FEDS Notes

June 21, 2024

Estimating Retail Credit in the U.S.

Jessica N. Flagg, Simona M. Hannon, Cisil Sarisoy, and Mark J. Wicks*

In this note, we estimate the size of an understudied segment of the consumer credit market—retail credit. Retail credit consists of the amounts owed to retail stores by their customers for purchases made on credit extended in partnership with a financial institution.1 Although retail credit is included in the consumer credit totals in Federal Reserve Statistical Release G.19, "Consumer Credit," a principal economic indicator providing the official estimate for consumer credit holdings in the U.S., it is not separately categorized on the release.2 Using several credit bureau data sets, we provide an estimate showing that the retail credit outstanding totalled $130 billion, or over 2.5 percent of total outstanding consumer credit as of the end of 2023.3 Moreover, nearly 85 million individuals (or about one-third of the entire U.S. adult population with credit records) had a retail credit account, with a median outstanding balance per account of $194 and a median monthly payment of $29.4 Furthermore, more than 60 percent of retail credit balances were held by borrowers with nonprime credit scores.5 Retail credit is more than 90 percent revolving in nature.

In the remainder of this note, we present a method for estimating retail credit, and then we provide some estimates and additional details for the sector.

Estimating Retail Credit Outstanding

To provide a complete overview of the retail credit outstanding universe in the U.S. over nearly two decades, 2005:Q1 to 2023:Q4, we combine data sets across two versions of the Federal Reserve Bank of New York's quarterly Consumer Credit Panel (CCP), a database on consumers' credit use and payment performance drawn from anonymized Equifax credit bureau records.6 The first version of the CCP is a newly released account- (or loan-) level version, while the second is at the individual borrower level. Both versions are needed to construct time series for retail credit, while the account-level version allows for a deeper look into the details of the sector. The resulting sample has coverage of up to 10 credit card accounts and up to 4 auto and personal loans per individual, and it contains industry code and account type indicators that allow for the categorization of the accounts.

As our definition of retail credit consists of the amounts owed to retail stores by their customers for purchases made on credit extended in partnership with a financial institution, the sector is likely primarily revolving in nature, consisting of all private-label credit cards and of nonrevolving credit holdings of sales finance companies. Accordingly, to construct our estimate, we examine three CCP account-level data sets—for credit cards, consumer finance accounts, and auto loans—in addition to the individual-level data set.7

The account-level data contain a rich set of variables for each loan, including industry and account type indicators, which are salient to our analysis. Specifically for credit cards, the industry indicators allow the categorization of outstanding balances or accounts by retail expenditure sector, or where the credit cards were used—for example, department stores, clothing stores, home furnishing stores, etc. For auto and personal loans, these indicators can be used to further differentiate the finance company holdings by finance company type—personal loan, sales finance, and a miscellaneous category—thus allowing the isolation of sales finance company holdings from other finance company holdings, which is key for our estimation. In addition, account type indicators allow the separation of accounts by credit type—revolving and nonrevolving.

Our estimation proceeds in four steps. First, we isolate private-label credit card holdings from the credit card account-level data using a method proposed by Rahman (2022). The method consists of classifying each credit card account by the industry code indicator associated with it and estimating the total outstanding private-label retail credit as the sum of those accounts with industry codes indicative of spending reflecting purchases at specified retailer types, such as those for automotive parts, at clothing stores, at contractors, at department stores, of home furnishings, of jewelry and cameras, at oil companies, or at sporting goods stores.8 The remainder of accounts—those with industry codes indicative of specific institution types or credit card companies—are considered to be part of the general-purpose credit card universe and, thus, are not included in our estimation.9 In column I of Table 1 we show that as of the end of 2023, private-label credit card holdings reflected in the credit card tradeline portion of the credit bureau data amount to $64.9 billion and are held in 107.3 million accounts by 68.5 million borrowers with a median age of 54 and a median Equifax Risk Score of 747. The median balance per account is $127, and the median account monthly payment is $29. More than 60 percent of balances are held by nonprime borrowers. The delinquency rate on these accounts, or the fraction of balances that are at least 30 days past due (excluding severely derogatory loans), is 6.2 percent.

Table 1: Retail Credit Characteristics as of 2023:Q4

| Revolving | Nonrevolving | Total | |||||

|---|---|---|---|---|---|---|---|

| Credit Card Tradelines |

Sales Fin. Cos. |

Personal Loan Cos. |

Misc. Cos. |

Sales Fin. Cos. Install. |

Sales Fin. Cos. Auto |

||

| I | II | III | IV | V | VI | VII | |

| Outstanding Balance (billion $) | 64.9 | 32.2 | 16.2 | 4.4 | 10.4 | 2.1 | 130.1 |

| Share of Total Balance (%) | 49.8 | 24.8 | 12.5 | 3.4 | 8 | 1.6 | 100 |

| Number of Accounts (million) | 107.3 | 20.3 | 16.1 | 4.3 | 1.5 | 0.1 | 149.7 |

| Number of Borrowers (million) | 68.5 | 18.7 | 15.2 | 4.2 | 1.5 | 0.2 | 84.8 |

| Balance per Account (median, $) | 127 | 787 | 268 | 560 | 3,605 | 9,928 | 194 |

| Account Monthly Payment (median, $) | 29 | 39 | 29 | 30 | 179 | 388 | 29 |

| Borrower Equifax Risk Score (median) | 747 | 723 | 737 | 600 | 628 | 592 | 742 |

| Borrower Age (median) | 54 | 51 | 56 | 46 | 42 | 40 | 53 |

| Share Balance Nonprime (%) | 63.2 | 51.5 | 55.6 | 83 | 64.7 | 87.5 | 60.5 |

| Delinquency (%) | 6.2 | 1.6 | 3.4 | 7.4 | 2.6 | 4.2 | 4.5 |

Note: Nonprime are borrowers with Equifax Risk Scores of 719 or less. Delinquency measures the fraction of balances that are at least 30 days past due and exclude severely derogatory loans.

Source: Federal Reserve Bank of New York Consumer Credit Panel (CCP)/Equifax.

Second, using information about the account type, we identify additional private-label credit card holdings not reflected in the credit card account-level data set that appear in the form of revolving credit accounts in the consumer finance account-level data set that covers holdings of sales finance companies, personal loan companies, and miscellaneous companies.10 In columns II, III, and IV of Table 1, we show that among finance companies, sales finance companies hold the largest outstanding balance—$32.2 billion that is held in 20.3 million accounts by 18.7 million consumers with a median age of 51 and a median Equifax Risk Score of 723. The median balance per account is $787, and the median account monthly payment is $39. A little more than half of the sales finance revolving credit balances are held by nonprime borrowers, and the delinquency rate on these accounts is low—1.6 percent. In contrast, larger shares of personal loan and miscellaneous company revolving credit balances are held by nonprime consumers—55.6 percent and 83 percent, respectively—and the delinquency rates on these accounts are also higher—3.4 percent and 7.4 percent, respectively. Moreover, we note differences in revolving credit holdings at finance companies across a number of dimensions. For example, the median personal loan company borrower age is the highest at 56, while the median miscellaneous company borrower age is the lowest at 46. Similarly, the median personal loan company borrower Equifax Risk Score is the highest at 737, while the median miscellaneous company borrower Equifax Risk Score is the lowest at 600. That said, although there are significant differences in the median balances across revolving retail credit categories—ranging from $127 for credit card tradelines, to $787 for a revolving sales finance company account—the common characteristic among these accounts is the relatively low median monthly payment—$29 or $30 for most accounts, and $39 for revolving sales finance accounts.

Third, to complete our estimate, we examine the nonrevolving credit holdings of sales finance companies reflected in the consumer finance and the auto loan-level data sets. These holdings consist of retail sales financing, installment sales contracts purchased at a discount and, in a small share, of loans categorized as auto loans in the data.11 Although sales finance companies are less in the spotlight nowadays, it is important to account for their holdings, as these companies are "specialized financial institutions which extend credit through retail dealers to consumers" and "which customarily purchase at discount the credit instruments that are given to retail dealers by their (...) customers" (see Plummer and Young, 1940, pp. 33-53) and, thus, are included in our definition. In columns V and VI of Table 1, we show the installment credit balances and those sales finance company balances that are categorized as auto. Installment credit balances amount to $10.4 billion and are held in 1.5 million accounts by 1.5 million borrowers with a median age of 42 and a median Equifax Risk Score of 628. The median balance per account is $3,605, and the median account monthly payment is $179. More than 60 percent of balances are held by nonprime borrowers. The delinquency rate on these accounts is 2.6 percent. Auto loan balances represent a very small share of retail credit and amount to $2.1 billion held in 100,000 accounts by 200,000 borrowers with a median age of 40 and a median Equifax Risk Score of 592.

Summing up the account-level estimates using data from the three sources, in column VII of Table 1 we present our estimate of total outstanding retail credit. As of 2023:Q4, we find that the retail credit sector totals $130 billion and consists of nearly 150 million accounts held by nearly 85 million borrowers with a median age of 53 and a median Equifax Risk Score of 742. The median balance per account is $194, and the median account monthly payment is $29. More than 60 percent of retail credit balances are held by nonprime borrowers, defined as those with Equifax Risk Scores of 719 or less. The delinquency rate on retail credit accounts is 4.5 percent.

Additional Details

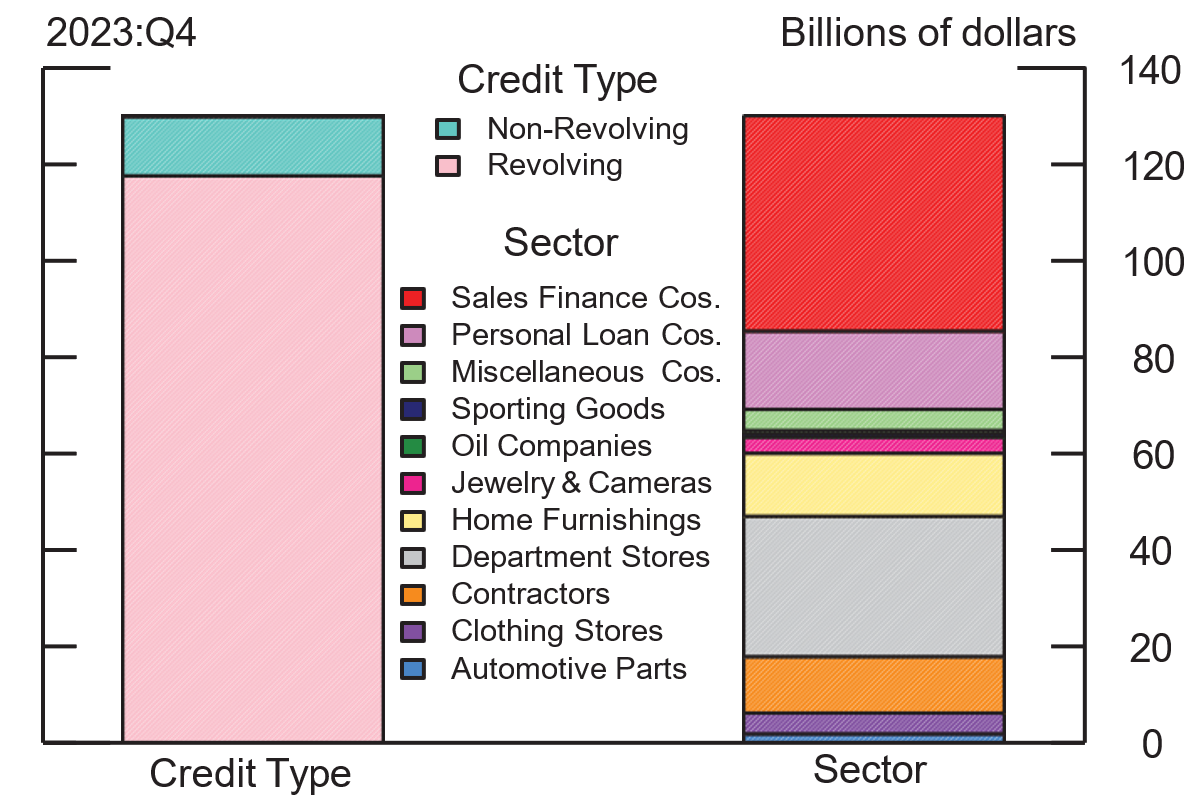

As our method of estimating total outstanding retail credit in the U.S. employs cross-sectoral data from multiple sources, once we assemble the relevant information from these sources, we can further separate retail credit holdings by credit type or sector, as shown in Figure 1. In the first bar we present total outstanding retail credit by type—thus showing that retail credit is primarily revolving in nature. In the second bar, we make the most of the information available to us across the multiple sources. We present retail credit outstanding by expenditure sector and finance company type. This level of detail allows us to show that significant shares of balances are spent at department stores (in gray) and are held by sales finance companies (in red).

Note: Key identifies in order from top to bottom. This figure shows retail credit balances by type of credit and sector expenditure and finance company type holder.

Source: Federal Reserve Bank of New York Consumer Credit Panel (CCP)/Equifax.

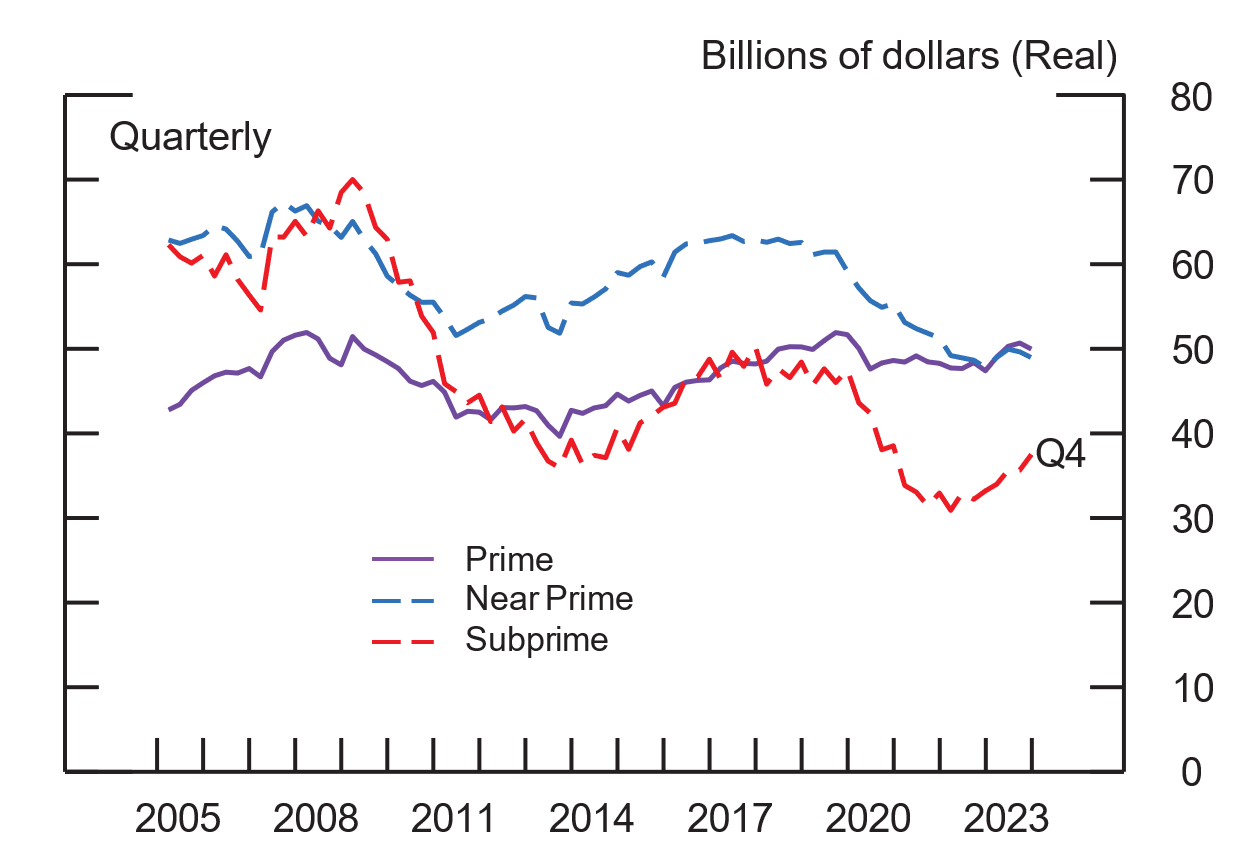

Finally, in Figure 2, we present retail credit trends by credit risk group—prime, near prime, and subprime. Notably, retail credit has not recovered to its pre-pandemic levels for two out of three borrower risk groups.12

Note: This figure shows retail credit balances by credit risk group. Near prime are borrowers with Equifax Risk Scores between 620 and 719, while prime are borrowers with Equifax Risk Scores greater than 719.

Source: Federal Reserve Bank of New York Consumer Credit Panel (CCP)/Equifax.

Conclusion

In this note, we provide an estimate of and some details for the retail credit sector in the U.S. by combining data sets across two versions of the CCP. Our data reveal that at the end of 2023, the retail credit sector amounted to $130 billion and that nearly 85 million individuals had a retail credit account. The median balance per retail credit account is $194, and the median monthly payment on such an account is about $29. Retail credit is primarily revolving in nature.

References

Lee, D. and W. van der Klaauw (2010). "An Introduction to the FRBNY Consumer Credit Panel". Staff Report no. 479, New York: Federal Reserve Bank of New York, November 10.

Plummer, W. C. and R. A. Young (1940). Sales Finance Companies and Their Credit Practices.

Rahman, M. (2022). "CCP Data Updates and Beyond," presentation at the 2022 Credit Bureau Data Users Conference.

* We thank Vitaly Bord, Shane Sherlund, and Kamila Sommer for useful comments and suggestions and David Jenkins for outstanding editing. The views in this note are those of the authors and do not necessarily reflect those of the Board of Governors of the Federal Reserve System or its staff.

Address: Board of Governors of the Federal Reserve System, 20th Street and Constitution Avenue NW, Washington, DC 20551, USA

Author Emails:

Jessica N. Flagg, [email protected].

Simona M. Hannon, [email protected].

Cisil Sarisoy, [email protected].

Mark J. Wicks, [email protected].

1. Our definition of retail credit does not reflect credit extended by retailers in partnership with financial institutions that can be used broadly, irrespective of retailer. Return to text

2. The Federal Reserve Statistical Release G.19, "Consumer Credit," captures retail credit as part of broader consumer credit categories, which prevents us from constructing a measure of retail credit from the G.19 data sources directly. Return to text

3. The total outstanding consumer credit estimate is sourced from the Federal Reserve Statistical Release G.19, "Consumer Credit". Return to text

4. As of 2023:Q4, the CCP covered approximately 284 million individuals, 241 million of which had credit scores. Return to text

5. Nonprime credit scores are Equifax Risk Scores of 719 or less. Return to text

6. The sampling procedure ensures that the same individuals remain in the sample in each quarter and allows for entry into and exit from the sample, so that the sample is representative of the target population in each quarter. For a description of the design and content of the CCP, see Lee and van der Klaauw (2010), as well as https://www.newyorkfed.org/medialibrary/interactives/householdcredit/data/pdf/data_dictionary_HHDC.pdf. As retail credit trades tend to have a lower incidence than other loan types, to ensure proper coverage, we construct our estimate using a 10 percent random sample from the total available 5 percent sample. Return to text

7. The credit card, consumer finance, and auto loan-level data sets start in 2000:Q2, 2005:Q1, and 2000:Q2, respectively. Consumer finance accounts are those with origination balances lower than $20,000 and industry codes indicative of sales finance companies and all accounts, irrespective of origination amounts, with industry codes indicative of personal loan companies and of a miscellaneous finance category. Although we inquired about the company types included in the miscellaneous category, in order to preserve data confidentiality, no further details could be made publicly available by Equifax. Return to text

8. Industry code indicators for the credit card account portion of the data set are only available starting with 2021:Q4. Our categories are constructed as following: automotive parts—industry codes AP, AT, and AZ, clothing stores—industry codes CG, CS, and CZ, department stores—industry codes DC, DM, DV, and DZ, home furnishings—industry codes HA, HF, HM, HT, and HZ, jewelry and cameras—industry codes JA and JC, contractors—industry codes LA, LH, LZ, TN, and TZ, oil companies—industry code OC, and sporting goods—industry codes SG, SZ, and SM. Return to text

9. We do not include in our estimations accounts with industry codes indicative of depository institutions (banks—BB, bank cards—BC, credit unions—FC, savings and loan companies—FS) or credit card companies (ON). Return to text

10. Sales finance companies are those with the FF industry code, personal loan companies are those with the FP industry code, and miscellaneous companies are those with the FZ industry code. Return to text

11. The loans categorized as auto loans are likely not traditional auto loans but rather installment loans for auto parts, auto accessories, and other auto-related items. Return to text

12. To construct the longer time series, since industry code indicators for the credit card account-level data set are only available starting with 2021:Q4, we supplement our estimates by turning to the individual-level data set that contains an estimate for holdings of private-label credit cards, without the industry and account type codes that allow the additional details with respect to where the balances were spent that we previously showed, but with the full borrower-level information available in the CCP. Estimates of private-label credit card holdings obtained from the two sources are comparable, but not identical, primarily due to the differences in the extent severely derogatory loans are reflected in the two versions of the CCP. Return to text

Flagg, Jessica N., Simona M. Hannon, Cisil Sarisoy, and Mark J. Wicks (2024). "Estimating Retail Credit in the U.S.," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, June 21, 2024, https://doi.org/10.17016/2380-7172.3535.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.