FEDS Notes

February 02, 2024

Assessing China's Efforts to Increase Self-Reliance

Francois de Soyres and Dylan Moore1

Since the beginning of 2018, the United States and China have been increasing tariff rates on each other's imports, spurring debates about a possible fragmentation of trade into blocs of aligned countries (Pierce and Yu (2023), Alfaro and Chor (2023)). Later that year, in a November 2018 speech to workers at a state-owned enterprise, President Xi Jinping mentioned that current events were forcing China to "travel the road of self-reliance." This vow has been forcefully reaffirmed in variety of public official communications since then. More recently, at the closing ceremony of the 2023 National People's Congress which gave President Xi an unprecedented third term, Xi insisted that "China should work to achieve greater self-reliance," referring to tensions with the U.S. and other democracies as part of the motivation for this objective.

In this note, we investigate the extent to which China is making progress towards its stated goal of greater self-reliance, defined as a higher reliance on domestically produced inputs. We start by briefly reviewing the growth model that China has pursued for decades, which is based on strong investment to expand export-oriented production capacity, coupled with restrained domestic consumption. Then, we document stark trends in key manufacturing and technology sectors that show that the Chinese economy is gradually becoming less dependent on imports. A particular focus on the automotive sector highlights the impressive pace at which China went from a net importer to a net exporter of finished cars, together with expanding its share of value-added in production. This case illustrates that while China is making progress in reducing its reliance on imported input, the country is not necessarily decreasing its reliance on exports to generate growth. We conclude by discussing the recent sharp decrease in inward foreign direct investment in China and the risk of a gradual decoupling of production between China and advanced economies.

1. China's growth model

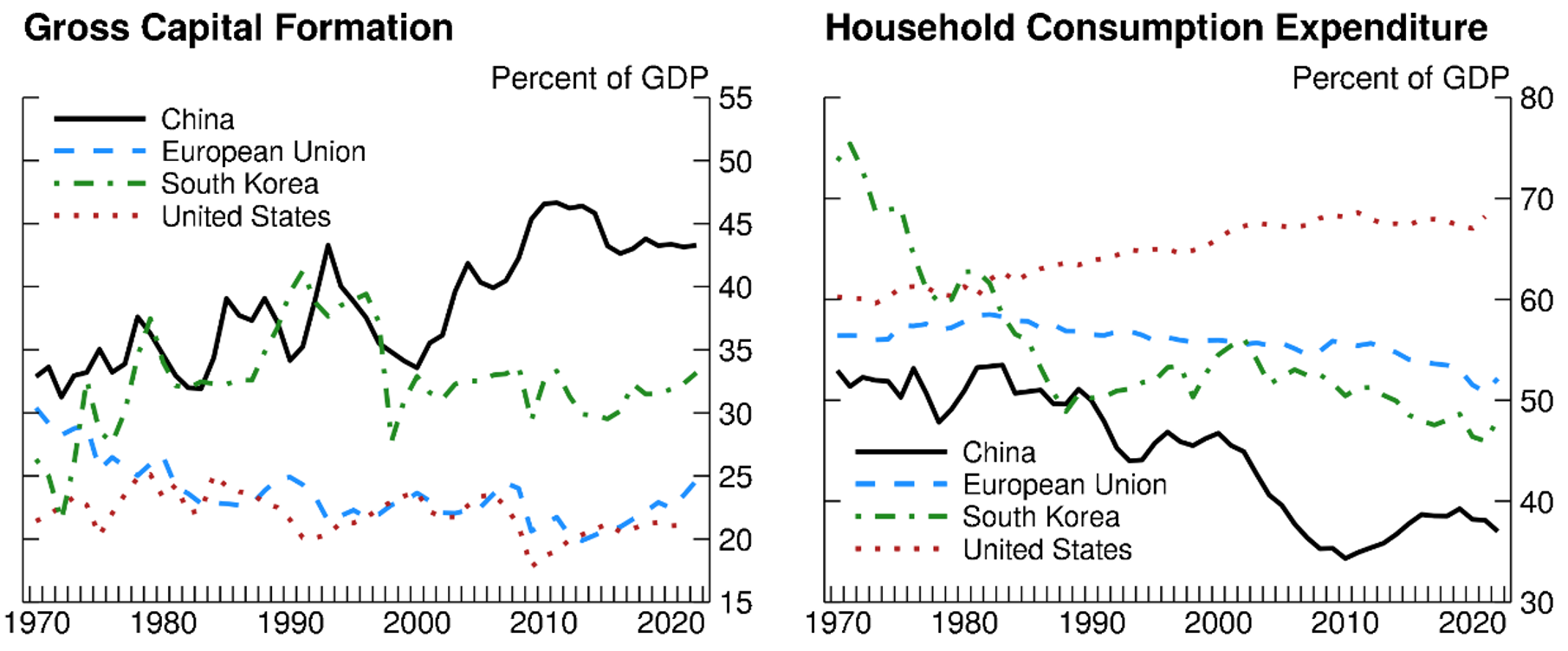

Over the past five decades, China's development model has been characterized by an increasingly high investment share of GDP (left panel, figure 1) together with a strikingly low household consumption share of GDP (right panel, figure 1). China expanded its production capacity, especially in manufacturing sectors with a goal to enhance exports and thus, without a corresponding increase in domestic demand, its economy became dependent on foreign demand.2 According to data from the International Monetary Fund, China's goods trade surplus reached an all-time high in 2022 of almost $900 billion, or about 5 percent of Chinese GDP that year, illustrating how much Chinese growth relies on foreign demand as an engine of growth.3

Note: The data extend through 2022 (2021 for the U.S.).

Source: The World Bank, World Development Indicators Online.

While the export-dependency of the Chinese economy has been widely discussed (Bown (2022), Hogan and Hufbauer (2023)), Chinese authorities have been more worried about the country's import-dependency, observing that China needs access to a variety of inputs for its own production. In 2018, President Xi Jinping called for a "whole-nation approach" to reducing China's dependence on imports of critical technology components. His strategy includes increasing the country's investment in strategically critical technology sectors, strengthening domestic talent-grooming, and "reshoring" to within the country expertise to spearhead innovation. Since Xi's original statement, these intentions have been repeatedly emphasized in government strategic documents about the future of the Chinese economy. Importantly, the "self-reliance" objective stated by Chinese authorities is focused on reducing the importance of imported input in production to replace them by domestic production, but it does not mean that China is intending to reduce its exports – on the contrary: the ever increasing trade surplus in goods shows that China continues to pursue an export-based growth strategy. In the remainder of this note, we investigate how much progress has been made on these strategic goals.

2. Decline of China's reliance on Imports

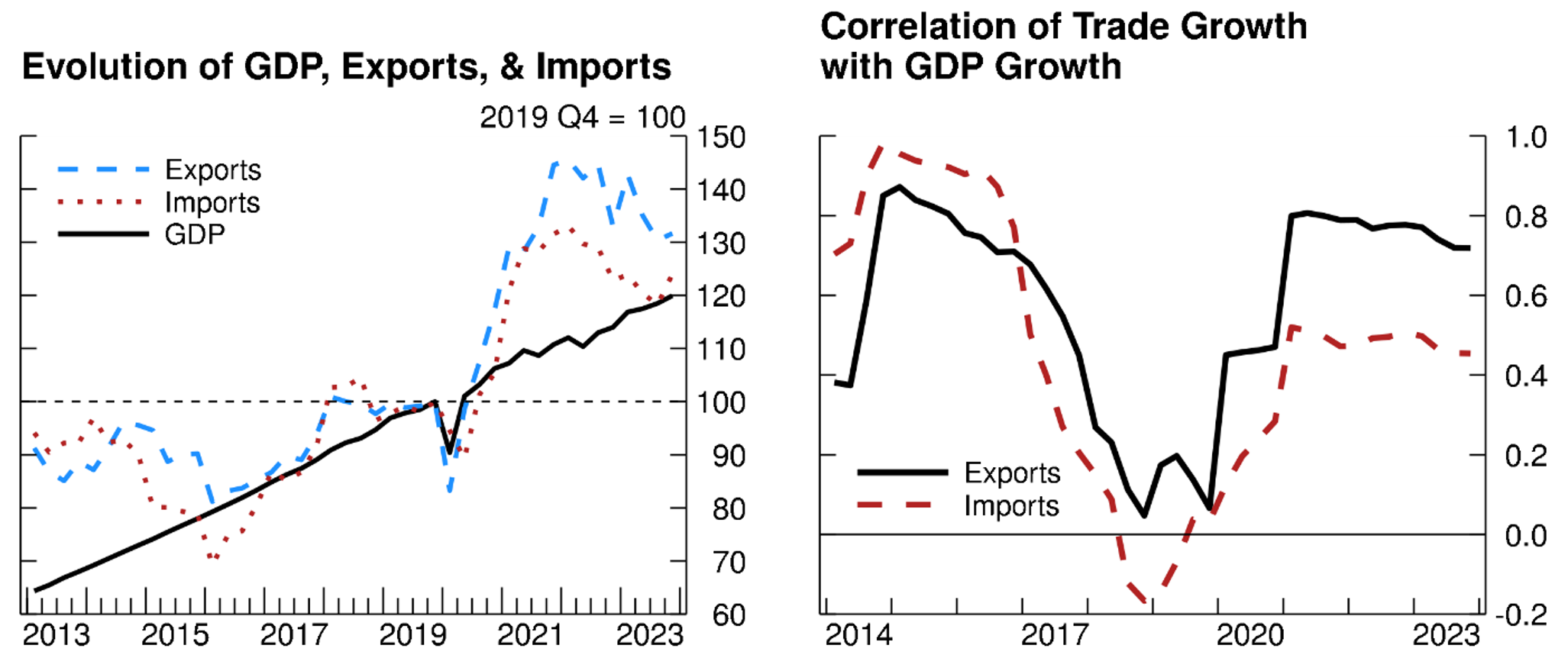

We start by looking at the joint evolution of GDP, imports, and exports. While imports and exports have historically been much more volatile than official GDP numbers, as is the case in most countries, figure 2 (left panel) reveals another remarkable fact: over the past 5 years, import growth has been notably weaker than export growth. To investigate this trend further, we use a 5-years rolling-window to compute the correlation between GDP, imports, and exports growth. As shown in the right panel of figure 2, the correlation between GDP growth and import growth has been systematically lower than the correlation with export growth for about a decade now. The reduced synchronization between GDP and imports could be an early sign of increasing self-reliance at work.

Left Figure

Note: Series are seasonally adjusted.

Source: Haver Analytics; FRB staff calculations.

Right Figure

Note: The data extend through 2023:04. Pearson correlations are calculated on 5-year moving windows of 4-quarter growth. The x-axis values are the end dates of the 5-year windows.

Source: Haver Analytics; FRB staff calculations.

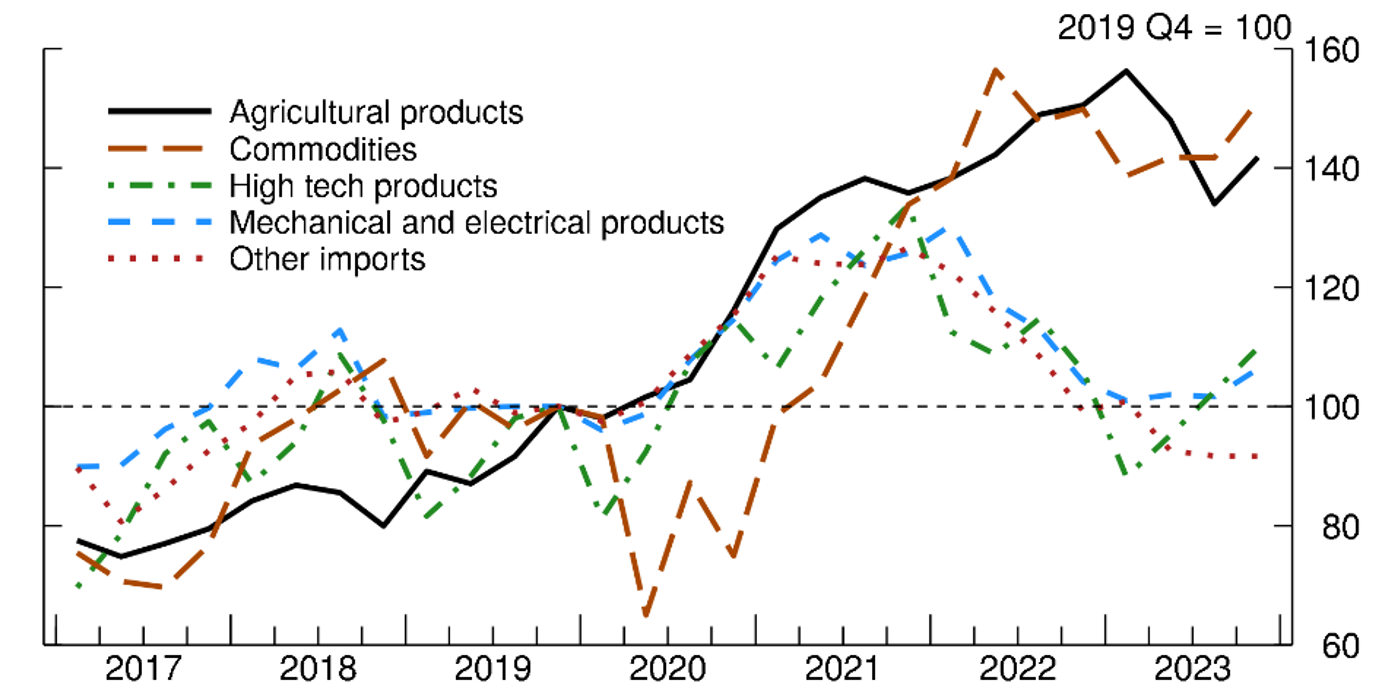

Moreover, taking a closer look at the sectoral level, we observe that the lukewarm Chinese imports are mostly driven by two sectors: (i) Mechanical & Electrical products and (ii) High-Tech products, which having been falling since early 2022 (figure 3).

Note: Data are seasonally adjusted and end in 2023:04. Categories are non-overlapping, based on national definitions of major categories. Commodities includes coal and lignite, crude oil, refined petroleum products, fertilizers, steel or iron products, unwrought copper and copper, and unwrought aluminum and aluminum. Other imports includes beauty cosmetics and toiletries, plastics in primary forms, textile yarns, fabrics, and their products, and garments and clothing accessories.

Share of total imports: 35% mechanical and electrical products, 23% high tech products, 18% commodities, 10% agricultural products, 3% other imports, 2% medicinal materials and pharmaceutical products (not shown).

Source: Haver Analytics.

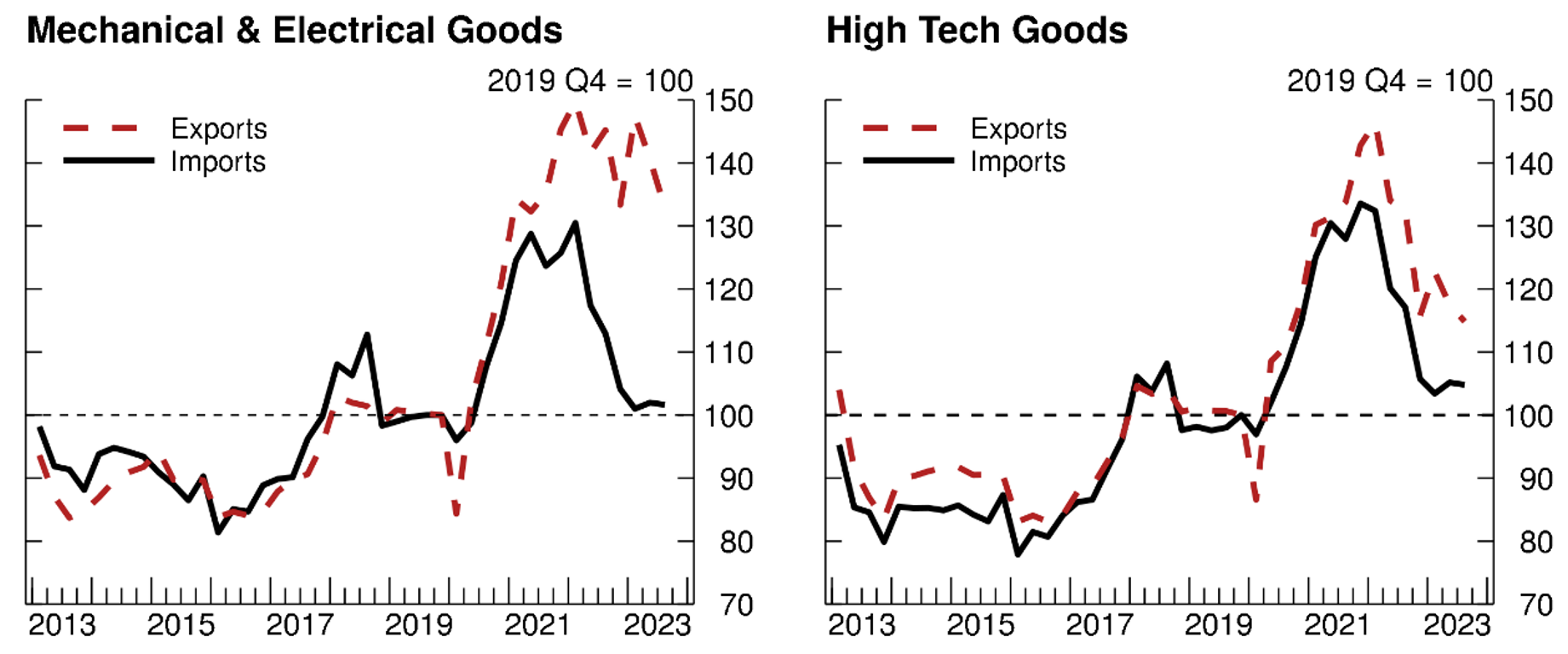

Is weak imports in selected sectors driven by weak external demand or does it reflect less reliance on imports to satisfy that demand? To investigate if the decrease in imports in these sectors could be driven by global forces, it is useful to look at the joint evolution of both imports and exports. Figure 4 reveals that imports and exports in these key sectors have decoupled since 2021, following a period in which the two measures moved closely together. Mechanical and electrical product exports have been relatively flat, while imports have experienced a significant decline. Over the same period, high tech goods exports have declined, but imports of such goods have dropped even more. The overall decline in high-tech trade is likely partially attributable to trade and investment restrictions imposed by the U.S. in this specific sector. Overall, it seems that the recent subdued import performance in key sectors comes from the combination of both a smaller reliance on imported input and sluggish foreign demand.

3. A Focus on the Automotive Sector

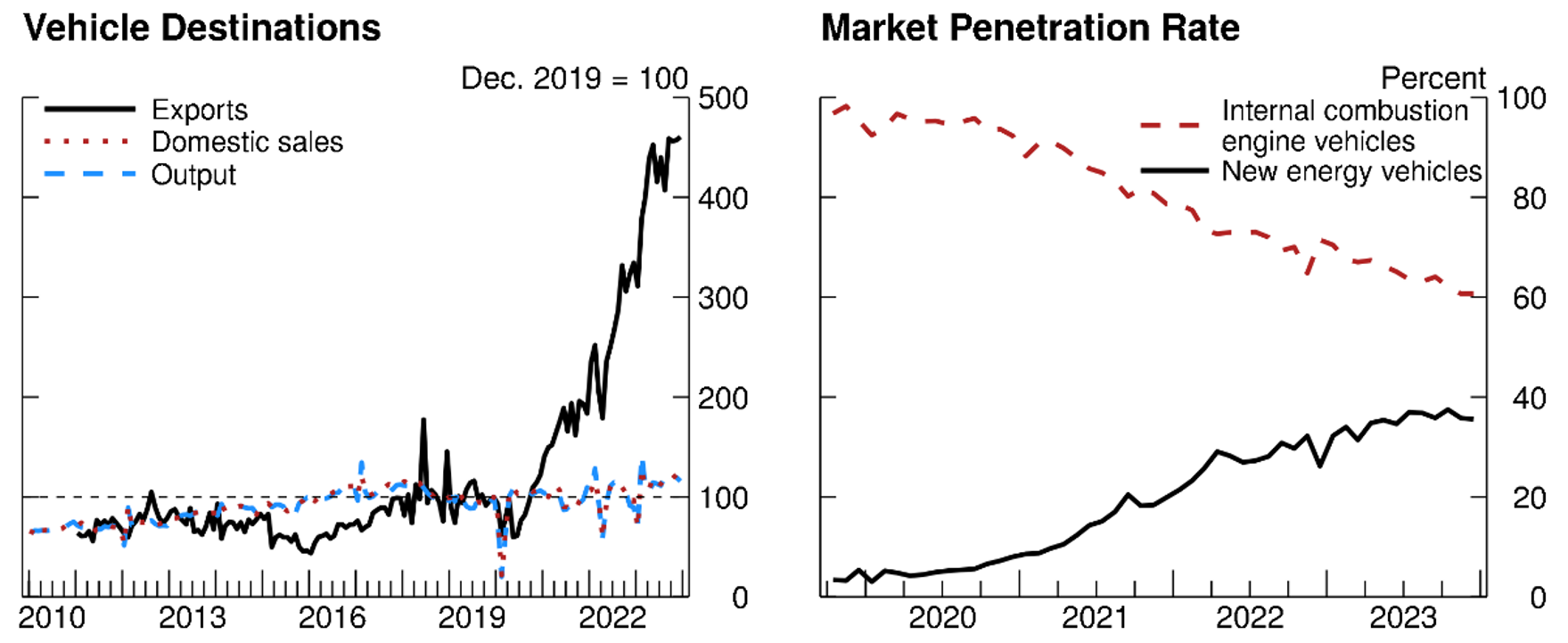

The Chinese automotive sector provides additional insights into the processes underlying China's pursuit of self-reliance. China has received widespread attention as now becoming the world's biggest producer of electric vehicles (EVs), and EVs are one of the many high-tech products the government is interested in supporting. However, it is not just EV production that has taken off. Chinese exports of all automobiles - including internal combustion engine (ICE) vehicles - have surged since 2020, greatly outpacing overall production and domestic sales (figure 5, left panel). These developments reflect several factors.

Note: New energy vehicles is the term used by the Chinese government for vehicles that are predominantly powered by electricity. The market penetration rate is the percentage ratio of each type of vehicle sales to total passenger vehicle sales.

Source: Haver Analytics.

First, China can produce cheaper cars relative to advanced economies due to lower domestic prices for components like steel and electronics. Local governments have also been providing subsidies, particularly to EV companies, further pushing down prices in the sector.

Second, Chinese domestic auto demand has shifted strongly towards EVs (figure 5, right panel), leaving China with excess capacity for ICE cars at a time of diminishing domestic demand for these vehicles. This has pushed China to export markets, where demand for ICE cars is not declining as rapidly, rather than closing these factories entirely.

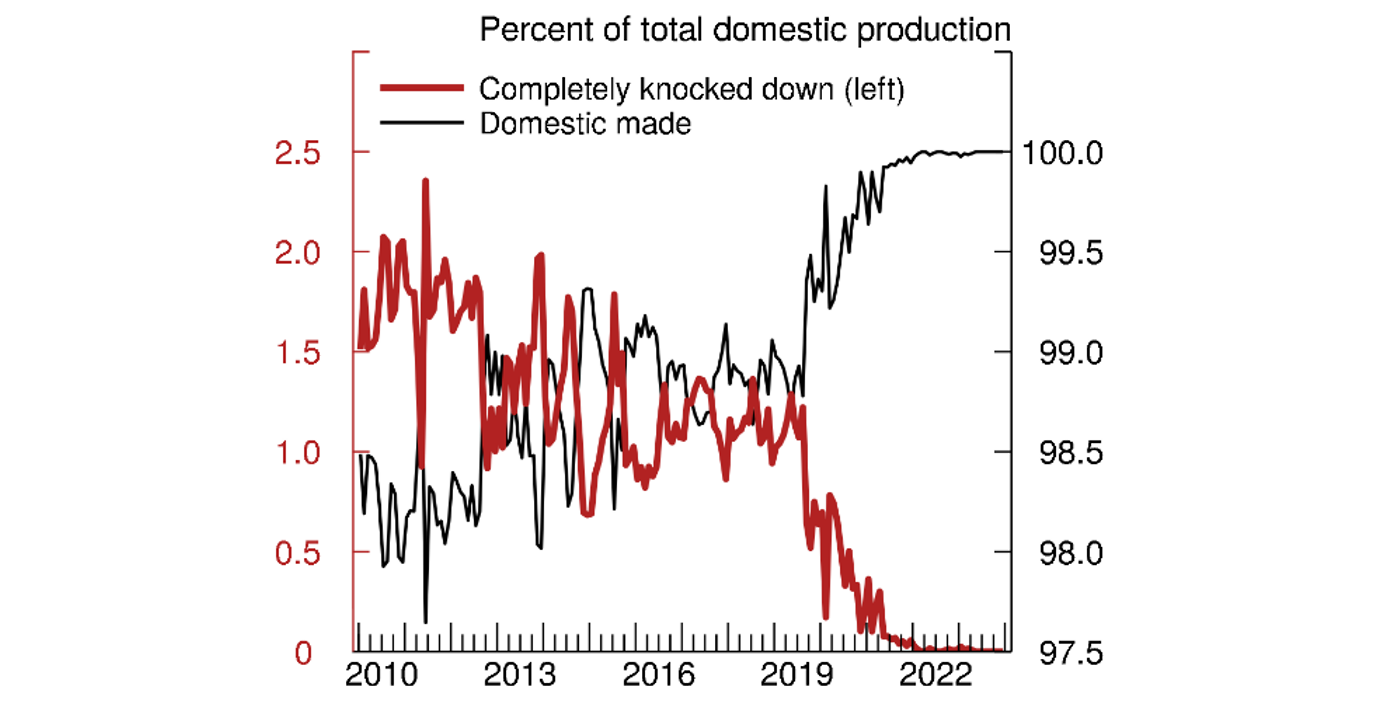

In addition to the rapid growth of auto exports, the composition of domestic auto production has also shifted over the past few years. This can be seen in the shift in domestic-made vehicles versus completely knocked down (CKD) vehicles as a share of total production. CKD vehicles are vehicles that are assembled in China but are made of imported parts and components. CKD vehicles are sometimes constructed using complete kits of auto parts that are ready for assembly. In contrast, domestic-made vehicles are made of domestically produced parts that are also assembled domestically. CKD vehicles have historically comprised a small portion of total auto production in China, but figure 6 shows that CKD vehicles have been completely phased out as of 2023. This demonstrates that China is undergoing not just an increase in auto production, but specifically a shift such that auto production is now comprised of 100% domestic-made vehicles.

Note: Value Is number of automobiles divided by total automobile production. Data extend through December.

Source: Haver Analytics.

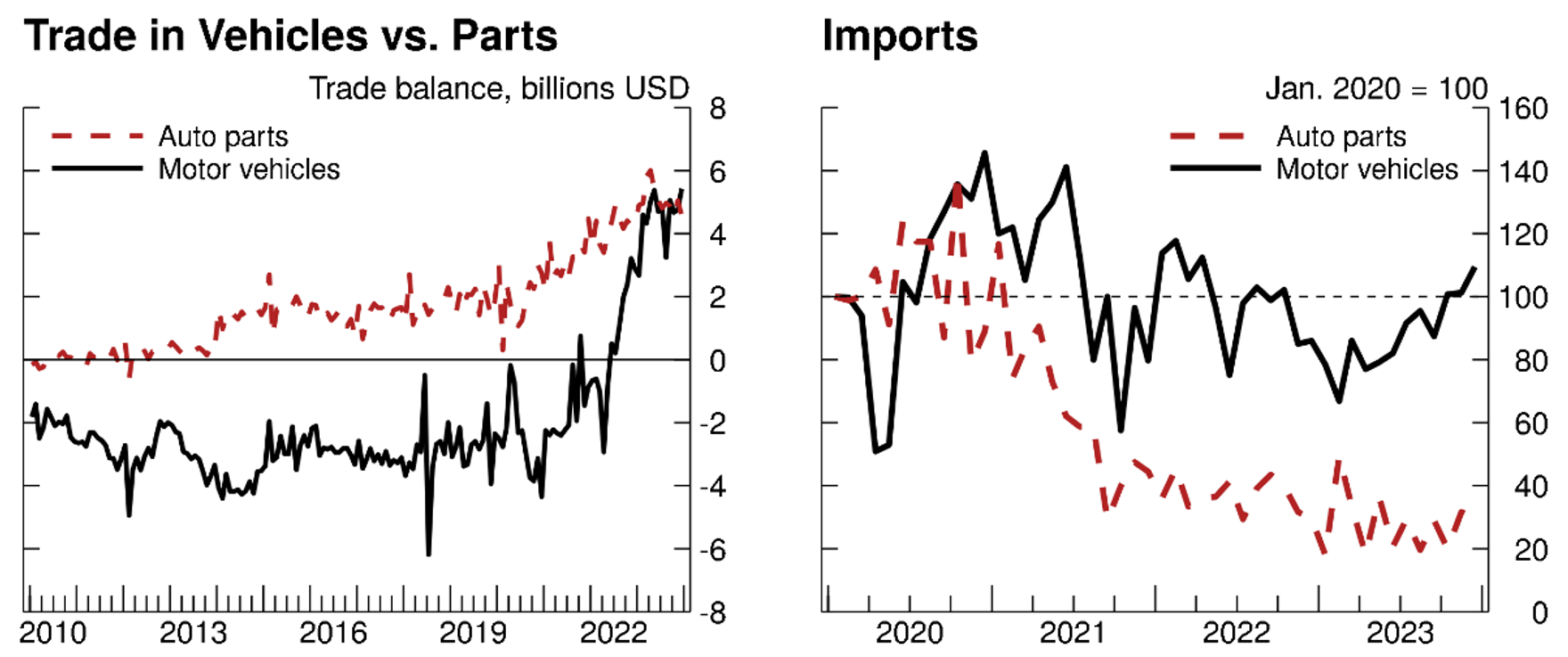

Further reinforcing this trend is figure 7 (left panel), which shows that China's trade balance in the automotive sector has experienced an impressive shift. For finished vehicles, China went from a net importer to a net exporter over the past few years, while at the same time significantly increasing its net export of auto parts. This supports the idea that China is not only gaining market shares in assembled vehicles but is also making progress towards comprehensive self-reliance. Moreover, the right panel of figure 7 reveals that the shift in trade balance is not just the result of growth in exports but also a steep decline in imports, particularly auto parts (figure 7, right panel).

4. Declining inward Foreign Direct Investment

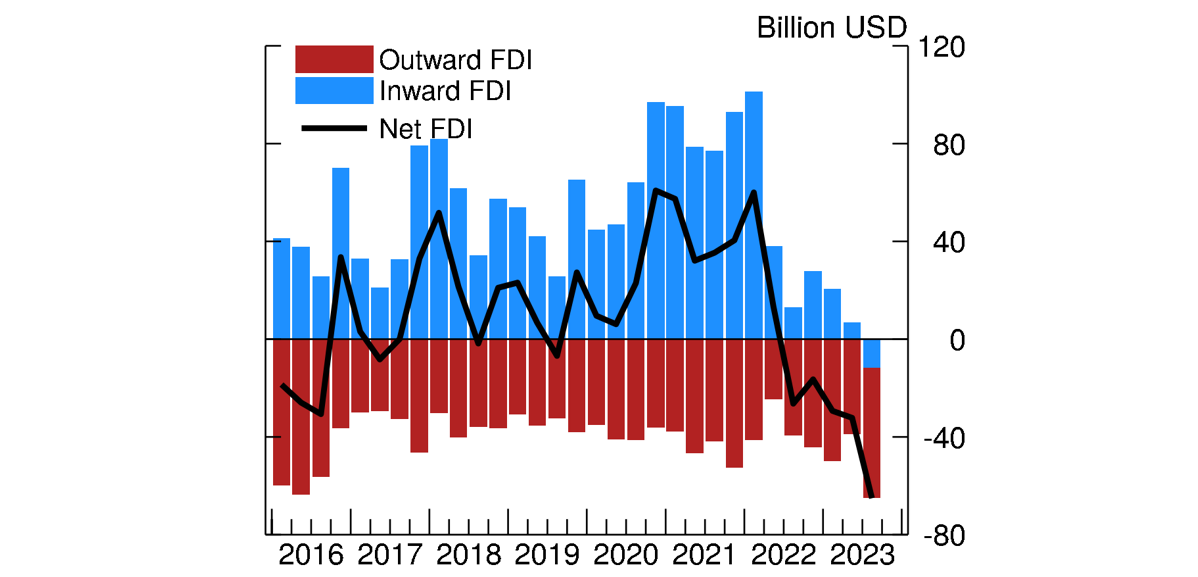

Over the past two years, China has been experiencing a steep decline in net FDI. As shown in figure 8, inward FDI in China turned negative in 2023:Q3 for the first time since the value began being recorded in 1998.4 By comparison, outward FDI has maintained a relatively flat level since 2017. There are many reasons for this remarkable decline in FDI, and there is likely a two-way causal relationship between weak FDI and the self-reliance objective.

Note: The key identifies bars in order from bottom to top.

Source: State Administration of Foreign Exchange (SAFE) accessed via Haver Analytics.

Some of this decline in inward FDI may be attributable to an interest rate gap in which China has maintained lower rates while many other countries maintain high rates. Other domestic issues, such as a precarious real estate sector and a crackdown on consulting firms through a counter-espionage law, may also be affecting inward FDI. That said, on top of these economic forces, the rise in geopolitical risks and fear of sanctions is likely to have played an important role as well: tensions between the U.S. and China have escalated over the past year, with the U.S. even implementing a ban on high-tech investment in China in August. As a result, global investors may have been directing part of their capital towards countries that are perceived as friendlier to the western bloc.

China's pursuit of self-reliance may be both a cause and a consequence of the sharp decline in inward FDI. China has implemented several policies in the name of national security that have made it more difficult for foreign firms to succeed. At the same time, steep declines in FDI coming into China could increase China's urgency in reducing its foreign dependence.

5. Concluding Thoughts

Since 2018, China has pursued its clear, stated objective of self-reliance, and seems to have made progress in several key sectors. As geopolitical tensions rise, domestic and foreign restrictions on cross-border trade and investment have also intensified, potentially increasing China's urgency in pursuing its self-reliance goals, which may in turn be also causing shift away from China by other countries, e.g. via FDI. Although the sustainability of this economy strategy remains unclear, China's declining reliance on imports, particularly in critical sectors like high tech and electrical products, illustrates that China has been moving towards achieving its stated goal.

At the same time, production linkages between China and the western bloc remain high. According to the OECD, China's contribution to foreign value added (FVA) in domestic final demand has grown significantly for member countries from 2010 to 2020. China's share of total FVA rose from 24.8% to 39.0% across that period, and the 2020 values are even higher in several key sectors, such as computer and electric equipment, where China contributes 66% of FVA. While decreasing its reliance on imports, China has simultaneously scaled up exports in sectors like automotives, and exports have become more closely linked to the overall GDP growth. In a sense, China is decreasing its reliance on imported inputs, but continues to maintain its reliance on foreign demand. All told, a delinking of global production processes and consumption from China is not in sight.

References

Ahmed, Shaghil (2017). "China's Footprints on the Global Economy: Remarks delivered at the Second IMF and Federal Reserve Bank of Atlanta Research Workshop on the Chinese Economy," IFDP Notes. Board of Governors of the Federal Reserve System, September 2017.

Alfaro, L., and D. Chor (2023, September). Global Supply Chains: The Looming "Great Reallocation". Working Paper 31661, National Bureau of Economic Research.

Bown, C. (2022a). Four Years Into the Trade War, are the US and China Decoupling. Working paper, Peterson Institute for International Economics.

Hogan, Megan and Hufbauer, Gary Clyde, "Despite disruptions, US-China trade is likely to grow". Peterson Institute for International Economics Policy Brief 23-14, October 2023.

Pierce, Justin R., and David Yu (2023). "Assessing the Extent of Trade Fragmentation," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, November 2023.

1. François de Soyres ([email protected]) and Dylan Moore ([email protected]) are with the Board of Governors of the Federal Reserve System. The views expressed in this note are our own, and do not represent the views of the Board of Governors of the Federal Reserve, nor any other person associated with the Federal Reserve System. Return to text

2. Ahmed (2017) documents how China's strong export growth between 1994 and 2017 was supported by export-led investment. Return to text

3. Of note, the accounting contribution of net exports to GDP does not fully capture the outward orientation of China's economy as imports of parts and components were also very high and imports had a high "export content". Return to text

4. A negative value for inward FDI means that foreigners are pulling money out of firms in China or selling off ownership stakes, or both. Return to text

de Soyres, Francois, and Dylan Moore (2024). "Assessing China's Efforts to Increase Self-Reliance," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, February 02, 2024, https://doi.org/10.17016/2380-7172.3436.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.