Equity Extraction and Mortgage Default

Keywords: Household finance, mortgages, equity extraction, default

Abstract:

Using a property-level data set of houses in Los Angeles County, I estimate that 30% of the recent surge in mortgage defaults is attributable to early home-buyers who would not have defaulted had they not borrowed against the rising value of their homes during the boom. I develop and estimate a structural model capable of explaining the patterns of both equity extraction and default observed among this group of homeowners. In the model, most of these defaults are attributable to the high loan-to-value ratios generated by this additional borrowing combined with the expectation that house prices would continue to decline. Only 30% are the result of income shocks and liquidity constraints. I use this model to analyze a policy that limits the maximum size of cash-out refinances to 80% of the current house value. I find that this restriction would reduce house prices by 14% and defaults by 28%. Despite the reduced borrowing opportunities, the welfare gain from this policy for new homeowners is equivalent to 3.2% of consumption because of their ability to purchase houses at lower prices.

1 Introduction

When house prices peaked and began to decline sharply in 2006, mortgage delinquencies surged, with the fraction of houses in some stage of the foreclosure process reaching 4% in 2010, almost eight times its historical average.1 Focusing on a sample of homeowners from Los Angeles County, California, I show that nearly 40% of these defaulting homeowners were earlier home-buyers who had purchased their homes before 2004. House price growth prior to the peak had been so strong that even after a 30% decline, prices still remained higher than they had been when these owners had first purchased their houses. For more than 90% of these defaulting homeowners, their original mortgage balances would have been less than the current value of their homes, leaving them with positive equity in their homes and little financial motivation to default. However, through cash-out refinances, second mortgages and home equity lines of credit, these homeowners had extracted much of the equity created by the rising value of their homes. As a result, their loan-to-value (LTV) ratios were on average more than 50 percentage points higher than they would have been without this additional borrowing and the majority had mortgage balances that exceeded the value of their homes. The goal of this paper is to develop a model that jointly explains the equity extraction of these early home-buyers and their subsequent decision to default. I use this model to evaluate policies that would limit the ability or incentives of existing homeowners to engage in additional borrowing and estimate the effect of such policies on house prices, default rates and homeowners' welfare.

In order to study the connection between equity extraction and default, I use a unique panel data set from CoreLogic covering single family homes in Los Angeles County, California, from 2000 through 2009.2This data differs from other commonly used mortgage data, such as the Lender Processing Services data or the CoreLogic Loan Performance data, in that the unit of analysis is the property rather than the individual mortgage and it is possible to link together all the mortgages held by a homeowner over the period spanned by the data. This allows me to compute the combined LTV ratio of all liens against a property and to observe when the homeowner withdraws equity.

Examining this data set, I find that the impact of equity extraction on default differs depending on which cohort of home buyers we consider, with earlier purchasers having had more opportunity to extract equity during the boom. Figure 1 breaks down each quarter's defaulters from my Los Angeles data by the year of purchase. While most defaulters during the recent surge were owners who had purchased their homes within several years of the 2006 peak in house prices, a significant and increasing number of defaulters were from earlier cohorts of purchasers. By 2009, more than 40% of the homeowners defaulting each quarter had purchased their homes in 2003 or earlier. At the point where homeowners from this group defaulted, over 40% of their outstanding mortgage debt was attributable to equity extraction subsequent to purchase. The importance of equity withdrawals declines for later cohorts, becoming insignificant for buyers purchasing after the 2006 peak (See Figure 2). In this paper, I therefore focus on these earlier cohorts of buyers.

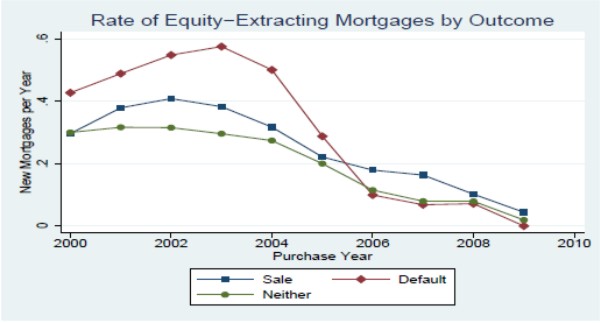

In Figure 3, I plot the distribution of estimated LTV ratios at the time of default for defaulting homeowners who purchased their homes between 2000 and 2003 and compare these LTV ratios to what they would have been had these homeowners not taken out additional mortgage debt.3 When these owners defaulted, I estimate that their average LTV ratio was just over 1.0, a quarter had LTV ratios over 1.4 and 10% had LTV ratios over 1.7. Without any equity extraction, the majority of these homeowners would have had LTV ratios under 0.6 and less than 10% would have had ratios that exceeded unity. Insofar as high LTV ratios were an important factor in these default outcomes, equity extraction is a key part of the story. There is also a significant difference in the rate of equity extraction between homeowners who ultimately defaulted and those who did not. In Figure 4, I compare the equity extraction rates of owners from each cohort who did and did not default during the observation period. Early buyers who remained in their homes throughout the sample period extracted equity at a rate of approximately once every three years. Among homeowners from this group who defaulted by 2009, the rate of equity extraction was 70% higher.4

Explaining this joint behavior of equity extraction and default decisions is made more difficult by limitations of the data. Many of the state variables that we expect to be important factors in these decisions, such as income, assets, the current house value, and expectations about future house prices, are all absent from my mortgage data, as they are from most other mortgage data sets. To fill in these gaps, I construct a dynamic model of homeowners who face both income and house price shocks and make decisions each period regarding savings, their mortgage balance, whether to sell their house and whether to default. The model is closest to those of Yao and Zhang (2008) and Campbell and Cocco (2011) with several important additions that allow me to capture important features of the data. First, in addition to permanent and transitory components, the income process includes a large discrete shock that I associate with unemployment and simulate to match evolving unemployment rates in the data. I find that these unemployment shocks are an important but not dominant driver of defaults. In the simulations, defaulters are five times more likely to be unemployed than the general population of homeowners but only 17% of defaulters are unemployed at the time of default.5Second, the model's treatment of house prices is novel in that it captures the predictability of short-term house price growth, as first documented by Case and Shiller (1989). Beyond the large movements in realized house prices, I find that changing expectations about future price growth is responsible for 20% of equity extraction when prices were rising during the boom and 34% of defaults as prices fell during the bust. Finally, I introduce a preference shock that accounts for the residual heterogeneity in the default decisions of underwater homeowners. This residual shock gives the model the flexibility to reproduce many of the patterns of household default decisions while maintaining income and house price shocks that are calibrated to match observable data.

I estimate the parameters of the model by matching a set of moments computed from the borrowing and default outcomes recorded in the CoreLogic mortgage data. In addition, the estimation draws on other data sources that contain information about the relationship between the model's unobserved states and observable information such as location, time period and features of the mortgages. I then use the estimated model to study the role of both income and house price shocks in homeowners' decisions to extract equity and default.

The model provides two key mechanisms that connect homeowners' equity extraction during the boom and their decision to default during the bust. First, homeowners who withdraw more equity end up with larger mortgage balances and larger mortgage payments, both of which directly increase the probability of default. Second, liquidity constrained households are more likely to extract equity in order to smooth consumption when hit by a negative income shock. This introduces a selection effect whereby those homeowners who take out larger mortgages are more likely to have fewer liquid assets and a history of negative income shocks, a condition that in itself increases the risk of default. Quantitatively, I find it is the direct effect of equity extraction rather than this selection effect that explains most of the connection between equity extraction and default. Income shocks and liquidity constraints account for only 30% of defaults following the decline in prices.

Using this estimated model, I study two counterfactual policies that would reduce homeowners' ability or incentive to extract equity. The first policy limits the amount of equity that existing homeowners can withdraw by prohibiting cash-out refinances from exceeding 80% of the current house value. This restriction is similar to a key provision of refinance policies currently in effect in Texas. In the second policy, I treat mortgages as full recourse loans. This means that after leaving the house, a defaulting borrower would continue to be obligated to repay the portion of the mortgage not covered by the sale price of the house. Most states allow the lender to take legal action against defaulting homeowners to enforce this obligation. California, however, where the present study is focused, is generally classified as a "non-recourse" states where such actions are prohibited.6

In the first policy experiment, I find that limiting the amount of equity that homeowners can extract reduces the amount of equity extracted during the boom by 23%. Because of the decreased collateral value of housing, prices fall by an average of 14% and the combination of lower house prices and less ability to borrow causes households to hold less debt and therefore to default at a lower rate. Of the homeowners who default in the baseline model, 41% do not under this policy. However, the overall default rate is only 28% lower. This is because of an offsetting increase in defaults that arises from the reduced borrowing opportunities for homeowners with small but positive amounts of equity. The inability of these homeowners to access this equity has two consequences. The first is to close a borrowing channel that could be used to prevent default should they experience a negative income shock and become liquidity constrained. The second effect is to reduce the value of staying in the home for homeowners with negative equity and the prospect of regaining some positive equity through price growth. By decreasing the value of having small levels of positive equity, this increases the probability that such households will default when presented with an opportunity to do so. The welfare gain of this restriction for new homeowners is equivalent to 3.2% of consumption due to the lower prices at which they can purchase housing. Under a more extreme version of the policy that prohibits homeowners from extracting any equity at all, the default rate falls to 20% of its original value. I therefore conclude that equity extraction was responsible for 80% of defaults among these early home-buyers, representing approximately 30% of the total number of defaults in Los Angeles County from 2006 to 2009.

In the other policy experiment, I find that granting full recourse to lenders reduces defaults significantly. First, because the mortgages that can be secured by the house are less valuable, house prices fall by 12% so homeowners have less expensive houses and smaller mortgages at the time of purchase. Second, because homeowners can no longer expect to be relieved of their repayment obligations upon default, they take on less debt, reducing their equity extraction during the boom by 18%. Finally, the policy creates a strong disincentive to default among homeowners who already have negative equity. The total default rate falls by 45%. I estimate that the overall welfare gain to new homeowners from this policy is equivalent to 2.7% of consumption, again due to the lower price of housing.

1.1 Related Literature

This paper contributes to several strands of the existing literature on default. Empirical studies of mortgage default such as by Deng, Quigley and Van Order (2000) and Bajari, Chu and Park (2008) have provided evidence for the importance of the LTV ratio in the default decision. This paper, in contrast, focuses on homeowners for whom the LTV ratio is endogenously determined so that quantifying the relationship between LTV ratios and defaults requires a model that also explains differences in borrowing decisions. Elul et al. (2009) further demonstrate the importance of the interaction between high LTV ratios and liquidity constraints in producing defaults. In the model presented in this paper, spending decisions made by households can cause them to exhaust their liquid assets so that the binding liquidity constraints also emerge as endogenous outcomes. Ghent and Kudlyak (2011) find that at a fixed level of negative equity, recourse decreases the probability of default by 30%. I argue that in addition to this effect, the threat of recourse results in homeowners approaching the default decision with less negative equity. On the subject of equity extraction, Hurst and Stafford (2004) show that homeowners with few liquid assets and a history of negative income shocks are more likely to extract equity. My model is consistent with their findings.

Regarding the relationship between refinancing and default, Foote, Gerardi and Willen (2008a) find that foreclosed homes in New England exhibited greater refinancing activity and tended to have more life-time mortgages than those that were not foreclosed upon. Mian and Sufi (2011) identify a correlation at the regional level between the rate of house price appreciation from 2002-2006 and the default rate between 2006-2008. Based on this relationship, they conclude that house price growth and the resulting equity withdrawal can account for 35% of the total number of defaults in this period. The conclusion supported by their analysis is that had prices not risen from 2002-2006, inducing homeowners to borrow against accumulated equity, the default rate during 2006-2008 might have been 35% lower. This differs from the counterfactual experiment that motivates the present study, in which house price growth is left unaltered but the borrowing opportunities of homeowners are changed.

Earlier structural models that include homeowners' mortgage choices and the option to default include Campbell and Cocco (2003), and Yao and Zhang (2008). More recently, Campbell and Cocco (2011) develop a model which focuses more on defaults but does not allow homeowners to refinance. An important difference between these papers and the present study is that I estimate my model using household-level data and am able to quantitatively match the cross-sectional and time series patterns of default found in that data. This provides me a realistic baseline model from which to run counter-factual policy experiments. Li, Lui and Yao (2008) also estimate a model of housing and mortgage choices using household data from the PSID, but in their model, homeowners never have an incentive to default.

A growing literature in macroeconomics studies the mortgage choices of homeowners in a general equilibrium setting in which prices are determined endogenously. Papers that study the effects of default risk on interest rates include Jeske, Krueger and Mittman (2010), Guler (2008), and Corbae and Quintin (2010). Chatterjee and Eyigungor (2009) study the equilibrium effects of default on house prices and include an analysis of the effects of foreclosure prevention policies on prices. Favilukis, Ludvigson, and Van Nieuwerburgh (2011) account for the boom and bust in U.S. aggregate house prices in a model where credit constraints on mortgages are relaxed and later re-tightened. The current paper does not attempt to solve for equilibrium interest rates. Also, while I do allow the overall level of house prices to adjust in response to policy changes, I the rate at which prices grow each period. This allows me to include a more realistic model of the income and house price risks that drive equity extraction and default.

The rest of the paper is organized as follows. In Section 2, I present a structural model of equity extraction and default. In Section 3, I describe my mortgage data set and the other sources of data on income and assets which I use to estimate the parameters of the model. I explain the estimation of this model in Section 4 and discuss the results of the estimation in Section 5. The policy experiments are described in Section 6. Finally, Section 7 concludes and discusses potential implications of my findings for current policy discussions.

2 Model

In this section, I describe a dynamic model of a homeowner who makes decisions about consumption and savings, is able to adjust his mortgage balance, and has the options to pay off his mortgage and sell the house or to default on the mortgage. The key novel feature is the set of shocks that allow the model to match the data: a large discrete unemployment shock, changing expectations about future house prices, and a continuous preference shock that captures residual heterogeneity in the default choices of underwater homeowners.

2.1 Preferences

Time in the model is discrete and households are infinitely lived. Each period, households consume housing services ![]() and non-housing consumption

and non-housing consumption

![]() and receive utility

and receive utility

|

In addition to the quantity of housing and non-housing consumption, households have time-varying preferences each period over whether to remain in their current house or to move to a different house. I denote the utility derived each period from the decision over whether to stay or move by

Preferences are time-separable with discount factor ![]() so that at time

so that at time ![]() ,

households have preferences over

,

households have preferences over

|

2.2 Income

Households have risky labor income ![]() that follows a process

that follows a process

where

The discrete unemployment shock in the income process is not standard in this literature.7 I introduce it for two reasons. First, a large and persistent income shock is likely an important factor in a household's default decision. Second, the observed measure of income shocks present in the data is an estimate of the local unemployment rate. When I simulate the model, I draw realizations of this unemployment shock in a way that is consistent with the patterns of unemployment found in the data.8

2.3 Assets

Households hold three kinds of assets, a one-period bond, their house, and a mortgage. The bond ![]() earns a risk-free savings rate

earns a risk-free savings rate ![]() and must be held in positive quantity.

and must be held in positive quantity.

2.3.1 Housing

The household must hold an amount of the housing asset equal to the amount of housing services consumed that period, so both are identified with the quantity ![]() . The price per unit of

housing is

. The price per unit of

housing is ![]() so the value of the house is

so the value of the house is

![]() . There is maintenance cost each period proportional to the value of the house,

. There is maintenance cost each period proportional to the value of the house, ![]() . Households may sell their house and purchase a house of different size

. Households may sell their house and purchase a house of different size

![]() , also priced at

, also priced at ![]() , by paying a fixed cost

, by paying a fixed cost

![]() and a transaction cost proportional to the value of the house being sold,

and a transaction cost proportional to the value of the house being sold,

![]() . Finally, a household that moves to a different house incurs a utility penalty equal to

. Finally, a household that moves to a different house incurs a utility penalty equal to

The proportionality factor which multiplies

Innovations to house prices have three components, two of which are common within the household's geographic region, indexed by ![]() , and one that that is idiosyncratic to the household.

First, there is a persistent regional component

, and one that that is idiosyncratic to the household.

First, there is a persistent regional component ![]() , which can take one of two values,

, which can take one of two values,

![]() and follows a Markov process with transition matrix

and follows a Markov process with transition matrix

![]() . Without loss of generality, I assume that

. Without loss of generality, I assume that

![]() so that

so that ![]() represents the high-price-growth state. Second, there

is an i.i.d. component to regional house prices

represents the high-price-growth state. Second, there

is an i.i.d. component to regional house prices

![]() . Finally, the is an i.i.d. idiosyncratic component

. Finally, the is an i.i.d. idiosyncratic component

![]() so that the total time-

so that the total time-![]() price

appreciation of house

price

appreciation of house ![]() in region

in region ![]() is given by:

is given by:

The expected price growth in the subsequent period,

is not constant over time, but depends on the current value of

I assume that households do not observe the true state ![]() , but rather they observe a history of regional house prices {

, but rather they observe a history of regional house prices {

![]() and solve a filtering problem to determine the probability distribution

and solve a filtering problem to determine the probability distribution

![]() over the two states

over the two states

![]() in each period.10 This

distribution, which can be summarized by

in each period.10 This

distribution, which can be summarized by

![]() , the probability that region

, the probability that region ![]() is in the high-appreciation state at

time

is in the high-appreciation state at

time ![]() , becomes a state variable in the household problem.11

, becomes a state variable in the household problem.11

2.3.2 Mortgages

The household holds a mortgage of size ![]() on which it makes interest payments

on which it makes interest payments ![]() but does not pay down the principal.12 Homeowners may change the size of their mortgage, subject to two restrictions on the new

mortgage. The first restriction is that the new total mortgage balance may not exceed a fraction

but does not pay down the principal.12 Homeowners may change the size of their mortgage, subject to two restrictions on the new

mortgage. The first restriction is that the new total mortgage balance may not exceed a fraction ![]() of the current house value. This limit on the LTV ratio may depend on current

beliefs about future house prices, so that lending standards are looser if prices are expected to rise, i.e.

of the current house value. This limit on the LTV ratio may depend on current

beliefs about future house prices, so that lending standards are looser if prices are expected to rise, i.e.

![]() , where the function

, where the function

![]() is increasing. There is no period-by period borrowing constraint so the LTV ratio,

is increasing. There is no period-by period borrowing constraint so the LTV ratio, ![]() , may become arbitrarily high if house prices decline. The second restriction is that mortgage payments may not exceed a fraction

, may become arbitrarily high if house prices decline. The second restriction is that mortgage payments may not exceed a fraction ![]() of permanent income,

of permanent income,

![]() , where

, where

![]() depending on whether the mortgage is for a new purchase (P) or to refinance the mortgage on the current home (R).

depending on whether the mortgage is for a new purchase (P) or to refinance the mortgage on the current home (R).

There are two costs associated with refinancing a mortgage, a fixed cost, which is fraction ![]() of permanent income, and a fraction

of permanent income, and a fraction ![]() of the the total size of the new mortgage. Although the interest rate on all allowed mortgages is the same, households wishing to borrow an amount greater than

of the the total size of the new mortgage. Although the interest rate on all allowed mortgages is the same, households wishing to borrow an amount greater than

![]() of the house value pay an additional one-time cost

of the house value pay an additional one-time cost

![]() . This additional cost captures actual costs such as mortgage insurance, as well as higher interest rates paid by borrowers taking out riskier mortgages.13 There is no cost associated with paying off the current mortgage and not taking out a new one. Thus the total cost of choosing a new mortgage

. This additional cost captures actual costs such as mortgage insurance, as well as higher interest rates paid by borrowers taking out riskier mortgages.13 There is no cost associated with paying off the current mortgage and not taking out a new one. Thus the total cost of choosing a new mortgage

![]() with

with ![]() is

is

![]() .

.

When the house is sold, the balance of the mortgage is repaid from the proceeds of the sale. If

![]() , then the funds generated by the sale are insufficient to repay the mortgage debt. In the data, I do see sales occurring for houses that appear to be worth less

than the outstanding mortgage balance. To capture this feature of the data, I allow homeowners to repay the balance of the mortgage in excess of

, then the funds generated by the sale are insufficient to repay the mortgage debt. In the data, I do see sales occurring for houses that appear to be worth less

than the outstanding mortgage balance. To capture this feature of the data, I allow homeowners to repay the balance of the mortgage in excess of

![]() out of savings. However, to do so, they incur a cost

out of savings. However, to do so, they incur a cost

![]() , which is proportional to the amount of mortgage debt being repaid from sources other than sale of the home. If

, which is proportional to the amount of mortgage debt being repaid from sources other than sale of the home. If ![]() , then homeowners freely pay off excess mortgage debt from their liquid assets. As

, then homeowners freely pay off excess mortgage debt from their liquid assets. As

![]() , households are unable (or unwilling) to use funds from other sources in order to pay off the mortgage. In reality, there is little evidence that homeowners

contribute other funds towards the repayment of a mortgage balance that is not covered by the sale price of the house. Rather, a finite value of

, households are unable (or unwilling) to use funds from other sources in order to pay off the mortgage. In reality, there is little evidence that homeowners

contribute other funds towards the repayment of a mortgage balance that is not covered by the sale price of the house. Rather, a finite value of ![]() likely describes the willingness of

banks to engage in short sales and to release the lien and accept the sale price as repayment even if it falls short of the outstanding debt. However, I do not model such short sales explicitly.14

likely describes the willingness of

banks to engage in short sales and to release the lien and accept the sale price as repayment even if it falls short of the outstanding debt. However, I do not model such short sales explicitly.14

2.4 Default

Mortgage default is modeled in a way to capture the fact that loans in California are non-recourse. Homeowners defaulting on their mortgages remain in their houses for the current period but do not have to make mortgage or maintenance payments. At the end of the period, they pay moving costs

![]() (but not the transaction cost

(but not the transaction cost

![]() ) and retain any remaining liquid assets

) and retain any remaining liquid assets ![]() . They incur the

non-monetary moving cost

. They incur the

non-monetary moving cost ![]() and permanently enter a frictionless rental market in which housing services are available at price

and permanently enter a frictionless rental market in which housing services are available at price ![]() . A household that cannot afford its mortgage and maintenance payments and does not have feasible options among changing its mortgage position or house size is forced to default. A household that does have other feasible options may

still choose to default as an optimal decision.

. A household that cannot afford its mortgage and maintenance payments and does not have feasible options among changing its mortgage position or house size is forced to default. A household that does have other feasible options may

still choose to default as an optimal decision.

2.5 Preference Shocks

Every period, the household receives a preference shock of strength ![]() that controls its preference for remaining in the current house. If the household leaves its house during this

period, either by selling or defaulting, it receives additional utility

that controls its preference for remaining in the current house. If the household leaves its house during this

period, either by selling or defaulting, it receives additional utility

With probability

This preference shock generalizes the "moving shock" that Cocco (2005) and others have introduced in order to match the rate at which homeowners sell their homes. In the limit

![]() , homeowners always move in response to this shock and it becomes equivalent to the moving shock of previous models. Allowing this shock to arrive with different

strengths provides a range of realizations for which homeowners whose mortgage balances far exceed their house values will default but those with mortgages only slightly above their hose house values will remain in their homes. This allows me to better match the increasing rate of default among

homeowners with higher amounts of negative equity.

, homeowners always move in response to this shock and it becomes equivalent to the moving shock of previous models. Allowing this shock to arrive with different

strengths provides a range of realizations for which homeowners whose mortgage balances far exceed their house values will default but those with mortgages only slightly above their hose house values will remain in their homes. This allows me to better match the increasing rate of default among

homeowners with higher amounts of negative equity.

2.6 Household Problem

The problem faced by the homeowner each period can be written recursively. The solution to this problem is given by a value function

where

- Continue to pay the mortgage

- Refinance into a new mortgage of size

. The amount of equity extracted is equal to

. The amount of equity extracted is equal to

- Sell the house and purchase a new house of size

with a new mortgage

with a new mortgage

- Default

where solves the renter's problem, defined below.

solves the renter's problem, defined below.

Expectations are taken over the possible realizations of the permanent and transitory income shocks, the unemployment shock, the regional and idiosyncratic house price shocks and the preference shock.16 The value function is the maximum value of these four choices

After default, renters make decisions over the housing and non-housing consumption. Renters are not responsible for maintenance costs and can costlessly adjust their housing consumption. The renter's problem can be written

2.7 Model Solution

The model has been constructed so that it is possible to reduce the dimension of the state space by rewriting the problem in terms of variables that are normalized by permanent income:

![]() and

and

![]() .17 In this formulation, neither the

level of permanent income

.17 In this formulation, neither the

level of permanent income ![]() , nor the level of housing prices

, nor the level of housing prices ![]() enters the household

problem explicitly, greatly reducing the size of the state space and the computational burden of solving the model. Details are shown in an appendix.

enters the household

problem explicitly, greatly reducing the size of the state space and the computational burden of solving the model. Details are shown in an appendix.

Once the problem has been expressed in these normalized variables, I discretize the state space and the control space and then solve the household problem using value function iteration. At values in between these discrete points, I approximate the value function using linear interpolation.

3 Data

In this section, I describe the sources of data that I use to estimate the parameters of the model presented above.

3.1 Liens Data

The main data set used in this analysis is a series of quarterly "open lien searches" conducted by CoreLogic on all single family residences in Los Angeles County, California from 2000 to 2009.18 These searches identify all outstanding mortgages currently open against each property. As described in the introduction, the novel feature of this data set is that the unit of analysis is the property rather than the mortgage. Because it is possible to link together all the mortgages taken out against each property, I can compute the total mortgage balance and measure equity extraction.

At the start of 2000, the data contains 1.2 million properties. As new residences are built, the number rises, reaching 1.3 million by the end of the sample. Each property is identified by unique numerical identifier as well as the postal address, which I use to identify the 2000 census tract and other geographical information. For each quarterly observation, the data include information about the most recent sale, including the date, the purchase price, a calculation of the combined LTV ratio at purchase, and whether it was a foreclosure sale. Including multiple owners of the same property, the data contains 1.9 million distinct ownership episodes.

3.1.1 Mortgages

In each quarter, the data includes information on up to four mortgages held against the property. For each mortgage, the data identifies the date and original amount of the loan, the maturity date, whether it was a purchase, refinance or junior mortgage, and the type of mortgage (conventional, FHA, VA etc.) There is additional information on junior mortgages such as whether it is a second or revolving mortgage. For most mortgages, the data also includes the interest rate and whether that rate is fixed or adjustable.19 A subset of adjustable rate mortgages, mostly from the end of the sample, also includes detailed information on the the contractual details governing rate adjustments.

There is no information about FICO scores or whether the loan is prime or sub-prime, but for many mortgages, there is an indicator of whether the mortgage lender is identified as a lender specializing in sub-prime mortgages. Gerardi et al. (2007) show that this measure is highly correlated with whether the loan itself can be categorized as sub-prime. Of the houses purchased after the start of the sample period, this indicator is present for 79% of purchase mortgages in the sample, with 22% of those mortgages classified as sub-prime. As shown in Table 1, the fraction of homes purchased with mortgages from sub-prime lenders grows from 14% in 2001 to 28% in 2004-2005 and drops off dramatically after 2006.

Although the data does not include payment history, CoreLogic calculates the outstanding balance on each mortgage each quarter using a proprietary algorithm. This allows identification of which refinances involve the extraction of equity. Figure 5 shows the number and type of new mortgages taken out each quarter, dividing these mortgages into cash-out refinances, non-cash-out refinances and junior mortgages. The rate at which new mortgages are taken out grows by a factor of five from 2000 to 2003, driven largely by cash-out refinances, and by a surge of non-cash-out refinances as interest rates reached historically low levels in 2003. From 2004 to 2007, approximately one in 12 homeowners took out an additional mortgage or withdrew cash through refinancing each quarter. The rate of cash-out refinancing falls as housing prices begin to decline in 2007, reaching a low point at the height of the financial crisis in 2008 before rebounding slightly in 2009.

3.1.2 Default

The data does not include information about whether a borrower has become delinquent. However, if the bank files a notice of default, which it must do to begin the foreclosure process, or a notice of trustee sale, indicating that it has set a date to sell the property, the types and dates of such filings are recorded in the data. The first filing of either of these notices is my measure of mortgage default. Although the notice of default can be filed up to one year after the borrower becomes delinquent, common practice in California is to issue such a notice when the mortgage becomes 90 days delinquent.

In Figure 1, I plot the total number of homeowners defaulting on their mortgages each quarter, broken down by the year of purchase. The default rate starts rising dramatically in 2006 when local house prices stop rising and begin to fall. By 2009, over 12,000 borrowers (more than 1% of all homeowners) are defaulting each quarter. Though these borrowers are disproportionately owners who purchased after 2003, a significant and increasing number of defaulters are drawn from earlier cohorts of purchasers. As I described in the introduction, only for these earlier homeowners did equity extraction play an important role in determining whether they later defaulted.

In Figure 6, I show the fraction of each cohort of buyers who are observed to sell or default by the end of the sample. Of the buyers who purchase in 2006, 40% have already defaulted by the end of 2009. The default rate is far lower for earlier cohorts, with only 7-8% of buyers from 2000-2002 having defaulted by the end of the sample period.

3.1.3 House Prices and Loan-to-Value Ratios

The borrower's combined LTV (cLTV) ratio is a key state variable in the model. The cLTV ratio at the time of purchase is included in the data. Table 1 shows that the mean cLTV ratio at purchase is 0.86-0.87 for most of the sample, rises to 0.88 in 2005 and then jumps to .90 in 2006 before falling down to 0.85 in 2007. The median cLTV ratio shows a similar behavior. A more striking pattern can be seen by looking at the fraction of purchases each quarter that were financed with mortgages with a cLTV ratio greater than or equal to 1.0. I plot this measure in Figure 7. The fraction rises from 10% to over 50% in the last quarter of 2006 and then declines precipitously to less than 2% by the middle of 2008.20

In subsequent periods, computing the LTV ratio21 requires first having an estimate of the current house value. To estimate the house value in each period, I first compute a local zip-code-level house price index. I then construct an estimate of the value of each house each quarter by starting with the observed purchase price and assuming that the rate of appreciation each quarter is equal to the growth in the local price index. By combining this value estimate with the total outstanding mortgage balance, I can construct an estimate of the LTV ratio for each observation.22

To calculate the house price index, I use the purchase information in the liens data to identify properties for which I observe multiple sales. I use these sales to construct a zip-code level repeat-sales housing price index, following the modification of Deng, Quigley and Van Order (2000) to the original algorithm of Case and Shiller. I perform kernel-weighted local polynomial smoothing across time on the resulting quarterly price estimates. Properties in the data are spread over 302 zip codes, and there are a sufficient number of transactions to generate reasonable house price series for approximately 250 of these zip-codes for the period 1986-2009. Though there is substantial variation in the size of the price fluctuations, most zip-codes exhibit similar trends, a peak in house prices around 1990, followed by a moderate decline and then a rapid appreciation starting around 2000. Prices peak in 2006 before declining dramatically and then appear to level off or even slightly recover in the final quarters of 2009. Average price increases from 2000 to 2006 were approximately 150% followed by a decline of almost 50%. A sample of house price indices for several zip-codes is shown in Figure 8.

3.1.4 Estimation Sample

I focus the analysis on earlier cohorts for whom equity extraction was an important factor in determining if they ultimately defaulted. For my estimation, I select houses purchased in 2002-2004. I exclude owners who have purchased their house through a foreclosure sale, houses that are not owner-occupied, and those with missing or outlying values of any variables used in the analysis. I further exclude homeowners with government loans insured by the Federal Housing Administration or guaranteed by the Veterans' Administration, mortgages with terms less than 15 year or greater than 40 years, those houses in zip-codes with fewer than 1000 observed repeated house sales, and houses that do not appear in the data in the quarter in which they were purchased. Of the 100,000 houses meeting these criteria, I randomly select 20% to keep the computations manageable. I include observations from the time of purchase through the second quarter of 2009.

The resulting sample contains 20,531 homeowners across 1,691 census tracts and 230 zip-codes. The median purchase price is $375,000 with a mean of $462,000 and a standard deviation of $341,000. Twenty-seven percent of the sample borrowed their purchase mortgages from a sub-prime lender. Fifty percent took out a second mortgage at the time of purchase and the combined LTV ratio at purchase has a mean of .875, a median of 0.9 and it is greater than or equal to unity for 26.2% of purchasers.23 The 42.7% of homeowners who purchased their homes with a fixed-rate mortgage have an average interest rate of 6.2%, with a standard deviation of 0.5%. Homeowners with adjustable-rate mortgages have an average interest rate of 5.9% with a standard deviation of 1.1%. The average household in this sample takes out 2.5 new mortgages during the sample period. Of these, 10% are non-cash-out refinances, 45% are cash-out refinances, 10% are home equity lines of credit and another 22% are classified as equity mortgages. By the end of the sample, 11% have defaulted and 27% have sold their homes without defaulting.

3.2 American Community Survey

Though I do not have observations of income shocks for individual households, I compute measures of local income shocks from the American Community Survey (ACS), an annual survey conducted by the U.S. Census Bureau since 2001.24Unemployment rates can be computed from this data for each congressional district, broken down by race and age group.25 I use software purchased from Geolytics to identify the congressional district of each property in the liens data, which spans 17 districts. Within each congressional district, I compute a local unemployment rate as a weighted average of the age-race specific rates. For weights, I use the demographic distribution of homeowners in the property's census tract from the 2000 census, also identified using the Geolytics software. When averaged across the sample, this rate begins below 5% in 2002-2003 and reaches 9.2% in 2009 during the recession.

The ACS also reports median annual household income among homeowners for each congressional district. I use growth in this statistic as an additional measure of local income shocks. The average growth rate fluctuates between three and five percent over most of this period but becomes negative in the final year of the sample.

3.3 Panel Study of Income Dynamics

The mortgage data includes no information about income or assets. Instead, I impute starting income and asset values for these homeowners by using observations of new homeowners in the Panel Study of Income Dynamics (PSID). The PSID is a longitudinal household survey conducted by the University of Michigan that has followed approximately 5000 families since 1968. The survey has been conducted biannually since 1997 and each wave since 1999 contains self-reported house values, a detailed breakdown of household income and asset holdings, and information about mortgages, including the principal balances, monthly payments, and interest rates. In particular, I am interested in the empirical relationship between assets and income and household characteristics present in my mortgage data set, such as initial LTV ratios and interest rate types and spreads.

I construct a sample of homeowners from the 1999-2007 waves who report having moved into their current residences within the 12 months preceding the interview and have a mortgage. For each household, I calculate two variables: the ratio of their after-tax household income to their mortgage payments and the total amount of liquid assets.26 The logarithm of the ratio of income to mortgage payments is well approximated by a normal distribution with mean of 1.4 (an absolute value of 4.1) and a standard deviation of 0.6. The median value of liquid assets is is $5000 and the 75th percentile is $20,000. Ten percent of new homeowners report no liquid assets.

I regress the logarithm of both variables on a set of covariates that can be computed from both the PSID and the liens data set: the combined LTV at purchase, whether there was a second mortgage at the time of purchase, a dummy for whether the purchase mortgage had an adjustable interest rate, a measure of the interest rate spread,27 and a dummy for whether the purchase occurred after 2005. Summary statistics for these covariates are shown in Table 2 and the results of these regressions are presented in Table 3. The regression of the ratio of income to mortgage payments uses 782 observations. Home buyers with higher LTV ratios have higher mortgage payments relative to their incomes. The 12% of buyers who purchase their homes using more than one mortgage have payments that are 20% higher than those without a second mortgage, and those buying after 2005 have higher payments by 13%. None of the other coefficients are significant. For assets, I estimate a Tobit model on 706 households with left-censoring at $1000. Those who purchase houses with a higher combined LTV have significantly fewer assets, as do those paying higher interest rates. Each additional percent on the interest rate corresponds to a decrease in assets of 38% for those with fixed-rate mortgages and 52% for borrowers with adjustable-rate mortgages.

The PSID also contains panel data on household income, which I use to calibrate the income process of the structural model presented above. I use the data set of after-tax household income constructed by Heathcote, Perri and Violante (2010), keeping only recent observations (after 1980) and only observations of homeowners, so as to better match my sample of post-2000 homeowners. This leaves me with 33,725 observations in which I can measure the growth of household income from one year to the next. I describe the calibration of the income process based on this data when I discus the parameterization of the model below.

3.4 Empirical Results

Before describing the estimation of the full structural model, I first estimate an empirical model of sales, equity extraction and default to study the dependence of these outcomes on observable household and local characteristics. I use the same estimation sample described above, dropping 355 observations with outlying values of some variables used in the estimation. I follow each house from purchase through the second quarter of 2009, creating a panel of 311,367 household-quarter observations of 20,176 distinct households. As I follow my estimation sample across time, I observe regional income shocks. My measure of the unemployment rate averages 5.7% with a standard deviation of 1.7%. Annual changes in median income levels average 4.0% with a standard deviation of 6.6%. Local house prices are recorded at the zip-code level. The sample spans 230 zip codes. One year house price appreciation averages 6.4% with a large standard deviation (17.0%) that captures a tremendous price increase through 2006 followed by a steep decline.

In each quarter, I consider four possible outcomes,

- The owner chooses to extract equity, either through a cash-out refinance or an additional junior mortgage.

- The owner sells the house and pays off the mortgage.

- The owner defaults on the mortgage, which I see in the data when the bank issues a notice of default.

- The owner makes none of the above choices, either continuing to pay all mortgages or refinancing without withdrawing equity.

I estimate a multinomial logistic regression with these four possible choices, with the last option, continuing to make payments, as the reference category. The estimation includes a set of fixed effects for the year of observation interacted with the year of purchase. Table 4 gives definitions and summary statistics for the variables used in the regression. Results are shown in Table 5.

High cumulative loan-to-value ratios at purchase, high interest rates, having an adjustable rate mortgage, and borrowing from lenders specializing in sub-prime mortgages are all associated with a greater propensity both to extract equity and to default. Comparisons to other data sets, such as the PSID, that include both mortgage information and other asset holdings suggest that high LTV ratios and high interest rates at purchase are both associated with low holdings of liquid assets. Households with LTV ratios above unity are more likely to default and this risk increases somewhat with higher LTV ratios. As the LTV ratios increases above one, households are also less likely to extract equity as there is no longer any equity to withdraw. High price growth leads to greater equity extraction, while negative house price appreciation is associated with higher default rates. Higher local unemployment rates are also associated with a greater likelihood of defaulting. Turning to local demographics from the 2000 census, I find that in locations with more educated populations, homeowners are somewhat more likely to take advantage of opportunities to extract equity and also somewhat less likely to default. These findings are consistent with a large body of previous work.

With regard to selling one's house, I find that households in areas with more homeowners under age 35 are more likely to sell, as are home buyers who purchase their homes with an adjustable rate mortgage, a high-LTV mortgage, or a mortgage with a higher interest rate. These latter measures are probably also indicative of younger owners with lower accumulations of liquid savings. Positive house price growth also increases the probability of sale as it give homeowners the positive equity they need to be able to sell.

I next attempt to match the moments from this estimation using the full structural model presented above.

4 Model Estimation

I estimate the key parameters of the model using the simulated method of moments. Several parameters, however, such as the processes for household income and house prices, rely on other data and are estimated separately.

A period in the model corresponds to one quarter. All quantities in the model are nominal.

4.1 Income

The income process has three components: the permanent shock, the discrete unemployment state, and the continuous transitory shock. I calibrate each of these outside the estimation.

The probability that an employed worker will become unemployed,

![]() is an important parameter in matching the default rate and I estimate it jointly with the other parameters of the model, as described below. Conditional on its value, I

fix the transition rate out of unemployment

is an important parameter in matching the default rate and I estimate it jointly with the other parameters of the model, as described below. Conditional on its value, I

fix the transition rate out of unemployment

![]() to achieve a steady state level of unemployment consistent with the data. The average unemployment rate in my sample is 6.2%. However, this rate combines both homeowners

and non-homeowners, while I am interested only in the rate among homeowners. In order to estimate the difference in unemployment rate by homeownership status, I use PSID data to estimate a logistic regression of the unemployment status of the head of household on homeownership status, also

including dummies for race and a quartic polynomial in the age of the head. I estimate an odds ratio of 0.31 for homeownership, meaning that controlling for age and race, a homeowner is only 31% as likely as a renter to be unemployed. Assuming the total population contains 63% homeowners, which is

the average census-tract-level homeownership rate in my sample from the 2000 census, this implies that the unemployment rate among homeowners is 55% of the overall rate. Therefore I target a steady-state unemployment rate of

to achieve a steady state level of unemployment consistent with the data. The average unemployment rate in my sample is 6.2%. However, this rate combines both homeowners

and non-homeowners, while I am interested only in the rate among homeowners. In order to estimate the difference in unemployment rate by homeownership status, I use PSID data to estimate a logistic regression of the unemployment status of the head of household on homeownership status, also

including dummies for race and a quartic polynomial in the age of the head. I estimate an odds ratio of 0.31 for homeownership, meaning that controlling for age and race, a homeowner is only 31% as likely as a renter to be unemployed. Assuming the total population contains 63% homeowners, which is

the average census-tract-level homeownership rate in my sample from the 2000 census, this implies that the unemployment rate among homeowners is 55% of the overall rate. Therefore I target a steady-state unemployment rate of

![]() I estimate a value

I estimate a value

![]() , which implies a job finding probability

, which implies a job finding probability

![]() =0.60, implying a median unemployment spell of just under one quarter. The average wage replacement rate in California is 50% so I set the replacement rate

=0.60, implying a median unemployment spell of just under one quarter. The average wage replacement rate in California is 50% so I set the replacement rate ![]() .

.

Following Heathcote, Perri and Violante (2010), I calibrate the remaining parameters of the income process to match the mean, the variance and the one-period auto-covariance of the one-year growth in household after-tax log income, using only recent observations of homeowners in their

data.28 Given my estimates for the unemployment process, the resulting parameters are

![]() for the permanent shock and

for the permanent shock and

![]() for the transitory one.

for the transitory one.

4.2 House Prices

To estimate the parameters of the house-price process, I use properties from the liens data with multiple recorded sales after 1986 to construct quarterly, zip-code-level repeat-sales house price indices using the algorithm from Deng, Quigley and Van Order (2000). The long-run growth rate of

housing prices is poorly identified from this window, which contains approximately two full cycles of price growth and decline. When I estimate the model of regional house prices using these zip-code-level indices, I impose the additional constraint that the annual nominal long run growth rate in

house prices equal 4%. I estimate mean appreciation in the two regimes to be

![]() with transition probabilities

with transition probabilities

![]() and a standard deviation of the regional i.i.d. house shock

and a standard deviation of the regional i.i.d. house shock

![]() This means that during a boom, homeowners expect prices to grow at 3.8% quarterly and for this appreciation to continue on average for 22 quarters. In periods of declining

house prices, average declines are 1.8% per quarter and last for 11 quarters on average.

This means that during a boom, homeowners expect prices to grow at 3.8% quarterly and for this appreciation to continue on average for 22 quarters. In periods of declining

house prices, average declines are 1.8% per quarter and last for 11 quarters on average.

In addition to changes in regional house prices, households face quarterly idiosyncratic price shocks

![]() . Consider a house

. Consider a house ![]() in region

in region

![]() that sells in period

that sells in period ![]() at price

at price ![]() and then again in period

and then again in period

![]() at price

at price

![]() . If the zip-code level house prices indices at the times of the two sales are

. If the zip-code level house prices indices at the times of the two sales are ![]() and

and

![]() , then the idiosyncratic portion of the change in prices

, then the idiosyncratic portion of the change in prices

|

is distributed

|

Depending on how I choose the the sample of repeat sales for this estimation, I get values of

In the data, I observe a correlation of 0.17 between the growth rates of median income and the zip-code-level house price index. However, there is also a significant amount of additional idiosyncratic variation in both income and house price growth for individual households. Using the calibrated parameters of my income and house price processes, I estimate that the correlation between house prices and permanent income for an individual homeowner is only 0.03.29 This is the value I use in the model.

4.3 Other Parameters

I fix the quarterly return on savings at ![]() and the mortgage interest rate at

and the mortgage interest rate at ![]() , the average interest rate in my sample. Quarterly maintenance costs are fixed at a fraction

, the average interest rate in my sample. Quarterly maintenance costs are fixed at a fraction ![]() of the house price, consistent with spending on alterations

and repairs reported by respondents in the American Housing Survey.30 During the boom, it was common to take out a mortgage equal to 100% of one's house

value so I set the limit on LTV ratios for new mortgages during periods of positive expected price growth to

of the house price, consistent with spending on alterations

and repairs reported by respondents in the American Housing Survey.30 During the boom, it was common to take out a mortgage equal to 100% of one's house

value so I set the limit on LTV ratios for new mortgages during periods of positive expected price growth to

![]() . After the crash, lending standards tightened and I use an 80% limit for periods of negative expected price growth,

. After the crash, lending standards tightened and I use an 80% limit for periods of negative expected price growth,

![]() . At intermediate values, I assume the limit is piecewise linear and include the value of

. At intermediate values, I assume the limit is piecewise linear and include the value of

![]() in the list of estimated parameters. Finally, I impose the additional borrowing costs for riskier mortgages on mortgages that exceed a threshold fraction

in the list of estimated parameters. Finally, I impose the additional borrowing costs for riskier mortgages on mortgages that exceed a threshold fraction

![]() of the value of the home. This is the LTV ratio above which private mortgage insurance is typically required.

of the value of the home. This is the LTV ratio above which private mortgage insurance is typically required.

4.4 Simulations

This leaves 18 model parameters that are key for matching patterns of sales, equity extraction and default found in the data: the three preference parameters

![]() , borrowing limits

, borrowing limits ![]() ,

, ![]() and

and

![]() , mortgage costs

, mortgage costs

![]() , moving costs

, moving costs

![]() , the rent-price ratio for defaulters

, the rent-price ratio for defaulters ![]() , parameters

of the preference shocks

, parameters

of the preference shocks

![]() and the rate of job loss

and the rate of job loss

![]() . These parameters are estimated using the simulated method of moments.

. These parameters are estimated using the simulated method of moments.

Each of the 20,531 households in my estimation sample is simulated 25 times. Simulations begin at the time of purchase and end when the homeowner moves or defaults, or reaches the end of the sample period, which extends to second quarter of 2009. This creates a maximum sample period of 30

quarters. The probability that an employed homeowner loses his job is held constant at

![]() and I vary the probability with which an unemployed worker becomes employed to reproduce the current local unemployment rate.31 Shocks to permanent income are drawn from a normal distribution with a mean to match the period and region specific growth rate of median income.

and I vary the probability with which an unemployed worker becomes employed to reproduce the current local unemployment rate.31 Shocks to permanent income are drawn from a normal distribution with a mean to match the period and region specific growth rate of median income.

The evolution of regional house prices follows the observed zip-code level house price indices calculated from the data. For each period, in each zip-code, I update ![]() using the

same filtering algorithm attributed to agents in the model. In Figure 9, I plot the distribution of

using the

same filtering algorithm attributed to agents in the model. In Figure 9, I plot the distribution of ![]() across zip-codes at different times. This graph

shows that until mid-2005, all households expected prices to continue rising. By the end of the boom in mid-2006, approximately half of households still believed that the probability of continued price growth was greater than 50%. The model predicts that by the start of 2008, all homeowners in the

sample would have believed that prices would continue to fall.

across zip-codes at different times. This graph

shows that until mid-2005, all households expected prices to continue rising. By the end of the boom in mid-2006, approximately half of households still believed that the probability of continued price growth was greater than 50%. The model predicts that by the start of 2008, all homeowners in the

sample would have believed that prices would continue to fall.

The continuous transitory income shocks and idiosyncratic house price shocks are drawn from their unconditional distributions.

I match a set of 190 observable moments motivated by the empirical analysis of the Section 3.4. These moments include the rates of new mortgage origination (excluding non-cash-out refinances), default and sale each quarter, plus the interaction of these rates with unemployment, median income growth, house price appreciation, LTV ratio at purchase and the current observed LTV ratio. I also target the rates of default and sale by LTV ratio, the LTV ratio of homeowners each period who do and do not default, the total number of households who sell and default, and the rate of equity extraction by purchase year and outcome. From the PSID data on new homeowners, I target the average value of mortgage payments as a fraction of income and the the 50th and 75th percentiles of the distribution of liquid assets.32

Due to the computational demands of this estimation, I use a parallelized implementation of the Nelder-Mead simplex algorithm, as described in Lee and Wiswall (2007).33

4.4.1 Initial Conditions

Each simulated household begins with a level of permanent income and an endowment of liquid assets, already having decided to purchase a house and now optimizing over the size of that house and a starting mortgage balance. Equivalently, the household makes choices over the starting LTV ratio and the fraction of its income consumed by its mortgage payments. The procedure by which I assign these starting values for income and assets is designed to satisfy two objectives. First, the model makes predictions about the optimal choice of house size and mortgage balance for each starting value of income and assets. Starting values should be assigned so that, on average, household are making choices consistent with these predictions. Second, based on my analysis of new homeowners in the PSID, there is significant heterogeneity in assets and income of homeowners immediately after purchase. Most of this heterogeneity cannot be explained based on observable characteristics of the household. However, analysis of these new homeowners reveals that there are statistically significant correlations between starting income and assets and some characteristics that are observable in the data. Most notably, homeowners with higher interest rates tend to begin with lower asset holdings but do not have larger mortgage payments relative to their income. (See Section 3.3.) These correlations should be reproduced in the simulations. The procedure by which I assign the initial conditions satisfies these two objectives. Details are described in an appendix. This procedure defines three additional free parameters, which I estimate jointly with the other parameters of the model. The definitions and estimated values of these parameters are contained in the appendix. Finally, I assume that homeowners are employed at the time of purchase.

5.1 Parameter Estimates

Parameter estimates are are shown in Table 6. I find a quarterly discount factor of 0.94. This low value is consistent with the fact that households only extract equity when they deplete their liquid assets and in the data, new equity-extracting mortgages are initiated

every 10-12 quarters. In the model, all spending beyond mortgage and maintenance payments is attributed to consumption and so the rapid rate at which assets are exhausted means that the desire for immediate consumption is very high and the discount factor must be low.34 The estimate of risk aversion is

![]() The share of housing consumption in the utility function is

The share of housing consumption in the utility function is

![]() , slightly higher than, for example, the 19% share of 2005 expenditures spent on shelter according to the Consumer Expenditure Survey, and consistent with the fact that

housing costs in Los Angeles are higher than the national average. The estimated values of mortgage costs

, slightly higher than, for example, the 19% share of 2005 expenditures spent on shelter according to the Consumer Expenditure Survey, and consistent with the fact that

housing costs in Los Angeles are higher than the national average. The estimated values of mortgage costs ![]() and

and ![]() mean that the cost of new mortgages is 15% of quarterly income income, which is approximately ten days worth of earnings, plus 1.2% of the value of the mortgage. This is slightly higher than actual initial mortgage fees, which averaged approximately 0.5% during

this period according to the Federal Housing Financing Board's Monthly Interest Rate Survey.

mean that the cost of new mortgages is 15% of quarterly income income, which is approximately ten days worth of earnings, plus 1.2% of the value of the mortgage. This is slightly higher than actual initial mortgage fees, which averaged approximately 0.5% during

this period according to the Federal Housing Financing Board's Monthly Interest Rate Survey.

Homeowners wishing to take out loans with LTV greater than 0.8 must pay a fraction ![]() of the entire balance. This can be thought of as approximately seven to ten years of mortgage

insurance payments, which are typically just under one percent of the total loan balance per year.

of the entire balance. This can be thought of as approximately seven to ten years of mortgage

insurance payments, which are typically just under one percent of the total loan balance per year.

New buyers are restricted from taking out mortgages whose payments are greater than

![]() of their after-tax income. For the sake of comparison, guidelines for conforming conventional loans call for mortgage payments not to exceed 28% of the borrower's gross income. I estimate that there are no income limits on homeowners wishing to refinance, i.e. a value of

of their after-tax income. For the sake of comparison, guidelines for conforming conventional loans call for mortgage payments not to exceed 28% of the borrower's gross income. I estimate that there are no income limits on homeowners wishing to refinance, i.e. a value of ![]() sufficiently large that it is a non-binding constraint.

This estimate is necessary for the model to reproduce the higher rate of equity extraction among defaulters compared to non-defaulters. Homeowners who ultimately defaulted tended to already have larger mortgages at the time of purchase, but this group of homeowners nevertheless extracted equity at

a greater rate than those who did not default. This suggests that households who already had significant mortgage obligations were committing increasingly large fractions of their income to debt payments as prices climbed. Overall, the median household in my estimation sample increases its mortgage

balance by 20% and a quarter of homeowners expand their debt by over 50%, rates that far exceed the growth of income during these years. The availability of mortgages with such high debt-to-income ratios is consistent with the popularity of "low-doc" and "no-doc" mortgages during this

period.

sufficiently large that it is a non-binding constraint.

This estimate is necessary for the model to reproduce the higher rate of equity extraction among defaulters compared to non-defaulters. Homeowners who ultimately defaulted tended to already have larger mortgages at the time of purchase, but this group of homeowners nevertheless extracted equity at

a greater rate than those who did not default. This suggests that households who already had significant mortgage obligations were committing increasingly large fractions of their income to debt payments as prices climbed. Overall, the median household in my estimation sample increases its mortgage

balance by 20% and a quarter of homeowners expand their debt by over 50%, rates that far exceed the growth of income during these years. The availability of mortgages with such high debt-to-income ratios is consistent with the popularity of "low-doc" and "no-doc" mortgages during this

period.

The rent-price ratio that prevails in the post-default rental market is ![]() , which equals 0.68 in annual terms. This estimate captures not just the true cost of rental housing but

all the costs associated with default including the distaste for renting, the impact on the homeowner's credit score and any potential stigma. This value is approximately ten times the true rent-price ratio, indicating a high cost of default. If the true rent-price ratio is 6%, this default cost is

equivalent to sacrificing 51% of future consumption. This high value reflects the low rate at which underwater homeowners default despite their strong financial incentive to do so. Even at LTV ratios above 1.5, the default rate is still less than 4.5% per quarter.

, which equals 0.68 in annual terms. This estimate captures not just the true cost of rental housing but

all the costs associated with default including the distaste for renting, the impact on the homeowner's credit score and any potential stigma. This value is approximately ten times the true rent-price ratio, indicating a high cost of default. If the true rent-price ratio is 6%, this default cost is

equivalent to sacrificing 51% of future consumption. This high value reflects the low rate at which underwater homeowners default despite their strong financial incentive to do so. Even at LTV ratios above 1.5, the default rate is still less than 4.5% per quarter.

In the data, there is a considerable amount of default among homeowners with positive equity. Homeowners with an LTV ratio less than .75 default at a rate of 0.14% per quarter, which is more than half the total default rate during the early part of the sample. Even after accounting for the fact

that these LTV ratios ignore the unobserved idiosyncratic component of house values, I estimate large moving costs to explain why these homeowners default rather than sell. The estimated values are a fixed cost of

![]() times quarterly income and transaction costs (

times quarterly income and transaction costs (![]() ) equal to 20%

of the sale price. With these values, the model successfully reproduces default rates at different LTV ratios as shown in Table 7.

) equal to 20%

of the sale price. With these values, the model successfully reproduces default rates at different LTV ratios as shown in Table 7.

I have assumed that the limit on LTV ratios for new mortgages is 1.0 during periods of positive expected price growth and 0.8 when prices are expected to decline. Based on the amount of borrowing in the data, I estimate that at the intermediate value, when the probability of a price decline is

0.5, the LTV limit on new loans,

![]() , is equal to 0.9.

, is equal to 0.9.

5.2 Comparing Data and Simulations

The success of the model in matching aggregate rates of equity extraction, sales and default can be seen in Figure 10. The model successfully captures both the timing and quantity of new equity extractions, which rise dramatically starting in 2003 to a rate of approximately 10-12% per quarter and then remain steady before dropping off rapidly in late 2006 after prices have started to decline. It is matching this time series of equity withdrawal rates that requires the model to have a lower maximum LTV ratio when future price growth is expected to be negative. Without this decrease, the model predicts a spike in equity extraction in late 2006 that is not found in the data. This happens because when households begin to expect that future prices will be lower, they want to convert equity into liquid assets before it is erased by falling prices. This creates additional demand for mortgage debt. A tightening of the supply of credit by lenders in response to this same change in expectations is necessary to prevent this spike in borrowing and bring the model simulations into better agreement with the data.

Next, I look at the rate at which homeowners sell their homes, shown in the upper-right panel of Figure 10. As house prices rise, homeowners accumulate positive equity and a greater proportion can afford to sell. When prices fall, more homeowners have negative equity and cannot. In the data, the rate at which homeowners sell their homes climbs from 1.0% per quarter at the beginning of the sample to 2.4% at the start of 2005. As prices decline, this rate falls to 0.4%. The model matches this pattern with the fraction of homeowners selling each quarter climbing from 0.7% to 2.2% and then falling to 0.3% after prices fall.

Model predictions for the default rate also match the data well. Default rates remain low at a rate around 0.2% per quarter until they begin to rise dramatically with the fall in house prices at the end of 2006. In the data, there is a dip in the default rate during the financial crisis of 2008. This drop is not present in the simulations. A possible explanation for this discrepancy is that I observe a default in the data only when the lender files a notice of default and begins the foreclosure process. Therefore a change in the rate at which banks foreclose will appear in the data as a change in the default rate. The simulations are consistent with the rise in delinquency rates during this period rather than the fall in foreclosures.

The model also captures the default rates at different LTV ratios.35When the estimated LTV ratio is less than 0.75, quarterly default rates are 0.14% in the data and 0.09% in the model. The observed default rate increases to 0.75% as the LTV ratio approaches unity and then jumps to 1.56% at ratios between 1.0 and 1.25. At higher levels of negative equity, the default rate continues to climb, reaching 4.2% per quarter at LTV ratios above 1.5. The model is consistent with this pattern, with default rates of 0.50% for homeowners with LTV ratios between 0.75 and 1.0 and 1.83% at ratios between 1.0 and 1.25. These are slightly higher than the comparable rates in the data. Then, to match the overall default rate, it under-predicts defaults by a similar margin at higher LTV ratios. A full comparison is shown in Table 7.