FEDS Notes

July 19, 2024

Small-Dollar Loans in the U.S.: Evidence from Credit Bureau Data1

Jessica N. Flagg and Simona M. Hannon2

Small-dollar loans were brought into the spotlight in March 2020, when five agencies—the Board of Governors of the Federal Reserve System, the Consumer Financial Protection Bureau (CFPB), the Federal Deposit Insurance Corporation (FDIC), the National Credit Union Administration (NCUA), and the Office of the Comptroller of the Currency (OCC)—issued a joint statement encouraging their supervised financial institutions to offer such loans to consumers and small businesses in response to the onset of the pandemic.3 The statement also noted that "offering short-term, unsecured credit products for creditworthy borrowers" would be considered favorably for Community Reinvestment Act purposes.4 Gorin et al. (2023) highlight the unusual nature of the guidance, as it encouraged an activity, in contrast with traditional guidance that typically calls attention to areas of concern.

In this note, we focus on small-dollar loans to consumers and provide an overview of this market as reflected in credit bureau data.5 Small-dollar loans have origination amounts of typically less than $1,000 and can be repaid by borrowers in up to several installments. Similar to personal loans in general, small-dollar loans are restricted by interest rate ceilings and by small-loan laws. In addition, other legislative developments, such as the Payday Rule or the dynamic state-level adoption of caps for small loans, also put their mark on the sector.6 Although they are usually issued by payday lenders or finance companies, they can also be originated by depository institutions—banks and credit unions. Against the backdrop of the complex legislative environment for the provision of personal loans (Flagg and Hannon, 2023a), over the past two decades, various programs and initiatives contributed to the development of small-dollar products meant to expand the availability of such loans at depository institutions, with a number of large banks recently introducing small-dollar loan programs (for examples, see Horowitz, 2023).7 As of the end of 2023, the small-dollar loans outstanding that are reflected in traditional credit bureau data amounted to $1.4 billion and consisted of 2.7 million accounts.

In the remainder of this note, we discuss select characteristics of the outstanding small-dollar loan balances reflected in a relatively new data source.

Small-Dollar Loans Outstanding

Data

Similar to our previous paper (Flagg and Hannon, 2023a), in which we examine the personal loan universe in the U.S., we base our analysis on small-dollar loan holdings reflected in the newly released loan-level version of the Federal Reserve Bank of New York Consumer Credit Panel (CCP)/Equifax data, a database on consumers' credit use and payment performance drawn from anonymized Equifax credit bureau records.8 That said, it is important to note that not all small-dollar loan holdings are reported to traditional credit bureaus. Some may be reported to alternative credit scoring companies, such as Clarity Services and DataX, while others may not make use of any rating models. Our CCP sample has coverage of all personal loan (or account) holdings (irrespective of loan size) issued by finance companies—personal loan companies, sales finance companies, and a miscellaneous finance company category—and depository institutions—banks, thrifts, and credit unions—and reflects up to 4 loans per individual.9 Moreover, our data include an indicator that allows the identification of small-dollar loans issued by FinTech lenders and narrative codes that enable the grouping of holdings by product type: secured and unsecured. The latter also includes "other" loans, a category that primarily consists of note loans, lines or credit, and installment sales contracts, among others. Although the CCP data do not contain interest rate information, the tradeline data set that we are using contains narrative codes indicating whether the interest rate on a certain loan is fixed. We define small-dollar loans as those personal loans with a credit limit of $1,000 or less that were opened in the previous two quarters.

As small-dollar loans have much lower incidence than other loan types, to ensure proper coverage, we use the total available nationally representative 5 percent random sample, covering the period between 2010:Q1 and 2023:Q4. As of the end of 2023, the consumer finance CCP loan-level sample showed that nearly 2.7 million individuals, or approximately 1 percent of the entire adult population covered by the CCP, had small-dollar loans.10

Findings

The small-dollar loan sector reflected in credit bureau data reached $1.4 billion and consisted of 2.7 million accounts. The median small-dollar loan balance is $507 and the median monthly payment is $89. Nearly one-third of loan balances are secured, half are fixed rate, and the majority are held by nonprime borrowers—those with Equifax Risk Scores lower than 720. Subprime borrowers—those with Equifax Risk Scores lower than 620—hold almost 70 percent of small-dollar loan balances.

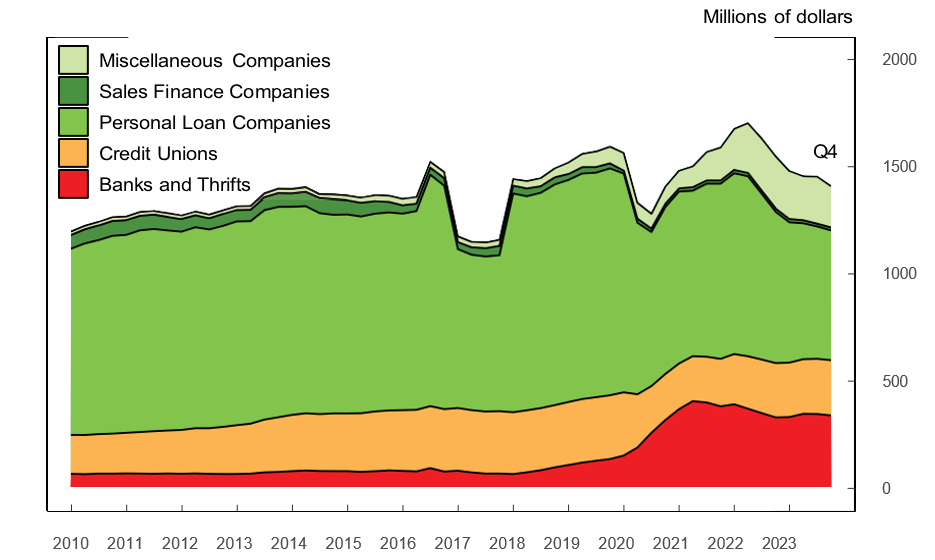

Looking at outstanding balances (Table 1, column I and Figure 1), we note that in contrast to the overall personal loan market that is dominated by depository institutions (Flagg and Hannon, 2023a), the small-dollar loan market is governed by finance companies that hold nearly 60 percent of balances, or $835 million. Among those, personal loan companies—those providing loans directly to consumers—hold the majority of balances, or $625 million. In addition, a growing number of small-dollar loans are being issued by lenders not traditionally classified as finance companies, but that offer such loans (labeled miscellaneous in our data). Within the depository institution sector, small-dollar loans are concentrated at banks, which currently hold 22 percent of total balances or $319 million. The bank share has notably increased since its stable level of around 6 percent prior to 2019. Forthcoming analysis suggests that while some of the increase can be attributed to the joint five-agency encouragement for small-dollar loan issuance (Hannon, a), the larger part of the increase consists of a rise in credit-builder loans (Hannon, c) which are reflected in credit bureau data as traditional loans.11 FinTech lender-issued small-dollar loan balances currently stand at $181 million or 13 percent of the market.

Table 1: Small-Dollar Loan Holdings, by Sector, as of 2023:Q4

| Lender Type | Outstanding Balance (million $) |

Number of Accounts (thousands) |

Borrower Equifax Risk Score (median) |

Borrower Age (median) |

Balance per Account (median$) |

Account Monthly Payment (median $) |

|---|---|---|---|---|---|---|

| I | II | III | IV | V | VI | |

| Depository Institutions | 599 | 1,150 | 602 | 38 | 505 | 85 |

| Banks | 319 | 659 | 590 | 37 | 501 | 48 |

| Thrifts | 6 | 10 | 590 | 44 | 521 | 91 |

| Credit Unions | 274 | 482 | 618 | 42 | 511 | 90 |

| Finance Companies | 835 | 1,533 | 570 | 42 | 527 | 90 |

| Personal Loan | 625 | 1,009 | 557 | 43 | 610 | 95 |

| Sales Finance | 15 | 27 | 587 | 47 | 562 | 55 |

| Miscellaneous | 195 | 498 | 597 | 40 | 354 | 70 |

| FinTech Lenders* | 181 | 452 | 584 | 38 | 342 | 73 |

| In Total | 1,434 | 2,684 | 586 | 40 | 507 | 89 |

Note: Small-dollar loans are identified as those loans opened in the previous two quarters and with a credit limit of $1,000 or less. *Although separately identified in the table, due to FinTech lenders' specific business models, FinTech balances are reflected across sectors. (See Flagg and Hannon, 2023a and Flagg and Hannon, 2023b.)

Source: Authors' calculations using Federal Reserve Bank of New York Consumer Credit Panel (CCP)/Equifax.

Note: Key identifies in order from top to bottom. This figure shows the small-dollar loan outstanding balances by sector. Data are seasonally adjusted.

Source: Authors' calculations using Federal Reserve Bank of New York Consumer Credit Panel (CCP)/Equifax.

Similar to outstanding balances, looking at the number of outstanding small-dollar loan accounts (Table 1, column II), we note that depository institutions hold fewer accounts than finance companies—1.150 million versus 1.533 million. The median finance company account balance is $527, with a median monthly payment of $90, while the median depository institution account balance is $505, with a median monthly payment of $85 (Table 1, columns V and VI). FinTech lenders hold 452,000 accounts, with a median account balance of $342 and a median monthly payment of $73 (Table 1, columns II, V, and VI).

Next, when examining the small-dollar loan sector through the borrowers credit risk profiles lens (Table 1, column III), we note the influence of institutional characteristics. Depository institutions tend to offer small-dollar loans to borrowers with slightly higher credit scores, with credit unions being the most risk averse, while, in contrast, finance companies stay true to their position as a traditional source of credit for riskier borrowers. The median depository institution small-dollar loan borrower Equifax Risk Score is 602, while the median risk score for a finance company account is 570. As FinTech lenders typically focus on marginal consumers (Elliehausen and Hannon, 2024), the median borrower risk score is 584, somewhere in between that for finance company borrowers and depository institution borrowers.

Looking at the borrowers' ages reflected in the CCP data (Table 1, column IV), we find small differences in small-dollar loan holdings. Depository institutions, banks in particular, tend to lend to slightly younger borrowers than finance companies. The median borrower age on a depository institution small-dollar loan account is 38, while that on a finance company account is 42. The median borrower age on a FinTech-issued small-dollar loan account is 38.

Finally, looking at small-dollar loan holdings by product type, borrower risk profile, and status (Table 2), we note that close to one-third of total outstanding balances are secured, half have fixed interest rates, and almost 70 percent are held by subprime borrowers (those with Equifax Risk Scores lower than 620).12 Secured loans are often those backed by collateral such as jewelry, savings accounts, or fine art, but they also include credit-builder loans—those with small origination amounts that are taken by consumers with either no or low credit scores in order to establish or improve their credit profiles. Unsecured loans can also take the form of note loans or promissory notes, which are less formal agreements usually for small-dollar amounts among parties with an existing lending relationship. In terms of both account and balance holdings, depository institutions and finance companies tend to hold different shares of secured, unsecured, and other loans. Depository institutions have more secured and unsecured holdings and almost no other balances or accounts, while finance companies tend to hold notable shares of unsecured and other balances and accounts, and smaller shares of secured holdings. Moreover, we note differences in fixed-rate loan holdings, with depository institutions holding larger shares of fixed-rate loans and balances in comparison to finance companies (about 70 percent relative to about 34 percent). FinTech-issued small-dollar loans are unsecured and nearly half have fixed rates. Exposures to subprime borrowers also vary by sector, with finance companies leading the small-dollar credit offerings for such borrowers, but with depository institutions also offering a notable share of small-dollar loans to subprime borrowers—about 60 percent. Nearly 70 percent of FinTech small-dollar loans are extended to subprime borrowers.

Table 2: Small-Dollar Loan Holdings Characteristics as of 2023:Q4

| Sector Holdings | Secured (%) | Unsecured (%) | Other (%) | Fixed Rate (%) | Subprime (%) | Delinquent (%) |

|---|---|---|---|---|---|---|

| I | II | III | IV | V | VI | |

| All Balance | 28 | 53 | 19 | 49 | 69 | 12 |

| Accounts | 25 | 57 | 18 | 51 | 66 | 10 |

| Depository Institutions | ||||||

| Balance | 38 | 61 | 1 | 70 | 60 | 8.4 |

| Accounts | 33 | 66 | 1 | 68 | 58 | 7.4 |

| Finance Companies | ||||||

| Balance | 21 | 47 | 32 | 34 | 75 | 14.5 |

| Accounts | 18 | 51 | 31 | 38 | 71 | 11.9 |

| FinTech Lenders* | ||||||

| Balance | 0.1 | 67 | 33 | 48 | 67 | 9.9 |

| Accounts | 0.1 | 76 | 24 | 63 | 62 | 7.9 |

Note: Approximately 95 percent of balances and accounts are held by nonprime borrowers, those with Equifax Risk Scores under 720. Subprime is Equifax Risk Score under 620. The shares reflected in the first three columns may not sum to 100 due to rounding. *Although separately identified in the table, due to FinTech lenders' specific business models, FinTech balances are reflected across sectors. (See Flagg and Hannon, 2023a and Flagg and Hannon, 2023b.)

Source: Authors' calculations using Federal Reserve Bank of New York Consumer Credit Panel (CCP)/Equifax.

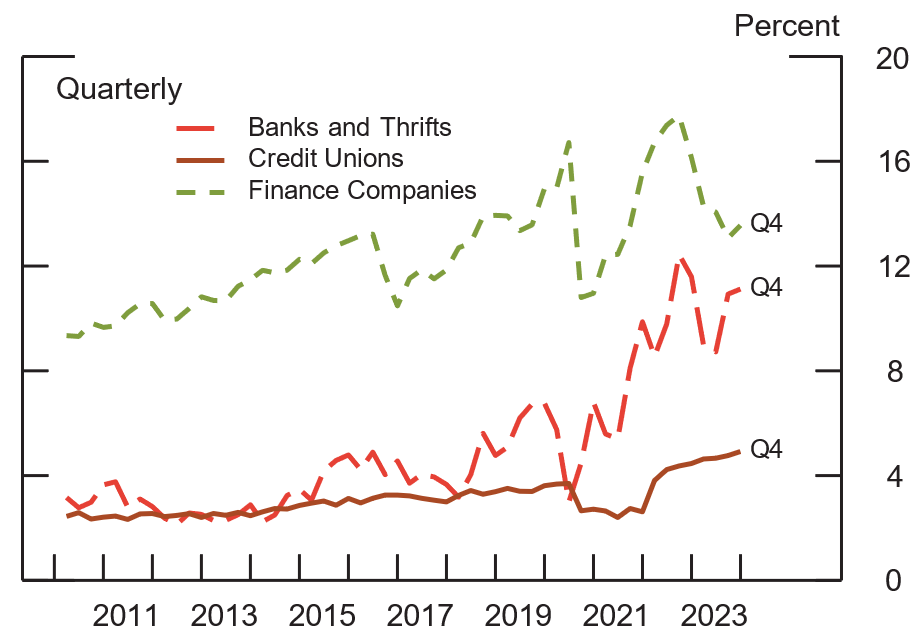

As shown in column VI of Table 2 and in Figure 2, delinquency rates vary by sector and, predictably, tend to be notably higher for finance companies.13 This is in line with the institutional risk segmentation, with banks and credit unions being risk averse and with finance companies being the primary credit provider for higher-risk borrowers. That said, small-dollar loan delinquency rates at banks have started to rise notably after the onset of the pandemic and are now closer to those at finance companies. Delinquency rates on FinTech loans are in between those for loans issued by depository institutions and finance companies.

Note: This figure shows the small-dollar loan delinquency rates by sector. Data are seasonally adjusted.

Source: Authors' calculations using Federal Reserve Bank of New York Consumer Credit Panel (CCP)/Equifax.

References

Elliehausen, G. and S. M. Hannon (2024). FinTech and Banks: Strategic Partnerships That Circumvent State Usury Laws. Finance Research Letters vol. 64, 105387.

Flagg, J. and S. Hannon (2023a). "An Overview of Personal Loans in the U.S.," FEDS Working Paper No. 2023-57. Washington: Board of Governors of the Federal Reserve System.

Flagg, J. and S. Hannon (2023b). "FinTech-Issued Personal Loans in the U.S.," FEDS Notes. Washington: Board of Governors of the Federal Reserve System.

Gorin, D., S. Gosky, and M. Suher (2023). "Empirical Assessment of SR/CA Small-Dollar Lending Letter Impact," FEDS Notes 2023. Washington: Board of Governors of the Federal Reserve System.

Hannon, S. "Effects of the Five-Agency Guidance on Small-Dollar Consumer Loan Issuance," forthcoming.

Hannon, S. "Effects of The Payday Rule," forthcoming.

Hannon, S. "Fiscal Policy and Credit-Builder Loans," forthcoming.

Horowitz, A. (2023, May). Affordable Credit Poised to Save Consumers Billions.

Lee, D. and W. van der Klaauw (2010). "An Introduction to the FRBNY Consumer Credit Panel". Staff Report no. 479, New York: Federal Reserve Bank of New York, November 10.

1. We thank Dan Gorin, Haja Sannoh, and Kamila Sommer for helpful comments and suggestions and David Jenkins for outstanding editing. The views in this note are those of the authors and do not necessarily reflect those of the Board of Governors of the Federal Reserve System or its staff. Return to text

2. Address: Board of Governors of the Federal Reserve System, 20th Street and Constitution Avenue NW, Washington, DC 20551, USA. Email: [email protected].

Address: Board of Governors of the Federal Reserve System, 20th Street and Constitution Avenue NW, Washington, DC 20551, USA. Email: [email protected]. Return to text

3. See Board of Governors of the Federal Reserve System, Consumer Financial Protection Bureau, Federal De- posit Insurance Corporation, National Credit Union Administration, and Office of the Comptroller of the Currency (2020), "Federal Agencies Encourage Banks, Savings Associations and Credit Unions to Offer Responsible Small-Dollar Loans to Consumers and Small Businesses Affected by COVID-19," join press release, March 26. Return to text

4. The guidance was further clarified in May 2020; see Board of Governors of the Federal Reserve System, Federal Deposit Insurance Corporation, National Credit Union Administration, and Office of the Currency (2020), "Federal Agencies Share Principles for Offering Responsible Small-Dollar Loans," joint press release, May 20. Return to text

5. Although small-dollar lending is typically exclusively associated with consumers and not small businesses, the March 2020 guidance was issued as a response to the onset of the pandemic. As a result, it is likely that the goal of the regulators was to inform their supervised institutions of the importance of credit availability to both consumers and businesses. That said, a small business loan or a microloan, as defined by the U.S. Small Business Administration, is up to $50,000 and has an average amount of $13,000. (See: SBA.) Return to text

6. The CFPB's transient and not fully enacted ruling titled Payday, Vehicle Title, and Certain High-Cost Installment Loans (the Payday Rule) temporarily restricted the availability of expensive personal loans starting with the time it was proposed in 2016. Despite its name, the Payday Rule was posed to affect the supply of all expensive small loans, irrespective of type or issuer. The effects of the Payday Rule are discussed by Hannon (b). Over the period of analysis, several states have adopted 36 percent caps on small loans—most recently Nebraska in November 2020, Illinois in March 2021, and New Mexico in January 2023. With the exception of the Payday Rule, which was applicable to high-cost loans across all states, the aforementioned regulatory restrictions apply locally and thus shape lenders' geographical concentration or credit supply. Return to text

7. Among them, the FDIC's Small-Dollar Loan Pilot Program (active between December 2007 and December 2009), the NCUA's ongoing Payday Alternative (PAL) Program (started in 2010), the National Federation of Community Development Credit Unions' Borrow and Save Program (launched in 2011), and, more recently, the aforementioned March 2020 five-agency guidance. Under the FDIC's Small-Dollar Loan Pilot Program, participating banks made small-dollar loans of $1,000 or less and nearly small-dollar loans between $1,000 and $2,500, amounting to 34,400 loans or $40.2 million (see: https://www.fdic.gov/smalldollarloans/). Credit unions are subject to their own 18 percent ceiling for traditional personal loans imposed by the NCUA. After 2010, credit unions were allowed to make small-dollar short-term loans, labeled Payday Alternative Loans (PAL), that can have interest rates of up to 28 percent. The PAL program has two versions: I (with loan amounts ranging between $200 and $1,000 and terms between 1 and 6 months), and II (with loan amounts up to $2,000 and terms between 1 and 12 months); (see: https://www.nafcu.org/compliance-blog/comparing-pals-i-and-pals-ii-loans). Return to text

8. The sampling procedure ensures that the same individuals remain in the sample in each quarter and allows for entry into and exit from the sample, so that the sample is representative of the target population in each quarter. See Lee and van der Klaauw (2010) for a description of the design and content of the CCP. See also https://www.newyorkfed.org/medialibrary/interactives/householdcredit/data/pdf/data_dictionary_HHDC.pdf. Return to text

9. Only sales finance accounts with origination balances of $20,000 or less are reflected in our data. Return to text

10. As of 2023:Q4, the CCP covered 284 million individuals, 241 million with credit scores. Return to text

11. Unlike traditional borrowing, however, prior to issuing such a loan, the lender deposits the funds received from the borrower into a certificate of deposit or savings account that is kept as collateral. The funds eventually become available to the borrower after making some payments or after the final payment is made; see: https://www.equifax.com/personal/education/credit-cards/articles/-/learn/credit-builder-loan/. Return to text

12. The nature of the collateral used to secure loans tends to vary by lender type. Banks usually offer secured loans collateralized by savings accounts or certificates of deposit, while finance companies use other personal goods to secure loans. Return to text

13. Delinquency rates across all sectors tend to be higher for small-dollar loans than for the remainder of personal loans (those with origination amounts larger than $1,000) we observe in our data (not shown). This is likely a reflection of the weaker credit profile of borrowers taking such loans. We previously noted how more than 95 percent of small-dollar accounts and balances are held by nonprime borrowers, those with Equifax Risk Scores under 720. Moreover, we also showed that nearly 70 percent of current issuance is to subprime borrowers, those with credit scores under 620. Return to text

Flagg, Jessica N., and Simona M. Hannon (2024). "Small-Dollar Loans in the U.S.: Evidence from Credit Bureau Data," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, July 19, 2024, https://doi.org/10.17016/2380-7172.3571.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.