FEDS Notes

July 01, 2020

Implementing Monetary Policy in an "Ample-Reserves" Regime: The Basics (Note 1 of 3)

Jane Ihrig, Zeynep Senyuz, and Gretchen C. Weinbach

The Committee intends to continue to implement monetary policy in a regime in which an ample supply of reserves ensures that control over the level of the federal funds rate and other short-term interest rates is exercised primarily through the setting of the Federal Reserve's administered rates, and in which active management of the supply of reserves is not required.

Source: FOMC's Statement Regarding Monetary Policy Implementation and Balance Sheet Normalization, January 2019.

The FOMC has stated that it intends to continue implementing monetary policy in a regime with an ample supply of reserves.1 This Note, the first in a three-part series, provides an introductory discussion of what it means to implement policy in such a regime and how the Fed ensures interest rate control in an environment with an ample supply of reserves in the banking system. In particular, we review how the Fed uses its key tools—administered rates—to keep the federal funds rate in the FOMC's target range.

Model of an ample-reserves implementation regime

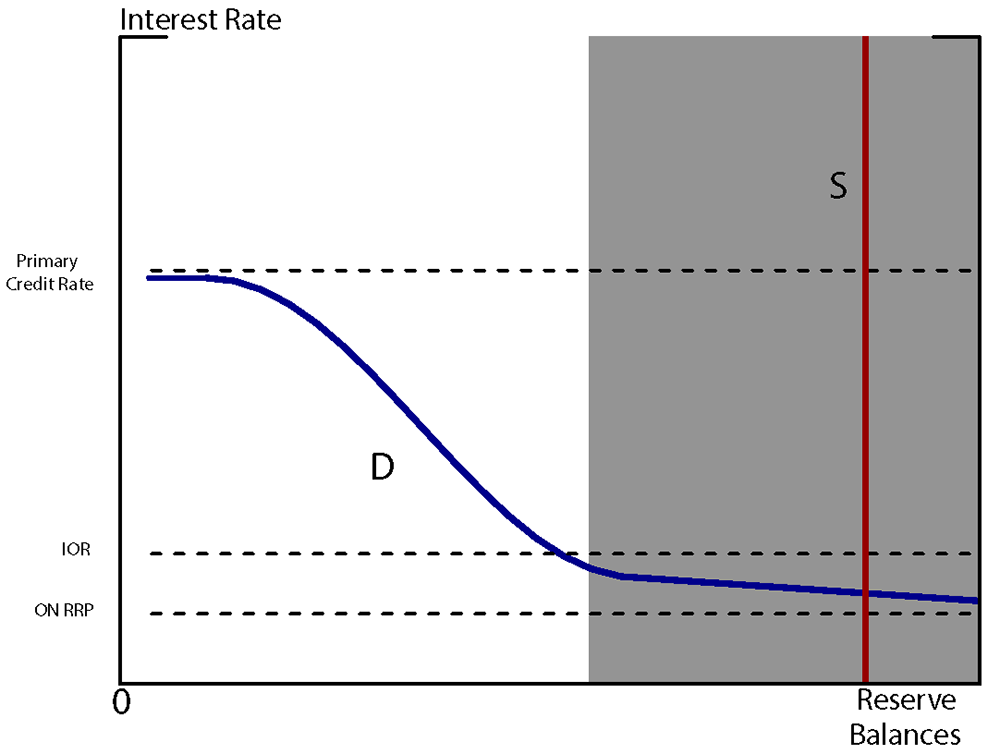

The Fed sets the stance of monetary policy by choosing a target range for the federal funds rate (FFR), which is the interest rate at which depository institutions, hereafter "banks" for short, lend funds to each other on an overnight basis.2 To understand how the Fed implements monetary policy in an ample-reserves regime—how it ensures the market-determined federal funds rate stays within the target range set by the FOMC when reserves are ample—consider the stylized model of the demand for and supply of reserves shown in figure 1.

The blue, downward-sloping curve represents banks' demand for reserves. Banks may want to hold reserves for a variety of reasons, including to meet intraday payment needs, earn interest on a high-quality liquid asset, and meet internal as well as regulatory liquidity risk management constraints. The demand curve has two portions. The steep portion of the curve, shown in the non-shaded region of the figure, captures the idea that the higher the opportunity cost of holding reserve balances, the lower is banks' demand. And, conversely, banks are generally inclined to hold more reserves as the cost of overnight borrowing in the federal funds market falls. On this steep portion of the curve, banks' demand is quite sensitive to changes in reserve supply. In other words, on this portion of the demand curve, the rate at which reserves are traded among banks, the federal funds rate, adjusts with even modest changes in reserve supply. The demand curve also has a nearly flat, or flat, portion, located where the quantity of reserves in the banking system is significantly larger. This portion of the demand curve is shown in the gray shaded region of the figure. The transition from the steep portion of the curve to the nearly flat portion illustrates that as the quantity of reserves in the banking system increases, at some point, banks do not find much benefit from holding additional reserves other than earning the interest the Fed pays on these balances. As a result, the blue demand curve flattens out at a level that is close to the interest on reserves (IOR) rate, the interest rate the Fed pays on these balances.

The vertical red line represents the Fed's supply of reserves. This line is vertical because the Fed alone determines the ultimate quantity of reserves in the banking system. An ample-reserves regime is one in which the reserve supply curve lies somewhere in the gray shaded region of the figure. In this region, the Fed's supply curve always intersects banks' demand curve on its nearly flat portion. Here, the federal funds rate does not materially move when the supply of reserves rises or falls. And this is the essence of what it means for the Fed to supply an "ample" quantity of reserves—reserves are considered ample when the Fed's supply is at least large enough so that the equilibrium FFR (where demand equals supply) does not materially change with movements in the quantity of reserves in the banking system. Importantly, this condition means that the Fed cannot control the federal funds rate through routine changes in the quantity of reserves, also known as open market operations. When implementing monetary policy in an ample-reserves regime, the Fed primarily relies on its administered interest rates to keep the FFR within the target range.

The Fed's administered rates

Administered rates are standing interest rates the Fed sets, or administers. These interest rates are denoted on the y-axis of figure 1. Two of these administered rates are key for the Fed's implementation of monetary policy: The IOR rate is the Fed's principal tool for interest rate control, and the overnight reverse repurchase agreement (ON RRP) facility offering rate is the Fed's supplementary tool for interest rate control.3

The IOR rate is the interest rate that banks earn from the Fed on the funds they deposit in their reserve accounts.4 When choosing whether to hold cash in their accounts at the Fed and earn the IOR rate or invest their cash in another money market instrument, such as Treasury bills, banks mainly consider their liquidity needs and the opportunity cost of holding reserves, the latter in the form of the relative returns available on alternative investments. With the payment of IOR, banks have little or no incentive to lend their reserves to other banks at rates lower than the IOR rate. In this sense, the IOR rate acts as a reservation rate in banks' intermediation activities, helping to establish a minimum, or a floor, under the various overnight market returns that banks take into account when considering how best to manage their cash. For example, a bank that wants to invest some cash for a short time might choose among the following options: Depositing the cash at the Fed and earning IOR; loaning the cash to another bank and earning the negotiated (market) FFR; or investing the cash in another money market alternative, such as by purchasing a Treasury bill or commercial paper. In considering any of these options, the bank should not accept an interest rate below what it can receive from the Fed. In addition, as long as the supply of reserves remains ample, cash lenders should compete with each other so that trading in the federal funds market occurs at rates that are never too far above the IOR rate. As a result, in an ample-reserves regime, the FFR is expected to trade near the IOR rate.

Banks are not the only institutions active in money markets. Federal Home Loan Banks (FHLBs) and money market mutual funds are also active in these markets. FHLBs account for the majority of lending in the federal funds market. Money market mutual funds lend substantial cash in other segments of money markets, which may influence trading conditions in the federal funds market. However, neither of these two types of active participants in money markets can earn IOR. As a result, the IOR rate by itself is unable to set a firm floor under the constellation of overnight money market rates.

To enhance its control of short-term interest rates, the Fed uses a supplementary tool, the offering rate at its standing ON RRP facility. Through this facility, the Fed temporarily accepts cash deposits from eligible counterparties in return for temporarily lending them securities it holds, with an agreement to reverse the transaction the next day, with interest. The interest the Fed pays on the deposits is the ON RRP rate. With the ON RRP rate available to be earned from the Fed, eligible institutions have little incentive to lend cash to others at a lower rate. Thus, the ON RRP rate plays the same role for these counterparties that the IOR rate does for banks—it acts as a reservation rate in money market investment and cash management decisions, helping to put a floor under the various overnight market rates that these institutions consider.

It is important to note that the IOR and ON RRP rates are relevant in decision making regardless of whether banks actually do adjust their reserve holdings, or the Fed's ON RRP counterparties actually do adjust their ON RRP deposits, on any given day or not. The IOR and the ON RRP facility are standing investment options; eligible institutions regularly take the IOR and ON RRP rates into account when considering their options for short-term investments in money markets. As a result, the federal funds rate and other short-term money market interest rates are guided by these administered rates. Given their ability to help steer short-term market interest rates, the Fed sets these administered rates in a way that keeps the federal funds rate in the FOMC's target range. Let's see how this works.

How does the Fed set its key administered rates?

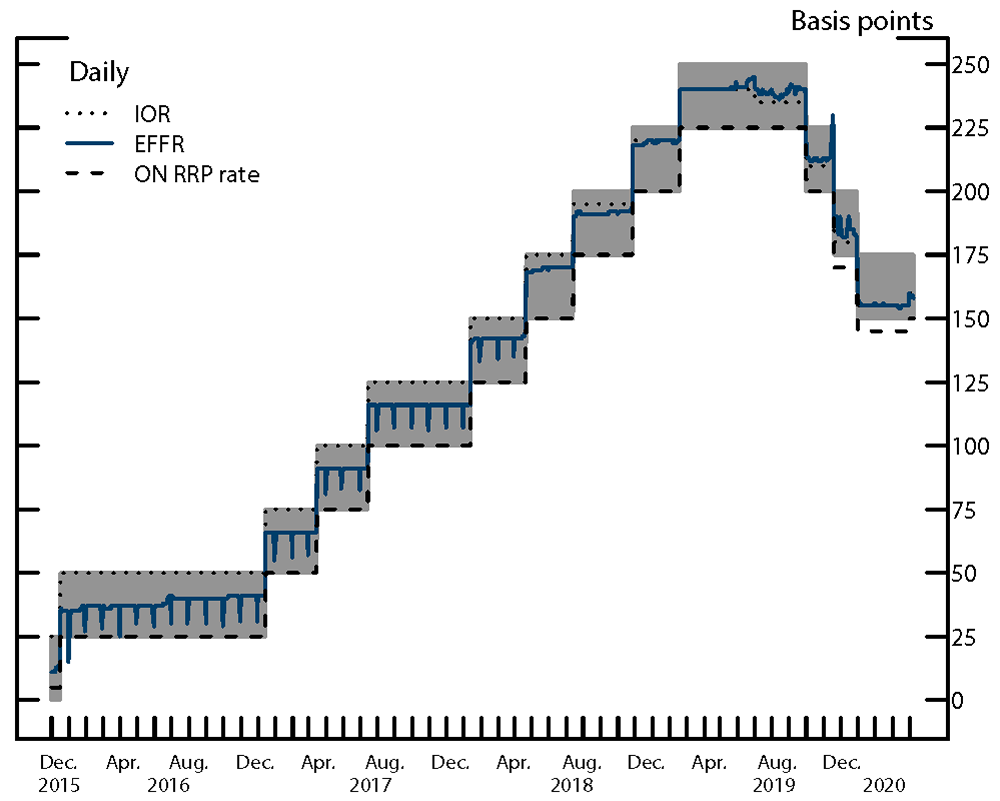

The Fed sets its administered rates relative to the FOMC's target range for the federal funds rate. As shown in figure 2, when the FOMC adjusts the stance of monetary policy by changing the target range for the federal funds rate (the gray shaded region), the Fed implements that change in markets by also adjusting the settings of its key administered rates, the IOR (dotted) and ON RRP (dashed) rates. These adjustments ensure that the effective federal funds rate—the median of the rates at which reserves change hands among banks (the solid blue line)—remains within the target range.

Source: Federal Reserve Bank of New York.

The Fed monitors conditions in money markets carefully and takes those conditions into account when setting its administered rates. At times, in response to those conditions, the Fed has altered the position of one or both of its key administered rates relative to the target range; the Fed can make such alterations even without moving the target range. In particular, the Fed has set the IOR rate at the top of the target range, and it has also set it below the top of the range by varying amounts. Similarly, the Fed has set the ON RRP rate at the bottom of the FOMC's target range, and it has set it a bit below that level. Changes in the settings of the administered rates relative to the target range are referred to as technical adjustments. What is important to remember is that technical adjustments are solely made to ensure interest rate control and do not indicate any change in the stance of monetary policy.

Final thoughts

We provided an introductory description of the approach and the tools the Fed uses to implement monetary policy in an ample-reserves regime. More information about the Fed's ample-reserves implementation regime may be found in Ihrig, Senyuz, and Weinbach (2020), the paper on which this Note series is based. Our second Note in this three-part series explains the actions and considerations the Fed undertakes in maintaining an ample supply of reserves over the long run. The third and final Note in the series describes how the Fed operates in an ample-reserves regime when responding to a crisis, such as the COVID-19 pandemic.

1. The FOMC's announcement, made in January 2019, may be found on the Federal Reserve Board's web site at the following link: https://www.federalreserve.gov/newsevents/pressreleases/monetary20190130c.htm. Return to text

2. Depository institutions include commercial banks, savings banks, credit unions, thrift institutions, and most U.S. branches and agencies of foreign banks. There are a few other institutions in the federal funds market as well. Specifically, Federal Home Loan Banks (FHLBs) are key lenders in this market. Return to text

3. The Fed's primary credit rate (sometimes referred to as the "discount rate") is also an administered rate. The primary credit rate is the interest rate charged to banks in good standing on the loans they receive against collateral from the Fed. Although the Fed's primary credit program is intended in part to provide a ceiling for short-term market interest rates by providing banks a backup source of funding at a higher-than-market rate, banks are typically reluctant to borrow from the central bank to avoid sending a negative signal about their financial condition. Return to text

4. For simplicity, we use "IOR rate" to refer to the single rate at which the Federal Reserve Banks pay interest on all reserve balances. Technically, the Fed has paid interest on two different components of reserves—required reserves, tied to the Fed's reserve requirements as specified in Regulation D, and excess reserves, balances that are above the level of reserves banks are required by the Fed to hold. Under authority from Congress granted in the Financial Services Regulatory Relief Act of 2006 and the Emergency Economic Stabilization Act of 2008, the Board of Governors directed the Federal Reserve Banks to pay interest on required reserve balances and on excess balances, and these two rates were set equal. With required reserve ratios set to zero in March 2020, the distinction has become moot (see the Fed's announcement, available on the Federal Reserve Board's web site at the following link: https://www.federalreserve.gov/newsevents/pressreleases/monetary20200315b.htm. Return to text

Ihrig, Jane, Zeynep Senyuz, and Gretchen C. Weinbach (2020). "Implementing Monetary Policy in an "Ample-Reserves" Regime: The Basics (Note 1 of 3)," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, July 01, 2020, https://doi.org/10.17016/2380-7172.2552.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.