FEDS Notes

June 21, 2021

The 104th Anniversary of the Federal Reserve's Oldest Data Collection

Scott Konzem, Virginia Lewis, Suzanna Stephens, Gretchen Weinbach, and Michael Zhang1

The Federal Reserve's oldest data collection, designed to gather weekly information about commercial banks' balance sheets, will turn 104 years old this year. Initiated in December 1917 in response to World War I, this voluntary collection currently underlies the Board's H.8 statistical release, Assets and Liabilities of Commercial Banks in the United States. This Note describes the origins of this collection, some highlights regarding its evolution, and how the data are used today.

Initial motivation

The Federal Reserve launched its collection of weekly bank balance sheet data in December 1917, as the United States' involvement in World War I was intensifying.2 The United States had declared war on Germany in April and was highly engaged that year in providing financial and other support to the war effort. In particular, the United States provided a range of supplies to its allies, including raw materials, munitions, and money, and it was also preparing for direct engagement in the war. As a result, the scale of U.S. federal spending quickly ramped up, and the Treasury began selling war bonds—referred to as Liberty Bonds or Liberty Loans—to finance U.S. war efforts. The Federal Reserve was involved in the marketing and facilitation of Liberty Bond sales, such as by lending to banks at favorable rates when proceeds were used for their purchase.

Against this backdrop, the Federal Reserve initiated a collection of bank balance sheet data to monitor the financial situation in the United States—the state of banking, credit, and financial conditions. The Federal Reserve Board published its rationale for collecting the data, as well as the process for its collection, in the Federal Reserve Bulletin on December 1, 1917:3

"In view of the extensive fiscal operations which will be undertaken by the Government during the period of the war, it has been thought by the Board desirable that those in charge of these operations, the member banks themselves, and the public should be able to have a clear view at all times of the financial situation. To this end the Board has decided that the member banks in about 100 of the most important cities should be requested to transmit once a week to their respective Federal Reserve Banks a condensed statement showing the principal items, such as deposits, loans, investments, cash, Government obligations owned, and loans on such securities. The preparation of these statements will involve but little labor and when tabulated they will reflect quite accurately the changing conditions in money and credit. The information given will thus be valuable to the business community and to the banks. It is intended that the figures be reported to the Federal Reserve Banks at the close of business on Friday of each week, beginning December 7, and that a summary be made by each Federal Reserve Bank and telegraphed to the Federal Reserve Board not later than the following Thursday, for publication when the Board's weekly statement is issued on Saturday."

This fundamental motivation for the collection of these data, referred to as weekly condition reports, has stood since the collection's inception. The collection continues to provide the Federal Reserve with an important source of high-frequency data used in the analysis of current banking developments. In today's vernacular, these data are collected for monetary policy purposes—for understanding the behavior of the banking sector and its role in the macroeconomy.4 The microdata collected from individual respondent banks are treated confidentially.5

What data items were initially collected?

The Federal Reserve Board's original "Form X-538" specified 13 "principle resources and liabilities" items that were regularly collected. This form is shown in Exhibit 1 (PDF) (and explained in Exhibit 2 (PDF)) as it was originally transmitted to Reserve Banks in November 1917, and it is also summarized in Table 1 below.

Table 1. Summary of the Bank Balance Sheet Items on Inaugural Form X-538

(first reported as-of December 7, 1917)

| Assets | Liabilities |

|---|---|

| Total U.S. securities (U.S. bonds, including Liberty bonds; U.S. certificates of indebtedness) | Net demand deposits |

| Loans secured by U.S. bonds and certificates | Time deposits |

| All other loans and investments | Government deposits |

| Reserve balances | |

| Cash in vault |

Each week, the Board received the individual items on form X-538 from each Federal Reserve Bank via telegram. The items were transmitted on a consolidated basis—each Reserve Bank aggregated the underlying data of the respondent banks located in the selected cities in their Federal Reserve district.6 As noted in the table above, the first transmission to the Board covered data as-of the close of business on Friday, December 7, 1917.

What did the inaugural data show?

The first transmission to the Federal Reserve covered about 600 banks from 96 different U.S. cities. The list of participating banks and cities grew over time. Exhibit 4 shows the Federal Reserve's description of the participating cities at the onset of the collection. As shown in the top row of the first table in this attachment, 607 banks initially reported data, and more than a dozen banks were added the following week.

The Federal Reserve regularly published the data it received each week. Exhibit 5 shows data for the first two weeks of these statistics as published in the Federal Reserve Bulletin for January 1, 1918. In the inaugural week of the collection, respondents collectively reported a bit more than $13 billion in assets, comprised of the balance sheet components summarized in Table 2. As indicated, banks generally carried various categories of loans, securities, and deposits.

Table 2. Initial Bank Balance Sheet Data Reported via Form X-538

(as of December 7, 1917; $millions, rounded)

| Assets | |

|---|---|

| Total U.S. securities | 1,763 |

| Loans secured by U.S. bonds and certificates | 374 |

| All other loans and investments | 9,542 |

| Reserve balances | 1,138 |

| Cash in vault | 388 |

| Liabilities | |

| Net demand deposits | 8,391 |

| Time deposits | 1,260 |

How has the data collection evolved over time?

The Federal Reserve has collected data on banks' balance sheets for monetary policy purposes continuously since 1917. Beginning with form X-538, described above, the forms subsequently used to collect these data have evolved over time in terms of the data items reported, respondent coverage, and reporting frequency. In this section we highlight some key events in the evolution of this collection.

The initial collection via form X-538 eventually grew to include three separate reporting forms: one for large domestic banks, one for small domestic banks, and one for foreign-related institutions. The use of separate forms enabled the Federal Reserve to tailor the data items collected to each bank group. Each of these related collections has their own lineage.

- The Federal Reserve relied on its inaugural form X-538 to collect data from domestic banks for many years. Submitted by Federal Reserve System member banks in U.S. "principal cities," the original participating banks likely skewed larger in size. This reporting form subsequently became the FR 416 and was in use until 1979, when the FR 2416 reporting form for large banks was implemented and used for several decades.7

- The Federal Reserve began collecting data from smaller Federal Reserve member banks in 1946. The reporting form used evolved over time, from the initial form FR 635, to the FR 644 starting in 1969, to the FR 2644 form, beginning in 1979 and still in use today.8 The reporting frequency of this segment of the collection also evolved over time; data were initially reported monthly, then semi-monthly beginning in 1959, and then weekly beginning in 1969.

- In 1972, the Federal Reserve began collecting data from U.S. branches and agencies of foreign banks in recognition of these banks' growing U.S. presence. The initial form, the FR 2886a, was reported monthly. The reporting frequency transitioned to weekly in 1979, and in 1981, the FR 2069 reporting form for large U.S. branches and agencies of foreign banks was implemented with an authorized panel size of 50 respondents. This addition to the family of reports enabled the Fed to span all types of commercial banks operating in the United States.

The general framework for the way the Fed collected and utilized data for small domestic banks changed significantly in 1984. At that time, the Board began using a sample approach to estimate bank credit and balance sheet items for the universe of small banks. As a result, a stratified sample of 1,100 banks, including nonmember banks for the first time, was selected to report the FR 2644. For the first time, estimated data for the universe of commercial banks in the United States were published. This practice continues today.

In July 2009, the Board streamlined the way it collected the weekly bank balance sheet data. It combined the three weekly reports into a single reporting form—today's FR 2644 form, Weekly Report of Selected Assets and Liabilities of Domestically Chartered Commercial Banks and U.S. Branches and Agencies of Foreign Banks (OMB No. 7100‑0075). Over the years, the respondent panels and data items collected on the previous three, and the current single, reporting form were occasionally modified. In addition, the Board's data publication also evolved over time along with the reporting forms.9 The FR 2644 collection continues today as the Federal Reserve's only source of high frequency information on banks' balance sheets.

What data are collected now and how are they used?

Today, the weekly FR 2644 reporting form is collected from an authorized sample of more than 800 hundred U.S. domestic banks and branches and agencies of foreign banks.10 Each respondent participates in the data collection on a voluntary basis. Today's FR 2644 sample data account for about 89 percent of the domestic assets of all U.S. commercial banks. To create estimates of the full commercial bank universe, the weekly data are combined with those from quarterly Call Reports to estimate various aggregated balance sheet items for the commercial banking sector as a whole.11 In particular, the Board uses data from the FR 2644 and the Call Reports to construct weekly estimates of aggregate U.S. bank credit (the sum of loans and securities outstanding on commercial banks' books) and numerous other balance sheet items, with a particular emphasis on loans. The content and frequency of the FR 2644 report is carefully reviewed and justified triennially in accordance with OMB's procedures for information collections.12

The Board publishes the data in aggregate form in the weekly H.8 statistical release.13 The H.8 release provides an estimated balance sheet for the banking industry as a whole as well as disaggregated data for three bank groups: large domestically chartered commercial banks, small domestically chartered commercial banks, and foreign-related institutions in the United States. Data items are available in levels (dollar amounts), with most also available as growth rates (annualized percent changes). The data are available at various frequencies (weekly, monthly, quarterly, and annually). In addition, seasonally adjusted and non-seasonally adjusted data are provided for each balance sheet item published in the H.8 release.

In the process of constructing the H.8 growth rate data, some adjustments are made to ensure the data's continuity across non-economic events. Such events include significant structure activity between banks and nonbanks (such as from mergers or acquisitions) as well as national accounting rule changes that result in a discrete change in banks' reporting basis. The "Notes on the Data" that periodically accompany H.8 releases describe these adjustments when they are implemented, including their size and the affected balance sheet components.14

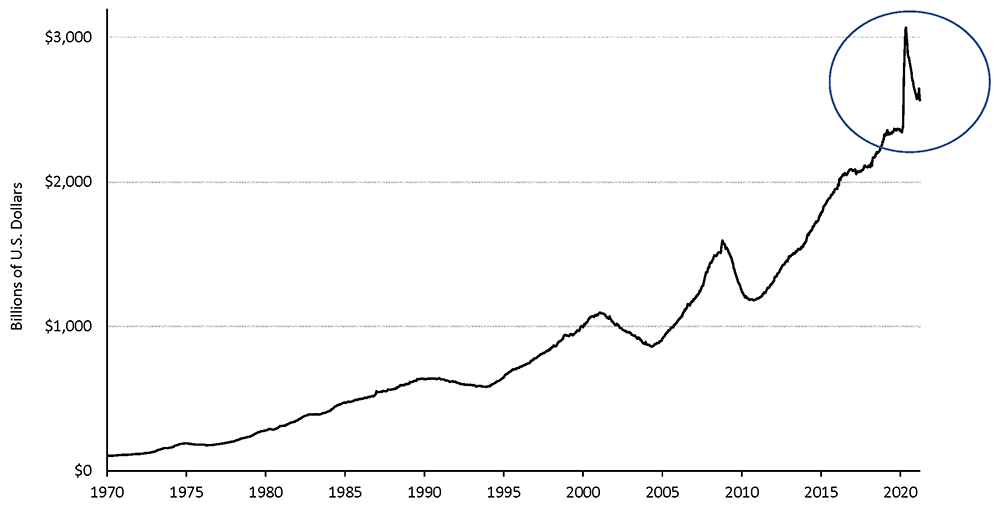

The Federal Reserve tracks the adjusted bank balance sheet data in the context of monitoring broad credit and funding conditions in the United States and abroad, as well as understanding how these conditions influence the economic activity of U.S. households and businesses. Data series constructed from the FR 2644 collection are regularly included in materials prepared for the Board of Governors, the Federal Open Market Committee, and the public, including the semiannual Monetary Policy Report to Congress.15 These data have proven particularly important during periods of rapid change in banking conditions or volatility in financial markets. For example, as shown in Figure 1, the outstanding amount of commercial and industrial loans surged, at an unprecedented pace, in the initial weeks of the onset of the COVID-19 pandemic in March 2019.

Figure 1. Banks' Weekly Commerical and Industrial (C&I) Loans Outstanding, January 1970 ‐ March 2021

Source: H.8 statistical release, Federal Reserve Board (https://www.federalreserve.gov/releases/h8/).

In addition to Federal Reserve staff and other government agencies, these statistics continue to be relied upon by a wide range of public users. The data are regularly cited by financial journalists, analysts, and academics in reviewing banking activity and consumer and business credit conditions.

Exhibit References

Exhibit 1: Letter From Secretary, Nov. 27, 1917, to Federal Reserve Agent, Enclosing Code Words for Use by Federal Reserve Banks in Forwarding Board Consolidated Figures of Weekly Reports of Member Banks Located in Selected Cities, Number X-533, Volume 6, Page 2991 (https://fraser.stlouisfed.org/assets/js/pdfjs/web/viewer.html?file=%2Ffiles%2Fdocs%2Fhistorical%2Fredbooks%2Ffrsbog_mim_v06_2991.pdf (PDF)).

Exhibit 2: Letter From Governor, Federal Reserve Board, Nov. 19, 1917, re Requesting Member Banks to Forward Weekly Statements to Their Federal Reserve Banks, & a Summary of Such Statements by Federal Reserve Banks to Federal Reserve Board, Number X-517, Volume 6, Page 2980 (https://fraser.stlouisfed.org/assets/js/pdfjs/web/viewer.html?file=%2Ffiles%2Fdocs%2Fhistorical%2Fredbooks%2Ffrsbog_mim_v06_2980.pdf (PDF)).

Exhibit 3: Mimeograph Letters and Statements of the Board, January 1916 - December 1917, [Volume 6], page 3998 (https://fraser.stlouisfed.org/assets/js/pdfjs/web/viewer.html?file=%2Ffiles%2Fdocs%2Fhistorical%2Fredbooks%2Ffrsbog_mim_v06_complete.pdf#page=525).

Exhibit 4: Federal Reserve Bulletin, January 1, 1918, pp 61-2 (https://fraser.stlouisfed.org/assets/js/pdfjs/web/viewer.html?file=%2Ffiles%2Fdocs%2Fpublications%2FFRB%2F1910s%2Ffrb_011918.pdf#page=65).

Exhibit 5: Federal Reserve Bulletin, January 1, 1918, pp 63-4 (https://fraser.stlouisfed.org/assets/js/pdfjs/web/viewer.html?file=%2Ffiles%2Fdocs%2Fpublications%2FFRB%2F1910s%2Ffrb_011918.pdf#page=67).

1. Konzem, Lewis, Stephens, Weinbach, and Zhang are staff in the Division of Monetary Affairs at the Federal Reserve Board currently responsible for compiling and publishing the H.8 statistical release. Return to text

2. This information is based on the essay, "Federal Reserve's Role During WWI" by Phil Davies, available at the following link: https://www.federalreservehistory.org/essays/feds-role-during-wwi. Return to text

3. See Federal Reserve Bulletin, December 1917, page 921 (https://fraser.stlouisfed.org/title/federal-reserve-bulletin-62/december-1917-21101). Return to text

4. The Board's Legal Division has determined that the FR 2644 is authorized by section 2A and 11(a)(2) of the Federal Reserve Act (12 U.S.C. §§ 225(a) and 248(a)(2)) and by section 7(c)(2) of the International Banking Act (12 U.S.C. § 3105(c)(2)) and is voluntary. Return to text

5. Individual respondent data, which began to be transmitted to the Board in 1959, are regarded as confidential under the Freedom of Information Act (5 U.S.C. § 552(b)(4)) and are not shared with the public. Also, these data are only shared inside the Federal Reserve System for monetary policy purposes; in particular, staff performing bank supervisory functions do not have access to the data. Return to text

6. The exception to this description of data aggregation was the calculation of the data item "Government deposits," which was to also include certain balances—Liberty Loans and U.S. certificate accounts—recorded on the books of each Reserve Bank; see Exhibit 3. Return to text

7. The FR 2416 reporting form was also known as the Weekly Report of Assets and Liabilities for Large Banks; OMB No. 7100 0075. Its last Supporting Statement to the Office of Management and Budget (OMB) is available at this link: https://www.federalreserve.gov/boarddocs/reportforms/formsreview/FR2069_FR2416_FR2644_20070117_omb.pdf Return to text

8. At that time, the FR 2644 reporting form was also known as the Weekly Report of Selected Assets; OMB No. 7100 0075. Return to text

9. The lineage of the H.8 statistical release is depicted in "Federal Reserve Board Statistical Releases: a Publications History," by Sian Seldin, FEDS 2016-16, Figure 4: https://www.federalreserve.gov/econresdata/feds/2016/files/2016016pap.pdf#page=53. (Prior to the time frame described in this lineage, data associated with the collection were published in the Federal Reserve Bulletin.) Return to text

10. Specifically, as of April 2021, the authorized maximum respondent panel size for the FR 2644 was 875 domestically chartered commercial banks and U.S. branches and agencies of foreign banks. Respondents represent all 12 Federal Reserve Districts as well as a range of bank sizes. Return to text

11. "Call Reports" refers to the following four regulatory reports: The Consolidated Reports of Condition and Income (FFIEC 031, FFIEC 041, and FFIEC 051; OMB No. 7100‑0036) and the Report of Assets and Liabilities of U.S. Branches and Agencies of Foreign Banks (FFIEC 002; OMB No. 7100‑0032). Every national bank, state member bank, insured state nonmember bank, and U.S. branch and agency of a foreign bank is required to file a consolidated Call Report normally as of the close of business on the last calendar day of each calendar quarter. The specific reporting requirements for a bank depend upon the size of the bank, whether it has any foreign offices, and the capital standards applicable to the bank. More information on Call Reports may be found at this link: https://www.ffiec.gov/ffiec_report_forms.htm. Return to text

12. The Paperwork Reduction Act of 1995 requires that U.S. federal government agencies obtain Office of Management and Budget (OMB) approval before requesting or collecting most types of information from the public. For information on the Paper Work Reduction Act, see: https://www.usability.gov/how-to-and-tools/guidance/pra-overview.html. For general information on OMB's report clearance process, see: https://www.usability.gov/how-to-and-tools/guidance/traditional-clearance-process.html. Information about federal agencies' information collections may be found in the Federal Register: https://www.federalregister.gov/. The FR 2644 reporting form and instructions are available to the public at this link: https://www.federalreserve.gov/apps/reportforms/reportdetail.aspx?sOoYJ+5BzDa9jexXCdkUSw==. Return to text

13. See https://www.federalreserve.gov/releases/h8/current/default.htm. Return to text

14. See the H.8 "About" page for more information on the various adjustments made to the data, available at this link: https://www.federalreserve.gov/releases/h8/about.htm. H.8 "Notes on the Data" may be found at this link: https://www.federalreserve.gov/releases/h8/h8notes.htm. Return to text

15. The Federal Reserve's Monetary Policy Report is available at this link: https://www.federalreserve.gov/monetarypolicy/mpr_default.htm. Return to text

Konzem, Scott, Virginia Lewis, Suzanna Stephens, Gretchen Weinbach, and Michael Zhang (2021). "The 104th Anniversary of the Federal Reserve's Oldest Data Collection," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, June 18, 2021, https://doi.org/10.17016/2380-7172.2921.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.