FEDS Notes

February 24, 2021

Preconditions for a general-purpose central bank digital currency

Jess Cheng, Angela N Lawson, and Paul Wong1

Introduction

Money is a social and legal construct underpinned by trust. Conceptions of money have evolved and money has taken many forms over the years. In North America, pre-colonial trade was often conducted in wampum, corn, and fur pelts. In fact, wampum, which are decorative beads made from shells, were recognized as official currency by the Massachusetts Bay Colony in 1650.2 The Federal Reserve note, which was first issued in 1914, is a relatively recent development by historical standards. Today, there are ongoing discussions on a new form of central bank money distinct from physical cash and limited-access central bank deposits. This report focuses on the potential for a general-purpose CBDC that can be used by the public for day-to-day payments.

Crucial to whether "money" is successful is whether it is seen as a safe, stable and reliable instrument. Cash, central bank deposits, and a potential CBDC are all liabilities of the central bank; funds in a bank account are the liability of a commercial bank; and honoring balances on a retail stored value card is an obligation of issuer—but most people do not think of money in terms of their status as a liability and obligation of banks or other entities. What people care about is not the nuances of how money is recorded on a ledger somewhere, but whether the "money" in question can be safely and reliably used to make a purchase today, as well as in the future. Most people take for granted that cash maintains its full value, funds at a bank are secure, and businesses will honor store credit. Seen in this light, a CBDC could offer another form of safe and reliable money.

Interest in central bank digital currencies has increased significantly in recent years in the United States and throughout the world with the introduction of global stablecoins, the growing presence of "bigtech" in payment services, and the prototyping of CBDCs by some central banks.3 The COVID-19 pandemic also highlighted inefficiencies in the retail payments market, specifically in the distribution of economic stimulus funds, and the potential benefits of a CBDC as a complement to currency and coin. Furthermore, several members of the U.S. Congress have introduced bills in the last year that seek to change fundamentally how the U.S. payment system currently functions.4 Research and experimentation are ongoing to help inform the conversation on whether a widely available, digital form of central bank money offers benefits in the United States and should be introduced.

This paper aims to identify some high-level environmental preconditions that support a general-purpose CBDC in the United States. These preconditions are necessary, though not sufficient, and can be broadly grouped into five areas: clear policy objectives, broad stakeholder support, strong legal framework, robust technology, and market readiness. Within each area, detailed elements are discussed. These areas and elements are not exhaustive because many systems, tools, processes, and structures will need to be in place for a CBDC. In addition, many of these elements are interconnected. For example, engaging with a broad array of stakeholders and monitoring market readiness could inform clear policy objectives and vice versa. This paper does not attempt to prescribe how to address these preconditions; it aims to spark further inquiry.

Clear Policy Objectives

A foundational element for introducing a CBDC is understanding its purpose: What can a CBDC be used for, how it can be used, and what potential value does it provide? A recent Bank for International Settlements report highlighted a number of potential benefits for a CBDC.5 These include enhancing payment system resiliency, increasing payments diversity, encouraging financial inclusion, and improving cross-border payments. Research papers and other reports have referenced the potential for a CBDC to support monetary policy.6 It is important to consider that a CBDC that is designed to support monetary policy transmission or economic stimulus payments, for example, would be quite different than a CBDC that is designed to be an alternative to cash.7 Without clear objectives, it would be difficult to establish business requirements for a CBDC.

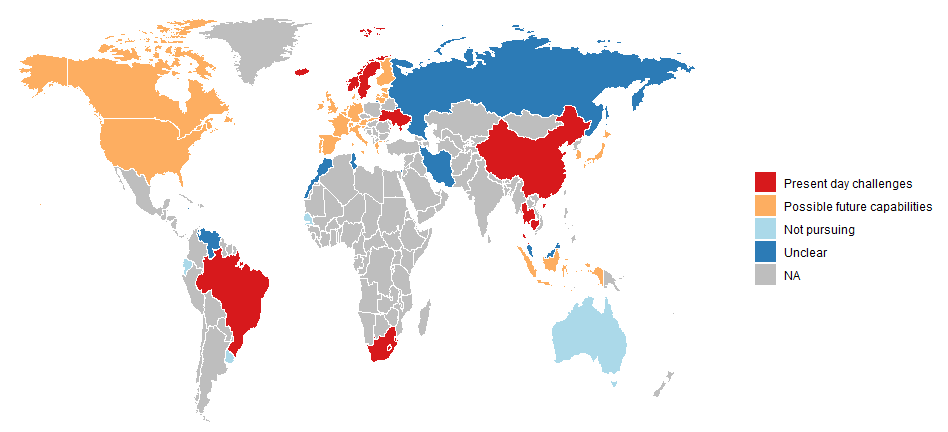

Central bank interest in CBDC research and experimentation varies significantly. However, these interests generally fall into two broad categories. One set of central banks is primarily looking to address present-day challenges, while for others it is exploring future capabilities. For some jurisdictions, a CBDC is intended to address a specific problem — inefficient payment systems, weak banking infrastructure, or declining cash use — or to promote national policy goals, such as supporting payments inclusion and protecting monetary sovereignty. For many advanced economies, the primary motivations are centered on potential payments innovation and general preparedness for a potential future state. Figure 1 highlights some of the central banks' primary motivations.

Sources: This map was compiled using data from the March 2020 BIS Quarterly Review and a 2020 working paper from the IMF, "A survey of research on retail central bank digital currency," and supplemented through additional secondary research. CBDC activity tracking sites from organizations such as the Atlantic Council were used. Motivations were broadly determined by the authors using the public statements attributed to sources within the central banks themselves or in some cases other news sources.

For the United States, whatever specific objectives may arise for a CBDC, they should be consistent with the Federal Reserve's longstanding objectives of the safety and efficiency of the nation's payments system, as well as monetary and financial stability. A CBDC arrangement must be in keeping with these objectives, which have guided the central bank since its establishment in 1913. These objectives should be complemented by the three foundational principles recently outlined by the Bank of Canada, European Central Bank, Bank of Japan, Sveriges Riksbank, Swiss National Bank, Bank of England, and Federal Reserve to "do no harm"; complement existing forms of money; and support innovation and efficiency.8 A CBDC arrangement should also support the Federal Reserve's broader work in consumer protection and community development.

Broad Stakeholder Support

Developing a CBDC requires input, engagement, and support from a range of stakeholders in both the public and private sectors and contributes significantly to market readiness. Though full agreement among stakeholders is likely impossible, an inclusive discussion and general consensus is a precondition. Key stakeholders include government bodies, end users, financial institutions, technology and infrastructure providers, academia, and standards development organizations. Broad stakeholder support will take time to achieve given the diverse interests involved and the number of complex decisions that will need to be made on system design and ecosystem development.

Government bodies. Governmental support is essential to facilitating the legal and societal changes that would be needed for the introduction of a CBDC. The legislative and executive branches of government would need to make critical decisions affecting the design and implementation of a CBDC. Consideration by Congress, for example, must be given to key areas such as the authority of the Federal Reserve to issue a general-purpose CBDC, the potential sea change in the relationship of the central bank with the public, and potential legislative changes related to contract law, privacy, and consumer protection (see also the Strong Legal Framework discussion below). Executive branch support is also needed from federal agencies on a number of design and implementation issues, including those related to tax, public spending, counterfeiting and fraud, anti-money-laundering, and cybersecurity. Coordination and harmonization of regulatory frameworks across various jurisdictions would also require the support of government at both the federal and state levels.

End users. Usability will be key given that a general-purpose CBDC must be designed for the people and organizations who use money to pay for goods and services. Including end users of various ages, geographic locations, payment habits, and financial literacy in the design and testing of a CBDC could help sharpen the basic features of a viable CBDC arrangement. For example, how will people use a CBDC–through a smartcard, smartphone, fingerprint, iris scan, or something else? Why would they choose a CBDC over another payment instrument? To make a CBDC that appeals to merchants, its designers will need to include benefits for retail transactions. These might include being a less expensive and faster alternative to existing payment options.

Engaging with individuals and businesses and consulting with consumer groups, community organizations, and business associations to understand the use case for a CBDC will help in the decision whether to issue a CBDC and its potential design. End-user input on privacy and usability would be particularly useful in designing a CBDC. Questions related to privacy would include identifying what type of information is kept on the system, who owns the information, who has access to it, and how it can be used. End-user input on security will also be important depending on the design on the system. For example, how much responsibility does the end user want when considering the tradeoffs that may need to be made with consumer protection and loss allocation?

Additionally, while the current payments system works well for most, a CBDC could help address unmet needs. According to a 2019 Federal Deposit Insurance Corporation report, 5.4 percent of American households had neither a savings nor a checking account, which means they might not have direct access to the bank-intermediated payment system.9 A recent Federal Reserve Bank of Atlanta report noted that "access to digital payment vehicles that don't depend on traditional bank accounts" may be an effective approach to addressing the needs of unbanked Americans.10 Engaging with end users or the groups that represent unbanked Americans can help determine whether or how a CBDC could be designed to support payment inclusion goals.11

Financial institutions. Introduction of a CBDC could result in significant changes to market structure and dynamics. There are important questions about the potential role of banks and other financial institutions in a CBDC arrangement. A CBDC might affect commercial bank deposits, bank credit, and the broader financial system. However, it is also possible there would be little to no disruption to the banking sector, depending on the features of a CBDC and how it is implemented.12 Engaging broadly with financial institutions of many types, from global systemically important banks to local community banks to internet-only banks, would inform policymakers on potential impacts, benefits, design considerations, and policy requirements.

Technology and infrastructure providers. Technology and infrastructure firms play a significant role in today's market, and support from these groups is a precondition of a CBDC issuance. A potential CBDC may take many different forms, some of which could be achieved through existing technology and infrastructures. Or it could use newer technologies, such as distributed ledgers, that are not widely used today. Or it could use a combination of existing and new technologies. CBDC arrangements may also allow or accelerate the entry of new providers, such as bigtech and fintech, into payment or other financial services. Incumbent firms that are unable or unwilling to embrace or develop new capabilities may experience negative impacts as new entrants emerge. Understanding these dynamics will inform design choices and help address questions of CBDC design, interoperability, market structure, and market adoption.

Others. Other stakeholders, such as academic institutions, think tanks, standards organizations, and the international community, can inform and support the foundations of a CBDC. Academic institutions and think tanks can provide thought leadership to inform policymaking. Standards organizations can contribute by defining terms, developing taxonomies, and creating specifications and standards in support of the broader ecosystem. The international community, such as other central banks and policy makers, is also important given the role of the U.S. dollar in international trade and finance as well as the opportunity to learn from CBDC pilots or initiatives in various jurisdictions. Other questions include how visitors and foreign businesses might access a CBDC, how it could be used offshore, and what rules should govern this type of use.

Strong Legal Framework

A principal role of the Federal Reserve in the U.S. financial system is to be the guardian of public confidence in money; thus a sound legal framework is a key precondition. It serves as the bedrock that enables users of a general-purpose CBDC and the market more broadly to be confident that the instrument they use to transfer value is robust and reliable, functions smoothly and securely, and comes with clear rules and protections for the payment recipient and for the consumer. Any cracks would undercut the public's trust in the CBDC. Critical first steps toward building such a sound legal framework include formulating a clear position on the legal issues highlighted below.

Clear legal authority. A first-order consideration is whether the issuance of a general-purpose CBDC would be consistent with the Federal Reserve's mandates, functions, and powers as enshrined in the central bank law, namely the Federal Reserve Act (FRA).13 The central bank exercises only powers and functions authorized under the FRA. For example, the FRA authorizes the Federal Reserve to issue Federal Reserve notes and to provide payment services to depository institutions and certain other entities.14 Consideration would need to be given as to whether additional amendments to the FRA would be required related to the issuance of a general-purpose CBDC.

Legal tender status. The topic of legal tender status is often raised in the context of CBDCs. In the United States, that status has specific meaning. By statute, all currency issued by the Federal Reserve is a valid and legal offer of payment for settling "debts" to a creditor.15 It is important to note that neither the statute nor any other federal law compels an individual or private business to accept currency or coins as payment for goods and services. Rather, these private-sector entities are generally free to develop their own policies on whether to accept cash, within the boundaries of any applicable state law and with appropriate notice.16 Although the status of CBDC as legal tender under U.S. law remains an open question, a general-purpose CBDC's recognition as legal tender would not guarantee its acceptance in commercial use; that would largely depend on the credibility of the CBDC, including the soundness of the legal framework underpinning it (for example, commercial law rules that facilitate market activities).17

Anti-money laundering, countering the financing of terrorism, and addressing sanctions evasion. It is critical that such a legal framework, as a precondition, includes approaches to combatting money laundering and countering the financing of terrorism so as to mitigate the risk that the CBDC could become a favored medium for illicit activities, particularly given the ease and speed at which potentially large amounts of money could be transferred. As a point of comparison, illicit activities in connection with virtual currencies are not just limited to direct use in transactions to commit crime or to support terrorism (such as buying and selling illicit things), but also include use by bad actors to launder their illicit proceeds or hide financial activity from authorities (such as law enforcement, national intelligence, tax, or economic sanctions authorities).18

Privacy. At the same time, it will be essential to consider how privacy is respected and how personal data is protected in a CBDC arrangement. Legal requirements vary, depending on the role a particular party plays in handling or processing a payment transaction–whether the party is a bank, service provider to a bank, affiliated party, or communication provider.19 Depending of the design of a CBDC and the extent of the central bank's role in the arrangement, the central bank could have access to an unprecedented scale of granular transaction information; possibly, transactional data could be available to certain third parties (like banks and service providers) or, in the extreme, to everyone. This close linkage between money and data contrasts with physical banknotes, which do not carry with them transaction data that can be connected to a specific person and their history of financial dealings.

Legal roles and responsibilities. Furthermore, a general-purpose CBDC may call for the central bank to step into roles and responsibilities with respect to the general public that are generally shouldered today by private-sector banks vis-à-vis their customers. As a consequence, it would become vital to address issues concerning the risks to be managed by the central bank under applicable law, including the gamut of legal responsibilities associated with the CBDC (namely with respect to anti-money-laundering, economic sanctions, privacy, and data security) that may be allocated to it.

In addition, a legal framework should equitably allocate loss for instances when things go awry—such as operational failures like error or delay, fraud, theft, or bankruptcy and insolvency—with clarity and predictability to reinforce public trust and market confidence in a CBDC. With respect to wholesale payments today, payments law provides loss allocation regimes that are calibrated to incentivize parties to take steps to minimize the chance of the loss occurring in the first place (for example, assign the risk of loss to the party in the best position to control it) or minimize the loss borne by individual transacting parties (for example, spread the burden of the loss). However, for a CBDC expected to be used by individuals and businesses, the question of how loss should be allocated will raise important questions beyond who is most able to manage the risk—what allocation is realistic and, importantly, fair?

Robust Technology

Technology will, in part, influence the design and functionality of a digital currency. In some cases, business and operational requirements for a particular CBDC design may require the development of new technologies. A nationwide CBDC arrangement based on distributed ledger technologies, for example, would require further advances, such as increased transaction throughput capabilities given the size of the U.S. economy. Further, access or integration points, such as digital wallets, may require additional development to meet operational standards. A CBDC that can operate offline, for example, may require use of other technologies such as secure hardware. Significant technology development and assessment work are needed in three core areas: system integrity, operational robustness, and operational resilience. Table 1 highlights key aspects of the technology capabilities underpinning a CBDC.

Table 1: Key Aspects of the Underpinning Technology

| Technology capabilities | What aspects are important? |

|---|---|

| System integrity. A CBDC needs to perform as intended in an unimpaired manner and free from unauthorized manipulation. | · Ability provide a secure and efficient transfer of assets |

| · Accurate recordkeeping, effective anticounterfeiting measures, and robust fraud detection | |

| · Ability for the arrangement to manage and protect against unauthorized access, use, disruption, modification, or destruction in order to provide system confidentiality, integrity, and availability | |

| · Careful implementation of strong information security controls in order to protect information assets | |

| Operational robustness. A CBDC must have the ability to operate correctly and reliably across a range of operational conditions. | · Provide instant settlement with continuous 24 hour/7 day availability |

| · Include flexible and adaptable technology so the arrangement can evolve as needed | |

| · Due consideration to operational robustness of the ecosystem and not only that of the arrangement operator (for example, issuance and distribution of a CBDC to poorly designed or poorly operated digital wallets may pose risks to the entire arrangement) | |

| Operational resilience. A CBDC also needs to have the ability to resist, absorb, and recover from or adapt to adverse conditions. | · Give due consideration to the potential impact of connectivity outages, if internet connection is required |

| · Address operational resilience from a people, information, systems, processes, and facilities perspective | |

| · Consider endpoint-to-endpoint resilience (that is, the “standard” for operational resilience should be at the end-user level and not solely with the settlement function of the arrangement) |

Market Readiness

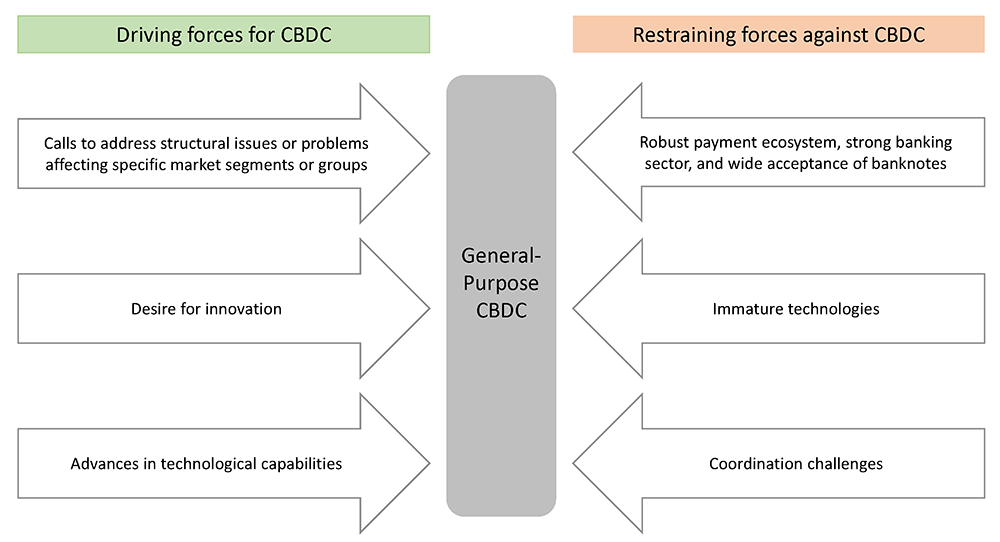

Market readiness refers to the appropriate timing for the introduction of a CBDC. A CBDC should have end users willing to adopt it (demand), and it must have an ecosystem ready to support it (supply). Assessing market readiness typically requires an understanding of the conditions likely to support or drive adoption, and of whether the component parts of that system are prepared and effectively coordinated. Though the timing of true market readiness may be impossible to predict, activities—surveys, interviews, focus groups, and testing with a broad spectrum of stakeholders, could help identify the market's progress (see also the Broad Stakeholder Support section above). Figure 2 illustrates some of the forces driving or resisting change. Forces driving change must effectively overcome the inertia of the status quo.20 These or other factors could be indicators of increasing or declining market readiness.

As conditions change, forces can be added or removed, strengthened or weakened.

Evident demand. Demand for a CBDC may arise from economic or policy interests or both. But no matter what is driving the issuance for a CBDC, both individuals and businesses should be willing to accept a new payment instrument amid the ever-growing array of payment options. As noted above in the section on broad stakeholder support, without basic features that enable usability, market acceptance may be limited. Consumers cite several reasons for choosing a particular payment method; they note convenience, speed, financial incentives, and security, among other factors.21 Even when a new product, such as contactless payments, can improve upon the existing payment, adoption might still be low. A 2020 discussion paper published by the Federal Reserve Bank of Philadelphia, for example, cites lack of awareness, psychological barriers, and misperceptions for the low level of contactless payment adoption.22

A CBDC is likely to face similar initial barriers. While at least one market survey shows a potentially growing interest by consumers in a CBDC, human behaviors are not easy to change. Interest may not translate into future use. The Federal Reserve Bank of San Francisco's 2019 Diary of Consumer Choice report notes, "Even as new payment methods continue to emerge, consumers tend to use the established methods of cash, debit cards, and credit cards for daily spending."23 To the extent that payment behavior is habitual, future research in consumer payment behavior could investigate the relative strengths of the pros and cons for a CBDC from a consumer use perspective in light of existing and potential future options.

Perhaps the most important driver of business demand is the fact that businesses accept the payment methods their customers want to use.24 Most businesses prefer fast, low-cost means for payments. This preference, however, can vary by implementation and organization. Some businesses may accept only cash, while others may have a no-cash policy. For business-to-business payments, a preference for electronic payments is often expressed, though can depend on the size of the operation or other variables.25 Some retail businesses as well want to reduce or eliminate cash to lower handling costs and improve transaction speeds. A Federal Reserve Bank of San Francisco research note, however, highlights that this may come at the expense of financial inclusion and an increase in other costs, including card network fees.26

Evident supply. Turning to the "supply" side of market readiness, the ecosystem structures, hardware infrastructure, and market participants must be ready to accept a CBDC. A CBDC ecosystem includes many functions, such as issuance, distribution, storage, usage, customer service, compliance, reporting, monitoring, and maintenance. To meet market readiness expectations, establishing a new payments rail and/or making upgrades or changes to traditional payment rails must be completed and tested. Establishing new point-of-sale technologies or even modifying existing ones will not be an easy task. Depending on the design of the arrangement, the necessary investment may be cost-prohibitive for some businesses. Even today, the ability to make contactless payments with a credit card or the use of QR codes for payments is not universal in the United States.

In ensuring evident supply, coordination of activities and communication between parties are essential. Coordination activities include establishing standards, creating a process for and an ability to upgrade various elements of the system to incorporate new technological features, functions, and security enhancements. Both individuals and businesses will need operational guidance on how the system will work and what they need to do to use it. Equally important is communication between market participants. Individuals, businesses, banks, payment service operators, the central bank, and others will all need to have a clear understanding of the rights and responsibilities of relevant parties. As discussed at the beginning of this note, money is a social and legal construct that must be fully understood and agreed to by users.

Conclusion

Issuing a CBDC in the United States would not be an easy task. A number of foundational elements would be required. Having clear policy objectives is key in guiding the design of a CBDC. Establishing broad stakeholder support is needed to effect the social and legal changes needed to refine how society thinks about money and how Americans use it. A strong legal framework must provide the legal basis for the issuance, distribution, use, and destruction of a CBDC. Moreover, a CBDC must be supported by robust technology that ensures its safety and efficiency. Lastly, market readiness is needed for widespread acceptance and adoption. These preconditions, and the work it takes to achieve them, are interconnected such that efforts in one area may lead to developments in another. These developments could strengthen or weaken the forces for change towards a general-purpose CBDC issuance. Each of the preconditions on its own will take significant time to achieve, and these preconditions represent only a starting point. As Federal Reserve Chair Jerome Powell recently remarked on CBDCs, "[T]here is a great deal of work yet to be done."27

References

Akana, Tom and Wei Ke, "Contactless Payment Cards: Trends and Barriers to Consumer Adoption in the U.S.," Discussion Paper, No 20-3, Philadelphia: Federal Reserve Bank of Philadelphia, May 2020.

Andolfatto, David (2019), "Assessing the Impact of Central Bank Digital Currencies on Private Banks," Working Paper, No 2018-026, Federal Reserve Bank of St. Louis: December.

Association for Finance Professionals (2019), 2019 AFP Electronic Payments Survey.

Arifovic, Jasmina, John Duffy, and Janet Hua Jiang (2017), "Adoption of a New Payment Method: Theory and Experimental Evidence," Bank of Canada Staff Working Paper, No 2017-28, Ottawa: Bank of Canada, July.

The Bank of Canada, European Central Bank, Bank of Japan, Sveriges Riksbank, Swiss National Bank, Bank of England, Board of Governors of the Federal Reserve and Bank for International Settlements (2020), Central Bank Digital Currencies: Foundational Principles and Core Features, Basel: Bank for International Settlements, October.

Bofinger, Peter and Thomas Haas (2020), "CBDC: A Systemic Perspective," Wurzburg Economic Papers, No 101, Wurzburg: University of Wurzburg, July.

Bostic, Raphael, Shari Bower, Oz Shy, Larry Wall, and Jessica Washington (2020), Digital Payments and the Path to Financial Inclusion, Atlanta: Federal Reserve Bank of Atlanta, September.

Carapella, Francesca, and Jean Flemming (2020), "Central Bank Digital Currency: A Literature Review," FEDS Notes, Washington: Board of Governors of the Federal Reserve System, November 9.

Cheng, Jess (2020), "How to Build a Stablecoin: Certainty, Finality, and Stability Through Commercial Law Principles," Berkeley Business Law Journal, Vol 17:2.

Committee on Payments and Market Infrastructures and Markets Committee (2018), Central Bank Digital Currencies, Basel: Bank for International Settlements, March.

Gilley, Ann, Marisha Godek, and Jerry Gilley (2009), "Change, Resistance, and the Organizational Immune System," SAM Advanced Management Journal, vol 74 no 4, p 4–10.

Greene, Claire and Joanna Stavins (2020), "Consumer Payment Choice for Bill Payments," Research Department Working Papers, No. 20-9, Boston: Federal Reserve Bank of Boston.

Grym, Aleksi (2020), "Lessons Learned from the World's First CBDC," BoF Economics Review, Issue 8, Helsinki: Bank of Finland.

Federal Deposit Insurance Corporation (2020), How America Banks: Household Use of Banking and Financial Services, Washington, DC: FDIC, October 19.

Frost, Jon, Leonardo Gambacorta, Yi Huang, Hyun Song Shin, and Pablo Zbinden (2019), "BigTech and the Changing Structure of Financial Intermediation," BIS Working Papers, No 779, Basel: Bank for International Settlements, April.

Huynh, Kim, Gradon Nicholls, and Oleksandr Shcherbakov (2019), "Explaining the Interplay Between Merchant Acceptance and Consumer Adoption in Two-Sided Markets for Payment Methods," Bank of Canada Staff Working Paper, No. 2019-32, Ottawa: Bank of Canada, August.

Maniff, Jesse Leigh (2020), "Motives Matter: Examining Potential Tension in Central Bank Currency Designs," Main Street Views/Policy insights from the Kansas City Fed, Kansas City: Federal Reserve Bank of Kansas City, July 1.

Powell, Jerome (2020), "Cross-Border Payments—A Vision for the Future," remarks at the International Monetary Fund and World Bank Group Annual Meetings 2020, October 19.

Tweedy, Ann C (2017), "From Beads to Bounty: How Wampum Became America's First Currency," Indian Country Today, October.

Wang, Claire (2019), "Cash Me if You Can: The Impacts of Cashless Businesses on Retailers, Consumers and Cash Use," Fednotes, San Francisco: Federal Reserve Bank of San Francisco, August 19.

Wong, Paul and Jesse Leigh Maniff (2020), "Comparing Means of Payment: What Role for a Central Bank Digital Currency?," FEDS Notes, Washington: Board of Governors of the Federal Reserve System, August 13.

1. The views expressed in this paper are solely those of the authors and should not be interpreted as reflecting the views of the Board of Governors or the staff of the Federal Reserve System. The authors would like to thank Guy Berg and Zofsha Y. Merchant (Federal Reserve Bank of Minneapolis); Jesse Leigh Maniff (Federal Reserve Bank of Kansas City); Joseph R. Torregrossa (Federal Reserve Bank of New York); and David Mills, Stephanie Martin, Lacy Douglas, Brendan Malone, and Sarah Wright (Federal Reserve Board) for their contributions to and assistance with this note. Return to text

2. See Tweedy (2017). Return to text

3. "Bigtech" refers to companies such as Facebook, Microsoft, Amazon, Apple, and Alphabet (Google) with established presence in the information technology sector. See Frost, Gambacorta, Huang, Shin, and Zbinden (2019). Return to text

4. Examples of recent bills include the "Financial Protections and Assistance for America's Consumers, States, Businesses, and Vulnerable Populations Act" (H.R. 6321) introduced by Rep. Maxine Waters on March 23, 2020; "Banking for All Act" (S. 3571) introduced by Senator Sherrod Brown on March 23, 2020; and "Automatic Boost to Communities Act" (H.R. 6553) introduced by Rep. Rashida Tlaib on April 17, 2020. As of October 21, 2020, all remain in committee. Return to text

5. See The Bank of Canada, European Central Bank, Bank of Japan, Sveriges Riksbank, Swiss National Bank, Bank of England, Board of Governors of the Federal Reserve and Bank for International Settlements (2020). Return to text

6. See Committee on Payments and Market Infrastructures and Markets Committee (2018) and Carapella and Flemming (2020). Return to text

7. See Wong and Maniff (2020). Return to text

8. See The Bank of Canada, European Central Bank, Bank of Japan, Sveriges Riksbank, Swiss National Bank, Bank of England, Board of Governors of the Federal Reserve, and Bank for International Settlements (2020). Return to text

9. The rate of unbanked households is the lowest it has ever been since the survey began in 2009. The report notes more than half of unbanked households express no interest in having a bank account. Half of this group cited a lack of funds to meet minimum balance requirements as a reason or the main reason for not having an account, though trust in the banking sector, high or unpredictable fees, and privacy are also factors. See Federal Deposit Insurance Corporation (2020). Return to text

10. See Bostic, Bower, Shy, Wall, and Washington (2020). Return to text

11. See Maniff (2020). Return to text

12. See, for example, Bofinger and Haas (2020); Grym (2020); and Andolfatto (2019). Return to text

13. Section 2A of the FRA provides: "The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy's long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates." Return to text

14. Section 16(1) states, "Federal reserve notes, to be issued at the discretion of the Board of Governors of the Federal Reserve System for the purpose of making advances to Federal reserve banks through the Federal reserve agents as hereinafter set forth and for no other purpose, are hereby authorized." That section of the FRA includes additional provisions prescribing, for example, that Federal Reserve notes bear "upon their faces" a "distinctive letter" and serial numbers and that notes "unfit for circulation" be destroyed. In addition, the Federal Reserve Banks offer a variety of payment services, including check collection and wire transfer services, under the authority of the FRA (see, e.g., FRA sections 13, 14, 16, and 19(f)). Return to text

15. Specifically, Section 31 U.S.C. 5103 states, "United States coins and currency (including Federal reserve notes and circulating notes of Federal Reserve banks and national banks) are legal tender for all debts, public charges, taxes, and dues." Return to text

16. As the U.S. Department of the Treasury further explains in its FAQ with respect to legal tender status: "For example, a bus line may prohibit payment of fares in pennies or dollar bills. In addition, movie theaters, convenience stores and gas stations may refuse to accept large denomination currency (usually notes above $20) as a matter of policy." Available at https://www.treasury.gov/resource-center/faqs/currency/pages/legal-tender.aspx. Return to text

17. See Cheng (2020). Return to text

18. See https://www.justice.gov/ag/page/file/1326061/download. Return to text

19. For example, at the federal level, the Gramm-Leach-Bliley Act applies to "financial institutions" (which includes companies that offer financial products or services to individuals) and addresses protection of consumer personal information both from the aspect of information security (15 U.S.C. § 6801(b)) and also in terms of information-sharing in the course of providing financial services. At the state level, some states also have data privacy and security laws that may apply to financial institutions and financial service providers, and laws generally vary state-by-state. Return to text

20. For a discussion on change resistance and the maintenance of the status quo within organizational systems, see Gilley, Godek, and Gilley (2009). Return to text

21. See, for example, Greene and Stavins (2009). Return to text

22. Many predicted contactless payments and the use of mobile wallets such as Apple or Samsung Pay, but consumer adoption in the United States has been slow. Though COVID-19 has spurred some additional momentum, barriers still remain. See Akana and Ke (2020). Return to text

23. Genesis Mining performed a survey of 400 Americans in July of 2020. It showed a year-over-year increase in respondents answer to the question, "Should the U.S. government replace physical cash with a digital-only dollar?" However, this question is significantly different than whether the U.S. should issue a complement to physical cash, not a replacement. More research in this area is needed. See https://blog.genesis-mining.com/perceptions-and-understanding-of-money-2020-a-note-from-marco-streng Return to text

24. See Huynh, Nicholls, and Shcherbakov (2019) and Arifovic, Duffy, and Jiang (2017). Return to text

25. See Association for Finance Professionals (2019). Return to text

26. See Wang (2019). Return to text

27. Powell (2020). Return to text

Cheng, Jess, Angela N Lawson, and Paul Wong (2021). "Preconditions for a general-purpose central bank digital currency," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, February 24, 2021, https://doi.org/10.17016/2380-7172.2839.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.