FEDS Notes

August 30, 2024

Internationalization of the Chinese renminbi: progress and outlook

The international role of the Chinese renminbi has received increased attention recently as Chinese authorities push for increased international usage of the renminbi and Western sanctions on Russia potentially increase renminbi attractiveness. Some newspaper article headlines even imply that the renminbi is about to rival the U.S. dollar as the world's dominant international currency.2

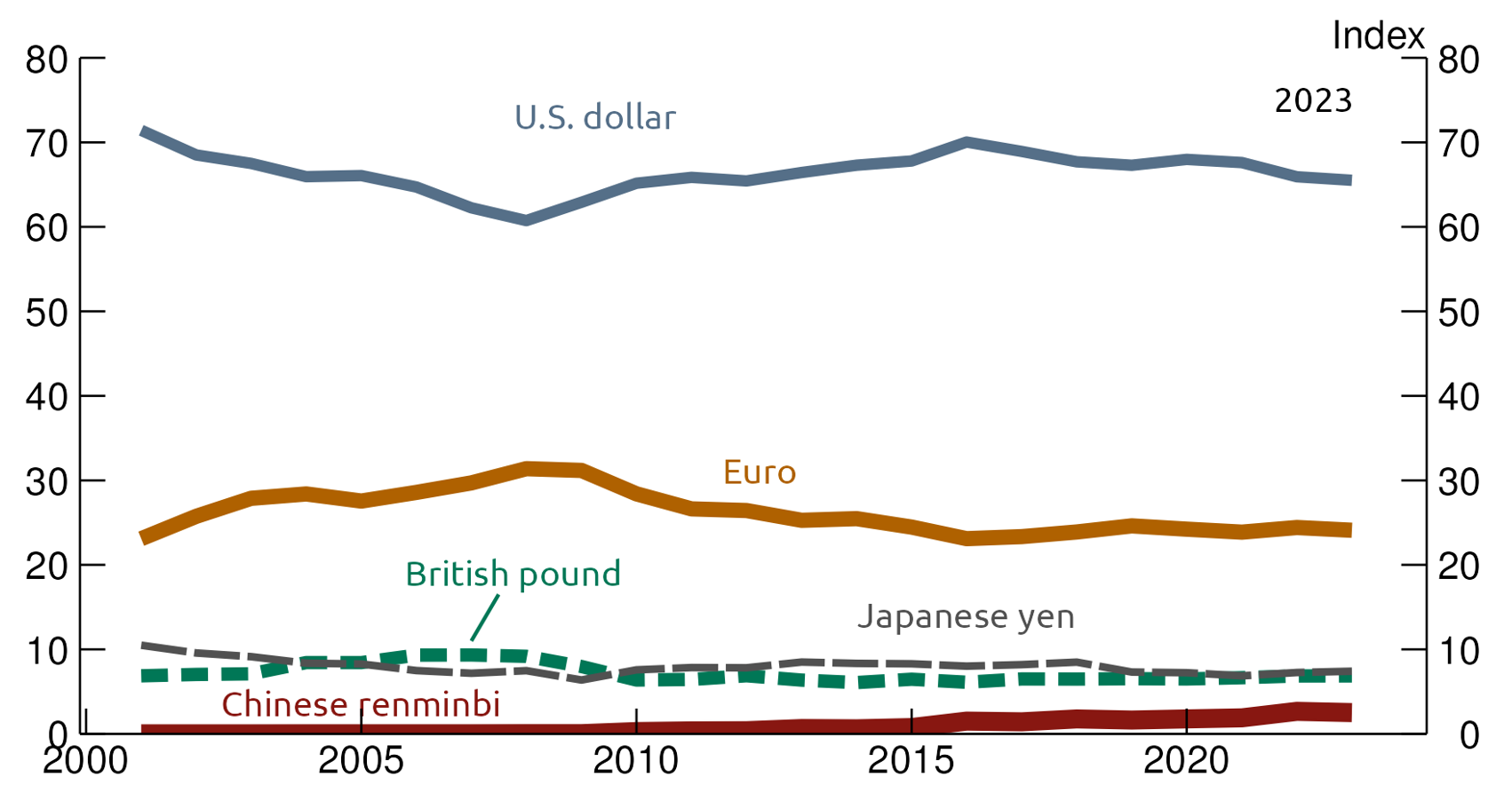

As I show in this note, the Chinese renminbi is nowhere close to overtaking the U.S. dollar in international importance. Using an aggregate measure of international currency usage following Bertaut, von Beschwitz, Curcuru (2023), the renminbi at just a 2.5 percent share lags very far behind the U.S. dollar, which has a 66 percent share (see Figure 1). It also still ranks behind the euro, the British pound, and the Japanese yen. This ranking is unchanged using a similar measure developed by the People's Bank of China (PBOC).3

Note: Index is a weighted average of each currency's share of globally disclosed FX reserves (25 percent weight), FX transaction volume (25 percent), foreign currency debt issuance (25 percent), foreign currency and international banking claims (12.5 percent), and foreign currency and international banking liabilities (12.5 percent).

Source: IMF COFER; BIS Triennial Central Bank Survey of FX and OTC Derivatives Market; Refinitiv; BIS locational banking statistics; Board staff calculations.

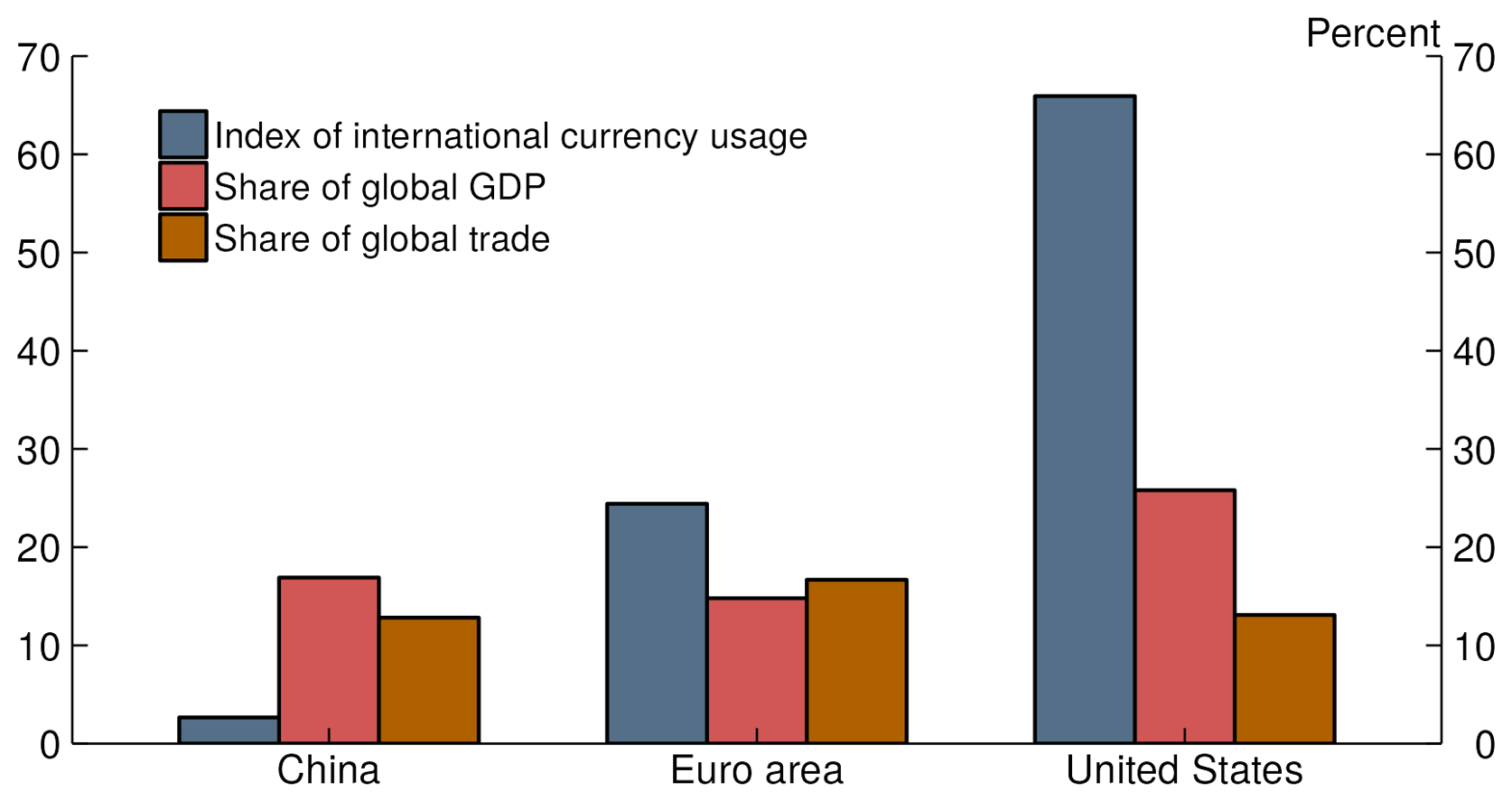

While overtaking of the dollar by the renminbi is out of the question in the foreseeable future, there are several reasons why the renminbi's international role may increase notably over the coming years. First, increased Western sanctions on Russia following its invasion of Ukraine have likely contributed to an increased use of renminbi in international transactions: immediately, by making it an attractive currency for trade with Russia, and, over the longer term, as other countries may increase renminbi usage to lower their exposure to potential future Western sanctions. Second, as shown in Figure 2, the current international usage of the renminbi is low compared to China's share of world gross domestic product (GDP) or world trade, implying a lot of potential for an increase in renminbi usage.4 Third, Chinese authorities are promoting the international role of the renminbi through a host of measures. Finally, over the last couple years, there has been a notable increase in the fraction of China's trade that is invoiced in renminbi and a corresponding increase in the renminbi fraction of global payments. Over time, these increases may be followed by increased renminbi usage in other areas, such as official foreign exchange reserves.

Note: Index of international currency usage is defined in Figure 1. Share of global GDP is measured in nominal terms. Share of global trade is the share of global trade in goods and services in nominal terms and excludes intra euro-area trade. Key identifies in order from left to right.

Source: IMF World Economic Outlook database, Haver, Eurostat, Comtrade, IMF COFER; BIS Triennial Central Bank Survey of FX and OTC Derivatives Market; Refinitiv; BIS locational banking statistics; Board staff calculations.

In the remainder of this note, I describe how China supports renminbi usage, discuss to which extent Chinese exchange rate management hinders renminbi internationalization, and look at a host of measures to document how far renminbi internationalization has progressed. I conclude by discussing the future prospects for renminbi internationalization.

How Chinese authorities support renminbi internationalization

Chinese authorities support renminbi internationalization in a variety of ways, including a network of dedicated renminbi clearing banks, the renminbi cross-border international payment system, renminbi swap lines, and bilateral agreements with countries to increase renminbi usage in trade.

China established a network of 31 designated offshore renminbi clearing banks in 27 countries, including most advanced economies and many large emerging economies. Clearing banks are typically local subsidiaries of Chinese banks, but in some cases they are subsidiaries of foreign banks. For example, in the U.S., the two official renminbi clearing banks are the subsidiary of Bank of China and JPMorgan Chase. Most of the clearing bank network was established between 2013 and 2016, but China has kept expanding it, with recent additions including Brazil, Pakistan, Kazakhstan, and Laos. Establishing an official clearing bank is associated with an increase of trade conducted in renminbi (Perez-Saiz and Zhang, 2023).

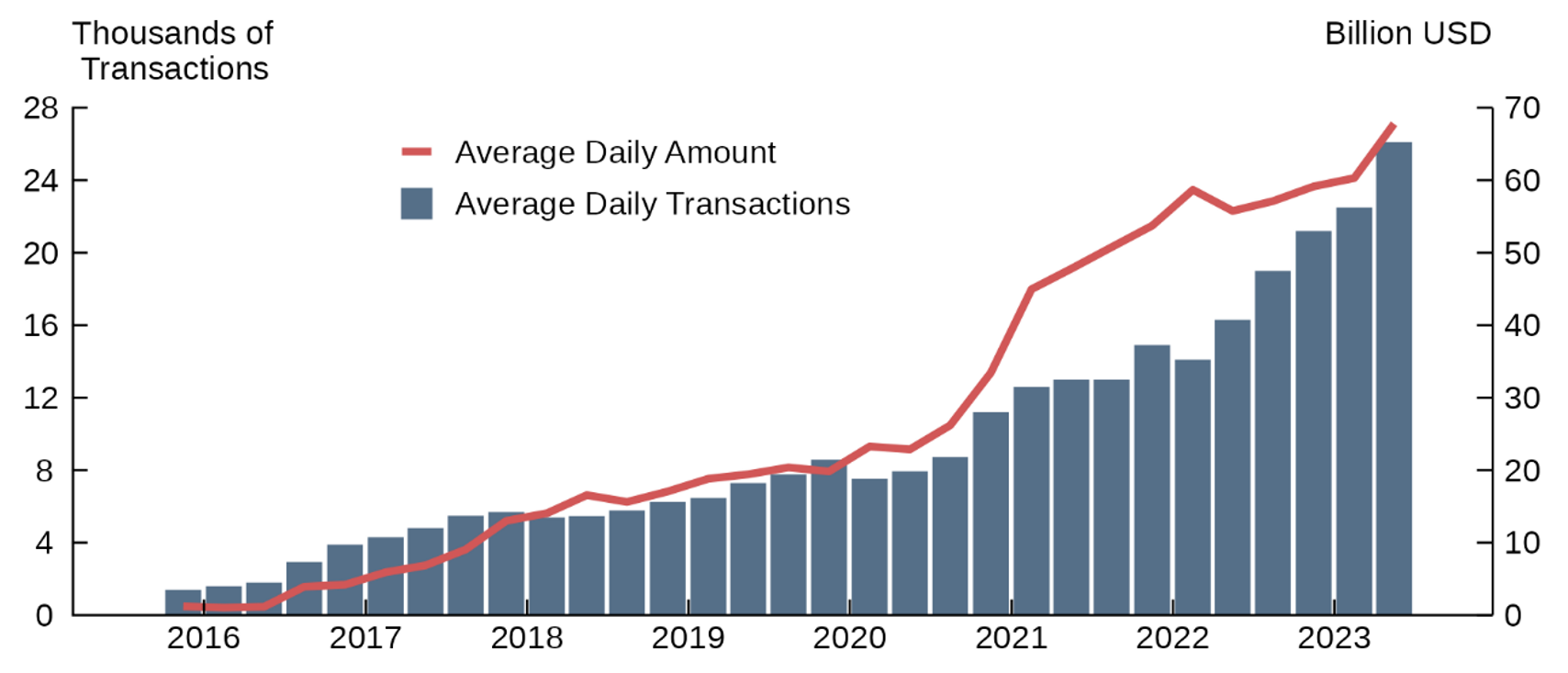

In 2015, China introduced the cross-border international payment system (CIPS) to support the international use of the renminbi. CIPS offers clearing and settlement for cross-border renminbi transactions. It also has messaging capabilities, which allows it to compete with SWIFT. That said, 80 percent of payments on CIPS reportedly still use SWIFT (Yeung and Goh, 2022). Since its introduction, the use of CIPS has increased continuously and adoption has sped up following war-related sanctions on Russia in 2022 (see Figure 3). That said, at a daily usage of about $60 billion, the volume of payments processed by CIPS are dwarfed by the $1,800 billion payments processed each day by the Clearing House Interbank Payments System (CHIPS), which is the main method of settling large U.S. dollar transactions.5

Source: People's Bank of China.

China is also a participant in project mBridge, which explores the use of a multi-central bank digital currency (CBDC) platform to conduct cross-border payments using CBDC. The other participants are Hong Kong, Thailand, United Arab Emirates, and Saudi Arabia. In June 2024, the project has reached the minimum viable product stage. It remains to be seen whether there will be meaningful uptake if/when the platform begins operations and whether more countries will join it.

China also supports the international role of the renminbi through a network of bilateral renminbi swap lines with foreign central banks. The swap lines allow the foreign central bank to borrow renminbi using its own currency as collateral. China has extended swap lines to 40 countries, including most advanced economies (with the notable exception of the U.S.) and many emerging market economies.

Chinese swap lines are notably different from those issued by the Federal Reserve. Federal Reserve swap lines are only extended to countries with high credit quality and are used in times of financial market stress (such as the 2008 financial crisis or the 2020 COVID-19 crisis) when U.S. dollar funding markets can dry up (Bertaut, von Beschwitz, Curcuru (2023)). In contrast, Chinese renminbi financing is not particularly sought after in a crisis and there is no evidence of increased usage of Chinese swap lines during financial crises. Rather, it has been argued that countries of low credit quality, who have difficulty borrowing in international capital markets, such as Argentina or Pakistan, routinely draw on their renminbi swap lines to obtain hard currency or window-dress their foreign reserves (Horn et al., 2023, Bahaj and Reis, 2022).6

China has also been encouraging other countries to start using the renminbi in their bilateral trade with China. For example, in March 2023, China announced an agreement with Brazil to use the Chinese renminbi and the Brazilian real, rather than U.S. dollar, for trade settlement between the two countries.7 This announcement was accompanied by making a Brazilian bank which is controlled by a Chinese state bank a direct participant in CIPS. In April 2023, Argentina also announced that it would pay for Chinese imports in yuan rather than U.S. dollar, though this decision may mainly reflect Argentina's limited U.S. dollar reserves.8

While Chinese authorities have managed to increase renminbi usage in many areas discussed above, the degree of foreign exchange rate management and capital controls, discussed in the next section, continue to limit the renminbi's more widespread use and the attractiveness of renminbi assets.

Foreign exchange management and capital controls

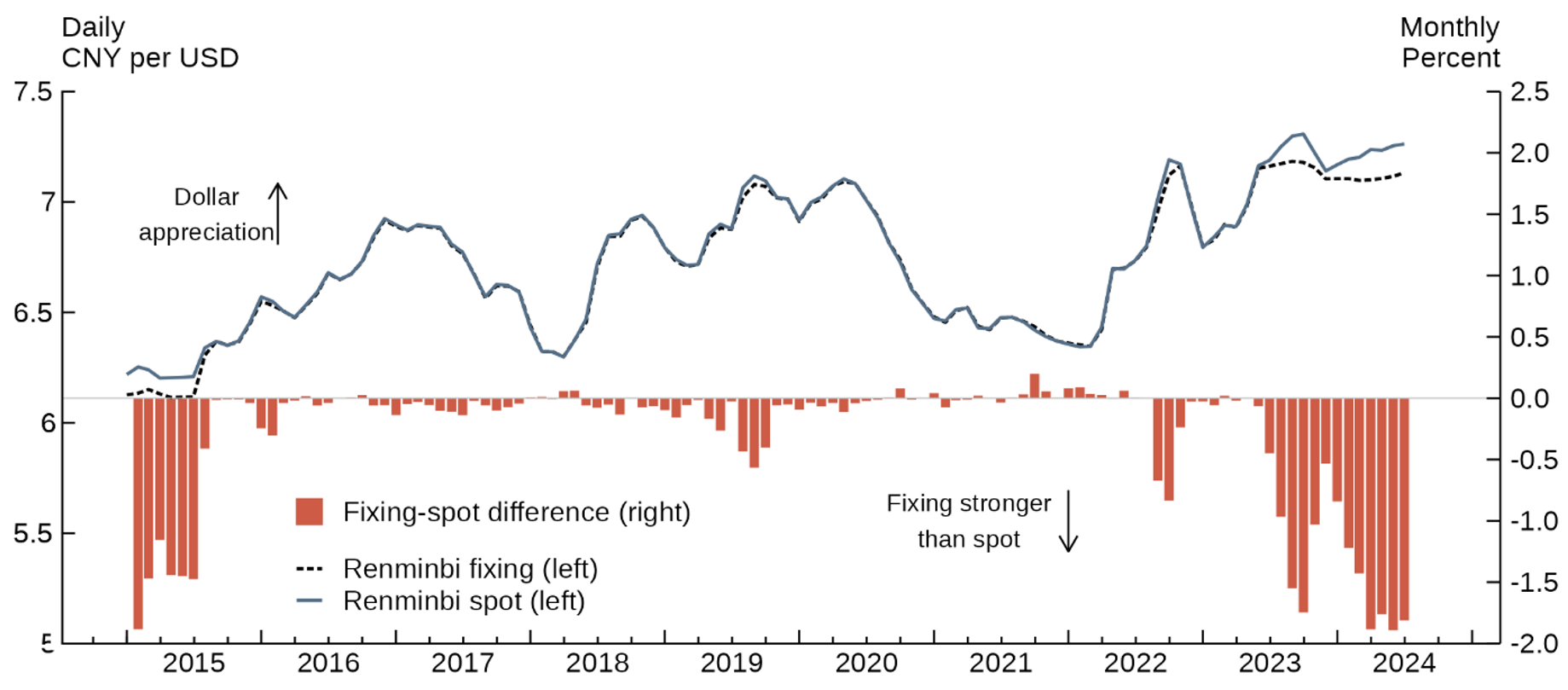

In contrast to popular reserve currencies such as the U.S. dollar or euro, the exchange rate of the Chinese renminbi is not freely floating but managed by the People's Bank of China (PBOC). Every morning, the PBOC sets the renminbi fixing rate against the U.S. dollar, which determines the location of the daily +/- 2 percent trading band within which dollar-renminbi transactions can be executed. Since August 2015, the PBOC had mostly set the fixing rate close to the prior day's closing exchange rate, thereby moving the trading band to adjust to market forces (see Figure 4). However, since August 2023, the PBOC has consistently set a notably more stable fixing to limit renminbi depreciation against the dollar. Indeed, the renminbi has often traded at the lower end of its trading band (the red bars in Figure 4 are close to negative 2 percent). Thus, foreign exchange management by the PBOC appears to have become more intensive recently.9

Note: Fixing-spot difference is the monthly average of the percentage difference between the renminbi fixing and the prior day's closing spot exchange rate.

Source: Bloomberg; Board staff calculations.

Such exchange rate management is enabled by the fact that China has capital controls, which are generally seen as making a currency less attractive for international investors. There is some debate as to what extent Chinese capital controls limit the international role of the renminbi. For example, Prasad (2021) argues that without a full liberalization of the Chinese capital account, the renminbi will not be able to become a global reserve currency. By contrast, Eichengreen et al. (2022) argue that a fully open capital account is not needed for the renminbi to take on a large international role. They argue that increased invoicing in renminbi could lead to renminbi accumulation by foreigners if the PBOC provides security through its dollar reserves.

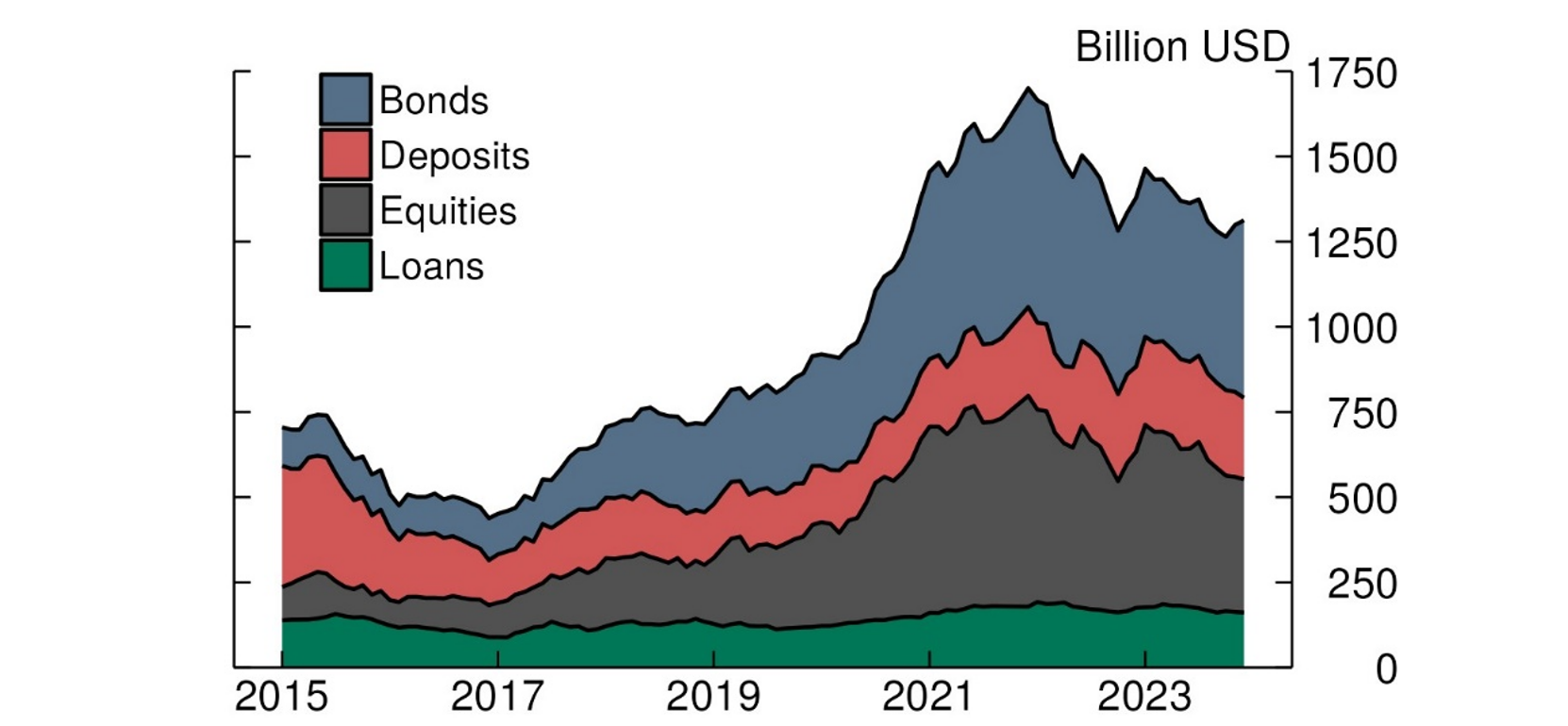

Indeed, foreign private investments can already access Chinese financial markets through a variety of programs such as the Bond Connect and Stock Connect, the Qualified Foreign Investor (QFI) and the China Interbank Bond Market (CIBM) direct. In addition, foreign official reserves (discussed in more detail below) are generally exempted from capital controls. As shown in Figure 5, foreign holdings of onshore Chinese assets increased notably between 2019 and 2022 as China was added to important global bond and equity indexes. However, since 2022 foreign assets holdings have declined amid a weak Chinese economy and problems in the Chinese property sector. These holdings currently stand at about $1.3 trillion compared to $27 trillion of foreign holdings of U.S. assets.10

Note: Key identifies in order from top to bottom.

Source: People's Bank of China.

To summarize, Chinese exchange rate management and capital controls are likely to weigh on renminbi internationalization as they increase the risk that divesting renminbi assets may become difficult or costly. The fact that exchange rate management has become notably tighter since August 2023, suggests that Chinese authorities put a higher emphasize on keeping the exchange rate stable than on supporting the international role of the renminbi.

International use of the renminbi

In the previous two sections, I discussed various measures Chinese authorities have taken to support renminbi usage and how their exchange rate management and capital controls may have weighed on renminbi internationalization. In this section, I take stock of the aggregate effect of these measures by studying various measures related to renminbi internationalization.

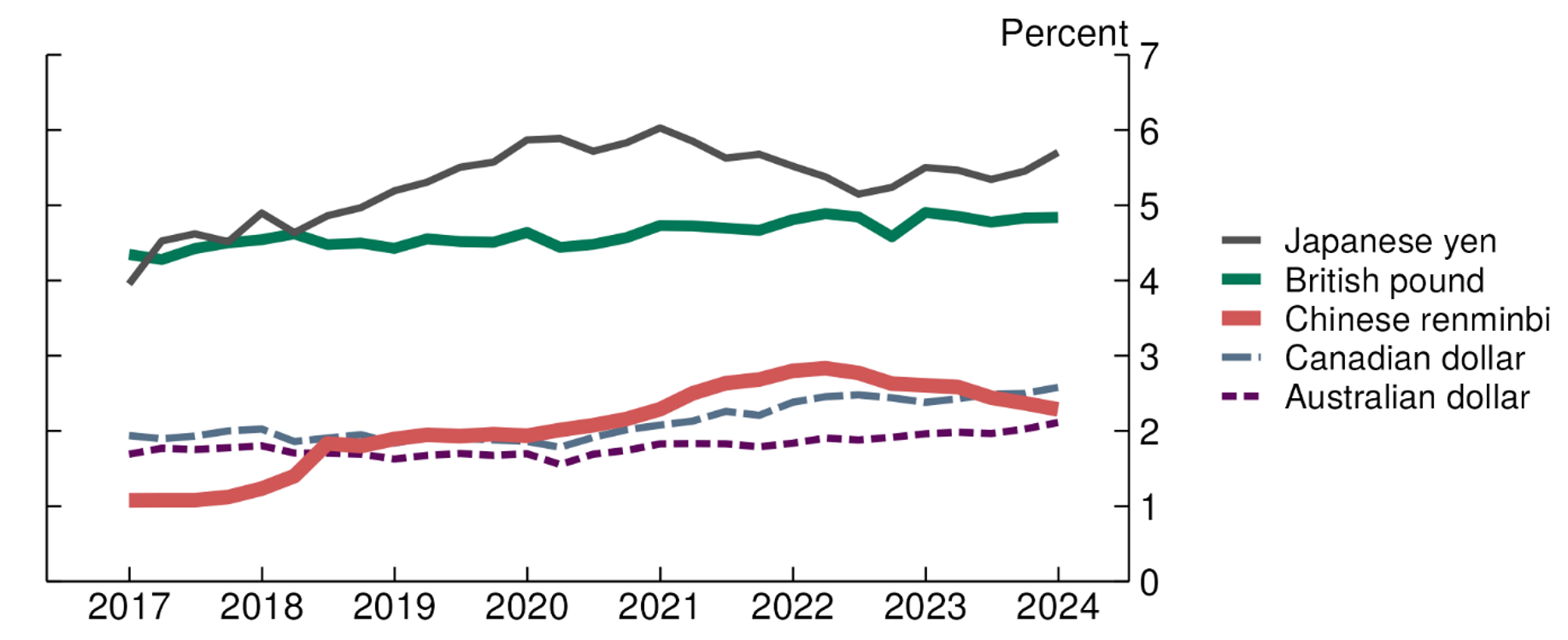

Official reserve holdings are an important measure of international usage of a currency. The Chinese renminbi fraction of allocated official foreign exchange (FX) reserves has more than doubled from 1.1 percent in 2016 to 2.8 percent in 2022 (see Figure 6). However, since then, it has declined to 2.3 percent as the exchange value of the Chinese renminbi depreciated. This decline also suggests that Western sanctions on Russia have (so far) not led to a material increase in renminbi reserve holdings. At this level, the renminbi remains a niche reserve currency with a fraction comparable to the Australian and Canadian dollars but lagging the British pound and the Japanese yen and being nowhere close the euro or U.S. dollar. This picture is unlikely to change in the near term, as a recent survey indicates that only a small fraction of central banks look to increase renminbi reserves.11

Note: Share of globally disclosed allocated foreign exchange reserves. U.S. dollar and euro shares are not shown but were 58.4 percent and 20.0 percent in Q4-2023, respectively.

Source: IMF COFER.

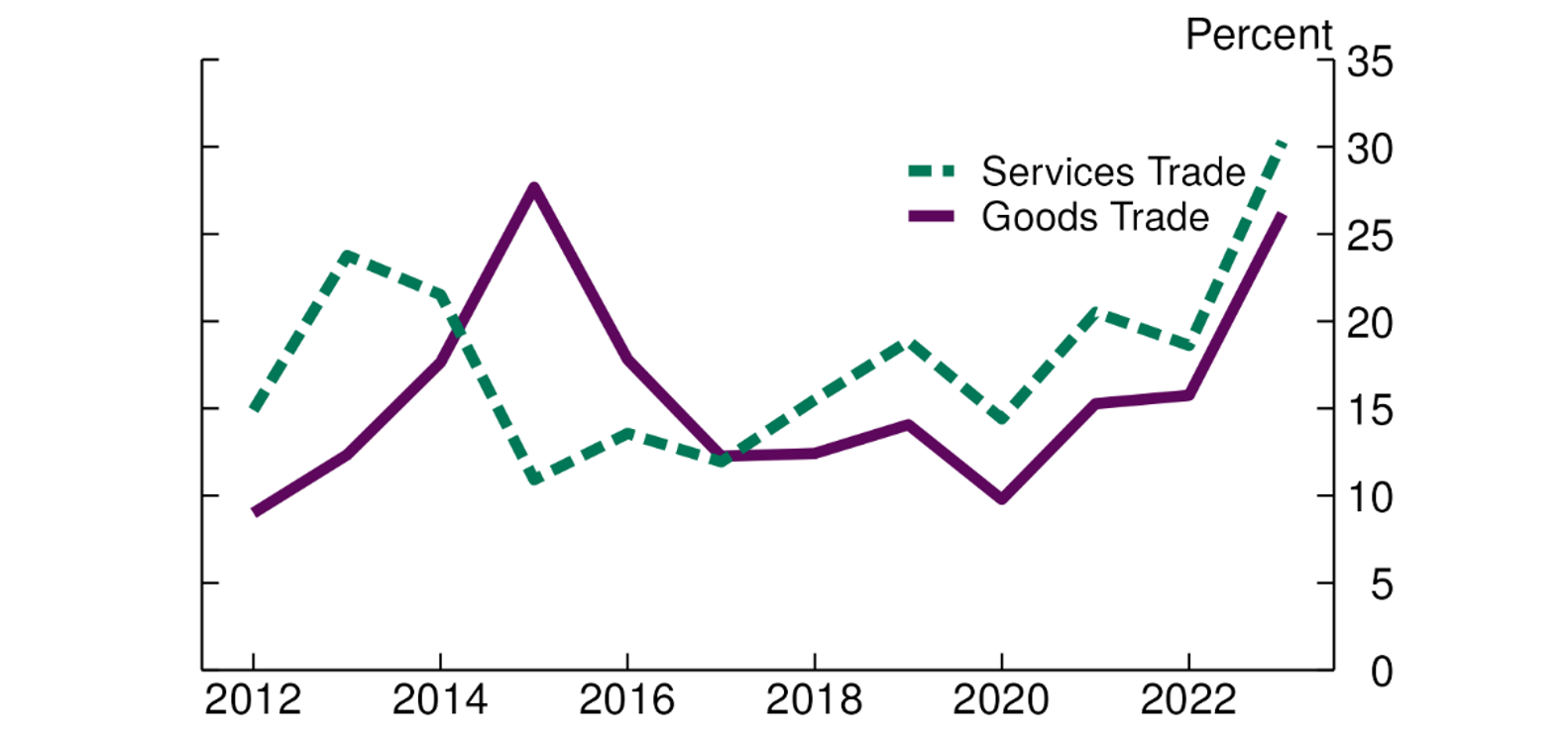

Currencies often develop into reserve currencies by first being used in trade invoicing (Eichengreen et al. (2022)). While the dollar is often used for trade that does not involve the United States, the Chinese renminbi is almost exclusively used for trade that involves China. Therefore, in Figure 7, I display the fraction of Chinese trade that is conducted in renminbi. For both goods and services trade, the renminbi fraction has increased notably in recent years reaching levels of 25 to 30 percent.

Note: Services trade includes other current account settled in renminbi.

Source: Haver Analytics; Board staff calculations.

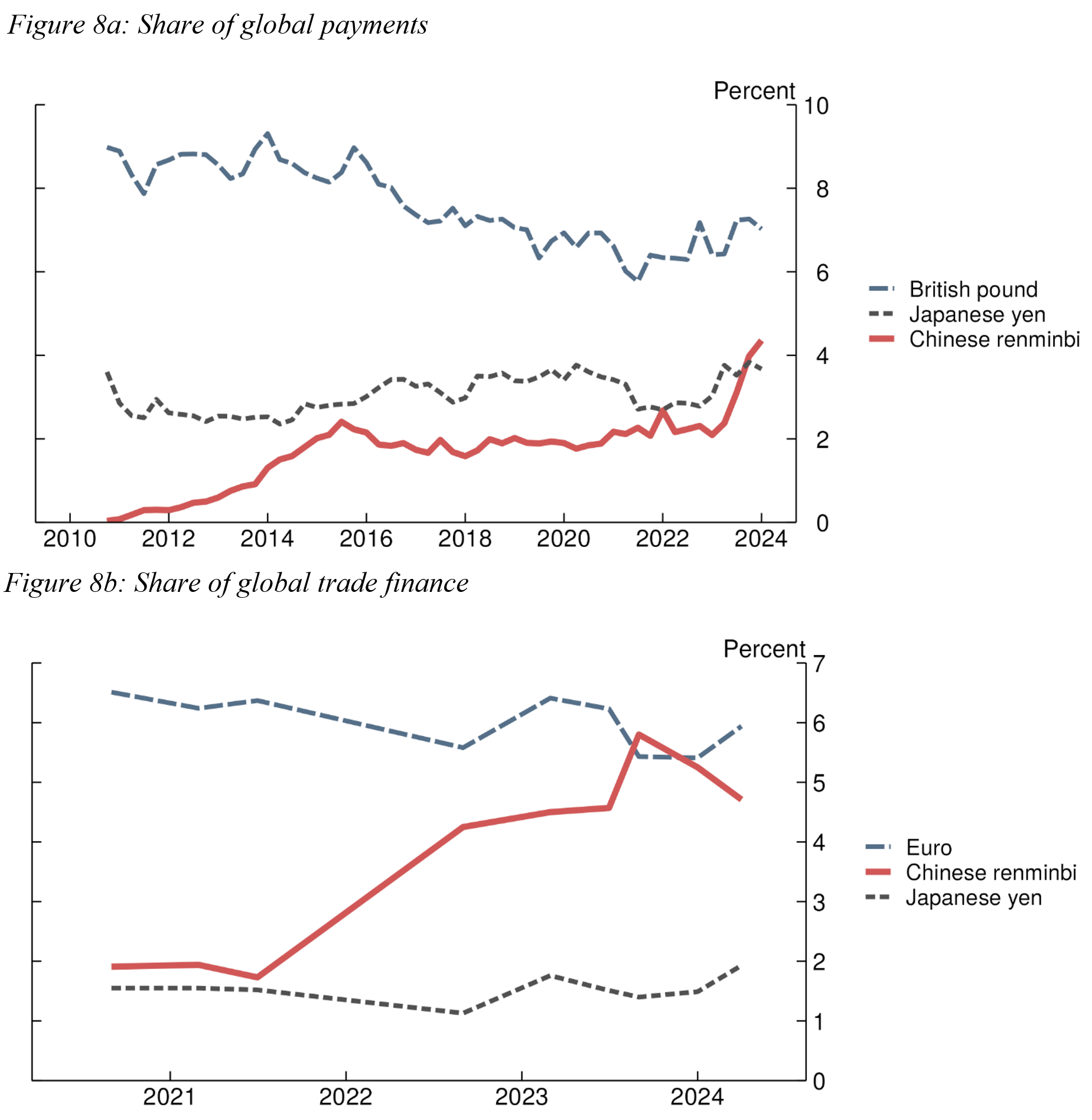

This increase in renminbi trade invoicing is also reflected in the renminbi share in payment and trade credit according to data provided by SWIFT. As shown in Figure 8a, the renminbi share of global payments jumped in 2023 from 2.1 to 4.3 percent, overtaking the Japanese yen. Despite this increase, the reminbi fraction remains far behind those of the U.S. dollar (47 percent) or the euro (23 percent). Turning to trade credit in Figure 8b, we also observe a notable increase to 6 percent share of global trade financing in recent years, which puts the renminbi on about the same level as the euro. This increase may be related to the fact that Chinese interest rates are currently lower than those in the advanced economies, making the renminbi an attractive financing currency. That said, with a share of 84 percent, the U.S. dollar continues to dominate trade financing.

Note: For Figure 8a, U.S. dollar and euro shares are not shown but were 22.8 and 47.0 percent in January 2024, respectively. For Figure 8b, the U.S. dollar share is not shown but was 84.1 percent in April 2024.

Source: Swift; Bloomberg.

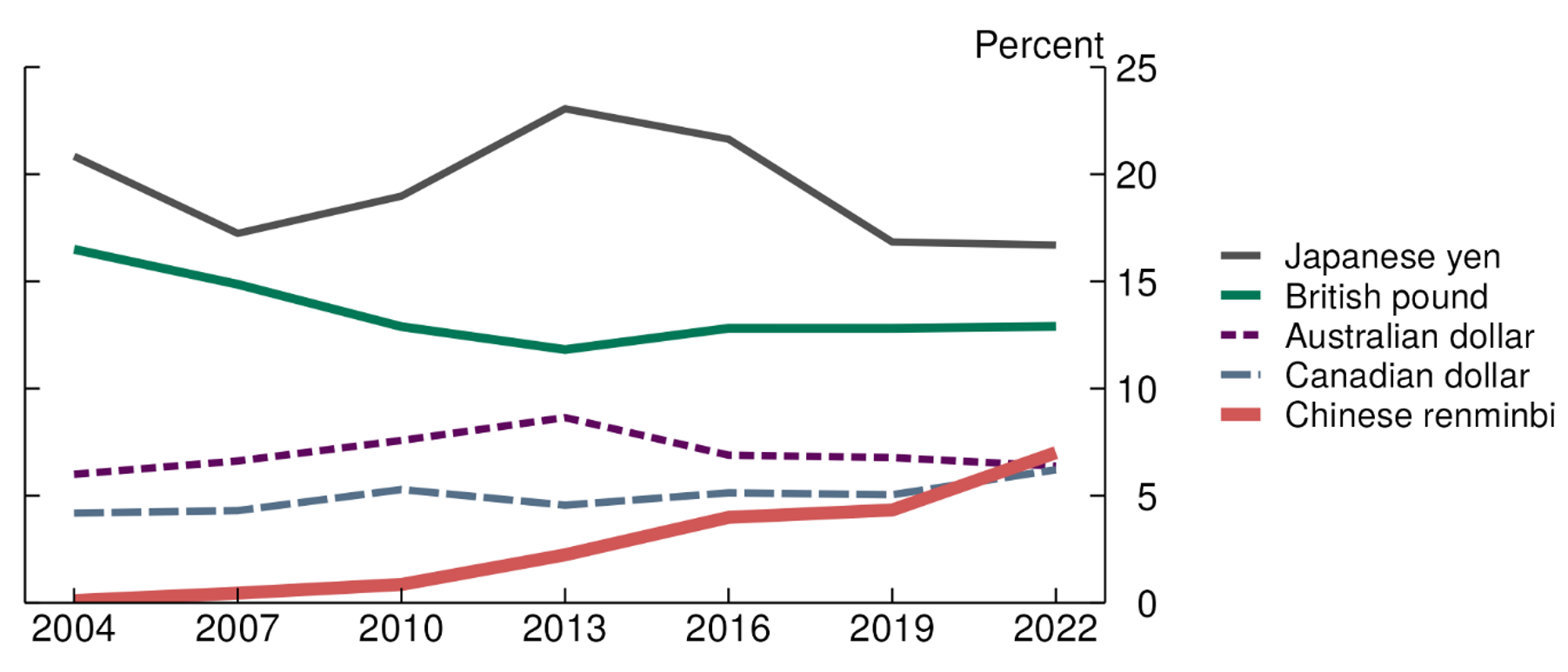

Finally, data on the currency share in over-the-counter FX transactions from the BIS Triennial Central Bank Survey are reported in Figure 9. Here also, the renminbi was able to register notable increases from a low starting point over the last 10 years. At the time of the last survey in 2022, 7 percent of FX transactions involved the renminbi, slightly ahead of the Canadian and Australian dollars but still notably behind the British pound at 13 percent and the Japanese yen at 17 percent. The foreign exchange market is also dominated by the U.S. dollar, which is involved in 88 percent of transaction, implying that most transactions are undertaken bilaterally with the U.S. dollar.12

Note: On a net-net basis. Percentages sum to 200 percent because every FX transaction includes two currencies. U.S. dollar and euro shares are not shown but were 88 percent and 31 percent in 2022, respectively.

Source: BIS Triennial Central Bank Survey of FX and OTC Derivatives Markets.

Conclusion and outlook

Over the last 10 years, the international role of the renminbi has increased notably from a very low starting point. Despite this increase, its international usage still lags behind even those of the British pound and Japanese yen. Thus, despite the Chinese economy being of broadly similar size as those of the U.S. and the euro area, the Chinese renminbi's international usage remains far behind those of the U.S. dollar and the euro.

Over the last two years, the renminbi has been influenced by cross-currents emanating from Western sanctions on Russia, increased Chinese efforts to promote renminbi trade invoicing, a weak Chinese economy, falling Chinese interest rates, and renminbi depreciation. On balance, these developments have resulted in the renminbi seeing a notably increased use in trade (in part to avoid Western sanctions) but a slightly reduced use as a reserve currency (likely reflecting renminbi depreciation and low Chinese interest rates). China has also seen a reduction in foreign asset holdings, likely reflecting pessimism about the Chinese economy.

Going forward, it will be interesting to see if the renminbi usage in trade continues to increase and whether that increased usage ultimately leads to a larger fraction of FX reserves being held in renminbi. While further increases in the international role of the renminbi seem likely, it cannot be ruled out that renminbi usage may decrease again, especially if Chinese authorities decide to impose stricter capital controls to lean against renminbi depreciation pressures.

In any case, absent any large-scale political or economic changes which damage the trust in the U.S. dollar, the Chinese renminbi will likely not rival the U.S. dollar for the role of the dominant global currency in the foreseeable future.

References

Bahaj, Saleem, and Ricardo Reis, 2022, The Workings of Liquidity Lines Between Central Banks, Research Handbook of Financial Markets.

Bertaut, Carol, Bastian von Beschwitz, and Stephanie Curcuru, 2023, "The International Role of the U.S. Dollar" Post-COVID Edition, FEDS Notes.

Cheung, Yin-Wong, 2020, A Decade of RMB Internationalization, BOFIT Policy Brief.

Eichengreen, Barry, Camille Macaire, Arnaud Mehl, Eric Monnet, and Alain Naef, 2022, Is Capital Account Convertibility Required for the Renminbi to Acquire Reserve Currency Status?, Working Paper.

Horn, Sebastian, Bradley C. Parks, Carmen M. Reinhart, and Christoph Trebesch, 2023, China as an international lender of last resort, NBER Working paper.

PBOC, 2023, RMB Internationalization Report.

Prasad, Eswar S. 2021. The Future of Money: How the Digital Revolution is Transforming Currencies and Finance. Harvard University Press.

Perez-Saiz, Hector and Longmei Zhang, 2023, Renminbi Usage in Cross-Border Payments: Regional Patterns and the Role of Swap Lines and Offshore Clearing Banks, IMF Working Paper.

Yeung, Raymond and Khoon Goh, 2022, Petroyuan Will Not Bring About a Regime Shift Soon, ANZ Research, China Insight.

1. I thank Shaily Acharya for excellent research assistance, Michele Dathan for providing issuance data, and Shaghil Ahmed, Brett Berger, Andrew Coflan, Patrick Douglass, Emre Yoldas, and Veronica Zapasnik for helpful comments. Return to text

2. See for example "China capitalizes on US sanctions in fight to dethrone dollar", Financial Times, August 24, 2023 (https://www.ft.com/content/3888bdba-d0d6-49a1-9e78-4d07ce458f42) and "Move over, U.S. dollar. China wants to make the yuan the global currency", Washington Post, May 16, 2023 (https://www.washingtonpost.com/world/2023/05/16/china-yuan-renminbi-us-dollar-currency-trade/). Return to text

3. See "2023 RMB Internationalization Report", Box 1 (page 6). Return to text

4. That said, the lower usage of the Chinese renminbi reflects the fact that China does not match the U.S. or the euro area in terms of openness to trade and capital flows, depth and liquidity of financial markets, or strength of property rights and the rule of law. Return to text

5. See https://www.theclearinghouse.org/payment-systems/CHIPS#:~:text=About%20CHIPS,and%20international%20payments%20per%20day. Return to text

6. Countries can window dress their foreign reserves by borrowing Chinese renminbi from the PBOC swap line, which increases their gross foreign exchange reserves in official statistics, while only creating a liability in their domestic currency. Return to text

7. "Brazil Takes Steps to Transact in Yuan as China Ties Grow", Bloomberg, March 30, 2023 (https://www.bloomberg.com/news/articles/2023-03-30/brazil-takes-steps-to-transact-in-yuan-as-ties-with-china-grow) Return to text

8. Argentina to pay for Chinese imports in yuan rather than dollars, Reuters, April 26, 2023 (https://www.reuters.com/world/china/argentina-govt-pay-chinese-imports-yuan-rather-than-dollars-2023-04-26/) Return to text

9. Offshore renminbi (CNH) is not subject to capital controls or a trading band. However, to keep the value of the offshore renminbi in line with the onshore renminbi, the PBOC has to reduce renminbi liquidity in offshore markets during times of depreciation pressures. The reduced liquidity then results in sharp spikes in offshore renminbi lending rates. Such volatile funding conditions reduce the attractiveness of long-term investment in offshore renminbi. Return to text

10. See "Preliminary Report on Foreign Holdings of U.S. Securities at End-June 2023" by the U.S. Department of the Treasury (https://home.treasury.gov/news/press-releases/jy2140). Return to text

11. See "Global central banks plan to increase dollar reserves, survey suggests", Financial Times, June 4, 2024, (https://www.ft.com/content/1be234f2-c680-4ce9-beb7-d0d9a2793330). Return to text

12. Because every transaction involves two currencies, the sum of all percentages adds up to 200 percent. Return to text

von Beschwitz, Bastian (2024). "Internationalization of the Chinese renminbi: progress so far and outlook," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, August 30, 2024, https://doi.org/10.17016/2380-7172.3592.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.