January 11, 2021

Federal Reserve Board announces Reserve Bank income and expense data and transfers to the Treasury for 2020

For release at 12:00 p.m. EST

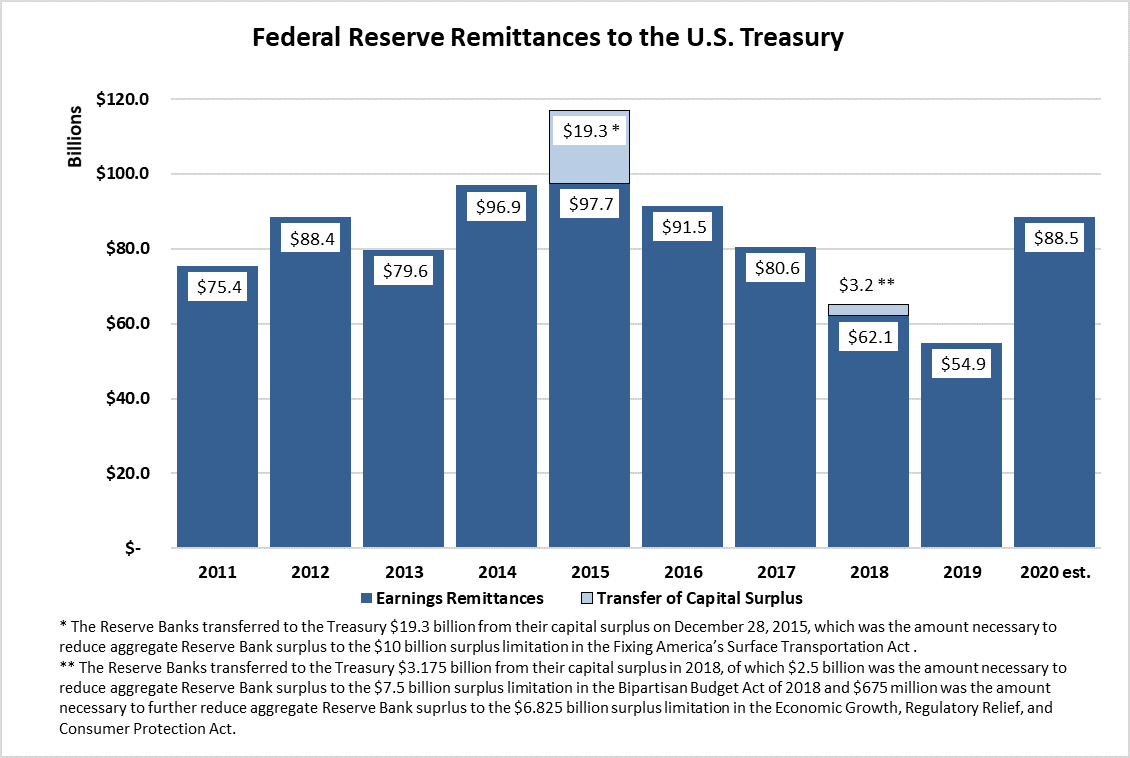

The Federal Reserve Board on Monday announced preliminary results indicating that the Reserve Banks provided for payments of approximately $88.5 billion of their estimated 2020 net income to the U.S. Treasury. The 2020 audited Reserve Bank financial statements are expected to be published in March and may include adjustments to these preliminary unaudited results.

The Federal Reserve Banks' 2020 estimated net income of $88.8 billion represents an increase of $33.3 billion from 2019, primarily attributable to a $27.1 billion decrease in interest expense associated with reserve balances held by depository institutions and a $5.3 billion decrease in interest expense associated with securities sold under agreements to repurchase. Net income for 2020 was derived primarily from $100 billion in interest income on securities acquired through open market operations--U.S. Treasury securities, federal agency and government-sponsored enterprise (GSE) mortgage-backed securities (MBS), and GSE debt securities, $723 million interest income on securities purchased under agreements to resell, realized gains of $664 million on GSE MBS, and foreign currency gains of $1.5 billion that result from the daily revaluation of foreign currency denominated investments at current exchange rates. The Federal Reserve Banks realized net income of $405 million from facilities established in response to the COVID-19 pandemic. The Federal Reserve Banks had interest expense of $7.9 billion primarily associated with reserve balances held by depository institutions, and interest expense of $711 million on securities sold under agreement to repurchase.

Operating expenses of the Reserve Banks, net of amounts reimbursed by the U.S. Treasury and other entities for services the Reserve Banks provided as fiscal agents, totaled $4.5 billion in 2020. In addition, the Reserve Banks were assessed $831 million for the costs related to producing, issuing, and retiring currency, $947 million for Board expenditures, and $517 million to fund the operations of the Consumer Financial Protection Bureau. Additional earnings were derived from income from services of $448 million. Statutory dividends totaled $386 million in 2020.

The attached chart illustrates the amount the Reserve Banks distributed to the U.S. Treasury from 2011 through 2020 (estimated).

For media inquiries, call 202-452-2955.

Note: On January 12, 2021, the press release was updated to indicate that the change in 2020 net income was attributable to $5.3 billion decrease in interest expense associated with securities sold under agreements to repurchase (not resell as originally written).