PDF

PDF

PDF

PDF

The Federal Reserve is responsible for promoting consumer protection and community development to help ensure a fair and transparent financial services marketplace that benefits all Americans.

The Federal Reserve understands that healthy communities and well-served consumers help support and drive economic growth. That's why the Federal Reserve is committed to ensuring that consumer and community perspectives inform its policy, research, and actions.

We all benefit more from a thriving, well-functioning economy when we have access to affordable and accessible financial products and services—like bank accounts, credit cards, and mortgages—that help us all save, invest, buy a home, borrow money, and more basically, provide financial security for our families and futures.

Watch: Building a more inclusive financial system

The Federal Reserve helps ensure that bank lenders and other financial institutions follow the federal laws and regulations that ensure that quality products and services are fairly offered and accessible to consumers and communities. The Federal Reserve shares this responsibility with various federal agencies, supervising financial institutions and enforcing these important consumer and community protections.

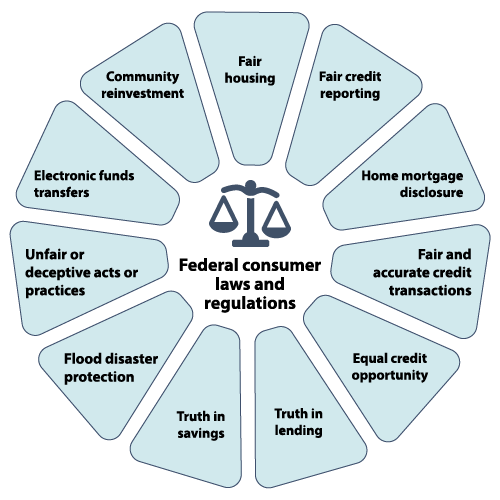

Federal government rules and statutes cover all types of consumer bank and lending accounts and transactions, and also ensure vital consumer and community practices are observed—like requiring banks to follow fair lending, fair housing, and community reinvestment laws.

The Federal Reserve investigates complaints and fields inquiries from consumers about their experiences with financial institutions and any potential regulatory or legal violations.

The Federal Reserve has uniform policies and procedures for investigating and responding to consumer complaints, which are implemented by staff at the 12 Reserve Banks and the Federal Reserve Consumer Help (FRCH) Center. The FRCH is a centralized consumer complaint and inquiry processing center, which allows consumers to contact the Federal Reserve online or by telephone, fax, mail, or email.

The Federal Reserve conducts rigorous research, analysis, and data collection to identify and assess consumer and community development issues to understand emerging opportunities and risks when making policy decisions.

The Federal Reserve supports research about communities and consumers, including the financially vulnerable, to understand their financial experiences and decisionmaking, and the major challenges they face, like getting access to financial services.

Since 2013, the Federal Reserve has conducted the Survey of Household Economics and Decisionmaking, which measures the economic well-being of U.S. households and identifies potential risks to their finances. The survey covers a range of topics relevant to financial well-being, including credit access and behaviors, savings, retirement, economic fragility, and education and student loans. Dedicated research in these areas helps identify trends that may impact financial well-being and helps inform whether those trends suggest the need to adjust consumer protection efforts or policies that ensure low- and moderate-income communities' perspectives, challenges, and opportunities are well-represented.

“The Federal Reserve has a deep commitment to supporting research that helps policymakers, community development practitioners, and researchers improve the economic well-being of families and communities.” —Chair Jerome H. Powell

Another critical way the Federal Reserve promotes consumer protection and community development is by engaging, convening, and informing key stakeholders to identify emerging issues and policies and practices to advance effective community reinvestment and consumer protection.

The Federal Reserve Board and Federal Reserve Banks interact directly with communities and community stakeholders through a wide-ranging, nationwide community development outreach program, with the ultimate purpose of understanding economic opportunities and challenges that either promote or hinder communities' participation in the nation's economic growth.

For example, the Federal Reserve Board meets semiannually with members of the Community Advisory Council (CAC) to hear diverse perspectives on the economic circumstances and financial services needs of consumers and communities, with a particular focus on the concerns of low- and moderate-income populations.

The Federal Reserve's work in community development is captured in a central portal at fedcommunities.org that links the System's community development resources and research by topic and region.

The Federal Reserve is responsible for promoting consumer protection and community development to help ensure a fair and transparent financial services marketplace that benefits all Americans.

The Federal Reserve understands that healthy communities and well-served consumers help support and drive economic growth. That's why the Federal Reserve is committed to ensuring that consumer and community perspectives inform its policy, research, and actions.

We all benefit more from a thriving, well-functioning economy when we have access to affordable and accessible financial products and services—like bank accounts, credit cards, and mortgages—that help us all save, invest, buy a home, borrow money, and more basically, provide financial security for our families and futures.

The Federal Reserve helps ensure that bank lenders and other financial institutions follow the federal laws and regulations that ensure that quality products and services are fairly offered and accessible to consumers and communities. The Federal Reserve shares this responsibility with various federal agencies, supervising financial institutions and enforcing these important consumer and community protections.

Federal government rules and statutes cover all types of consumer bank and lending accounts and transactions, and also ensure vital consumer and community practices are observed—like requiring banks to follow fair lending, fair housing, and community reinvestment laws.

The Federal Reserve investigates complaints and fields inquiries from consumers about their experiences with financial institutions and any potential regulatory or legal violations.

The Federal Reserve has uniform policies and procedures for investigating and responding to consumer complaints, which are implemented by staff at the 12 Reserve Banks and the Federal Reserve Consumer Help (FRCH) Center. The FRCH is a centralized consumer complaint and inquiry processing center, which allows consumers to contact the Federal Reserve online or by telephone, fax, mail, or email.

The Federal Reserve conducts rigorous research, analysis, and data collection to identify and assess consumer and community development issues to understand emerging opportunities and risks when making policy decisions.

The Federal Reserve supports research about communities and consumers, including the financially vulnerable, to understand their financial experiences and decisionmaking, and the major challenges they face, like getting access to financial services.

Since 2013, the Federal Reserve has conducted the Survey of Household Economics and Decisionmaking, which measures the economic well-being of U.S. households and identifies potential risks to their finances. The survey covers a range of topics relevant to financial well-being, including credit access and behaviors, savings, retirement, economic fragility, and education and student loans. Dedicated research in these areas helps identify trends that may impact financial well-being and helps inform whether those trends suggest the need to adjust consumer protection efforts or policies that ensure low- and moderate-income communities' perspectives, challenges, and opportunities are well-represented.

“The Federal Reserve has a deep commitment to supporting research that helps policymakers, community development practitioners, and researchers improve the economic well-being of families and communities.” —Chair Jerome H. Powell

Another critical way the Federal Reserve promotes consumer protection and community development is by engaging, convening, and informing key stakeholders to identify emerging issues and policies and practices to advance effective community reinvestment and consumer protection.

The Federal Reserve Board and Federal Reserve Banks interact directly with communities and community stakeholders through a wide-ranging, nationwide community development outreach program, with the ultimate purpose of understanding economic opportunities and challenges that either promote or hinder communities' participation in the nation's economic growth.

For example, the Federal Reserve Board meets semiannually with members of the Community Advisory Council (CAC) to hear diverse perspectives on the economic circumstances and financial services needs of consumers and communities, with a particular focus on the concerns of low- and moderate-income populations.

The Federal Reserve's work in community development is captured in a central portal at fedcommunities.org that links the System's community development resources and research by topic and region.