FEDS Notes

July 30, 2021

U.S. Zombie Firms: How Many and How Consequential?1

Giovanni Favara, Camelia Minoiu, and Ander Perez-Orive

The unprecedented fiscal and monetary policy support in the wake of the COVID-19 pandemic has brought to the fore concerns that cheap credit could fuel the financing of zombie firms—that is, firms that are unable to generate enough profits to cover debt-servicing costs and that need to borrow to stay alive. Many observers have recently commented that zombie firms may crowd out lending to productive firms and erode the strength of the U.S. economy.2

In this note, we present new facts about zombie firms in the United States that help inform this debate: we identify zombie firms and estimate the share of such firms among private and publicly listed firms; discuss their main characteristics; and examine their ability to tap credit markets before and after the onset of the pandemic.

Our main finding is that zombie firms are not a prominent feature of the U.S. economy. Among both private and publicly listed firms, zombie firms are few in number and generally small; they are mostly concentrated in the manufacturing and retail sectors and account for a small share of total credit to nonfinancial firms. Furthermore, the share of listed firms that we identify as zombies displays a cyclical pattern, rising in recessions and falling during expansions, likely reflecting a mix of aggregate and industry-specific shocks.

While these findings shed new light on the nature and importance of zombie firms in the U.S. economy, assessing whether the pandemic-driven recession and the unprecedented fiscal and monetary support that it triggered could lead to the proliferation of zombie firms remains an open question that can only be addressed as more data become available.

Identifying Zombie Firms

There is no formal definition of a zombie firm, but it is generally agreed that these firms are economically unviable and manage to survive by tapping banks and capital markets (Caballero, Hoshi, and Kashyap 2008). Accordingly, we identify zombie firms in U.S. data by requiring that they are highly leveraged and unprofitable.3 More precisely, we require that zombie firms have leverage above the sample annual median, interest coverage ratio (ICR) below one, and negative real sales growth over the preceding three years.4 High leverage and low ICR help identify firms that cannot cover their debt-servicing costs, while negative sales growth identifies firms with low growth prospects, as sales growth is a good predictor of firms' future performance.5

We use data from two main sources. For publicly listed firms, we obtain financial information from Compustat. For private firms, the data source is the supervisory FR Y-14Q database, which contains annual balance sheet data for firms borrowing from banks that are subject to supervisory stress tests. The FR Y-14Q data has the advantage that it provides the most comprehensive coverage of private U.S. firms.6

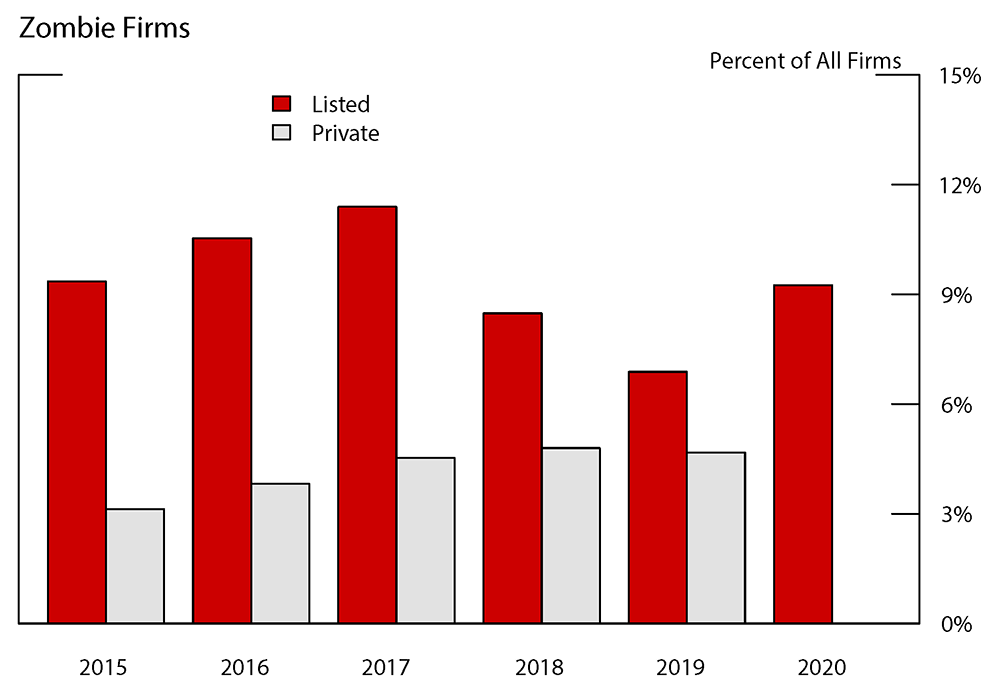

As shown in Figure 1, between 2015 and 2019, our filters select roughly 10 percent of public firms and five percent of private firms as zombies. For listed firms—for which balance sheet data are available—we also estimate that the share of firms in zombie status in 2020 remains in the single digits despite the severity of the COVID-19 recession.

Note: This figure plots the share of publicly listed and private firms in zombie status during 2015-20. The share of private firms in zombie status for 2020 is missing because the latest available data on firms' financials in FR Y-14Q is 2019.

Source: Authors' calculations based on S&P Global, Compustat, Wharton Research Data Services, http://wrds.wharton.upenn.edu/; Federal Reserve Board, Y-14.

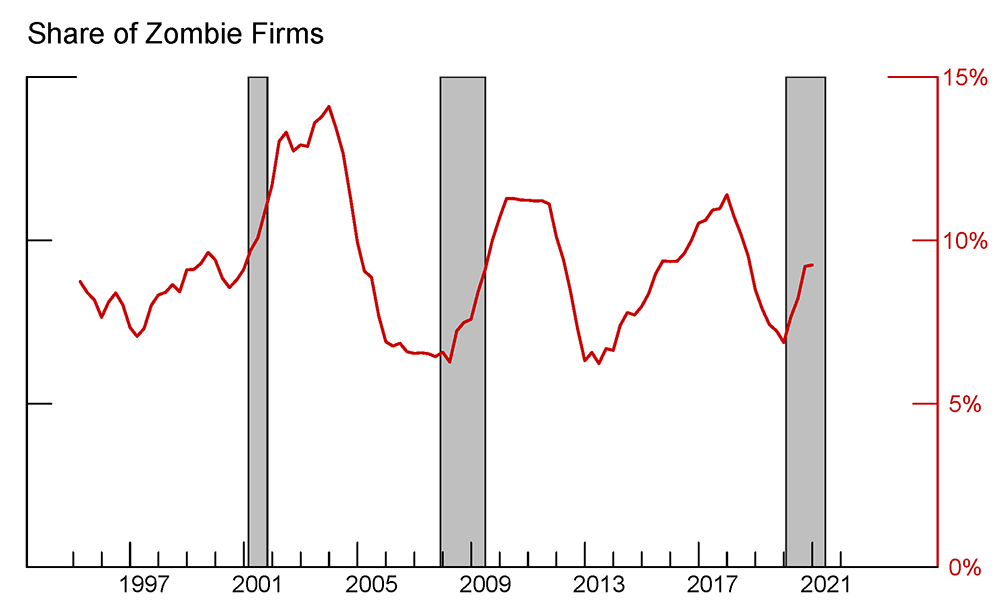

Looking back further in time, Figure 2 shows that for listed firms the share of zombies since 2000 was not much different than in recent years. Over the past 20 years, we estimate that this share has fluctuated within a narrow range and closely tracks business cycles and industry dynamics, such as the decline of the oil and gas sector starting in 2014.

Note: This figure plots the share of publicly listed firms that are in zombie status during 2000-20. The shaded bars indicate periods of business recession as defined by the National Bureau of Economic Research: January 1980–July 1980, July 1981–November 1982, July 1990–March 1991, March 2001–November 2001, and December 2007–June 2009.

Source: Authors' calculations based on S&P Global, Compustat, Wharton Research Data Services, http://wrds.wharton.upenn.edu/; NBER.

How do our estimated shares of zombie firms compare with those typically reported in the financial press and the academic literature? Figure 3 summarizes this information with U.S. data. The financial press usually identifies as zombies those firms that are mature and have ICRs below one, while the typical metric used by the academic literature adds the condition that firms have high leverage and rely on cheap bank credit—that is, banks granting loans to firms at interest rates that are below those charged to the most creditworthy firms (e.g., AAA-rated).7 .

Note: This figure plots the share of publicly listed firms (left panel) and the share of private firms (right panel) that are in zombie status according to alternative measures. The financial press measure considers firms that are mature and have ICRs below one to be zombies. The metric used by the academic literature adds to a low ICR requirement the condition that firms have high leverage and rely on cheap bank credit (that is, firms pay interest rates that are below those applied to the most creditworthy (AAA-, AA-, or A- rated) companies).

Source: Authors' calculations based on S&P Global, Compustat, Wharton Research Data Services, http://wrds.wharton.upenn.edu/; Federal Reserve Board, Y-14.

The estimates reported in Figure 3 show that our filters identify a lower share of zombie firms than are generally reported by the financial press and the academic literature, both for private and publicly listed firms. One likely explanation is that we require firms to not only have limited debt-servicing capacity, but also bleak growth prospects.8

Characteristics and Lifecycle of Zombie Firms

A question of interest is whether zombie firms are widespread across industries or concentrated in a few declining sectors. Focusing on firms identified as zombies at the end of 2019, Figure 4 shows that while listed firms classified as zombies are highly concentrated in the manufacturing sector, zombies among private firms are over-represented relative to nonzombie firms in the retail trade sector, manufacturing and in the mining, oil, and gas industry.

Note: This figure plots the industry distribution of publicly listed firms (left panel) and that of private firms (right panel) by zombie and nonzombie status at the end of 2019. The industry classification is based on two-digit NAICS classification. Sectors with shares of zombie firms lower than four percent are omitted.

Source: Authors' calculations based on S&P Global, Compustat, Wharton Research Data Services, http://wrds.wharton.upenn.edu/; Federal Reserve Board, Y-14.

Another question of interest is whether zombie firms are perceived by investors as riskier than nonzombie firms. Figure 5 shows that the vast majority of firms identified as zombies at the end of 2019 are rated speculative-grade, based either on Standard and Poor's (S&P) ratings for listed firms or on banks' internal assessment of risk for private firms. In addition, banks appear to assess that a nonnegligible share of private zombie firms is at risk of imminent default with little prospect for recovery—that is, with rating below CCC.9

Note: This figure focuses on credit ratings of firms with zombie and nonzombie status at the end of 2019. In the left panel, the credit ratings distribution is based on S&P ratings of publicly listed firms; in the right panel, the ratings distribution is based on banks' internal rating scores mapped to the S&P ratings scale.

Source: Authors' calculations based on S&P Global, Compustat, Wharton Research Data Services, http://wrds.wharton.upenn.edu/; S&P Global, RatingsDirect; Federal Reserve Board, Y-14.

How does the typical zombie firm compare with nonzombie firms along key balance sheet characteristics? Using data between 2015 and 2019, the entries in Table 1 suggest that among publicly listed firms (columns 1-2), those in zombie status are smaller in size, have lower return on assets, hold less cash and have lower investment opportunities (as reflected by a lower Tobin's q) than their nonzombie counterparts. For private firms, the average zombie firm is comparable in size, but is less profitable and holds less cash than other firms. With the exception of asset size for private firms, the p-values of equality of medians for zombie and nonzombie firms (columns 3 and 6) indicate that these differences are not only economically large but also statistically significant.

Table 1. Characteristics of U.S. Zombie Firms

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Listed firms | Private firms | |||||

| Zombie | Nonzombie | p-value (1)=(2) | Zombie | Nonzombie | p-value (4)=(5) | |

| Size (assets in $ mn) | 374.6 | 1,191.2 | 0.00 | 24.7 | 24.7 | 0.98 |

| Return on assets | -3.4 | 6.8 | 0.00 | 2.8 | 12.2 | 0.00 |

| Cash (% assets) | 6.4 | 8.3 | 0.00 | 2.8 | 5.8 | 0.00 |

| Tobin's q | 0.8 | 5.7 | 0.00 | - | - | - |

Note: This table reports sample medians of key firm characteristics for publicly listed firms (columns 1-2) and respectively private firms (columns 4-5) in zombie and nonzombie status during the 2015-19 period, with a p-value for nonparametric test of equality of medians across the two groups (columns 3 and 6). The samples are restricted to those firms with sufficient data to be classified as either zombie or nonzombie.

Source: Authors' calculations based on S&P Global, Compustat, Wharton Research Data Services, http://wrds.wharton.upenn.edu/; Federal Reserve Board, Y-14.

Figure 6 sheds light on another important question about zombie firms, namely the ability of these firms to stay in business despite their low profitability. The left panel of Figure 6 depicts the duration of zombie status, defined as the number of consecutive years that a firm had been in zombie status, given that it was classified as such in 2019. As shown, the zombie status of listed firms is not very persistent. Most zombie firms have been in this status for less than five years, with the maximum duration being eight years.

Note: This figure reports the distribution of zombie status duration for publicly listed firms in zombie status in 2019 (left panel), where duration is defined as the number of years that zombie firm has been in that status; and the bankruptcy rates for firms in zombie status and distressed firms in nonzombie status during 2015-19 (right panel), where distressed firms are in the top quartile of default probability based on the naïve version of the Merton distance-to-default model of Bharath and Shumway (2008).

Source: Authors' calculations based on S&P Global, Compustat, Wharton Research Data Services, http://wrds.wharton.upenn.edu/; S&P Global, Global Market Intelligence; Federal Reserve Board, Y-14; Mergent/FISD.

One likely explanation why firms tend to exit the zombie status after a few years is bankruptcy. Indeed, the right panel of Figure 6 shows that between 2016 and 2020, zombie firms filed for bankruptcies at a rate that is significantly higher than that of even distressed nonzombie firms—defined as firms that are in the top quartile of the probability of default distribution across all firms. Interestingly, as indicated by the 2020 bar in this panel, the number of zombie firms that sought bankruptcy protection through either chapter 7 or chapter 11 has more than doubled in 2020, likely as a result of the deterioration of economic conditions following the COVID-19 pandemic. The evidence in this panel points to the potentially beneficial role of U.S. bankruptcy laws, which through debt restructuring and corporate reorganization may alleviate debt overhang (Ponticelli and Alencar 2016, Favara et al. 2017) and shorten the duration of firms' zombie status (McGowan and Andrews, 2018).

Zombie Firms' Financing in Normal Times and During the Pandemic

We next evaluate zombie firms' ability to borrow in the bond and loan markets. As shown in Figure 7, the share of nonfinancial business credit to zombie firms is small: between 2015 and 2020, issuance of corporate bonds by zombie firms is less than five percent of total bond issuance (left panel) and bank credit exposure to zombie firms is below seven percent of total bank credit exposure (right panel).

Note: This figure reports the share of total bond issuance volume (left panel) and bank credit utilization (right panel) of firms in zombie status during 2015-19.

Source: Authors' calculations based on S&P Global, Compustat, Wharton Research Data Services, http://wrds.wharton.upenn.edu/; Mergent/FISD; Federal Reserve Board, Y-14.

Furthermore, in 2020, zombie firms accounted for an even smaller share of the total bonds issued than before the pandemic, and their outstanding bank credit relative to total bank credit to nonfinancial firms is lower than in previous years. Taken together, these findings suggest that zombie firms not only had limited access to external financing in normal times, but they also did not disproportionately tap the bond or bank loan markets to raise new money during the pandemic.

Figure 8 provides additional insights about the credit conditions available to zombie firms in 2020. The left panel plots the distribution of interest rates that zombie firms and nonzombie firms with high default probability (distressed nonzombie firms) paid on their outstanding debt in 2020. As shown, zombie firms borrowed in 2020 at interest rates that were higher, on average, than those paid by distressed nonzombie firms. In addition, as reported in the right panel, zombie firms reduced their leverage throughout 2020, in stark contrast to all nonzombie firms, which increased debt balances in the first two quarters of 2020, likely as a result of the corporate "dash for cash" that translated into outsized issuance of corporate bonds and drawdowns of credit lines (Acharya and Steffen, 2021, Brunnermeier and Krishnamurthy, forthcoming).

Note: The left panel reports the interest rate distribution for firms in zombie status and for distressed firms in nonzombie status in 2020. The right panel reports the change in aggregate outstanding balances relative to the previous quarter for zombie and nonzombie firms. In the left panel, the interest rate is computed as interest expenses divided by total outstanding debt; and distressed firms are in the top quartile of default probability based on the naïve version of the Merton distance-to-default model of Bharath and Shumway (2008).

Source: Authors' calculations based on S&P Global, Compustat, Wharton Research Data Services, http://wrds.wharton.upenn.edu/.

Altogether, the evidence indicates that zombie firms did not benefit much more than comparable nonzombie firms from the easing of financing conditions in 2020. If anything, these firms reduced their leverage and, when they borrowed, they did so at higher rates than those paid by nonzombie firms close to default. There is also no indication that zombie firms benefitted much from the credit and lending facilities that the Federal Reserve created in support of credit conditions amid the COVID-19 pandemic. For example, none of the firms that in our sample were classified as zombies in 2019 participated in the Secondary Market Corporate Credit Facility and only one firm borrowed under the Main Street Lending Program.

Zombie Firms and Banks

The academic literature usually points to a weak banking sector as a key factor facilitating the emergence and the survival of zombie firms. Caballero, Hoshi, and Kashyap (2008), for example, document that in the 1990s, the rise of zombie firms in Japan was spurred by undercapitalized banks that continued to lend to unprofitable firms for fear of having to recognize losses on banks' portfolios. More recently, Acharya et. al (2019) and Blattner, Farinha and Rebelo (2019) show that in the aftermath of the Global Financial Crisis, weak European banks directed cheap credit to nonviable firms, keeping these firms alive.10

Motivated by this evidence, we examine how U.S. banks assess the risk of lending to zombie firms. Table 2 reports several risk attributes of bank lending using data on loans outstanding during 2015-19. In contrast to the typical finding of the academic literature for foreign economies, we find that U.S. banks do not seem to offer credit at favorable terms to zombie firms. In fact, U.S. banks on average charge zombie firms higher loan spreads, require more collateral and offer shorter-maturity loans than nonzombie firms. Moreover, banks appear to assess zombie firms as having higher probability of default and systematically rate their credit ratings to be lower than those of the other firms.

Table 2. Characteristics of U.S. Bank's Loans to Zombie Firms

| (1) | (2) | (3) | |

|---|---|---|---|

| Zombie | Nonzombie | p-value (1)=(2) | |

| Loan spread (bps) | 212 | 142 | 0.00 |

| Collateralization rate | 0.91 | 0.85 | 0.00 |

| Maturity (years) | 6.32 | 6.68 | 0.00 |

| Probability of default | 0.16 | 0.03 | 0.00 |

| Internal bank rating | B | BB | 0.00 |

Note: This table reports sample means of key characteristics for loan facilities to firms in zombie and nonzombie status (columns 1-2) and the p-value for two-sided t-test of equality of means across the two groups (column 3). The sample refers to all bank loan facilities outstanding during 2015-19. The p-value for the rating is based on the bank's numerical rating mapped to the S&P rating scale, ranging from 1 for AAA-rated firms to 10 for D-rated firms.

Source: Federal Reserve Board, Y-14.

Altogether, the evidence in this and the previous sections suggests that U.S. banks not only have limited credit exposure to zombie firms, but they also lend to zombie firms at terms suggesting an elevated assessment of credit risk.

Main Takeaways

In this note, we provide a panoramic view of the prevalence of zombie firms in the U.S. economy. Our main assessment is that zombie firms—defined as nonviable firms with low growth prospects that survive on cheap credit—are not an important feature of the U.S. economy, so far, and did not benefit disproportionally from the improvement in credit market conditions resulting from the unprecedented fiscal and monetary support following the outbreak of the COVID-19 pandemic.

Despite this assessment, it is too early to dismiss concerns that the current economic conditions may be breeding new zombie firms. The COVID-19 pandemic is an economic shock of unprecedented magnitude, and while its potential scarring effects on the economy are difficult to predict, it may severely damage some sectors of the economy, turning many firms into zombies. Whether this risk materializes can only be assessed as new data become available and will depend on the strength of the economic recovery post pandemic.

References

Acharya, V. Viral, Eisert, Tim, Eufinger, Christian, and Hirsch, Christian 2019." Whatever it takes: The real effects of unconventional monetary policy." Review of Financial Studies 32(9): 3366-3411.

Acharya, V. Viral and Steffen, Sascha. 2020. "The risk of being a fallen angel and the corporate dash for cash in the midst of COVID." Review of Corporate Finance Studies 9(3): 430–471.

Arrowsmith, Martin, Griffiths, Martin, Franklin, Jeremy, Wohlmann, Evan, Young, Gary, and Gregory, David. 2013. "SME forbearance and its implications for monetary and financial stability." Bank of England Quarterly Bulletin Q4.

Albertazzi, Ugo, and Marchetti, Domenico J. 2010. "Credit supply, flight to quality and evergreening: An analysis of bank-firm relationships after Lehman." Bank of Italy Working Paper No. 756.

Banerjee, Ryan, and Hofmann, Boris. 2018. "The rise of zombie firms: Causes and consequences." BIS Quarterly Review September.

Banerjee, Ryan, and Hofmann, Boris. 2020. "Corporate zombies: Anatomy and life cycle." BIS Working Paper No. 882.

Bharath, Sreedhar T., and Shumway, Tyler. 2008. "Forecasting default with the Merton distance to default model." Review of Financial Studies 21(3): 1339-1369.

Bidder M. Rhys, John R. Krainer, and Shapiro, Adam Hale. 2021. "De-leveraging or de-risking? How banks cope with loss." Review of Economic Dynamics 39:100-127.

Bonfim, Diana, Cerqueiro, Geraldo, Degryse, Hans, and Ongena, Steven. 2020. "On-site inspecting zombie lending." CEPR Discussion Paper DP14754.

Brunnermeier, Markus, and Krishnamurthy, Arvind. Forthcoming. "Corporate debt overhang and credit policy." Brooking Papers of Economic Activity.

Caballero, Ricardo J., Hoshi, Takeo, and Kashyap, K. Anil. 2008. "Zombie lending and depressed restructuring in Japan." American Economic Review, 98(5): 1943-77.

Favara, Giovanni, Ivanov, Ivan, T., and Rezende, Marcelo. Forthcoming. "GSIB surcharges and bank lending: Evidence from U.S. corporate loan data." Journal of Financial Economics.

Favara, Giovanni, Morellec, Erwan, Schroth, Enrique, and Valta, Philip. 2017. "Debt enforcement, investment, and risk taking across countries." Journal of Financial Economics 123(1): 22-41.

McGowan, Adalet M. and Andrews, Dan. 2018. "Design of insolvency regimes across countries." OECD Economics Department Working Paper 1504.

McGowan, Adalet M., Andrews, Dan, and Millot, Valentine. 2018. "The walking dead? Zombie firms and productivity performance in OECD countries." Economic Policy 33(96): 685-736.

Peek, Joe, and Rosengren, Eric S. 2005. "Unnatural selection: Perverse incentives and the misallocation of credit in Japan." American Economic Review 95(4): 1144-1166.

Ponticelli, Jacopo, and Alencar, Leonardo S. 2016. "Court enforcement, bank loans, and firm investment: Evidence from a bankruptcy reform in Brazil." The Quarterly Journal of Economics 131(3): 1365-1413.

Schivardi, Fabiano, Sette, Enrico, and Tabellini, Guido. 2017. "Credit misallocation during the European financial crisis." Bank of Italy Working Paper No. 1139.

Schivardi, Fabiano, Sette, Enrico, and Tabellini, Guido. 2020. "Identifying the real effects of zombie lending." Review of Corporate Finance Studies 9(3): 569-592.

1. We are grateful to Rochelle Edge, Dalida Kadyrzhanova, Andreas Lehnert, and Min Wei for helpful comments, and Craig Chikis and Quinn Danielson for excellent research assistance. Return to text

2. See, for instance, "Here's one more economic problem the government's response to the virus has unleashed: Zombie firms" (Washington Post, June 23, 2020), "The rescues ruining capitalism" (Wall Street Journal, July 24, 2020), "March of zombie companies just gets louder in the stock market" (Bloomberg, July 18, 2020), "Pandemic debt binge creates new generation of 'zombie' companies" (Financial Times, September 13, 2020), "The corporate undead—What to do about zombie firms" (The Economist, September 26, 2020). Return to text

3. One would also like to impose an age requirement, as young firms, unable to generate profits, may erroneously be classified as zombie firms. Firm age, however, is difficult to measure for both private and publicly listed firms. Our findings should therefore be interpreted with the caveat that we may classify as zombies those firms that are unable to generate profits because of the early stage of their lifecycle. Return to text

4. The ICR is defined as the ratio of earnings before interest and taxes over interest expenses. Return to text

5. McGowan, Andrews, and Millot (2018), and Banerjee and Hoffman (2018, 2020) use similar, albeit less restrictive, criteria to identify zombie firms in an international panel of publicly listed firms. McGowan, Andrews, and Millot (2018) require that zombie firms be at least 10 years old and have an ICR less than one for at least three consecutive years. Banerjee and Hoffman (2020) add to these requirements the condition that firms' Tobin's q be lower than the industry median. Return to text

6. The supervisory FR Y-14Q database is maintained by the Federal Reserve to assess, regulate, and supervise banks and financial institutions with at least $100 billion in total consolidated assets. Starting in 2012, the data contain annual balance sheet information of firms that have outstanding C&I loan commitments exceeding $1 million. The FR Y-14Q excludes information from small banks and very small businesses, but it covers roughly three quarters of total U.S. commercial and industrial lending (Bidder, Krainer, Shapiro, 2021; Favara, Ivanov and Rezende, forthcoming). Our earliest estimate of zombie firms in FR Y-14Q is 2015, as we require that zombie firms have negative real sales growth over the preceding three years. Return to text

7. See, Caballero, Hoshi, and Kashyap (2008), Acharya et al (2019), Schivardi, Sette, and Tabellini (2017, 2020) as examples of academic work, and "The rescues ruining capitalism," Wall Street Journal (July 24, 2020) or "Here's one more economic problem the government's response to the virus has unleashed: Zombie firms," Washington Post (June 23, 2020) as examples from the financial press. Return to text

8. We estimate shares of zombie firms that are similar to those reported by the financial press and the academic literature if we drop the requirement that firms have bleak growth prospects. Return to text

9. The distributions of industry and ratings classifications are broadly similar over the 2015-19 period. Return to text

10. For Japan, see also Peek and Rosengren (2005). For European economies see also Albertazzi and Marchetti (2010) and Schivardi, Sette and Tabellini (2017, 2020) for Italy; Bonfim et al. (2020) for Portugal; and Arrowsmith et al (2013) for England. Return to text

Favara, Giovanni, Camelia Minoiu, and Ander Perez-Orive (2021). "U.S. Zombie Firms: How Many and How Consequential?," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, July 30, 2021, https://doi.org/10.17016/2380-7172.2954.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.