FEDS Notes

June 22, 2018

Gender-Related Differences in Credit Use and Credit Scores

Although gender-related discrepancies have been researched extensively in the labor market and other contexts, relatively little is known regarding gender-related differences in credit market experiences.2 This gap is especially noteworthy in the context of the past 15 years, when loose credit conditions in the 2000s gave way first to record defaults and foreclosures and then to tight lending standards that precluded many young adults from buying their first homes.3 These developments underscored the importance of the credit market in the financial lives of households, including their success in accumulating wealth and a secure level of general welfare.

In part, the lack of research on gender and credit is due to data limitations. The Equal Opportunity Credit Act largely prohibits the use of demographic information, including gender, in credit underwriting, pricing, reporting, and scoring.4 As a result, information on credit histories and demographic characteristics has rarely been collected in the same data source, making evaluation of gender-related differences in the credit market challenging.5 Another factor that makes such analysis difficult is that for married couples, financial decisions are typically made together, adding to the complexity of identifying gender-specific credit market experiences and decisions.

This note takes advantage of a unique proprietary data set that collects credit payment histories, debt portfolios, credit scores, and demographic information for a sample of consumers. I focus on the comparison between single males and single females, each of whom is responsible for his or her own financial decisions. While I am not able to paint a complete picture of gender-related differences for the entire population (as I am looking at singles only, and single men and women are younger, on average, than the overall population of adults), the analysis sheds light on early-life-cycle gender-related differences in credit market experiences, some of which may have long-lasting effects. For example, a bankruptcy record can stay on a borrower's credit report for up to 10 years and significantly limit one's access to credit markets. In addition, Dokko, Li, and Hayes (2015) show that credit scores are predictive of relationship formation and dissolution, with people having lower credit scores less likely to enter relationships and less likely to keep relationships together.

While I am, of course, unable to control for every relevant characteristic of the individuals in my data set, I am able to control for age, educational attainment, race, and income. And after controlling for those variables, I find that single females tend to have higher installment loan balances, higher revolving credit utilization rates, and greater prevalence of delinquency and bankruptcy histories than otherwise comparable single males. Reflecting such differences in debt usage and credit history, on average, single female consumers have lower credit scores than comparable single male consumers.

Earlier Studies on Gender-Related Differences in Credit Markets

Studies on gender-related differences in credit markets have been sparse, and little consensus appears to have emerged from these analyses. For example, in the credit card market, a 2015 study by Experian suggests that women, on average, have more credit card accounts open. But this study and a 2015 National Debt Relief Survey also find that men and women carry largely similar credit card balances (with differences noted for consumers younger than 24 or older than 55) and credit card utilization rates and have a similar likelihood of making only minimum monthly payments and incurring late or over-limit fees. However, other research, such as the FINRA Investor Education National Financial Capability Study, find women to be more likely than men to carry balances, to pay only minimum monthly payments, and to be assessed late fees. In the mortgage market, a study of the HMDA and the Lending Patterns data finds women's experiences to be similar to men's as measured by origination, denial, and fallout rates, while the 2015 Experian study finds that women tend to have lower mortgage loan amounts and lower delinquency rates.

The lack of consistency and limited statistical power of the existing literature on the topic are in part attributable to the fact that many of the studies used ad hoc surveys with relatively small sample sizes. Many of these surveys did not directly collect debt usage data. For the surveys that collected such data, consumers may underreport their debt outstanding and negative credit events due to debt-associated stigmas. Such measurement challenges underscore the importance of administrative data for such analysis. In addition, most analysis does not explicitly account for whether the men and women in the study were solely responsible for their own financial decisions. This note attempts to address these two challenges.

Data Description

Our analysis uses the Mintel/Comperemedia monthly proprietary survey of credit offers, with about 2,500 consumers selected to participate in the survey each month. Each participating consumer is given a set of envelopes and asked to put mail from an array of sectors that Mintel monitors, including credit offers, into the envelopes and send them back to Mintel weekly during the participating month. Mintel digitizes the information in these offers and forwards it to TransUnion, one of the three major U.S. credit reporting agencies, where survey participants' credit histories, including their VantageScore 2.0 credit scores, are merged in.6 In addition, Mintel collects demographic data from the survey participants, including gender and marital status, through a separate questionnaire. As a result, the Mintel data include a unique combination of credit and demographic attributes of a sample of consumers, which is rarely observed in other data sources. Our data span over 10 years, from January 2007 to September 2017.7

Results

I focus on single men and women between the ages of 21 and 40 observed in the Mintel data who have valid credit history profiles merged from the TransUnion data. One limitation of the Mintel data is that the demographic information does not distinguish between singles who have never married and those who are separated or divorced. I exclude the individuals who are not married but are living with others, because these individuals might be separated or divorced single parents who may have a tighter budget and credit constraints and be more likely to make financial decisions jointly with other household members.8 I also remove individuals who have an annual income above $200,000. The remaining sample includes over 3,700 men and nearly 4,000 women. As shown in table 1, consumers between 31 and 40 years old and with higher educational attainment are disproportionately represented in the sample for both single men and women, partly because I restrict the sample to those with a valid match of credit histories.9 In addition, relative to the men in the sample, I see more single women younger than 30 in the sample (partly due to marital age differences), and more single women in the sample have college degrees and are nonwhite. I will address these demographic differences observed in my sample in the analysis below.

Table 1: Demographics of the Mintel Sample of Singles

| Single Male | Single Female | |

|---|---|---|

| Age (%) | ||

| 21-30 | 23.3 | 37.3 |

| 31-40 | 76.7 | 62.7 |

| Education (%) | ||

| High school and below | 14.2 | 11 |

| Some college | 20.7 | 17.5 |

| College degree | 65.1 | 71.5 |

| White (%) | 82.9 | 72.2 |

| Family income (2015$) | 47,705 | 42,271 |

| N | 3,776 | 3,931 |

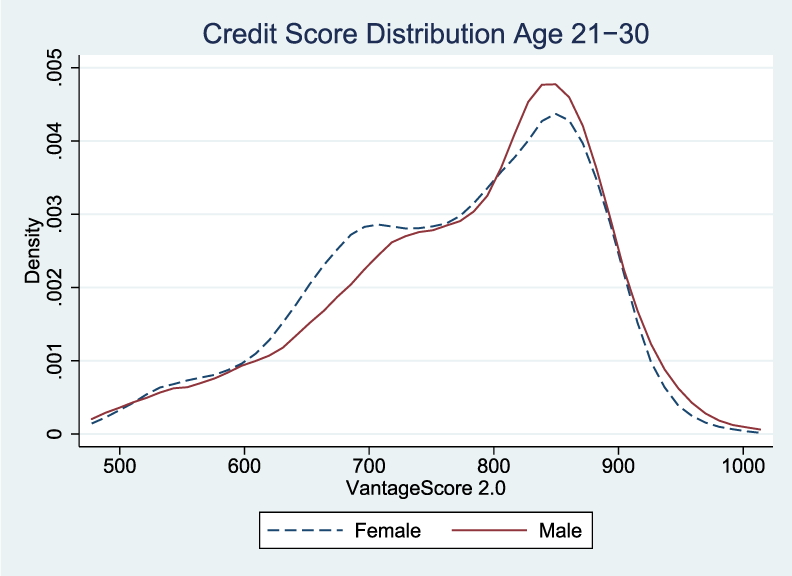

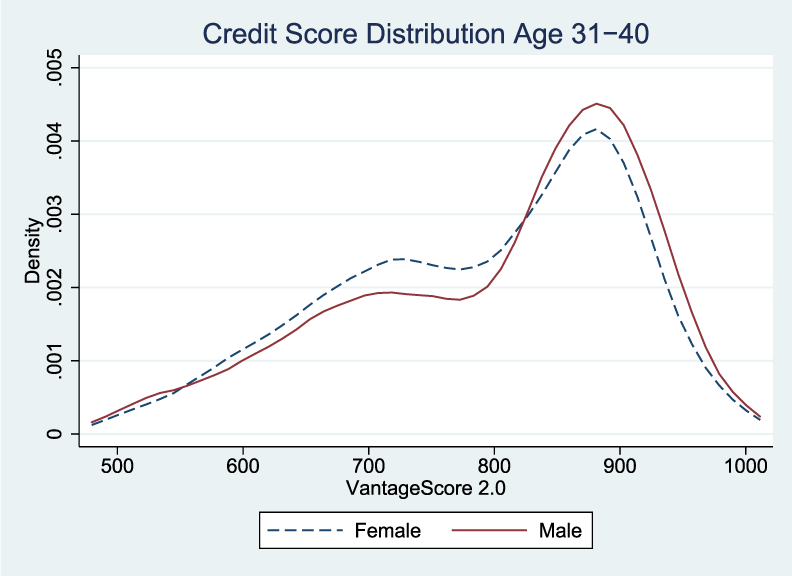

Table 2 presents summary statistics for key credit attributes of single male and single female consumers. As the top two rows indicate, the single men in my sample have somewhat higher credit scores, with the gap being wider for the 31-40 age group (at the median in particular). Such discrepancies, as illustrated in the comparisons of the fitted kernel density functions of male and female credit score distributions (figure 1), while small in magnitude, are evident across essentially the full range of credit scores. That is, the blue dashed line--depicting women's credit scores--lies above the red solid line (men's) for scores below 710 for the age 21 to 30 group and for scores below 800 for the age 31 to 40 group; the red solid line lies above the blue dashed line for scores above 810 or so for both age groups.10

Table 2: Summary Statistics of Key Credit Attributes

| Age 21-30 | Age 31-40 | |||

|---|---|---|---|---|

| Male | Female | Male | Female | |

| VantageScore 2.0 mean | 768 | 762 | 793 | 785 |

| VantageScore 2.0 median | 786 | 776 | 828 | 806 |

| Total number of trades mean | 14.4 | 16.1 | 17 | 29.7 |

| Total number of trades median | 12 | 14 | 14 | 18 |

| Age of credit history (months) mean | 116 | 124 | 182 | 187 |

| Age of credit history (months) median | 109 | 114 | 178 | 185 |

| Total outstanding debt mean | 50,324 | 50,597 | 78,673 | 82,273 |

| Total outstanding debt mean median | 17,675 | 24,794 | 25,446 | 36,848 |

| Total revolving credit limit | 22,912 | 18,477 | 28,753 | 29,395 |

| Total revolving debt balance | 5,162 | 4,242 | 6,547 | 6,974 |

| Revolving credit utilization ratio | 24.9 | 30.6 | 25.2 | 27.6 |

| Total installment debt balance | 14,933 | 23,194 | 12,459 | 15,050 |

| Total mortgage debt balance | 30,087 | 22,964 | 59,450 | 60,085 |

| Number of credit inquiries | 3 | 2.3 | 2.1 | 2 |

| Ever became delinquent before | 25.50% | 29.30% | 29.80% | 33.90% |

| Filed for bankruptcy | 4.90% | 2.20% | 4.20% | 8.00% |

Note: Table reports sample means (unshaded rows) and medians (shaded rows), including consumers with zero debt balances.

Moreover, single women, on balance, appear to have more intensive credit usage than single men. In particular, single women tend to have longer credit histories (measured as the age of the oldest account on one's credit record), higher total debt outstanding (at the median in particular), greater revolving credit utilization rates (for example, the ratio of balances to limits in credit card accounts), and higher installment loan balances. However, the younger single women in my sample have considerably less mortgage debt and the older cohort has only a little more. Furthermore, single women are more likely to have past-payment delinquencies on their credit histories. Finally, the bankruptcy filing history comparison is mixed, with the prevalence of bankruptcy flags being higher for single men younger than 30 but higher by an even larger margin for single women older than 30.11

Next, I examine whether the sample central tendencies presented in table 2 reflect correlated demographic differences between the single male and female sample groups. To begin with, I analyze if the credit score gaps between single men and women can be accounted for by sample demographic differences. As shown in table 3, controlling for yearly fixed effects, projecting credit scores on gender alone (column 1) indicates a statistically significant male-female score gap of about 18 points, reconfirming the results shown in the top rows of table 2. Controlling for demographic characteristics that include an age polynomial, educational attainment, race, and logarithm of annual income narrows, but does not fully eliminate, the gender gap (column 2). Gender-related differences in credit history attributes, however, appear to drive the gender credit score gap. When I control for these credit attributes--which include the logarithm of a number of credit attributes, and the delinquency and bankruptcy indicators--consistent with Avery, Brevoort, and Canner (2010), I find that the gender coefficient becomes numerically small and statistically indistinguishable from zero (column 3).12 The results hold regardless of whether demographic variables are included as additional controls. Moreover, the miniscule increases of R-squared (not shown) suggest that adding the gender indicator does not increase the explanatory power of such statistical models of credit scores.

Table 3: What Accounts for Gender Differences in Credit Scores?

| (1) | (2) | (3) | |

|---|---|---|---|

| Female | -17.7*** | -10.8*** | -0.1 |

| Controlling for | |||

| Demographic characteristics | No | Yes | No |

| Credit history attributes | No | No | Yes |

| Yearly fixed effects | Yes | Yes | Yes |

| R-squared | 0.008 | 0.181 | 0.795 |

| N | 7,707 | 7,707 | 7,707 |

I further explore whether single men and women have different credit market experiences that cannot be explained by the other demographic variables available to my analysis. To do so, I regress the logarithm of a number of credit attributes, and the delinquency and bankruptcy indicators, on a gender dummy, an age polynomial, race and education dummies, and log of income, controlling for yearly fixed effects. As shown in table 4, relative to a single male with comparable observable characteristics, a single female tends to have more tradelines in her credit file, a longer credit history, more total debt, more revolving and installment debt, higher revolving credit utilization rates, fewer credit inquiries, and more past delinquencies or bankruptcy records.13 The results presented in table 4 are qualitatively similar when analyzing age-group subsamples and on pre- and post-crisis subsamples.

Table 4: Gender Gaps in Credit Market Experiences

| Log of | Female indicator | |

|---|---|---|

| Total number of tradelines | 0.227*** (0.017) |

|

| Age of credit history (months) | 0.066*** (0.009) |

|

| Total outstanding debt | 0.327*** (0.063) |

|

| Revolving credit limit | 0.063 (0.063) |

|

| Revolving debt balance | 0.297*** (0.069) |

|

| Revolving credit utilization ratio | 0.251*** (0.037) |

|

| Installment debt balances | 0.659*** (0.113) |

|

| Mortgage debt balances | 0.013 (0.125) |

|

| Number of credit inquiries | -0.188** (0.077) |

|

| Ever became delinquent before | 0.061*** (0.011) |

|

| Filed for bankruptcy | 0.028*** (0.005) |

|

Note: Controlling for an age polynomial, educational attainments, race, log of annual income, and yearly fixed effects. Standard errors are presented in parentheses.

Concluding Remarks

Using a unique proprietary data set, I study differences in credit market experiences between single men and women younger than 40 years old. I find that, in the data sample I am able to construct, the single women in this age group have, on average, somewhat lower credit scores than the single men with comparable demographic characteristics. The credit score gaps reflect the fact that single women have more intensive use of credit and have experienced more difficulties repaying their debt in the past. Such differences may reflect economic circumstances, labor market experiences, underlying potential gender differentials in attitudes toward borrowing, financial literacy levels, and men and women being potentially treated differently by the credit market and institutions.14 In addition, marital separations and divorces may affect women's personal finances more than men's. Because our data do not distinguish those who are never married from those who separated or divorced, our analysis cannot attribute the observed gaps to each of these specific factors. Indeed, students of the household finance market have long recognized the difficulties caused by selection and unobservable characteristics on interpreting statistical differentials. Finally, in addition to credit scores and credit history attributes, lenders may also use additional legitimate information not available to me, such as on banking account balances and time at current address or current employer, in loan underwriting and pricing. How gender differences in these factors affect individuals' access to credit remains largely unknown, and further research in this understudied area is warranted.

References

Avery, Robert, Kenneth Brevoort, and Glenn Canner (2010). "Does Credit Scoring Produce a Disparate Impact?" Finance and Economics Discussion Series 2010-58. Washington: Board of Governors of the Federal Reserve System.

Bhutta, Neil (2015). "The ins and outs of mortgage debt during the housing boom and bust." Journal of Monetary Economics, vol. 76.

Dokko, Jane, Geng Li, and Jessica Hayes (2015). "Credit Scores and Committed Relationship," Finance and Economics Discussion Series 2015-081. Washington: Board of Governors of the Federal Reserve System.

Durkin, Thomas, and Gregory Elliehausen (1989). "Theory and Evidence of the Impact of Equal Credit Opportunity: An Agnostic Review of Literature," Journal of Financial Services Research, vol. 2.

Goodman, Sarena, Alice Henriques, and Alvaro Mezza (2017). "Where Credit is Due: The Relationship between Family Background and Credit Health," Finance and Economics

Discussion Series 2017-032. Washington: Board of Governors of the Federal Reserve System.

Goodman, Laurie, Jun Zhu, and Bing Bai (2016). "Women are Better than Men at Paying their Mortgages," Research Report. Washington: Urban Institute.

Han, Song, Ben Keys, and Geng Li (2018). "Unsecured Credit Supply, Credit Cycles, and Regulation," Review of Financial Studies, vol. 31.

Klapper, Leora, Annamaria Lusardi, and Peter van Oudheusden (2016). "Financial Literacy around the World: Insights from the Standard & Poor's Ratings Services Global Financial Literacy Survey," Research Report.

Yellen, Janet (2017). "So We All Can Succeed: 125 Years of Women's Participation in the Economy," speech delivered at 125 Years of Women at Brown Conference, Providence, Rhode Island, May 5, www.federalreserve.gov/newsevents/speech/yellen20170505a.htm.

1. The views presented in this note are the author's and do not necessarily represent those of the Federal Reserve Board or its staff. I thank my colleagues at the Federal Reserve Board for helpful comments. Steve Ramos provided able research assistance. Return to text

2. Chair Yellen's (2017) speech at the 125 Years of Women's Participation in the Economy Conference at Brown University is a notable recent treatment on discrepancies in the labor market. Return to text

3. See, for example, Bhutta (2015). Return to text

4. See, for example, Durkin and Elliehausen (1989) for a treatment on the Equal Opportunity Credit Act. Return to text

5. A notable exception is the data used in Avery, Brevoort, and Canner (2010), which merge a sample of TransUnion credit records with account holders' demographic information acquired from the Social Security Administration and a demographic information company. Goodman, Henriques, and Mezza (2017) present a more recent effort to link alternative data to individuals' credit records in a study of how family background may affect early-career credit health. Return to text

6. This credit score product ranges between 501 and 990 and was jointly developed by Equifax, Experian, and TransUnion. Return to text

7. For a more detailed description of the Mintel data, see, for example, Han, Keys, and Li (2018). Return to text

8. Over 85 percent of singles between the ages of 21 and 40 never married in the PSID data between 2005 and 2015. Return to text

9. To put the Mintel statistics in perspective, about 30 percent of similar singles in the PSID data between 2005 and 2015 had high school or lower educational attainments, and less than 50 percent had college degrees. The match between the TransUnion and the Mintel data is implemented using consumers' name and addresses by TransUnion. The matched data are made available to final users after all personally identifiable information is removed. Younger consumers are less likely to be matched because they either do not have a valid credit profile or change addresses more frequently. Return to text

10. Note that credit scores are not necessarily a linear representation of credit risks. Accordingly, the absolute magnitudes of score differences between men and women are not necessarily a linear representation of the differences in their respective credit risks. Return to text

11. The overall bankruptcy rate is higher for the single women in our sample. Return to text

12. Indeed, according to Fair Isaac Corporation, a major credit scoring services provider, the credit scores it produces use only payment history, debt portfolio, and length of credit history as input information. Return to text

13. Tradelines are the accounts of a consumer that lenders report to credit reporting agencies. Return to text

14. For example, the Survey of Consumer Finances data show that the single men aged between 20 and 40 in the sample of the survey are less likely to borrow when their income is cut than the comparable single female in the sample. Using survey data collected globally, Klapper, Lusardi, and Oudheusden (2016) show that women have, on average, lower levels of financial literacy but are also less likely to be overconfident. In addition, Goodman, Zhu, and Bai (2016) document that women are, on average, paying a higher mortgage interest rate than men vis-a-vis their respective credit risks. Return to text

Li, Geng (2018). "Gender-Related Differences in Credit Use and Credit Scores," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, June 22, 2018, https://doi.org/10.17016/2380-7172.2188.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.