FEDS Notes

February 26, 2015

The Effects of Forward Guidance in Three Macro Models

Hess Chung

Introduction

With the federal funds rate at its effective zero lower bound since the end of 2008, much attention has been focused on estimating the effects of "unconventional" monetary policy actions, such as large-scale asset purchases or explicit forward guidance concerning the future path of the funds rate. Given the difficulties of obtaining direct econometric estimates of the effects of these policies, the use of structural models to gauge these effects is attractive.1 In this note, I focus on the effects of forward guidance and compare the predictions of three structural models: FRB/US, EDO and the model of Smets and Wouters (2007), which is representative of a wide class of dynamic stochastic general-equilibrium (DSGE) models.2

These models share many key features, including consumption smoothing by households and sticky prices and wages. Hence, the models have qualitatively similar properties. Most notably, when modeling forward guidance as a pre-announced period of fixed interest rates followed by the return to a monetary-policy rule, all the three models predict that the macroeconomic effects are larger the further in advance the policy is announced. Nevertheless, model estimates of the size and timing of effects on output and, especially, inflation differ substantially, suggesting that further work robustly and precisely estimating these effects is warranted.

Simulating the Effects of Forward Guidance

Broadly speaking, "forward guidance" can refer to any central bank communication regarding the future path of the policy rate. In this note, I consider the effects of a commitment by the central bank to deviate from its historically typical reaction function at some point in the future. Specifically, the forward guidance experiments in this note consist of a 1-percentage-point "shock" to the monetary policy rule at several horizons, holding the federal funds rate at baseline up to the point at which the shock is realized. The assumption that the funds rate is at baseline prior to the shock may reflect, for example, a binding zero lower bound constraint.3 As is common in the literature, these simulations neglect the effects of uncertainty on household and firm behavior and characterize the effects of the experiment on macroeconomic aggregates under the condition that no unexpected shocks hit the economy after the beginning of the simulation.4

Simulations of the effects of forward guidance are sensitive not only to the duration of the fixed-interest regime, but also to the behavior of monetary policy after interest rates can again respond to aggregate conditions. For these simulations, monetary policy responds according to a feedback rule that features inertia by also depending on the previous period's interest rate:

where Rt is the federal funds rate (annualized), πt is the inflation rate (annualized) and Yt is the output gap.5

The Effects of Conventional Monetary Policy

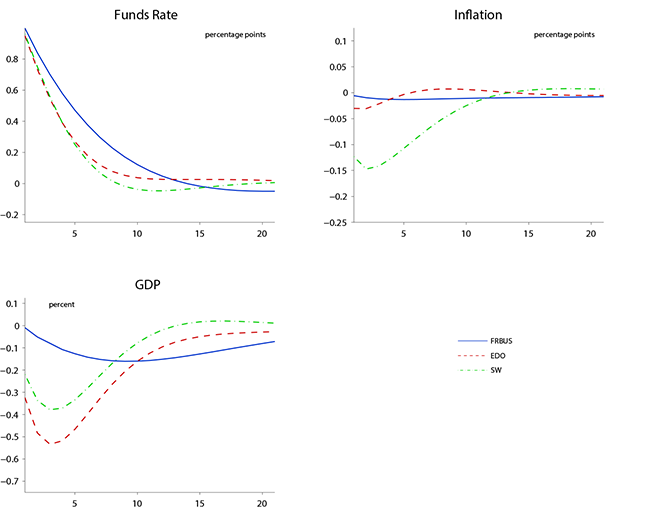

The effects of a 1-percentage-point contemporaneous shock to the monetary policy rule in the three models are shown in Figure 1. Output responses in the EDO and Smets-Wouters ("SW") models have similar contours and are quantitatively quite close, with a peak effect on real GDP of around 50 basis points three quarters after the shock. By contrast, the output response in FRB/US is smaller and peaks later, more than two years after the shock. In EDO and FRB/US, the response of prices to such an unanticipated monetary policy shock is small at all horizons. The larger price effects in the Smets-Wouters model derive, at least in part, from a larger coefficient relating marginal costs to inflation than in the other two models.

| Figure 1: Effects of an Unanticipated Shock to the Monetary Policy Rule |

|---|

|

Source: Simulation data created by the author.

The Transmission of Anticipated Monetary Policy Actions and the Forward Guidance Puzzle

In most conventional models, plans for consumption, leisure and production are sensitive to the entire expected path of real short-term interest rates. For example, a higher expected real interest rate at a given date in the future encourages households to lower consumption prior to that date, and leads to attendant shifts in labor supply and saving necessary to support that change in consumption. Similarly, from the perspective of investors, higher expected risk-free real rates favor portfolio shifts out of physical capital and towards the risk-free instrument until, in equilibrium, the marginal product of capital at that time adjusts to equalize the expected returns on the two assets, adjusted for risk and any other factors that make the cash flows from physical capital and bonds less than perfect substitutes to the marginal investor.

When nominal rigidities prevent offsetting movements in the price level, monetary policy interventions can affect expected real interest rates. Moreover, in models commonly used for policy analysis, the reaction of inflation to policy interventions amplifies the effect of movements in nominal interest rates, as inflation prior to the shock tends to move in the opposite direction. As the realization of the shock becomes more distant in time, the larger and larger expected declines in the price level induce rapidly increasing drops in output as well.6

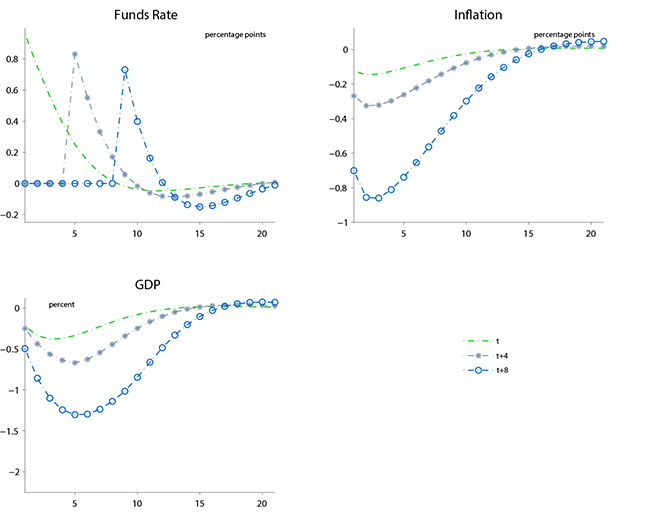

As demonstrated in a number of recent papers, in models like those considered here, these inter-temporal incentives are strong enough that anticipated monetary policy interventions can drive very large changes in prices and activity, a property labeled the "Forward Guidance Puzzle" by Del Negro et al (2012).7 The results from the Smets-Wouters model, shown in Figure 2, are broadly representative. In this model, the peak effect on output rises from around 40 basis points in the third quarter of the simulation for an unanticipated shock to almost 70 basis points in quarter 5 for a shock anticipated 4 quarters ahead and more than 1-1/4 percent for a shock that occurs 8 quarters ahead. The pattern of outcomes for inflation is similar.

| Figure 2: Effects of Forward Guidance in the Smets-Wouters Model |

|---|

|

Source: Simulation data created by the author.

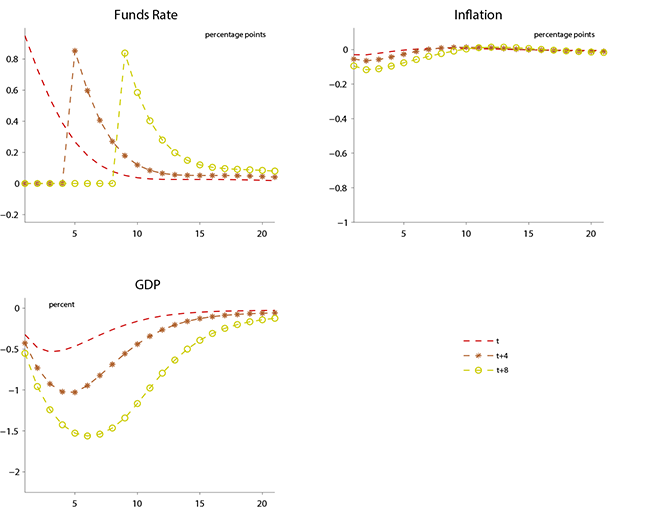

The EDO model structure closely resembles the structure used in Smets-Wouters and, as displayed in Figure 3, yields forward guidance effects on output comparable to that model. However, in EDO, the response of inflation to anticipated shocks is considerably more muted. As noted above, at least in part, these smaller inflation effects reflect a lower coefficient relating inflation to marginal costs in EDO. Moreover, costs themselves are less responsive to anticipated policy shocks in EDO, further reducing the response of inflation.

| Figure 3: Effects of Forward Guidance in the EDO Model |

|---|

|

Source: Simulation data created by the author.

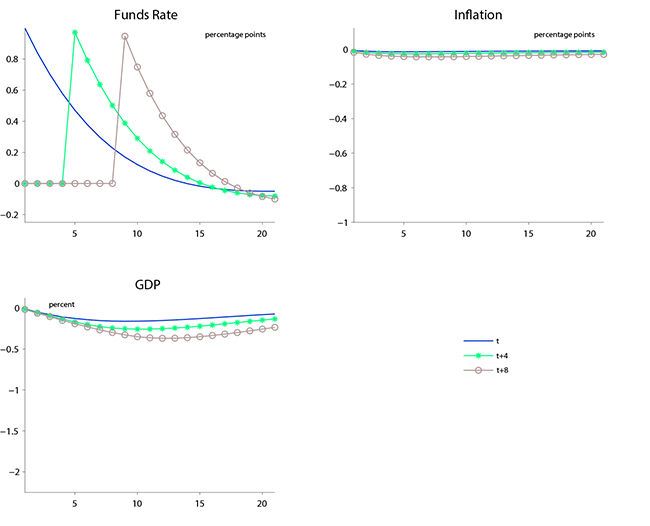

The effects of these experiments in FRB/US are displayed in Figure 4. The basic amplification mechanism underlying the Forward Guidance Puzzle remains visible, with the peak effect on output more than doubling as the shock moves from being unanticipated to being anticipated 8 quarters ahead. However, output and inflation are much less responsive than in the DSGE models. For example, an anticipated shock 8 quarters in the future lowers the level of output by 40 basis points, only one-third of the effect in Smets-Wouters.

| Figure 4: Effects of Forward Guidance in the FRB/US Model |

|---|

|

Source: Simulation data created by the author.

Conclusion

All three models considered here share a core New Keynesian structure, involving consumption smoothing by forward-looking households, price and wage rigidities, and identical rules governing the systematic component of monetary policy. As a result, the three models share many of the qualitative features of that class of models, including the increasing effects of a period of pegged nominal interest rates. Despite this common core, the models differ, sometimes substantially, on a number of dimensions, including the exact modeling of household and firm decisions and the data sample used to estimate key behavioral parameters. While results from simulations of conventional (unanticipated) monetary policy shocks do differ somewhat across models, simulations involving forward guidance about future policy actions exhibit much greater divergence. Careful consideration of the empirical support for the key differences driving these divergent responses is clearly warranted.8

References

Carlstrom, Charles, Timothy S. Fuerst, and Matthias Paustian. July 2012. "Inflation and Output in New Keynesian Models with a Transient Interest Rate Peg." Bank of England working paper 459.

Chung, Hess, Edward Herbst and Michael Kiley. 2014. "Effective Monetary Policy Strategies in New-Keynesian Models: A Re-Examination." NBER Macroeconomics Annual 2014, vol. 29.

Del Negro, Marco, Marc Giannoni, and Christina Patterson. October 2012 (revised May 2013). "The Forward Guidance Puzzle." Staff Report 574, Federal Reserve Bank of New York.

McKay, Alisdair, Emi Nakamura and Jón Steinsson. January 2015. "The Power of Forward Guidance Revisited." NBER Working Paper 20882.

Reifschneider, David and John C. Williams. 1999. "Three Lessons for Monetary Policy in a Low Inflation Era." Journal of Money, Credit and Banking (November, 2000).

Wu, Jing Cynthia and Fan Dora Xia. 2013 (revised July, 2014). "Measuring the Macroeconomic Impact of Monetary Policy at the Zero Lower Bound." Working Paper 13-77, Booth School of Business, University of Chicago.

1. While a sizable literature aims to estimate the effects of unconventional policy announcements on financial market variables, there are relatively few direct estimates of the effects of forward guidance on macroeconomic variables. See, however, Wu and Xia 2013 for one recent approach. Return to text

2. Specifically, I use the version of the Smets-Wouters model from Volker Wieland's Macroeconomic Model Database (www.macromodelbase.com). Return to text

3. To interpret the fixed-rate period as a binding ZLB constraint, note that it is necessary also to assume a baseline such that the policy shock does not cause the ZLB to bind also after the shock is realized, when the funds rate may drop below baseline. Return to text

4. Technically, the DSGE models are simulated using first-order approximations around the deterministic steady-state, with the fixed interest rate regime implemented using anticipated shocks to the monetary policy reaction function. The FRB/US simulations assume perfect foresight for all forward-looking optimality conditions. Return to text

5. For EDO and Smets-Wouters, the reaction function depends on the output gap used for model estimation. In EDO and FRB/US, the output gap is a production-function gap, where potential output is that level of output that could be produced with the current production technology and capital stock, but with trend capital utilization and labor inputs. In Smets-Wouters, the output gap is defined relative to the level of production that would have obtained, given the shocks that have hit the economy, but in the absence of nominal rigidities. Using a flex-price output gap in EDO would somewhat attenuate the output response, with a peak effect of around 1¼ percent for an anticipated shock 8 quarters ahead. Return to text

6. The models here all feature adjustment costs on investment, which also yields output effects that grow larger as the realization date recedes, even absent any movement in the price level; the increasing movements in output simply reflect the additional time provided for gradual adjustment of investment and the capital stock. As demonstrated by Carlstrom et al (2012), in some of the models here, the increasing strength of output and inflation effects as a function of the realization date holds only up to some critical realization date, after which, for at least some time, positive anticipated shocks to the monetary policy rule are actually stimulative, on impact. Return to text

7. The amplification of demand shocks by a period of fixed interest rates is well-established in the literature, as shown in Reifschneider and Williams (1999) and the papers cited therein. For recent papers describing the implications of this mechanism for forward guidance, see, for example, Del Negro et al (2012) and Carlstrom et al (2012). Return to text

8. A number of papers have shown that plausible modifications to the basic New Keynesian core can significantly reduce the effects of anticipated monetary policy interventions. Possible modifications include the approach advocated by Del Negro et al (2012), which limits, by construction, the implied reaction of long-term interest rates and the modeling of nominal rigidities through sticky information rather than sticky prices, which, as shown in Carlstrom et al (2012) and Chung et al (2014), reduces the amplification of forward guidance effects due to pre-emptive price-setting. Recent work in McKay et al (2015) also suggests that the basic New Keynesian assumption of frictionless consumption-smoothing by a representative agent may yield strong forward guidance effects at long horizons relative to models that feature certain kinds of financial market incompleteness. Return to text

Please cite as:

Chung, Hess (2015). "The Effects of Forward Guidance in Three Macro Models," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, February 26, 2015. https://doi.org/10.17016/2380-7172.1488

Disclaimer: FEDS Notes are articles in which Board economists offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers.