FEDS Notes

February 27, 2017

Are Basel's Capital Surcharges for Global Systemically Important Banks Too Small?

Wayne Passmore and Alexander H. von Hafften

The Basel Committee on Banking Supervision (BCBS, the Basel Committee, or Basel) has developed a methodology for identifying global systemically important banks (G-SIBs) and standards for requiring G-SIBs to hold more common equity (BCBS, 2013). As part of this process, the Financial Stability Board (FSB) publicly releases an annual list of G-SIBs identified under the Basel Committee's methodology and their common equity requirement; the table shows the 2015 list (FSB, 2016). One goal of additional regulations for G-SIBs is to directly target "too big to fail" concerns surrounding the largest and most globally important banks.

| Bucket | Capital Surcharge | G-SIB Score Range (in basis points) | 2016 List of G-SIBs (in alphabetical order) |

|---|---|---|---|

| 5 | 3.50% | 530-629 | (empty) |

| 4 | 2.50% | 430-529 | Citigroup JP Morgan Chase |

| 3 | 2.00% | 330-429 | Bank of America BNP Paribas Deutsche Bank HSBC |

| 2 | 1.50% | 230-329 | Barclays Credit Suisse Goldman Sachs Industrial and Commercial Bank of China Limited Mitsubishi UFJ FG Wells Fargo |

| 1 | 1.00% | 130-229 | Agricultural Bank of China Bank of China Bank of New York Mellon China Construction Bank Groupe BPCE Groupe Crédit Agricole ING Bank Mizuho FG Morgan Stanley Nordea Royal Bank of Scotland Santander Société Générale Standard Chartered State Street Sumitomo Mitsui FG UBS Unicredit Group |

Source: Financial Stability Board (2016).

One goal of G-SIB capital surcharges is to make government bailouts of G-SIBs less likely by having G-SIBs self-insure themselves against severe financial crises. Traditionally, either central banks would stand ready to lend to solvent banks on good collateral or the government would implement some other assistance (e.g., the Troubled Asset Relief Program) to mitigate the catastrophic losses stemming from severe financial crises. But if the goal is to avoid all public bailouts, banks must "self-insure" against all losses, even catastrophic losses. Such self-insurance might result in restrictive credit conditions during times without financial crisis, but this policy would reassure taxpayers that public funds would not be used to assist G-SIBs. Although higher bank capital lessens the probability of financial crises, a complete assessment of social welfare would also need to investigate the potential negative effects of higher capital requirements on bank lending and economic growth.

If the purpose of these capital surcharges is to ensure the survival of G-SIBs through serious crises without extraordinary public assistance, our best estimate suggests that Basel capital surcharges are too low.1 Based on our calculations, the Basel system has three shortcomings: (1) it underestimates the probability that a G-SIB can fail, (2) it fails to account for short-term funding, and (3) it excludes too many banks from G-SIB capital surcharges. Based on our best estimate, we find the current Basel capital surcharges should be between 225 and 525 basis points higher for G-SIBs that are not reliant on short-term funding; G-SIBs that are reliant on short-term funding should have even higher capital surcharges. For 2015, our best estimate implies that the banking system would have needed at least €175 billion more common equity to survive--without bailouts--a financial crisis similar to that of 2007 to 2009.2 The bulk of the capital shortfall is accounted for by a very small number of G-SIBs that rely heavily on short-term funding.

Since our best estimate does not account for other elements of Basel III, we also estimate capital surcharges based on the 95 percent confidence intervals around our best estimate.3 The optimistic bound may appeal to observers who believe the other reforms of Basel III (and regulatory oversight generally) are likely effective for lowering the probability of default and the social losses of G-SIB defaults, relative to those experienced during the 2007-09 financial crisis. In contrast, the pessimistic bound may appeal to observers who doubt the effectiveness of regulation and Basel reform. Within the range of reasonable estimates, these observers desire the highest capital levels that would have likely prevented G-SIB defaults during the last financial crisis. However, since all three estimates--best, pessimistic, and optimistic--are higher than those currently implemented, we find that Basel G-SIB capital surcharges are too small regardless of prior beliefs about the effectiveness of other Basel III reforms.

How do our estimates of capital compare with some recent literature on bank capitalization? Using an alternate approach, Dagher et al. (2016) estimate common equity to risk-weighted assets of between 15 and 23 percent to avoid failures similar to the previous financial crisis. The Minneapolis Plan (Federal Reserve Bank of Minneapolis, 2016) proposes initial minimum capital requirements of 23.5 percent of risk-weighted assets, which could increase to as high as 38 percent if banks remain systemically important. Overall, our best estimate of the G-SIB capital surcharges and our conclusion that they are too small seem in line with some other recent studies of bank capital.

Expected Impact Theory

The Basel Committee's approach to capital surcharges is based on the expected impact theory (BCBS, 2013), which uses three key features to derive capital surcharges: (1) an estimation of probability of default, F(·); (2) a method of measuring social losses given default, H(·); and (3) a choice of reference bank, r4. The probability of default estimation relates the level of capital held by a bank to the probability of its default. The social losses given default of a bank are the costs incurred by that bank’s failure on the financial system and the wider economy. The expected impact of a bank's failure is the product of the probability of its default and its social losses given default.

The reference bank defines the extent of social losses that can be borne by the public without government intervention. In the expected impact theory, banks are classified as either G-SIBs, whose social losses are higher than those of the reference bank, or "normal" banks, whose social losses are lower. Thus, the reference bank is a conjectured bank that is the most systemically important bank that public authorities are willing to let fail. In this theory, the purpose of G-SIB capital surcharges is to reduce the probability of default of a G-SIB until its expected impact is equal to the expected impact of the reference bank, or:

where kr is the capital held by the reference bank, kGSIB is the capital surcharge, and f is a proxy for the failure point at which a bank can no longer operate.5

Basel Capital Surcharges

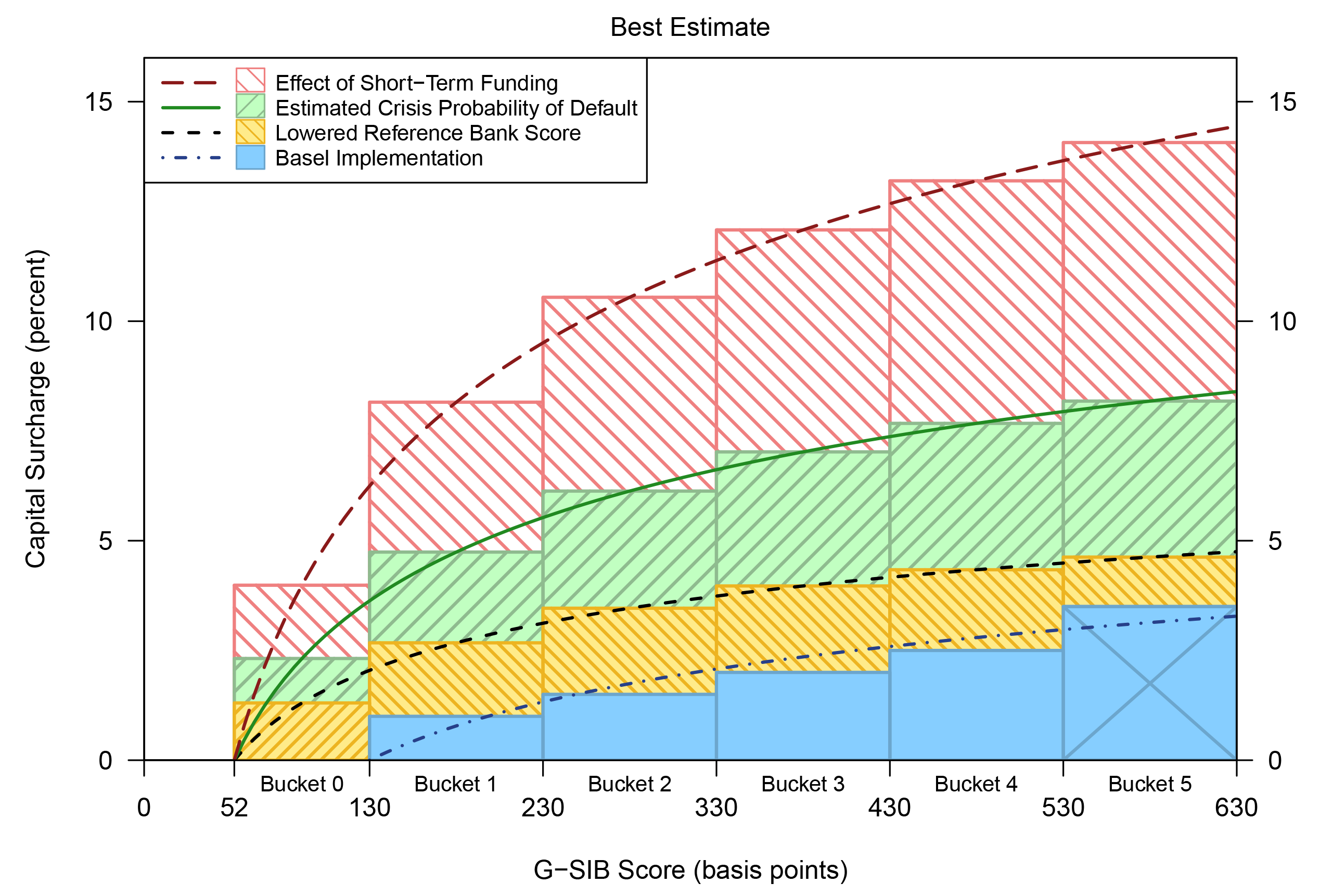

To produce a common equity requirement, the Basel Committee adopts a bucketing approach. The G-SIB score is intended to measure the social losses given the default of a bank.6 In the Basel system, the reference bank G-SIB score is 130 basis points. Higher buckets, which each span 100 basis points, indicate higher levels of systemic importance and therefore higher capital surcharges. The current common equity requirement is 1 percent for Bucket 1 and an additional 50 basis points for each higher bucket.7 In figure 1, the solid shaded blue boxes are the Basel Committee's capital surcharges based on its G-SIB scoring system (also listed in table 2), and the ball-and-chain blue line is a continuous approximation.

|

|

Colors in key correspond with bars, in order from top to bottom.

Note: See BCBS (2013) for details about the global systemically important bank (G-SIB) score. For Basel capital surcharges, the reference bank G-SIB score is 130 basis points; for the best estimate, the reference bank G-SIB score is 52 basis points, which is the lower bound of the one-sided 95 percent confidence interval of the correlated loss model centered at 130 basis points. Probability of default and the effect of short-term funding are estimated using the lower tail of the return on risk-weighted assets distribution from 2008-2013. Bucket 5 is crossed out to indicate that it is empty (Financial Stability Board, 2016). Continuous capital surcharges are based on a capital conservation buffer of 2.5 percent from BCBS (2010).

Source: BCBS (2016a), BCBS (2016b), Bureau van Dijk (2016), Financial Stability Board (2016).

Estimated Capital Surcharges

Our analysis tackles three problems with the Basel G-SIB capital surcharge methodology. First, the Basel system chooses a reference bank without accounting for error in the assessment of systemic importance by the G-SIB score.8 Second, the Basel system has no formal model underlying the assessment of probability of default. We propose and estimate a commonly-used model and show the Basel system underestimates probability of default for all banks. Finally, the Basel system neglects short-term funding. Without accounting for short-term wholesale funding, the Basel system further underestimates probability of default for banks using a high proportion of such funding.

Figure 1 illustrates our best estimate of G-SIB capital surcharges. First, we posit that, although the regulatory assessment of which banks are G-SIBs is correct on average, the G-SIB score is a somewhat fallible assessment of systemic importance. As a result, the Basel choice of 130 basis points can misclassify G-SIBs as normal banks. Using market-based valuations of systemic importance to estimate the extent of this error, we lower the reference bank score until we are 95 percent confident that all G-SIBs are properly classified; this lowered reference bank score is 52 basis points. The short-dashed black line is the continuous capital surcharge function using a reference bank score of 52 basis points in place of 130 basis points. The shaded right-hatched yellow boxes show the capital surcharge increases, including 175 basis points for Bucket 1 and Bucket 4. In addition, a lower reference bank score creates Bucket 0, which holds G-SIB score between 52 basis points and 130 basis points, with a capital surcharge of 125 basis points.

Because, by definition, observing the default of a G-SIB is difficult, we use extremely low realizations of return on assets to provide a measure of the probability of default (as in BCBS, 2013, and Board of Governors, 2015). The solid green line is the continuous capital surcharge function estimated using returns on risk-weighted assets (RORWAs) of large commercial banks and bank holding companies from countries with Basel or European Union membership in 2008 to 2013.9 The shaded left-hatched green boxes are the associated surcharge increases, which include 100 basis points for Bucket 0, 200 basis points for Bucket 1, and 325 basis points for Bucket 4.

Despite recent literature describing the relationship between short-term funding, defaults, and financial stability, the Basel G-SIB methodology omits uninsured short-term funding.10 In figure 1, the long-dashed red line is the continuous capital surcharge function estimated by splitting the RORWA sample into high and low short-term funders by the median. The unshaded right-hatched pink boxes show the additional capital required for banks using short-term funding in excess of 10 percent of risk-weighted assets (approximately the median proportion for short-term funding). The size of this additional capital requirement includes 175 basis points for Bucket 0, 350 basis points for Bucket 1, and 550 basis points for Bucket 4.

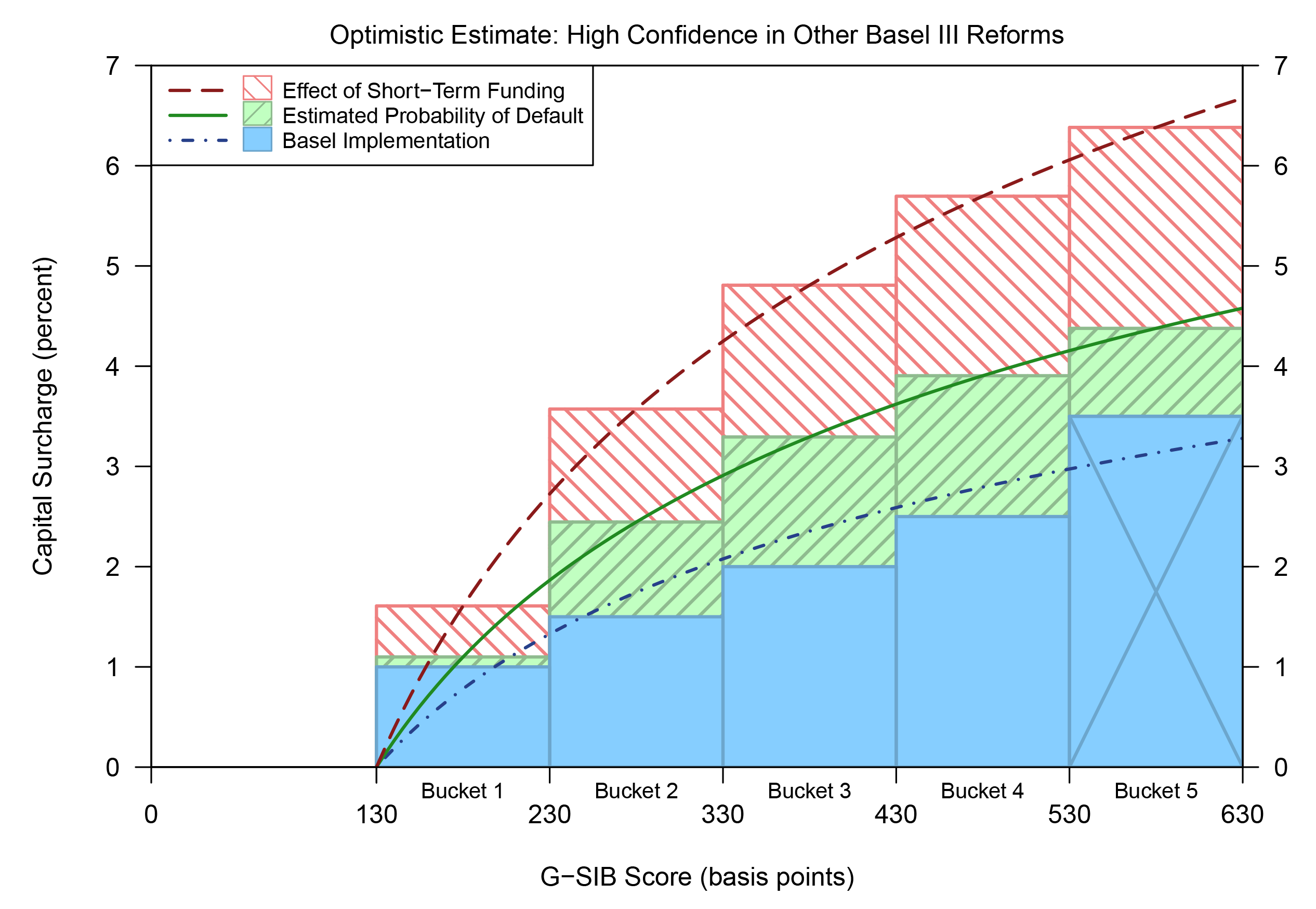

Optimistic Estimate: High Confidence in Other Basel III Reforms

Figure 2 illustrates an alternative set of estimated capital surcharges that represents an optimistic perspective about how other Basel III reforms reduce the expected impact of G-SIB defaults. Based on the belief that Basel correctly assesses the level of social losses given default necessary to initiate government intervention, the optimistic reference bank score is set at the Basel level of 130 basis points. Thus, unlike the best estimate, optimistic capital surcharges do not increase from lowering the reference bank score to account for possible misclassification by regulators. In addition, instead of using the mean estimates, optimistic capital surcharges use the lower bounds of 95 percent confidence intervals for probability of default parameters (with and without high short-term funding). Although lower than the best estimate, these optimistic capital surcharges are still higher than Basel capital surcharges.

|

|

Colors in key correspond with bars, in order from top to bottom.

Note: See BCBS (2013) for details about the global systemically important bank (G-SIB) score. For Basel capital surcharges and the optimistic estimate, the reference bank G-SIB score is 130 basis points. Probability of default and the effect of short-term funding are estimated using the lower tail of the return on risk-weighted assets distribution from 2008-2013; the optimistic estimate uses the lower bounds of the 95 percent confidence intervals of estimated parameters. Bucket 5 is crossed out to indicate that it is empty (Financial Stability Board, 2016). Continuous capital surcharges are based on a capital conservation buffer of 2.5 percent from BCBS (2010).

Source: BCBS (2016a), BCBS (2016b), Bureau van Dijk (2016), Financial Stability Board (2016).

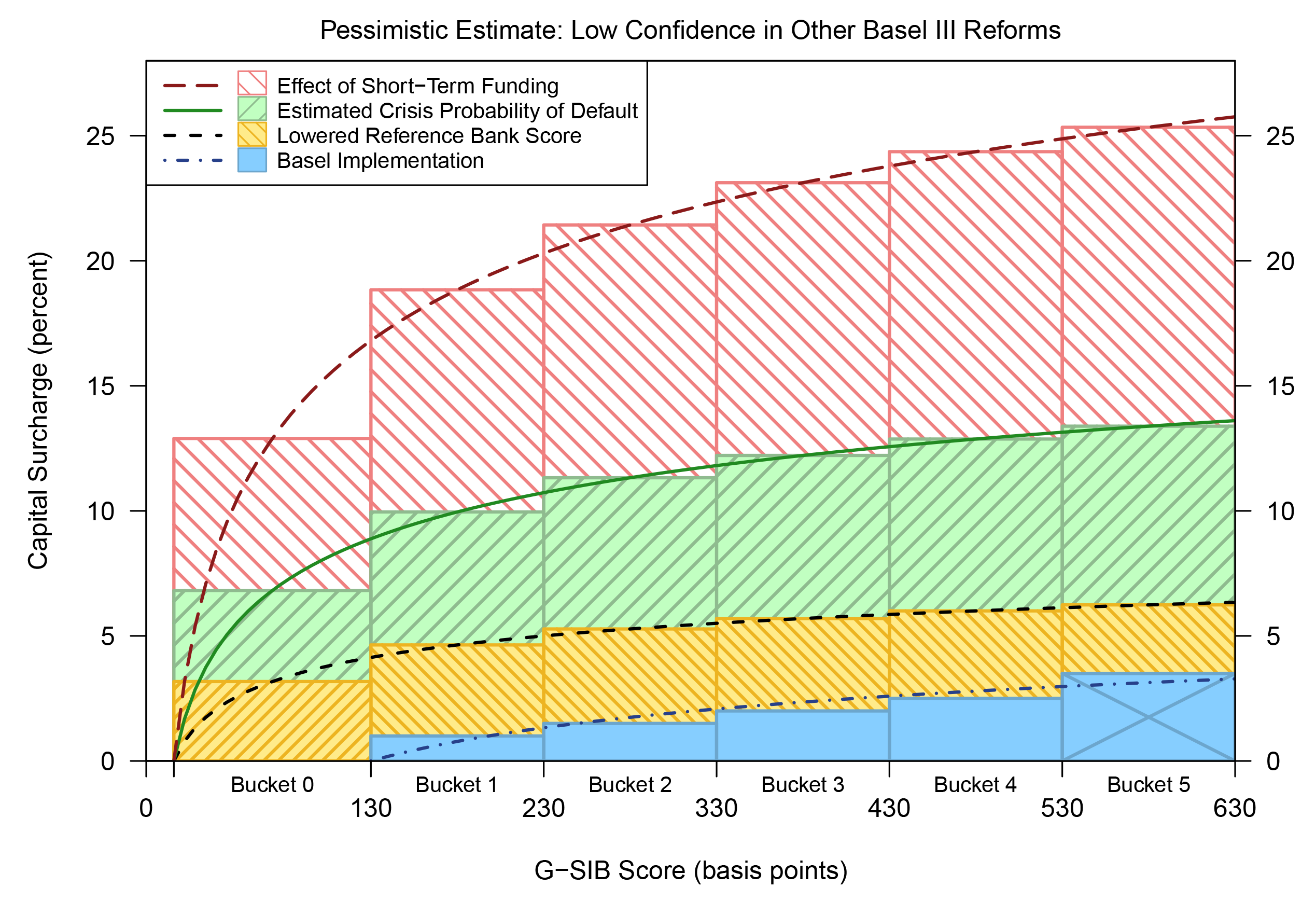

Pessimistic Estimate: Low Confidence in Other Basel III Reforms

Figure 3 illustrates a third formulation of estimated capital surcharges; it is consistent with the view that the effectiveness of regulatory oversight is limited and increasing capital is the strictly preferred method of decreasing the expected impact of G-SIB defaults. Since all banks in the Basel sample are larger than the smallest banks that received bailouts in the 2007-09 financial crisis, the reference bank score is set at 16 basis points, which is the minimum G-SIB score of banks in the Basel sample.11 In addition, for this formulation the probability of default parameters (with and without high short-term funding) use the upper 95 confidence interval bounds of probability of default estimates. Accordingly, this approach yields historically high levels of capitalization.

|

|

Colors in key correspond with bars, in order from top to bottom.

Note: See BCBS (2013) for details about the global systemically important bank (G-SIB) score. For Basel capital surcharges, the reference bank G-SIB score is 130 basis points; for the pessimistic estimate, the reference bank G-SIB score is 16 basis points, which is the minimum G-SIB score in the Basel sample of banks. Probability of default and the effect of short-term funding are estimated using the lower tail of the return on risk-weighted assets distribution from 2008-2013; the pessimistic estimate uses the upper bounds of the 95 percent confidence intervals of estimated parameters. Bucket 5 is crossed out to indicate that it is empty (Financial Stability Board, 2016). Continuous capital surcharges are based on a capital conservation buffer of 2.5 percent from BCBS (2010).

Source: BCBS (2016a), BCBS (2016b), Bureau van Dijk (2016), Financial Stability Board (2016).

Conclusion

Table 2 compares G-SIB capital surcharges from the Basel system and the three estimated systems. Our best estimate of G-SIB capital surcharges would (1) raise capital requirements 375 to 525 basis points for banks currently subject to capital surcharges, (2) create an additional lower bucket with a surcharge of 225 basis points for some very large and systemically important banks that are not currently subject to any capital surcharge, and (3) include a short-term funding measure that further boosts capital surcharges 175 to 550 basis points for banks that fund assets with a high proportion of short-term funding. Observers who are pessimistic about the Basel III reforms would desire even higher capital surcharges. Although optimistic observers would suggest lower capital surcharges, these estimated capital surcharges are also higher than current Basel capital surcharges.

| G-SIB Scores | Basel | Best | Optimistic | Pessimistic | |

|---|---|---|---|---|---|

| Bucket 5 | 530-629 | 350 | 825 / 1400 | 450 / 650 | 1350 / 2525 |

| Bucket 4 | 430-529 | 250 | 775 / 1325 | 400 / 575 | 1275 / 2425 |

| Bucket 3 | 330-429 | 200 | 700 / 1200 | 325 / 475 | 1225 / 2300 |

| Bucket 2 | 230-329 | 150 | 625 / 1050 | 250 / 350 | 1125 / 2150 |

| Bucket 1 | 130-229 | 100 | 475 / 825 | 100 / 150 | 1000 / 1875 |

| Bucket 0 | 52-129 16-51 |

None None |

225 / 400 None |

None None |

675 / 1300 675 / 1300 |

Note: Units for G-SIB scores and capital surcharges are basis points. See BCBS (2013) for details about the global systemically important bank (G-SIB) score. For the Basel implementation and the optimistic estimate, the reference bank G-SIB score is 130 basis points. For the best estimate, the reference bank G-SIB score is 52 basis points, which is the lower bound of the one-sided 95 percent confidence interval of the correlated loss model centered at 130 basis points. For the pessimistic estimate, the reference bank G-SIB score is 16 basis points, which is the minimum G-SIB score in the Basel sample of banks. Probability of default and the effect of short-term funding are estimated using the lower tail of the return on risk-weighted assets distribution from 2008-2013; the best, optimistic, and pessimistic estimates use the mean estimate, the lower bounds of the 95 percent confidence intervals, and the upper bounds of the 95 percent confidence intervals, respectively. For each estimated bucket, the smaller capital surcharge applies to banks that fund less than 10 percent of their risk-weighted assets with short-term funding, and the larger capital surcharge applies to banks that fund more than 10 percent of their risk-weighted assets with short-term funding. Bucket 5 is empty (Financial Stability Board, 2016). Estimated capital surcharges assume the capital conservation buffer of 2.5 percent from BCBS (2010).

Source: BCBS (2016a), BCBS (2016b), Bureau van Dijk (2016), Financial Stability Board (2016).

References

Basel Committee on Banking Supervision (2016a). "G-SIB Framework: Denominators," ![]() webpage, Bank for International Settlements, (accessed December 1, 2016).

webpage, Bank for International Settlements, (accessed December 1, 2016).

Basel Committee on Banking Supervision (2016b). "G-SIB Assessment Sample," ![]() webpage, Bank for International Settlements, (accessed December 1, 2016).

webpage, Bank for International Settlements, (accessed December 1, 2016).

Basel Committee on Banking Supervision (2013). "Global Systemically Important Banks: Updated Assessment Methodology and the Higher Loss Absorbency Requirement (PDF)," ![]() Bank for International Settlements, July.

Bank for International Settlements, July.

Basel Committee on Banking Supervision (2010). "Basel III: A Global Regulatory Framework for More Resilient Banks and Banking Systems (PDF)," ![]() Bank for International Settlements, December; revised June 2011.

Bank for International Settlements, December; revised June 2011.

Board of Governors of the Federal Reserve System (2015). "Calibrating the G-SIB Surcharge," white paper. Washington: Board of Governors, July 20.

Bulow, Jeremy and Paul Klemperer (2013). "Market-based bank capital regulation," Working Paper Series No. 151, Stanford Business School, September.

Bureau van Dijk (2016). Bankscope Database (accessed March 24, 2016, through Wharton Research Data Services).

Dagher, Jihad, Giovanni Dell'Ariccia, Luc Laeven, Lev Ratnovski, and Hui Tong (2016). "Benefits and Costs of Bank Capital," IMF Staff Discussion Note 16 (4).

Demirguc-Kunt, Asli, and Harry Huizinga (2010). "Bank Activity and Funding Risk: The Impact on Risk and Returns," Journal of Financial Economics, vol. 98 (3): pp. 626–50.

Federal Reserve Bank of Minneapolis (2016). "The Minneapolis Plan to End Too Big to Fail," ![]() released November 16, (accessed November 16, 2016).

released November 16, (accessed November 16, 2016).

Financial Stability Board (2016). "2016 List of Global Systemically Important Banks (G-SIBs) (PDF)," ![]() released November 21, (accessed December 1, 2016).

released November 21, (accessed December 1, 2016).

Gorton, Gary, and Andrew Metrick (2012). "Securitized Banking and the Run on Repo," Journal of Financial Economics, vol. 104 (3): pp. 425-51.

Gorton, Gary B., Andrew Metrick, and Lei Xie (2014). "The Flight from Maturity," NBER Working Paper Series 20027. Cambridge, Mass.: National Bureau of Economic Research, April.

Haldane, Andrew. (2011). "Capital Discipline," speech given at the American Economic Association, Denver, Colorado, January 9.

Ivashina, Victoria, and David Scharfstein (2010). "Bank Lending during the Financial Crisis of 2008," Journal of Financial Economics, vol. 97 (3): pp. 319–38.

Martin, Antonie, David Skeie, and Ernst-Ludwig von Thadden (2014). "The Fragility of Short-Term Secured Funding Markets," Journal of Economic Theory, vol. 149: pp. 15–42.

Passmore, Wayne, and Alexander H. von Hafften (2017). "Are Basel's Capital Surcharges For Global Systemically Important Banks Too Small?" Finance and Economics Discussion Series 2017-021. Washington: Board of Governors of the Federal Reserve System.

Sarin, Natasha and Lawrence Summers (2016), "Have big banks gotten safer?" Brookings Paper on Economic Activity, BPEA Conference Draft, September 15-16.

White, Phoebe, and Tanju Yorulmazer (2014). "Bank Resolution Concepts, Tradeoffs, and Changes in Practices," Federal Reserve Bank of New York Economic Policy Review, vol. 20 (2): pp. 153–73.

1. This note summarizes the findings of Passmore and von Hafften (2017). Return to text

2. This aggregate is the sum of our estimated common equity shortfalls for banks in the Basel sample based on their current equity holdings, most of which are above regulatory minimums. If banks perceive current equity cushions above regulatory minimums as necessary to maintain, the capital shortfall would be much larger. In addition, since our data is from the previous financial crisis, it presumes that governments take similar actions to shore-up the financial system generally during a future crisis. If governments intervene in a less forceful manner in future crises, the needed bank capital could again be much larger. Return to text

3. Basel III is a set of "reforms to strengthen global capital and liquidity rules with the goal of promoting a more resilient banking sector" (BCBS, 2010). Other elements of Basel III include the countercyclical capital buffer, the leverage ratio, the liquidity coverage ratio (LCR), the net stable funding ratio (NSFR), the total loss-absorbing capacity proposal (TLAC), and resolution plans (see BCBS, 2010 [rev. 2011]). Return to text

4. The Federal Reserve Board of Governors has established capital surcharges for global systemically important bank holding companies that is similar to the BCBS methodology. The Board's surcharges are also calibrated using the expected impact theory (Board of Governors, 2015), but the Board's surcharges are almost always higher than those under the BCBS methodology. Return to text

5. The Basel failure point is arguably book common-equity-to-risk-weighted-assets below 4.5 percent (BCBS, 2013). As noted by many observers, regulatory bank capital often substantially lags behind market valuations, and market actions may impose effective failure on G-SIBs before the regulatory failure point is reached. For recent commentary and analysis, see Bulow and Klemperer (2013), Haldane (2011), and Sarin and Summers (2016). Return to text

6. Outlined in BCBS (2013), the G-SIB score is a weighted average of 12 market shares, which are indicators of size, interconnectedness, substitutability/financial institution infrastructure, complexity, and cross-border activity. Return to text

7. Bucket 5, which has a 100 basis point increase over Bucket 4, is empty; Bucket 5 is intended as an incentive for G-SIBs to avoid becoming more systemically important. We place an "X" over this bucket in the figures to indicate it is unused at this time. Return to text

8. A larger reference bank indicates that public authorities have a higher tolerance for the social losses created by a G-SIB failure and, as a result, the G-SIB needs less capital. Return to text

9. This data set is from the Bankscope database (Bureau van Dijk, 2016). Return to text

10. The U.S. implementation of the BCBS G-SIB assessment methodology includes short-term funding as an indicator in the G-SIB score (Board of Governors, 2015). The short-term funding literature includes Demirguc-Kunt and Huizinga (2010); Gorton and Metrick (2012); Ivashina and Scharfstein (2010); and Martin, Skeie, and von Thadden (2014). Return to text

11. See White and Yorulmazer (2014) for an account of government interventions in response to the 2007–09 financial crisis. The Basel sample includes the largest 75 bank holding companies as determined by total exposures and any other bank holding companies that were designated G-SIBs in the previous year (BCBS, 2016b). Return to text

Please cite as:

Passmore, Wayne, and Alexander H. von Hafften (2017). "Are Basel's Capital Surcharges for Global Systemically Important Banks Too Small?" FEDS Notes. Washington: Board of Governors of the Federal Reserve System, February 27, 2017, https://doi.org/10.17016/2380-7172.1859.

Disclaimer: FEDS Notes are articles in which Board economists offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers.