October 08, 2008

Shared National Credits Program1 Reports Large Increase in Credit Volume and Significant Deterioration in Credit Quality

- Board of Governors of the Federal Reserve System

- Federal Deposit Insurance Corporation

- Office of the Comptroller of the Currency

- Office of Thrift Supervision

For immediate release

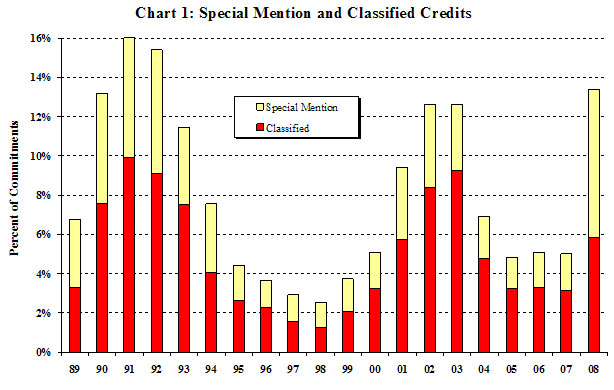

The volume of Shared National Credits (SNC),2 loan commitments of $20 million or more and held by three or more federally supervised institutions, rose 22.6 percent to $2.8 trillion, and the volume of criticized credits increased to $373.4 billion, or 13.4 percent of the SNC portfolio, according to the 2008 SNC review results released today by federal bank and thrift regulators. The results of the review--reported by the Board of Governors of the Federal Reserve System, the Office of the Comptroller of the Currency, the Federal Deposit Insurance Corporation, and the Office of Thrift Supervision--are based on analyses prepared in the second quarter of 2008 of credit data provided by federally supervised institutions as of December 31, 2007.

The record growth in credit volume is concentrated in large syndicated loans that were underwritten in late 2006 and the first half of 2007 led by the Media and Telecom, Utilities, Finance and Insurance, and Oil and Gas industry sectors. The SNC portfolio experienced nominal growth in the last half of 2007.

Criticized credits3 increased $259.3 billion and represent 13.4 percent of the SNC portfolio compared with 5.0 percent in the 2007 SNC review. Credits rated special mention (potentially weak credits) increased by $167.9 billion and represent 7.5 percent of the SNC portfolio compared with 1.9 percent in the 2007 SNC review. Classified credits (credits with well-defined weaknesses) increased $91.5 billion and represent 5.8 percent of the SNC portfolio compared with 3.1 percent in the 2007 SNC review. The criticized credits and related ratios do not include the effects of hedging or other techniques that organizations often use to mitigate risk.

Classified credits held by United States (U.S.) domiciled banking organizations increased to $47.2 billion from $19.2 billion, and the classified ratio increased to 4.1 percent from 2.0 percent, still low compared to the entire portfolio. Classified credits held by foreign banking organizations increased to $45.9 billion, and the classified ratio increased to 4.2 percent from 1.9 percent. Classified credits held by non-bank entities increased to $70.0 billion from $34.8 billion and represent 42.9 percent of classified credits. The volume of classified credits held by non-banks is particularly significant given their relatively small 19.9 percent share of the SNC portfolio.

For the second consecutive year, the review included an assessment of underwriting standards. Examiners again found an inordinate volume of syndicated loans with structurally weak underwriting characteristics particularly in non-investment grade or leveraged transactions.

Table 1: SNC Commitments ($ billions)

| Total Commitments | % Change 2007 - 2008 |

||||||||

|---|---|---|---|---|---|---|---|---|---|

| 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | ||

| Substandard |

|

|

|

|

|

|

|

|

|

| Doubtful |

|

|

|

|

|

|

|

|

|

| Loss |

|

|

|

|

|

|

|

|

|

| Total Classified |

|

|

|

|

|

|

|

|

|

| Percent of Commitments |

|

|

|

|

|

|

|

|

|

| Memo: Nonaccrual classified |

|

|

|

|

|

|

|

|

|

| Special Mention |

|

|

|

|

|

|

|

|

|

| Total Criticized |

|

|

|

|

|

|

|

|

|

| Percent of Commitments |

|

|

|

|

|

|

|

|

|

| Total SNC Commitments |

|

|

|

|

|

|

|

|

|

Note: Figures may not add to totals due to rounding.

Year dates represent the official SNC review period. Credit data is collected as of December 31 and updated through the end of the annual review.

Overview

The 2008 SNC review included 8,746 credits totaling $2.8 trillion extended to 5,742 borrowers. Credit commitments increased by a record $514 billion, or 22.6 percent, following $401 billion growth, or 21.4 percent, in the 2007 SNC Review. This represents the largest percentage growth since 1998 and reflects the merger and acquisition financing boom that continued through the first half of 2007. Total outstandings, or drawn amounts, of $1.2 trillion were up $373 billion, or 44.6 percent, and represent 43.3 percent of commitments compared with 36.7 percent in 2007.

Criticized credits rose to $373.4 billion and represent 13.4 percent of the SNC portfolio compared with only 5.0 percent in the 2007 SNC review. Special mention credits increased to $210.4 billion from $42.5 billion in 2007 and represent 7.5 percent of the SNC portfolio compared with only 1.9 percent in 2007. Special mention credits also constitute a much higher percentage of total criticized credits this year at 56.4 percent compared with 37.3 percent in 2007. A large number of special mention credits support highly leveraged merger and acquisition transactions originated in 2006 and 2007 that are characterized by weak underwriting standards.

Classified credits rose to $163.1 billion from $71.6 billion and represent 5.8 percent of the SNC portfolio compared with 3.1 percent in 2007. Credits classified substandard rose to $154.9 billion from the 2007 review. The severity of the classifications increased this year with doubtful and loss credits totaling $8.1 billion compared with $2.0 billion in 2007. Nonaccrual4 classified credits increased to $22.3 billion from $3.9 billion, but represent a relatively low 0.80 percent of the total portfolio.

Industry Trends

The agencies are introducing an industry presentation format that aggregates industries vertically along product origination and distribution lines. The industry format places credits in seven primary groups, largely following the outline of the 2007 Census NAICS codes (See Appendix B). The seven primary groups are further dissected into twenty-four sectors constructed from ninety-three sub-sectors. An industry mapping file (92 KB PDF) is included as an attachment to the press release.

Services is the largest group at $788 billion, or 28.3 percent of the total portfolio, and increased by 33.7 percent from 2007. Commodities is the second largest group at $597 billion, or 21.4 percent of the total portfolio, and increased 35.9 percent. Financial is the third largest group at $545 billion, or 19.6 percent of the total portfolio. Within the industry groups, sectors with the largest growth are Media and Telecom at $78 billion, or 36.4 percent, Utilities at $63 billion, or 38.3 percent, Finance and Insurance at $62 billion, or 13.2 percent, and Oil and Gas at $50 billion, or 36.2 percent. Eighteen of the twenty-four sectors experienced double digit growth rates.

Criticized credits are concentrated in Services, $151.4 billion or 40.6 percent of total criticized credits, Commodities, $69.5 billion or 18.6 percent, and Manufacturers, $53.4 billion or 14.3 percent. Special mention credits constitute 70.4 percent and 78.0 percent of the criticized credits in the Services and Commodities groups, respectively, but only 24.7 percent of the Manufacturers group. The highest criticized industry groups by percentage are Services, 19.2 percent; Real Estate, 15.6 percent; and Manufacturers, 13.4 percent. Within the industry groups, the highest criticized sectors by percentage are Automotive, 41.5 percent; Commercial Services, 40.8 percent; Transportation Services, 24.3 percent; and Media and Telecom, 24.0 percent.

Classified credits are concentrated in Services, $44.8 billion, Manufacturers, $40.2 billion, Financial, $29.9 billion, and Real Estate, $25.3 billion. Real Estate is the highest classified group at 11.4 percent followed by Manufacturers at 10.1 percent. Within the industry groups, highly classified sectors include Automotive, 34.7 percent, Food and Drug Stores, 14.0 percent, Transportation Services, 12.4 percent, and Real Estate and Construction, 11.4 percent.

Special mention credits are concentrated in the Media and Telecom sector, $47.1 billion or 22.4 percent of special mention; Materials and Commodities Excluding Energy, $27.9 billion or 13.3 percent; Commercial Services, $23.8 billion or 11.3 percent; and Utilities, $23.6 billion or 11.2 percent.

Trends by Entity Type

The portion of SNC credit commitments held by U.S. domiciled banking organizations declined slightly to 41.1 percent from 42.7 percent, the fourth consecutive year of decline. Holdings by foreign banking organizations declined as well to 39 percent from 41.4 percent. Holdings by non-bank organizations, such as securitization pools, hedge funds, insurance companies, and pension funds, increased to 19.9 percent from 15.9 percent.

Non-bank organizations hold the largest volume and percentage of classified credits at $70 billion, or 42.9 percent of total classified credits compared with 48.6 percent in 2007. In addition, 12.6 percent of non-bank organization credits are classified compared with only 4.1 percent of the U.S. bank portfolio and 4.2 percent of the foreign bank portfolio.

Although non-bank organizations continue to hold the largest dollar volume and percentage of classified credits, the growth in classified credits over the past year was evenly distributed. Classified credits held by U.S. banks increased $28.0 billion, or 145.8 percent, with foreign banks classified credits increasing $28.3 billion and non-banks classified credits increasing $35.2 billion, or 101.2 percent.

SNC Underwriting

The SNC Review included an evaluation of underwriting standards on approximately one thousand credits booked, or funded, in 2007. Areas evaluated included structure, repayment terms, pricing, collateral, loan agreements, and financial analysis and monitoring techniques. Examiners continued to identify an inordinate volume of syndicated loans with structurally weak underwriting characteristics, particularly for credits supporting M&A transactions of highly leveraged companies. Nearly all these credits were underwritten prior to the disruptions in the credit market in mid 2007.

The most commonly cited types of structurally weak underwriting were liberal repayment terms, repayment dependent on refinancing or recapitalization, and nonexistent or weak loan covenants. Examiners also found that an excessive number of loan agreements did not provide adequate warnings and allow for proactive control over the credit.

The impact of the volume of syndicated loans with structurally weak underwriting characteristics is evidenced by the rise in criticized credits this year. In fact, 56 percent of the 2007 vintage credits included in this year's underwriting review were criticized special mention or substandard compared with 21 percent last year. In addition, most of the 2006 vintage credits that were analyzed during the 2007 SNC review remain outstanding, and the criticized percentage of those credits has increased to 33 percent.

The agencies have longstanding guidance, particularly through their April 2001 Interagency Guidance on Leveraged Financing, Sound Risk Management Practices, stressing the importance of prudential underwriting for leveraged financial transactions. However, examiners have found that underwriting practices are more likely to be compromised when syndicated loans are underwritten for resale versus more prudential underwriting standards used for loans held for investment. Consequently, banks that originate syndicated loans for distribution should have risk management systems in place to ensure underwriting standards are reasonably consistent with underwriting standards used if holding the loan for investment. More specifically, banks should ensure underwriting practices include a comprehensive and realistic assessment of a borrower's capacity to repay or de-lever over a reasonable period of time. SNCs with structurally weak underwriting characteristics and borrower financial performance and projections that do not support the prospects of reasonable repayment will be subject to regulatory criticism by the agencies.

In addition, syndicated pipeline commitments are expected to be periodically evaluated to determine if creditworthiness, pricing, and covenant structures provide reasonable protection in the event of a change in market credit risk appetite. Credit commitments that do not fit an institution's hold for investment criteria should be subjected to concentration limits and stress testing processes that evaluate a borrower's ability to perform under different economic scenarios.

| Media Contacts: | ||

| Federal Reserve Board | Deborah Lagomarsino | 202-452-2955 |

| OCC | Kevin Mukri | 202-874-5770 |

| FDIC | David Barr | 202-898-6992 |

| OTS | William Ruberry | 202-906-6677 |

Appendix A

Committed and Outstanding Balances (Dollars in Billions)

| Year | Special Mention | Sub-standard | Doubtful | Loss | Total Classified | Total Criticized | Total Committed | Total Outstanding |

|---|---|---|---|---|---|---|---|---|

| 1989 | 24.0 | 18.5 | 3.5 | 0.9 | 22.9 | 46.9 | 692 | 245 |

| 1990 | 43.1 | 50.8 | 5.8 | 1.8 | 58.4 | 101.5 | 769 | 321 |

| 1991 | 49.2 | 65.5 | 10.8 | 3.5 | 79.8 | 129.0 | 806 | 361 |

| 1992 | 50.4 | 56.4 | 12.8 | 3.3 | 72.5 | 122.9 | 798 | 357 |

| 1993 | 31.7 | 50.4 | 6.7 | 3.5 | 60.6 | 92.3 | 806 | 332 |

| 1994 | 31.4 | 31.1 | 2.7 | 2.3 | 36.1 | 67.5 | 893 | 298 |

| 1995 | 18.8 | 25.0 | 1.7 | 1.5 | 28.2 | 47.0 | 1,063 | 343 |

| 1996 | 16.8 | 23.1 | 2.6 | 1.4 | 27.1 | 43.9 | 1,200 | 372 |

| 1997 | 19.6 | 19.4 | 1.9 | 0.9 | 22.2 | 41.8 | 1,435 | 423 |

| 1998 | 22.7 | 17.6 | 3.5 | 0.9 | 22.0 | 44.7 | 1,759 | 562 |

| 1999 | 30.8 | 31.0 | 4.9 | 1.5 | 37.4 | 68.2 | 1,829 | 628 |

| 2000 | 36.0 | 47.9 | 10.7 | 4.7 | 63.3 | 99.3 | 1,951 | 705 |

| 2001 | 75.4 | 87.0 | 22.5 | 8.0 | 117.5 | 192.8 | 2,049 | 769 |

| 2002 | 79.0 | 112.0 | 26.1 | 19.1 | 157.1 | 236.1 | 1,871 | 692 |

| 2003 | 55.2 | 112.1 | 29.3 | 10.7 | 152.2 | 207.4 | 1,644 | 600 |

| 2004 | 32.8 | 55.1 | 12.5 | 6.4 | 74.0 | 106.8 | 1,545 | 500 |

| 2005 | 25.9 | 44.2 | 5.6 | 2.7 | 52.5 | 78.3 | 1,627 | 522 |

| 2006 | 33.4 | 58.1 | 2.5 | 1.2 | 61.8 | 95.2 | 1,874 | 626 |

| 2007 | 42.5 | 69.6 | 1.2 | 0.8 | 71.6 | 114.1 | 2,275 | 835 |

| 2008 | 210.4 | 154.9 | 5.5 | 2.6 | 163.1 | 373.4 | 2,789 | 1,208 |

Appendix B5

Summary of Shared National Credit Industry Trends

(Dollars in Billions)

|

Industry |

2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | |

|---|---|---|---|---|---|---|---|---|

|

Services |

||||||||

|

Commitment |

462.8 |

407.6 |

377.1 |

401.6 |

464.0 |

589.3 |

788.1 |

|

|

Classified |

56.5 |

51.9 |

21.6 |

24.0 |

20.1 |

18.1 |

44.8 |

|

|

Special Mention |

19.9 |

11.9 |

12.7 |

5.7 |

13.3 |

14.3 |

106.6 |

|

|

% Classified |

12.2% |

12.7% |

5.7% |

6.0% |

4.3% |

3.1% |

5.7% |

|

|

% Special Mention |

4.3% |

2.9% |

3.4% |

1.4% |

2.9% |

2.4% |

13.5% |

|

|

Commodities |

||||||||

|

Commitment |

395.1 |

345.7 |

312.0 |

325.6 |

364.1 |

439.6 |

597.4 |

|

|

Classified |

35.2 |

55.3 |

32.7 |

18.0 |

18.3 |

10.7 |

15.3 |

|

|

Special Mention |

26.7 |

26.7 |

15.2 |

8.9 |

7.6 |

7.0 |

54.2 |

|

|

% Classified |

8.9% |

16.0% |

10.5% |

5.5% |

5.0% |

2.4% |

2.6% |

|

|

% Special Mention |

6.8% |

7.7% |

4.9% |

2.7% |

2.1% |

1.6% |

9.1% |

|

|

Financial |

||||||||

|

Commitment |

414.4 |

381.6 |

372.7 |

363.2 |

431.1 |

506.3 |

545.2 |

|

|

Classified |

12.0 |

9.5 |

4.2 |

0.9 |

2.1 |

19.2 |

29.9 |

|

|

Special Mention |

4.7 |

3.7 |

0.6 |

0.5 |

2.9 |

3.3 |

13.9 |

|

|

% Classified |

2.9% |

2.5% |

1.1% |

0.3% |

0.5% |

3.8% |

5.5% |

|

|

% Special Mention |

1.1% |

1.0% |

0.2% |

0.1% |

0.7% |

0.7% |

2.5% |

|

|

Manufacturers |

||||||||

|

Commitment |

337.5 |

283.8 |

261.7 |

271.9 |

289.4 |

339.4 |

397.4 |

|

|

Classified |

42.6 |

27.9 |

11.6 |

7.3 |

18.8 |

18.8 |

40.2 |

|

|

Special Mention |

16.7 |

8.7 |

2.6 |

9.6 |

8.1 |

10.8 |

13.2 |

|

|

% Classified |

12.6% |

9.8% |

4.4% |

2.7% |

6.5% |

5.5% |

10.1% |

|

|

% Special Mention |

5.0% |

3.1% |

1.0% |

3.5% |

2.8% |

3.2% |

3.3% |

|

|

Real Estate |

||||||||

|

Commitment |

106.2 |

97.9 |

99.5 |

122.9 |

159.2 |

203.6 |

221.1 |

|

|

Classified |

3.0 |

2.3 |

1.6 |

0.6 |

0.6 |

2.9 |

25.3 |

|

|

Special Mention |

1.4 |

1.6 |

0.9 |

0.2 |

0.5 |

2.2 |

9.2 |

|

|

% Classified |

2.8% |

2.4% |

1.6% |

0.5% |

0.4% |

1.4% |

11.4% |

|

|

% Special Mention |

1.3% |

1.6% |

0.9% |

0.1% |

0.3% |

1.1% |

4.2% |

|

|

Distribution |

||||||||

|

Commitment |

129.7 |

112.0 |

108.7 |

122.3 |

146.1 |

175.7 |

206.9 |

|

|

Classified |

8.0 |

5.4 |

2.2 |

1.7 |

1.5 |

1.9 |

7.5 |

|

|

Special Mention |

9.5 |

2.6 |

0.9 |

1.0 |

0.9 |

4.7 |

13.2 |

|

|

% Classified |

6.2% |

4.8% |

2.0% |

1.4% |

1.0% |

1.1% |

3.6% |

|

|

% Special Mention |

7.3% |

2.3% |

0.8% |

0.8% |

0.6% |

2.7% |

6.4% |

|

|

Government |

||||||||

|

Commitment |

20.9 |

18.4 |

14.3 |

19.1 |

20.1 |

21.6 |

33.1 |

|

|

Classified |

0.2 |

0.2 |

0.0 |

0.0 |

0.4 |

0.1 |

0.0 |

|

|

Special Mention |

0.1 |

0.1 |

0.1 |

0.0 |

0.1 |

0.1 |

0.1 |

|

|

% Classified |

0.9% |

0.8% |

0.3% |

0.1% |

1.8% |

0.5% |

0.0% |

|

|

% Special Mention |

0.5% |

0.5% |

0.6% |

0.0% |

0.4% |

0.2% |

0.4% |

|

|

All Industries (Total) |

||||||||

|

Commitment |

1,866.7 |

1,647.0 |

1,546.1 |

1,626.6 |

1,873.9 |

2,275.4 |

2,789.2 |

|

|

Classified |

157.5 |

152.4 |

74.0 |

52.5 |

61.8 |

71.7 |

163.0 |

|

|

Special Mention |

79.1 |

55.3 |

32.8 |

25.9 |

33.4 |

42.4 |

210.4 |

|

|

% Classified |

8.4% |

9.3% |

4.8% |

3.2% |

3.3% |

3.2% |

5.8% |

|

|

% Special Mention |

4.2% |

3.4% |

2.1% |

1.6% |

1.8% |

1.9% |

7.5% |

|

Note: Figures may not add to totals due to rounding.

Appendix C: Exposures by Entity Type

Share of Total Commitments (%)

| 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | |

|---|---|---|---|---|---|---|---|---|

| US Banking Institutions | 46.2 | 45.3 | 45.4 | 46.5 | 44.8 | 44.3 | 42.7 | 41.1 |

| Insured | 43.8 | 42.8 | 42.5 | 43.4 | 41.5 | 40.8 | 38.9 | 37.4 |

| Uninsured(*) | 2.3 | 2.5 | 2.9 | 3.1 | 3.3 | 3.5 | 3.8 | 3.7 |

| FBOs | 45.4 | 44.8 | 43.8 | 41.6 | 42.1 | 41.5 | 41.4 | 39.0 |

| Insured | 5.0 | 5.1 | 5.4 | 5.5 | 6.0 | 6.2 | 6.4 | 5.1 |

| Uninsured(*) | 40.4 | 39.7 | 38.4 | 36.1 | 36.1 | 35.3 | 35.0 | 33.9 |

| Nonbanks | 8.4 | 9.9 | 10.8 | 12.0 | 13.1 | 14.3 | 15.9 | 19.9 |

Total Classifications ($ billion)

| 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | |

|---|---|---|---|---|---|---|---|---|

| US Banking Institutions | 48.5 | 53.7 | 43.6 | 18.8 | 11.9 | 13.1 | 19.2 | 47.2 |

| Insured | 43.9 | 47.6 | 37.8 | 16.0 | 8.6 | 9.0 | 13.2 | 38.3 |

| Uninsured(*) | 4.6 | 6.0 | 5.8 | 2.8 | 3.2 | 4.1 | 6.0 | 9.0 |

| FBOs | 44.0 | 60.0 | 65.0 | 31.3 | 15.5 | 17.3 | 17.6 | 45.9 |

| Insured | 7.3 | 8.4 | 6.8 | 2.8 | 1.5 | 1.6 | 2.3 | 5.1 |

| Uninsured(*) | 36.7 | 51.6 | 58.3 | 28.5 | 14.0 | 15.7 | 15.4 | 40.8 |

| Nonbanks | 25.0 | 42.1 | 43.6 | 24.0 | 25.0 | 31.5 | 34.8 | 70.0 |

| Totals | 117.5 | 155.8 | 152.2 | 74.2 | 52.5 | 61.8 | 71.6 | 163.1 |

Classifieds as % of Commitments

| 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | |

|---|---|---|---|---|---|---|---|---|

| US Banking Institutions | 5.1 | 6.4 | 5.8 | 2.6 | 1.6 | 1.6 | 2.0 | 4.1 |

| Insured | 4.6 | 5.7 | 5.1 | 2.2 | 1.2 | 1.1 | 1.4 | 3.3 |

| Uninsured(*) | 0.5 | 0.7 | 0.8 | 0.4 | 0.4 | 0.5 | 0.6 | 0.8 |

| FBOs | 4.7 | 7.2 | 9.0 | 4.9 | 2.3 | 2.2 | 1.9 | 4.2 |

| Insured | 0.8 | 1.0 | 0.9 | 0.4 | 0.2 | 0.2 | 0.2 | 0.5 |

| Uninsured(*) | 3.9 | 6.2 | 8.1 | 4.4 | 2.0 | 2.0 | 1.6 | 3.7 |

| Nonbanks | 14.4 | 22.9 | 24.5 | 13.0 | 11.7 | 11.8 | 9.6 | 12.6 |

| Totals | 5.7 | 8.4 | 9.3 | 4.8 | 3.2 | 3.3 | 3.1 | 5.8 |

Total Nonaccrual Commitments ($ billion)

| 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | |

|---|---|---|---|---|---|---|---|---|

| US Banking Institutions | n.a. | 22.5 | 18.4 | 7.7 | 3.9 | 2.8 | 0.8 | 7.4 |

| Insured | n.a. | 19.4 | 16.5 | 0.1 | 3.1 | 1.8 | 0.5 | 6.3 |

| Uninsured(*) | n.a. | 3.1 | 1.9 | 7.6 | 0.8 | 1.0 | 0.3 | 1.1 |

| FBOs | n.a. | 30.5 | 29.5 | 17.6 | 9.0 | 4.7 | 0.9 | 5.6 |

| Insured | n.a. | 3.9 | 3.2 | - | 0.4 | 0.4 | 0.2 | 1.0 |

| Uninsured(*) | n.a. | 26.6 | 26.3 | 17.6 | 8.6 | 4.3 | 0.7 | 4.6 |

| Nonbanks | n.a. | 21.1 | 20.5 | 12.3 | 11.9 | 10.2 | 2.2 | 9.3 |

| Totals | n.a. | 74.1 | 68.4 | 37.6 | 24.8 | 17.7 | 3.9 | 22.3 |

(*)Uninsured refers to organizations that do not take consumer deposits such as holding companies, brokerage firms, finance companies, etc.

Note: Figures may not add to totals due to rounding

Footnotes

1. The Shared National Credit (SNC) Program was established in 1977 by the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency. In 2001, the Office of Thrift Supervision became an assisting agency. The annual program seeks to provide an efficient and consistent review and classification of shared national credits. Return to text

2. A SNC is any loan and/or formal loan commitment, and any asset such as other real estate, stocks, notes, bonds and debentures taken as debts previously contracted, extended to borrowers by a supervised institution, its subsidiaries and affiliates. Further, a SNC must have an original amount that aggregates $20 million or more and either 1) is shared by three or more unaffiliated supervised institutions under a formal lending agreement or 2) a portion is sold to two or more unaffiliated supervised institutions with the purchasing institutions assuming their pro rata share of the credit risk.

Credits include syndicated loans and loan commitments, letters of credit, commercial leases, as well as other forms of credit. Credit commitments include both drawn and undrawn portions of credit facilities. This release reports only the par amounts of commitments; these may differ from the amounts at which loans are carried by investors.

A supervised institution is one which is subject to supervision by one of the federal bank regulatory agencies, including all FDIC-insured banks, their branches, subsidiaries, and affiliates; bank holding companies and their non-bank subsidiaries and affiliates; and federal and state-licensed branches and agencies of foreign banks. Return to text

3. Criticized credits are the total of credits classified substandard, doubtful, and loss--and credits rated special mention. Classified credits are only those rated substandard, doubtful, and loss. Under the agencies' Uniform Loan Classification Standards, classified credits have well-defined weaknesses, including default in some cases. Special mention credits exhibit potential weaknesses, which may result in further deterioration if left uncorrected.

Excerpt from federal banking agencies' examination manuals defining regulatory classifications: A Substandard asset is inadequately protected by the current sound worth and paying capacity of the obligor or of the collateral pledged, if any. Assets so classified must have a well-defined weakness or weaknesses that jeopardize the liquidation of the debt. They are characterized by the distinct possibility that the institution will sustain some loss if the deficiencies are not corrected. An asset classified Doubtful has all the weaknesses inherent in one classified Substandard, with the added characteristic that the weaknesses make collection or liquidation in full, on the basis of currently existing facts, conditions, and values, highly questionable and improbable. Assets classified Loss are considered uncollectible and of such little value that their continuance as bankable assets is not warranted. This classification does not mean that the asset has absolutely no recovery or salvage value but rather that it is not practical or desirable to defer writing off this basically worthless asset even though partial recovery may be affected in the future. Amounts classified Loss should be promptly charged off.

Excerpt from the June 10, 1993 Interagency Statement on the Supervisory Definition of Special Mention Assets: A Special Mention asset has potential weaknesses that deserve management's close attention. If left uncorrected, these potential weaknesses may result in deterioration of the repayment prospects for the asset or in the institution's credit position at some future date. Special Mention assets are not adversely classified and do not expose an institution to sufficient risk to warrant adverse classification. Return to text

4. Nonaccrual loans are defined for regulatory reporting purposes as "loans and lease financing receivables that are required to be reported on a nonaccrual basis because (a) they are maintained on a cash basis due to a deterioration in the financial position of the borrower, (b) payment in full of interest or principal is not expected, or (c) principal or interest has been in default for 90 days or longer, unless the obligation is both well secured and in the process of collection." Return to text