Financial Accounts of the United States - Z.1

Recent Developments RSS Data Download

The recent developments discussed below refer to data through June 30, 2024.

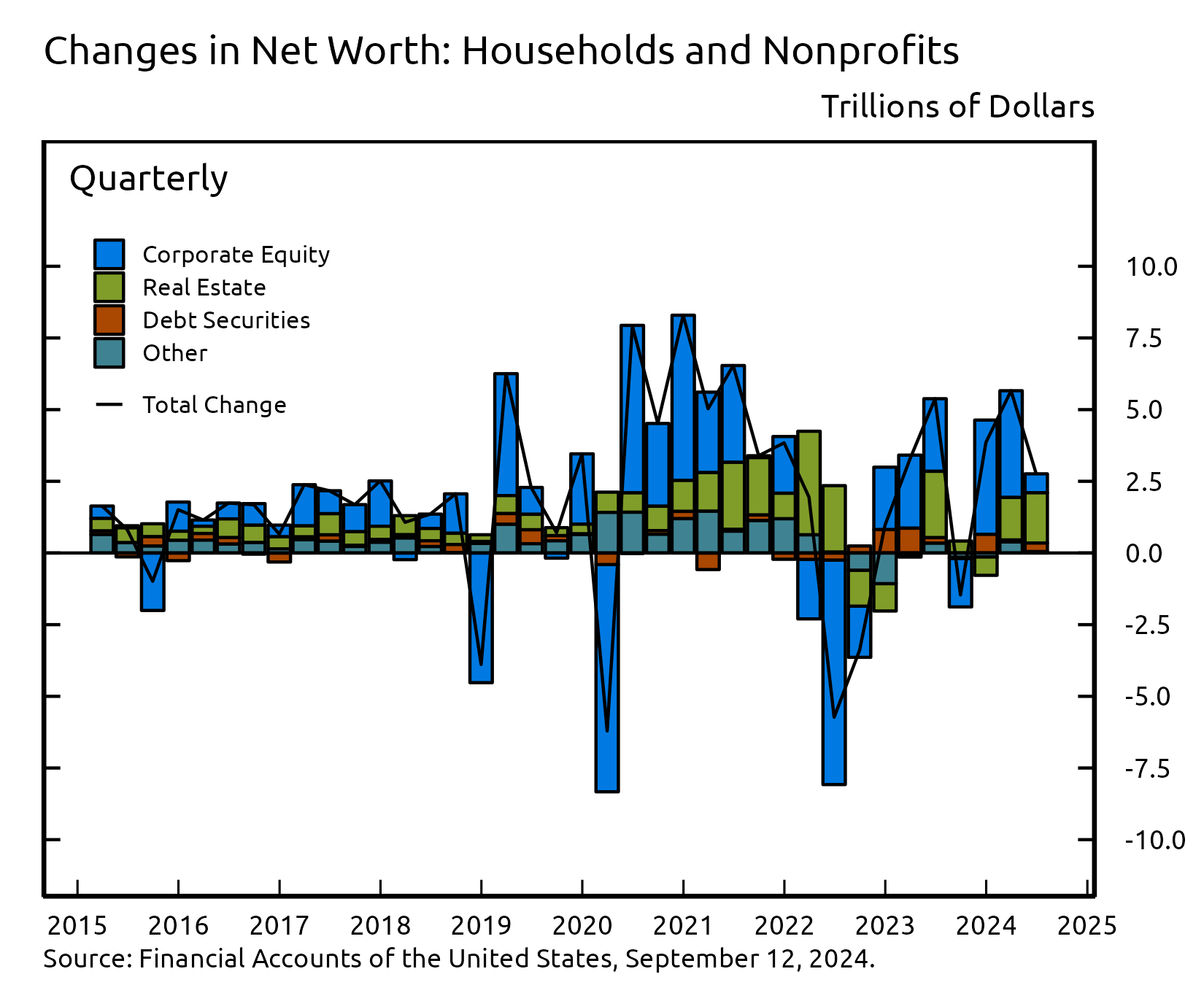

- Household net worth increased by $2.8 trillion in the second quarter, primarily driven by increases in stock prices and home prices.

- Household debt increased at a seasonally adjusted annual rate of 3.2% in the second quarter amid an uptick in mortgage debt growth and somewhat tepid growth of nonmortgage consumer credit.

- Nonfinancial business debt expanded 3.8% at a seasonally adjusted annual rate in the second quarter, reflecting solid growth in debt securities and loans from banks and other nonbank financial institutions.

Household Net Worth

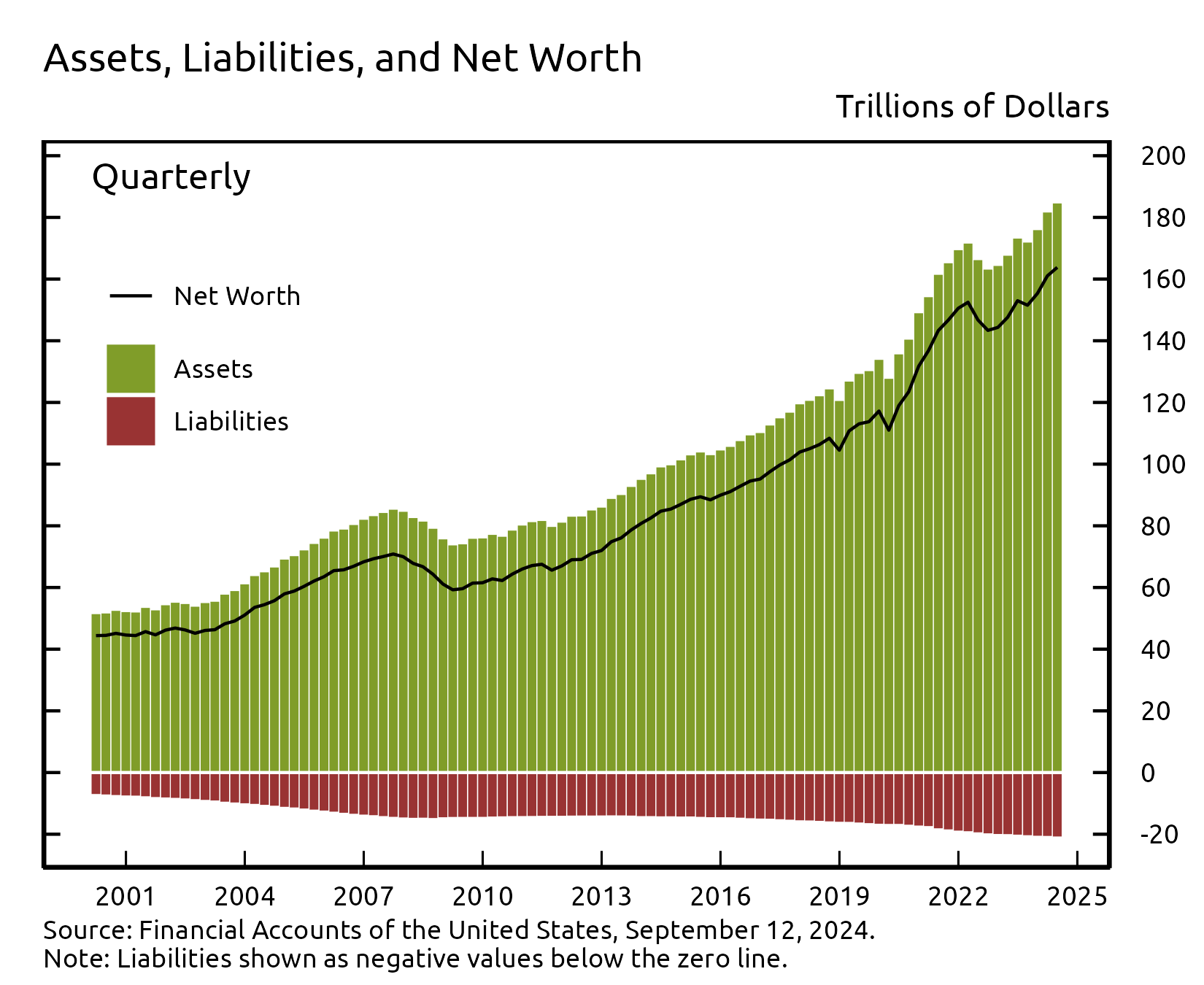

The net worth of households and nonprofit organizations increased by $2.8 trillion to $163.8 trillion in the second quarter. The change in household net worth reflects gains on both real estate holdings and corporate equity assets. The value of real estate on the household balance sheet increased by $1.8 trillion in the second quarter, while the value of directly and indirectly held equity rose by $0.7 trillion.

View interactive | Accessible version | CSV | Data Dictionary | Chart Note (1) |

Directly and indirectly held corporate equities ($51.5 trillion) and household real estate ($48.2 trillion) remain the largest components of household net worth. Household debt (seasonally adjusted) was $20.2 trillion.

View interactive | Accessible version | CSV | Data Dictionary |

Household Balance Sheet Summary

| Description | 2022 | 2023 | 2023:Q3 | 2023:Q4 | 2024:Q1 | 2024:Q2 |

|---|---|---|---|---|---|---|

| Net Worth | 144.33 | 155.38 | 151.52 | 155.38 | 161.04 | 163.80 |

| Change in Net Worth | -6.21 | 11.04 | -1.46 | 3.86 | 5.66 | 2.76 |

| Equities | 39.79 | 47.16 | 43.18 | 47.16 | 50.89 | 51.55 |

| Change in Equities | -9.51 | 7.37 | -1.69 | 3.99 | 3.72 | 0.66 |

| Real Estate | 42.59 | 44.90 | 45.27 | 44.90 | 46.44 | 48.22 |

| Change in Real Estate | 3.69 | 2.31 | 0.51 | -0.36 | 1.54 | 1.78 |

For more data on household net worth, see table B.101

Nonfinancial debt

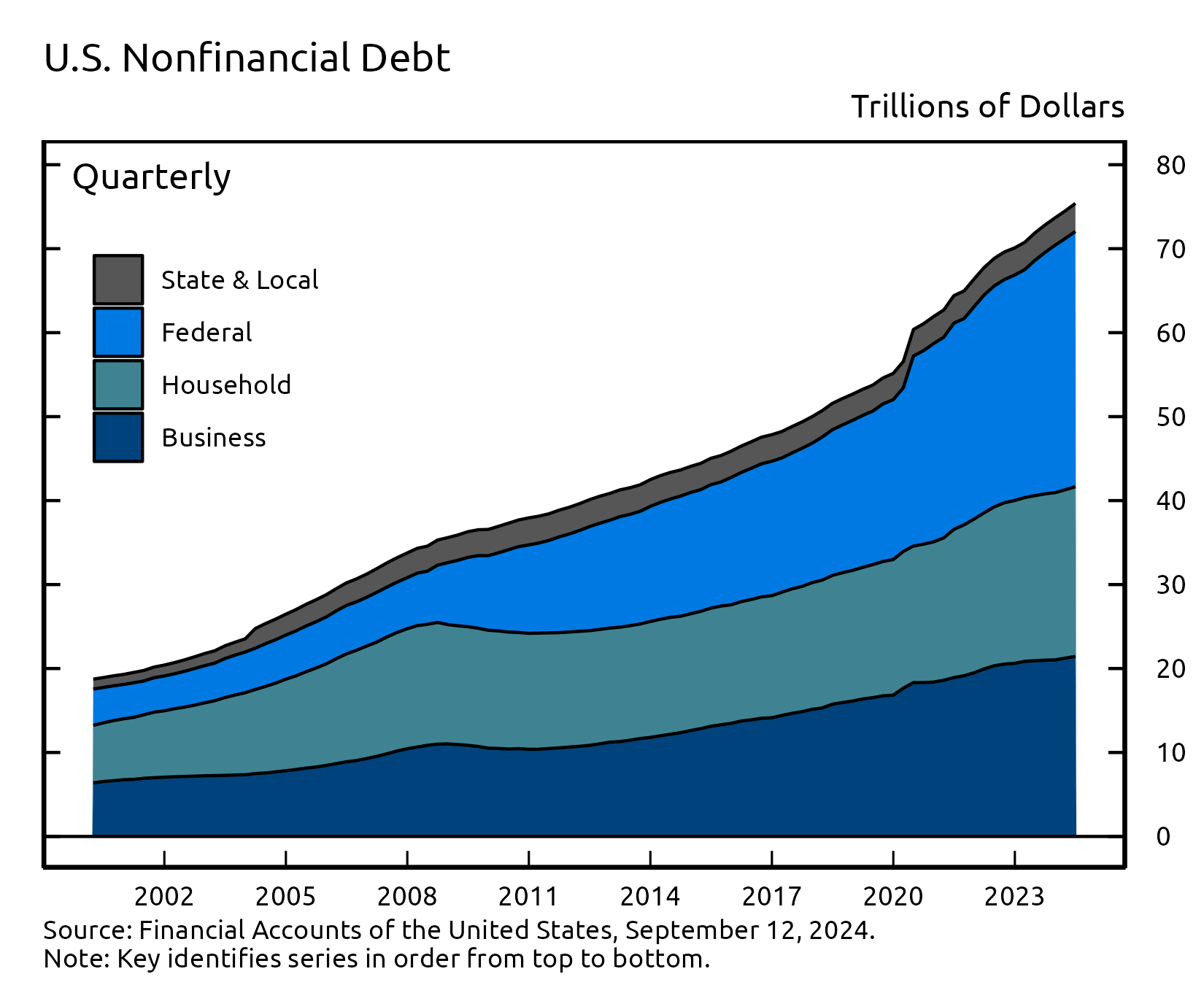

Household debt grew by 3.2% in the second quarter of 2024, up a bit from the previous quarter (this and subsequent rates of growth are reported at a seasonally adjusted annual rate). Home mortgage debt expanded by 3.0% while nonmortgage consumer credit grew by 1.6%.

Nonfinancial business debt grew at a 3.8% pace in the second quarter, down slightly from a 4.0% pace in the previous quarter, reflecting solid net issuance of debt securities and a pickup in nonmortgage loan growth at banks and nonbank financial institutions.

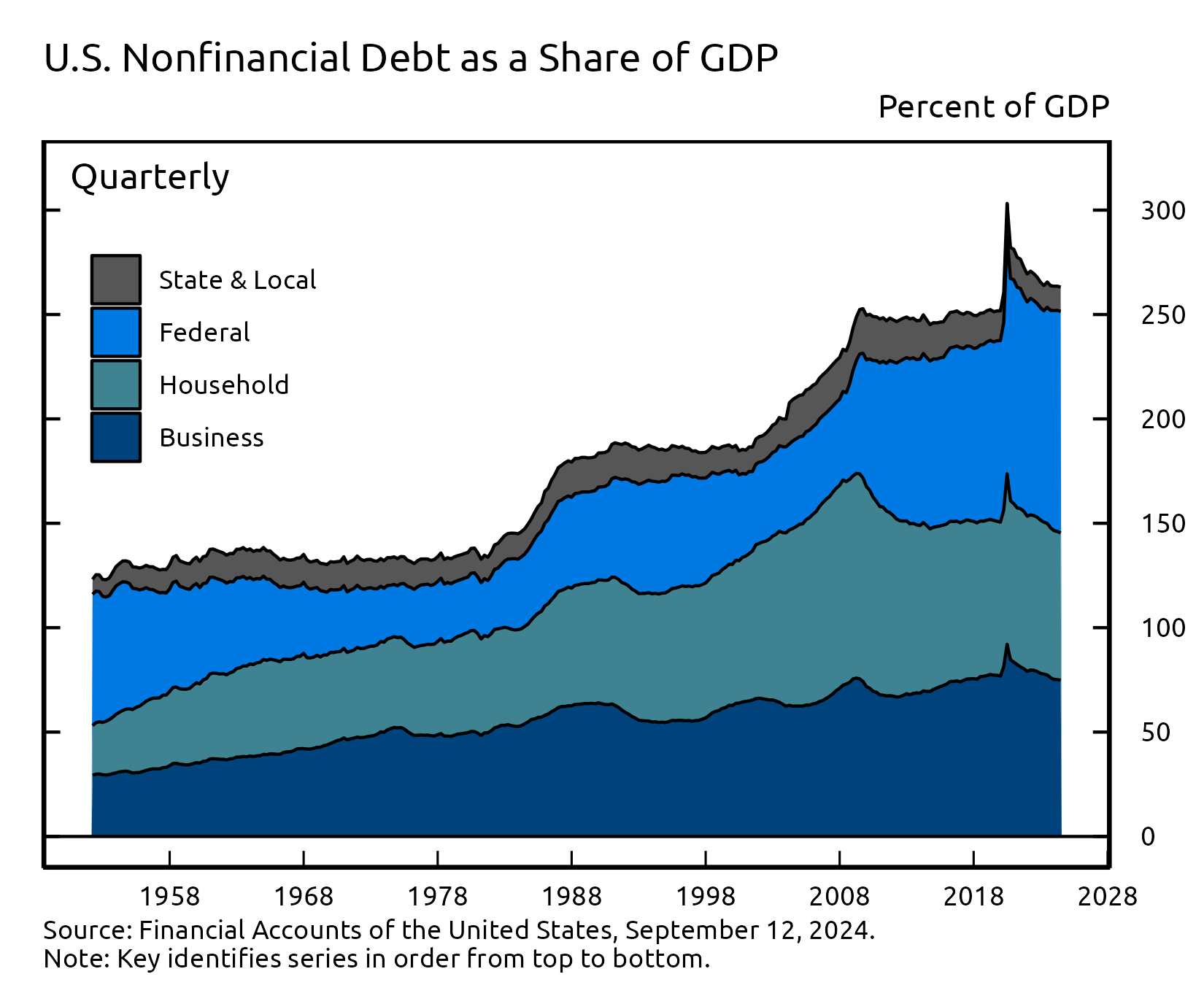

Overall, domestic nonfinancial debt grew at an annual rate of 4.7% in the second quarter, a bit faster than in the previous quarter but still weaker than the average pace recorded over the previous few years. Federal government debt increased at a 6.3% pace, while state and local government debt expanded at an annual rate of 6.0%.

The ratio of nonfinancial debt outstanding to GDP was down slightly in the second quarter. For more data on nonfinancial debt, see table D.1 (rates of debt growth), table D.2 (borrowing), and table D.3 (debt outstanding).Debt Growth by Sector

| Description | 2022 | 2023 | 2023:Q3 | 2023:Q4 | 2024:Q1 | 2024:Q2 |

|---|---|---|---|---|---|---|

| Total Nonfinancial | 5.62 | 5.12 | 5.33 | 4.72 | 4.49 | 4.73 |

| Households and Nonprofits | 6.20 | 2.76 | 3.11 | 2.29 | 2.76 | 3.15 |

| Nonfinancial Business | 5.64 | 2.00 | 1.25 | 0.67 | 3.97 | 3.79 |

| Federal Government | 6.11 | 9.76 | 10.60 | 10.01 | 6.20 | 6.31 |

| State and Local Governments | -1.54 | 0.68 | -0.26 | -1.07 | 3.07 | 5.97 |

Debt Outstanding by Sector

| Description | 2022 | 2023 | 2023:Q3 | 2023:Q4 | 2024:Q1 | 2024:Q2 |

|---|---|---|---|---|---|---|

| Total Nonfinancial | 70.10 | 73.68 | 72.83 | 73.68 | 74.51 | 75.39 |

| Households and Nonprofits | 19.39 | 19.92 | 19.81 | 19.92 | 20.05 | 20.21 |

| Nonfinancial Business | 20.62 | 21.03 | 21.00 | 21.03 | 21.24 | 21.44 |

| Federal Government | 26.85 | 29.47 | 28.75 | 29.47 | 29.93 | 30.40 |

| State and Local Governments | 3.24 | 3.26 | 3.27 | 3.26 | 3.29 | 3.34 |

Accessible version | CSV | Data Dictionary |

Accessible version | CSV | Data Dictionary |

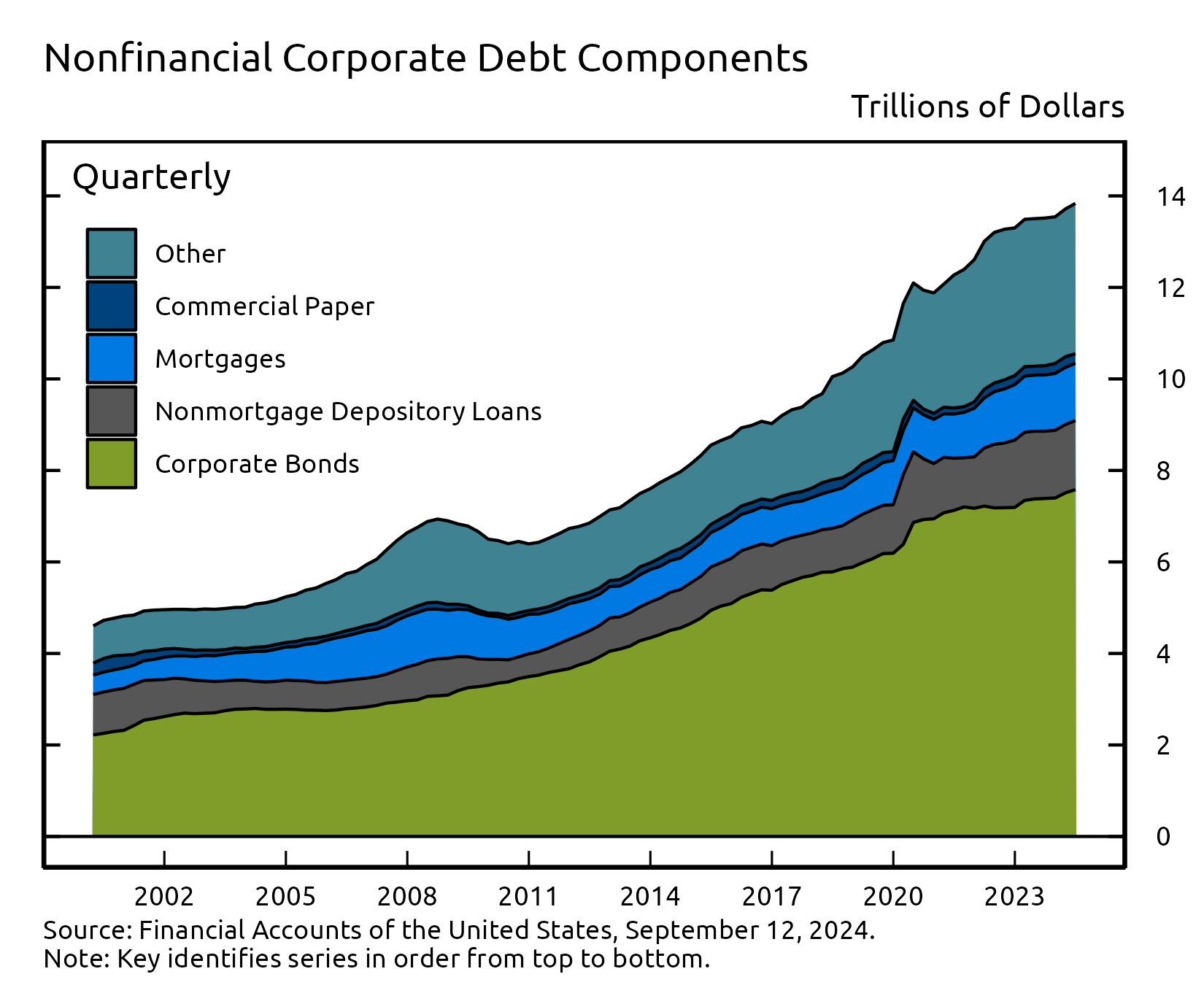

Looking at the components of nonfinancial business debt, corporate bonds increased by about $71 billion in the second quarter while mortgage loans increased by $32 billion. Nonmortgage loans at depository institutions increased by $28 billion, while other nonbank nonmortgage loans increased by $54 billion in the second quarter.

Outstanding nonfinancial corporate debt was $13.9 trillion. Corporate bonds, at roughly $7.6 trillion, accounted for 55% of the total. Nonmortgage depository loans were about $1.5 trillion. Other types of debt include loans from nonbank financial institutions, loans from the federal government, industrial revenue bonds, and commercial paper.

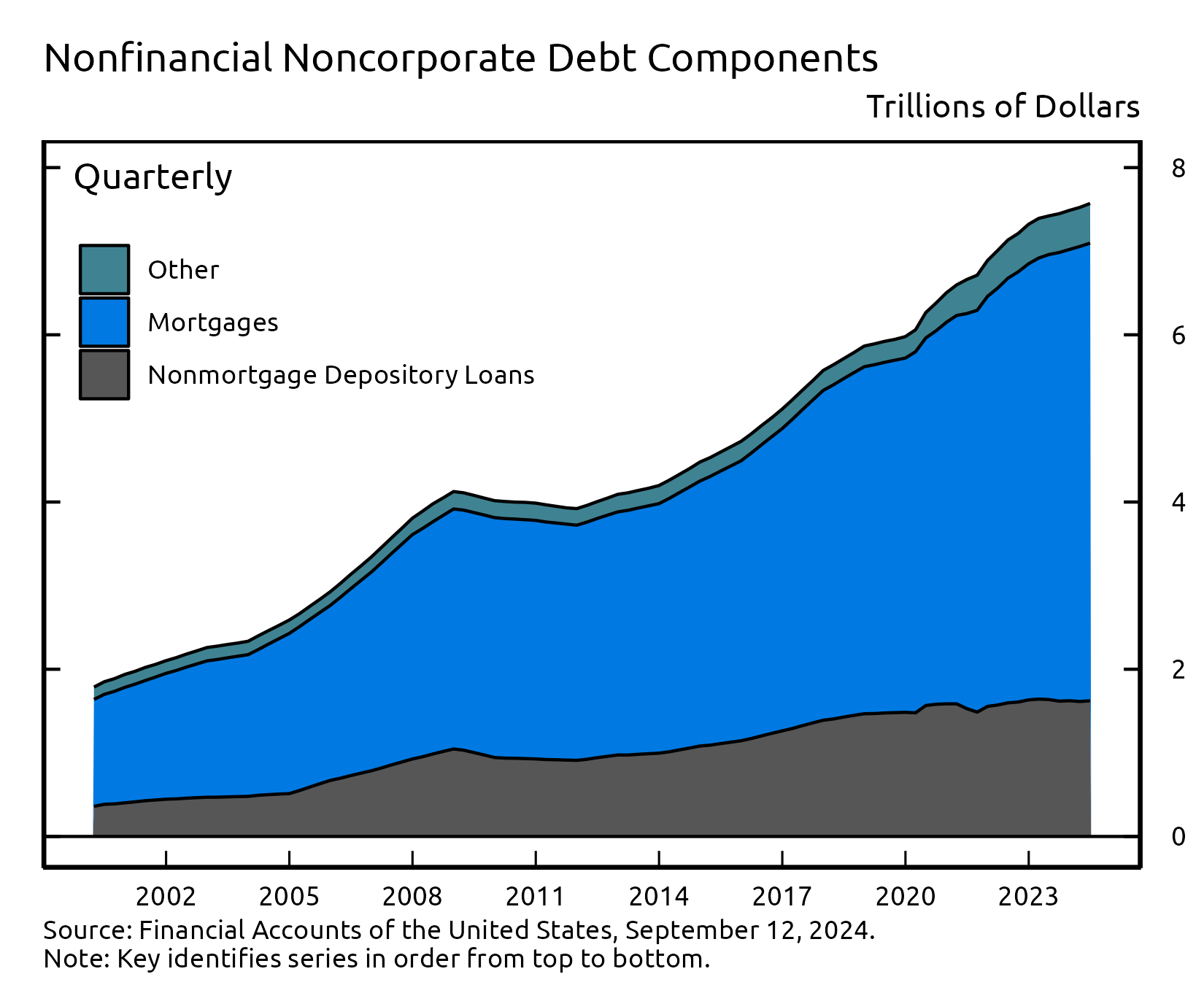

The nonfinancial noncorporate business sector consists mostly of smaller businesses, which are typically not incorporated. Nonfinancial noncorporate business debt was $7.6 trillion in the second quarter. Mortgage loans, at roughly $5.5 trillion, accounted for about 72% of the total, while nonmortgage depository loans ($1.6 trillion) accounted for most of the remainder.

Accessible version | CSV | Data Dictionary |

Accessible version | CSV | Data Dictionary |

For more data on nonfinancial business balance sheets, including debt, see tables B.103 and B.104.

Coming soon

- Enhanced

Financial Accounts Projects will be updated on Friday,

September 20, 2024, including the Distributional Financial

Accounts, which provide a quarterly estimate of the

distribution of U.S. household wealth.

- Financial Accounts data for the third quarter of 2024 will be published on Thursday, December 12, 2024, at 12:00 noon.

Chart Notes

- Changes in net worth consist of transactions, revaluations, and other volume changes. Corporate equity and debt securities include directly and indirectly held securities. Real estate is the value of owner-occupied real estate. Other includes equity in noncorporate businesses, consumer durable goods, fixed assets of nonprofit organizations, and all other financial assets apart from corporate equities and debt securities, net of liabilities, as shown on table B.101 Balance Sheet of Households and Nonprofit Organizations.