FEDS Notes

September 20, 2024

The Evolution of the Federal Reserve's Agency MBS Holdings1

Dave Na, Ellie Newman, and Bernd Schlusche

Introduction

The Federal Reserve (Fed) utilized its balance sheet as a monetary policy tool in response to the Global Financial Crisis (GFC) and the COVID-19 pandemic, acquiring large quantities of Treasury and agency securities.2 In 2022, the Fed began to reduce the size of its securities portfolio held in the System Open Market Account (SOMA) by allowing securities to roll off its balance sheet in amounts up to specific monthly redemption caps for Treasury securities and agency securities. In June 2024, the Fed slowed the pace of balance sheet runoff by reducing the monthly redemption cap on its Treasury securities while maintaining the monthly redemption cap on its agency securities. In this note, we discuss the evolution of the agency mortgage-backed securities (MBS) holdings in the SOMA with a focus on the events that led to agency MBS becoming a meaningful portion of the Fed's balance sheet and provide projections for SOMA agency MBS principal payments and for the associated size of the SOMA agency MBS portfolio under alternative interest rate paths.

Responses to the Global Financial Crisis and Covid-19 Pandemic

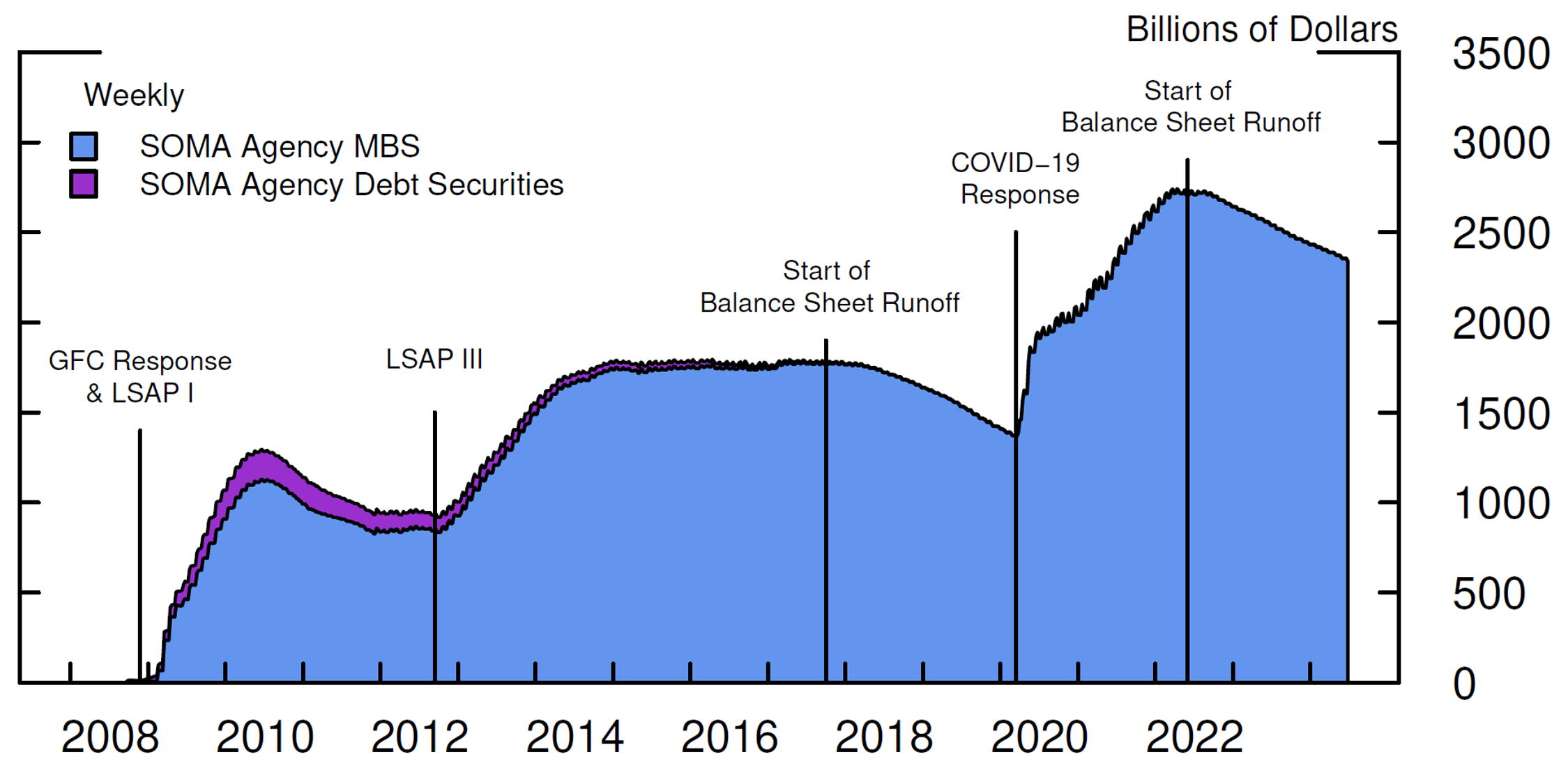

In response to the GFC, the Fed conducted large-scale asset purchase (LSAP) programs, along with other policy actions, to support market functioning and fulfill its statutory mandate of maximum employment and price stability. As shown in Figure 1, the Fed acquired roughly $200 billion of agency debt and $1.25 trillion of agency MBS through 2010, as part of its initial round of securities purchases (LSAP I), to provide support to U.S. housing markets and to improve conditions in financial markets more generally.3 In 2012, to support a stronger economic recovery, the Fed implemented another round of agency MBS purchases during LSAP III, acquiring $40 billion per month of agency MBS. After tapering the monthly purchase amounts of agency MBS in 2013, the Fed concluded its purchases in 2014. By the end of these purchase programs, the Fed held roughly $1.8 trillion in agency MBS, accounting for about 40 percent of the SOMA portfolio, along with about $40 billion of agency debt securities. In 2017, the Fed began reducing its securities holdings and concluded the reduction of its aggregate securities holdings in 2019, decreasing SOMA agency MBS holdings by roughly $300 billion to $1.5 trillion.4

Note: Key identifies in order from bottom to top.

Source: Board of Governors of the Federal Reserve System, H.4.1

Similarly, in response to the COVID-19 pandemic—an extraordinary shock that disrupted economic activities and caused unprecedented challenges for financial markets, the Fed implemented various policy actions to support the U.S. economy. Among other actions, the Federal Open Market Committee (FOMC) announced on March 15, 2020, that the Fed would increase its SOMA agency MBS holdings by at least $200 billion to help support the flow of credit to households and businesses.5 This plan was later amended to conduct purchases in amounts needed to support smooth market functioning, resulting in a total purchase of $700 billion of agency MBS within two months. By mid-2020, market functioning had improved, and later that year, the purchase amounts of agency MBS were set to a monthly purchase pace of $40 billion to sustain smooth market functioning and to continue to help foster accommodative financial conditions. In November 2021, the FOMC announced that the Fed would begin to taper its securities purchases, and the Fed ultimately ended its purchases in early 2022. As illustrated in Figure 1, SOMA agency MBS holdings had increased from $1.4 trillion in early 2020 to $2.7 trillion in mid-2022, accounting for about 30 percent of the SOMA portfolio.

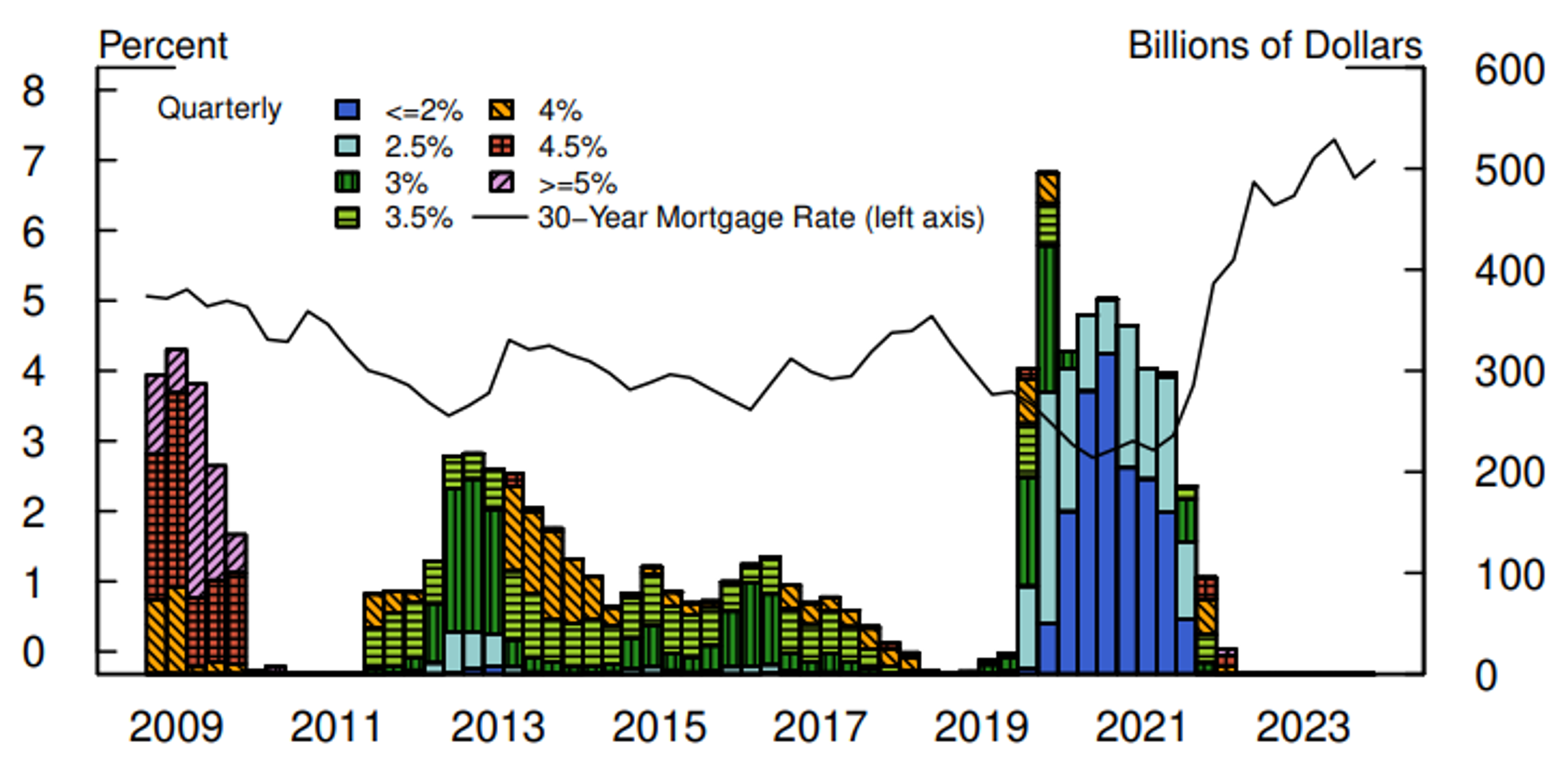

Agency MBS purchases were carried out by the Federal Reserve Bank of New York's Open Market Trading Desk (the Desk) through the To-Be-Announced (TBA) forward market that offers both high liquidity and transparent pricing.6 The Desk's agency MBS purchases in the TBA market were concentrated in recently issued and most actively traded securities, with coupons that were closely tied to primary mortgage rates, for settlement in the following month. Consistent with this practice, as shown in Figure 2, the agency MBS purchases were spread across various coupons—ranging from 1.5 percent to 6.5 percent, which represent the coupons that were produced during the agency MBS purchase periods.7

Note: Values are rounded to billions of dollars.

Source: Board of Governors of the Federal Reserve System; Federal Reserve Bank of New York; Federal Home Mortgage Corporation

Balance Sheet Runoff that Started in 2022

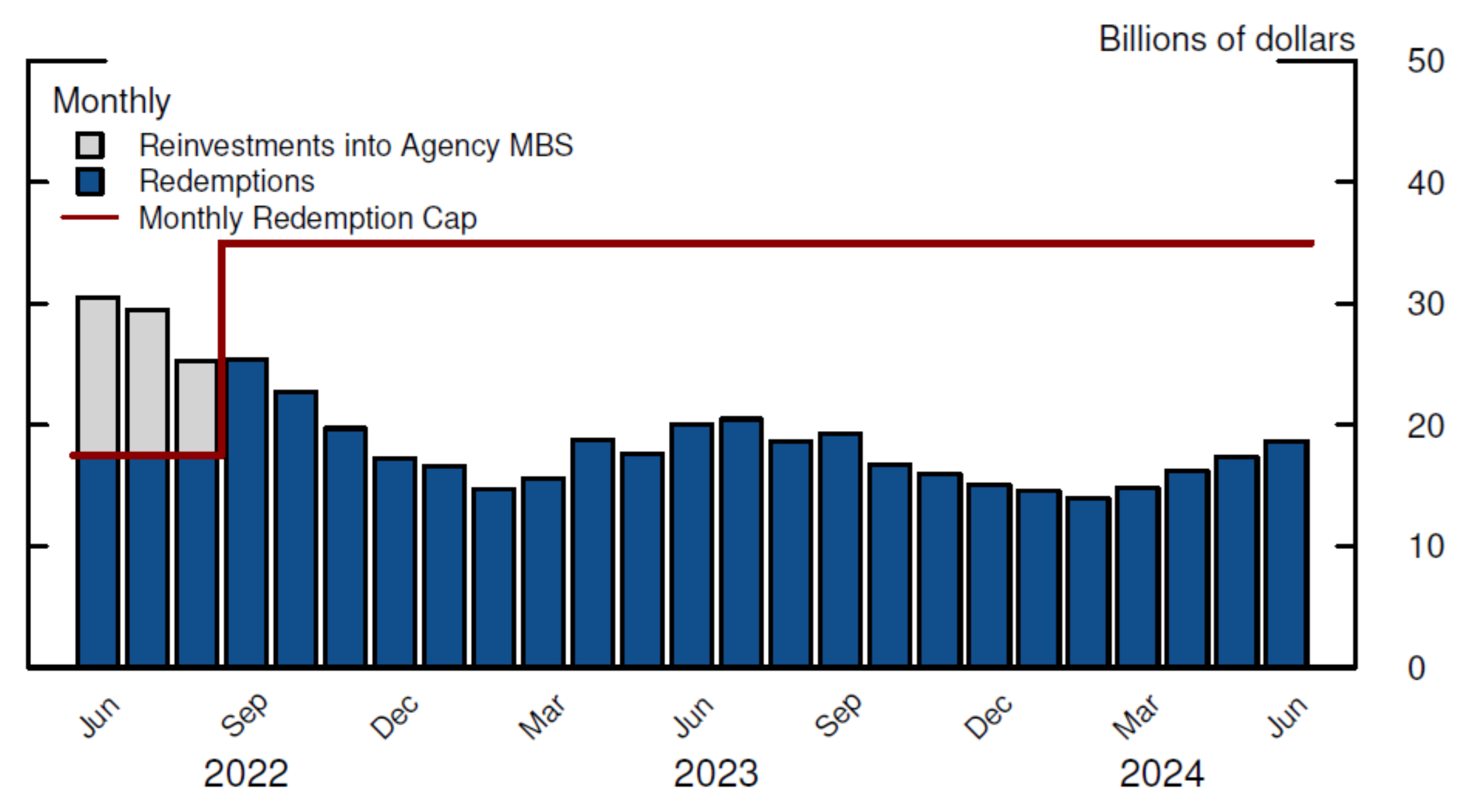

In May 2022, the FOMC announced that the Fed would reduce its SOMA holdings of agency securities by redeeming maturing securities up to a cap of $17.5 billion per month starting in June 2022 and that this cap would be increased to $35 billion per month in September 2022.8 However, the amounts of principal payments from the Fed's agency securities have declined in recent years, and the monthly principal payments have been below the $35 billion-per-month redemption cap; therefore, the size of the SOMA agency MBS portfolio has decreased at a much slower pace than in the case of a binding cap. Specifically, from June 2022 through June 2024, the monthly redemption amounts of SOMA agency MBS averaged about $18 billion and total SOMA agency MBS holdings decreased roughly $450 billion over that period, roughly half of the maximum amount of $820 billion that would have rolled off if the cap had been binding (Figure 3).

Source: Federal Reserve Bank of New York

The principal payments from the SOMA agency MBS holdings have recently been below the redemption cap primarily because the prevailing mortgage rate for many borrowers is higher than the rates on their existing mortgages. As such, effectively all of the mortgages underlying the SOMA agency MBS are "out-of-the-money" to refinance, which disincentivizes prepayment.9

Understanding agency MBS is essential to comprehend this dynamic. Agency MBS are securitized pools of mortgages, and the most popular residential mortgage in the United States is a 30-year fixed rate loan where the amortization schedule specifies how the loan is intended to be repaid; at origination, the borrower is expected to make 360 equal payments consisting of principal and interest payments. However, it is common for a mortgage borrower to retain a right to make additional payments or completely payoff the loan at any time without any penalty, and these payments, which result in deviations from the original amortization schedule, are considered prepayments. Therefore, prepayment, or the early repayment of principal, is an embedded option in MBS which is freely exercised by mortgage borrowers—generally either when mortgage rates decline making it economically advantageous to refinance existing mortgages or when the underlying residential property is sold. Historically, refinancing of an existing loan was the dominant source of prepayment. However, in the current high interest rate environment, there is little to no refinancing activity from the agency MBS held in the SOMA, and therefore the monthly principal payments have been relatively low, with scheduled principal payments accounting for roughly half of the monthly principal payments and the other half representing prepayments mostly due to turnover activities.10

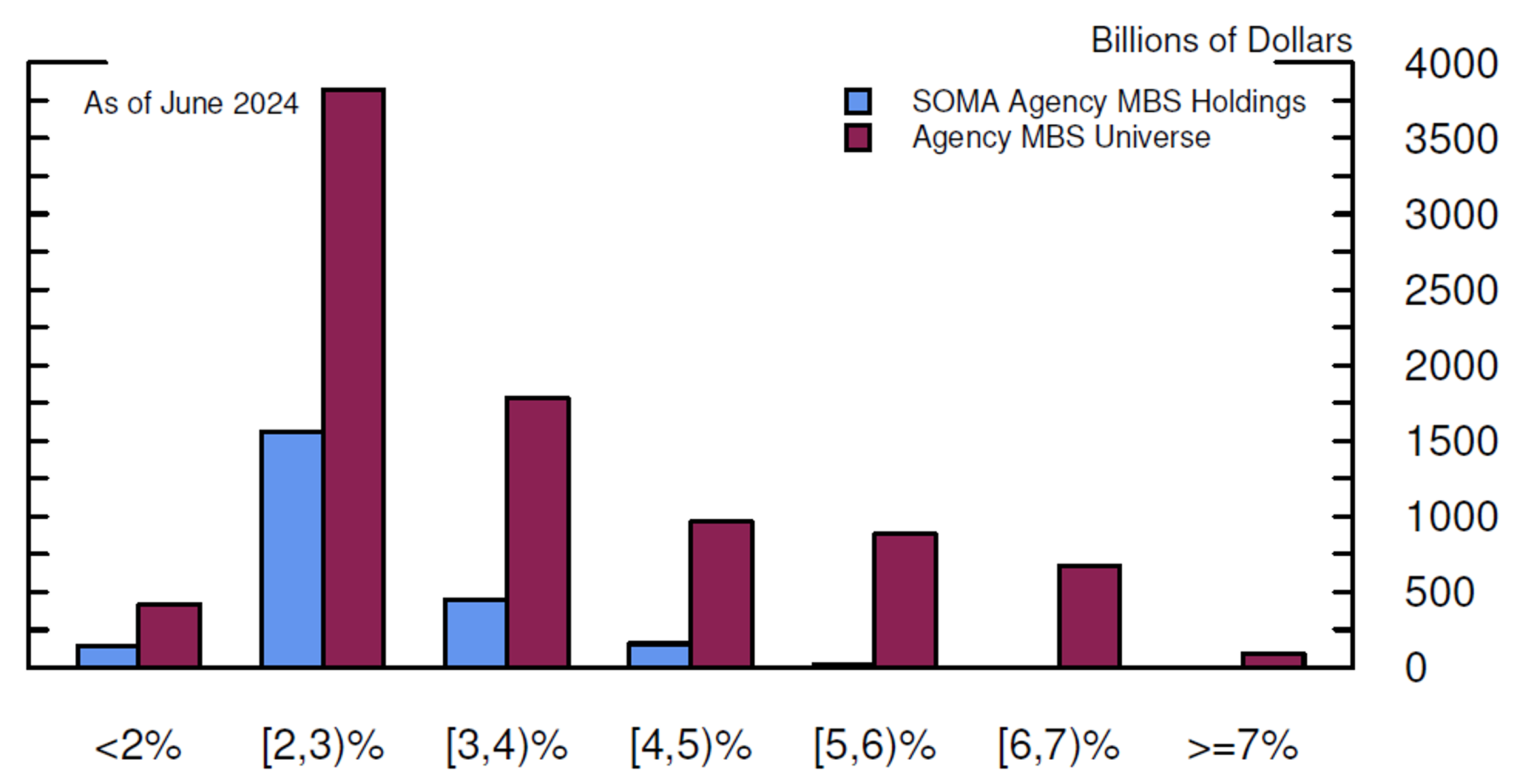

As of June 2024, the Fed held approximately $2.3 trillion of agency MBS, representing almost 30 percent of the outstanding balance in the agency MBS market.11 Figure 4 shows the distribution across coupons for both the SOMA agency MBS holdings—the blue bars—and the agency MBS universe—the red bars. The SOMA agency MBS holdings are more concentrated in low coupons—more than 90 percent of the holdings have coupons of less than 4 percent—compared with the agency MBS universe with 70 percent of the outstanding securities having coupons of less than 4 percent. Given the concentration in low coupon securities and relatively high prevailing mortgage rates, a vast majority of the agency MBS held in the SOMA are far out-of-the-money to refinance and may be subject to the "lock-in" effect—the reluctance of homeowners to sell their home with a low-rate mortgage and purchase another home with a higher-rate mortgage. Thus, even a notable decline in mortgage rates would likely not materially affect agency MBS principal payments in the near-term, as shown in the subsequent section.

Note: Values are rounded to billions of dollars. Key identifies in order from left to right.

Source: Federal Reserve Bank of New York; Authors' calculations based on eMBS security-level data

Projections for the SOMA Agency MBS portfolio under Alternative Interest Rate Scenarios

In this section, we provide projections for SOMA agency MBS principal payments and the size of the Fed's agency MBS portfolio under a baseline scenario and under two illustrative scenarios with alternative paths for interest rates and macroeconomic outcomes to assess the interest-rate sensitivity of the projected principal payments and of the projected size of the SOMA agency MBS portfolio.

Methodology and Assumptions

We use the FRB/US model to generate baseline paths for the federal funds rate, the 10-year Treasury yield, the 30-year primary mortgage rate, and other financial and macroeconomic variables that are consistent with the FOMC participants' Summary of Economic Projections (SEP) submitted for the June 2024 FOMC meeting.12 In addition, we construct two alternative scenarios—one in which interest rate paths are higher than in the baseline (high-rate scenario) and one in which interest rate paths are lower than in the baseline (low-rate scenario)—to assess the interest rate sensitivity of the principal payments from the Fed's agency MBS holdings and the size of the agency MBS portfolio.13 To construct these scenarios, we apply a sequence of symmetric spending shocks and shocks to the term premiums embedded in various interest rates in the FRB/US model to the baseline. These shocks transmit through the macroeconomy as modeled in the FRB/US model and thus affect variables—for example, the mortgage rate and house prices—that, in turn, influence the principal payments from the Fed's agency MBS holdings. Consistent with the FOMC's May 2024 announcement, we assume that the monthly redemption cap on agency securities remains at its current level of $35 billion and principal payments in excess of this cap are reinvested into Treasury securities.14

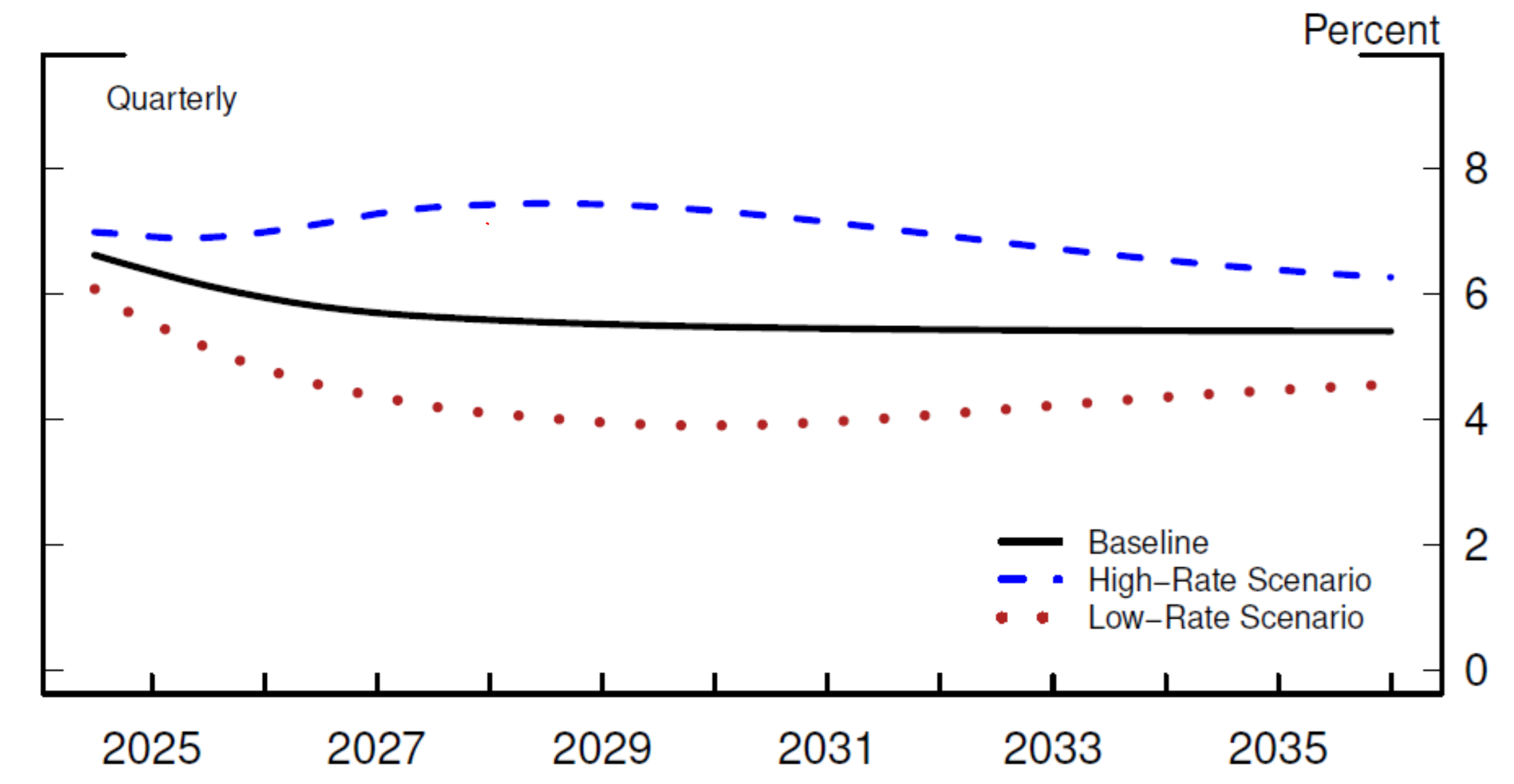

Figure 5 plots the projected path for the 30-year primary mortgage rate under the baseline along with the paths under the two alternative scenarios. Under the baseline, the mortgage rate, as indicated by the black line, is projected to decline from about 7 percent to about 5 percent in the next few years and to stay at that level thereafter. In the high-rate scenario, the mortgage rate—indicated by the dashed-blue line—is projected to be, on average, about 140 basis points higher over the projection horizon than in the baseline scenario, with the rate difference between these scenarios reaching a peak of nearly 200 basis points. In the low-rate scenario, the mortgage rate—indicated by the dotted-red line—is projected to be, on average, about 120 basis points lower than in the baseline scenario, with the rate difference between these scenarios reaching a peak of about 160 basis points.

We use a staff MBS prepayment model to project principal payments from the Fed's agency MBS holdings. In the model, given the prepayment option embedded in agency MBS, principal payments from the Fed's agency MBS portfolio depend primarily on interest rates as well as security characteristics and other factors.15

Projections

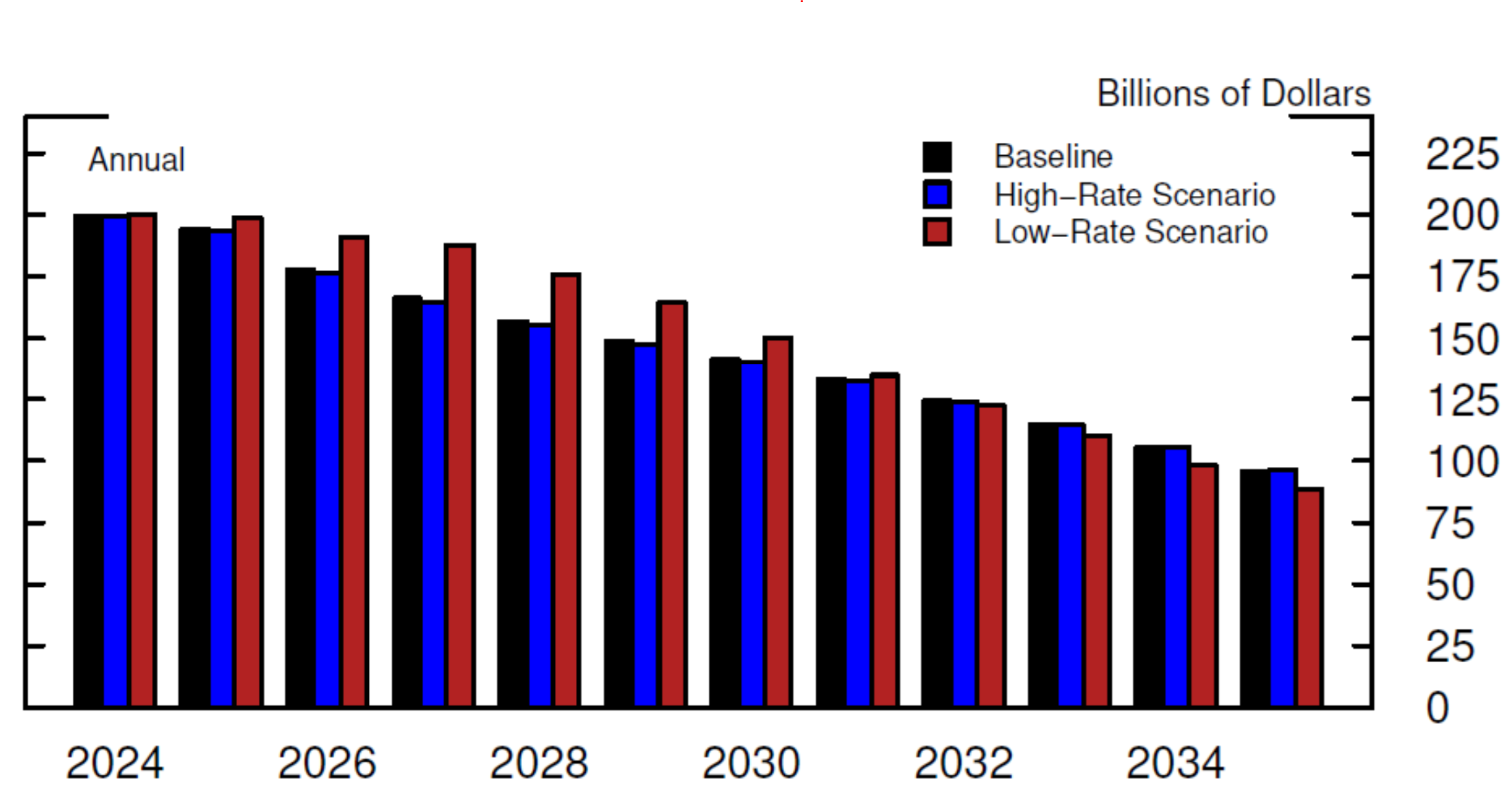

Figure 6 plots the projected annual principal payments from the Fed's agency MBS portfolio under the baseline scenario (the black bars) along with the projected payments under the high-rate scenario (the blue bars) and the low-rate scenario (the red bars). Agency MBS principal payments under the baseline are roughly $200 billion for 2024 before gradually decreasing primarily due to the decline in the size of the Fed's agency MBS portfolio. Projected principal payments under the high-rate scenario are remarkably similar to those under the baseline, given that the prepayment optionality on most of the agency MBS held by the Fed is already far "out-of-the money" to refinance under the baseline scenario. Under the low-rate scenario, some agency MBS in the Fed's portfolio become "in-the-money" to refinance, resulting in somewhat higher principal payments in that scenario compared with the other two scenarios.

Note: Key identifies in order from left to right.

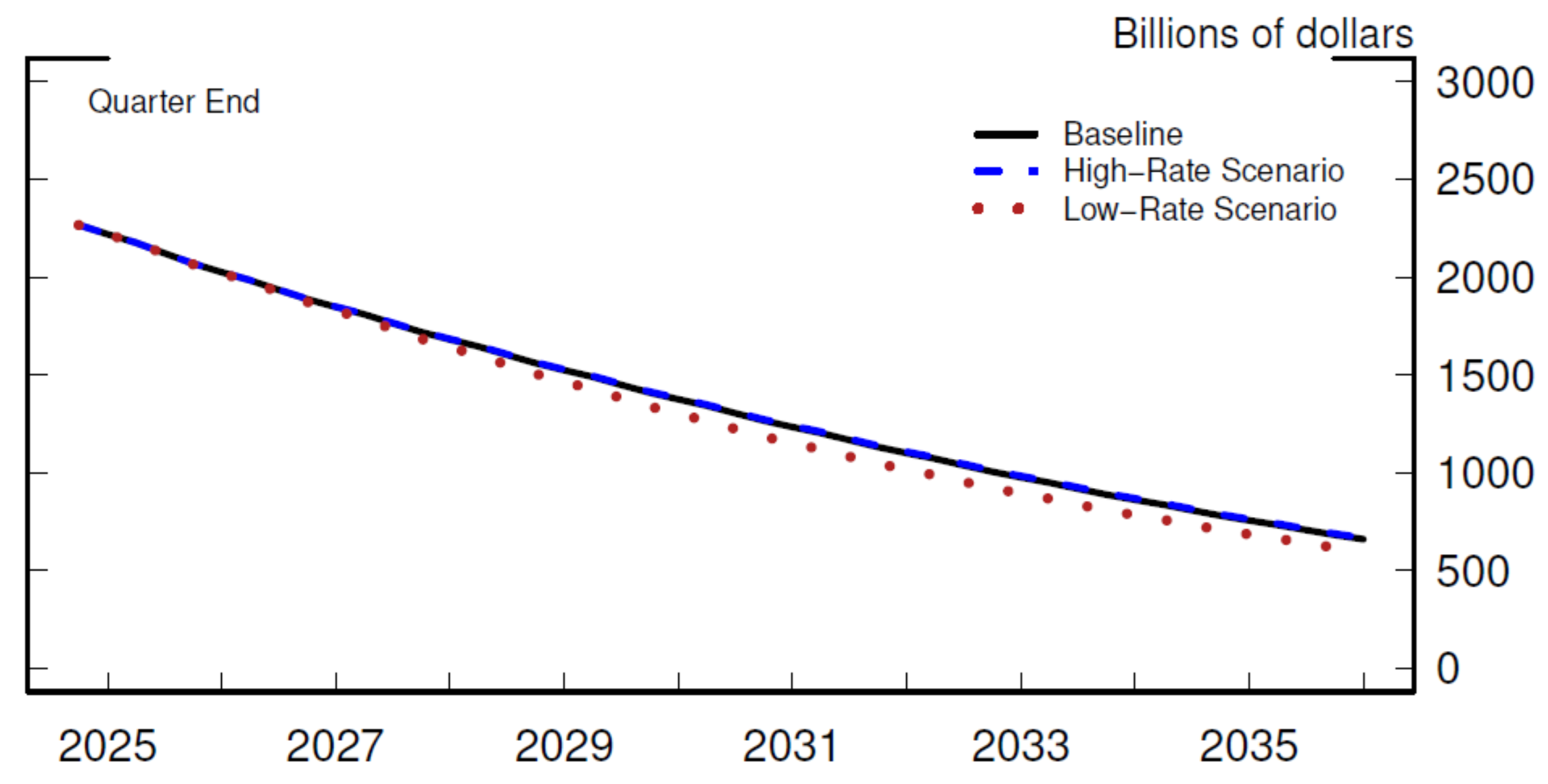

Figure 7 plots the projected paths of the Fed's agency MBS holdings under each scenario conditional on the respective projected principal payments shown in Figure 6. Under both the baseline and the high-rate scenario—the black and dashed-blue lines, respectively, the Fed's agency MBS portfolio is projected to decrease from its size of $2.3 trillion in June 2024 to about $1.2 trillion by the end of 2030 and to about $700 billion by the end of 2035.

Reflective of the somewhat higher projected principal payments under the low-rate scenario, the portfolio size under that scenario, as indicated by the dotted-red line, declines a bit faster than under the other scenarios. Nevertheless, the size of the SOMA agency MBS portfolio under the low-rate scenario still stands at about $1.2 trillion by the end of 2030—about 15 percent of the projected size of the SOMA portfolio—and at about $600 billion by the end of 2035—about 6 percent of the projected size of the SOMA portfolio.16,17

Conclusion

In this note, we documented the evolution of the Fed's agency MBS portfolio over time. In addition, we presented projections for principal payments from the Fed's agency MBS portfolio and the corresponding size of the portfolio under alternative interest rate scenarios. Projected principal payments under the high-rate scenario and under the baseline scenario are remarkably similar, given that the prepayment optionality on most of the SOMA agency MBS is far "out-of-the money" to refinance under these scenarios. Under the low-rate scenario, principal payments are somewhat higher compared with the other two scenarios as some agency MBS in the Fed's portfolio become slightly "in-the-money" to refinance. However, the differences are not sizeable enough to meaningfully impact the path of agency MBS in the Fed's portfolio.

Appendix: Balance Sheet Policy Announcements and Actions related to Agency MBS18

| Date/Link | Policy Announcements and Actions |

|---|---|

| 11/25/2008 | The FOMC announces its intention to purchase up to $100 billion of agency debt securities and up to $500 billion of agency MBS. |

| 3/18/2009 | The FOMC expands purchase amounts to a total of up to $200 billion in agency debt securities and a total of up to $1.25 trillion in agency MBS. |

| 8/10/2010 | The FOMC states that it will maintain the size of its securities holdings by reinvesting principal payments from agency securities into Treasury securities and by continuing to roll over its maturing Treasury securities. |

| 9/21/2011 | The FOMC announces that it will reinvest principal payments from its holdings of agency securities into agency MBS while maintaining its policy of rolling over maturing Treasury securities. |

| 9/13/2012 | The FOMC announces an open-ended purchase program of $40 billion per month in agency MBS. |

| 12/18/2013 | The FOMC announces that it will start to taper its purchases of agency MBS. |

| 9/17/2014 | The FOMC publishes the statement "Policy Normalization Principles and Plans." The Committee announces its intention to hold "in the longer run, no more securities than necessary to implement monetary policy efficiently and effectively" and to hold "primarily Treasury securities." |

| 10/29/2014 | The FOMC announces that it will conclude its asset purchase program. The policy of reinvesting the principal of maturing securities is maintained. |

| 9/20/2017 | The FOMC announces that, in October, the Committee will initiate the balance sheet normalization program described in the June 2017 "Addendum to the Committee’s Policy Normalization Principles and Plans." |

| 3/20/2019 | The FOMC releases the "Balance Sheet Normalization Principles and Plans," which states that the reduction in its aggregate securities holdings concludes at the end of September 2019. The release also stated that principal payments received from agency securities will be reinvested in Treasury securities subject to a maximum amount of $20 billion per month; any principal payments in excess of that maximum will continue to be reinvested in agency MBS. |

| 7/31/2019 | The FOMC announced that it will conclude the reduction of its aggregate securities holdings in the System Open Market Account in August, two months earlier than previously indicated. |

| 3/15/2020 | The FOMC announces that it will increase its holdings of agency MBS by at least $200 billion over the coming months. |

| 3/23/2020 | The FOMC announces that it will continue to purchase agency MBS "in the amounts needed." |

| 12/16/2020 | The FOMC introduces guidance on asset purchases and announces that it will continue to increase its holdings of agency MBS by at least $40 billion per month until substantial further progress has been made toward the Committee's goals. |

| 11/3/2021 | The Fed begins tapering asset purchases. |

| 1/26/2022 | The FOMC releases the "Principles for Reducing the Size of the Federal Reserve’s Balance Sheet." |

| 3/16/2022 | The Fed ends its agency MBS purchases and continues to reinvest all principal payments. |

| 5/4/2022 | The FOMC releases detailed plans for significantly reducing the size of the Fed's balance sheet (consistent with the principles released in January 2022). Beginning on June 1, 2022, the Fed will start reducing its holdings of agency MBS. |

| 5/1/2024 | The Fed announces a slowdown in the pace of balance sheet runoff to start in June 2024. The monthly redemption cap on agency securities is maintained at $35 billion, and any principal payments from agency securities in excess of this cap will be reinvested into Treasury securities. |

References

Anderson, Alyssa, Philippa Marks, Dave Na, Bernd Schlusche, and Zeynep Senyuz (2022a). "An Analysis of the Interest Rate Risk of the Federal Reserve's Balance Sheet, Part 2: Projections under Alternative Interest Rate Paths," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, July 15, 2022.

Anderson, Alyssa, Dave Na, Bernd Schlusche, and Zeynep Senyuz (2022b). "An Analysis of the Interest Rate Risk of the Federal Reserve's Balance Sheet, Part 1: Background and Historical Perspective," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, July 15, 2022.

Bonis, Brian, John Kandrac, and Luke Pardue (2017). "Principal Payments on the Federal Reserve's Securities Holdings," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, June 16, 2017.

Bonis, Brian, Lauren Fiesthumel, and Jamie Noonan (2018). "SOMA's Unrealized Loss: What does it mean?", FEDS Notes. Washington: Board of Governors of the Federal Reserve System, August 13, 2018.

Federal Reserve Bank of New York (2024). "Open Market Operations During 2023 (PDF)," April 17, 2024.

Ferris, Erin E. Syron, Soo Jeong Kim, and Bernd Schlusche (2017). "Confidence Interval Projections of the Federal Reserve Balance Sheet and Income," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, January 13, 2017.

Vickery, James and Joshua Wright (2013). "TBA trading and liquidity in the agency MBS market," FRBNY Economic Policy Review, May 2013.

1. James Trevino provided excellent technical support, and Samin Abdullah provided excellent research assistance. We thank David Bowman, Jim Clouse, Chris Gust, Sebastian Infante, and Zeynep Senyuz for their useful comments and suggestions. The views expressed in this note are our own, and do not necessarily represent the views of the Board of Governors or the Federal Reserve System. Return to text

2. Both agency mortgage-backed securities (MBS) and agency debt securities are referred to as agency securities. Agency MBS are securities backed by pools of mortgage loans and are issued and guaranteed by either the government agency, Ginnie Mae, or the government-sponsored enterprises, Fannie Mae and Freddie Mac. Agency debt securities include direct obligations of the government-sponsored enterprises Fannie Mae, Freddie Mac, and the Federal Home Loan Banks. Return to text

3. In this note, we mainly discuss the large-scale purchases of agency MBS. Other policy actions include large-scale purchases of Treasury securities, lowering the target range for the federal funds rate, forward guidance, and the establishment of various facilities and programs. Of note, LSAP II did not include purchases of agency securities and is not discussed in this note. Refer to the Appendix for balance sheet policy announcements and actions concerning SOMA agency MBS. Return to text

4. After balance sheet runoff concluded, holdings of SOMA agency MBS continued to decline approximately $100 billion until early 2020 because principal payments received from agency securities were reinvested in Treasury securities subject to a maximum amount of $20 billion per month and any principal payments in excess of that maximum were reinvested in agency MBS. Return to text

5. Refer to the Appendix for balance sheet policy announcements and actions concerning SOMA agency MBS. Return to text

6. TBA contracts represent a commitment to purchase agency MBS with specific characteristics, such as a specific maturity and a specific coupon, at a future settlement date. For more information regarding the TBA market, refer to Vickery and Wright (2013). Additional information regarding the Fed's agency MBS purchases is available at https://www.newyorkfed.org/markets/ambs-treasury-faq.html, https://www.newyorkfed.org/markets/ambs/ambs_schedule, and https://www.dallasfed.org/research/economics/2021/0826. Return to text

7. MBS production coupons fluctuate with prevailing primary mortgage rates. As such, the Desk primarily purchased agency MBS with coupons between 4 and 5 percent during the 2009 purchase period, while the purchases were concentrated in coupons less than or equal to 3 percent during the 2020 purchase period. Return to text

8. Initially, the principal payments exceeding these monthly redemption caps were reinvested into agency MBS, but this policy was amended in 2024 such that principal payments exceeding the monthly redemption cap would be reinvested into Treasury securities. The principles and plans for reducing the size of the Fed's balance sheet are available at https://www.federalreserve.gov/monetarypolicy/policy-normalization.htm. Return to text

9. Conversely, when the prevailing mortgage rate is lower than the mortgage rate a borrower is paying, the borrower is "in-the-money" to refinance because it is financially advantageous for the borrower to pay off the old mortgage by refinancing into a new lower-rate mortgage. Return to text

10. Although we primarily discuss refinancing and turnover activities, there are four common sources of prepayments for agency MBS: 1. refinancing (either to take advantage of a lower mortgage rate or to convert home equity into cash), 2. turnover due to home sales, 3. curtailment (partial payments over the scheduled amounts), and 4. buyouts (involuntary prepayment due to delinquencies and defaults). Furthermore, the prepayment optionality is not exercised efficiently, which makes projecting monthly agency MBS principal payments complex and challenging. See Bonis et al. (2017) for more details. Return to text

11. We approximate the outstanding balance of agency MBS to be the sum of the par value of outstanding TBA-eligible agency MBS. Return to text

12. See Anderson et al. (2022a) for details regarding the construction of the SEP-consistent baseline projection. Return to text

13. See Ferris et al. (2017) and Anderson et al. (2022a) for projections of the Fed's balance sheet and income under alternative interest rate paths and associated macroeconomic outcomes obtained from stochastic simulations. Return to text

14. This policy is consistent with the FOMC's intention to hold primarily Treasury securities in the longer run. More information on the Fed's policy normalization is available at https://www.federalreserve.gov/monetarypolicy/policy-normalization.htm. Return to text

15. In the model, prepayment activity is a function of various factors including refinancing incentives (the difference between the weighted-average coupon of a security and the prevailing mortgage rate), seasonal turnover, house prices, and a number of security-level characteristics, such as the weighted averages of loan ages, loan sizes, loan-to-value ratios, and credit scores of the borrowers. Return to text

16. The report "Open Market Operations During 2023" (Federal Reserve Bank of New York, 2024) contains projections for the Fed's balance sheet and income using interest rate paths based on responses from the January 2024 Desk Surveys. Despite somewhat different assumptions, the projected path for the size of the SOMA agency MBS portfolio is largely similar to the baseline projection in this note. Return to text

17. The effect of different interest rate paths on the market value of the SOMA agency MBS portfolio and, in turn, the unrealized gain or loss position of the portfolio is beyond the scope of this note. The report "Open Market Operations During 2023" provides projections for the unrealized gain and loss position of the SOMA portfolio based on baseline interest rates as well as interest rates that are one hundred basis points higher or lower than the baseline. Also, see Bonis et al. (2018) and Anderson et al. (2022b) for details regarding the Fed's unrealized gain or loss position. Return to text

18. Most of the announcements and actions also concerned Treasury securities but this Appendix exclusively focuses on those regarding the Fed's agency MBS portfolio. Return to text

Na, Dave, Ellie Newman, and Bernd Schlusche (2024). "The Evolution of the Federal Reserve's Agency MBS Holdings," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, September 20, 2024, https://doi.org/10.17016/2380-7172.3612.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.