FEDS Notes

August 02, 2024

Disinflation Progress: A Comparison of Advanced Economies

François de Soyres, Grace Lofstrom, Mitch Lott, Chris Machol, Zina Saijid1

Following several decades of low inflation in most advanced economies, the Covid pandemic gave rise to unprecedented global economic conditions, materializing in a synchronized surge in price pressures.

In this note, we analyze the recent inflation burst and assess the disinflation progress across advanced economies. We find that although inflation rates are at similar levels in advanced economies, there is substantial variation in the underlying causes, composition, and diffusion of inflation, contextualizing why some central banks in advanced economies have already begun easing policy rates and others have not.

1. A first view of headline and core inflation

The pandemic affected both the supply and demand side of the economy, hampering firms' ability to produce, as well as consumers' ability to consume. To mitigate the health and economic fallout of the pandemic, governments engaged in large fiscal and monetary stimulus programs. While these policies supported activity and minimized economic scarring from the pandemic, they likely also contributed to price pressures: first in goods sectors followed by services sectors as economies re-opened.

Despite the synchronicity, the drivers explaining the inflationary surge vary across advanced economies.

In the United States and Canada, where the surge occurred first, inflation was predominantly caused by supply and demand imbalances, as large fiscal support bolstered aggregate demand while suppliers experienced significant constraints, leading to widespread inflationary pressures (de Soyres et al. 2023). Specifically, supply chain bottlenecks played an outsized role in the U.S., contributing to about half of excess inflation, compared to approximately one-third in other advanced economies (de Soyres et al. 2024a).

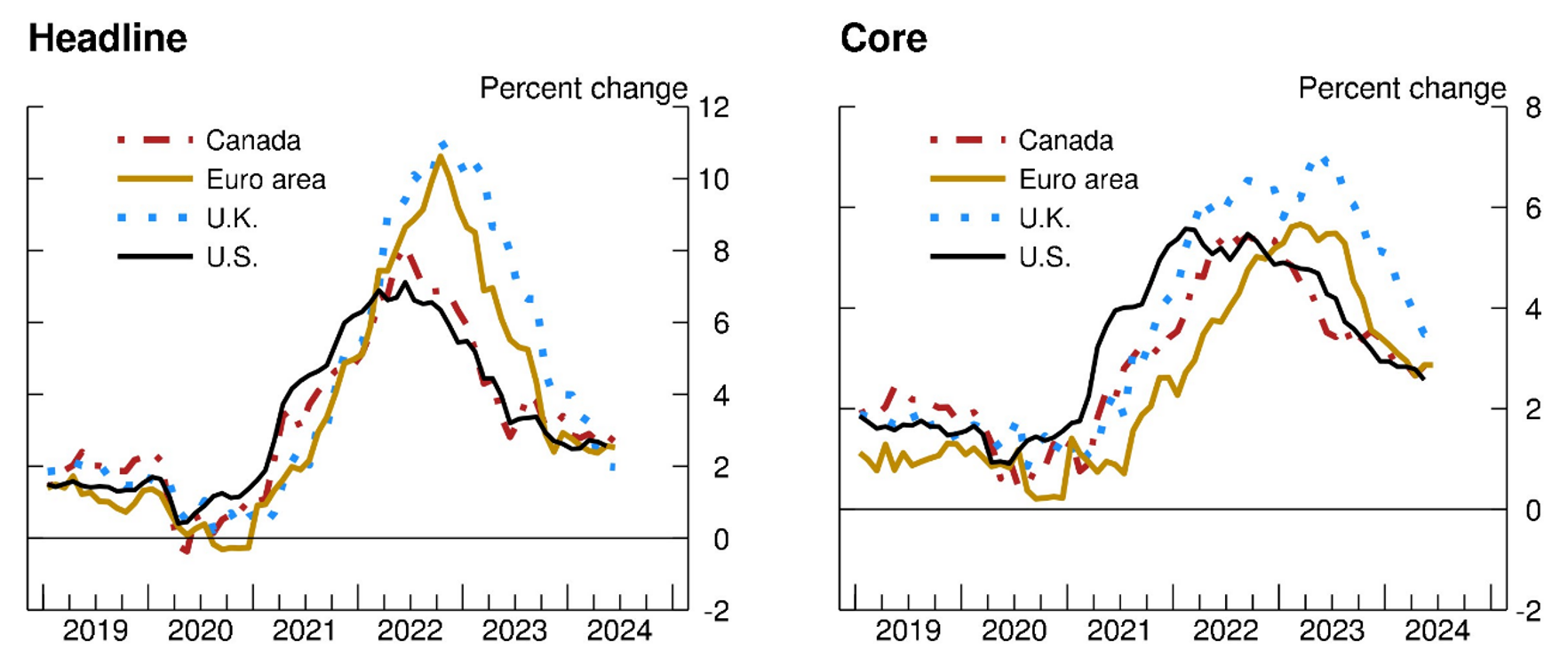

In the euro area and the United Kingdom, 12-month headline inflation peaked nearly a year later and at a much higher level, as inflation was further compounded by the disruption in energy markets caused by the Russian invasion of Ukraine (Figure 1). The surge in energy prices, in particular natural gas prices, gradually passed through to core inflation, as input-output linkages as well as formal and informal wage indexation mechanisms pushed up production costs across all sectors of the economy.

Note: Inflation rates are the PCE for the U.S. and CPI for foreign economies. Data extend through May for the U.S. and June for all other economies.

Source: Haver Analytics; FRB staff calculations.

The "last mile" of disinflation is proving difficult.

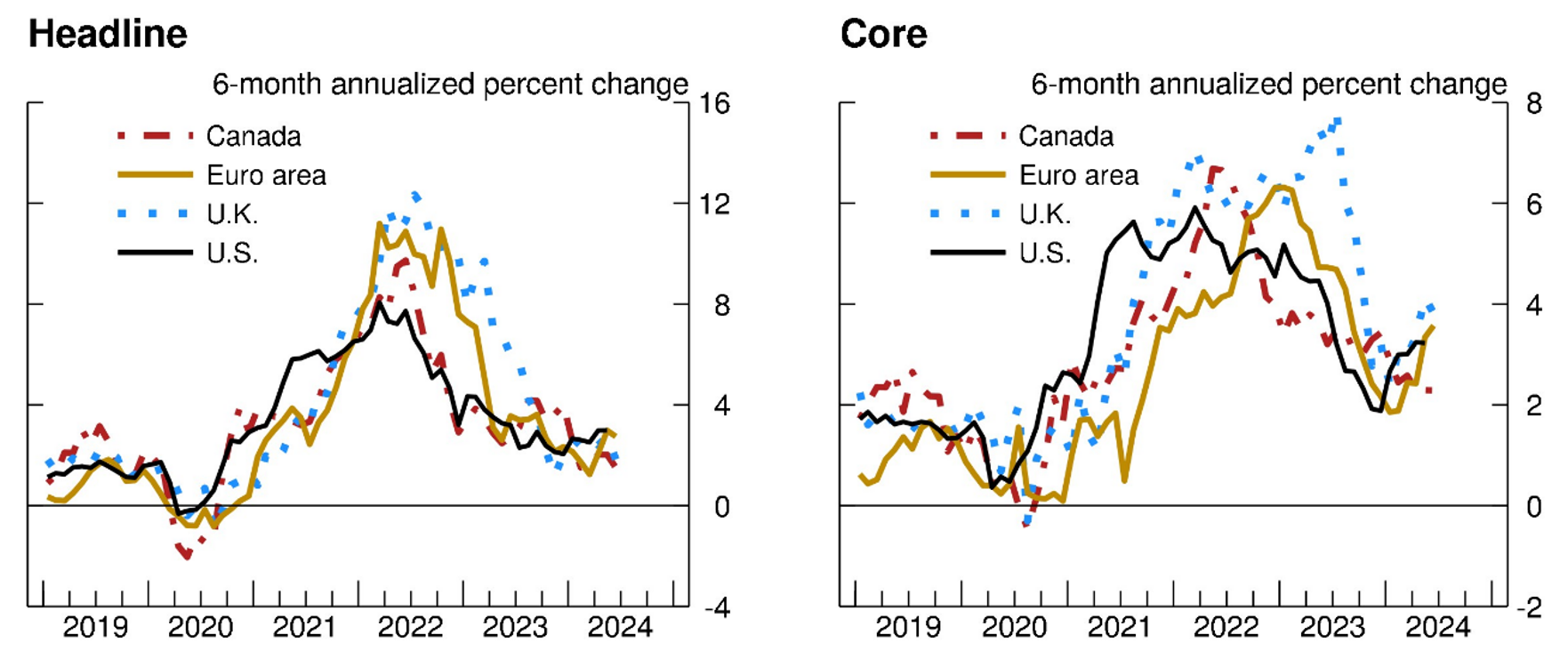

Although 12-month inflation has continuously abated over the past year and a half, the pace of disinflation has slowed considerably since early 2024 (Figure 1). Inflation rates expressed in higher frequency terms are more informative about the latest developments than these 12-month measures, which smooth out short-term fluctuations.2 Indeed, 6-month (annualized) inflation shown in Figure 2, shows that price pressures have resurfaced of late, with both headline and core 6-month inflation rates picking up. This upturn is particularly notable for core inflation: after a period of close to 2 percent growth in 6-month terms in late 2023, prices pressures reemerged notably in early 2024 and 6-month rates edged up to about 3 percent in the U.S., the U.K., and the euro area. To better understand the drivers of inflation persistence, the next section turns to a more disaggregated view and looks at sectoral inflation.

Note: Inflation rates are the annualized 6-month change in PCE for the U.S. and CPI for foreign economies. Data extend through May for the U.S. and June for all other economies.

Source: Haver Analytics; FRB staff calculations.

2. The importance of core services ex. housing

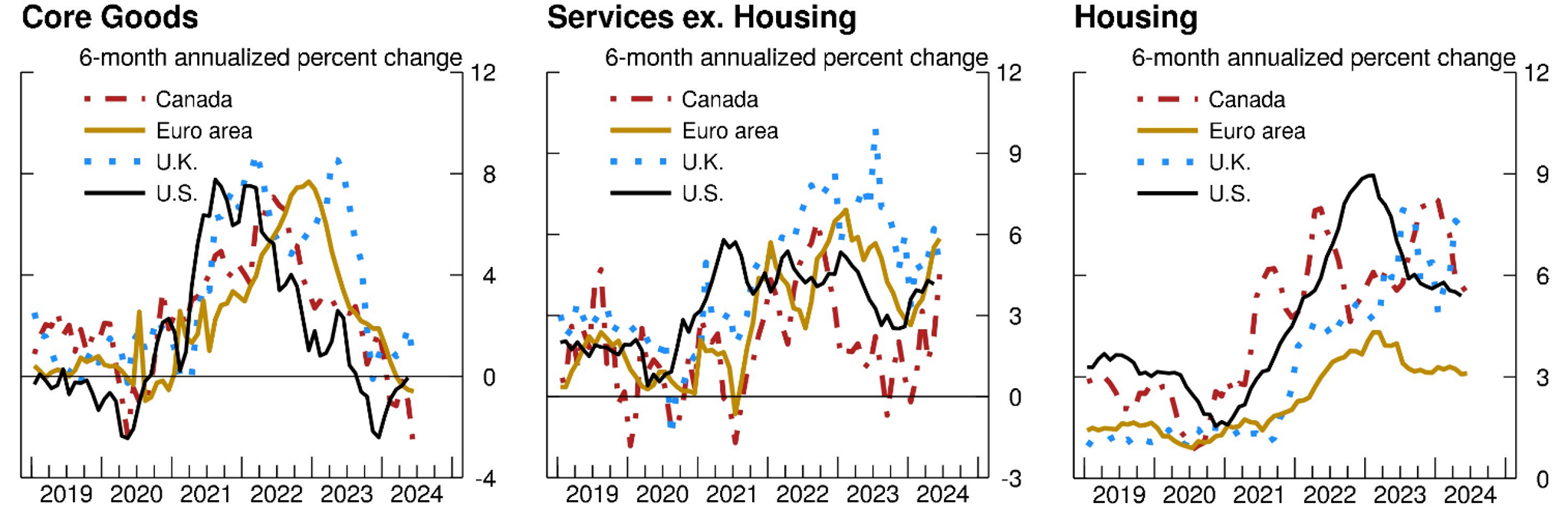

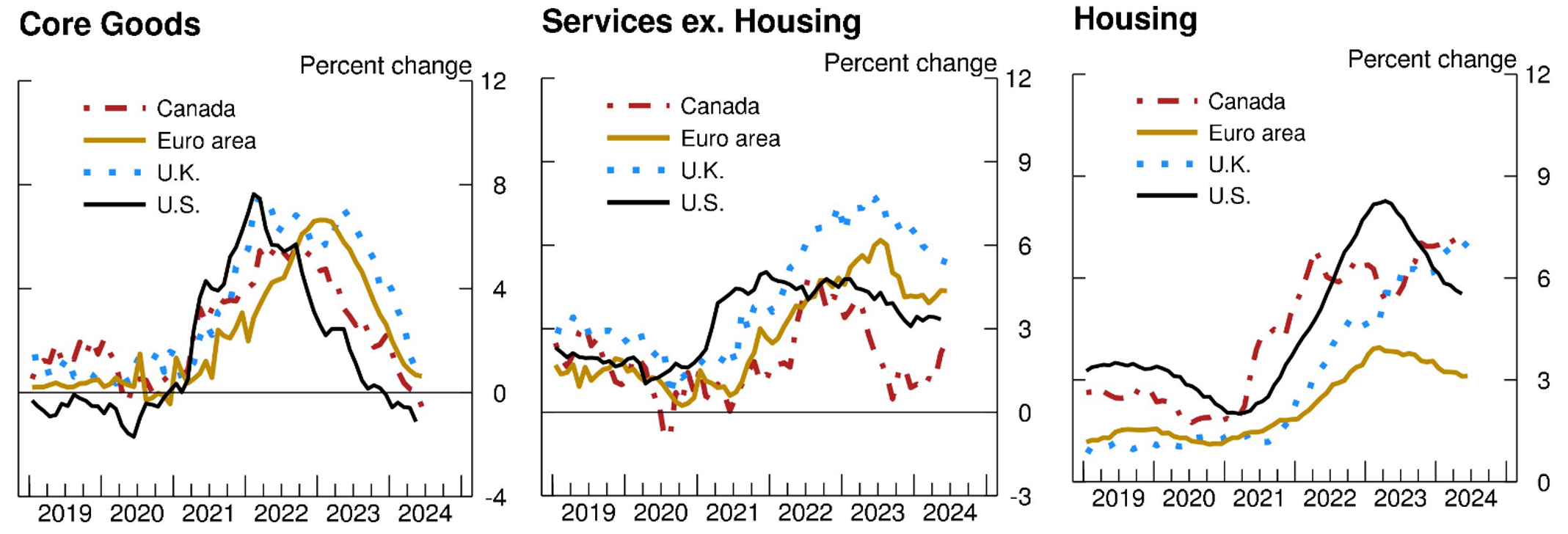

Looking at the key components of core inflation reveals that bumpiness in services explains the more limited progress towards inflation goals in recent months. This stickiness suggests that the last mile of disinflation - the continued reduction of inflation rates to central banks' target - may take some time.

Note: Inflation rates are annualized. Data are the PCE for the U.S. and CPI for foreign economies. Data extend through May for the U.S. and June for all other economies.

Source: Haver Analytics; FRB staff calculations.

Core goods inflation across advanced economies has broadly returned to pre-pandemic levels (left panel of figure 3), largely reflecting the normalization of supply chain disruptions amid a rebalancing of consumer demand from goods to services. This component has accounted for a significant portion of the disinflation observed over the past year and a half. However, progress in services ex. housing inflation (middle panel), which is closely linked to domestic wage developments and country specific idiosyncratic factors, has been more uneven. This category has reaccelerated to varying in degrees in recent months across advanced economies and is especially problematic for the euro area and the UK where this component has a large weight in the key inflation measures (see Table 1).

Table 1: Comparing subcomponents of key inflation measures across advanced economies

| Weights of core and its subcomponents in inflation measures | ||||

|---|---|---|---|---|

| Core | Goods | Housing Services | Services ex. Housing | |

| Canada | 76.3 | 21.6 | 25.9 | 28.8 |

| Euro area | 70.6 | 25.7 | 9.4 | 35.5 |

| United Kingdom | 77.6 | 28.6 | 9.1 | 39.9 |

| United States | 88.3 | 22.4 | 16.3 | 49.6 |

Source: Haver Analytics and national statistical agencies. Weights reported are as of 2024.

Note: For the U.S., table reports PCE price index weights using data for 2024:Q1 personal consumption expenditures. Components may not sum due to rounding.

Housing services inflation remains noticeably above per-pandemic levels across advanced economies. That said, housing costs have been a less important driver of inflation in Europe than in the U.S. and Canada due to how housing is treated in the CPI. In the U.S. and Canada owner-occupied housing is included in the CPI, whereas key inflation measures in the euro area and the U.K. do not include this measurement.3 Consequently, housing accounts for a higher proportion of total consumer expenditures, and therefore has a higher weight in the PCE price index in the U.S. than the HICP in the euro area, as shown in Table 2 in the appendix. In addition, the methodology used to measure the "price" of owner-occupied housing also influences the trajectory of housing inflation. In the U.S., owner-occupied housing prices are measured using a rental equivalence method, and changes in market rents take time to show through to the broader measure of housing costs.4 Canada is among few countries where mortgage costs are included in the measurement of owner-occupied housing prices. Given the direct linkage to interest rates, this category of inflation will likely ease only as interest rates are reduced.

There are differences across AFEs in the challenges they face in overcoming the last mile of disinflation. In Canada, housing costs are especially problematic due to their outsized influence on the CPI. In Europe, services ex. housing inflation is particularly high, and policymakers have emphasized a need to see further deceleration in wage growth for services inflation to converge to the 2 percent inflation target.

Wage pressures a factor in remaining inflation pressures

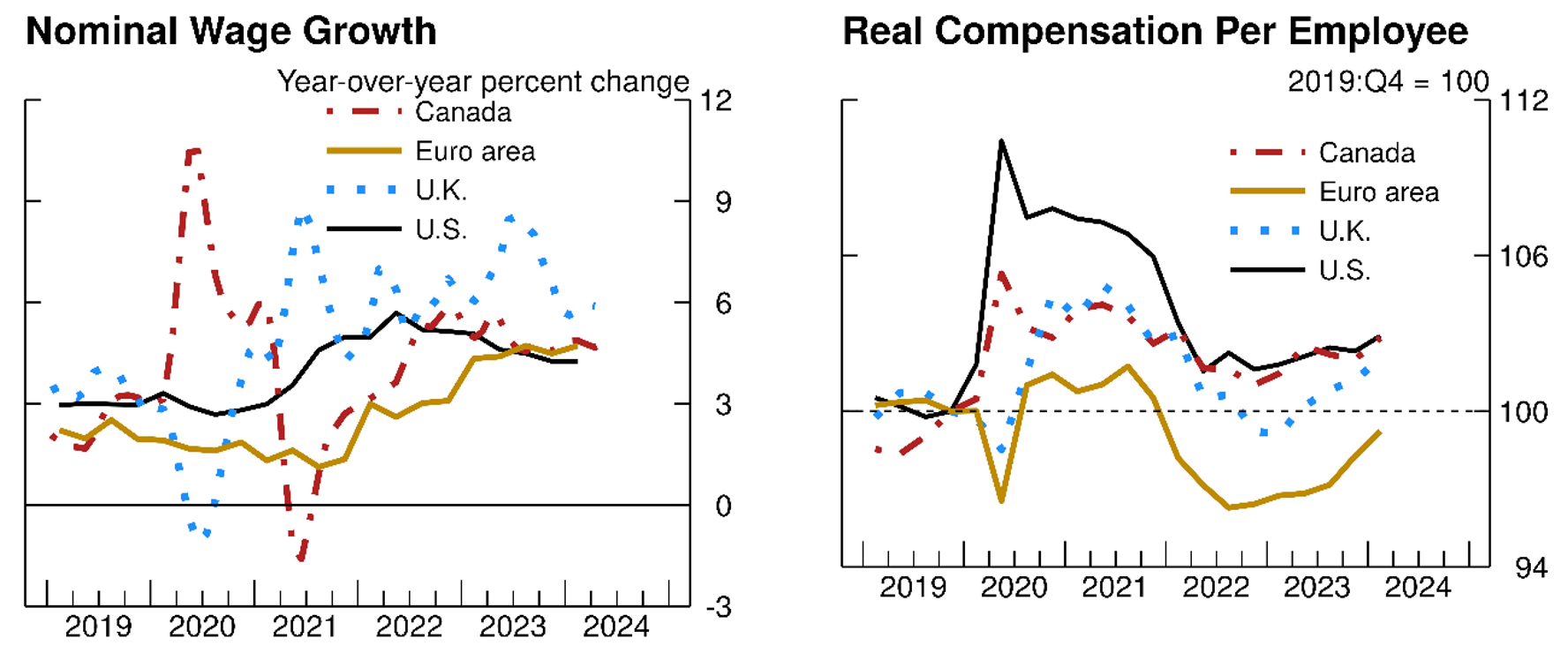

Further progress towards the inflation target depends in part on the dynamics of nominal wage growth. Recent research by Blanchard and Bernanke (2024), https://www.piie.com/publications/working-papers/2024/analysis-pandemic-era-inflation-11-economies, suggests that as the effects of past supply shocks have faded, wage inflation has become the more prominent source of inflation pressures. In most countries, nominal wage growth is running above inflation and remains at levels that would be inconsistent with central banks' targets. For example, in the euro area, negotiated wage reached 4.7% in the first quarter of 2024, reflecting strong bargaining power for incumbent workers in key sectors.

Stubbornly high nominal wage growth reflects different forces across the advanced economies (AEs) (Figure 4). In the U.S., elevated nominal wage is more likely linked to a tight labor market, with vacancy rates lingering above pre-pandemic levels. Research by Ball, Leigh, and Mishra (2022) and Blanchard and Bernanke (2024), https://www.piie.com/publications/working-papers/2024/analysis-pandemic-era-inflation-11-economies, has shown that labor market tightness, as measured by the ratio of job vacancies to unemployment, can explain some of the rise in core inflation in the post-Covid era. In the euro area, however, nominal wage growth might reflect the "catching up" of real wages: as inflation outpaced nominal wages over the past few years, real wages declined sharply, and are still somewhat below pre-pandemic levels.

Nominal wage developments may also reflect differences in labor market institutions and policy choices. During the Covid-19 pandemic, faced with an unprecedented shock, some AEs aimed to preserve firm-employee matches and thus to prevent spikes in unemployment, which in previous recessions had proven to be very persistent. While such policies mitigated staggering unemployment rates towards the beginning of the pandemic in the euro area and the U.K., they also restricted the ability of the economy to adapt through sectoral reallocation and might have led to a form of labor hoarding whereby labor is under-utilized within firms (de Soyres et al. 2024b). In this sense, the high level of nominal wage growth in the euro area could be less a sign of labor market tightness and could instead reflect workers' stronger bargaining power in ongoing wage negotiations and the compensation for the previous loss in real wages.

Left Panel:

Note: Data are the negotiated wage growth tracker for the euro area, the Employment Cost Index for the U.S., and 3-month moving averages of average weekly earnings for the U.K. and Canada. Latest values are 2024:Q1 for the U.S. and Euro area, April for the U.K., and June for Canada.

Source: Haver Analytics; Office for National Statistics.

Right Panel:

Note: Data extend through 2024:Q1. Real compensation per employee is computed as total compensation of all employees divided by the product of employment and CPI.

Source: Haver Analytics; Office for National Statistics.

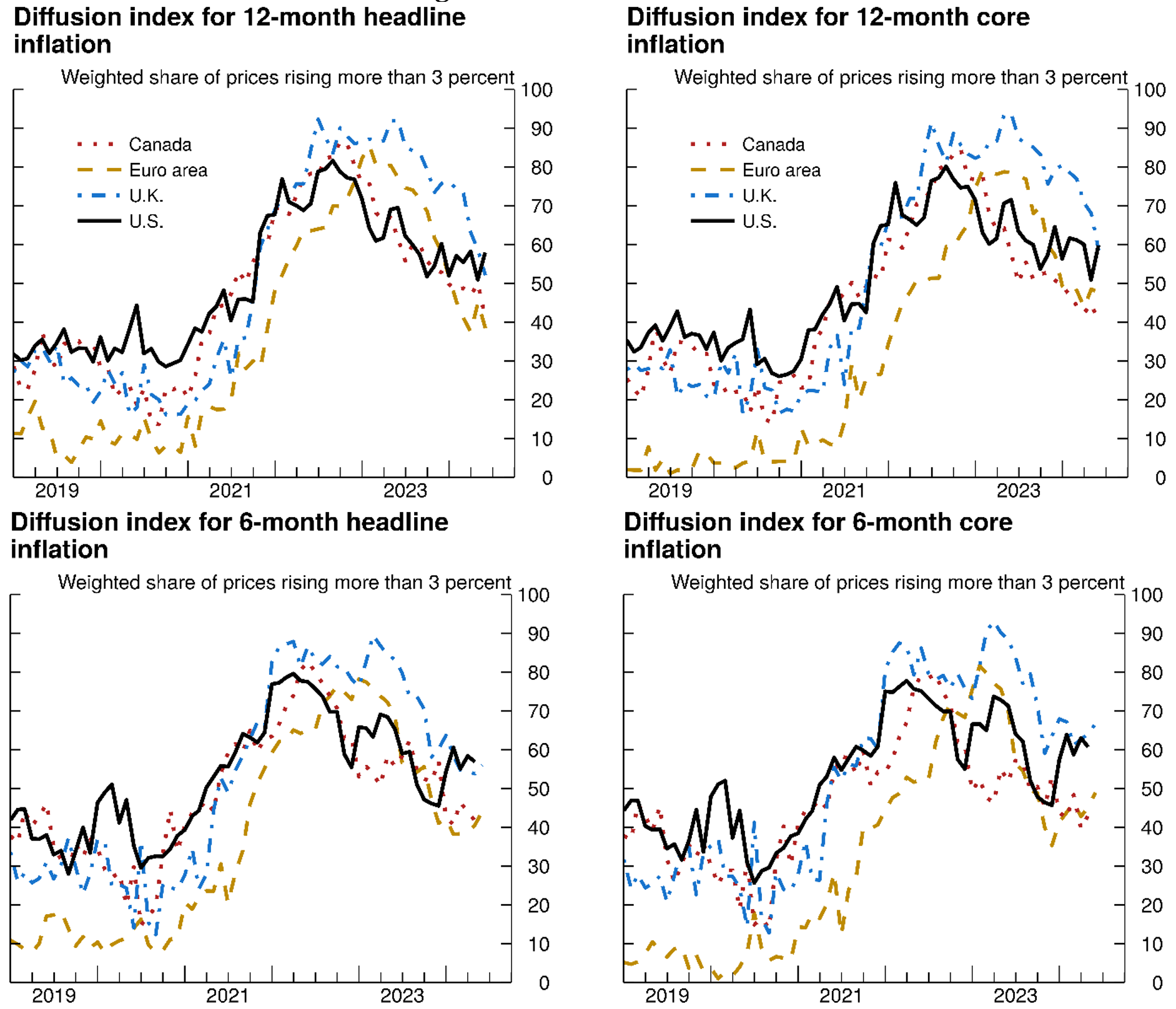

3. Dispersion of price pressure: a look at diffusion indexes

An alternative way of assessing the nature of inflationary pressures is to look at the number of categories whose price increases are above a target level. Figure 5 depicts a series of diffusion indices, showing the weighted share of CPI/PCE price index components rising more than 3 percent on a year-over-year basis (left) and on a 6-month, annualized basis (right). A low value for this diffusion index means that price pressures are concentrated in a narrow set of sectors of the economy, while a higher value implies that inflation is more widespread.

Coinciding with the pattern observed for inflation itself, the diffusion index for U.S. headline inflation increased somewhat earlier than for others. While inflation was similarly broad-based for all AEs at their peak, the broad trajectory of the U.S. diffusion index seems to have departed from the other advanced economies in recent months, with a resurgence in the weighted share of prices increasing more than 3 percent at an annual rate. As of June 2024, the diffusion index for 6-month headline inflation in the euro area was 44 percent, while it was just under 60 percent in the May PCE inflation reading (latest available) in the U.S.

The diffusion indices for core inflation show a similar pattern as the headline measures, with the most substantial progress made in Canada and the euro area, where the 6-month measure has fallen below 50 percent. While the index remains noticeably above its pre-pandemic level in the euro area, the index need not entirely fall back to the prior level for inflation to return to target as inflation before the pandemic was running well below 2 percent.

Additionally, headline and core diffusion indices for the U.S. appear to be more volatile overall than for other AEs. The smoother decline and lower volatility of diffusion indices in the euro area and Canada might have played a role in the recent communications from the European Central Bank and the Bank of Canada that have expressed more confidence in the downward trajectory of their preferred inflation measures.5

Note: Indices are constructed from 94 headline and 73 core series for the Euro area, 158 headline and 102 core series for Canada, 85 headline and 65 core series for the U.K., and 199 headline and 171 core series for the U.S. The data extend through May 2024 for the U.S., and June 2024 for all other countries. U.S. data are PCE components.

Source: Haver Analytics; FRB staff calculations.

4. On the synchronicity of inflation

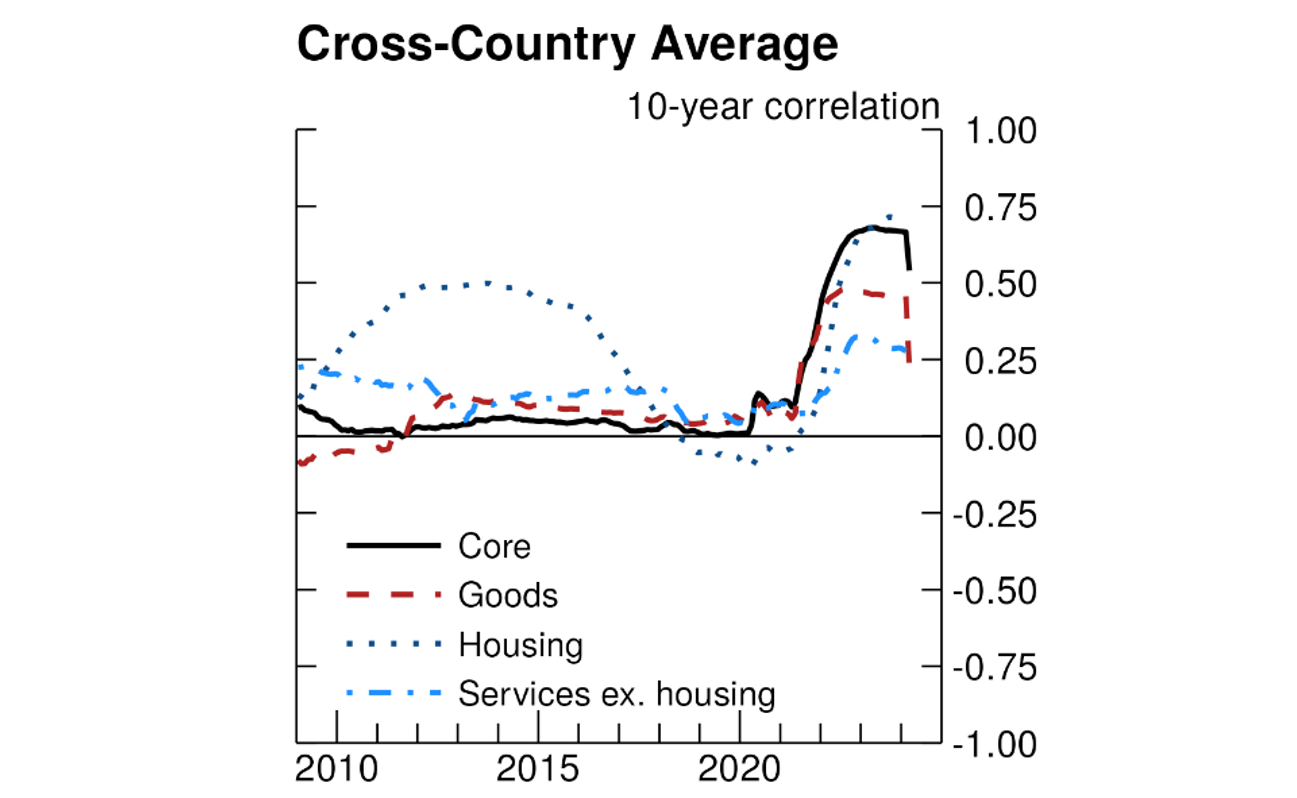

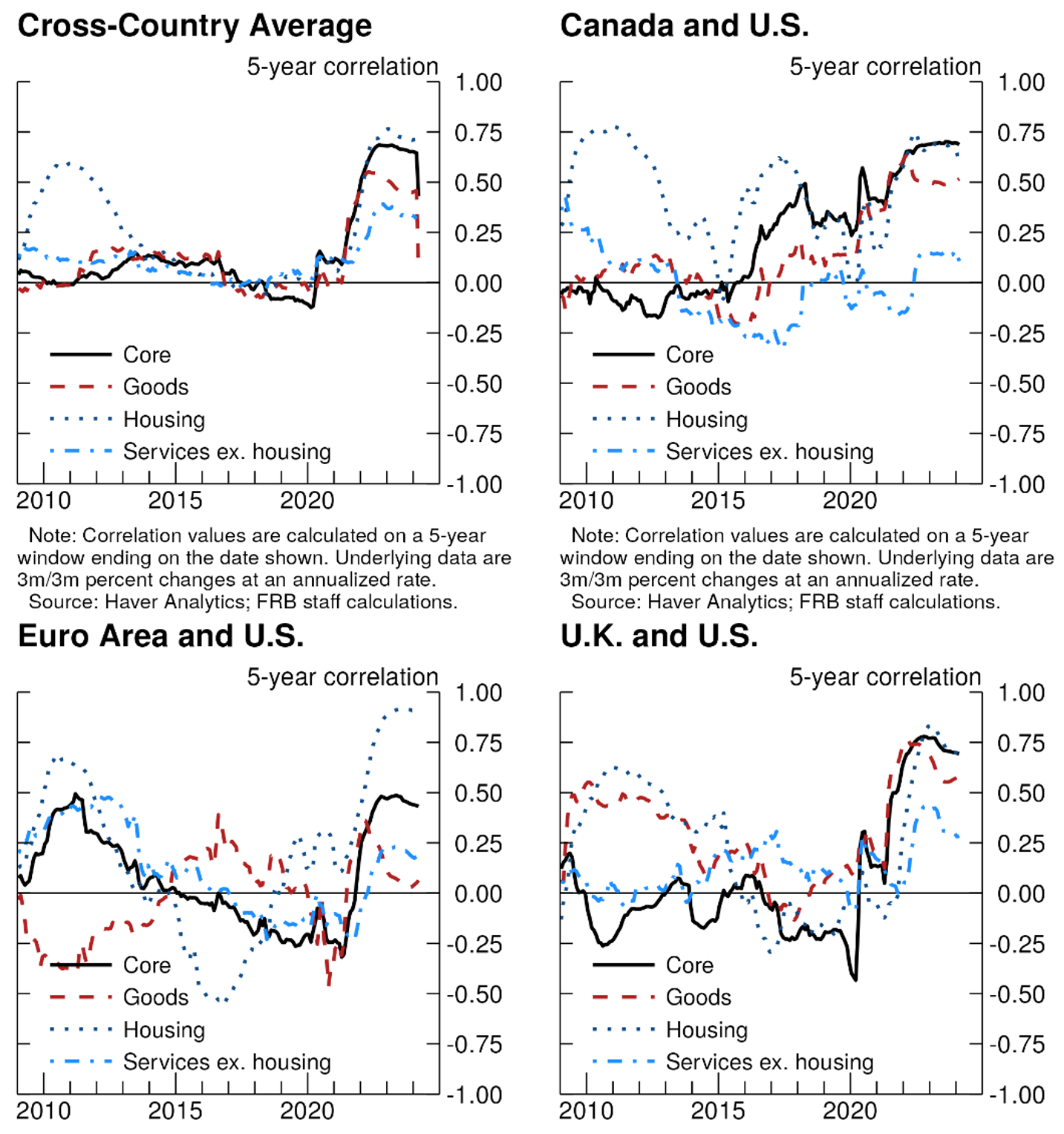

The latest inflation surge has been characterized by a high degree of international synchronization, as described precisely in Cascaldi-Garcia et al (2024). As suggested by Figures 2 and 3, the correlation of headline and core inflation seems to hide different degrees of co-movement across specific sectors. To unpack these elements, we compute the bilateral correlation for sectoral inflation series, using a 10-year moving window, for every pair of economies within the set of advanced economies used above.6 When computing this index of inflation co-movement, we use a measure of inflation momentum defined as the annualized three-month-on-three-month price growth—a metric commonly used by other central banks, notably the European Central Bank.7

Figure 6 presents the evolution of the unweighted average correlation of inflation momentum across all country-pairs.8 As expected, the synchronization of momentum for core inflation among advanced economies increased significantly in the aftermath of the COVID pandemic, with correlation increasing from around 0 in 2020 to just below 0.75 at its peak in mid-2023 (black line in Figure 6). Since mid-2023, core inflation synchronization decreased a touch, but remains elevated by historical standards.

Note: Correlation values are calculated on a 10-year window ending on the date shown. Underlying data area 3m/3m percent changes at an annualized rate.

Source: Haver Analytics; FRB staff calculations.

Looking at the individual components, the synchronization of inflation momentum is significantly more prominent for core goods than for services ex. housing. Since goods are traded across countries, this observation is not surprising: goods inflation is more likely to reflect global economic conditions as well as the propagation of shocks and policies. Conversely, services ex. housing are not traded, are more labor intensive, and hence are more likely to reflect the domestic economic conditions in each country. As the correlation of services ex. housing started to decrease somewhat, future inflation development could feature more idiosyncratic movements and less commonality across countries.

It is also interesting to note that the correlation of inflation momentum in housing has been much more volatile historically, possibly due to cross-border housing investment, global financial cycles, or variability in passthrough from monetary policy to housing prices.9

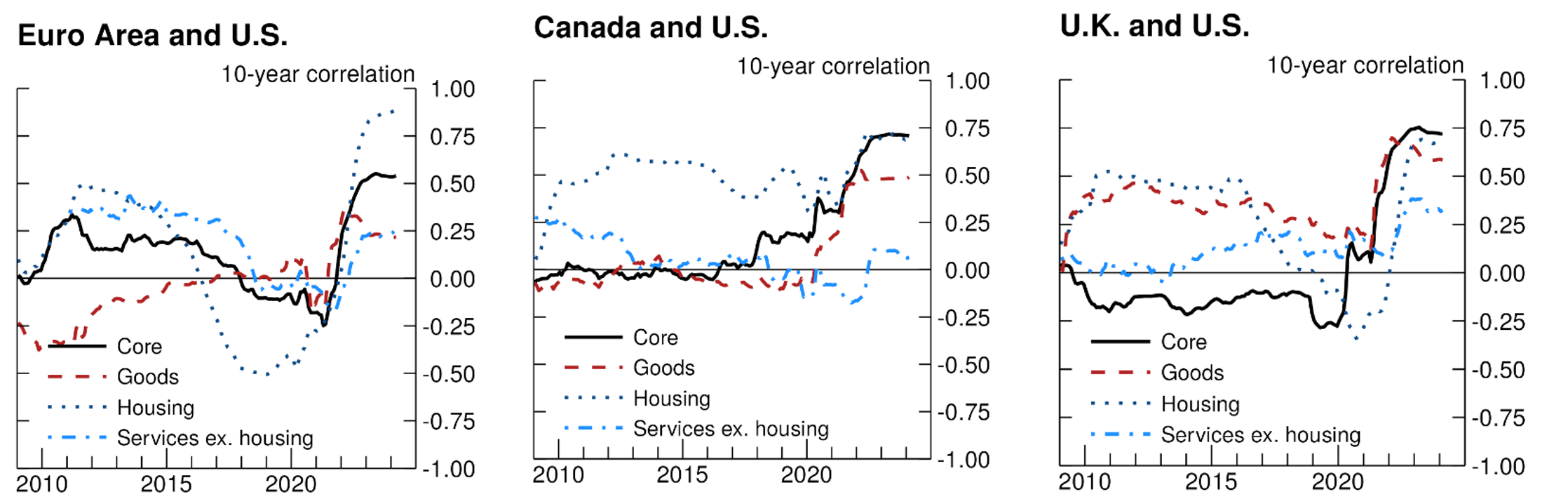

As shown in Figure 7, bilateral correlation of core inflation momentum between the U.S. and each of our select advanced economies similarly spike in the post-pandemic period. However, some differences across countries emerge: In Canada, the co-movement of inflation momentum with the U.S. is currently strong for the goods and housing sectors, while services ex. housing continued to exhibit a near-zero correlation throughout the last few years. Meanwhile, in the euro are and U.K, where inflation in services ex. housing picked up some since early 2024, the surge in inflation synchronization with the U.S. was more broadly based.

In sum, the recent inflationary episode is characterized not only by broad-based price increases across sectors, but also by notable co-movements in core inflation momentum between the countries. However, recent data suggest that average co-movement has begun to decline, suggesting the last mile of disinflation could feature more idiosyncratic developments.

Note: Correlation values are calculated on a 10-year window ending on the date shown. Underlying data area 3m/3m percent changes at an annualized rate.

Source: Haver Analytics; FRB staff calculations.

5. Conclusion

Following a steady easing in inflation last year, progress this year on disinflation has been uneven across countries and sectors. In particular, progress in services ex. housing has been bumpy with this category accelerating in recent months in some AEs. In addition, there is notable dispersion across countries in how broad-based inflation is across categories, with price pressures appearing more widespread in the U.S. and the U.K. than in Canada and the euro area. Moreover, the average co-movement in core inflation between the countries in key AEs has begun to decline, suggesting that progress on the last mile of disinflation could diverge across countries. These distinctions might have contributed to differences in the timing of rate cuts across economies, with some central banks easing in recent months while others are looking for more confirmation that inflation is sustainably moving toward target.

Navigating the last mile of disinflation will likely require further cooling in nominal wage growth, which could be accompanied by slower growth. Past experience shows that there is some, albeit limited, precedent for inflation to be successfully tamed without a substantial weakening in growth (de Soyres and Saijid 2024). Though some central banks have eased in recent months, expressing greater confidence in the disinflationary path, the tone in their communications remains cautionary. Their latest forward guidance emphasizes data dependency, a gradual easing cycle, and no pre-commitment to a particular path for policy, allowing central banks to preserve the ability to be nimble in response to changing conditions.

References

- Ball, Laurence, Daniel Leigh, and Prachi Mishra (2022). "Understanding U.S. Inflation During the COVID Era," IMF Working Paper. (Washington: IMF, October).

- Bernanke, Ben and Olivier Blanchard (2024). "An Analysis of Pandemic-Era Inflation in 11 Economies," PIIE Working Paper. (Washington: PIIE, May).

- Beschin, Anna, Katalin Bodnár, Ramon Gomez-Salvador, Eduardo Gonçalves, Marcel Tirpák, Marcel, and Marco Weißler, 2024. "Recent inflation developments and wage pressures in the euro area and the United States," Economic Bulletin Boxes, European Central Bank, vol. 3.

- Cascaldi-Garcia, Danilo, Luca Guerrieri, Matteo Iacoviello, and Michele Modugno (2024). "Lessons from the co-movement of inflation around the world," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, June 28, 2024,

- Cotton, Christopher D. 2024. "A Faster Convergence of Shelter Prices and Market Rent: Implications for Inflation." Federal Reserve Bank of Boston Current Policy Perspectives. June 17, 2024.

- de Soyres, François, Ana Maria Santacreu, and Henry Young, "Demand-Supply Imbalance during the COVID-19 Pandemic: The Role of Fiscal Policy," Federal Reserve Bank of St. Louis Review, First Quarter 2023, pp. 21-50.

- de Soyres, François, Alexandre Gaillard, Ana Maria Santacreu, and Dylan Moore. 2024a. "Supply Disruptions and Fiscal Stimulus: Transmission through Global Value Chains." AEA Papers and Proceedings, 114: 112–17.

- de Soyres, François, Joaquin Garcia-Cabo Herrero, Nils Goernemann, Sharon Jeon, Grace Lofstrom, and Dylan Moore (2024b). "Why is the US GDP recovering faster than other advanced economies?," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, May 17, 2024.

- de Soyres, François, and Zina Saijid (2024). "Lessons from Past Monetary Easing Cycles," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, May 31, 2024.

Appendix Table 1: Comparing housing component of key inflation measures across advanced economies

| Weights of housing components in inflation measures | Measurement of Owner-occupied housing (OOH) in CPIs | |||||

|---|---|---|---|---|---|---|

| Housing | Rents | Owner-occupied housing (in () is mortgage costs) | Other1 | Is OOH included? | Valuation method | |

| United States | 16.1 | 3.5 | 11.7 | 0.9 | Yes | Rental equivalence |

| Canada | 25.9 | 7.4 | 18.6 (5.6) | Yes | User-cost approach | |

| Euro area (HICP) | 9.4 | 5.6 | 3.8 | No | ||

| United Kingdom (CPI) | 9.1 | 7.8 | 1.3 | No | ||

1. Other includes services related to housing like maintenance and repairs, insurance, and water and sewage services. For Canada, these categories are included in the overall owner-occupied housing component.

Note: For the U.S., table reports PCE price index weights using data for 2024:Q1 personal consumption expenditures.

Source: Haver Analytics and national statistical agencies. Weights reported are as of 2024.

Source: Haver Analytics; FRB staff calculations.

Note: Correlation values are calculated on a 5-year window ending on the date shown. Underlying data area 3m/3m percent changes at an annualized rate.

Source: Haver Analytics; FRB staff calculations.

1. François de Soyres ([email protected]), Grace Lofstrom ([email protected]), Mitch Lott ([email protected]), Chris Machol ([email protected]), and Zina Saijid ([email protected]) are with the Board of Governors of the Federal Reserve System. The views expressed in this note are our own, and do not represent the views of the Board of Governors of the Federal Reserve, nor any other person associated with the Federal Reserve System. Return to text

2. Central bank targets are expressed in 12-month terms. Return to text

3. The charts in this note show the PCE price index, which is the official inflation target series of the Federal Reserve. The PCE price indexes for rents and owner-occupied housing are based on the comparable CPI series. Return to text

4. See Cotton (2024). Return to text

5. In the opening statement to the press conference accompanying the June 5, 2024 policy decision, Governor Macklem of the Bank of Canada noted that "our confidence that inflation will continue to move closer to the 2% target has increased over recent months" supported in part by "the proportion of CPI components increasing faster than 3% is now close to its historical average, suggesting price increases are no longer unusually broad-based." See Tiff Macklem (2024), "Monetary Policy Decision Press Conference Opening Statement", Bank of Canada, June 5.

During the Q&A session of the press conference following the June 6, 2024 policy decision, ECB President Christine Lagarde expressed that "there are bumps on this road that we are travelling with more confidence that the disinflationary path is actually materializing" and cited the considerable progress on inflation made in recent months and the improved inflation outlook. See Christine Lagarde and Luis de Guindos (2024), "Monetary policy statement (with Q&A)", European Central Bank, June 6, https://www.ecb.europa.eu/press/press_conference/monetary-policy-statement/2024/html/ecb.is240606~d32cd6cc8a.en.html. Return to text

6. Focusing on the U.S., U.K., euro area and Canada, there are a total of 6 country-pairs. In appendix, we also show that results obtained with a 5-year moving window are very similar. Return to text

7. See for example ECB Chief Economist Philip Lane's speech at the 29th Dubrovnik Economic Conference (PDF) in May 2023, or the ECB Economic Bulletin by Beschin et al. (2024). Return to text

8. In this chart and the next, we use the CPI for the U.S. and not the PCE price index, because of historical data availability. Return to text

9. Note that the correlation in core inflation may be greater than or less than the average of the correlation in the components in the chart, because the correlation of core inflation also accounts for cross-component correlations. Return to text

de Soyres, François, Grace Lofstrom, Mitch Lott, Chris Machol, and Zina Saijid (2024). "Disinflation Progress: A Comparison of Advanced Economies," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, August 02, 2024, https://doi.org/10.17016/2380-7172.3576.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.