics of counterparty credit risk.

(3) To obtain [AGENCY] approval to calculate the distributions of exposures upon which the EAD calculation is based, the bank must demonstrate to the satisfaction of [AGENCY] that it has been using for at least one year an internal model that broadly meets the following minimum standards, with which the bank must maintain compliance:

(i) The model must have the systems capability to estimate the expected exposure to the counterparty on a daily basis (but is not expected to estimate or report expected exposure on a daily basis).

(ii) The model must estimate expected exposure at enough future dates to accurately reflect all the future cash flows of contracts in the netting set.

(iii) The model must account for the possible non-normality of the exposure distribution, where appropriate.

(iv) The bank must measure, monitor, and control current counterparty exposure and the exposure to the counterparty over the whole life of all contracts in the netting set.

(v) The bank must measure and manage current exposures gross and net of collateral held, where appropriate. The bank must estimate expected exposures for OTC derivative contracts both with and without the effect of collateral agreements.

(vi) The bank must have procedures to identify, monitor, and control specific wrong-way risk throughout the life of an exposure. Wrong-way risk in this context is the risk that future exposure to a counterparty will be high when the counterparty's probability of default is also high.

(vii) The model must use current market data to compute current exposures. When estimating model parameters based on historical data, at least three years of historical data that cover a wide range of economic conditions must be used and must be updated quarterly or more frequently if market conditions warrant. The bank should consider using model parameters based on forward-looking measures such as implied volatilities, where appropriate.

(viii) A bank must subject its internal model to an initial validation and annual model review process. The model review should consider whether the inputs and risk factors, as well as the model outputs, are appropriate.

(4) Maturity. (i) If the remaining maturity of the exposure or the longest-dated contract in the netting set is greater than one year, the bank must set M for the exposure or netting set equal to the lower of 5 years or M(EPE), where:

(B) dfk is the risk-free discount factor for future time period tk; and

(C) Δtt = tt − tk-1.

(ii) If the remaining maturity of the exposure or the longest-dated contract in the netting set is one year or less, the bank must set M for the exposure or netting set equal to 1 year, except as provided in paragraph (d)(7) of section 31.

(5) Collateral agreements. A bank may capture the effect on EAD of a collateral agreement that requires receipt of collateral when exposure to the counterparty increases but may not capture the effect on EAD of a collateral agreement that requires receipt of collateral when counterparty credit quality deteriorates. For this purpose, a collateral agreement means a legal contract that specifies the time when, and circumstances under which, the counterparty is required to exchange collateral with the bank for a single financial contract or for all financial contracts covered under a qualifying master netting agreement and confers upon the bank a perfected, first priority security interest, or the legal equivalent thereof, in the collateral posted by the counterparty under the agreement. This security interest must provide the bank with a right to close out the financial positions and the collateral upon an event of default of, or failure to perform by, the counterparty under the collateral agreement. A contract would not satisfy this requirement if the bank's exercise of rights under the agreement may be stayed or avoided under applicable law in the relevant jurisdictions. Two methods are available to capture the effect of a collateral agreement:

(i) With prior written approval from [AGENCY], a bank may include the effect of a collateral agreement within its internal model used to calculate EAD. The bank may set EAD equal to the expected exposure at the end of the margin period of risk. The margin period of risk means, with respect to a netting set subject to a collateral agreement, the time period from the most recent exchange of collateral with a counterparty until the next required exchange of collateral plus the period of time required to sell and realize the proceeds of the least liquid collateral that can be delivered under the terms of the collateral agreement, and, where applicable, the period of time required to re-hedge the resulting market risk, upon the default of the counterparty. The minimum margin period of risk is 5 business days for repo-style transactions and 10 business days for other transactions when liquid financial collateral is posted under a daily margin maintenance requirement. This period should be extended to cover any additional time between margin calls; any potential closeout difficulties; any delays in selling collateral, particularly if the collateral is illiquid; and any impediments to prompt re-hedging of any market risk.

(ii) A bank that can model EPE without collateral agreements but cannot achieve the higher level of modeling sophistication to model EPE with collateral agreements can set effective EPE for a collateralized counterparty equal to the lesser of:

(A) The threshold, defined as the exposure amount at which the counterparty is required to post collateral under the collateral agreement, if the threshold is positive, plus an add-on that reflects the potential increase in exposure over the margin period of risk. The add-on is computed as the expected increase in the netting set's exposure beginning from current exposure of zero over the margin period of risk. The margin period of risk must be at least five business days for exposures or netting sets consisting only of repo-style transactions subject to daily re-margining and daily marking-to-market, and 10 business days for all other exposures or netting sets; or

(B) Effective EPE without a collateral agreement.

(6) Own estimate of alpha. With prior written approval of [AGENCY], a bank may calculate alpha as the ratio of economic capital from a full simulation of counterparty exposure across counterparties that incorporates a joint simulation of market and credit risk factors (numerator) and economic capital based on EPE (denominator), subject to a floor of 1.2. For purposes of this calculation, economic capital is the unexpected losses for all counterparty credit risks measured at a 99.9 percent confidence level over a one-year horizon. To receive approval, the bank must meet the following minimum standards to the satisfaction of [AGENCY]:

(i) The bank's own estimate of alpha must capture in the numerator the effects of:

(A) The material sources of stochastic dependency of distributions of market values of transactions or portfolios of transactions across counterparties;

(B) Volatilities and correlations of market risk factors used in the joint simulation, which must be related to the credit risk factor used in the simulation to reflect potential increases in volatility or correlation in an economic downturn, where appropriate; and

(C) The granularity of exposures, that is, the effect of a concentration in the proportion of each counterparty's exposure that is driven by a particular risk factor.

(ii) The bank must assess the potential model risk in its estimates of alpha.

(iii) The bank must calculate the numerator and denominator of alpha in a consistent fashion with respect to modeling methodology, parameter specifications, and portfolio composition.

(iv) The bank must review and adjust as appropriate its estimates of the numerator and denominator on at least a quarterly basis and more frequently when the composition of the portfolio varies over time.

(7) Other measures of counterparty exposure. With prior written approval of [AGENCY], a bank may set EAD equal to a measure of counterparty credit risk exposure, such as peak EAD, that is more conservative than an alpha of 1.4 (or higher under the terms of paragraph (c)(2)(ii)(B)) times EPE for every counterparty whose EAD will be measured under the alternative measure of counterparty exposure. The bank must demonstrate the conservatism of the measure of counterparty credit risk exposure used for EAD.

(a) Scope. (1) This section applies to wholesale exposures for which:

(i) Credit risk is fully covered by an eligible guarantee or eligible credit derivative; and

(ii) Credit risk is covered on a pro rata basis (that is, on a basis in which the bank and the protection provider share losses proportionately) by an eligible guarantee or eligible credit derivative.

(2) Wholesale exposures on which there is a tranching of credit risk (reflecting at least two different levels of seniority) are securitization exposures subject to the securitization framework in part V.

(3) A bank may elect to recognize the credit risk mitigation benefits of an eligible guarantee or eligible credit derivative covering an exposure described in paragraph (a)(1) of this section by using the PD substitution approach or the LGD adjustment approach in paragraph (c) of this section or using the double default treatment in section 34 (if the transaction qualifies for the double default treatment in section 34). A bank's PD and LGD for the hedged exposure may not be lower than the PD and LGD floors described in paragraphs (d)(2) and (d)(3) of section 31.

(4) A bank must use the same risk parameters for calculating ECL as it uses for calculating the risk-based capital requirement for the exposure.

(b) Rules of recognition. (1) A bank may only recognize the credit risk mitigation benefits of eligible guarantees and eligible credit derivatives.

(2) A bank may only recognize the credit risk mitigation benefits of an eligible credit derivative to hedge an exposure that is different from the credit derivative's reference exposure used for determining the derivative's cash settlement value, deliverable obligation, or occurrence of a credit event if:

(i) The reference exposure ranks pari passu (that is, equally) with or is junior to the hedged exposure; and

(ii) The reference exposure and the hedged exposure share the same obligor (that is, the same legal entity), and legally enforceable cross-default or cross-acceleration clauses are in place.

(c) Risk parameters for hedged exposures - (1) PD substitution approach - (i) Full coverage. If an eligible guarantee or eligible credit derivative meets the conditions in paragraphs (a) and (b) of this section and the protection amount (P) of the guarantee or credit derivative is greater than or equal to the EAD of the hedged exposure, a bank may recognize the guarantee or credit derivative in determining the bank's risk-based capital requirement for the hedged exposure by substituting the PD associated with the rating grade of the protection provider for the PD associated with the rating grade of the obligor in the risk-based capital formula in Table 2 and using the appropriate ELGD and LGD as described in paragraphs (c)(1)(iii) and (iv) of this section. If the bank determines that full substitution of the protection provider's PD leads to an inappropriate degree of risk mitigation, the bank may substitute a higher PD than that of the protection provider.

(ii) Partial coverage. If an eligible guarantee or eligible credit derivative meets the conditions in paragraphs (a) and (b) of this section and the protection amount (P) of the guarantee or credit derivative is less than the EAD of the hedged exposure, the bank must treat the hedged exposure as two separate exposures (protected and unprotected) in order to recognize the credit risk mitigation benefit of the guarantee or credit derivative.

(A) The bank must calculate its risk-based capital requirement for the protected exposure under section 31, where PD is the protection provider's PD, ELGD and LGD are determined under paragraphs (c)(1)(iii) and (iv) of this section, and EAD is P. If the bank determines that full substitution leads to an inappropriate degree of risk mitigation, the bank may use a higher PD than that of the protection provider.

(B) The bank must calculate its risk-based capital requirement for the unprotected exposure under section 31, where PD is the obligor's PD, ELGD is the hedged exposure's ELGD (not adjusted to reflect the guarantee or credit derivative), LGD is the hedged exposure's LGD (not adjusted to reflect the guarantee or credit derivative), and EAD is the EAD of the original hedged exposure minus P.

(C) The treatment in this paragraph (c)(1)(ii) is applicable when the credit risk of a wholesale exposure is covered on a pro rata basis or when an adjustment is made to the effective notional amount of the guarantee or credit derivative under paragraphs (d), (e), or (f) of this section.

(iii) LGD of hedged exposures. The LGD of a hedged exposure under the PD substitution approach is equal to:

(A) The lower of the LGD of the hedged exposure (not adjusted to reflect the guarantee or credit derivative) and the LGD of the guarantee or credit derivative, if the guarantee or credit derivative provides the bank with the option to receive immediate payout upon triggering the protection; or

(B) The LGD of the guarantee or credit derivative, if the guarantee or credit derivative does not provide the bank with the option to receive immediate payout upon triggering the protection.

(iv) ELGD of hedged exposures. The ELGD of a hedged exposure under the PD substitution approach is equal to the ELGD associated with the LGD determined under paragraph (c)(1)(iii) of this section.

(2) LGD adjustment approach - (i) Full coverage. If an eligible guarantee or eligible credit derivative meets the conditions in paragraphs (a) and (b) of this section and the protection amount (P) of the guarantee or credit derivative is greater than or equal to the EAD of the hedged exposure, the bank's risk-based capital requirement for the hedged exposure would be the greater of:

(A) The risk-based capital requirement for the exposure as calculated under section 31, with the ELGD and LGD of the exposure adjusted to reflect the guarantee or credit derivative; or

(B) The risk-based capital requirement for a direct exposure to the protection provider as calculated under section 31, using the PD for the protection provider, the ELGD and LGD for the guarantee or credit derivative, and an EAD equal to the EAD of the hedged exposure.

(ii) Partial coverage. If an eligible guarantee or eligible credit derivative meets the conditions in paragraphs (a) and (b) of this section and the protection amount (P) of the guarantee or credit derivative is less than the EAD of the hedged exposure, the bank must treat the hedged exposure as two separate exposures (protected and unprotected) in order to recognize the credit risk mitigation benefit of the guarantee or credit derivative.

(A) The bank's risk-based capital requirement for the protected exposure would be the greater of:

(1) The risk-based capital requirement for the protected exposure as calculated under section 31, with the ELGD and LGD of the exposure adjusted to reflect the guarantee or credit derivative and EAD set equal to P; or

(2) The risk-based capital requirement for a direct exposure to the guarantor as calculated under section 31, using the PD for the protection provider, the ELGD and LGD for the guarantee or credit derivative, and an EAD set equal to P.

(B) The bank must calculate its risk-based capital requirement for the unprotected exposure under section 31, where PD is the obligor's PD, ELGD is the hedged exposure's ELGD (not adjusted to reflect the guarantee or credit derivative), LGD is the hedged exposure's LGD (not adjusted to reflect the guarantee or credit derivative), and EAD is the EAD of the original hedged exposure minus P.

(3) M of hedged exposures. The M of the hedged exposure is the same as the M of the exposure if it were unhedged.

(d) Maturity mismatch. (1) A bank that recognizes an eligible guarantee or eligible credit derivative in determining its risk-based capital requirement for a hedged exposure must adjust the protection amount of the credit risk mitigant to reflect any maturity mismatch between the hedged exposure and the credit risk mitigant.

(2) A maturity mismatch occurs when the residual maturity of a credit risk mitigant is less than that of the hedged exposure(s). When a credit risk mitigant covers multiple hedged exposures that have different residual maturities, the longest residual maturity of any of the hedged exposures must be taken as the residual maturity of the hedged exposures.

(3) The residual maturity of a hedged exposure is the longest possible remaining time before the obligor is scheduled to fulfil its obligation on the exposure. If a credit risk mitigant has embedded options that may reduce its term, the bank (protection purchaser) must use the shortest possible residual maturity for the credit risk mitigant. If a call is at the discretion of the protection provider, the residual maturity of the credit risk mitigant is at the first call date. If the call is at the discretion of the bank (protection purchaser), but the terms of the arrangement at origination of the credit risk mitigant contain a positive incentive for the bank to call the transaction before contractual maturity, the remaining time to the first call date is the residual maturity of the credit risk mitigant. For example, where there is a step-up in cost in conjunction with a call feature or where the effective cost of protection increases over time even if credit quality remains the same or improves, the residual maturity of the credit risk mitigant will be the remaining time to the first call.

(4) A credit risk mitigant with a maturity mismatch may be recognized only if its original maturity is greater than or equal to one year and its residual maturity is greater than three months.

(5) When a maturity mismatch exists, the bank must apply the following adjustment to reduce the protection amount of the credit risk mitigant: Pm = E × (t-0.25)/(T−0.25), where:

(i) Pm = protection amount of the credit risk mitigant, adjusted for maturity mismatch;

(ii) E = effective notional amount of the credit risk mitigant;

(iii) t = the lesser of T or the residual maturity of the credit risk mitigant, expressed in years; and

(iv) T = the lesser of 5 or the residual maturity of the hedged exposure, expressed in years.

(e) Credit derivatives without restructuring as a credit event. If a bank recognizes an eligible credit derivative that does not include as a credit event a restructuring of the hedged exposure involving forgiveness or postponement of principal, interest, or fees that results in a credit loss event (that is, a charge-off, specific provision, or other similar debit to the profit and loss account), the bank must apply the following adjustment to reduce the protection amount of the credit derivative: Pr = Pm x 0.60, where:

(1) Pr = protection amount of the credit derivative, adjusted for lack of restructuring event (and maturity mismatch, if applicable); and

(2) Pm = effective notional amount of the credit derivative (adjusted for maturity mismatch, if applicable).

(f) Currency mismatch. (1) If a bank recognizes an eligible guarantee or eligible credit derivative that is denominated in a currency different from that in which the hedged exposure is denominated, the protection amount of the guarantee or credit derivative is reduced by application of the following formula: Pc = Pr × (1−HFX), where:

(i) Pc = protection amount of the guarantee or credit derivative, adjusted for currency mismatch (and maturity mismatch and lack of restructuring event, if applicable);

(ii) Pr = effective notional amount of the guarantee or credit derivative (adjusted for maturity mismatch and lack of restructuring event, if applicable); and

(iii) HFX = haircut appropriate for the currency mismatch between the guarantee or credit derivative and the hedged exposure.

(2) A bank must set HFX equal to 8 percent unless it qualifies for the use of and uses its own internal estimates of foreign exchange volatility based on a 10-business day holding period and daily marking-to-market and remargining. A bank qualifies for the use of its own internal estimates of foreign exchange volatility if it qualifies for:

(i) The own-estimates haircuts in paragraph (a)(2)(iii) of section 32;

(ii) The simple VaR methodology in paragraph (a)(3) of section 32; or

(iii) The internal models methodology in paragraph (c) of section 32.

(3) A bank must adjust HFX calculated in paragraph (f)(2) of this section upward if the bank revalues the guarantee or credit derivative less frequently than once every 10 business days using the square root of time formula provided in paragraph (a)(2)(iii)(A)(2) of section 32.

(a) Eligibility and operational criteria for double default treatment. A bank may recognize the credit risk mitigation benefits of a guarantee or credit derivative covering an exposure described in paragraph (a)(1) of section 33 by applying the double default treatment in this section if all the following criteria are satisfied.

(1) The hedged exposure is fully covered or covered on a pro rata basis by:

(i) An eligible guarantee issued by an eligible double default guarantor; or

(ii) An eligible credit derivative that meets the requirements of paragraph (b)(2) of section 33 and is issued by an eligible double default guarantor.

(2) The guarantee or credit derivative is:

(i) An uncollateralized guarantee or uncollateralized credit derivative (for example, a credit default swap) that provides protection with respect to a single reference obligor; or

(ii) An nth-to-default credit derivative (subject to the requirements of paragraph (m) of section 42).

(3) The hedged exposure is a wholesale exposure (other than a sovereign exposure).

(4) The obligor of the hedged exposure is not:

(i) An eligible double default guarantor or an affiliate of an eligible double default guarantor; or

(ii) An affiliate of the guarantor.

(5) The bank does not recognize any credit risk mitigation benefits of the guarantee or credit derivative for the hedged exposure other than through application of the double default treatment as provided in this section.

(6) The bank has implemented a process (which has received the prior, written approval of the [AGENCY]) to detect excessive correlation between the creditworthiness of the obligor of the hedged exposure and the protection provider. If excessive correlation is present, the bank may not use the double default treatment for the hedged exposure.

(b) Full coverage. If the transaction meets the criteria in paragraph (a) of this section and the protection amount (P) of the guarantee or credit derivative is at least equal to the EAD of the hedged exposure, the bank may determine its risk-weighted asset amount for the hedged exposure under paragraph (e) of this section.

(c) Partial coverage. If the transaction meets the criteria in paragraph (a) of this section and the protection amount (P) of the guarantee or credit derivative is less than the EAD of the hedged exposure, the bank must treat the hedged exposure as two separate exposures (protected and unprotected) in order to recognize double default treatment on the protected portion of the exposure.

(1) For the protected exposure, the bank must set EAD equal to P and calculate its risk-weighted asset amount as provided in paragraph (e) of this section.

(2) For the unprotected exposure, the bank must set EAD equal to the EAD of the original exposure minus P and then calculate its risk-weighted asset amount as provided in section 31.

(d) Mismatches. For any hedged exposure to which a bank applies double default treatment, the bank must make applicable adjustments to the protection amount as required in paragraphs (d), (e), and (f) of section 33.

(e) The double default dollar risk-based capital requirement. The dollar risk-based capital requirement for a hedged exposure to which a bank has applied double default treatment is KDD multiplied by the EAD of the exposure. KDD is calculated according to the following formula: KDD = Ko × (0.15 + 160 × PDg),

where:

(2) PDg = PD of the protection provider.

(3) PDo = PD of the obligor of the hedged exposure.

(4) LGDg = (i) The lower of the LGD of the unhedged exposure and the LGD of the guarantee or credit derivative, if the guarantee or credit derivative provides the bank with the option to receive immediate payout on triggering the protection; or

(ii) The LGD of the guarantee or credit derivative, if the guarantee or credit derivative does not provide the bank with the option to receive immediate payout on triggering the protection.

(5) ELGDg = The ELGD associated with LGDg.

(6) ρos(asset value correlation of the obligor) is calculated according to the appropriate formula for (R) provided in Table 2 in section 31, with PD equal to PDo.

(7) b (maturity adjustment coefficient) is calculated according to the formula for b provided in Table 2 in section 31, with PD equal to the lesser of PDo and PDg.

(8) M (maturity) is the effective maturity of the guarantee or credit derivative, which may not be less than one year or greater than five years.

(a) Definitions. For purposes of this section:

(1) Delivery-versus-payment (DvP) transaction means a securities or commodities transaction in which the buyer is obligated to make payment only if the seller has made delivery of the securities or commodities and the seller is obligated to deliver the securities or commodities only if the buyer has made payment.

(2) Payment-versus-payment (PvP) transaction means a foreign exchange transaction in which each counterparty is obligated to make a final transfer of one or more currencies only if the other counterparty has made a final transfer of one or more currencies.

(3) Normal settlement period. A transaction has a normal settlement period if the contractual settlement period for the transaction is equal to or less than the market standard for the instrument underlying the transaction and equal to or less than 5 business days.

(4) Positive current exposure. The positive current exposure of a bank for a transaction is the difference between the transaction value at the agreed settlement price and the current market price of the transaction, if the difference results in a credit exposure of the bank to the counterparty.

(b) Scope. This section applies to all transactions involving securities, foreign exchange instruments, and commodities that have a risk of delayed settlement or delivery. This section does not apply to:

(1) Transactions accepted by a qualifying central counterparty that are subject to daily marking-to-market and daily receipt and payment of variation margin;

(2) Repo-style transactions (which are addressed in sections 31 and 32); 19

(3) One-way cash payments on OTC derivative contracts (which are addressed in sections 31 and 32); or

(4) Transactions with a contractual settlement period that is longer than the normal settlement period (which are treated as OTC derivative contracts and addressed in sections 31 and 32).

(c) System-wide failures. In the case of a system-wide failure of a settlement or clearing system, the [AGENCY] may waive risk-based capital requirements for unsettled and failed transactions until the situation is rectified.

(d) Delivery-versus-payment (DvP) and payment-versus-payment (PvP) transactions. A bank must hold risk-based capital against any DvP or PvP transaction with a normal settlement period if the bank's counterparty has not made delivery or payment within five business days after the settlement date. The bank must determine its risk-weighted asset amount for such a transaction by multiplying the positive current exposure of the transaction for the bank by the appropriate risk weight in Table 5.

| Number of business days after contractual settlement date | Risk weight to be applied to positive current exposure |

|---|---|

| From 5 to 15 | 100% |

| From 16 to 30 | 625% |

| From 31 to 45 | 937.5% |

| 46 or more | 1,250% |

(e) Non-DvP (non-delivery-versus-payment) transactions. (1) A bank must hold risk-based capital against any non-DvP transaction with a normal settlement period if the bank has delivered cash, securities, commodities, or currencies to its counterparty but has not received its corresponding deliverables by the end of the same business day. The bank must continue to hold risk-based capital against the transaction until the bank has received its corresponding deliverables.

(2) From the business day after the bank has made its delivery until five business days after the counterparty delivery is due, the bank must calculate its risk-based capital requirement for the transaction by treating the current market value of the deliverables owed to the bank as a wholesale exposure.

(i) A bank may assign an obligor rating to a counterparty for which it is not otherwise required under this rule to assign an obligor rating on the basis of the applicable external rating of any outstanding unsecured long-term debt security without credit enhancement issued by the counterparty.

(ii) A bank may use a 45 percent ELGD and LGD for the transaction rather than estimating ELGD and LGD for the transaction provided the bank uses the 45 percent ELGD and LGD for all transactions described in paragraphs (e)(1) and (2) of this section.

(iii) A bank may use a 100 percent risk weight for the transaction provided the bank uses this risk weight for all transactions described in paragraphs (e)(1) and (2) of this section.

(3) If the bank has not received its deliverables by the fifth business day after counterparty delivery was due, the bank must deduct the current market value of the deliverables owed to the bank 50 percent from tier 1 capital and 50 percent from tier 2 capital.

(f) Total risk-weighted assets for unsettled transactions. Total risk-weighted assets for unsettled transactions is the sum of the risk-weighted asset amounts of all DvP, PvP, and non-DvP transactions.

- A bank may instead apply a 300 percent risk weight to the EAD of an eligible margin loan if the bank is not able to assign a rating grade to the obligor of the loan. Return to text

- See 12 CFR part 3, Appendix A, section 3(a)(3)(iii) (national banks); 12 CFR part 208, Appendix A, section III.C.3. (state member banks); 12 CFR part 225, Appendix A, section III.C.3. (bank holding companies); 12 CFR part 325, Appendix A, section II.C.a. (state non-member banks); 12 CFR 567.6(a)(1)(iii) and (iv) (savings associations). Return to text

- For purposes of this determination, for OTC derivative contracts, a bank must maintain a written and well reasoned legal opinion that this agreement meets the criteria set forth in the definition of qualifying master netting agreement. Return to text

- Unsettled repo-style transactions are treated as repo-style transactions under sections 31 and 32. Return to text

,

,