Freedom of Information Office

2013 New Currency Budget

-

Print Version (PDF)

Contents

Action

On December 13, 2012, the Board approved the 2013 new currency budget totaling $797.6 million, which represents an increase of $77.0 million or 10.7 percent from 2012 estimated expenses, and an increase of $50.6 million or 6.8 percent from the approved 2012 budget.

Discussion

Under authority delegated by the Board, the director of the Division of Reserve Bank Operations and Payment Systems (RBOPS) submits an annual print order for new currency to the director of the Bureau of Engraving and Printing (BEP). Upon reviewing the order, the BEP estimates printing costs for new currency during the calendar year (CY). We use these estimates to prepare the annual budget for new currency. The Board then reviews and approves the final budget. Printing costs for Federal Reserve notes comprise about 92 percent of the new currency budget. Expenses for currency transportation, the currency quality assurance (CQA) program, the currency education program (CEP), and counterfeit-deterrence research comprise the remaining eight percent.1 Once the Board approves the new currency budget, it assesses the costs of new currency to each Federal Reserve Bank on a monthly basis through an accounting procedure similar to that used in assessing the costs of the Board's operating expenses to the Banks.

Table 1 provides details on the Board's CY 2012 budget, 2012 estimate, and 2013 budget.2

Table 1

New Currency Budget

(calendar year)

2012

Budget

(thousands)

2012

Estimate

(thousands)

2013

Budget

(thousands)

Percent Change

2012E/2012B

2032B/2012E

Print volume (number of notes)

7,956,427

7,810,800

8,180,705

-1.8

4.7

BEP Expenses

Printing Federal Reserve notes

$707,231

$686,634

$734,774

-2.9

7.0

Other

$3,692

$3,310

$3,435

-10.3

3.8

Board Expenses

Currency transportation

$22,795

$17,084

$30,697

-25.1

79.7

Currency quality assurance program

$5,200

$7,800

$13,400

50.0

71.8

Currency education program

$2,800

$500

$9,512

-82.1

1,802.4

Counterfeit-deterrence research

$5,318

$5,316

$5,782

0.0

8.8

Total expenses

$747,036

$720,644

$797,600

-3.5

10.7

2012 New Currency Expenses

Staff estimates that total expenses related to new currency will be $720.6 million in 2012, which are $26.4 million or 3.5 percent below the 2012 budget. This reduction in expenses is attributable mostly to a reduction in estimated Federal Reserve note printing costs and currency transportation costs, which are discussed below.

2012 Printing Costs

Estimated expenses for printing Federal Reserve notes in CY 2012 are $686.6 million, which are $20.6 million or 2.9 percent lower than the budgeted amount. The Board's FY 2012 print order included 1.5 billion new-design $100 notes to build an inventory of notes that will be used when the Board begins issuing the new design.3 In order to meet our order, both the Western Currency Facility (WCF) of the BEP in Ft. Worth, Texas, and the Eastern Currency Facility (ECF) in Washington, D.C., were required to convert presses to print the new-design $100 notes and undergo production validation processes, as established by the CQA program. Toward that goal, the WCF converted and conducted production validation on three of its presses. The ECF, however, could not convert its presses from production of the current-design $100 note, as planned, because in late 2011 and early 2012, international demand for $100 notes exceeded our estimates. Specifically, demand increased approximately 40 percent between October 2011 and February 2012. Accordingly, the director of RBOPS modified the FY 2012 print order by increasing the number of current-design $100 notes by 400 million to meet heightened demand and reducing the amount of new-design $100 notes by the same amount. This modification resulted in no change to the total number of notes in the order, but decreased the number of more-expensive new-design $100 notes, thereby reducing estimated expenses by nearly $13 million.4 Expenses were reduced further when the BEP refunded approximately $6.9 million to the Board as part of the transfer of the currency education program from the BEP to the Board.5

2012 Transportation Expenses

Estimated CY 2012 expenses for currency transportation are $17.1 million, which are $5.7 million or 25.1 percent lower than the budgeted amount. This lower amount is primarily attributable to not shipping as many new-design $100 notes as we had budgeted. The 2012 budget assumed that we would begin shipping new-design $100 notes in January 2012; however, because of continued production problems at the BEP, we did not begin shipping these notes until June. We expect to ship new-design $100 notes to all Reserve Banks throughout 2013.

2012 Currency Quality Assurance Program Expenses

Estimated CY 2012 expenses for the CQA program are $7.8 million, which are $2.6 million or 50 percent higher than the budgeted amount.6 This increase is attributable to our underestimation of the extent of intervention needed to transform the BEP's quality system and the establishment of a portfolio and project management office (PPMO). The CQA consultants designed and implemented the new PPMO office at the BEP to improve visibility and prioritization of BEP projects across its two facilities.7

During 2012, the CQA consultants continued to facilitate the implementation of a new quality system for the BEP. The Board, the BEP, and the CQA consultants formed cross functional teams to improve product and technology development, quality system management, standard operating procedures, process changes, training programs, inspection of incoming raw materials, supplier management, and equipment calibration and maintenance. Additionally, the CQA consultants worked closely with the WCF as it resumed production of the new-design $100 note to provide detailed planning, to analyze quality incidents, and to identify BEP resource needs to support the new quality system.

2012 Currency Education Program Expenses

Estimated CY 2012 expenses for the CEP are $500 thousand, which are $2.3 million or 82 percent lower than the budgeted amount of $2.8 million. This lower amount is because we scaled back education efforts as a result of the continued delay in issuance of the new-design $100 note. We included three months of CEP expenses in the CY 2012 budget to relaunch the program and announce a new issue date. The continued delay, however, negated the need for this funding and temporarily reduced expenses for the program. In addition, RBOPS staff cut unnecessary costs and performed the majority of CEP-related tasks with internal resources, further minimizing costs to the Board.

2013 New Currency Budget

The proposed 2013 new currency budget is $797.6 million, which is 10.7 percent higher than the 2012 estimate and 6.8 percent higher than the 2012 budget. The majority of the expenses result from the Board's FY 2013 print order of 2.5 billion new-design $100 notes to build inventories for issuance.

In addition to the costs associated with printing these more-expensive new-design $100 notes, the budget includes funding to ship the new-design $100 notes to each Reserve Bank in anticipation of the target issue date, to educate the public about the new note leading up to the day of issue, and to continue CQA program initiatives toward improving the quality systems at the BEP.

2013 Printing Costs

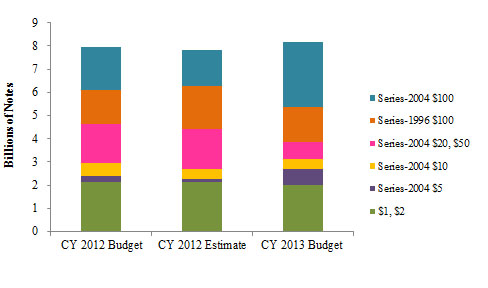

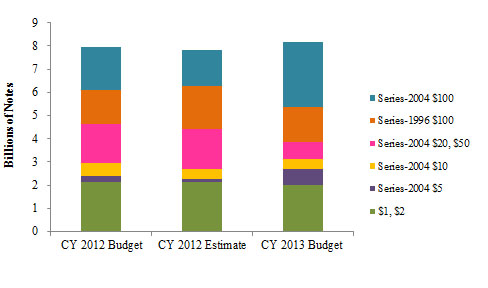

The new currency budget includes $734.8 million in printing costs for CY 2013, which represents a nearly seven percent increase from the 2012 estimate. The increase is primarily attributable to a higher volume of more-expensive new-design $100 notes.8 As shown in chart 1, the Board's 2013 calendar year budget includes approximately 1.3 billion more new-design $100 notes than the 2012 estimate.

Table 2

Number of Notes Produced (calendar year)

Type of Note

2012 Estimate

(thousands)

2013 Budget

(thousands)

Percent Change

2012E/2013B

$1, $2

2,137,600

1,991,905

-6.8

Series-2004 $5

140,800

691,200

390.9

Series-2004 $10

409,600

452,800

10.5

Series-2004 $20, $50

1,750,400

734,400

-58.0

Series-1996 $100

1,817,200

1,500,800

-17.4

Series-2004 $100

1,555,200

2,809,600

80.7

Total

7,810,800

8,180,705

4.7

Quantity and Type of Notes

The BEP's printing costs are based on the total quantity and types of notes the Board orders. Although the total number of notes included in the CY 2013 budget only increased 4.7 percent compared with the 2012 estimate, the number of new-design $100 notes increased 80.7 percent. These notes are the most expensive to produce because of new security features that will protect our highest denomination note, which is a target for counterfeiters around the world. The increase in cost for the new-design $100 notes is partially offset by a 12.8 percent decrease in the volume of $1 through $50 notes. The decline for these denominations reflects higher-than-expected end-of-year inventories at the Reserve Banks, which resulted from lower destruction rates, rather than declining demand. We estimated that the destruction rates would decline as a result of the Reserve Banks' misfaced notes policy, but they declined by more than we originally estimated.9 For budget planning purposes, the BEP provided us with estimates of 2013 printing costs, which are presented in table 3, by type of note.

Table 3

Calendar Year BEP Printing Costs

Note typea

Projected 2013 fixed costs

(thousands of dollars)b

Projected 2013 variable costs

(per thousand notes)

Projected 2013 total costs

(per thousand notes)c

Estimated 2012 total costs

(per thousand notes)

$1, $2

$60,169

$20.88

$54.46

$51.81

Series-2004 $5d

$29,398

$36.52

$97.76

$84.63

Series-2004 $10d

$17,929

$32.58

$89.75

$85.13

Series-2004 $20, $50d

$45,791

$37.80

$97.67

$92.47

Series-1996 $100d

$81,825

$35.25

$77.73

$67.23

Series-2004 $100

$151,811

$66.06

$126.73

$151.44

Average cost per thousand notese

$49.74

$42.07

$91.81

$88.73

a. $1 and $2 notes do not include the security features that are in the series-1996 and series-2004 design notes; series-1996 $100 notes include a watermark and color-shifting ink; series-2004 $5 notes include two watermarks and additional security features; and series-2004 $10, $20, and $50 notes include watermarks, additional security features, and a new color-shifting ink. The series-2004 $100 note will include a watermark, a 3D security ribbon, a new color-shifting feature ("the Bell in the Inkwell"), additional security features, and a new color-shifting ink. This higher level of security for the series-2004 $100 note has significantly increased the cost for both paper and ink. Return to table.

b. The projected fixed costs are the BEP's estimates of fixed costs associated with the production of each denomination. Return to table.

c. The projected total costs per thousand notes are projected fixed costs divided by the number of notes in the Board's order, plus variable costs per thousand notes. Projected total costs for all denominations, except the new-design $100 note, in 2013 are higher than estimated 2012 total costs because the fixed costs are spread among 23 percent fewer notes. Meanwhile, the projected 2013 total costs for new-design $100 notes are lower than estimated 2012 total costs because the fixed costs are spread over 127 percent more notes. Return to table.

d. The variable cost billing rates for series-1996 $100 notes and series-2004 $5, $10, $20, and $50 notes are comparable because paper costs about 17 percent more for series-2004 notes due to additional security features embedded in the paper, but ink costs about 83 percent more for series-1996 $100 notes because a larger quantity of color-shifting ink is used in their production (the "$100" contains three numerals, whereas the "$10," "$20," and "$50" contain two numerals). However, ink accounts for less than 25 percent of variable costs while paper accounts for almost 50 percent. Return to table.

e. The average cost per thousand notes for 2013 is the volume-weighted average of the fixed, variable, and total costs. For 2012, the unit cost per thousand notes is the volume-weighted average of the fixed and variable costs divided by the estimated number of notes printed during CY 2012. Return to table.

BEP Fixed and Variable Costs

The 2013 print cost budget of $734.8 million is comprised of $386.9 million (52.7 percent) in fixed costs and $347.9 million (47.3 percent) in variable costs. Components of the BEP's fixed costs include capital investment, prepress and engraving, fixed manufacturing overhead and support, research and development, and general and administrative staff.10 Components of the BEP's variable costs include paper, ink, direct labor, and other variable manufacturing costs.

The main drivers for the fixed costs are manufacturing support (including costs for facilities maintenance, engineering, and a new integrated security system), general and administrative staff, and depreciation.11 Over 13 percent ($51 million) of the BEP's budgeted fixed costs includes payments for previously committed equipment purchases (production, accounting, and inventory automation systems, a new offset press for the WCF, and single-note inspection equipment) and a targeted level of working capital so that the BEP can make future capital commitments.12

The variable costs are directly attributable to the volume of notes included in the Board's FY 2013 print order, and vary by denomination, as shown in table 3. The variable costs fluctuate from $20.88 per thousand notes for $1 notes to $66.06 per thousand notes for new-design $100 notes, and are determined primarily by the cost of paper.13

2013 Currency Transportation

The 2013 currency transportation budget is $30.7 million, which is $13.6 million or nearly 80 percent higher than the 2012 estimate. This budget includes the cost of shipping new currency from the BEP to Reserve Banks, of intra-System shipments of fit and unprocessed currency, and of returning currency pallets from the Reserve Banks to the BEP. Over 95 percent of the difference between the 2013 budget and 2012 estimate ($13 million) is attributable to costs associated with shipping 2.5 billion new-design $100 notes from the BEP's two facilities to each of the 28 Federal Reserve offices in preparation for issuance. We expect to make approximately the same number of intra-System shipments in 2013 as we made in 2012. We negotiated new transportation agreements with armored carriers, effective November 2012, that we expect will save the Board more than $1.6 million per year.

2013 Currency Quality Assurance Program Expenses

The 2013 budget for the CQA program is $13.4 million, which is $5.6 million or 71.8 percent higher than 2012 estimated expenses. This increase will allow the CQA consultants to continue facilitating the implementation of the new quality system for the BEP, to support the new-design $100 note issuance by ensuring the BEP produces a sufficient quantity of notes that meet agreed-upon quality standards, and to provide temporary resources to the BEP to sustain critical aspects of the quality system.

The original estimate for the CQA program was $19 million over the five-year contract period. The higher-than-expected costs for the program reflect the lack of an adequate infrastructure at the BEP to support a quality assurance system. The BEP does not have a fully integrated IT system to collect critical production data, nor does it have staff able to analyze the data to provide management with relevant information that would resolve production problems and improve production efficiencies. Additionally, the BEP lacks adequate staff in many critical areas of the organization and new skills needed to support the quality system. As a result, more CQA consultants than originally anticipated are needed to fill the gaps that exist throughout the BEP. Because of these challenges, we now estimate the CQA program will cost approximately $65 million and will require a contract extension from 2014 to 2018.

During 2012, the BEP was not able to integrate effectively into its operations several CQA initiatives and we believe that without increased attention from the CQA consultants, the BEP will not be able to sustain the quality improvements. Until BEP staff can learn and demonstrate the required capabilities, we propose adding 14 consultants to the CQA program.14 The additional consultants will sustain the quality system and augment BEP staff to support critical improvements that were implemented throughout the organization in 2012.15 We believe that without these additional resources, needed process changes to implement a robust quality system will not be adopted.

We continue to monitor the work and expenses of the CQA consultants using metrics based on contract performance and on progress to improve quality at the BEP. One of the metrics we monitor is the spoilage rate of notes produced. At the start of the program, the CQA consultants projected a 20 percent reduction in the spoilage rates for notes the BEP is currently producing following CQA implementation. With the assistance of the CQA consultants, the WCF has reduced spoilage rates for the new-design $100 note from 23 percent in FY 2010 (before the creasing issue was identified) to 15 percent in FY 2012, which represents a 35 percent reduction in the spoilage rate. We estimate that in FY 2012 and FY 2013, the reduced spoilage rate equates to the WCF producing 256 million fewer new-design $100 notes that do not meet agreed-upon quality standards while producing the quantity of notes needed to fulfill our order. The savings from reduced spoilage already achieved are $17.3 million, based on variable costs in 2012 and 2013.

During 2013, CQA consultants will continue to work with the BEP to advance the quality improvement efforts into a sustainable enterprise-wide system. Efforts will continue to focus on several BEP areas, including materials, production, equipment, facilities, and product design and development. The CQA consultants will also focus on the BEP's management processes to monitor and continuously improve the quality system. Specifically, they will build capabilities at the BEP for more robust data analysis of statistical process controls. This enhanced data analysis will allow the BEP to apply corrective and preventative actions, perform more effective internal audits, and perform more consistent pre-production testing and in-process inspections of production and inventory systems.16 Rigorous data analysis and product planning are standard elements for any efficient manufacturing environment.

The CQA consultants will also assist the BEP with production and quality activities related to the production of the new-design $100 note, particularly validating production lines at the ECF, investigating quality issues, and inspecting manufacturing processes. Any improvements or process changes identified by the CQA consultants related to the production of the new-design $100 note will be incorporated as systemic improvements in the overall quality system at the BEP.

The 2013 budget also includes funding for the CQA consultants to assist with the newly chartered and designed PPMO at the BEP. The establishment of an enterprise-wide project management office is critical for the BEP to manage effectively the broad range of ongoing and forecasted projects. The CQA consultants will be assigned to the PPMO temporarily, until the BEP fills vacancies with new, qualified employees.

2013 Currency Education Program Expenses

The 2013 CEP budget is $9.5 million, which is $9 million higher than the 2012 estimate. We included funding for education efforts throughout 2013 to educate the global public about the new-design $100 note. The goal of the CEP is to protect and maintain confidence in U.S. currency by providing information on all circulating designs of Federal Reserve notes to the global public. The program is focused on ensuring that users of U.S. currency know what genuine Federal Reserve notes look like, are aware of the security features in each denomination, and know how to use those security features to distinguish between genuine and counterfeit notes.

In addition to general currency education related tasks, we will dedicate significant resources to education efforts in support of the new-design $100 note. Because there are currently over eight billion $100 notes in circulation worldwide, the CEP must reach a diverse global population to ensure a smooth transition to the new design. Users of the $100 note around the world need to be aware not only of the new security and design features, but also that there is no need to trade in older-design notes when the new-design notes begin circulating. The education program for the new-design $100 note will include global outreach to businesses and consumers and training seminars in partnership with the United States Secret Service (USSS) for financial institutions and law enforcement entities both in the U.S. and abroad.

Through efficient management and aggressive cost-cutting, we have reduced the education budget in support of the new-design $100 note more than 60 percent to $9.5 million from the $24 million the BEP had projected to spend had it retained responsibility for the CEP. The majority of these cost-savings result from us bringing most of the CEP work in-house and by leveraging a broad coalition of existing Reserve Bank, USSS, BEP, and State Department staff. The tasks that cannot be sourced internally will be contracted and account for 90 percent of the 2013 CEP budget. The major expense drivers include the printing and fulfillment of educational materials in more than 20 languages, outreach to businesses and retailers in over 25 countries, and hosting and developing the NewMoney.gov educational website.

Counterfeit-Deterrence Research

The 2013 budget for counterfeit-deterrence research is $5.8 million, which is $466 thousand or about 9 percent over the 2012 estimate. The funding includes primarily the costs associated with the Central Bank Counterfeit Deterrence Group (CBCDG). The CBCDG operates under the auspices of the G-10 central bank governors to combat digital counterfeiting and includes 32 central banks. The Board's $5.5 million share of the 2013 CBCDG budget comprises 95 percent of the Federal Reserve's counterfeit-deterrence budget. The other five percent reflects additional research toward increasing security of Federal Reserve notes.

Other Reimbursements to the Bureau of Engraving and Printing

The 2013 budget includes $3.4 million to reimburse the BEP for expenses incurred by its Destruction Standards and Compliance Division of the Office of Compliance (OC) and Mutilated Currency Division (MCD) of the Office of Financial Management. The OC develops standards for cancellation and destruction of unfit currency and for note accountability at the Reserve Banks, and reviews Reserve Banks' cash operations for compliance with its standards. As a public service, the MCD also processes claims for the redemption of damaged or mutilated currency.

Budget Risks

The BEP will need to implement a currency reader program to comply with a court order requiring the Treasury Department to provide meaningful access for blind and visually-impaired people in denominating U.S. currency.17 The program will likely have two components: developing a statement of work (SOW) and selecting a vendor to produce currency readers and a distribution system for these readers.18 We are working with the BEP to develop the SOW for the reader, but we would not expect any expenses related to the purchase of readers until 2014. If, however, the process is accelerated, the BEP could incur substantial expenses in 2013 that are not included in its currency billing rates.

Appendix: New Currency Expenses

Footnotes

1. In October 2010, the Board contracted with PRTM (which was subsequently acquired by PricewaterhouseCoopers) to assess, develop, and implement a quality system, which is known as the CQA program, for the BEP's production of Federal Reserve notes. Return to text.

2. Because the BEP operates on a fiscal year that began October 1, 2012, and ends September 30, 2013, we estimate the Board's calendar-year budget for new currency by eliminating the cost of notes that the BEP will produce in the first quarter of its fiscal year and estimating the volume and associated printing costs of notes we project the BEP will produce in the fourth quarter of the calendar year. Return to text.

3. The new-design $100 note is the last denomination to be issued as part of the series-2004 design family of notes. This design family began with the issuance of the series-2004 $20 note in October 2003, followed by the $50 note in September 2004, the $10 note in March 2006, and the $5 note in March 2008. The new-design $100 note incorporates advanced technology that makes it easier for the public to authenticate and more difficult for counterfeiters to replicate. The Board had previously announced that the new-design $100 note would begin circulating in February 2011, but had to postpone the introduction because of production problems at the BEP. Return to text.

4. The variable cost of production for the current-design $100 note is $29.04 per thousand notes compared with $60.92 for the new-design $100 note. Return to text.

5. The Board assumed responsibility from the BEP for the currency education program on October 1, 2011. The BEP, however, received funding from the Board (through the 2011 billing rates) between October 1 and December 31, 2011, to fund the currency education program, which it did not use. The BEP then provided a refund to the Board in 2012. Return to text.

6. In a memorandum to the director of RBOPS dated May 21, 2012, staff explained the need for an additional $2.8 million than was included in the 2012 budget for the CQA program. This increase in CQA program expenses did not result in an overrun of the 2012 budget as it was offset by lower-than-planned expenses in other budget items. Return to text.

7. One of the findings in the Department of the Treasury Office of Inspector General audit report Bill Manufacturing: Improved Planning and Production Oversight Over NexGen $100 Note is Critical (OIG-12-038, dated January 24, 2012) was to "Ensure BEP implements a comprehensive, integrated project management function, in conjunction with [the Board, the United States Secret Service], and other relevant stakeholders, for the current NexGen $100 note program and all future note designs." Return to text.

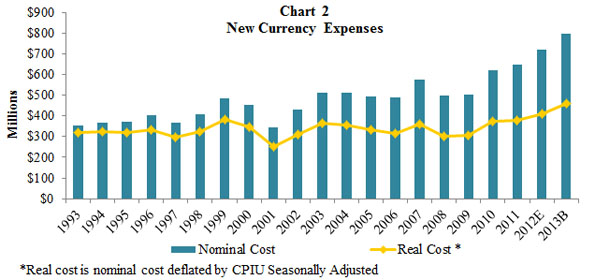

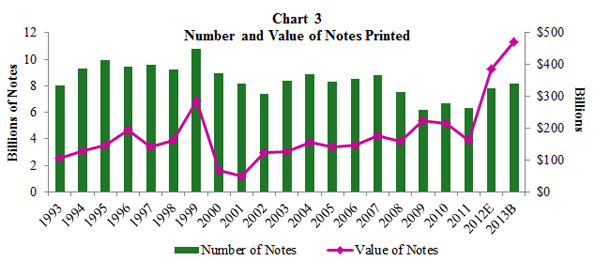

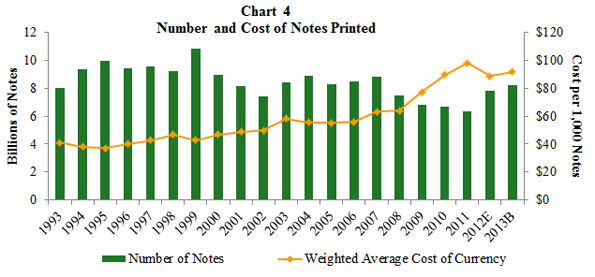

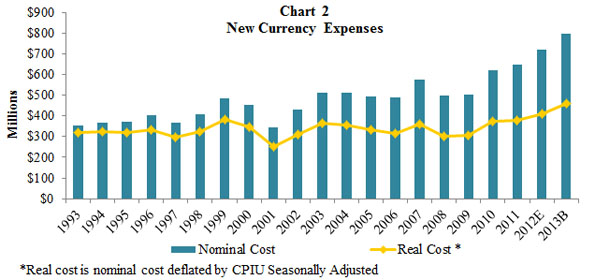

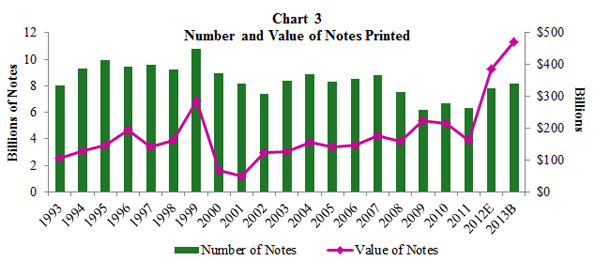

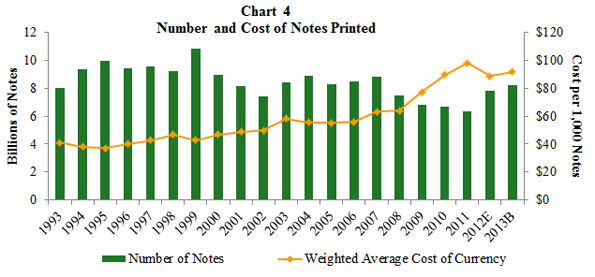

8. Charts 2-4 in the attachment show the new currency expenses, the value and number of notes printed, and the number and cost of notes printed from 1993 through the 2013 budget period. Return to text.

9. Misfaced notes are notes that are reverse-side up rather than portrait-side up. For operational reasons, before April 2011, misfaced notes were destroyed during Reserve Bank processing even if they were otherwise fit for recirculation. Beginning in April 2011, Reserve Banks began to pay out "misfaced" notes ($1 - $20 notes only) to depository institutions and accept misfaced notes ($1 - $20 notes only) in deposits from depository institutions. Since the policy was implemented, the destruction rate of $1 notes has decreased by approximately four percentage points and the average destruction rate of $5 through $20 notes has decreased by an average of nearly seven percentage points. Return to text.

10. In 2012, the BEP included salary and overtime expenses for all employees in its fixed costs. For 2013, we requested that the BEP include salary and overtime expenses in its variable costs, which it did. Salary and overtime expenses for general and administrative staff, however, are still included as fixed costs because the BEP does not adjust these staffing levels based on the size of the Board's print order. Return to text.

11. The BEP estimates that if salaries and overtime for production staff had been included in variable costs in 2012, instead of fixed costs, total fixed costs would have been $393.6 million. Fixed costs adjusted for production staff salaries and overtime have declined by nearly two percent between 2012 and 2013. Return to text.

12. The Memorandum of Understanding between the BEP and the Board, dated December 22, 2011, states that "for any unplanned capital commitments over $1 million (not reflected in the capital plan), BEP will notify the director of RBOPS before executing a contract." Return to text.

13. The variable cost for paper is at least twice as expensive as the variable costs for both ink and direct labor for all denominations. The cost for paper is principally determined by the level of sophistication of the embedded security features within the paper and the cost and complexity of incorporating these security features into the paper. Return to text.

14. Currently, the CQA program is supported by 17 FTE consultants who develop and implement the BEP's quality system. Return to text.

15. To address the labor gaps within BEP, the CQA consultants are conducting a BEP-wide assessment to determine the essential competencies for all positions and to assist in developing training and hiring plans that will meet the needs of the CQA program. Return to text.

16. Improvements in pre-production test methodologies will identify design and process vulnerabilities that will reduce the risk of catastrophic failures, such as the new-design $100 note creasing issue. Return to text.

17. The BEP has been working to meet the requirements of a 2008 court order requiring the Secretary of the Treasury to provide meaningful access for blind and visually impaired people to denominate U.S. currency. Return to text.

18. The readers will be provided to blind and visually-impaired people at no expense to them. Return to text.

- Print Version (PDF)

Contents

Action

On December 13, 2012, the Board approved the 2013 new currency budget totaling $797.6 million, which represents an increase of $77.0 million or 10.7 percent from 2012 estimated expenses, and an increase of $50.6 million or 6.8 percent from the approved 2012 budget.

Discussion

Under authority delegated by the Board, the director of the Division of Reserve Bank Operations and Payment Systems (RBOPS) submits an annual print order for new currency to the director of the Bureau of Engraving and Printing (BEP). Upon reviewing the order, the BEP estimates printing costs for new currency during the calendar year (CY). We use these estimates to prepare the annual budget for new currency. The Board then reviews and approves the final budget. Printing costs for Federal Reserve notes comprise about 92 percent of the new currency budget. Expenses for currency transportation, the currency quality assurance (CQA) program, the currency education program (CEP), and counterfeit-deterrence research comprise the remaining eight percent.1 Once the Board approves the new currency budget, it assesses the costs of new currency to each Federal Reserve Bank on a monthly basis through an accounting procedure similar to that used in assessing the costs of the Board's operating expenses to the Banks.

Table 1 provides details on the Board's CY 2012 budget, 2012 estimate, and 2013 budget.2

Table 1

New Currency Budget

(calendar year)

|

2012 Budget (thousands) |

2012 Estimate (thousands) |

2013 Budget (thousands) |

Percent Change | ||

|---|---|---|---|---|---|

| 2012E/2012B | 2032B/2012E | ||||

| Print volume (number of notes) | 7,956,427 | 7,810,800 | 8,180,705 | -1.8 | 4.7 |

| BEP Expenses | |||||

| Printing Federal Reserve notes | $707,231 | $686,634 | $734,774 | -2.9 | 7.0 |

| Other | $3,692 | $3,310 | $3,435 | -10.3 | 3.8 |

| Board Expenses | |||||

| Currency transportation | $22,795 | $17,084 | $30,697 | -25.1 | 79.7 |

| Currency quality assurance program | $5,200 | $7,800 | $13,400 | 50.0 | 71.8 |

| Currency education program | $2,800 | $500 | $9,512 | -82.1 | 1,802.4 |

| Counterfeit-deterrence research | $5,318 | $5,316 | $5,782 | 0.0 | 8.8 |

| Total expenses | $747,036 | $720,644 | $797,600 | -3.5 | 10.7 |

2012 New Currency Expenses

Staff estimates that total expenses related to new currency will be $720.6 million in 2012, which are $26.4 million or 3.5 percent below the 2012 budget. This reduction in expenses is attributable mostly to a reduction in estimated Federal Reserve note printing costs and currency transportation costs, which are discussed below.

2012 Printing Costs

Estimated expenses for printing Federal Reserve notes in CY 2012 are $686.6 million, which are $20.6 million or 2.9 percent lower than the budgeted amount. The Board's FY 2012 print order included 1.5 billion new-design $100 notes to build an inventory of notes that will be used when the Board begins issuing the new design.3 In order to meet our order, both the Western Currency Facility (WCF) of the BEP in Ft. Worth, Texas, and the Eastern Currency Facility (ECF) in Washington, D.C., were required to convert presses to print the new-design $100 notes and undergo production validation processes, as established by the CQA program. Toward that goal, the WCF converted and conducted production validation on three of its presses. The ECF, however, could not convert its presses from production of the current-design $100 note, as planned, because in late 2011 and early 2012, international demand for $100 notes exceeded our estimates. Specifically, demand increased approximately 40 percent between October 2011 and February 2012. Accordingly, the director of RBOPS modified the FY 2012 print order by increasing the number of current-design $100 notes by 400 million to meet heightened demand and reducing the amount of new-design $100 notes by the same amount. This modification resulted in no change to the total number of notes in the order, but decreased the number of more-expensive new-design $100 notes, thereby reducing estimated expenses by nearly $13 million.4 Expenses were reduced further when the BEP refunded approximately $6.9 million to the Board as part of the transfer of the currency education program from the BEP to the Board.5

2012 Transportation Expenses

Estimated CY 2012 expenses for currency transportation are $17.1 million, which are $5.7 million or 25.1 percent lower than the budgeted amount. This lower amount is primarily attributable to not shipping as many new-design $100 notes as we had budgeted. The 2012 budget assumed that we would begin shipping new-design $100 notes in January 2012; however, because of continued production problems at the BEP, we did not begin shipping these notes until June. We expect to ship new-design $100 notes to all Reserve Banks throughout 2013.

2012 Currency Quality Assurance Program Expenses

Estimated CY 2012 expenses for the CQA program are $7.8 million, which are $2.6 million or 50 percent higher than the budgeted amount.6 This increase is attributable to our underestimation of the extent of intervention needed to transform the BEP's quality system and the establishment of a portfolio and project management office (PPMO). The CQA consultants designed and implemented the new PPMO office at the BEP to improve visibility and prioritization of BEP projects across its two facilities.7

During 2012, the CQA consultants continued to facilitate the implementation of a new quality system for the BEP. The Board, the BEP, and the CQA consultants formed cross functional teams to improve product and technology development, quality system management, standard operating procedures, process changes, training programs, inspection of incoming raw materials, supplier management, and equipment calibration and maintenance. Additionally, the CQA consultants worked closely with the WCF as it resumed production of the new-design $100 note to provide detailed planning, to analyze quality incidents, and to identify BEP resource needs to support the new quality system.

2012 Currency Education Program Expenses

Estimated CY 2012 expenses for the CEP are $500 thousand, which are $2.3 million or 82 percent lower than the budgeted amount of $2.8 million. This lower amount is because we scaled back education efforts as a result of the continued delay in issuance of the new-design $100 note. We included three months of CEP expenses in the CY 2012 budget to relaunch the program and announce a new issue date. The continued delay, however, negated the need for this funding and temporarily reduced expenses for the program. In addition, RBOPS staff cut unnecessary costs and performed the majority of CEP-related tasks with internal resources, further minimizing costs to the Board.

2013 New Currency Budget

The proposed 2013 new currency budget is $797.6 million, which is 10.7 percent higher than the 2012 estimate and 6.8 percent higher than the 2012 budget. The majority of the expenses result from the Board's FY 2013 print order of 2.5 billion new-design $100 notes to build inventories for issuance.

In addition to the costs associated with printing these more-expensive new-design $100 notes, the budget includes funding to ship the new-design $100 notes to each Reserve Bank in anticipation of the target issue date, to educate the public about the new note leading up to the day of issue, and to continue CQA program initiatives toward improving the quality systems at the BEP.

2013 Printing Costs

The new currency budget includes $734.8 million in printing costs for CY 2013, which represents a nearly seven percent increase from the 2012 estimate. The increase is primarily attributable to a higher volume of more-expensive new-design $100 notes.8 As shown in chart 1, the Board's 2013 calendar year budget includes approximately 1.3 billion more new-design $100 notes than the 2012 estimate.

Table 2

Number of Notes Produced (calendar year)

| Type of Note |

2012 Estimate (thousands) |

2013 Budget (thousands) |

Percent Change 2012E/2013B |

|---|---|---|---|

| $1, $2 | 2,137,600 | 1,991,905 | -6.8 |

| Series-2004 $5 | 140,800 | 691,200 | 390.9 |

| Series-2004 $10 | 409,600 | 452,800 | 10.5 |

| Series-2004 $20, $50 | 1,750,400 | 734,400 | -58.0 |

| Series-1996 $100 | 1,817,200 | 1,500,800 | -17.4 |

| Series-2004 $100 | 1,555,200 | 2,809,600 | 80.7 |

| Total | 7,810,800 | 8,180,705 | 4.7 |

Quantity and Type of Notes

The BEP's printing costs are based on the total quantity and types of notes the Board orders. Although the total number of notes included in the CY 2013 budget only increased 4.7 percent compared with the 2012 estimate, the number of new-design $100 notes increased 80.7 percent. These notes are the most expensive to produce because of new security features that will protect our highest denomination note, which is a target for counterfeiters around the world. The increase in cost for the new-design $100 notes is partially offset by a 12.8 percent decrease in the volume of $1 through $50 notes. The decline for these denominations reflects higher-than-expected end-of-year inventories at the Reserve Banks, which resulted from lower destruction rates, rather than declining demand. We estimated that the destruction rates would decline as a result of the Reserve Banks' misfaced notes policy, but they declined by more than we originally estimated.9 For budget planning purposes, the BEP provided us with estimates of 2013 printing costs, which are presented in table 3, by type of note.

Table 3

Calendar Year BEP Printing Costs

| Note typea |

Projected 2013 fixed costs (thousands of dollars)b |

Projected 2013 variable costs (per thousand notes) |

Projected 2013 total costs (per thousand notes)c |

Estimated 2012 total costs (per thousand notes) |

|---|---|---|---|---|

| $1, $2 | $60,169 | $20.88 | $54.46 | $51.81 |

| Series-2004 $5d | $29,398 | $36.52 | $97.76 | $84.63 |

| Series-2004 $10d | $17,929 | $32.58 | $89.75 | $85.13 |

| Series-2004 $20, $50d | $45,791 | $37.80 | $97.67 | $92.47 |

| Series-1996 $100d | $81,825 | $35.25 | $77.73 | $67.23 |

| Series-2004 $100 | $151,811 | $66.06 | $126.73 | $151.44 |

| Average cost per thousand notese | $49.74 | $42.07 | $91.81 | $88.73 |

a. $1 and $2 notes do not include the security features that are in the series-1996 and series-2004 design notes; series-1996 $100 notes include a watermark and color-shifting ink; series-2004 $5 notes include two watermarks and additional security features; and series-2004 $10, $20, and $50 notes include watermarks, additional security features, and a new color-shifting ink. The series-2004 $100 note will include a watermark, a 3D security ribbon, a new color-shifting feature ("the Bell in the Inkwell"), additional security features, and a new color-shifting ink. This higher level of security for the series-2004 $100 note has significantly increased the cost for both paper and ink. Return to table.

b. The projected fixed costs are the BEP's estimates of fixed costs associated with the production of each denomination. Return to table.

c. The projected total costs per thousand notes are projected fixed costs divided by the number of notes in the Board's order, plus variable costs per thousand notes. Projected total costs for all denominations, except the new-design $100 note, in 2013 are higher than estimated 2012 total costs because the fixed costs are spread among 23 percent fewer notes. Meanwhile, the projected 2013 total costs for new-design $100 notes are lower than estimated 2012 total costs because the fixed costs are spread over 127 percent more notes. Return to table.

d. The variable cost billing rates for series-1996 $100 notes and series-2004 $5, $10, $20, and $50 notes are comparable because paper costs about 17 percent more for series-2004 notes due to additional security features embedded in the paper, but ink costs about 83 percent more for series-1996 $100 notes because a larger quantity of color-shifting ink is used in their production (the "$100" contains three numerals, whereas the "$10," "$20," and "$50" contain two numerals). However, ink accounts for less than 25 percent of variable costs while paper accounts for almost 50 percent. Return to table.

e. The average cost per thousand notes for 2013 is the volume-weighted average of the fixed, variable, and total costs. For 2012, the unit cost per thousand notes is the volume-weighted average of the fixed and variable costs divided by the estimated number of notes printed during CY 2012. Return to table.

BEP Fixed and Variable Costs

The 2013 print cost budget of $734.8 million is comprised of $386.9 million (52.7 percent) in fixed costs and $347.9 million (47.3 percent) in variable costs. Components of the BEP's fixed costs include capital investment, prepress and engraving, fixed manufacturing overhead and support, research and development, and general and administrative staff.10 Components of the BEP's variable costs include paper, ink, direct labor, and other variable manufacturing costs.

The main drivers for the fixed costs are manufacturing support (including costs for facilities maintenance, engineering, and a new integrated security system), general and administrative staff, and depreciation.11 Over 13 percent ($51 million) of the BEP's budgeted fixed costs includes payments for previously committed equipment purchases (production, accounting, and inventory automation systems, a new offset press for the WCF, and single-note inspection equipment) and a targeted level of working capital so that the BEP can make future capital commitments.12

The variable costs are directly attributable to the volume of notes included in the Board's FY 2013 print order, and vary by denomination, as shown in table 3. The variable costs fluctuate from $20.88 per thousand notes for $1 notes to $66.06 per thousand notes for new-design $100 notes, and are determined primarily by the cost of paper.13

2013 Currency Transportation

The 2013 currency transportation budget is $30.7 million, which is $13.6 million or nearly 80 percent higher than the 2012 estimate. This budget includes the cost of shipping new currency from the BEP to Reserve Banks, of intra-System shipments of fit and unprocessed currency, and of returning currency pallets from the Reserve Banks to the BEP. Over 95 percent of the difference between the 2013 budget and 2012 estimate ($13 million) is attributable to costs associated with shipping 2.5 billion new-design $100 notes from the BEP's two facilities to each of the 28 Federal Reserve offices in preparation for issuance. We expect to make approximately the same number of intra-System shipments in 2013 as we made in 2012. We negotiated new transportation agreements with armored carriers, effective November 2012, that we expect will save the Board more than $1.6 million per year.

2013 Currency Quality Assurance Program Expenses

The 2013 budget for the CQA program is $13.4 million, which is $5.6 million or 71.8 percent higher than 2012 estimated expenses. This increase will allow the CQA consultants to continue facilitating the implementation of the new quality system for the BEP, to support the new-design $100 note issuance by ensuring the BEP produces a sufficient quantity of notes that meet agreed-upon quality standards, and to provide temporary resources to the BEP to sustain critical aspects of the quality system.

The original estimate for the CQA program was $19 million over the five-year contract period. The higher-than-expected costs for the program reflect the lack of an adequate infrastructure at the BEP to support a quality assurance system. The BEP does not have a fully integrated IT system to collect critical production data, nor does it have staff able to analyze the data to provide management with relevant information that would resolve production problems and improve production efficiencies. Additionally, the BEP lacks adequate staff in many critical areas of the organization and new skills needed to support the quality system. As a result, more CQA consultants than originally anticipated are needed to fill the gaps that exist throughout the BEP. Because of these challenges, we now estimate the CQA program will cost approximately $65 million and will require a contract extension from 2014 to 2018.

During 2012, the BEP was not able to integrate effectively into its operations several CQA initiatives and we believe that without increased attention from the CQA consultants, the BEP will not be able to sustain the quality improvements. Until BEP staff can learn and demonstrate the required capabilities, we propose adding 14 consultants to the CQA program.14 The additional consultants will sustain the quality system and augment BEP staff to support critical improvements that were implemented throughout the organization in 2012.15 We believe that without these additional resources, needed process changes to implement a robust quality system will not be adopted.

We continue to monitor the work and expenses of the CQA consultants using metrics based on contract performance and on progress to improve quality at the BEP. One of the metrics we monitor is the spoilage rate of notes produced. At the start of the program, the CQA consultants projected a 20 percent reduction in the spoilage rates for notes the BEP is currently producing following CQA implementation. With the assistance of the CQA consultants, the WCF has reduced spoilage rates for the new-design $100 note from 23 percent in FY 2010 (before the creasing issue was identified) to 15 percent in FY 2012, which represents a 35 percent reduction in the spoilage rate. We estimate that in FY 2012 and FY 2013, the reduced spoilage rate equates to the WCF producing 256 million fewer new-design $100 notes that do not meet agreed-upon quality standards while producing the quantity of notes needed to fulfill our order. The savings from reduced spoilage already achieved are $17.3 million, based on variable costs in 2012 and 2013.

During 2013, CQA consultants will continue to work with the BEP to advance the quality improvement efforts into a sustainable enterprise-wide system. Efforts will continue to focus on several BEP areas, including materials, production, equipment, facilities, and product design and development. The CQA consultants will also focus on the BEP's management processes to monitor and continuously improve the quality system. Specifically, they will build capabilities at the BEP for more robust data analysis of statistical process controls. This enhanced data analysis will allow the BEP to apply corrective and preventative actions, perform more effective internal audits, and perform more consistent pre-production testing and in-process inspections of production and inventory systems.16 Rigorous data analysis and product planning are standard elements for any efficient manufacturing environment.

The CQA consultants will also assist the BEP with production and quality activities related to the production of the new-design $100 note, particularly validating production lines at the ECF, investigating quality issues, and inspecting manufacturing processes. Any improvements or process changes identified by the CQA consultants related to the production of the new-design $100 note will be incorporated as systemic improvements in the overall quality system at the BEP.

The 2013 budget also includes funding for the CQA consultants to assist with the newly chartered and designed PPMO at the BEP. The establishment of an enterprise-wide project management office is critical for the BEP to manage effectively the broad range of ongoing and forecasted projects. The CQA consultants will be assigned to the PPMO temporarily, until the BEP fills vacancies with new, qualified employees.

2013 Currency Education Program Expenses

The 2013 CEP budget is $9.5 million, which is $9 million higher than the 2012 estimate. We included funding for education efforts throughout 2013 to educate the global public about the new-design $100 note. The goal of the CEP is to protect and maintain confidence in U.S. currency by providing information on all circulating designs of Federal Reserve notes to the global public. The program is focused on ensuring that users of U.S. currency know what genuine Federal Reserve notes look like, are aware of the security features in each denomination, and know how to use those security features to distinguish between genuine and counterfeit notes.

In addition to general currency education related tasks, we will dedicate significant resources to education efforts in support of the new-design $100 note. Because there are currently over eight billion $100 notes in circulation worldwide, the CEP must reach a diverse global population to ensure a smooth transition to the new design. Users of the $100 note around the world need to be aware not only of the new security and design features, but also that there is no need to trade in older-design notes when the new-design notes begin circulating. The education program for the new-design $100 note will include global outreach to businesses and consumers and training seminars in partnership with the United States Secret Service (USSS) for financial institutions and law enforcement entities both in the U.S. and abroad.

Through efficient management and aggressive cost-cutting, we have reduced the education budget in support of the new-design $100 note more than 60 percent to $9.5 million from the $24 million the BEP had projected to spend had it retained responsibility for the CEP. The majority of these cost-savings result from us bringing most of the CEP work in-house and by leveraging a broad coalition of existing Reserve Bank, USSS, BEP, and State Department staff. The tasks that cannot be sourced internally will be contracted and account for 90 percent of the 2013 CEP budget. The major expense drivers include the printing and fulfillment of educational materials in more than 20 languages, outreach to businesses and retailers in over 25 countries, and hosting and developing the NewMoney.gov educational website.

Counterfeit-Deterrence Research

The 2013 budget for counterfeit-deterrence research is $5.8 million, which is $466 thousand or about 9 percent over the 2012 estimate. The funding includes primarily the costs associated with the Central Bank Counterfeit Deterrence Group (CBCDG). The CBCDG operates under the auspices of the G-10 central bank governors to combat digital counterfeiting and includes 32 central banks. The Board's $5.5 million share of the 2013 CBCDG budget comprises 95 percent of the Federal Reserve's counterfeit-deterrence budget. The other five percent reflects additional research toward increasing security of Federal Reserve notes.

Other Reimbursements to the Bureau of Engraving and Printing

The 2013 budget includes $3.4 million to reimburse the BEP for expenses incurred by its Destruction Standards and Compliance Division of the Office of Compliance (OC) and Mutilated Currency Division (MCD) of the Office of Financial Management. The OC develops standards for cancellation and destruction of unfit currency and for note accountability at the Reserve Banks, and reviews Reserve Banks' cash operations for compliance with its standards. As a public service, the MCD also processes claims for the redemption of damaged or mutilated currency.

Budget Risks

The BEP will need to implement a currency reader program to comply with a court order requiring the Treasury Department to provide meaningful access for blind and visually-impaired people in denominating U.S. currency.17 The program will likely have two components: developing a statement of work (SOW) and selecting a vendor to produce currency readers and a distribution system for these readers.18 We are working with the BEP to develop the SOW for the reader, but we would not expect any expenses related to the purchase of readers until 2014. If, however, the process is accelerated, the BEP could incur substantial expenses in 2013 that are not included in its currency billing rates.

Appendix: New Currency Expenses

Footnotes

1. In October 2010, the Board contracted with PRTM (which was subsequently acquired by PricewaterhouseCoopers) to assess, develop, and implement a quality system, which is known as the CQA program, for the BEP's production of Federal Reserve notes. Return to text.

2. Because the BEP operates on a fiscal year that began October 1, 2012, and ends September 30, 2013, we estimate the Board's calendar-year budget for new currency by eliminating the cost of notes that the BEP will produce in the first quarter of its fiscal year and estimating the volume and associated printing costs of notes we project the BEP will produce in the fourth quarter of the calendar year. Return to text.

3. The new-design $100 note is the last denomination to be issued as part of the series-2004 design family of notes. This design family began with the issuance of the series-2004 $20 note in October 2003, followed by the $50 note in September 2004, the $10 note in March 2006, and the $5 note in March 2008. The new-design $100 note incorporates advanced technology that makes it easier for the public to authenticate and more difficult for counterfeiters to replicate. The Board had previously announced that the new-design $100 note would begin circulating in February 2011, but had to postpone the introduction because of production problems at the BEP. Return to text.

4. The variable cost of production for the current-design $100 note is $29.04 per thousand notes compared with $60.92 for the new-design $100 note. Return to text.

5. The Board assumed responsibility from the BEP for the currency education program on October 1, 2011. The BEP, however, received funding from the Board (through the 2011 billing rates) between October 1 and December 31, 2011, to fund the currency education program, which it did not use. The BEP then provided a refund to the Board in 2012. Return to text.

6. In a memorandum to the director of RBOPS dated May 21, 2012, staff explained the need for an additional $2.8 million than was included in the 2012 budget for the CQA program. This increase in CQA program expenses did not result in an overrun of the 2012 budget as it was offset by lower-than-planned expenses in other budget items. Return to text.

7. One of the findings in the Department of the Treasury Office of Inspector General audit report Bill Manufacturing: Improved Planning and Production Oversight Over NexGen $100 Note is Critical (OIG-12-038, dated January 24, 2012) was to "Ensure BEP implements a comprehensive, integrated project management function, in conjunction with [the Board, the United States Secret Service], and other relevant stakeholders, for the current NexGen $100 note program and all future note designs." Return to text.

8. Charts 2-4 in the attachment show the new currency expenses, the value and number of notes printed, and the number and cost of notes printed from 1993 through the 2013 budget period. Return to text.

9. Misfaced notes are notes that are reverse-side up rather than portrait-side up. For operational reasons, before April 2011, misfaced notes were destroyed during Reserve Bank processing even if they were otherwise fit for recirculation. Beginning in April 2011, Reserve Banks began to pay out "misfaced" notes ($1 - $20 notes only) to depository institutions and accept misfaced notes ($1 - $20 notes only) in deposits from depository institutions. Since the policy was implemented, the destruction rate of $1 notes has decreased by approximately four percentage points and the average destruction rate of $5 through $20 notes has decreased by an average of nearly seven percentage points. Return to text.

10. In 2012, the BEP included salary and overtime expenses for all employees in its fixed costs. For 2013, we requested that the BEP include salary and overtime expenses in its variable costs, which it did. Salary and overtime expenses for general and administrative staff, however, are still included as fixed costs because the BEP does not adjust these staffing levels based on the size of the Board's print order. Return to text.

11. The BEP estimates that if salaries and overtime for production staff had been included in variable costs in 2012, instead of fixed costs, total fixed costs would have been $393.6 million. Fixed costs adjusted for production staff salaries and overtime have declined by nearly two percent between 2012 and 2013. Return to text.

12. The Memorandum of Understanding between the BEP and the Board, dated December 22, 2011, states that "for any unplanned capital commitments over $1 million (not reflected in the capital plan), BEP will notify the director of RBOPS before executing a contract." Return to text.

13. The variable cost for paper is at least twice as expensive as the variable costs for both ink and direct labor for all denominations. The cost for paper is principally determined by the level of sophistication of the embedded security features within the paper and the cost and complexity of incorporating these security features into the paper. Return to text.

14. Currently, the CQA program is supported by 17 FTE consultants who develop and implement the BEP's quality system. Return to text.

15. To address the labor gaps within BEP, the CQA consultants are conducting a BEP-wide assessment to determine the essential competencies for all positions and to assist in developing training and hiring plans that will meet the needs of the CQA program. Return to text.

16. Improvements in pre-production test methodologies will identify design and process vulnerabilities that will reduce the risk of catastrophic failures, such as the new-design $100 note creasing issue. Return to text.

17. The BEP has been working to meet the requirements of a 2008 court order requiring the Secretary of the Treasury to provide meaningful access for blind and visually impaired people to denominate U.S. currency. Return to text.

18. The readers will be provided to blind and visually-impaired people at no expense to them. Return to text.