Aggregate Reserves of Depository Institutions and the Monetary Base - H.3

Technical Q&As RSS DDP

This page provides additional information about data in the Board of Governors' statistical release on aggregate reserves of depository institutions and the monetary base (H.3). Most of the information is of a technical nature and represents answers to questions that may be of interest to a range of analysts and researchers. The page will be updated as such questions arise.

Frequently Asked Questions on the Consolidation of the H.3 and H.6 Statistical Releases

1. Why is the Federal Reserve consolidating the H.3 and H.6 statistical releases?

Posted: 08/20/2020A. As announced on March 15, 2020, the Board of Governors reduced reserve requirement ratios on net transaction accounts to 0 percent, effective March 26, 2020. This action eliminated reserve requirements for all depository institutions. As a result, many of the release items on the H.3 statistical release are zero beginning with the two weeks ending April 8, 2020. Consequently, the Board has decided to consolidate the remaining relevant release items from the H.3 statistical release onto the H.6 statistical release.

2. Does the consolidation of the H.3 and H.6 releases mean that the Board’s decision to eliminate reserve requirements is permanent?

Posted: 08/20/2020A. Currently, the Board has no plans to reimpose reserve requirements. However, the Board may adjust reserve requirement ratios in the future if conditions warrant.

3. When will the Federal Reserve consolidate the H.3 and H.6 statistical releases?

Posted: 08/20/2020A. The remaining relevant items from the H.3 statistical release will be consolidated onto the H.6 statistical release with the H.6 statistical release published on Thursday, September 24, 2020. The last H.3 statistical release will be published on Thursday, September 17, 2020.

4. What H.3 release items have been zero since the elimination of reserve requirements? When did these items first go to zero?

Posted: 08/20/2020A. The following H.3 release items have been zero beginning with the two weeks ending April 8, 2020:

- Reserve balance requirements (table 1)

- Top of the penalty-free band (table 1)

- Bottom of the penalty-free band (table 1)

- Balances maintained to satisfy reserve balance requirements (table 1)

- Reserves, required (table 2)

- Vault cash, used to satisfy required reserves (table 2)

5. Which H.3 release items remain relevant after the elimination of reserve requirements and will be consolidated onto the H.6 statistical release?

Posted: 08/20/2020A. The monetary base and nonborrowed reserves, including their components, remain relevant concepts after the elimination of reserve requirements. The components of these concepts include (1) “Currency in circulation” and “Total balances maintained” for the monetary base and (2) “Total reserves” and “Total borrowings from the Federal Reserve” for nonborrowed reserves. These two concepts and their components are H.3 release items and will be consolidated onto the H.6 statistical release. The “Total balances maintained” H.3 release item will be relabeled as “Reserve balances” on the H.6 statistical release. The H.6 statistical release will provide monthly averages of these items.

There are other H.3 release items that are nonzero after the elimination of reserve requirements that will not be consolidated onto the H.6 release. The items include the following:

- Balances maintained that exceed the top of the penalty-free band (table 1): With the elimination of reserve requirements, all reserve balances maintained are balances that exceed the top of the penalty-free band. Reserve balances will be consolidated onto the H.6 statistical release.

- Total and surplus vault cash (table 2): These vault cash measures reflect vault cash held by depository institutions not exempt from reserve requirements, which the H.3 release considered to be those depository institutions that have net transaction accounts greater than the reserve requirement exemption amount. Vault cash held by this subset of institutions is no longer relevant with the elimination of reserve requirements.

- Breakdown of total borrowings from the Federal Reserve by program or facility (table 3): To calculate nonborrowed reserves, total borrowings from the Federal Reserve are subtracted from total reserves. Total borrowings will be consolidated onto the H.6 statistical release. The detailed breakdown of total borrowings by program or facility is not needed for the calculation and will not be consolidated onto the H.6 statistical release. In addition, table 1 of Statistical Release H.4.1, “Factors Affecting Reserve Balances of Depository Institutions and Condition Statement of Federal Reserve Banks,” contains the detailed breakdown of “Loans” at a weekly frequency.

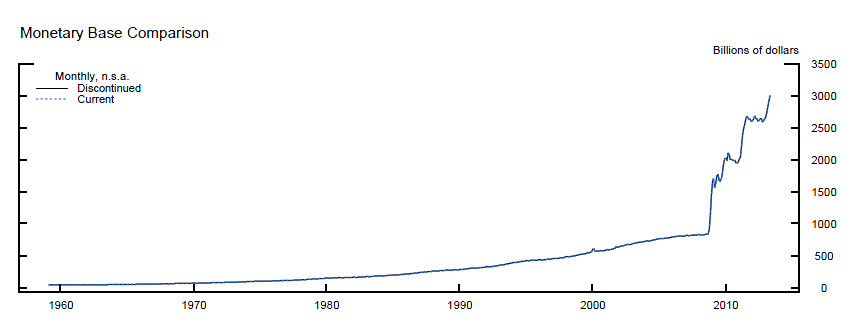

6. What is the monetary base?

Posted: 08/20/2020A. The monetary base is one measure of the money supply. The monetary base is the sum of currency in circulation and reserve balances (deposits held by banks and other depository institutions in their accounts at the Federal Reserve). Monthly average data on the monetary base and its components will be made available in table 1 of the H.6 release. The monetary base can also be derived by adding “Reserve balances with Federal Reserve Banks” and “Currency in circulation” from table 1 of the H.4.1 statistical release. This derivation can be done using weekly averages or Wednesday levels.

7. What are nonborrowed reserves?

Posted: 08/20/2020A. Nonborrowed reserves measure the amount of reserves provided through channels that are not considered borrowings. Such channels may include open market operations, foreign currency swap arrangements with foreign central banks, and certain special purpose vehicles.

Nonborrowed reserves are the difference between total reserves and total borrowings from the Federal Reserve.

- Total reserves are equal to the sum of reserve balances and vault cash used to satisfy reserve requirements, the latter of which is zero with the elimination of reserve requirements that was effective on March 26, 2020.

- Total borrowings from the Federal Reserve include credit extended through the Federal Reserve’s regular discount window programs and credit extended through certain Federal Reserve liquidity facilities.

Monthly data on nonborrowed reserves and its components will be available in table 1 of the H.6 release. With the elimination of reserve requirements, nonborrowed reserves can also be derived by subtracting “Loans” from “Reserve balances with Federal Reserve Banks” from table 1 of the H.4.1 statistical release. This derivation can be done using weekly averages or Wednesday levels.

8. Will monthly averages of the H.3 items being consolidated onto the H.6 statistical release continue to be calculated as prorated averages of biweekly figures?

Posted: 08/20/2020A. Yes. Monthly averages of the H.3 release items being consolidated onto the H.6 statistical release will continue to be calculated as prorated averages of biweekly figures. Any differences in the monthly average values of these consolidated items available from the H.3 and H.6 Data Download Program (DDP) are the result of revisions to the consolidated items captured in the H.6 DDP and not differences in the calculation method used to produce the monthly averages.

9. How will the Federal Reserve consolidate the H.3 and H.6 releases?

Posted: 08/20/2020A. Nonseasonally adjusted, monthly average data on the monetary base and nonborrowed reserves will be consolidated onto table 1 of the H.6 release. The monetary base and its components will be added to the left of the columns containing nonseasonally adjusted data on the M1 and M2 money stock measures. Nonborrowed reserves and their components will be added as memorandum items to the right of the columns containing nonseasonally adjusted data on the M1 and M2 money stock measures. A template of table 1 of the consolidated H.6 statistical release can be found here. Please note the amount of monthly data shown on table 1 of the consolidated H.6 statistical release will be reduced from 24 to 17 months. All historical data are accessible in the H.6 DDP.

10. Why is the Federal Reserve removing columns containing data on traveler’s checks concurrent with its consolidation of the H.3 and H.6 statistical releases?

Posted: 08/20/2020A. The Board ceased publication of outstanding amounts of U.S. dollar-denominated traveler’s checks of nonbank issuers in early 2019. The last reported value for this H.6 release item was December 2018. Currently, the columns labeled "Traveler’s checks" are blank and will be removed from the H.6 release as a matter of housekeeping. For more information, see the section below titled "Frequently Asked Questions on the Discontinuance of Nonbank Traveler’s Checks."

11. Will historical data for all H.3 release items remain available in the Data Download Program?

Posted: 08/20/2020A. Yes, historical data for all H.3 release items will remain available in the H.3 DDP. In the H.3 DDP, maintenance period average and monthly average data for all H.3 release items will have data through the two weeks ending September 9, 2020, and August 2020, respectively. The data that will remain available in the H.3 DDP for all H.3 release items will be as of the last publication of the H.3 release on September 17, 2020, and will not be revised.

12. After the consolidation of the H.3 and H.6 statistical releases, where will up-to-date data on the H.3 release items consolidated onto the H.6 statistical release be available?

Posted: 08/20/2020A. With the release consolidation on September 24, 2020, up-to-date data on the H.3 release items consolidated onto the H.6 statistical release will be available in the H.6 DDP. For these items, the H.6 DDP will contain time series of the data items from January 1959 through the last month published on the H.6 release. Unlike the H.3 DDP, the time series in the H.6 DDP for these items are subject to revision. The “build your own” and preformatted packages in the H.6 DDP will incorporate the consolidated items.

13. Why is the Federal Reserve discontinuing the 12 H.6 DDP preformatted packages associated with the H.6 historical tables?

Posted: 08/20/2020A. The Board is discontinuing the 12 “H.6 historical table” preformatted packages because the data items in these packages are contained in the monthly or the weekly “H.6 statistical release” preformatted packages. The Board provided the “H.6 historical table” preformatted packages to mirror the presentation of historical release data that was retired in 2012 once the H.6 DDP became available. Users have gained familiarity with the H.6 DDP and appear to rely on the preformatted packages associated with the current statistical release or the “build your own” functionality to select their desired release items.

Frequently Asked Questions on the Change to the Payment of Interest on Excess Reserve Balances

1. Did the calculation of interest change on required reserve balances?

Posted: 07/23/2015A.

No. Interest on required reserve balances continues to be calculated by multiplying the average interest rate on required reserves (IORR rate) over the maintenance period by the average level of balances maintained over the maintenance period up to the top of the penalty-free band.

2. Did the calculation of interest change on excess reserve balances?

Posted: 07/23/2015

A.

Yes. Beginning July 23, 2015, interest is calculated for depository institutions with excess reserve balances by multiplying the interest rate on excess reserves (IOER rate) in effect each day of the maintenance period by the institution's total balances that day less an adjustment to avoid the double payment of interest on balances maintained up to the top of the penalty-free band.

3. Why was the methodology for calculating interest on excess reserve balances changed?

Posted: 07/23/2015

A. Prior to July 23, 2015, interest on excess reserves was calculated as the arithmetic average of the daily IOER rate in effect over a maintenance period multiplied by the institution's average level of excess balances maintained over that maintenance period. That methodology implied that the full effect of an increase in the IOER rate on other short-term market rates may not be realized until the subsequent maintenance period in cases when an IOER rate change did not coincide with the beginning of a maintenance period. Because the new methodology calculates IOER by multiplying the IOER rate in effect each day of the maintenance period by the institution's total balances that day, the new methodology should allow for any effect of an increase in the IOER rate on other short-term rates to be realized immediately, regardless of when during a maintenance period an IOER rate change takes place.

For the final rule amending Regulation D to permit interest payments to be based on a daily interest rate on excess reserves rather than on a maintenance period average rate, see the notice in the Federal Register (80 FR 35565).

4. Does the Federal Reserve publish daily interest rates on reserve balances?

Posted: 07/23/2015

A.

Yes. IORR and IOER rates effective on a given day are reported on the "Interest on Required Balances and Excess Balances" page on the Federal Reserve Board's public website and are available in the Policy Rates Data Download Program. The current day’s rates are made available late in the day around 4:30 p.m. Eastern Time.

5. Does the Federal Reserve continue to make historical maintenance period interest rates paid on reserve balances available?

Posted: 07/23/2015

A.

Yes. Maintenance period interest rates paid on required reserve balances and excess reserve balances previously published on the H.3 release for maintenance periods beginning October 9, 2008 through July 22, 2015, remain available in the H.3 Data Download Program.

6. Are data available to calculate the maintenance period interest rate paid on required reserve balances?

Posted: 07/23/2015

A.

Yes. The maintenance period interest rate paid on required reserves can be calculated by averaging the daily IORR rates over a maintenance period. Daily IORR and IOER rates are reported on the "Interest on Required Balances and Excess Balances" page on the Federal Reserve Board's public website and are available in the Policy Rates Data Download Program. The current day's rates are made available late in the day around 4:30 p.m. Eastern Time.

7. Where can I find additional information on interest on reserve balances?

Posted: 07/23/2015

A. For more information on the formulas used to calculate interest on reserve balances, see Regulation D or the Reserve Maintenance Manual. For general background on interest on reserve balances and the publication of daily IORR and IOER rates, see the "Interest on Required Balances and Excess Balances" page on the Federal Reserve Board's public website.

Frequently Asked Questions on the Reporting of Balances Maintained by Entities Designated as Systemically Important Financial Market Utilities in the H.3 Release

1. What are designated financial market utilities (FMUs)?

Posted: 02/20/2014A.

On July 18, 2012, the Financial Stability Oversight Council designated eight FMUs as systemically important under Title VIII of the Dodd-Frank Wall Street Reform and Consumer Protection Act. The Dodd-Frank Act permits the Federal Reserve Board to authorize a Federal Reserve Bank to establish and maintain an account for such designated FMUs and to provide certain financial services to such entities. On December 5, 2013, the Federal Reserve Board promulgated provisions in the Board's Regulation HH that set out the conditions and minimum requirements for a Reserve Bank to open and maintain accounts for designated FMUs (12 CFR 234.6). These provisions became effective February 18, 2014.

2. Did some of the entities that were designated by the Financial Stability Oversight Council have Federal Reserve accounts prior to February 18, 2014?

Posted: 02/20/2014

A.

Yes. Some entities that became designated FMUs in July 2012 had pre-existing Reserve Bank accounts under other statutory authority.

3. Where are balances maintained by designated FMUs with Federal Reserve Banks reported in the H.3 release?

Posted: 02/20/2014

A. Balances maintained in pre-existing Reserve Bank accounts prior to February 18, 2014, by entities that became designated FMUs are reported in "Total reserve balances maintained" and "Balances maintained that exceed the top of the penalty-free band" on table 1 and "Total balances maintained" on table 2 of the H.3 release.

Balances maintained in Reserve Bank accounts of designated FMUs on and after February 18, 2014, are not reported in the H.3 release. These balances are reported in the H.4.1 statistical release available at: http://www.federalreserve.gov/releases/h41/.

4. Where can I find additional information on designated FMUs?

Posted: 02/20/2014

A. For more information on designated FMUs on the Federal Reserve Board's website, please refer to: http://www.federalreserve.gov/paymentsystems/designated_fmu_about.htm

For more information regarding the Financial Stability Oversight Council's designations, please refer to: http://www.gpo.gov/fdsys/pkg/FR-2011-07-27/pdf/2011-18948.pdf#page=11

For more information regarding the final rule on Regulation HH pertaining to designated FMU accounts and services, please refer to:

http://www.gpo.gov/fdsys/pkg/FR-2013-12-20/html/2013-29711.htm

Frequently Asked Questions about the July 11, 2013 changes

Table 1 Q&A

1. What is a penalty-free band?

Posted: 07/11/2013A.

A penalty-free band is a range on both sides of the reserve balance requirement within which an institution needs to maintain its average balance over the maintenance period in order to satisfy its reserve balance requirement. The penalty-free band replaced carryover and routine penalty waivers. For more information, see Regulation D and the Reserves Administration Enhancements Resource Center.

2. How are the top and bottom of the penalty-free band calculated?

Posted: 07/11/2013

A. For each institution, the top of the penalty-free band is equal to the institution’s reserve balance requirement plus an amount that is the greater of 10 percent of the institution’s reserve balance requirement or $50,000. For each institution, the bottom of the penalty-free band is equal to the institution’s reserve balance requirement less an amount that is the greater of 10 percent of the institution’s reserve balance requirement or $50,000. For additional information, including how to calculate the penalty-free band for a pass-through correspondent, see the Reserves Maintenance Manual.

3. What is "total reserve balances maintained"?

Posted: 07/11/2013

A. "Total reserve balances maintained" is the amount of balances institutions hold in accounts at Federal Reserve Banks that are available to satisfy reserve requirements. Historically, this series excluded balances held in a reserve account for contractual clearing purposes. Since the elimination of the contractual clearing balances program on July 11, 2012, "total reserve balances maintained" in table 1 in the H.3 statistical release is equivalent to "total balances maintained" in table 2 in the H.3 statistical release.

4. Can "balances maintained that exceed the top of the penalty-free band" be derived by subtracting "reserve balances requirements" from "total reserve balances maintained"?

Posted: 07/11/2013

A. No. The reserve balance requirement is the midpoint of the penalty-free band. "Balances maintained that exceed the top of the penalty-free band" reflects balances maintained that exceed the top, rather than the midpoint, of each institution's penalty-free band.

5. Can "balances maintained that exceed the top of the penalty-free band" be derived by subtracting the "top of penalty-free band" from "total reserve balances maintained"?

Posted: 07/11/2013

A. No. "Total reserve balances maintained" is calculated as the sum across all institutions, regardless of whether they are above or below the top of the penalty-free band. "Top of penalty-free band" is derived by adding the top of the penalty-free band for each institution, regardless of the level of balances each institution maintains. "Balances maintained that exceed the top of the penalty-free band" is the sum of balances maintained across institutions that maintain balances in excess of the top of their respective penalty-free bands and excludes institutions that maintain balances that fall below the top of their respective penalty-free bands. For an explanation of how "balances maintained that exceed the top of the penalty-free band" is calculated, see question 7.

6. How is "balances maintained to satisfy reserve balance requirements" calculated?

Posted: 07/11/2013

A. "Balances maintained to satisfy reserve balance requirements," which consist of those up to and including the top of the penalty-free band, is calculated separately for each institution and then aggregated. If an institution maintains an average level of reserve balances over a maintenance period below the top of its penalty-free band, then balances maintained to satisfy reserve balance requirements is equal to the institution’s average level of reserve balances maintained over the maintenance period. For all other institutions, balances maintained to satisfy reserve balance requirements is equal to the top of their penalty-free bands.

7. How is "balances maintained that exceed the top of the penalty-free band" calculated?

Posted: 07/11/2013

A. "Balances maintained that exceed the top of the penalty-free band" is calculated separately for each institution and then aggregated. If an institution maintains an average level of reserve balances over a maintenance period above the top of its penalty-free band, then balances maintained that exceed the top of the penalty-free band is equal to the institution’s average level of reserve balances maintained over a maintenance period less the top of its penalty-free band. For all other institutions, balances maintained that exceed the top of the penalty-free band is zero.

8. Why is the "excess reserves" series last published in the July 5, 2013, H.3 statistical release not included in the current H.3 statistical release?

Posted: 07/11/2013

A. The concept of "excess reserves," defined as total reserve balances less reserve balance requirements, no longer aligns with the remuneration structure following phase two of the simplification of reserves administration. The purpose of the H.3 statistical release is to give the public insight into how depository institutions collectively manage their reserves within the current framework for the implementation of monetary policy. Following phase two of the simplification of reserves administration, the Board of Governors determines the interest rate to be paid on "balances maintained to satisfy reserve balance requirements" up to and including the top of the penalty-free band. The Board also separately determines the rate to be paid on "balances maintained that exceed the top of the penalty-free band." For more information, see Regulation D.

9. How do I get to the historical concept of "excess reserves" using the current H.3 statistical release?

Posted: 07/11/2013

A. The historical concept of "excess reserves" no longer has the same meaning following phase two of the simplification of reserves administration. Nevertheless, to get at the historical concept of "excess reserves" using the current H.3 statistical release, take "total reserve balances maintained" (table 1, column 4) less "reserve balance requirements" (table 1, column 1). Alternatively, one can view excess as the amount of balances maintained that satisfy the minimum requirements, which can be calculated by taking "total reserve balances maintained" (table 1, column 4) less "bottom of penalty-free band" (table 1, column 3).

10. Where can I find a historical time series for "excess reserves"?

Posted: 07/11/2013

A. The historical time series of "excess reserves" last published in the July 5, 2013, H.3 statistical release will remain available through the Data Download Program.

11. What is "interest rates paid on balances maintained"?

Posted: 07/11/2013

A. The Board of Governors determines the interest rates to be paid on balances maintained at the Federal Reserve. "Balances maintained to satisfy reserve balance requirements" up to and including the top of the penalty-free band are remunerated at the rate paid on balances maintained up to the top of the penalty-free band. "Balances maintained that exceed the top of the penalty-free band" are remunerated at the interest rate to be paid on excess balances. For more information, see Regulation D.

12. Where can I find the historical series associated with interest rates paid on reserve balances?

Posted: 07/11/2013

A. The historical data of interest rates paid on required and excess reserves prior to the simplified reserve requirement regime is available in the Interest on Reserves Archive and the Data Download Program, as part of the H.3 statistical release data package.

Table 2 Q&A

13. Is "total balances maintained" in table 2 in the H.3 statistical release different from "total reserve balances maintained" in table 1 in the H.3 statistical release?

Posted: 07/11/2013A. Yes, it is different historically. "Total balances maintained" are balances that an institution holds in a reserve account directly at a Federal Reserve Bank. Historically, these balances included "total reserve balances maintained" to satisfy reserve requirements and balances held for contractual clearing purposes, the latter of which was eliminated with phase one of the simplification of reserves administration. Since the elimination of the contractual clearing balances program on July 11, 2012, "total balances maintained" in table 2 in the H.3 statistical release is equivalent to "total reserve balances maintained" in table 1 in the H.3 statistical release.

14. How does "total balances maintained" in table 2 in the H.3 statistical release and "total reserve balances maintained" in table 1 in the H.3 statistical release relate to "other deposits held by depository institutions" published in the H.4.1 statistical release?

Posted: 07/11/2013

A. "Total balances maintained" are balances that an institution holds in a reserve account directly at a Federal Reserve Bank and is equivalent to "other deposits held by depository institutions" published in the H.4.1 statistical release. Historically, these balances included balances held for contractual clearing purposes. Since the elimination of the contractual clearing balances program on July 11, 2012, with phase one of the simplification of reserves administration, "total reserve balances maintained" in table 1 in the H.3 statistical release is equivalent to "total balances maintained" in table 2 in the H.3 statistical release and "other deposits held by depository institutions" published in the H.4.1 statistical release.

15. How does "currency in circulation" in table 2 in the H.3 statistical release relate to "currency in circulation" published in the H.4.1 statistical release?

Posted: 07/11/2013

A. "Currency in circulation" in table 2 in the H.3 statistical release is calculated from the same data as "currency in circulation" published in the H.4.1 statistical release. However, the former is calculated as a two-week average ending on Wednesday to align with the reserve maintenance periods whereas the latter is calculated as a Wednesday level and a one-week average ending on Wednesday.

16. Why is the monetary base calculation in the current H.3 statistical release different from the monetary base calculation last published in the July 5, 2013, H.3 statistical release?

Posted: 07/11/2013

A. The simplification of reserves administration provides an opportunity to streamline the process of calculating the monetary base so that it reflects the fundamental concept of this measure. The fundamental concept of the monetary base, or "high-powered money," is the sum of total balances maintained by depository institutions at the Federal Reserve plus currency in circulation. Historically, the monetary base calculation included other steps, which are outlined in the answer to question 18.

17. Is there a substantial difference between the historical time series for the monetary base published in the current H.3 statistical release and the monetary base last published in the July 5, 2013, H.3 statistical release?

Posted: 07/11/2013

A. No. The levels and growth rates of the two series are nearly identical.

18. What are the historical differences between the monetary base published in the current H.3 statistical release and the monetary base last published in the July 5, 2013, H.3 statistical release?

Posted: 07/11/2013

A. The formula of the monetary base last published on July 5, 2013, included (1) "as of" adjustments, which were eliminated with phase one of the simplification of reserves administration; (2) lagged accounting for the vault cash held at certain institutions; and (3) currency in circulation calculated as a two-week average, ending on Monday. The historical time series of the simplified monetary base does not include as-of adjustments or lagged accounting for the vault cash held at certain institutions. The simplified monetary base includes currency in circulation calculated as two-week averages, ending on Wednesdays, to align with the reserve maintenance periods.

19. Where can I find a historical time series for the simplified monetary base published in the current H.3 statistical release?

Posted: 07/11/2013

A. The historical time series of the simplified monetary base is available through the Data Download Program. The Board also maintains the availability of the historical data for the monetary base last published in the July 5, 2013, H.3 statistical release.

20. Can I reconstruct the monetary base last published in the July 5, 2013, H.3 statistical release using data published in the current H.3 statistical release?

Posted: 07/11/2013

A. No. However, the historical data of the monetary base last published in the July 5, 2013, H.3 statistical release will be made available through the Data Download Program.

21. Are the series published in the H.3 statistical release break-adjusted and seasonally adjusted?

Posted: 07/11/2013

A. No. Data in the H.3 statistical release, including the simplified monetary base, are not adjusted for regulatory changes in reserve requirements and are not seasonally adjusted. The break-adjustment methodology formerly used relied on the assumption that excess reserves are tightly controlled. Since 2008, excess reserves have expanded substantially, making the basis of that methodology no longer valid. Nevertheless, the methodology by which these measures were once break-adjusted and seasonally adjusted is archived on the H.3 statistical release website. Also, the Federal Reserve Bank of St. Louis publishes a break-adjusted and seasonally adjusted monetary base series.

Table 3 Q&A

22. Table 3 in the current H.3 statistical release looks like table 1a last published in the July 5, 2013, H.3 statistical release--are they substantively the same?

Posted: 07/11/2013A. Table 1a last published in the July 5, 2013, H.3 statistical release was renumbered as table 3 in the current H.3 statistical release, and the nonborrowed reserves series published in table 2 in the July 5, 2013, H.3 statistical release was moved to table 3 in the current H.3 statistical release.