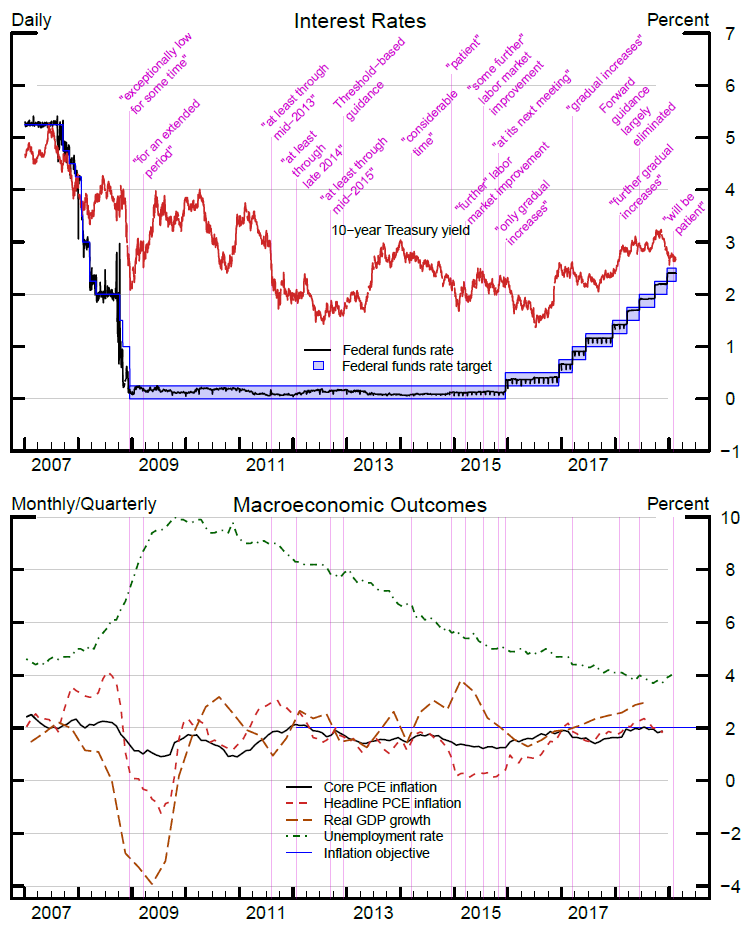

Timelines of Policy Actions and Communications:

Forward Guidance about the Federal Funds Rate

The list that follows summarizes important components of the FOMC's guidance about the future path of the federal funds rate ("forward guidance"), as communicated through its postmeeting statements. Because households and businesses use this information in making decisions about spending and investment, forward guidance about future monetary policy can influence financial and economic conditions today. In the aftermath of the Global Financial Crisis, the FOMC used forward guidance to support economic activity and a return of inflation to 2 percent. For an introduction to forward guidance, see "What is forward guidance and how is it used in the Federal Reserve's monetary policy?"

- December 16, 2008: The FOMC lowers its target for the federal funds rate to a range of 0 to 1/4 percent, which the FOMC considers to be an effective lower bound. In addition, the Committee states that "weak economic conditions are likely to warrant exceptionally low levels of the federal funds rate for some time."

- March 18, 2009: The FOMC replaces "for some time" with "for an extended period" in its postmeeting statement.

- August 9, 2011: The FOMC announces it will likely keep the federal funds rate at exceptionally low levels "at least through mid-2013."

- January 25, 2012: The FOMC replaces "at least through mid-2013" with "at least through late 2014."

- September 13, 2012: In conjunction with the announcement of its third large-scale asset purchase program (henceforth "LSAP3"), the FOMC states that it "expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens." In addition, it indicates that exceptionally low levels for the federal funds rate are likely to be warranted "at least through mid-2015."

- December 12, 2012: In conjunction with the announcement of the extension of longer-term Treasury purchases under LSAP3, the FOMC introduces threshold-based forward guidance by stating that it expects to keep the federal funds rate between a range of 0 and 1/4 percent and that it anticipates that this exceptionally low range would be maintained "at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee's 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored."

- December 18, 2013: The FOMC announces it "likely will be appropriate to maintain the current target range for the federal funds rate well past the time that the unemployment rate declines below 6-1/2 percent, especially if projected inflation continues to run below the Committee's 2 percent longer-run goal."

- March 19, 2014: The FOMC replaces its threshold-based forward guidance with the statement that it expects it likely will be appropriate to maintain the current target range for the federal funds rate for "a considerable time after the asset purchase program ends, especially if projected inflation continues to run below the Committee's 2 percent longer-run goal, and provided that longer-term inflation expectations remain well anchored." The FOMC also states its anticipation that, "even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run."

- October 29, 2014: The FOMC states that "it likely will be appropriate to maintain the 0 to 1/4 percent target range for the federal funds rate for a considerable time following the end of its asset purchase program this month, especially if projected inflation continues to run below the Committee's 2 percent longer-run goal, and provided that longer-term inflation expectations remain well anchored." The conditional nature of this period is emphasized: "However, if incoming information indicates faster progress toward the Committee's employment and inflation objectives than the Committee now expects, then increases in the target range for the federal funds rate are likely to occur sooner than currently anticipated. Conversely, if progress proves slower than expected, then increases in the target range are likely to occur later than currently anticipated."

- December 17, 2014: The FOMC announces that "it can be patient in beginning to normalize the stance of monetary policy."

- March 18, 2015: The FOMC replaces the indication that "it can be patient" with the indication that an increase in the target range "remains unlikely at the April FOMC meeting" and that such an increase will be appropriate when the FOMC "has seen further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term." The FOMC further indicates that this change in the forward guidance "does not indicate that the Committee has decided on the timing of the initial increase in the target range."

- July 29, 2015: The FOMC alters the guidance referring to "further improvement" in the labor market to "some further improvement."

- October 28, 2015: The FOMC replaces the clause "how long it will be appropriate to maintain [the target range]" with "whether it will be appropriate to raise the target range at its next meeting."

- December 16, 2015: The FOMC raises the target range for the first time since before the financial crisis. The FOMC indicates that "the stance of monetary policy remains accommodative after this increase." The FOMC expects that "economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run." The FOMC also states that it anticipates that it would maintain its reinvestment policy "until normalization of the level of the federal funds rate is well under way."

- March 15, 2017: The mention of "only gradual increases" in the future path of the federal funds rate is changed to "gradual increases." Also, the statement now emphasizes the Committee's "symmetric inflation goal" instead of its "inflation goal."

- January 31, 2018: The expression "gradual increases" is changed to "further gradual increases."

- June 13, 2018: The FOMC drops the sentence indicating that the federal funds rate is "likely to remain, for some time, below levels that are expected to prevail in the longer run."

- September 26, 2018: The FOMC drops a sentence indicating that "the stance of monetary policy remains accommodative," which had been in place since December 2015.

- January 30, 2019: The FOMC no longer indicates a judgment that "some further gradual increases [in the target range for the federal funds rate] will be consistent" with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective. Instead, the FOMC conveys that it "will be patient as it determines what future adjustments to the target range […] may be appropriate to support these outcomes."

Sources: FRED, Federal Reserve Bank of St. Louis.

Notes: Headline and core PCE inflation are shown on a 12-month basis. Real GDP growth is shown on a four-quarter change basis. The unemployment rate is on a monthly basis.