January 10, 2014

Reserve Bank income and expense data and transfers to the Treasury for 2013

For immediate release

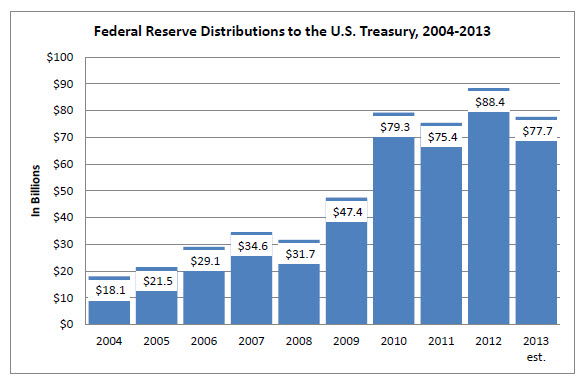

The Federal Reserve Board on Friday announced preliminary unaudited results indicating that the Reserve Banks provided for payments of approximately $77.7 billion of their estimated 2013 net income to the U.S. Treasury. Under the Board's policy, the residual earnings of each Federal Reserve Bank are distributed to the U.S. Treasury, after providing for the costs of operations, payment of dividends, and the amount necessary to equate surplus with capital paid-in.

The Federal Reserve Banks' 2013 estimated net income of $79.5 billion was derived primarily from $90.4 billion in interest income on securities acquired through open market operations (U.S. Treasury securities, federal agency and government-sponsored enterprise (GSE) mortgage-backed securities (MBS), and GSE debt securities). Operating expenses of the Reserve Banks, net of amounts reimbursed by the U.S. Treasury and other entities for services the Reserve Banks provided as fiscal agents, totaled $3.8 billion in 2013. In addition, the Reserve Banks were assessed $702 million for the costs related to producing, issuing, and retiring currency, $580 million for Board expenditures, and $563 million to fund the operations of the Consumer Financial Protection Bureau. The Reserve Banks had interest expense of $5.2 billion on depository institutions' reserve balances, and recorded losses of $1.3 billion that result from the daily revaluation of foreign currency denominated asset holdings at current exchange rates.

Additional earnings were derived from income from services of $436 million, and net income of $143 million attributable to the consolidated limited liability companies that were created in response to the financial crisis. In 2013, statutory dividends totaled $1.6 billion and $147 million of net income was used to equate surplus to capital paid-in.

The attached chart illustrates the amount of Federal Reserve Banks' residual earnings distributed to the U.S. Treasury from 2004 through 2013 (estimated).

For media inquiries, call 202-452-2955.