Financial Accounts of the United States - Z.1

Recent Developments RSS Data Download

This release reports data through December 31, 2020.

- Household net worth increased by $7.1 trillion in the fourth quarter, reflecting large gains in stock prices and home prices.

- Household debt grew at an annual pace of 6.5%, mainly because of continued growth in home mortgages.

- Nonfinancial business debt increased at a modest annual rate of 0.8%, reflecting an increase in corporate bonds and a decline in nonmortgage depository loans 1.

Household Net Worth

The net worth of households and nonprofit organizations increased by $7.1 trillion to $130.4 trillion in the fourth quarter. The value of directly and indirectly held corporate equities increased by $4.9 trillion largely because of further gains in corporate equity prices. The value of real estate held by households increased by $0.9 trillion. After three quarters of solid growth, household net worth is now about $12 trillion above its level at the end of 2019.

View interactive | Accessible version | CSV | Data Dictionary | Chart Note (1) |

Real estate ($32.0 trillion) and directly and indirectly held corporate equities ($39.8 trillion) were among the largest components of household net worth. Household debt (seasonally adjusted) was $16.6 trillion.

View interactive | Accessible version | CSV | Data Dictionary |

Household Balance Sheet Summary

| Description | 2019 | 2020 | 2020:Q1 | 2020:Q2 | 2020:Q3 | 2020:Q4 |

|---|---|---|---|---|---|---|

| Net Worth | 118.22 | 130.36 | 111.45 | 119.59 | 123.23 | 130.36 |

| Change in Net Worth | 12.70 | 12.15 | -6.77 | 8.14 | 3.64 | 7.14 |

| Equities | 34.06 | 39.77 | 26.35 | 32.30 | 34.89 | 39.77 |

| Change in Equities | 7.32 | 5.71 | -7.70 | 5.95 | 2.59 | 4.88 |

| Real Estate | 29.93 | 32.04 | 30.32 | 30.79 | 31.24 | 32.04 |

| Change in Real Estate | 1.55 | 2.11 | 0.39 | 0.47 | 0.45 | 0.80 |

For more data on household net worth, see table B.101

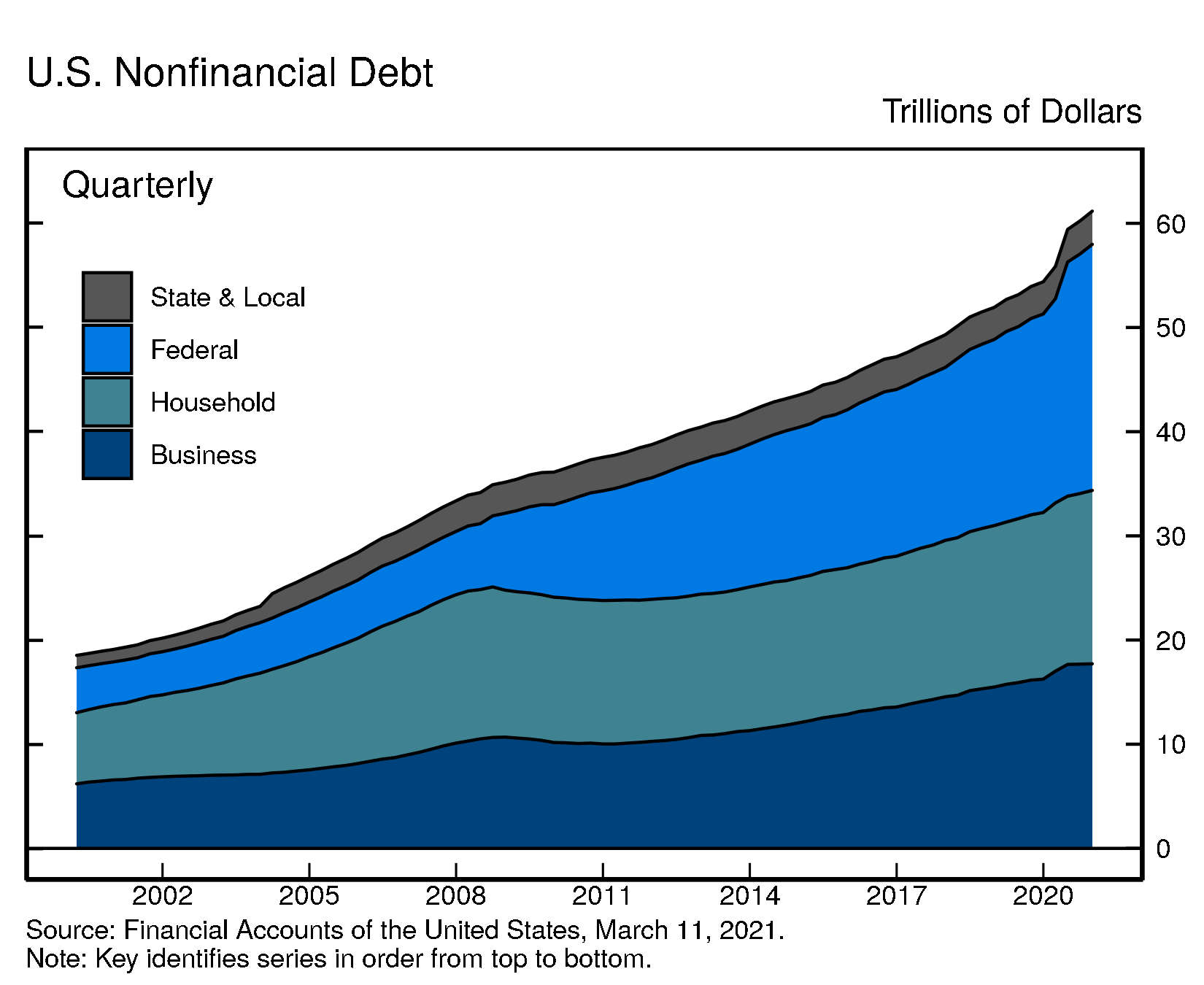

Nonfinancial debt

Household debt grew by 6.5% in the fourth quarter of 2020 (this and subsequent rates of growth are reported at a seasonally adjusted annual rate). Home mortgages increased by 5.2%, after growing by 5.7% in the third quarter. Nonmortgage consumer credit increased at a more moderate 2.3% pace, about the same pace as in the third quarter. The increase in consumer credit reflects growth in auto loans and student loans, while credit card balances continued to decline. Robust growth in margin debt also boosted household debt growth over the second half of 2020.

Nonfinancial business debt edged up at a modest rate of 0.8%, reflecting increases in corporate bonds outstanding and declines in nonmortgage depository loans. Federal debt rose 10.9%. State and local debt increased 1.7%.

As GDP continued to recover in the third quarter, the ratio of nonfinancial debt to GDP moved down further. In the second quarter, the ratio had spiked, driven by the drop in GDP and the expansion in federal debt related to the fiscal stimulus.

For more data on nonfinancial debt, see table D.1 (rates of growth) and table D.3 (outstanding).

Debt Growth by Sector

| Description | 2019 | 2020 | 2020:Q1 | 2020:Q2 | 2020:Q3 | 2020:Q4 |

|---|---|---|---|---|---|---|

| Total Nonfinancial | 4.75 | 12.47 | 10.83 | 25.47 | 5.45 | 6.26 |

| Households and Nonprofits | 3.34 | 4.08 | 3.78 | 0.07 | 5.72 | 6.53 |

| Nonfinancial Business | 4.83 | 9.08 | 19.03 | 15.13 | 0.54 | 0.76 |

| Federal Government | 6.67 | 23.96 | 11.38 | 58.86 | 9.10 | 10.93 |

| State and Local Governments | 0.33 | 2.91 | 0.84 | 3.49 | 5.55 | 1.66 |

Debt Outstanding by Sector

| Description | 2019 | 2020 | 2020:Q1 | 2020:Q2 | 2020:Q3 | 2020:Q4 |

|---|---|---|---|---|---|---|

| Total Nonfinancial | 54.39 | 61.17 | 55.86 | 59.42 | 60.23 | 61.17 |

| Households and Nonprofits | 16.00 | 16.64 | 16.15 | 16.15 | 16.38 | 16.64 |

| Nonfinancial Business | 16.24 | 17.72 | 17.01 | 17.66 | 17.68 | 17.72 |

| Federal Government | 19.06 | 23.62 | 19.60 | 22.48 | 22.99 | 23.62 |

| State and Local Governments | 3.10 | 3.19 | 3.10 | 3.13 | 3.17 | 3.19 |

Accessible version | CSV | Data Dictionary |

Accessible version | CSV | Data Dictionary |

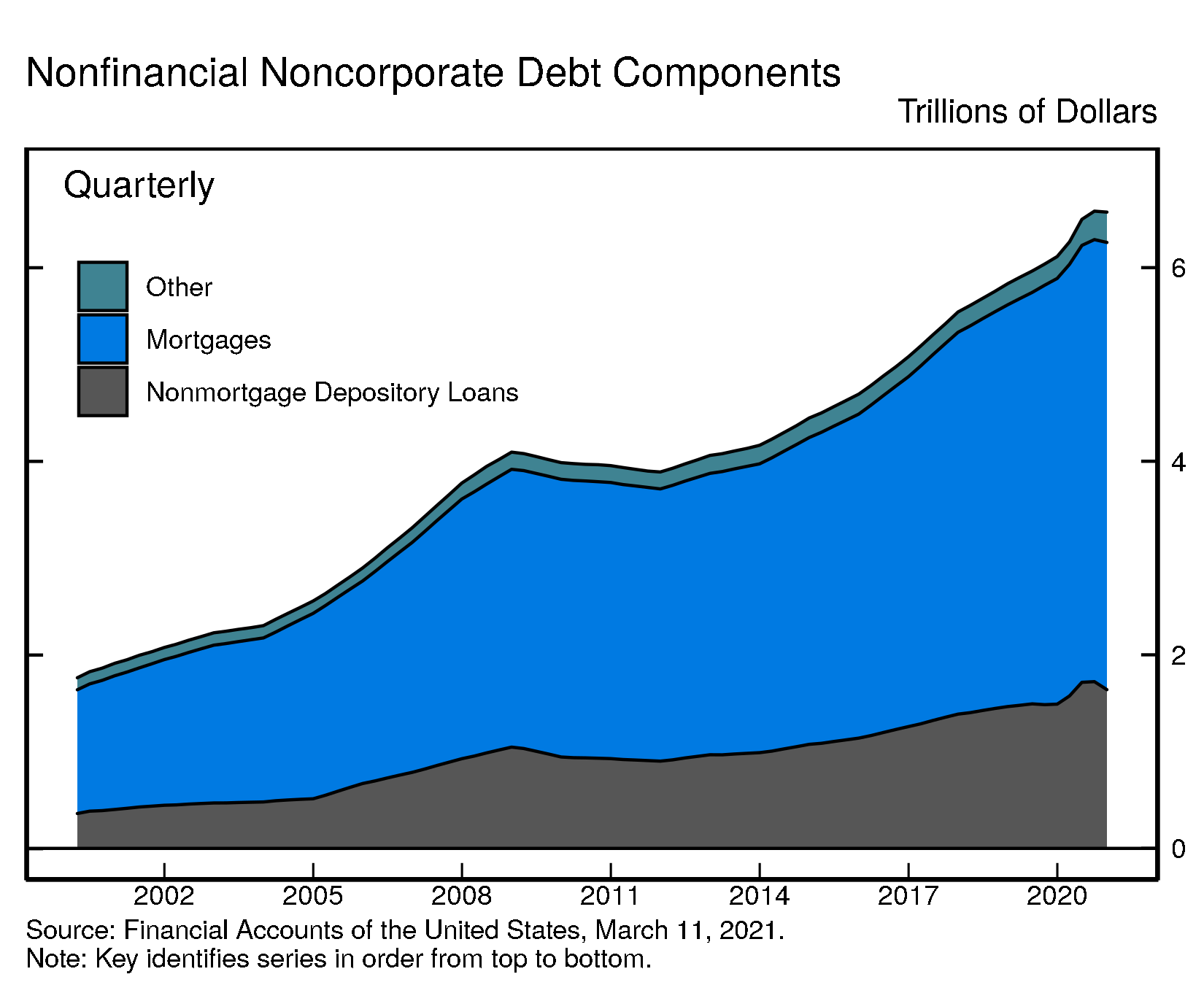

Looking at the various components of nonfinancial business debt, nonmortgage depository loans to nonfinancial business declined $118 billion, reflecting forgiveness of loans extended under the Paycheck Protection Program, or PPP, and weak loan origination. Nonmortgage depository loans had expanded notably over the first half of 2020 as firms tapped their lines of credit at banks and PPP loans were disbursed.

The majority of the loans that were disbursed under the PPP in 2020 (excluding about $95 billion of loans that were forgiven in the fourth quarter) are still on the lenders' balance sheet as of the end of the year, and thus are still included in our measure of nonfinancial business debt, even though a large fraction of them is expected to be forgiven. A technical Q&A (www.federalreserve.gov/releases/z1/z1_technical_qa.htm) provides additional details on the treatment of PPP loans in the Financial Accounts.

Partly offsetting the decline in nonmortgage bank loans, corporate bonds continued to increase, although at a slower pace than in the second and third quarters.

Overall, outstanding nonfinancial corporate debt was $11.1 trillion. Corporate bonds, at roughly $6.5 trillion, accounted for 59% of the total. Nonmortgage depository loans were about $1.1 trillion. Other types of debt include loans from nonbank institutions, loans from the federal government, and commercial paper.

The nonfinancial noncorporate business sector consists mostly of smaller businesses, which are typically not incorporated. Nonfinancial noncorporate business debt was $6.6 trillion, of which $4.6 trillion were mortgage loans and $1.6 trillion were nonmortgage depository loans.

Accessible version | CSV | Data Dictionary |

Accessible version | CSV | Data Dictionary |

For more data on nonfinancial business balance sheets, including debt, see tables B.103 and B.104

Coming soon

- The Distributional Financial Accounts, which provide a quarterly measure of the distribution of U.S. household wealth, will be published on Friday, March 19. Other Enhanced Financial Accounts Projects (www.federalreserve.gov/releases/efa/enhanced-financial-accounts.htm) will also be updated on March 19.

- Financial Accounts data for the first quarter of 2021 will be published on Thursday, June 10, 2021, at 12:00 noon.

Chart Notes

- Changes in net worth consist of transactions, revaluations, and other volume changes. Corporate equity and debt securities include directly and indirectly held securities. Real estate is the value of owner-occupied real estate. Other includes equity in noncorporate businesses, consumer durable goods, fixed assets of nonprofit organizations, and all other financial assets apart from corporate equities and debt securities, net of liabilities, as shown on table B.101 Balance Sheet of Households and Nonprofit Organizations

Depository loans include bank loans (bank credit) and loans from nonbank depository institutions such as credit unions and savings and loans associations.↩