FEDS Notes

February 26, 2025

Central bank liquidity facilities around the world

David Arseneau, Mark Carlson, Kathryn Chen, Matt Darst, Dylan Kirkeeng, Elizabeth Klee, Matt Malloy, Benjamin Malin, Emilie O'Malley, Friederike Niepmann, Mary-Frances Styczynski, Melissa Vanouse, and Alexandros P. Vardoulakis

A core task of central banks is to provide liquidity to banks, with the goal of facilitating monetary policy implementation, ensuring the smooth functioning of the payment system, and promoting financial stability. While central banks around the world pursue these goals, the design of liquidity facilities differs across countries. This note provides an overview of liquidity facilities around the world that resemble the Federal Reserve's discount window as well as intraday credit, comparing and contrasting setups in different countries.

The discount window and intraday credit in the United States

The Federal Reserve's discount window has three typical lending programs: primary credit, secondary credit and seasonal credit. The most broadly used program is primary credit, which is available to depository institutions that are in generally sound financial condition and granted on a "no questions asked" basis. Currently, the primary-credit rate is set at the top of the target range for the federal funds rate. Depository institutions may borrow for a term of up to 90 days. A Reserve Bank may also extend secondary credit to a depository institution that is not eligible for primary credit. Secondary credit loans are made on a very short-term basis—usually overnight and at rates above the primary credit rate.1 By providing liquidity to banks on demand, the discount window could, in principle, set a ceiling on the overnight interbank rate, thereby helping with monetary policy implementation, while also promoting financial stability.

In addition to the discount window, the Federal Reserve also offers depository institutions intraday credit during operating hours to support the smooth functioning of the payment system. Collateralized intraday credit is provided at no cost, and uncollateralized intraday credit is provided for a fee.

Mapping central bank liquidity facilities by function

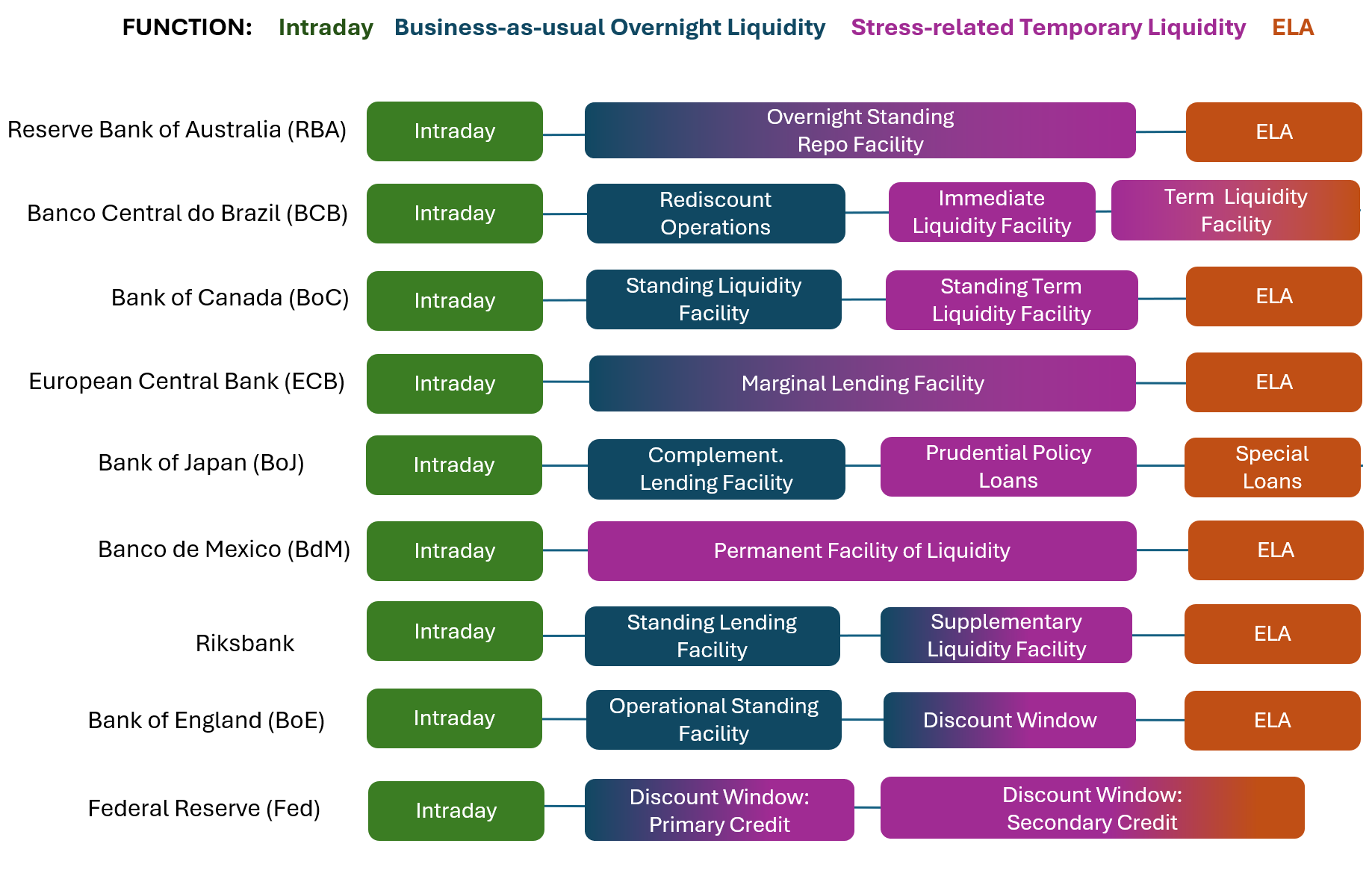

This note focuses on programs around the world that are most like the Fed's discount window: Standing facilities that provide short-term liquidity on demand to approved counterparties of the central bank against a broad range of collateral. This note also addresses intraday credit provision, but largely does not cover liquidity provision similar to that under Section 14 of the Federal Reserve Act in the U.S. context (i.e., providing liquidity under open-market operation (OMO) authority, such as permanent or temporary OMOs and the Standing Repo Facility), or under Section 13(3) ("unusual and exigent circumstances" emergency facilities).2 In terms of foreign countries considered, the note provides details for facilities at eight foreign central banks (FCBs): Reserve Bank of Australia (RBA), Banco Central do Brazil (BCB), Bank of Canada (BoC), European Central Bank (ECB), Bank of Japan (BoJ), Banco de México (BdM), Riksbank, and Bank of England (BoE).

Types of liquidity facilities

Discount-window like facilities exist to satisfy liquidity demand by financial institutions arising from the management of payment flows, unexpected liquidity shortages, or more severe funding pressures. We distinguish four facility types with different functions:

- Intraday liquidity provision to provide temporary credit to balance timing differences of intraday flows and support the smooth functioning of the payment system.

- Business-as-usual overnight liquidity provision (BAUL) to insure against interbank market misallocation of liquidity at the end of the day. Like intraday liquidity provision, this function is for business-as-usual (BAU) needs. This facility often helps control interbank rates, playing a role in monetary policy implementation.

- Stress-related temporary liquidity provision (STL) to insure against unexpected, but short-lived, liquidity shortages and to address self-fulfilling bank runs. This facility type is for situations when institutions face liquidity outflows due to temporary idiosyncratic stress or systemic funding pressures but are deemed solvent without the need for additional interventions.

- Emergency Liquidity Assistance (ELA) to provide liquidity support to institutions that face more persistent liquidity shortages, which could put their viability at risk and raise broader financial stability concerns.3

Figure 1 classifies foreign central bank liquidity facilities that share similarities with the functions of the Fed's discount window and intraday credit programs into these four types and presents the U.S. facilities across a similar spectrum for comparison. On the left are facilities with functions to satisfy BAUL needs, while facilities further to the right provide liquidity under increasing stress.

High-level takeaways from foreign central bank liquidity facilities

First, all FCBs provide intraday liquidity and have some form of ELA.4 Intraday liquidity is provided separately from other forms of liquidity. ELA is also provided through a separate program. ELA may comprise or be separate from liquidity provision during resolution, which may fall under the responsibility of a separate authority, with some FCBs facing legal restrictions regarding lending to insolvent institutions.5

Second, the design of the facilities in the intermediate space differs considerably across foreign countries. Specifically, some central banks attempt to separate overnight liquidity provision for BAU purposes from liquidity provision to address temporary stress by offering separate facilities with different pricing, term, and/or accepted collateral.6 The BCB, BoC, BoJ, BdM and BoE have a medium-term lending facility (30 days to 3 months) in addition to an overnight facility. Other central banks do not make a distinction. Specifically, the RBA and ECB have only one facility for BAUL/STL purposes, which is overnight.7,8

Of note, through primary and secondary credit combined, the U.S. discount window serves more functions than the facilities in other countries. Primary credit is associated with BAUL and STL, while secondary credit can be seen as providing mainly STL and ELA.9

Finally, foreign central banks differ in their approach to outstanding negative account balances at the end of the business day or "overnight overdrafts" (not shown in Figure 1). In the U.S., overnight overdrafts are actively discouraged and charged a penalty rate.10 The BoJ and the BdM have similar overnight overdraft policies whose use is discouraged. Most other central banks instead generally convert outstanding negative account balances at the end of the business day into loans from their BAUL facilities.

Common characteristics of liquidity facilities

Table 1 captures the characteristics of the different types of foreign central bank facilities. While the exact terms of the various liquidity facilities vary significantly across foreign central banks, there are a few typical features.

Table 1: Characteristics of foreign liquidity facilities

| Intraday Credit | BAU Overnight Liquidity | Stress-Related Temporary Liquidity | ELA | |

|---|---|---|---|---|

| Counterparties (CPs) | Monetary Policy/Payment CPs | Monetary Policy/Payment CPs | Banks, sometimes nonbanks | Banks, sometimes nonbanks |

| Solvency of borrowers | Solvent | Solvent | Solvent, yet illiquid | Credible recovery, fiscal coordination |

| Form | Standing | Standing | Standing | Special request |

| Collateral | High-quality to broader collateral | Often high-quality | Broader inc. loans | Broadest |

| Haircuts | By asset, publicly available | By asset, publicly available | By asset, publicly available | Case-by-case basis |

| Interest rate | Zero | 10-35 bps penalty | 25-75bps penalty | Rate could be less or more punitive |

| Tenor | Intraday | Overnight | Overnight to 3 months | Flexible, typically 6 months to 1 year |

| Disclosures | Mostly none | Aggregate only | Aggregate only | Potential for aggregate/individual |

When moving from business as usual to ELA, overall: (i) the accepted collateral becomes broader, (ii) pricing becomes more expensive, (iii) the tenor increases, and (iv) lending becomes more discretionary.

Intraday credit is collateralized in foreign countries, often extended against high-quality collateral and carries zero interest.11 BAUL is provided in many countries against the same type of collateral that is accepted for intraday credit, while the interest rate ranges from 10-35bp above the overnight interbank rate target. Liquidity is extended fairly automatically with no questions asked.

STL facilities typically accept broader collateral than intraday credit and BAUL facilities and have longer tenors of up to 3 months. Foreign central banks do not disclose individual transactions conducted under the BAUL and STL facilities, publishing aggregate usage if at all and often only with a lag.

For ELA, the type of collateral accepted at this facility can be quite different across central banks, with some central banks not requiring collateral for ELA. In cases where no collateral is required, the fiscal authority is involved. ELA loans have a tenor of up to one year. The interest rate set on loans and haircuts applied are fairly flexible and less transparent than for other facilities, reflecting the larger discretion of central banks in extending longer-term loans, with decisions taken on a case-by-case basis.12

The primary and secondary credit programs in the U.S. differ from the typical features of foreign liquidity facilities in a few respects. Most notably, U.S. banks access liquidity facilities based on their supervisory rating, capital position, and other factors, while in foreign countries banks may also select a liquidity facility based on terms such as pricing and collateral. Additionally, the maturity shortens as banks move from primary credit to secondary credit going from 90 days to overnight. Finally, the Federal Reserve Act requires the Federal Reserve to disclose details about individual transactions under the discount window with a two-year lag.13

Same trade-offs, different design choices

Differing design choices by central banks are, in part, explained by different legal and institutional constraints, monetary policy frameworks, or the structure of the financial system. For example, in the United States, Federal Home Loan Banks play a key role in providing BAUL/STL liquidity to banks.

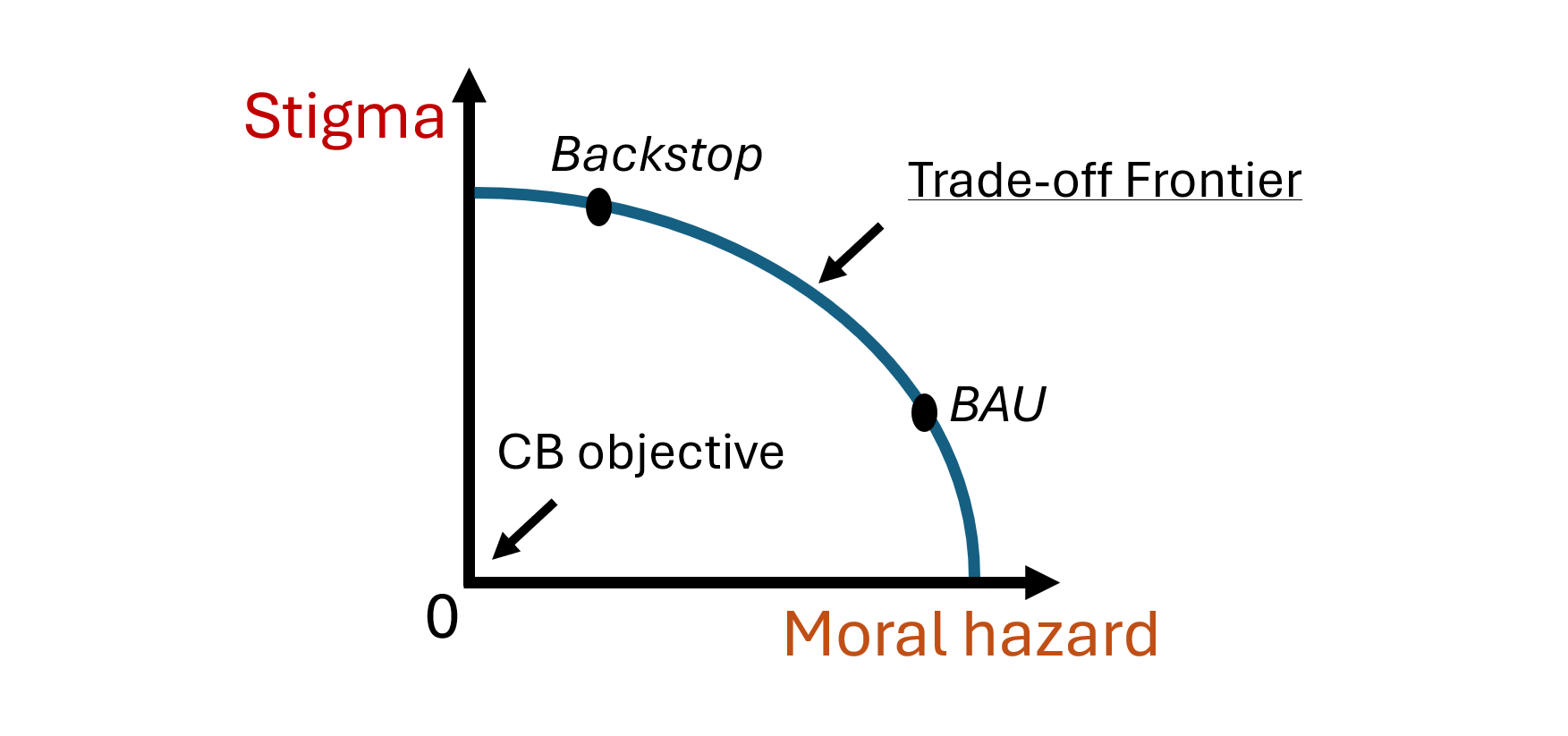

These differences notwithstanding, all central banks have essentially the same goals of supporting monetary policy implementation, while promoting financial stability and the smooth functioning of the payment system. Similarly, in designing liquidity facilities, central banks all face the same difficult task of meeting liquidity provision goals while, at the same time, limiting the undesired consequences. This trade-off is typically described as the trade-off between stigma and moral hazard.

Stigma captures the idea that an individual bank might be hesitant to borrow from a liquidity facility because doing so could send a negative signal about its financial condition to others—counterparties, competitors, regulators, market participants, and the public more generally.14 If stigma discourages use, the effectiveness of a liquidity facility can be undermined. Moral hazard captures the idea that access to public liquidity can incentivize financial institutions to take on excessive risk. If banks and market participants assume that the central bank will provide liquidity in adverse situations, banks may take on more liquidity risk and providers of wholesale funding will not demand higher compensation for the risks taken on by the bank.

Figure 2 shows a simplified presentation of this trade-off. Central banks want to minimize both stigma and moral hazard. However, central banks cannot choose any combination of stigma and moral hazard. Instead, they are bound by how the incentives of market participants shape the tradeoff between stigma and moral hazard, depicted by the frontier in the figure. Central banks can adjust the terms of a facility, including the interest rate, eligible collateral, haircuts, and disclosure practices regarding its use to choose a point on the frontier that best serves the intended purpose. For example, borrowing from a backstop facility may be expensive to limit usage and minimize moral hazard, but at the risk of potentially inducing stigma. To reduce stigma, disclosures may be limited. Alternatively, a BAU facility may be calibrated so that the terms are attractive, and the facility is used more frequently, lowering the stigma of the facility but making moral hazard worse. To compensate for the increased moral hazard, the facility may only accept high-quality collateral, or access may be restricted to banks in sound condition.

The differences in the designs of liquidity facilities reflect strategies to deal with this core trade-off with central banks choosing a combination of interest rate, collateral requirements, collateral haircuts etc. that best meets their goals while minimizing undesired consequences. Having differentiated facilities for distinct purposes may help alleviate the moral hazard-stigma tradeoff.

Conclusions

Liquidity facilities differ considerably across countries, reflecting differences in legal and institutional constraints, monetary policy implementation frameworks, and financial system structures. Still, central banks have similar goals and face similar challenges, resulting in a few key commonalities in facility designs among foreign central banks. While the goals will remain the same, the environment is changing. Technology is advancing, monetary policy implementation frameworks are reforming, liquidity management at banks is progressing. As a result, central bank liquidity facilities around the world may evolve along with these developments.

Appendix

Details on foreign countries' facilities that serve U.S. discount-window functions15

Reserve Bank of Australia

| Overnight Standing Facility Repo | Exceptional Liquidity Assistance (ELA) Repos | |

|---|---|---|

| Purpose | Cover a bank that is unexpectantly short funds, for example, because of a technical issue or an incoming payment that never arrived. | Support a solvent bank facing an emergency liquidity scenario. |

| Pricing | Cash rate target + 25bp. | No set terms. |

| Form | On demand, Discretionary Repos. | On demand, Discretionary Repos. |

| Maturity | Overnight. | Term. |

| Eligible Collateral | Broad range of securities collateral, but does not accept bank loans; banks self-securitize loans creating asset-backed securities that are not sold. | Broad range of securities collateral, but does not accept bank loans. |

| Eligible Counterparty | Members of the payment system (Reserve Bank Information and Transfer System (RITS) and of Austraclear) that settle payments across their own central bank account. | Members of the payment system (Reserve Bank Information and Transfer System (RITS) and of Austraclear). |

| Disclosure | Aggregated amount of usage disclosed after a 3-month delay. | Never used so no information on disclosure. |

Brazil (Banco Central do Brasil)

| Rediscount operations | Immediate Liquidity Facility (LLI) | Term Liquidity Facility (LLT) | |

|---|---|---|---|

| Purpose | Smooth functioning of payments and meeting reserve requirements. | Help financial institutions with short-term liquidity mismatches. | Help financial institutions with medium-term liquidity mismatches. LOLR market-wide. ELA individual. |

| Pricing | Intraday: Zero. Overnight: Policy rate plus 35 basis points. Instant payments: 90% of policy rate. | Policy rate plus 65 bps. | Starting at policy rate + 90 bps. Sliding as operation elapses, down to 55 bps. Average 62 bps for 1 year. |

| Form | Repurchase Agreement. | Collateralized lending ("pool-pledge"). | Collateralized lending ("pool-pledge"). |

| Maturity | Intraday/Overnight. | Up to 45 business days. | Up to 1 year. |

| Eligible Collateral | Securities issued by the National Treasury. | Corporate bonds. Commercial paper (basket "A"). | Corporate bonds, commercial paper, securitized credit claims (CCB) (basket "A" and basket "B"). |

| Eligible Counterparty | Financial institutions with reserves or settlement account and with instant payment account. | Financial institutions with reserves or settlement account. | Narrower. Credit institutions (banks, finance and mortgage companies, credit cooperatives) with reserves or settlement account. |

| Disclosure | Nothing disclosed. | Nothing disclosed. | Nothing disclosed. |

Canada (Bank of Canada)

| Standing Liquidity Facility | Standing Term Liquidity Facility | Emergency Lending Assistance | |

|---|---|---|---|

| Purpose | To ensure orderly settlement in the payments system. | Temporary liquidity support to healthy institutions. | A loan or advance to eligible financial institutions (FIs) or financial market infrastructures (FMIs) at the central bank’s discretion. Provide funding in recovery or resolution. |

| Pricing | Bank Rate (i.e., target rate + 25 bps) | Two-tier pricing: 35 bps above OIS for marketable securities; 75 bps above OIS for loan collateral. In all cases, the Bank Rate is the minimum. | BoC has discretion to charge a rate higher than the Bank Rate. |

| Form | On demand. | On demand. | On demand. |

| Maturity | Intraday and overnight. | Up to 30 days. | Maximum term of six months. |

| Eligible Collateral | Broad range including U.S. Treasuries, but concentration limits. No mortgages. Haircut: Depends on collateral. | Marketable securities and mortgages. Much wider set of collateral than SLF. Haircut: Same as SLF for marketable securities & non-mortgage loans. For insured (uninsured) residential mortgages, haircut is 10 (10 to 50) percent. | Depends on the program. Will accept mortgages. |

| Eligible Counterparty | Lynx counterparties. | Member of Payments Canada that are federally or provincially regulated and judged to be financially sound. | Banks and certain FMIs. |

| Disclosure | Aggregate level reported on weekly balance sheet. | Aggregate level reported on weekly balance sheet. | Aggregate level reported on weekly balance sheet. |

Euro Area (European Central Bank)

| Marginal Lending Facility | Emergency Liquidity Assistance | |

|---|---|---|

| Purpose | Meets idiosyncratic funding needs of individual banks; serves as a ceiling in the interest rate corridor. | Temporary loans by euro-area National Central Bank to solvent financial institutions. |

| Pricing | +25 basis points over Main Refinancing Operation (MRO) rate. | All lending details are determined by the national central bank at the time the ELA is set up. Depending on size of ELA operation, a non-objection from the Governing Council may be required to determine ELA provision does not interfere with singleness of monetary policy. Pricing should be at least +100 bp. ELA does not have a pre-defined set of collateral; National CBs can accept other types of collateral. Haircuts on collateral would mirror settings with other facilities. Potential counterparties are broad to include financial institutions, not just banks. |

| Form | Bilateral on demand, but automatic if intraday credit account overdrawn at end of day. | |

| Maturity | Overnight. | |

| Eligible Collateral | Euro-denominated investment-grade securities and loans. As the MLF is part of the Eurosystem monetary policy operations (see Guideline ECB/2014/60, as amended), eligible collateral is the same as for MROs and Long-Term Refinancing Operations (LTROs). | |

| Eligible Counterparty | Banks. | |

| Disclosure | Daily Disclosure of Aggregate Borrowings. |

Japan (Bank of Japan)

| Complementary Lending Facility | Prudential Policy Loans | Special Loans | |

|---|---|---|---|

| Purpose | Facilitates money market operations and ensures the smooth functioning and stability of financial markets. | Cover temporary shortage of funds in financial institutions to maintain stability of financial system. | As needed to maintain stability of the financial system, including the extension of uncollateralized lending at the request of the government. |

| Pricing | Basic loan rate for use within 5 business days of a month. The basic loan rate is currently at 50 bp, which is 25 bp above the policy rate. 2.0% plus the basic loan rate for use beyond 5 days.* *This restriction has been suspended for the time being. | The basic loan rate, but a penalty rate may also be imposed. The basic loan rate is currently at 50 bp, which is 25 bp above the policy rate. | Penalty rate. |

| Form | At the request of a counterparty. | At the request of a counterparty. | At request of the government. |

| Maturity | Overnight. | Minimum (up to 3 months in principle). | Minimum. |

| Eligible Collateral | Negotiable instruments, Japanese government or other securities or in the form of electronically recorded monetary claims. | Negotiable instruments, Japanese government or other securities or in the form of electronically recorded monetary claims. | Not necessary. |

| Eligible Counterparty | Current account holders who are approved as eligible for this facility. BOJ reviews counterparties annually. | Current account holders who have entered into loan contracts with the BOJ. | No limitations for the subject counterparty. BOJ adheres to four principles when deciding whether to lend. The four principles are: 1) must be a strong likelihood that systemic risk may materialize; 2) no alternatives available; 3) all parties are required to take clear responsibility to avoid moral hazard; and 4) financial soundness of BOJ should not be impaired. |

| Disclosure | Aggregate amounts. | Aggregate amounts. | Disclose financial institutions that use the facility but not the individual transaction details. |

Mexico (Banco de México)

| Overnight Lending Facility | Permanent Facility of Liquidity | ELA | |

|---|---|---|---|

| Purpose | The purpose is to compensate end-of-day liquidity shortages at commercial/development bank current accounts at Banco de México. The cost of the facility is punitive to encourage banks to use the market not the central bank. | Support banks in times of financial market stresses. | Extreme situations; high stress periods. Rules are not published on its features to avoid moral hazard. |

| Pricing | 2 times the monetary policy rate. Pricing is expensive reflecting the fact that this facility is just a backstop. | 1.06 times the monetary policy rate. | Varies. |

| Form | On demand. | On demand. Financial Stability Department helps monitor condition of the borrowers. | On demand. Discretionary; decision based on staff research on case-by-case basis. |

| Maturity | Overnight. | Up to one month. | Varies but flexible. |

| Eligible Collateral | Cash deposits in the central banks that still exist for historical reasons. | Broader range of collateral than OLF and collateralized overdrafts. | |

| Eligible Counterparty | Commercial and development banks. | Commercial banks. | |

| Disclosure | Not disclosed. | Not at individual bank level; aggregate lending. | Not at individual bank level; aggregate lending. |

Sweden (Riksbank)

| Standing Lending Facility | Supplementary Liquidity Facility | Emergency Liquidity Assistance | |

|---|---|---|---|

| Purpose | To steer the overnight rate and help manage counterparties’ liquidity. | To steer the overnight rate and help manage counterparties’ liquidity. | Financial system stability. Consultation with supervisors and Treasury expected. |

| Pricing | Policy rate plus 10 bps. | Policy rate plus 75 bps. | Flexible. |

| Form | Automatic if the balance of a bank’s Riksbank account shows a deficit when the payment system closes for the day. | Automatic if the deficit in a bank’s Riksbank account exceeds the counterparty's adjusted value of primary collateral when the payment system closes for the day. | Discretionary and very Flexible. Can be a loan or an operation. |

| Maturity | Overnight. | Overnight. | Flexible. |

| Eligible Collateral | Securities issued by governments, securities issued by central banks, and other receivables at central banks. | Securities issued by international organizations, securities guaranteed by governments, covered securities, securities issued by agencies, and corporate bonds (minimum rating A-/A3). | Flexible. |

| Eligible Counterparty | Monetary policy counterparties – financial companies and credit institutions. | Monetary policy counterparties – financial companies and credit institutions. | |

| Disclosure | None. | None. | None. |

United Kingdom (Bank of England)

| Operating Standing Lending Facility | Discount Window Facility35 | ELA/Resolution Liquidity | |

|---|---|---|---|

| Purpose | Keeps money market rates in line with policy rate; addresses unexpected payment shocks. | Firm specific, for firm meeting threshold conditions. | Available as needed. |

| Pricing | Bank Rate plus 25bp (-25bp for deposits). | Fee rate varies. | Flexible but need to fulfill financial stability criterion. |

| Form | On demand. Lending (deposit) transaction. | On demand facility. | |

| Maturity | Overnight. | Up to 30 days but can be rolled over for Banks, Building Societies, and Broker dealers; 5 days for CCPs. | |

| Eligible Collateral | High Quality, Highly Liquid Sovereign Debt (Level A). | Investment-Grade Securities and Loans (Levels A, B, C). Only level A and B for CCPs. | |

| Eligible Counterparty | Banks, Building Societies, Broker dealers, CCPs, International Central Securities Depositories (ICSD). | Banks, Building Societies, Broker dealers, and CCPs. | |

| Disclosure | Average across counterparties over maintenance period with lag. | Aggregate of daily averages over quarter, with 5 quarter lag. |

1. Additionally, seasonal credit is available to smaller institutions with seasonal liquidity needs. For more information, see https://www.frbdiscountwindow.org/pages/general-information/seasonal-lending-program. Return to text

2. This note omits many foreign central bank facilities for monetary policy implementation purposes even though they may provide liquidity during stress episodes. Return to text

3. ELA is not necessarily established as a facility available on a standing basis. Several central banks decide whether to provide ELA on a case-by-case basis. Return to text

4. To be precise, ELA is provided by the national central banks in the euro area not by the ECB. For the purpose of this note, we do not make that distinction explicit in the text/charts as the national central banks are part of the Eurosystem. Return to text

5. The Federal Reserve also faces legal restrictions in lending to undercapitalized entities. Return to text

6. For details of all the foreign facilities shown in Figure 1 outside of intraday credit, see the appendix. It provides information on the key features of the liquidity facilities by foreign country/region. Return to text

7. The Riksbank set-up is distinct: While we classify the Riksbank's standing liquidity facilities into two facility types, the Standing Lending Facility and the Supplementary Liquidity Facility are both overnight and could be seen as one facility serving BAU purposes where the pricing of liquidity depends on the underlying collateral. Because the Supplementary Liquidity Facility accepts lower-quality collateral, we shade it also in purple. Return to text

8. The RBA has typically addressed system-wide stress by expanding its regular open market repo operations instead of relying on standing facilities. Return to text

9. Primary credit is normally granted on a "no-questions-asked basis," and may be used for any purpose, including financing the sale of federal funds, while secondary credit may not be used to fund an expansion of the borrower's assets. Return to text

10. In addition, institutions that incur overnight overdrafts are subject to ex post counseling by the Fed. Return to text

11. The Federal Reserve extends uncollateralized intraday credit for a fee. Return to text

12. While commonly accepted collateral has the same haircuts as in other facilities, for less common collateral, haircuts are frequently determined on a case-by-case basis under ELA. Return to text

13. Additionally, the Federal Reserve publishes information on aggregate borrowing from the Discount Window in the weekly H.4.1 release titled "Federal Reserve Balance Sheet: Factors Affecting Reserve Balances". Return to text

14. A negative signal could start a vicious circle, where counterparties withdraw funding, which increases the banks' liquidity needs. Return to text

15. The information in the appendix was collected in mid-2024 and does not include potential changes made to foreign facilities thereafter. Return to text

Arseneau, David, Mark Carlson, Kathryn Chen, Matt Darst, Dylan Kirkeeng, Elizabeth Klee, Matt Malloy, Benjamin Malin, Emilie O’Malley, Friederike Niepmann, Mary-Frances Styczynski, Melissa Vanouse, and Alexandros P. Vardoulakis (2025). "Central bank liquidity facilities around the world," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, February 26, 2025, https://doi.org/10.17016/2380-7172.3740.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.