FEDS Notes

August 02, 2024

Estimating Securities-Based Loans Outstanding1

Alexander Bruce and Simona M. Hannon2

Securities-based loans are loans for personal use that are backed by the borrowers' investment portfolios.3 The key benefit provided by such loans is the ability for borrowers to obtain access to funding without having to liquidate their portfolios.4 Furthermore, these loans have flexible repayment terms, low interest rates, and tax benefits (Ensign and Rubin, 2021).5 That said, these loans are sensitive to market conditions and are subject to interest rate risk.6 Additionally, they are considered demand loans, meaning that they may be recalled at any time (FINRA, 2024). Although securities-based loans are included in the consumer credit totals in the Federal Reserve Statistical Release G.19, "Consumer Credit," a principal economic indicator providing the official estimate for consumer credit holdings in the U.S., these loans are not separately categorized on the release.7 Moreover, since these loans are generally not reported to credit bureaus, there is limited visibility into this rapidly rising, yet understudied sector.8 Using several sources of data, we provide an estimate for this sector showing that as of 2024:Q1, securities-based loans totaled $138 billion or 2.7 percent of total outstanding consumer credit.9

In the remainder of this note, we present a method for estimating securities-based outstanding loans and we compare our results to publicly available information. We conclude with a short discussion of recent developments in this sector.

1. Estimation

Although these type of loans can be offered by financial firms, such as brokerage firms, for example, they are usually offered in partnership with a bank (FINRA, 2024). As a result, to construct our estimate, we turn to information for the bank sector.

To estimate total outstanding securities-based loans over the past 13 years, 2011:Q1 to 2024:Q1, we examine bank information reflected in four data sources: the Reports of Condition and Income (Call Report), the Federal Reserve Bank of New York Consumer Credit Panel (CCP)/Equifax, the Top 100 Federal Family Education Loan Program (FFELP) Holders list published by the Department of Education, and Enterval for bank private student loan holdings.10 We measure securities-based loans as the residual between bank holdings of all other consumer loans and all known loan categories that are not securities-based loans (bank-issued personal loans reported to credit bureaus and student loans).

Our estimation proceeds in five steps. First, we examine quarterly Call Report information as all banks are required as of 2011:Q1 to report their holdings of other consumer loans, including single payment and installment, and all student loans in category (d) under "Loans to individuals for household, family, and other personal expenditures", item 6 on Part I of Schedule RC-C.11 The Call Report instructions further clarify the types of loans that should be included in this item and list nine types of loans, those for: purchases of household appliances, furniture, trailers, and boats; repairs or improvements to the borrower's residence; educational expenses, including student loans; medical expenses; personal taxes; vacations; consolidation of personal (nonbusiness) debts; purchases of real estate or mobile homes to be used as a residence by the borrower's family; and other personal expenditures. Moreover, the Call Report instructions specify that when such loans take the form of installment loans, demand loans, single payment time loans, and hire purchase contracts, they should be reported in this category irrespective of size, maturity, and bank department issuing the loan.12 Importantly, loans for purchasing or carrying securities, or margin loans, are specifically excluded from this category.13

In other words, considering the loan types listed in the Call Report instructions, banks include two broad loan categories in other consumer loans—loans for personal use and student loans. The loans for personal use can take the form of either personal loans, which are typically reported to credit bureaus, or securities-based loans, which usually do not require a credit check. Student loans can be either FFELP or private. As a result, to isolate securities-based loans outstanding from total bank holdings of other consumer loans, we need to examine estimates for bank-held personal loans and both types of student loans. As of 2024:Q1, the Call Report showed that banks held $358 billion of other consumer loans.

Second, to estimate bank personal loan holdings, similar to other analyses of personal loans (that is, Flagg and Hannon, 2023, Flagg and Hannon, 2024), we use a newly released quarterly loan-level version of the CCP, a database on consumers' credit use and payment performance drawn from anonymized Equifax credit bureau records.14 Our sample contains industry code indicators that allow us to categorize the personal loan holdings by sector—finance companies, banks, thrifts, and credit unions, thus allowing the separation of bank balances, which is salient for our estimation. As personal loans tend to have lower incidence than other loan types, to ensure proper representation, we base our estimates on a 10 percent random sample from the total available 5 percent sample. As of the end of 2024:Q1, the consumer finance CCP loan-level sample showed that banks held $170 billion in personal loans.15

Third, to obtain the bank FFELP balances, we turn to the lists of the top 100 and top 50 FFELP holders published annually by the Department of Education. Although the program ended in 2010, as of the most recent report published as of 2023:Q3, there are approximately $2.8 billion of FFELP loans held by banks that remain outstanding.16

Fourth, we obtain quarterly private student loan bank holding estimates from Enterval. As of 2024:Q1, banks held approximately $47 billion in private student loans.

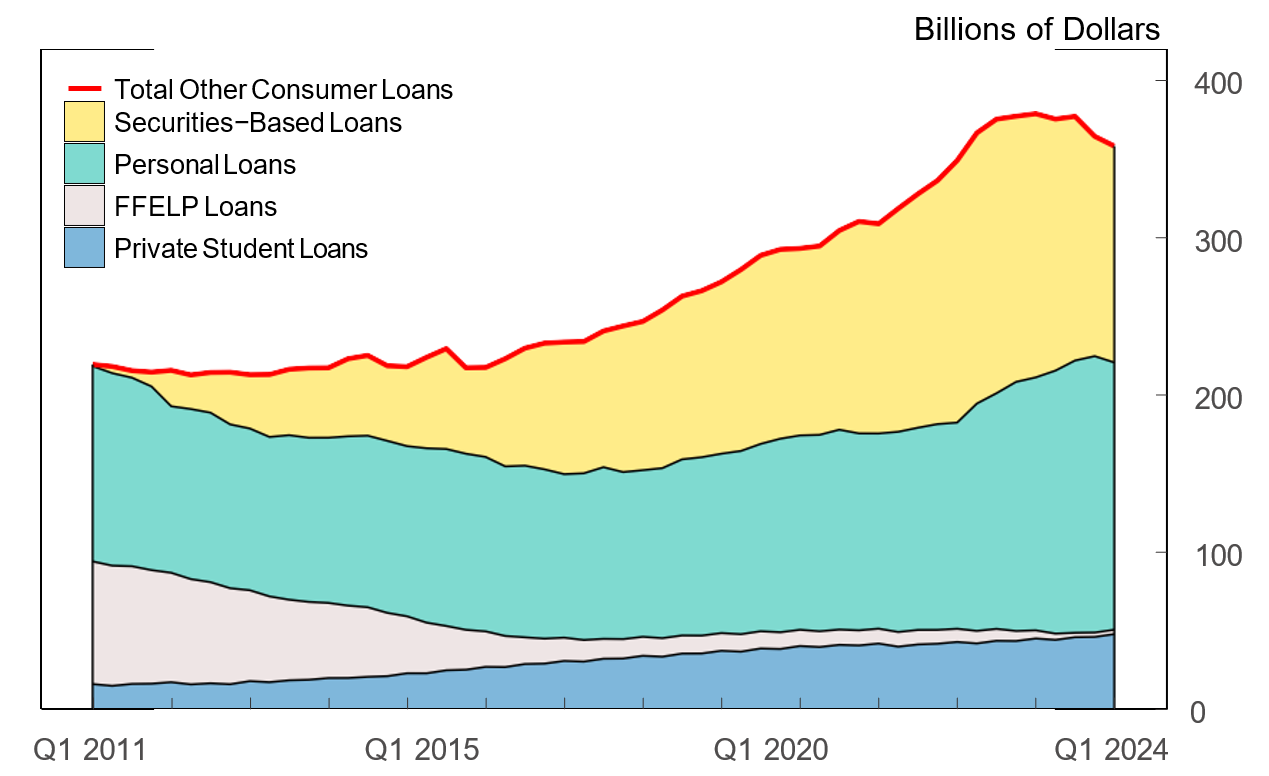

Finally, we estimate the total outstanding securities-based loans, shown in yellow in Figure 1, as the difference between other consumer loans from all banks reported on the Call Report, personal loans, and student loans of both types—FFELP and private. We find that, as of 2024:Q1, securities-based loans outstanding amounted to $138 billion.17

Note: Key identifies in order from top to bottom. This figure shows the bank-held loans to individuals for household, family, and other personal expenditures by loan type.

Source: Authors' calculations using the Reports of Condition and Income (Call Report), Federal Reserve Bank of New York Consumer Credit Panel (CCP)/Equifax, the Top 100 and Top 50 Federal Family Education Loan Program (FFELP) Holders list from the Department of Education, and Enterval.

2. Comparison with Other Estimates

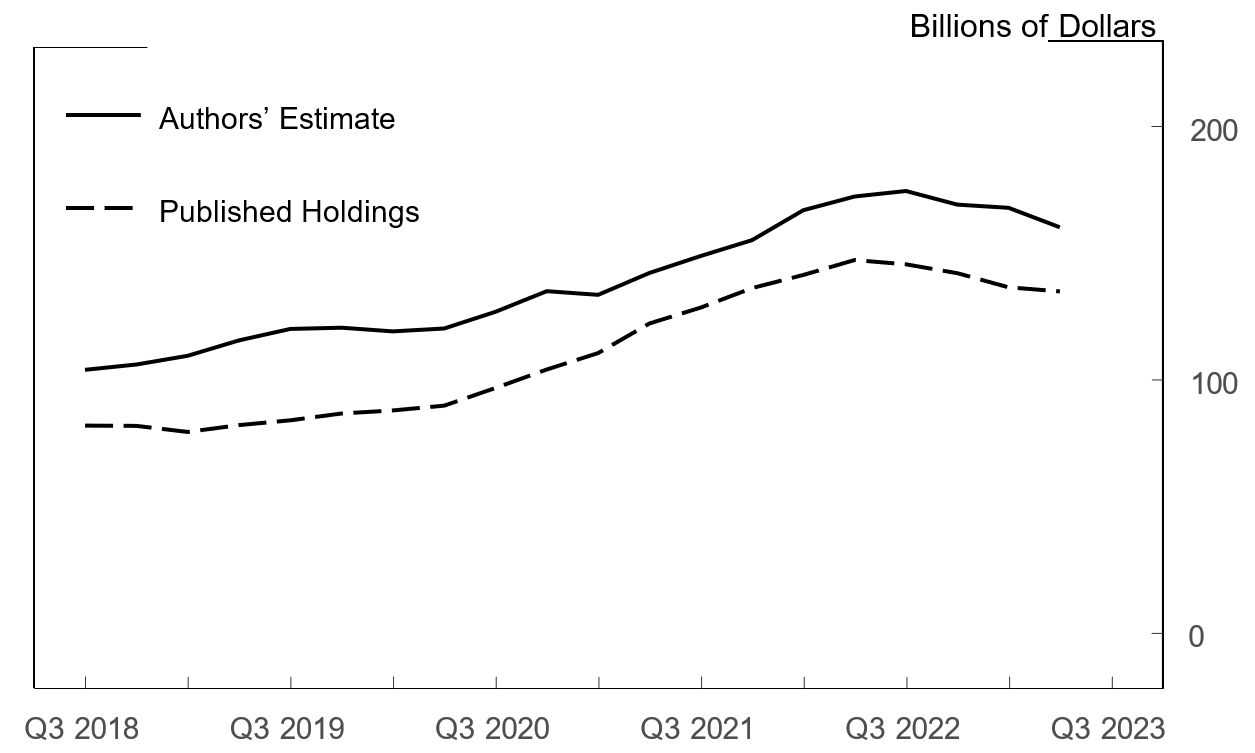

To our knowledge, there is no data source covering the universe of securities-based lending. That said, one news article references holdings of securities-based loans at two large banks over the period between 2018:Q3 and 2023:Q2 (see Eisen, 2023). Together, the securities-based loan balances at the two institutions range between $81.8 billion in 2018:Q3 and $134.9 billion in 2023:Q2, while our estimate ranges between $104 billion and $160.4 billion over the same period. In Figure 2, we compare our estimate with the holdings of the two institutions. As expected, our estimate is higher than the aggregate holdings of the two banks as there are additional market participants offering such loans.18 However, the trends followed by the two estimates are very similar for the period we can compare data from both sources.

Note: This figure shows authors' estimate for securities-based loans plotted together with estimates of holdings of such loans at select market participants published in a Wall Street Journal article (Eisen, 2023).

Source: Federal Reserve Board and Wall Street Journal.

3. Discussion

In this note, we provide an estimate for the securities-based loan sector in the U.S. by combining information from a number of data sets. We reveal that, as of 2024:Q1, the securities-based loans amounted to $138 billion. Together with approximately $180 billion in margin loans, they are part of a rising asset-based consumer lending sector that currently stands at approximately $318 billion.19

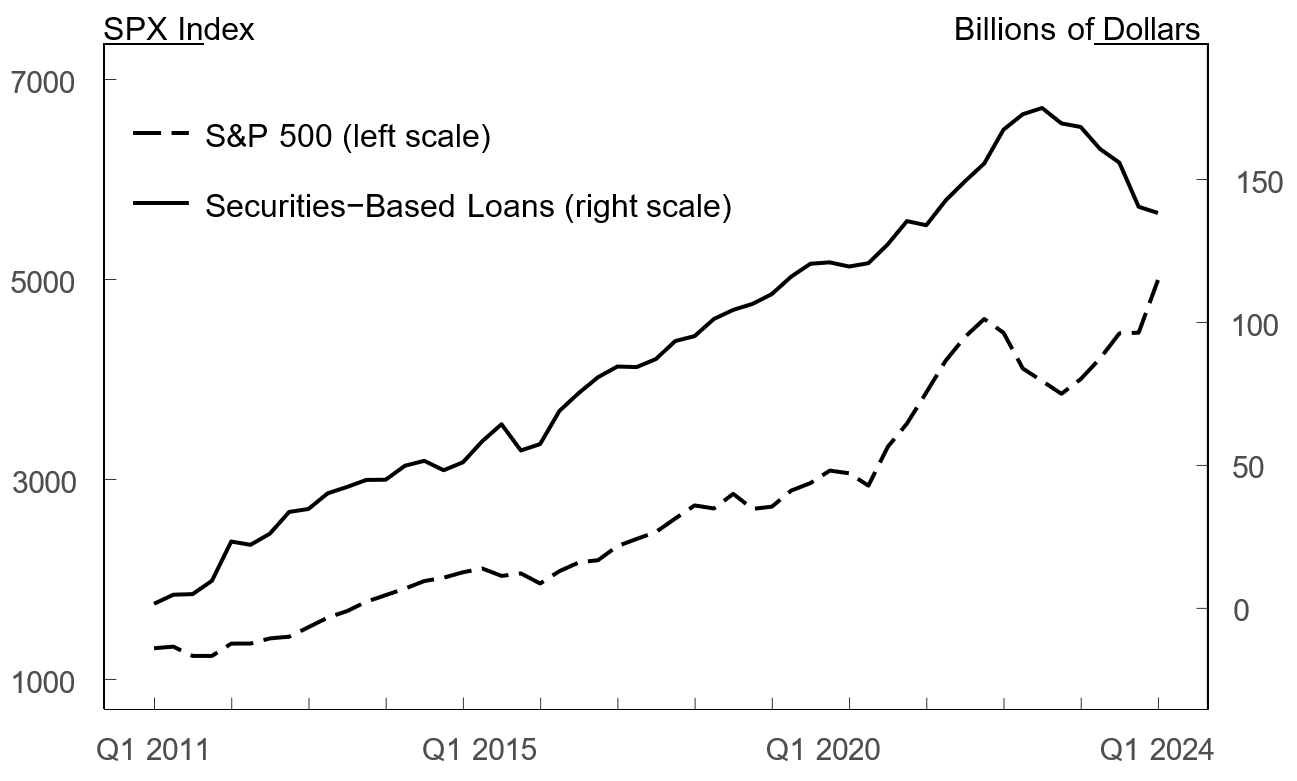

As shown in Figure 3, in the aftermath of the Global Financial Crisis, securities-based loans rapidly expanded through 2022:Q3, when they peaked at $174.7 billion. Their growth was supported by the consistent increase in stock prices against the backdrop of the low interest rate environment. As their portfolio values were rising, investors were increasingly using their securities as collateral to borrow at low interest rates of only a few percentage points over reference rates—the prime rate or the SOFR rate (FINRA, 2024, Wells Fargo, 2024).20 In contrast, interest rates on bank-issued personal loans and those on credit cards, both potential substitutes for such credit, ranged between 9 and 11 percent and 12 and 16 percent, respectively, over the period.21

Note: This figure shows authors' estimate for securities-based loans plotted together with the quarterly average S&P 500 index reflecting the stock market conditions over the period.

Source: Federal Reserve Board and Wall Street Journal.

Following the 2022 change in market conditions, securities-based loans started to decline and currently stand 20 percent below their peak.22 In 2022, while the stock market was experiencing a marked decline that lasted for the better part of the year, interest rates started to rise in March. Although it is difficult to separately assess the effects of each factor, the rise in interest rates may be the main contributor to the decline in securities-based loans. Indeed, one lender offering such loans explains in their regulatory filings a decrease in their holdings of securities-based loans as being caused by an increase in paydowns motivated by higher interest rates.23

References

Ameriprise (2024). "Securities-Based Lending." https://www.ameriprise.com/binaries/content/assets/ampcom/securities-based-lending-brochure.pdf.

Eisen, B. (2023). "The Rich Are Borrowing Less Against Their Portfolios". The Wall Street Journal, July 18.

Ensign, R. L. and R. Rubin (2021). "Buy, Borrow, Die: How Rich Americans Live Off Their Paper Wealth". The Wall Street Journal, July 13.

FINRA (2024). "Securities-Backed Lines of Credit Explained". https://www.finra.org/investors/insights/securities-backed-lines-credit.

Flagg, J. and S. Hannon (2023). "An Overview of Personal Loans in the U.S.," FEDS Working Paper No. 2023-57. Washington: Board of Governors of the Federal Reserve System, August. https://www.federalreserve.gov/econres/feds/an-overview-of-personal-loans-in-the-us.htm.

Flagg, J. and S. Hannon (2024). "Small-Dollar Loans in the U.S.: Evidence from Credit Bureau Data," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, July. https://www.federalreserve.gov/econres/notes/feds-notes/small-dollar-loans-in-the-us-evidence-from-credit-bureau-data-20240719.html.

Kawashima, C. (2024). "3 Ways to Borrow Against Your Assets". https://www.schwab.com/learn/story/3-ways-to-borrow-against-your-assets. Charles Schwab.

Lee, D. and W. van der Klaauw (2010). "An Introduction to the FRBNY Consumer Credit Panel". Technical report, New York: Federal Reserve Bank of New York, November 10, https://www.newyorkfed.org/research/staff_reports/sr479.html.

Luthi, B. (2021). "What Is Securities-Based Lending?". https://www.experian.com/blogs/ask-experian/what-is-securities-based-lending/. Experian.

Wells Fargo (2024). "Securities-Based Borrowing". https://www.wellsfargoadvisors.com/why-wells-fargo/products-services/lending/securities-based.htm.

1. We thank Jessica Flagg, Katherine Kelly, Virginia Lewis, Geng Li, Haja Sannoh, Shane Sherlund, and Kamila Sommer helpful comments and suggestions, Alice Volz for help with the Survey of Consumer Finances data, and Shannon Luk for outstanding editing. The views in this note are those of the authors and do not necessarily reflect those of the Board of Governors of the Federal Reserve System or its staff. Return to text

2. Address: Board of Governors of the Federal Reserve System, 20th Street and Constitution Avenue NW, Washington, DC 20551, USA Email: [email protected].

Address: Board of Governors of the Federal Reserve System, 20th Street and Constitution Avenue NW, Washington, DC 20551, USA Email: [email protected]. Return to text

3. Securities-based loans, also referred to as non-purpose loans, are different from margin loans which are loans taken from brokers and that function as margin accounts. (See: Margin Loans, Regulation U.) In contrast to securities-based loans, margin loans allow investors to purchase securities. Return to text

4. Typically, an investor can borrow 50 to 95 percent of their account (FINRA, 2024). In addition, securities-based loans are typically structured as lines of credit, so borrowers have additional flexibility to repay and borrow again. Return to text

5. Market commentators generally attribute securities-based loans to higher net worth individuals. Furthermore, the firms offering these products may have loan qualification requirements with respect to the market value of the account (FINRA, 2024). Return to text

6. Borrowers can be asked to replenish their collateral if the value of their portfolio drops below a certain threshold. Interest rates on these loans are usually variable (Kawashima, 2024) and follow the prime or the Secured Overnight Financing Rate (SOFR) rates plus a premium (FINRA, 2024). Return to text

7. The Federal Reserve Statistical Release G.19, "Consumer Credit," captures securities-based lending as part of the depository institutions sector, which prevents us from constructing a measure of securities-based loans from the G.19 data sources directly. Return to text

8. See: Luthi (2021). Some lenders may require a credit check (Ameriprise, 2024). Return to text

9. The total outstanding consumer credit estimate is sourced from the Federal Reserve Statistical Release G.19, "Consumer Credit". Return to text

10. Starting with the 2023 list, the Department of Education publishes only the list of the top 50 FFELP holders. Return to text

11. Before 2011:Q1, other consumer loans were reported in the same category with auto loans. Return to text

12. Recall that securities-based loans are categorized as demand loans. Return to text

13. See: Call Report Instructions (PDF). Return to text

14. The sampling procedure ensures that the same individuals remain in the sample in each quarter and allows for entry into and exit from the sample, so that the sample is representative of the target population in each quarter. See Lee and van der Klaauw (2010) for a description of the design and content of the CCP. See also https://www.newyorkfed.org/medialibrary/interactives/householdcredit/data/pdf/data_dictionary_HHDC.pdf. Return to text

15. Our CCP-derived estimate is adjusted using thrift Call report data to remove some thrift balances we believe are reflected among bank holdings of personal loans. Return to text

16. Each year, the Department of Education publishes the Top 100 or Top 50 FFELP holders list for the previous academic year. We identify banks by selecting all institutions that have the word "bank" in their name, but without the words "savings" or "loans" to avoid accounting for the holdings of savings and loans companies. (Other lender types include credit unions, finance companies, and state and nonprofit institutions.). Return to text

17. $358 billion in total other consumer loans reported on the Call Report minus $170 billion in outstanding personal loans, minus $2.8 billion in FFELP loans, and minus $47 billion in private student loans. To obtain quarterly estimates for the FFELP balances we used linear interpolation and we carried forward the 2023:Q3 value. Although we believe that our estimate reflects the majority of securities-based loans outstanding, it does not capture such loans that may have been issued by non-bank entities without a bank partner. Return to text

18. We were able to identify more than a dozen banks offering securities-based loans. Return to text

19. Estimates based on the 2022 Survey of Consumer Finances show that margin loans also rose over the past decade, reaching $179.4 billion in 2022. Return to text

20. The prime rate was at its historical low of 3.25 percent for most of the decade and it exceeded 5.50 percent for a short period toward the end of 2018 through the first half of 2019 and then again after September 2022. Aside from some upticks in 2019, the SOFR rate was below 5 percent until May 2023. See: Board of Governors of the Federal Reserve System (US), Bank Prime Loan Rate [DPRIME], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DPRIME, June 26, 2024, and Federal Reserve Bank of New York, Secured Overnight Financing Rate [SOFR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/SOFR, June 26, 2024. Return to text

21. These estimates are sourced from the Federal Reserve Statistical Release G.19, "Consumer Credit". Return to text

22. The decline in securities-based loans follows the 2022 change in market conditions with a lag partly due to the fact that our securities-based estimates represent outstanding balances and not originations, which would likely be more sensitive to changes in market conditions. Return to text

23. See page 61 of Bank of America's Form 10-K, https://investor.bankofamerica.com/regulatory-and-other-filings/annual-reports/content/0000070858-24-000122/0000070858-24-000122.pdf, for 2023, retrieved on June 26, 2024. Securities-based loans typically require monthly interest-only payments and can be repaid at any time (FINRA, 2024). Return to text

Bruce, Alexander, and Simona M. Hannon (2024). "Estimating Securities-Based Loans Outstanding," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, August 02, 2024, https://doi.org/10.17016/2380-7172.3591.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.