FEDS Notes

May 31, 2024

Lessons from Past Monetary Easing Cycles

Francois de Soyres and Zina Saijid1

Many central banks are at a critical juncture in their current monetary policy cycles as they assess whether it would be appropriate to embark on an easing phase following one of the most aggressive episodes of monetary tightening in recent history. In this note, we highlight key aspects of past monetary policy easing episodes in selected advanced economies and what lessons we may learn from these past experiences.

Reviewing the historical record, we identify instances where monetary policy was tightened in response to increased inflation, and subsequently dialed back when inflationary pressures abated. From these selected "inflation-abating" episodes, we show that only a minority can be categorized as "inflation-success" where inflation indeed settled close to Central Banks' target. In these instances, the easing phase of the monetary policy cycle starts when core inflation is on a downward trajectory, but still above a desired level, but subsequently is reduced to within a narrow band around the target within a reasonable time horizon. Other episodes, where core inflation remains far from target, can be labelled as "inflation-failure". Examining the differences between successful and failed easing episodes, we show that "inflation-success" episodes happened when the previous peak of inflation was lower – signaling that Central Banks had tightened policy more swiftly when inflationary pressures were on the rise. Moreover, "inflation-success" episodes started when inflation was closer to target, and the growth backdrop was slightly firmer compared to "inflation-failures". Accordingly, "inflation-success" episodes are also associated with smaller previous cumulative tightening and easing. Finally, we note that soft-landings, in which inflation is contained without inducing a recession, are rare but not unprecedented.

Identifying "inflation-abating" easing episodes

For our analysis we consider monetary policy easing episodes in 13 advanced economies (AEs), employing quarterly data between 1960 and 2019.2 Our analysis focuses on easing episodes that were associated with declining inflation and/or reduced inflation concerns as opposed to those that were implemented primarily in response to slowing in growth or weak labor markets. We refer to these instances as "inflation-abating" easing episodes. For this note, an easing episode is when the policy rate decreases compared to the previous quarter and had not decreased already in the year prior.3 Among these such episodes, we define "inflation-abating" easing episodes as instances where core inflation is on a downward trajectory, but still above a desired level, before the start of easing. More specifically, an "inflation-abating" episode is one where core inflation declined over the four quarters prior to the onset of easing, and the decline in four-quarter inflation was at least 0.5 percentage point.4 While the majority of central banks officially target headline inflation, we condition our analysis on core inflation as in discussing and thinking about the conduct of monetary policy, many central banks consider core inflation to be a useful proxy for underlying inflation.

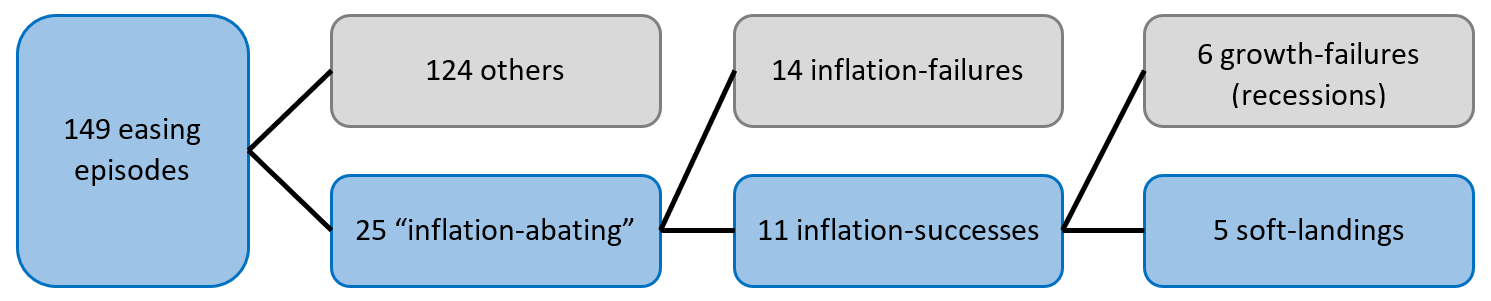

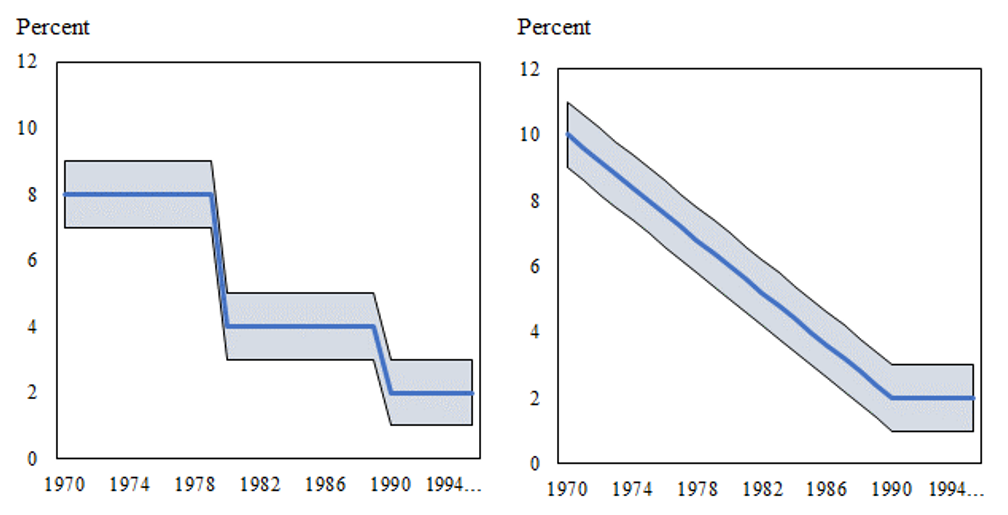

Inflation abating episodes represent less than one fifth of all easing cycles (25 out of 149 episodes). From this set we distinguish between three types of episodes: "inflation-failure", "inflation-success", and "soft-landings". An easing episode is viewed as an "inflation-success" when four-quarter core inflation is within one percentage point of the implied-inflation target, a year and a half (six quarters) out from when policymakers transition to easing. Since Central Banks did not have official inflation target until the 90s or later (depending on the Central Bank), we use implied inflation targets estimated in Milani (2020). In practice, we benchmark against a piecewise, linear target series that falls from around 9 percent in the early 1970s to 2 percent by the early 1990s (further details about the implied inflation target series are in the Appendix). If core inflation is above the upper end of this range then it is considered an "inflation-failure".

Of the 25 inflation-abating episodes, 11 were "inflation-successes".5 We further distinguish "soft landing" episodes, defined as instances where inflation is tamed without generating a significant period of weak growth. In practice, an episode is defined as a "soft-landing" if there no instance of a technical recession (i.e. two consecutive quarters of negative growth) over the period from the start of the preceding tightening cycle until six quarters from the start of easing. Soft landings represent a less than half of "inflation-success" episodes (5 out of 11).

Economic activity around easing cycles

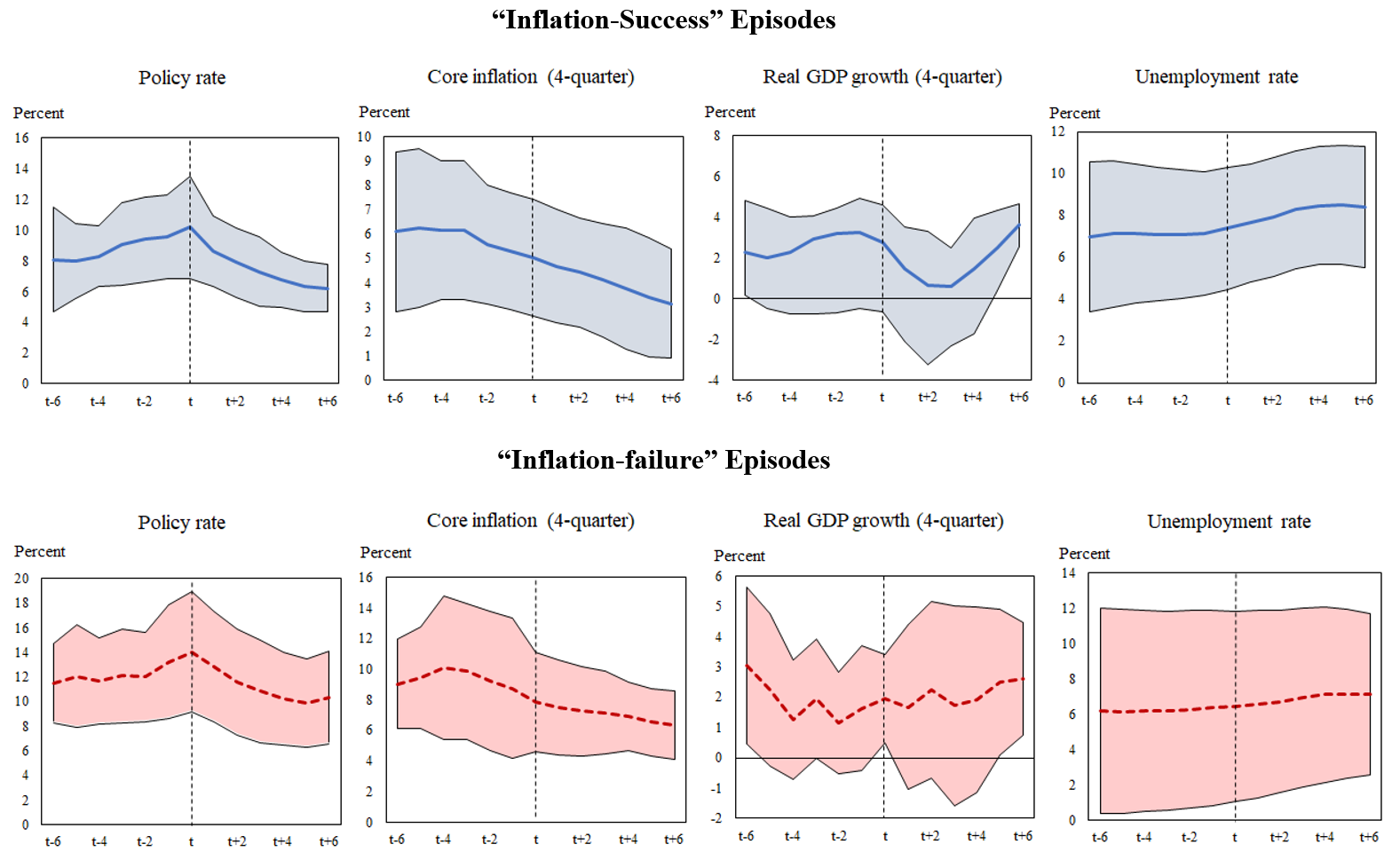

Figure 2 below compares the evolution of key macroeconomic variable around the start of easing cycles, separating between "inflation-successes" (shown by the blue lines) and "inflation-failures" (shown by the red dashed lines). We show the average values of the policy rate, core inflation, GDP growth, and the unemployment rate.

Note: Due to data limitations for some variables, averages are calculated based on data for 9 of the 11 successful "inflation-abating" easing episodes and for 10 of the 14 unsuccessful "inflation-abating" easing episodes.

Source: Staff calculations.

On average, in both types of episodes, monetary policy easing starts about a year after the preceding peak in Core inflation. In the "inflation-failures", however, the policy rate begins to drift up a year and a half out, suggesting that policy makers had to tighten monetary policy again. Indeed, the decline in core inflation is more sustained in "inflation-successes," whereas "inflation-failures" appear to be associated with slower and more gradual disinflation during the easing phase, suggesting that policymakers might have been too quick to start easing. In episodes where inflation was contained, growth shows a more pronounced slowdown, on average, but begins to rebound about three quarters out from the start of easing. Finally, keeping inflation in check is associated with labor-market sacrifice, with the unemployment rate rising prior to and after the start of easing. The increase in the unemployment rate is little more pronounced in the "inflation-successes", on average.

Characteristics of "inflation-success" easing episodes and lessons learned

Refining our analysis further, Table 1 below summarizes the key characteristics of different types of "inflation-abating" easing cycles, separating "inflation-success", "inflation-failures" and soft-landings. In particular, compared to episodes where the central bank failed to tame inflation, "inflation-success" episodes are associated with a lower level of core inflation at the onset of easing – which, in many cases, highlights that "inflation-success" was achieved when monetary policy remained at its peak tightening until core inflation was closer to target. In addition, the "inflation-success" episodes were associated with a smaller inflation shock. That is, in "inflation-success" episodes, core inflation at its peak was closer to the implied target compared to in "inflation-failures" episodes. In terms of the economic growth backdrop, successful episodes started on average in a slightly higher growth environment. The timing of the start of easing is similar across episodes, with policymakers waiting on average about a year after core inflation peaks to start easing.

Table 1: Characteristics of past easing episodes

| Historical Averages | |||

|---|---|---|---|

| Inflation-failures | Inflation-successes | Soft-landings | |

| (14 episodes) | (11 episodes) | (5 episodes) | |

| Core Inflation (4-quarter change) | 8.9 | 5.6 | 4.7 |

| Peak Core in excess of target | 8.2ppt | 2.6ppt | 2.4ppt |

| Quarters from peak Core to easing | 5 | 5 | 6 |

| Real GDP growth (4-quarter change) | 1.8 | 2.6 | 4.1 |

| Unemployment rate at easing | 7.3 | 6.7 | 8 |

| "Hike-to-Easing" U-rate change | +0.1ppt | +0.2ppt | -0.7ppt |

| Decline in Core from peak | 4.1ppt | 3.7ppt | 2.8ppt |

| Characteristics of policy cycle | |||

| Cumulative tightening | 511bp | 304bp | 262bp |

| Cumulative easing after 6 qtr. | 413bp | 351bp | 232bp |

Note: Staff calculations. Summary statistics for past easing cycles in a sample of 13 countries from 1960–2019. Core inflation, real GDP growth, and the unemployment rate rows in the table are measured at the quarter prior to the start of easing. Peak core is the deviation of core at its peak prior to start of easing from the desired target level. Quarters from peak to easing is measured as the number of quarters from when core inflation peaks to the quarter prior to the start of easing. "Hike-to-Easing" U-rate change is the change in the unemployment rate from the start of the preceding hiking cycle to the quarter prior to the start of easing. Decline in core from peak is the deflation from core at its peak until 6 quarters from when easing starts. Cumulative tightening is the increase in the policy rate in the preceding tightening cycle, and cumulative easing is the decrease in the policy rate in the 6 quarters from the start of easing.

The magnitude of tightening to contain inflation and the subsequent easing also varies across episodes. Tightening was typically larger in the "inflation-failures", reflecting that many of these instances were in the 1970s and 80s when central banks embarked on aggressive tightening in order to sharply reduce inflation that was running well in excess of desired levels. Among "inflation-success" episodes, soft-landing ones were associated with smaller tightening and smaller easing, and without an increase in the unemployment rate, which might reflect the fact that the preceding peak of core inflation was closer to target than in non-soft-landing episodes.

Several lessons can be drawn from our analysis. First, a monetary policy tightening-easing cycle is more likely to be deemed an "inflation-success" if the central bank acts early, that is when tightening begins when inflation is not substantially in excess of the target. A caveat to this conclusion is that the analysis does not consider the types of shocks (i.e. supply or demand) that initially drove inflationary pressures and monetary policy considerations can certainly depend on the types of shocks. Second, in the instances where inflation was tamed, by acting early, central banks have to tighten less. And third, successfully taming inflation need not be accompanied by a material weakening in growth and a rise an unemployment.6

A Narrative approach

To complement our empirical investigation with more detailed historical background, Table 2 briefly discusses the prevailing economic conditions for the "inflation-success" episodes. In the soft-landing episodes, policymakers began to ease against the backdrop of an improving inflation outlook and a slowdown in growth, though not to a degree where policymakers were anticipating a recession. When considering whether to loosen the policy stance, policymakers generally were of the view that inflation has been contained and they could provide some support to the broader economy without reigniting inflationary pressures. Of note, in two of these episodes, Australia and Italy in 1996, the policy rate was held steady at a restrictive level for an extended period before the start of easing.

Table 2: Brief narratives of "inflation-success" easing episodes

| Country | Duration | Economic growth | Inflation | Monetary policy | |

|---|---|---|---|---|---|

| Inflation and growth success | United States | 1984q4-1986q4 | Slowdown in growth from the robust pace in first half of 1984 | Favorable inflation readings, inflation expectations declining, appreciating dollar | Modest easing was desirable given economic slowdown, lower money supply growth, and favorable inflation readings…Committee judged that moderate expansion in activity not likely to be associated with renewed upward pressure on prices. |

| United States | 1995q3-1996q1 | Moderating growth, sluggish consumer spending | Receding inflationary pressures, inflation close to 2 percent, and tight labor market | Modest easing was desirable given economic slowdown and receding of potential inflationary pressures. Committee judged that a slight easing of the stance of policy would incur little risk of stimulating increased inflation. | |

| Australia | 1996q3-1999q3 | Scope for stronger growth, moderate employment growth | Underlying inflation had returned to the range targeted by the Bank (2-3 percent), unemployment described as relatively high | Began easing with aim to reduce unemployment and of view that economy could sustain a pickup in growth without rekindling inflationary pressures. | |

| Italy | 1996q3-1999q2 | Slowing growth, but recession would be avoided | Improving inflation outlook and in long-term inflation expectations | Began easing in July 1996 as actual inflation decelerated more rapidly than market expectations. | |

| Inflation success, but growth failure | Germany | 1974q4-1975q4 | Material slowdown in activity and rising unemployment; tight monetary policy had slowed housing and durable goods demand | Progress towards price stability, but not without economic costs | Transition to monetary targeting. Bundesbank pursued an expansionary monetary policy to revive economic growth amid signs of progress on inflation. Intention was to balance stimulating growth but guard against undoing progress on inflation. |

| Canada | 1976q4-1977q3 | Softening growth and modest rise in unemployment | Inflation decelerating, helped in part by wage and price controls introduced in late 1975 | The BOC had adopted a monetary target for in 1975, which was thought to contribute to the deceleration in inflation, allowing for interest rate cuts. | |

| Australia | 1977q4-1979q1 | Material softening in growth | Inflation decelerating | The RBA had adopted a monetary target in 1975, this appeared to help in reducing in inflation, allowing for rate cuts against a backdrop of also slowing growth. | |

| United States | 1981q4-1983q1 | High unemployment and material weakening in growth | Easing inflation but still above target | Easing was gradual despite recession in late 1981-early 1982 due to the intentional aggressive disinflationary policy under Fed Chair Volcker. | |

| France | 1993q2-1994q3 | Recession and rising unemployment | Moderating inflation | Tight monetary policy necessitated by the 1992 currency crisis and need to maintain credibility in European Exchange Rate Mechanism. Began to ease to provide some economic relief but at the same time proceeded gradually to resist pressure on the currency. | |

| Sweden | 1992q4-1994q1 | Low economic activity, and increased private saving | Inflation close to target, but upside risk to inflation expectations amid currency depreciation | Easing coincided with the abandonment of the fixed exchange rate regime and move to inflation targeting. The Riksbank intervened in foreign exchange markets in late 1992 and in 1993 to counteract the inflationary effects of the weakening currency. |

In other inflation-successes, taming inflation came at greater economic cost. For example, the Federal Reserve's aggressive tightening cycle between late 1980 until around the middle of 1981 led to a recession and sharp increase in unemployment, but core inflation subsequently fell to around 5 percent in 1983. In some cases, the inflation success was not long lasting, such as in Australia and Canada in the late 1970's.7 In France and Sweden, the tightening cycles that preceded the easing in the early 1990's were related to combating pressures on the local currency. In Sweden, the fixed-exchange rate regime was abandoned and the Riksbank adopted inflation targeting which eventually led to price stability. These episodes are among the least comparable to the recent experience.

Conclusion

The historical record of "inflation-abating" episodes shows that in most cases, policy makers were not successful in taming inflation. In instances that were successful, in most cases those were associated with a recession. However, soft-landings, in which inflation is contained without inducing a recession, are not unprecedented. On average, soft-landings are characterized by a smaller preceding policy tightening, an inflation reading closer to target (or the midpoint of the target range) at the onset of easing, and a relatively firmer growth backdrop. Thus, successful policy management appears more likely when policymakers act early, more parsimoniously, and pre-emptively – and a successful inflation-abating easing cycle could be achieved without a notable increase in unemployment.

Financial markets and professional forecasters are expecting that central banks will achieve their inflation targets in the next two years, with differences across countries. Moreover, amid receding core inflation, financial markets are speculating that major advanced economy central banks will begin easing around the middle of this year, with some central banks in Europe having already reduced their interest rate.

As of mid-May, market pricing for year-end 2025 implies that market participants expect roughly 125bp of easing from the Federal Reserve and Bank of England, and 150bp from the Bank of Canada and the European Central Bank. Compared to the historical record, such shallow easing after roughly a year and half from the start of easing would be unprecedented. Some commentators have argued that a possible reason for the expected shallow path is speculation that the neutral rate of interest, r*, has increased globally, driven in part by an anticipation of higher levels of government debt as well as a surge in investment demand in the wake of the green transition. Accordingly, market pricing currently assumes that interest rates could remain elevated relative to the period between the Great Financial crisis and COVID-19 pandemic.

References

- Ari, Anil, Carlos Mulas-Granados, Victor Mylonas, Lev Ratnovski, and Wei Zhao, 2023. "One Hundred Inflation Shocks: Seven Stylized Facts," IMF Working Papers 2023/190, International Monetary Fund.

- Cecchetti, S., Feroli, M., Hooper, P., Mishkin, F. S., & Schoenholtz, K. L., 2023. "Managing disinflations". In US Monetary Policy Forum, University of Chicago Booth School of Business, February (Vol. 24).

- Milani, Fabio, 2020. "Learning And The Evolution Of The Fed'S Inflation Target," Macroeconomic Dynamics, Cambridge University Press, vol. 24(8), pages 1904-1923, December.

Appendix

We use the implied inflation target for the Federal Reserve identified in Milani (2020) to assess whether easing episodes were successful. The implied inflation target, based on a model that assumes that economic agents have rational expectations, displays large shifts over time: the target falls from 8 percent in the 1970s, to 4 percent in the 1980s, and further to 2 percent to in the 1990s. A visual representation of the stepwise, implied target with a 1 percent band is shown in left panel of the figure. To smooth for the large shifts in the implied target between 1970s and 1990s, we create a piecewise, linear time series that is based on the discrete values for the implied target. This is series is then used in our analysis, a visual representation of which is shown in right panel of the figure.

Note: Milani (2020) and staff calculations.

1. François de Soyres ([email protected]) and Zina Saijid ([email protected]) are with the Board of Governors of the Federal Reserve System. The views expressed in this note are our own, and do not represent the views of the Board of Governors of the Federal Reserve, nor any other person associated with the Federal Reserve System. Return to text

2. The data set employed are from the paper Caldara, Dario, Francesco Ferrante, Matteo Iacoviello, Andrea Prestipino, and Albert Queralto (2024), "The International Spillovers of Synchronous Monetary Tightening," Journal of Monetary Economics, 141, January, pp.127-152, https://www.matteoiacoviello.com/research.htm. The 13 advanced economies are Australia, Canada, France, Germany, Italy, Spain, Japan, New Zealand, Norway, Sweden, Switzerland, the United Kingdom, and the United States. Return to text

3. Of note, monetary policy can still be restrictive after a decrease in the policy rate, with the real interest rate remaining above the neutral rate – a situation that likely happens at the beginning of an easing cycle. Hence, an easing cycle should not be interpreted as a period where monetary policy is accommodative. Return to text

4. We include two episodes in the United States that deviate slightly from our criteria: the easing cycles that started in 1984 and 1996, where inflation was running close to desired levels at the onset of easing. Return to text

5. This observation resonates with Ari et al (2023). Studying over 100 inflation shock episodes, the authors show that only 60 percent of these episodes were successful, defined as cases where inflation is brought back within 5 years. Return to text

6. Relatedly, looking at 17 disinflationary episodes in the United States, Cecchetti et al. (2023) argues that inflation rarely recedes without at least a mild recession. Return to text

7. These cases were ultimately unsuccessful as they did not result in a sustained period of low and stable inflation. Return to text

de Soyres, Francois, and Zina Saijid (2024). "Lessons from Past Monetary Easing Cycles," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, May 31, 2024, https://doi.org/10.17016/2380-7172.3504.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.