IFDP Notes

September 22, 2017

The Sensitivity of the U.S. Dollar Exchange Rate to Changes in Monetary Policy Expectations

I. Introduction

The prospect of rising U.S. interest rates has focused attention on the response of the dollar to changes in monetary policy expectations, especially given some evidence that the dollar has become more responsive to policy surprises during the post-crisis period. For example, Federal Reserve Board Governor Brainard stated that "changes in expectations regarding the path of policy in the United States relative to other major economies lead to exchange rate movements that appear to be several times bigger than they were several years ago,"1 and linked this behavior to research suggesting that this is the "byproduct of an economy operating near the effective lower bound where the ability to provide additional support in response to negative shocks is limited." 2

This note summarizes recent work in the International Finance Division of the Federal Reserve Board on the relationship between movements in exchange rates and monetary policy expectations. Many factors drive exchange rates. This work focuses on shifts in the value of the dollar immediately following central bank announcements to identify the effect of changes in monetary policy expectations, and discusses recent trends. The approach is similar to a growing body of research, including Ferrari et al (2016), Glick and Leduc (2013, 2015), Hausman and Wongswan (2011), Kearns and Manners (2006), Rogers et al. (2015), and Rosa (2011).

Summarizing our main results, our estimates suggest that historically the dollar has appreciated between 2.5 and 5 percent against most other currencies following a 100 basis point surprise increase in U.S. monetary policy expectations. The reaction of exchange rates to changes in the difference between U.S. and foreign expected policy rates following announcements by foreign central banks is a similar magnitude, and in some cases even greater. This sensitivity of the dollar to changes in monetary policy expectations varies across currencies and measures of policy expectations, as well as across time. We leave further study of the variation over time to future research.

II. Exchange Rate Reaction to Unexpected Changes in Monetary Policy Expectations

If a policy move is consistent with market expectations, this information should already be incorporated into exchange rates, and policy rate changes which were consistent with expectations should have little impact on the exchange rate. In contrast, unexpected increases in the differential between domestic and foreign interest rates will cause the domestic currency to appreciate. The academic literature has attributed this appreciation to the increased attractiveness of domestic assets, which attract foreign capital inflows (Dornbusch (1976), Frankel (1979), and Eichenbaum and Evans (1995)).

The usual starting point for studying the relationship between exchange rates and interest rates is the theory of Uncovered Interest Parity (UIP), which states that the expected nominal dollar returns from investing in two similar bonds denominated in different currencies should be equal to each other:

where X is the exchange rate (expressed as foreign currency per dollar) at time t in k years, and if,t and id,t are the annualized holding period return on foreign and domestic interest rates, respectively.

Taking logs of the UIP equation and adding the assumption that the nominal exchange rate is mean-reverting yields a model in which if there is a shock that causes U.S. interest rates to rise, then the dollar will immediately appreciate by an amount proportional to the change in the interest rate differential:

The quantity in parenthesis is the unexpected change in interest rate differentials over the event window, or the "surprise" dS.

To estimate equation (1), we regress the change in exchange rates on interest rate surprises following FOMC announcements:

where dXi is the log change in the exchange rate i, dSj is the change in policy rate expectations ("surprise") estimated using changes in interest rate or interest rate differential j, and ϵi is an error term. A positive value of dXi represents appreciation of the base currency (usually U.S. dollars), and a positive value of dSj represents an increase in the differential between base currency interest rates and foreign rates ("interest rate differential"). Equation (1) suggests that β (the "sensitivity") should be positive. In our estimation, β is scaled to represent the percent change in the exchange rate corresponding to a 100 basis point increase in expected policy rates; in other words, β equal to 1 means that on average the dollar appreciates by 1 percent following a 100 basis point surprise.

Data and Methodology

We estimate equation (1) across a variety of exchange rates; the Data Appendix provides additional information and a table of summary statistics. We use three trade-weighted dollar indexes (advanced economy, emerging economy, and broad) and bilateral exchange rates between the U.S. and seven countries/regions (Euro Area, United Kingdom, Canada, Japan, Mexico, Brazil, Korea).3

We use two measures of policy surprises. The first is the overnight change in the USD Overnight Index Swap (OIS) rate at the two-year horizon. This measure is appealing because it contains information about changes in both the current level of the U.S. short rate as well as the expected path of future short rates.

Because, theory suggests it is changes in interest rate differentials which drive exchange rate movements, rather than changes in domestic rates alone, we also use a differential based measure of surprises. Since unexpected changes in interest rates are transmitted across economies (Craine and Martin (2008), Fratzscher et al. (2013), Rogers et al. (2014)), and Gilchrist et al. (2014)), a U.S. surprise could in principle be accompanied by an equal surprise move in foreign policy expectations, with little net impact on interest rate differentials and the dollar.

As shown in Table 1, the amount of OIS rate spillover can indeed be substantial. We estimate the spillover by regressing changes in foreign currency OIS rates on changes in USD OIS rates following FOMC and foreign central bank rate announcements. We find there is significant movement in the OIS rates of countries not experiencing a policy announcement. OIS forward rates in the other countries move up to 60 percent as much as OIS rates in the country where the policy announcement is being made. To capture these spillovers, we subtract the change in the foreign currency OIS forward rates from the change in USD OIS forward rates, and use this difference as the surprise for the four advanced foreign economies where there is an active OIS market—Germany, Canada, Japan and the United Kingdom. We also combine changes in these foreign OIS rates into an Advanced Foreign Economy (AFE) aggregate OIS rate.4

Table 1: Foreign Currency OIS Rate Changes on Central Bank Rate Announcement Days

$$$\displaystyle d\left(Foreign OIS\right)_t=\mu + \gamma d\left(Domestic OIS\right)_t + \epsilon_t$$$

| Events | Domestic OIS | Foreign OIS | γ | T-statistic | N | R2 |

|---|---|---|---|---|---|---|

| FOMC Announcement Days | USD | EUR | 0.37*** | (6.81) | 60 | 0.324 |

| GBP | 0.59*** | (5.30) | 60 | 0.271 | ||

| CAD | 0.58*** | (11.82) | 60 | 0.587 | ||

| JPY | 0.02 | (1.31) | 60 | 0.020 | ||

| ECB Announcement Days | EUR | USD | 0.45*** | (7.92) | 80 | 0.224 |

| GBP | 0.56*** | (9.40) | 80 | 0.345 | ||

| CAD | 0.32*** | (5.05) | 79 | 0.228 | ||

| JPY | 0.00 | (0.25) | 80 | 0.001 | ||

| BOE Announcement Days | GBP | USD | 0.44*** | (6.29) | 87 | 0.244 |

| EUR | 0.59*** | (8.47) | 87 | 0.296 | ||

| CAD | 0.39*** | (5.23) | 87 | 0.195 | ||

| JPY | 0.05*** | (2.71) | 87 | 0.047 | ||

| BOC Announcement Days | CAD | USD | 0.10 | (1.49) | 60 | 0.016 |

| EUR | 0.05 | (0.85) | 60 | 0.009 | ||

| GBP | 0.34*** | (6.89) | 60 | 0.240 | ||

| JPY | -0.00 | (-0.37) | 60 | 0.001 | ||

| BOJ Announcement Days | JPY | USD | 0.82*** | (2.94) | 96 | 0.074 |

| EUR | 0.13 | (0.72) | 97 | 0.005 | ||

| GBP | 0.59** | (2.05) | 97 | 0.018 | ||

| CAD | 0.25 | (0.93) | 97 | 0.007 |

Notes: Estimation on domestic central bank event dates using robust regression. Positive γ means there is a positive covariance between changes in foreign and domestic OIS rates on domestic central bank announcement dates. ***, ** and * denote significance at the 1%, 5% and 10% level, respectively.

The estimations use two sample periods. The full sample starts in January 2002 when USD OIS swap data are first available on Bloomberg, and ends in June 2017. Our estimations begin in 2010 when the surprise is based on changes in policy differentials, because foreign OIS swap data become fully available January 2010.

Dollar Sensitivity to Changes in OIS Forward Rates

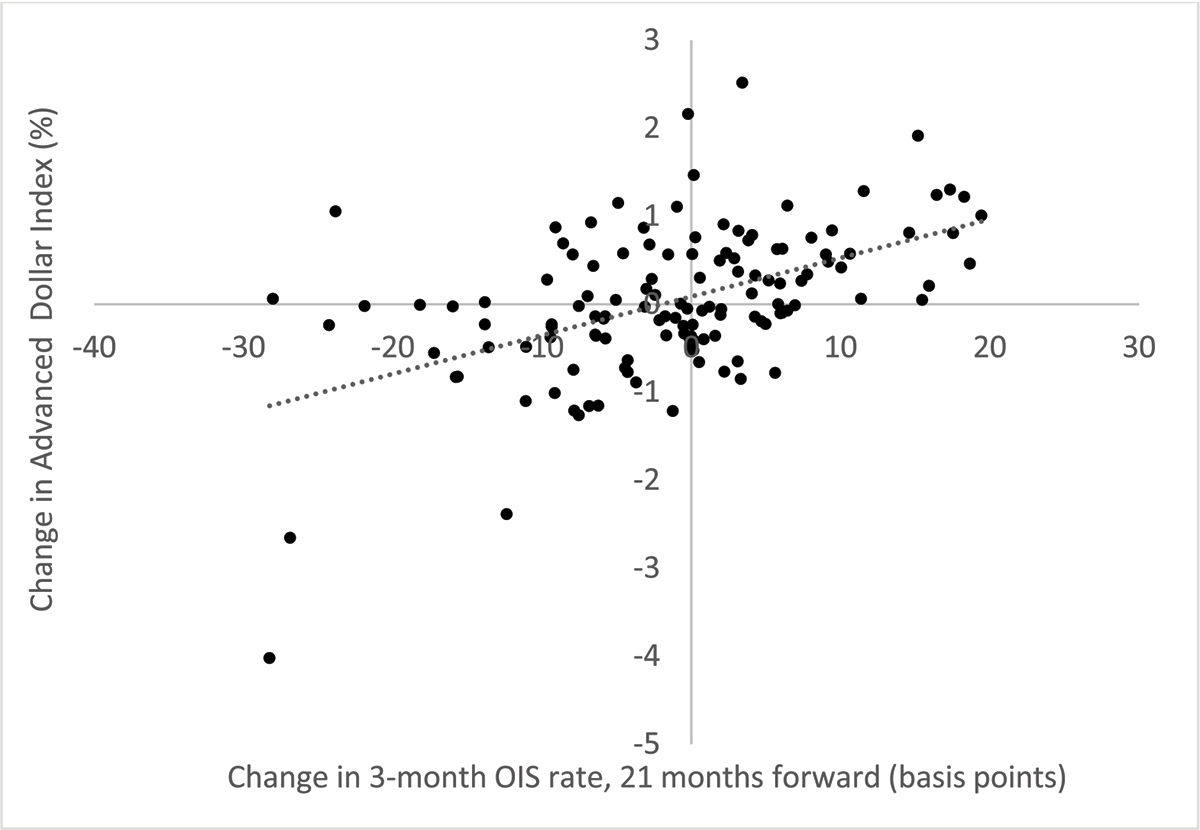

Notes: Daily changes on FOMC announcement days January 2002-June 2017. The dotted line represents the prediction of a linear regression through the data.

Figure 1 plots movements in the Federal Reserve Board's advanced economy dollar index on FOMC announcement days, against changes in short-term policy rate expectations as measured by movements in USD OIS forward rates. There is a wide range of past experience, with exchange rates occasionally depreciating in response to increases in expected policy rates as well as appreciating much more strongly than average.

Consistent with theory, the slope of the regression line through the data in Figure 1 is positive. The slope of this line is shown in Table 2, which also includes estimates of equation (2) for other exchange rates using movements in the forward USD OIS rate as the surprise.5 For the 2002-2017 sample period the β's are positive and highly significant for all the indexes and bilateral exchange rates shown, and are similar across advanced and emerging economy currencies. For the advanced index, the β of 3.41 implies that a 100 basis point increase in the OIS forward rate corresponds to a 3.41 percent appreciation of the advanced dollar index. The Japanese yen reacts most strongly, with an estimated appreciation of over 5 percent following a 100 basis point move in the OIS forward. The β for the emerging index is on the lower end of the range, in part because the currencies of several emerging market economies are actively managed. The magnitude of these estimated sensitivities are similar to those in Kearns and Manners (2006), Rosa (2011), and Glick and Leduc (2013) among others, even though those studies use different measures of exchange rate surprise.

Table 2: Changes in the U.S. Dollar and USD Forward OIS Rates on FOMC Announcement Days

$$$\displaystyle dX_{i,t}=\alpha + \beta dS_{j,t} + \epsilon_{i,t}$$$

| Xi | Advanced | Broad | Emerging | EUR | GBP | CAD | JPY | MXN | BRL | KRW |

|---|---|---|---|---|---|---|---|---|---|---|

| Estimation period: Jan. 2002-June 2017 | ||||||||||

| β | 3.41*** | 2.15*** | 1.25*** | 3.61*** | 2.87*** | 1.86*** | 5.04*** | 2.06*** | 2.25** | 2.76*** |

| (5.74) | (5.35) | (5.06) | (4.73) | (4.54) | (3.09) | (6.92) | (3.24) | (2.39) | (4.27) | |

| α | 7.80 | 1.15 | -2.10 | 12.08 | -1.92 | 6.37 | 4.40 | -1.48 | 7.13 | -2.20 |

| (1.35) | (0.29) | (-0.87) | (1.63) | (-0.31) | (1.09) | (0.62) | (-0.24) | (0.78) | (-0.35) | |

| No. obs. | 130 | 130 | 130 | 130 | 130 | 130 | 130 | 130 | 130 | 130 |

| R2 | 0.140 | 0.121 | 0.112 | 0.108 | 0.098 | 0.045 | 0.200 | 0.059 | 0.032 | 0.074 |

| Estimation period: Jan. 2010-June 2017 | ||||||||||

| β | 4.83*** | 3.60*** | 2.52*** | 5.68*** | 3.94*** | 2.23* | 6.34*** | 4.39*** | 2.47 | 4.73*** |

| (3.92) | (4.08) | (3.80) | (3.66) | (3.35) | (1.78) | (4.64) | (2.82) | (1.37) | (3.46) | |

| α | 13.40 | 7.42 | 3.20 | 19.42 | 1.48 | 6.44 | 9.55 | 0.28 | 15.23 | 14.43 |

| (1.41) | (1.09) | (0.63) | (1.62) | (0.16) | (0.67) | (0.91) | (0.02) | (1.10) | (1.37) | |

| No. obs. | 60 | 60 | 60 | 60 | 60 | 60 | 60 | 60 | 60 | 60 |

| R2 | 0.185 | 0.181 | 0.146 | 0.184 | 0.141 | 0.039 | 0.212 | 0.094 | 0.024 | 0.149 |

Notes: Estimation using robust regression. A positive β indicates dollar appreciation. The surprise Sj is the change in 1-month USD OIS rate, 23 months forward. T-statistics in parentheses. ***, ** and * denote significance at the 1%, 5% and 10% level, respectively.

As hinted at in the introduction, the dollar appears more sensitive to changes in policy expectations in the post-crisis period, shown in the bottom half the table. The estimated β is higher for every index and currency, and many of the differences are statistically significant. For example, the sensitivity of the advanced index rises to almost 5 percent appreciation for a 100 basis point increase in the OIS forward rate. For the other exchange rates, the sensitivity ranges from 2.2 to 6.3 percent per 100 basis points. There is a discussion of the higher sensitivity in recent years in Section III.

Dollar Sensitivity to Changes in OIS Differentials

Measures of dollar sensitivity based on changes in OIS forward differentials are larger than estimates based on changes in USD OIS forward rates alone because of cross-border policy rate spillovers. Table 3 shows the results of estimating equation (2) using the change in OIS forward differentials as the surprise measures. In the first column we use our AFE weighted exchange and policy rates. In the other columns we use bilateral exchange rates and the change in the difference between the USD and individual foreign currency rate OIS rate as the surprise.

Table 3: Changes in the U.S. Dollar and USD - AFE OIS Differentials

$$$\displaystyle dX_{i,t}=\alpha + \beta dS_{j,t} + \epsilon_{i,t}$$$

| Sj | USD - AFE | USD - EUR | USD - GBP | USD - CAD | USD - JPY |

|---|---|---|---|---|---|

| Xi | Advanced | EUR | GBP | CAD | JPY |

| β | 6.71*** | 5.92*** | 3.08** | 5.04** | 6.64*** |

| (3.52) | (2.74) | (2.36) | (2.49) | (4.69) | |

| α | 13.02 | 19.51 | -0.53 | 6.96 | 8.27 |

| (1.33) | (1.57) | (-0.06) | (0.74) | (0.78) | |

| No. obs. | 60 | 60 | 60 | 60 | 60 |

| R2 | 0.154 | 0.112 | 0.070 | 0.074 | 0.209 |

Notes: Estimation using robust regressions on FOMC announcement days. A positive β indicates dollar appreciation. The surprise Sj is difference in the change of the 1-month USD and foreign OIS rates, 23 months forward. T-statistics in parentheses. ***, ** and * denote significance at the 1%, 5% and 10% level, respectively.

The cross-border spillovers result in smaller changes in the policy differentials than changes in USD OIS rates alone, as some of the U.S. policy surprise is offset by corresponding movements in policy expectations abroad. As a result, the estimated β's in Table 3 are higher than those in Table 2 because the surprise measure used in the estimation includes the offsetting foreign surprise. For example, the advanced index is estimated to appreciate about 6.7 percent following an unexpected 100 basis point appreciation of the USD – AFE OIS differential, higher than the estimate of 4.8 percent in Table 2 which does not include the AFE OIS offset. There are also increases in the sensitivities for the individual AFE currencies, though the increase is statistically significant only for the Canadian dollar.

Using this machinery, we also examine the reaction of exchange rates to unexpected changes in policy rates associated with foreign central bank announcements. We find that for some countries the reaction of the bilateral dollar exchange rates to foreign policy surprises, in Table 4, is stronger than the reaction of those exchange rates to FOMC-related surprises. Because exchange rate changes are still measured from the U.S. dollar perspective, a negative β means the dollar depreciates following a widening of the spread between foreign and USD OIS forward rates. The β estimates for the sensitivity to the change in the foreign currency–USD OIS forward differential, shown in the right columns, is over -8 following Bank of Canada announcements, and almost -9 following European Central bank announcements. We are studying this strong sensitivity of the dollar to foreign central bank announcements in ongoing research.

Table 4: Reaction on Foreign Central Bank Rate Announcement Days

$$$\displaystyle dX_{i,t}=\alpha + \beta dS_{j,t} + \epsilon_{i,t}$$$

| Sj | Foreign Currency OIS Rate | Foreign Currency OIS Rate - USD OIS Rate | ||

|---|---|---|---|---|

| European Central Bank Announcement Days, Xi=EUR | ||||

| β | -8.89*** | (-9.61) | -8.82*** | (-6.91) |

| α | 2.47 | (0.36) | 2.17 | (0.27) |

| No. obs. | 80 | 80 | ||

| R2 | 0.431 | 0.332 | ||

| Bank of England Announcement Days, Xi=GBP | ||||

| β | -3.65*** | (-3.64) | -2.98** | (-2.47) |

| α | 8.78 | (1.53) | 6.31 | (1.07) |

| No. obs. | 87 | 87 | ||

| R2 | 0.095 | 0.047 | ||

| Bank of Canada Announcement Days, Xi=CAD | ||||

| β | -8.77*** | (-8.70) | -8.23*** | (-7.81) |

| α | 0.12 | (0.02) | -0.10 | (-0.01) |

| No. obs. | 60 | 60 | ||

| R2 | 0.480 | 0.477 | ||

| Bank of Japan Announcement Days, Xi=BOJ | ||||

| β | -18.92*** | (-4.85) | -5.75*** | (-4.56) |

| α | -16.61** | (-2.20) | -15.08** | (-2.41) |

| No. obs. | 97 | 97 | ||

| R2 | 0.100 | 0.125 | ||

Notes: Estimation of using robust regressions on foreign central bank announcement days. As in earlier tables, exchange rate changes are measured from the USD perspective, so negative β indicates dollar depreciation when there is a widening of the foreign currency - USD differential. T-statistics in parentheses. ***, ** and * denote significance at the 1%, 5% and 10% level, respectively.

III. Variation in the Dollar Sensitivity over Time

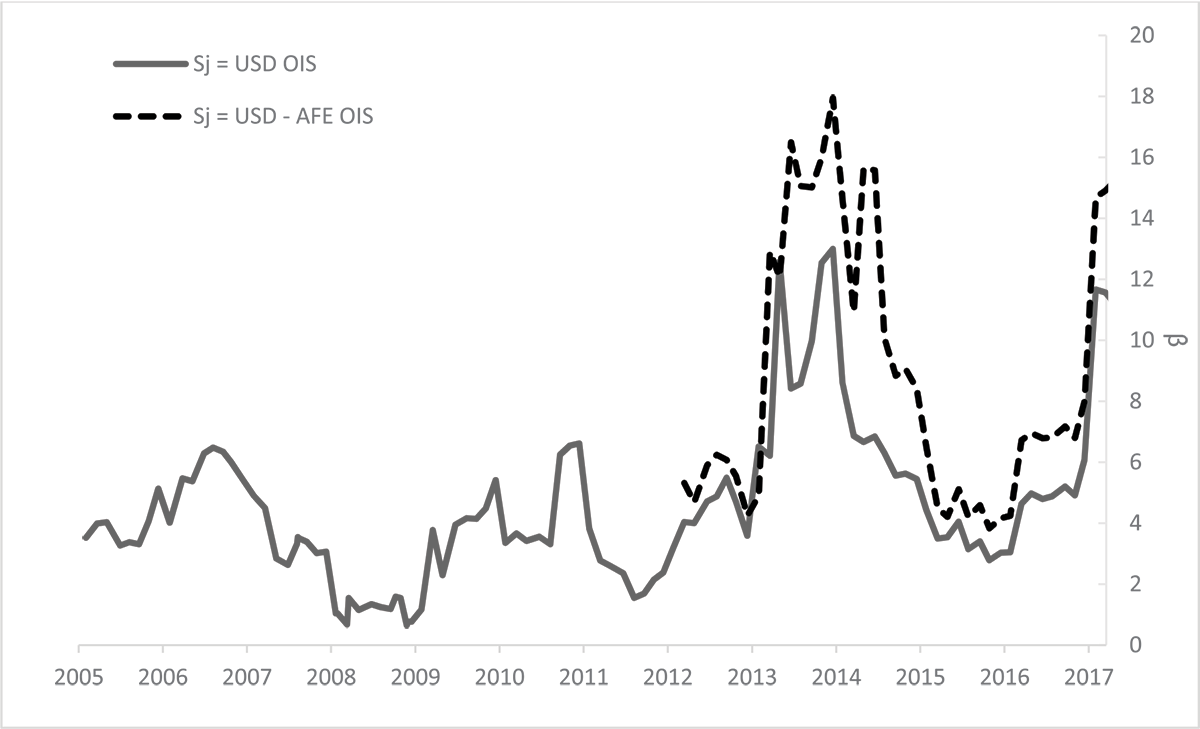

As noted in the introduction, communication by Federal Reserve officials has drawn attention to time variation in the sensitivity of the dollar to changes in monetary policy expectations. This can be seen in Figure 2, which plots the β from equation (2) estimated in a rolling 2-year window for a regression of the changes in the advanced dollar index on the changes in the USD OIS forward rates on FOMC announcement days. The β briefly hits 12 following the "taper tantrum" episode of May 2013, falls back, and then reaches 12 once again in mid-2017. The β for the USD-AFE OIS differential also rises over time, reaching 15 at the end of the sample period. This post-crisis increase in sensitivity is also noted in Glick and Leduc (2015), Rogers et al. (2015), and Ferrari et al. (2016).

Notes: Estimation of β using rolling 2-year robust regressions on FOMC announcement days. Xi is the advanced dollar index.

The variation in sensitivity could be the result of structural breaks in the relationship between exchange rates and policy expectations, which we test for using a supremum Wald test (Andrews (1993)). A significant test statistic indicates that the null hypothesis of no structural break is rejected. When the USD OIS forward rate is the surprise measure, in the top half of Table 5, the Wald test statistics indicate the presence of a statistically significant structural break in β for the three dollar indexes, and the euro, yen and Korean won bilateral exchange rates. Most of the significant breaks occurred in late 2008 during the peak of the global financial crisis, and for all the significant breaks the values of β in the post-break periods are statistically significant and larger than the pre-break β's.

Table 5: Structural Break Tests

$$$\displaystyle dX_{i,t}=\alpha + \beta dS_{j,t} + \epsilon_{i,t}$$$

| Wald | Pre-break | Post-break | ||||||

|---|---|---|---|---|---|---|---|---|

| Sj | Xi | Statistic | P-value | Break Date | β | T-stat | β | T-stat |

| Estimation period: Jan. 2002-June 2017 | ||||||||

| USD OIS | Advanced | 12.00** | 0.04 | 16-Dec-2008 | 2.41*** | (3.69) | 4.91*** | (4.16) |

| Broad | 17.02*** | 0.00 | 16-Dec-2008 | 1.19*** | (2.88) | 4.03*** | (5.02) | |

| Emerging | 16.23*** | 0.01 | 22-Jun-2011 | 0.90*** | (4.29) | 3.39*** | (4.13) | |

| EUR | 13.28** | 0.02 | 16-Dec-2008 | 2.24*** | (2.67) | 5.81*** | (3.89) | |

| GBP | 5.44 | 0.49 | 18-Mar-2008 | 1.66** | (1.99) | 3.10*** | (3.55) | |

| CAD | 6.90 | 0.30 | 18-Mar-2008 | 1.40** | (2.08) | 2.52*** | (2.46) | |

| JPY | 10.22* | 0.09 | 16-Dec-2008 | 3.47*** | (3.76) | 7.71*** | (6.20) | |

| MXN | 9.43 | 0.12 | 21-Sep-2011 | 1.25** | (2.27) | 6.92*** | (3.58) | |

| BRL | 3.51 | 0.81 | 18-Mar-2009 | 1.35 | (1.17) | 2.09 | (1.21) | |

| KRW | 23.91*** | 0.00 | 23-Jun-2010 | 1.75*** | (2.96) | 5.11*** | (3.66) | |

| Estimation period: Jan. 2010-June 2017 | ||||||||

| USD OIS - AFE OIS | Advanced | 7.64 | 0.23 | 22-Jun-2011 | 9.74** | (1.99) | 6.83*** | (3.30) |

| Broad | 7.28 | 0.27 | 22-Jun-2011 | 6.14* | (1.91) | 4.73*** | (3.06) | |

| Emerging | 5.81 | 0.44 | 21-Sep-2011 | 1.57 | (1.09) | 3.78*** | (2.89) | |

| USD OIS - EUR OIS | EUR | 7.55 | 0.24 | 16-Dec-2015 | 4.43** | (2.09) | 14.88 | (1.59) |

| USD OIS - GBP OIS | GBP | 14.73** | 0.01 | 22-Jun-2011 | 5.75* | (1.68) | 4.41*** | (3.08) |

| USD OIS - CAD OIS | CAD | 19.10*** | 0.00 | 16-Dec-2015 | 4.30** | (2.23) | 7.79 | (0.45) |

| USD OIS - JPY OIS | JPY | 8.20 | 0.19 | 22-Jun-2011 | 7.41*** | (2.66) | 6.89*** | (4.21) |

Notes: Results from supremum Wald test on equation (1) on all FOMC rate announcements days in sample period. ***, ** and * denote significance at the 1%, 5% and 10% level, respectively.

In addition to structural breaks around the beginning of the financial crisis, for a couple of currencies we also find structural within the post-crisis period. In the bottom half of Table 5 we test for structural breaks after 2010, using OIS differentials as the surprise measure. There are significant structural breaks for the British pound in June 2011 and the Canadian dollar in June 2015.6 Unlike the top half of the table, the β estimates are not higher for the post-break period. We also tested for a structural break in June 2014 when the dollar began a multi-month run of appreciation, using a Chow (1960) test for equal coefficients before and after the break. In results not shown, the break was not statistically significant for any currency except the Korean won.

In sum, there appears to be a break in the relationship between changes in exchange rates and monetary policy expectations at the start of the crisis, with a higher sensitivity in the post-crisis period. Several explanations have been put forward for this increased sensitivity, but there is no consensus on the cause, and previous periods of heightened sensitivity did not persist. Ferrari et al. (2016) cites the growth of algorithmic trading and the speed at which market participants process monetary policy news. Glick and Leduc (2015) and Rogers et al. (2015) point to the limited movements in short-term rates in the post-crisis period, and the introduction of unconventional monetary policy actions such as forward guidance and asset purchases. We leave a more thorough study of the time-varying β for further research.

IV. Two Applications

We conclude with two applications. First, we use the estimation results to predict the response of exchange rates to changes in interest rates over longer time horizons. Between June 2014 and June 2017 the dollar indexes appreciated about 20 percent (Table 6). During this period, the cumulative change in the advanced economy interest rate differential was 109 basis points. Applying the β equal to 3.41 from Table 2 to the change results in a predicted appreciation of only 3.7 percent. Restricting this analysis to just the changes that occur on FOMC announcement days predicts dollar depreciation because the cumulative change in the OIS differential on FOMC announcement days is negative. The estimate for changes in the emerging market index of the dollar misses the mark by an even larger amount. This predictive exercise highlights the fact that at times other factors dominate the role of interest rates in exchange rate movements (a finding consistent with the generally low R2's in these regressions).

Table 6: Actual and Predicted U.S. Dollar Movements between June 2014 and June 2017

$$$\displaystyle dX_{i,t}=\alpha + \beta dS_{j,t} + \epsilon_{i,t}$$$

| Advanced | Emerging | |

|---|---|---|

| U.S. exchange rate index levels: | ||

| June 2 2014 | 76.67 | 130.24 |

| June 1 2017 | 92.26 | 155.28 |

| Appreciation over period | 20.3% | 19.2% |

| Total interest rate change (Sj): | 109 | 76 |

| Sensitivity (β ): | 3.41 | 1.25 |

| Predicted response to interest rate change (β x Sj): | 3.7% | 1.0% |

Notes: The surprise Sj is the change in the forward USD - AFE OIS differential for the advanced index, the USD OIS rate for the emerging index. The sensitivity β is from Table 2 for the full sample.

Second, we use our estimates to evaluate the potential response of the dollar to prospective policy changes. At the June 2017 FOMC meeting, the median 2019 Federal funds rate in the FOMC Survey of Economic Projections (SEP) was 2.9 percent.7 This was much higher than the market implied 1-month, 2-year OIS forward rate, which was about 1.5 percent at that time. If the much higher path of U.S. rates implied by the SEP path were realized, financial market participants would be surprised by a cumulative 1.4 percentage points over the next 2 years. Multiplying this surprise by the β estimates for the advanced dollar index of 3.41 for the full sample and 4.83 for the more recent sample (both from Table 2), implies that policy surprises could push the dollar higher against the AFE currencies by 4-3/4 - 6¾ percent over the following 2 years. That said, the previous analysis has shown that in practice the exchange rate will be pushed around by many other factors, so the actual exchange rate movements could be much different.

V. References

Adrian, T., Crump, R. K. and Moench E. (2013), "Pricing the Term Structure with Linear Regressions," Journal of Financial Economics 110(1), 110-38

Andrews, D. W. K. (1993), "Tests for parameter instability and structural change with unknown change point," Econometrica 61, 821–856.

Brainard, L. (2016a). "The Economic Outlook and Implications for Monetary Policy," Speech at the Council on Foreign Relations, Washington, D.C., June 3.

Brainard, L. (2016b) "The 'New Normal' and What It Means for Monetary Policy," Speech at the Chicago Council on Global Affairs, Chicago, IL, September 12.

Chow, G. C. (1960), "Tests of equality between sets of coefficients in two linear regressions," Econometrica 28, 591–605.

Craine, R. and Martin, V. L. (2008), "International monetary policy surprise spillovers, "Journal of International Economics 75(1), 180–196.

Dornbusch, R. (1976), "Expectations and Exchange Rate Dynamics," Journal of Political Economy 84, 1161-1176.

Eichenbaum, M., Evans, C.L. (1995), "Some empirical evidence on the effects of shocks to monetary policy on exchange rates," The Quarterly Journal of Economics 110(4), 975–1009.

Fratzscher, M., Lo Duca, M. and Straub, R. (2013), "On the international spillovers of us quantitative easing," European Central Bank Working Paper No. 1557, European Central Bank, Frankfurt.

Ferrari, M., Kearns, J. and Schrimpf A. (2016), "Monetary shocks at high-frequency and their changing FX transmission around the globe," BIS working paper.

Frankel, J. (1979), "On the Mark: A Theory of Floating Exchange Rates Based on Real Interest Differentials", American Economic Review, 610-622.

Glick, R., and Leduc, S. (2013), "The effects of unconventional and conventional us monetary policy on the dollar," in Federal Reserve Bank of San Francisco Working paper.

Glick, R., and Leduc, S. (2015), "Measuring the Effect of the Zero Lower Bound on Medium- and Longer-Term Interest Rates," Federal Reserve Bank of San Francisco Working Paper.

Hausman, J.K., and Wongswan, J. (2011), "Global asset prices and FOMC announcements", Journal of International Money and Finance 30 (3), 547-571.

Kearns, J., and Manners, P. (2006), "The impact of monetary policy on the exchange rate: A study using intraday data," International Journal of Central Banking 2(4), 157–183.

Rogers, J. H., Scotti, C. and Wright, J. H. (2015), "Unconventional monetary policy and inter-national risk premia," Working Paper, Federal Reserve Board.

Rosa, C. (2011), "The high-frequency response of exchange rates to monetary policy actions and statements," Journal of Banking & Finance 35(2), 478–489.

VII. Data Appendix

Table A1: Data Description

| Data Series | Description |

|---|---|

| Exchange Rates | For daily changes, Federal Reserve Board's H.10 release, which contains exchange rates as of noon NY time. We use the nominal major currencies index as our "advanced" index, and the nominal Other important trading partners (OITP) index as our "emerging" index. See https://www.federalreserve.gov/releases/h10/summary/ For high frequency data exchange rates and yields, Thompson Reuters Tick History. |

| Overnight Interest Swaps (OIS) | Bloomberg. The references rates are: Federal funds rate effective rate for USD OIS swaps; EONIA for euro area EUR, SONIA for the U.K GBP, CORRA for Canada CAD and TONAR for Japan JPY. The weights for the advanced foreign economy (AFE) aggregate OIS rate are based on the trade weights reported in the Federal Reserve Board's H.10 release (0.47 for the euro area, 0.09 for the United Kingdom, 0.29 for Canada, and 0.15 for Japan). 1-day forward changes are used for the reaction of Japanese OIS rates as the Japanese market closes before the start of the other central bank meetings. 1-day forward changes are also used for the reaction GBP OIS rates to FOMC meetings because on most days the final Bloomberg OIS quote occurs before the FOMC statement. The surprises in the note are constructed from the 1-month OIS rate, 23-months forward implied by an Adrian, Crump, and Moench (2013) term structure model fitted to the OIS swap rates. |

| Central Bank Announcements | Bloomberg |

Table A2: Summary Statistics

| Obs | Mean | Std. Dev. | Min | Max | |

|---|---|---|---|---|---|

| Exchange rates (percent change) | |||||

| Advanced | 123 | 0.06 | 0.86 | -4.02 | 2.51 |

| Broad | 123 | 0.01 | 0.58 | -2.28 | 1.75 |

| Emerging | 123 | -0.04 | 0.44 | -1.67 | 1.47 |

| EUR | 123 | 0.06 | 1.04 | -4.73 | 2.64 |

| GBP | 123 | -0.02 | 0.88 | -4.18 | 2.56 |

| CAD | 123 | 0.10 | 0.84 | -2.98 | 3.43 |

| JPY | 123 | 0.00 | 1.02 | -4.31 | 3.11 |

| MXN | 123 | -0.02 | 1.07 | -5.79 | 4.14 |

| BRL | 123 | -0.04 | 1.39 | -8.56 | 4.19 |

| KRW | 123 | -0.20 | 1.46 | -12.38 | 2.37 |

| Interest rates (yield change in basis points) | |||||

| Front-month federal funds future | 123 | -0.74 | 5.55 | -46.50 | 13.50 |

| 2-year U.S. Treasury yields | 123 | 0.02 | 8.15 | -35.20 | 25.80 |

| 2-year German Bund yields | 123 | 0.00 | 3.92 | -13.50 | 17.40 |

| 2-year U.K. Gilt yields | 123 | -0.34 | 4.30 | -16.60 | 13.00 |

| 2-year Canadian Treasury yields | 123 | 0.16 | 5.42 | -15.50 | 22.20 |

| 2-year Japanese Government Bond yields | 123 | -0.20 | 1.95 | -9.00 | 9.00 |

| 10-year U.S. Treasury yields | 123 | -0.44 | 9.20 | -47.30 | 19.80 |

| 10-year German Bund yields | 123 | 0.24 | 4.16 | -9.40 | 12.20 |

| 10-year U.K. Gilt yields | 123 | 0.11 | 4.56 | -11.10 | 13.80 |

| 10-year Canadian Treasury yields | 123 | -0.14 | 5.60 | -22.10 | 11.20 |

| 10-year Japanese Government Bond yields | 123 | -0.71 | 2.44 | -7.80 | 5.50 |

| USD OIS 23x24 month forward | 123 | -0.97 | 9.73 | -28.25 | 19.44 |

| EUR OIS 23x24 month forward | 60 | -0.35 | 4.30 | -9.60 | 12.05 |

| GBP OIS 23x24 month forward | 60 | 0.75 | 5.66 | -11.22 | 18.88 |

| CAD OIS 23x24 month forward | 60 | 0.21 | 5.31 | -10.86 | 15.03 |

| JPY OIS 23x24 month forward | 60 | -0.14 | 0.90 | -2.16 | 1.68 |

Notes: FOMC announcement days Jan. 2010-June 2017 for foreign OIS forwards, Jan. 2002-June 2017 for other series. Changes are daily, except for the federal funds futures which is the change in a narrow window around the FOMC announcement. Exchange rates are from the Federal Reserve Board’s H.10 report. All currencies expressed FC/USD.

1. Brainard, Lael (2016b). "The "New Normal" and What It Means for Monetary Policy," speech delivered at the Chicago Council on Global Affairs, Chicago, Illinois, September 12. Return to text

2. Brainard, Lael (2016a). "The Economic Outlook and Implications for Monetary Policy," speech delivered at the Council on Foreign Relations, Washington, September 3. Return to text

3. We compute daily exchange rate changes from the noon rates published by the Federal Reserve Board on the H.10 report, as we are interested in the movements of the published exchange rate indexes which are available only at this daily frequency. Because the FOMC announcements usually occur around 2 p.m. EST, we compute the change from noon the day of the announcement to noon the following day. This timing captures the reaction in Asian markets, some of which have already closed for the day at the time of the FOMC announcement. Return to text

4. Even though the OIS market in these four foreign countries is fairly liquid, at times there are small pricing discrepancies which are amplified when the yields are used to construct forward rates, which is our proxy for future policy expectations. As a result, the forwards constructed directly from the foreign currency OIS swap rates can be very volatile. To address this, we fit an Adrian, Crump, and Moench (2013) term structure model to market OIS rates, and then use the forward rates implied by the model. We use bilateral trade weights for the four foreign countries to construct an advanced foreign economy (AFE) aggregate OIS forward rate. The Data Appendix provides the country weights used to construct the AFE OIS forwards. Return to text

5. For all regressions we use Stata's robust regression routine which reduces the weight on regression outliers. Return to text

6. Using the unadjusted OIS forward differentials, the only significant structural break is for Canada in June 2015. Return to text

7. https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20170614.htm Return to text

Curcuru, Stephanie E. (2017). "The Sensitivity of the U.S. Dollar Exchange Rate to Changes in Monetary Policy Expectations," IFDP Notes. Washington: Board of Governors of the Federal Reserve System, September 2017, https://doi.org/10.17016/2573-2129.36.

Disclaimer: IFDP Notes are articles in which Board economists offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than IFDP Working Papers.